Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 14 companies across 9 industries

Healthcare

Dr. Lal Pathlabs

Emcure Pharmaceuticals

Media & Entertainment

Phantom Digital Effects

Engineering & Capital Goods

De Neers Tools

Markolines Pavement Technologies

Services

Felix Industries

Chemicals

Aeron Composite

Platinum Industries

Energy

Oil India

Neyveli Lignite

Telecom

Tejas Networks

FMCG

Jubilant Foodworks

Westlife Foodworld

Metals

Hindalco

Healthcare

Dr. Lal Pathlabs | Small Cap | Healthcare

Dr. Lal Pathlabs Limited is a leading provider of diagnostic and healthcare services in India. The company operates a vast network across the country, offering a wide range of tests for patient diagnosis, disease prevention, monitoring, and treatment. They cater to individual patients, hospitals, healthcare providers, and corporate clients.

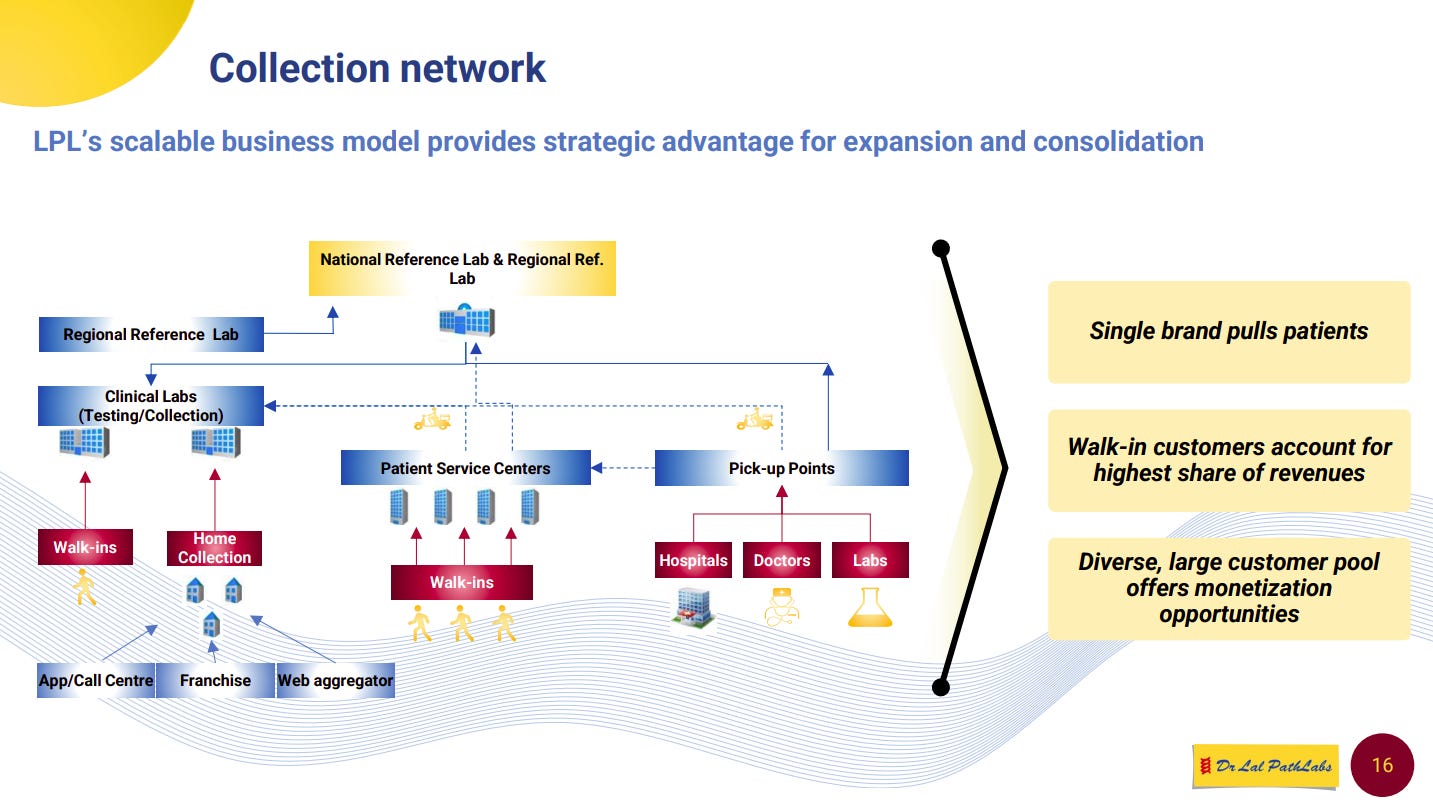

Dr. Lal PathLabs continues to lean on its biggest strength — a hub-and-spoke collection network that pulls in walk-in customers, home collections, hospitals, and franchises into one brand funnel. This scalable model keeps customer acquisition costs low and ensures walk-ins remain the company’s most profitable revenue driver.

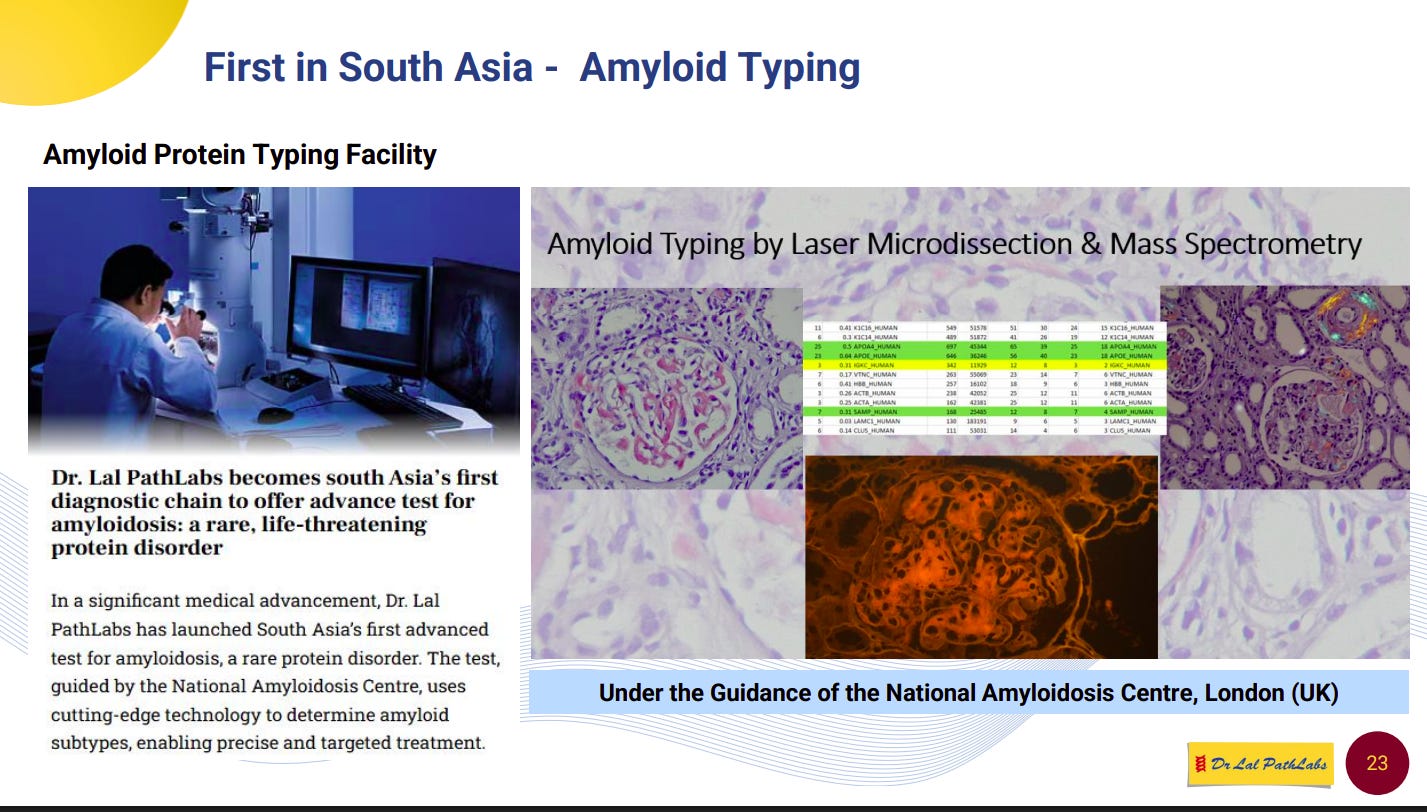

Dr. Lal PathLabs is pushing deeper into high-end diagnostics — becoming South Asia’s first chain to offer advanced amyloid typing, a rare and complex test usually done only at global centres. It signals the company’s move up the value curve, tapping specialised, premium diagnostics guided by international expertise.

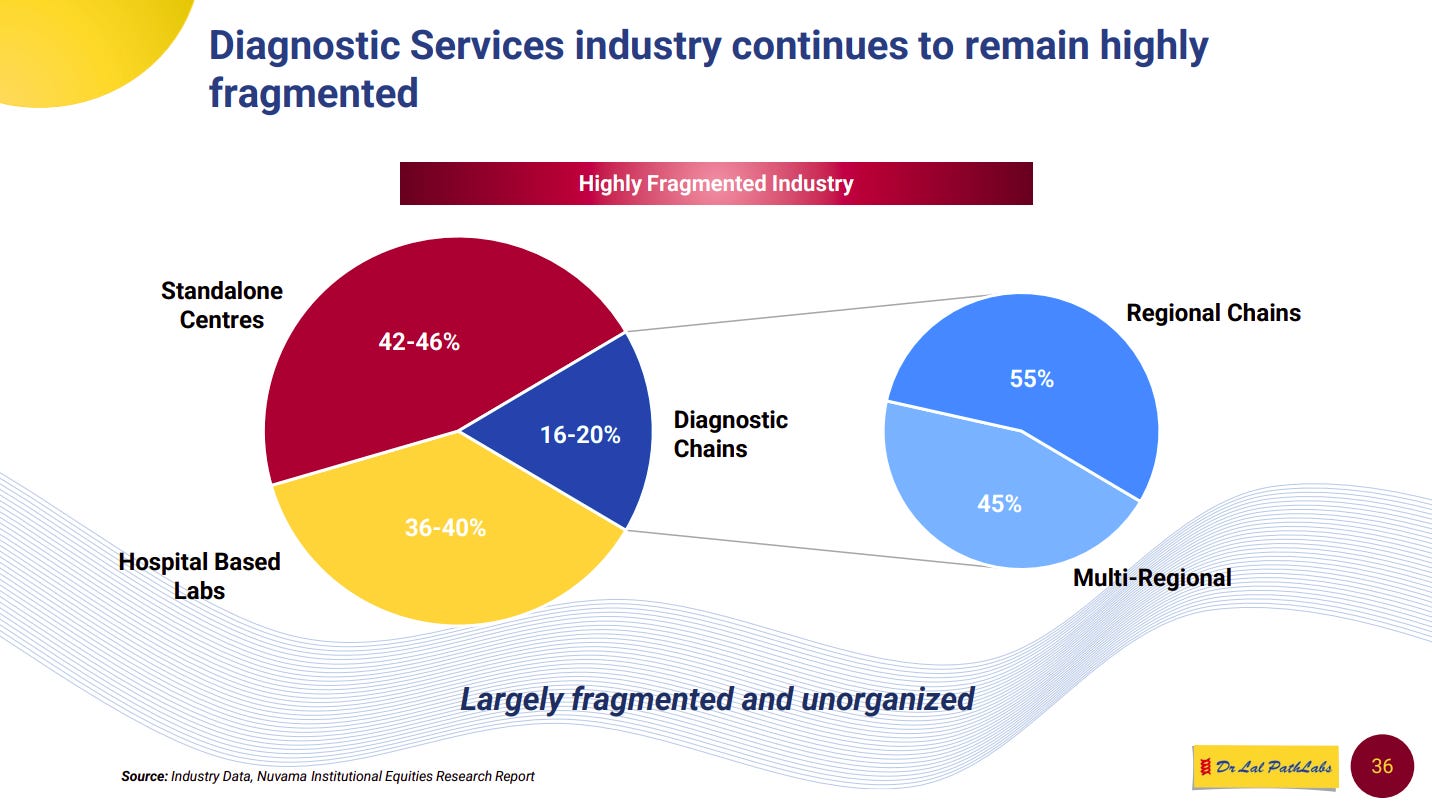

India’s diagnostics market is still highly fragmented, with standalone labs and hospital-based centres together controlling over 75% of the market — leaving organised chains like Lal PathLabs with just 16–20%. The uneven structure means there’s still a long runway for consolidation, brand-led trust, and scale-based efficiencies.

Emcure Pharmaceuticals | Small Cap | Healthcare

Emcure Pharmaceuticals is a prominent Indian pharmaceutical company specializing in the development, manufacturing, and global marketing of a wide range of pharmaceutical products across various therapeutic areas. With a strong presence in key areas such as Gynaecology, cardiology, oncology, and respiratory, Emcure Pharmaceuticals has established itself as a leader in the industry.

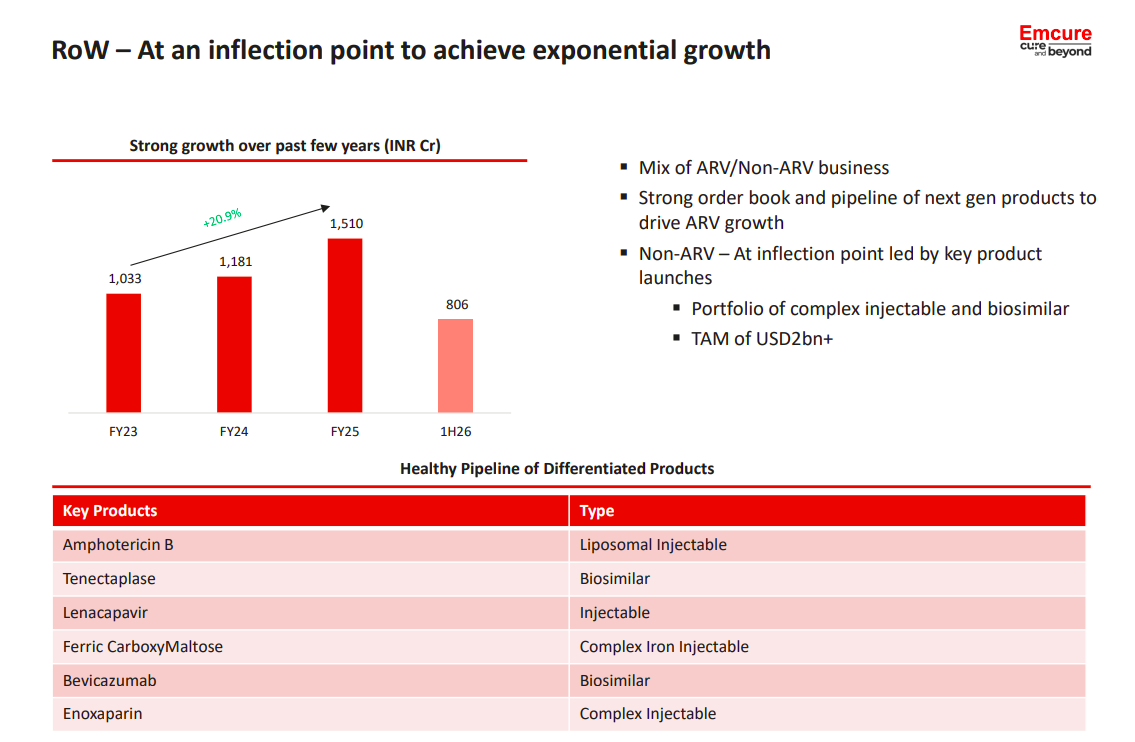

RoW revenues have grown strongly from FY23 to FY25, supported by a mix of ARV and non-ARV products. With new launches in complex injectables and biosimilars (USD 2bn+ TAM), the non-ARV segment is now at an inflection point for accelerated growth.

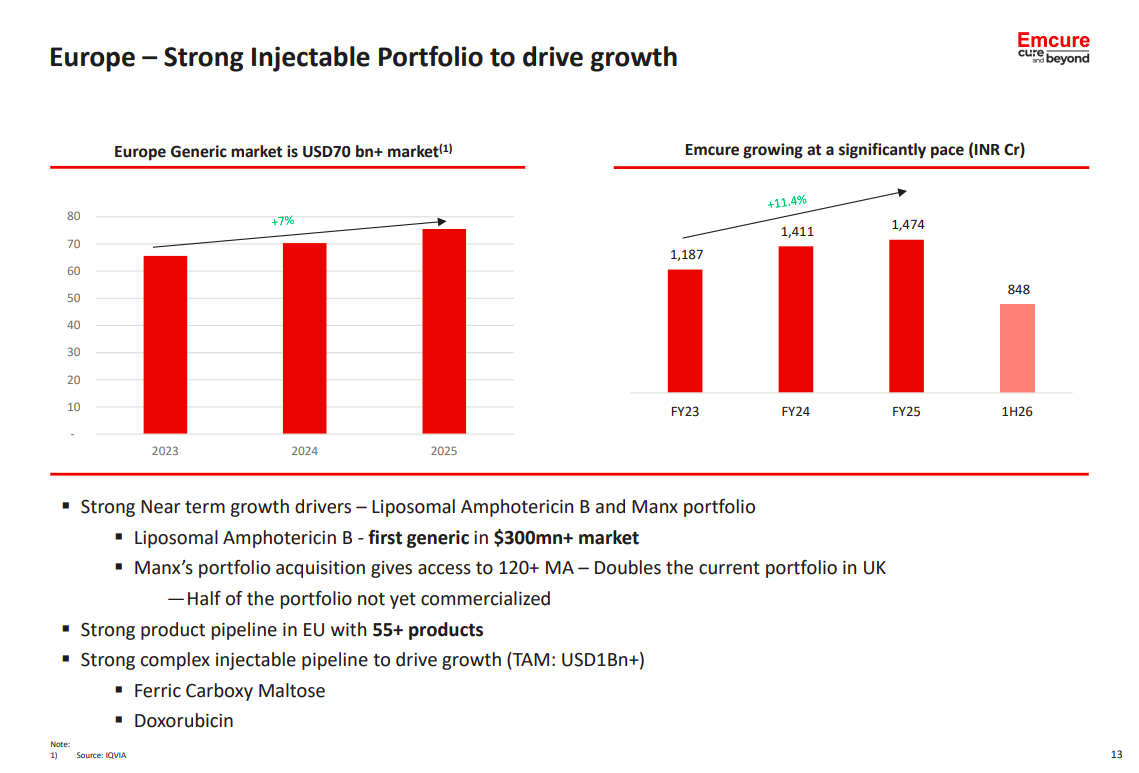

Emcure is scaling well in Europe with steady market growth and an expanding injectable pipeline. Near-term drivers include Liposomal Amphotericin B and the Manx portfolio, supported by 55+ EU products and a strong complex injectable lineup.

Growth is strengthened by in-licensing anti-diabetic and weight-loss drugs, alongside strategic acquisitions like Zuvendus and Manx Healthcare. These moves deepen the portfolio, enhance IP access, and expand distribution across India and Europe.

Emcure is broadening its India presence through OTC, dermatology, and super-specialty segments, tapping into high-growth categories. New launches across antifungal, psoriasis, pigmentation, renal, onco, and CNS strengthen its specialty brand portfolio.

Media & Entertainment

Phantom Digital Effects | Micro Cap | Media & Entertainment

Phantom Digital Effects Limited is a creative VFX studio that specializes in providing high-end visual effects solutions for commercials, feature films, and web series globally. They offer a wide range of VFX services including Final Compositing, Roto, 3D Elements, Photo real creatures, Environments, Match Move, and Animations. With a track record of delivering thousands of shots for domestic and international feature films, web series, and commercials, the company also collaborates with larger visual effects studios on subcontracting projects.

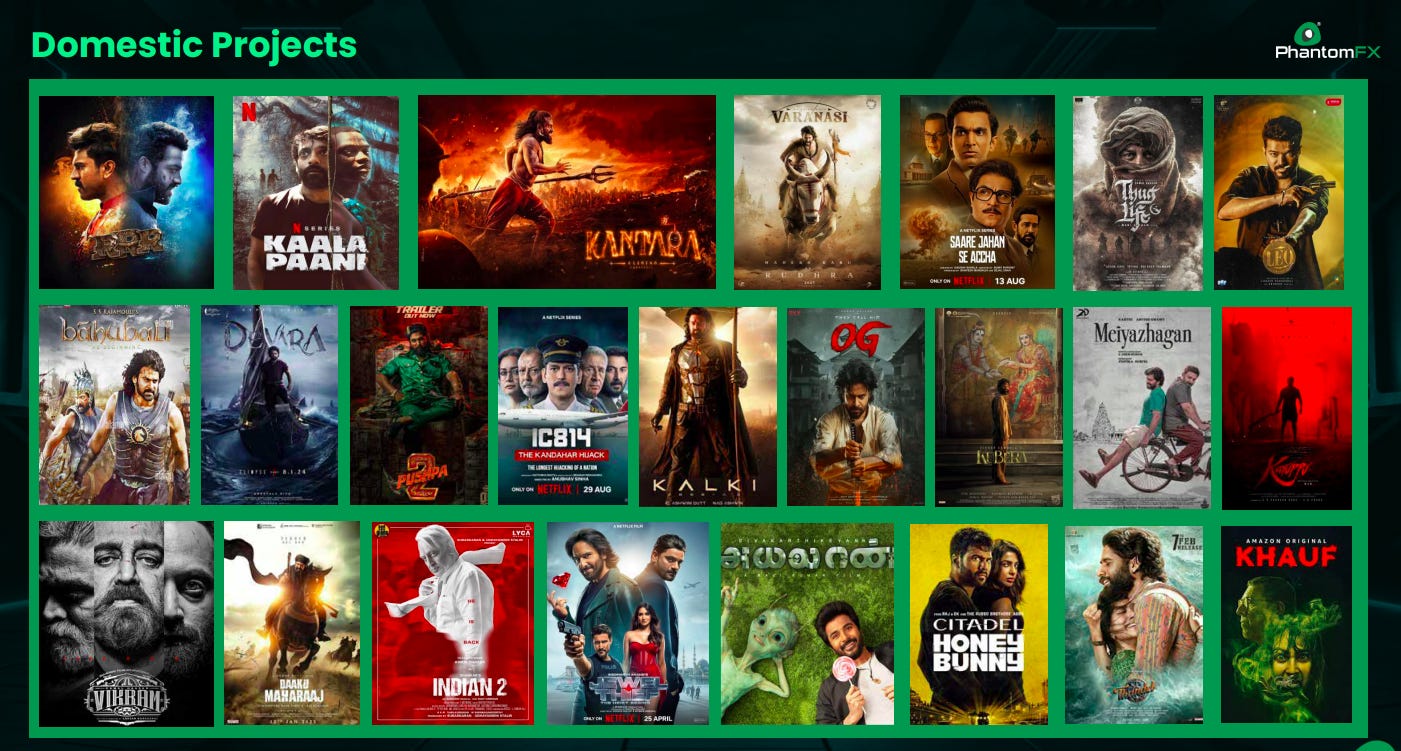

PhantomFX has delivered VFX work for major Indian films and OTT projects including Kantara, Kaala Paani, Leo, Kalki, Baahubali, and others. The slate highlights deep involvement across regional and mainstream cinema.

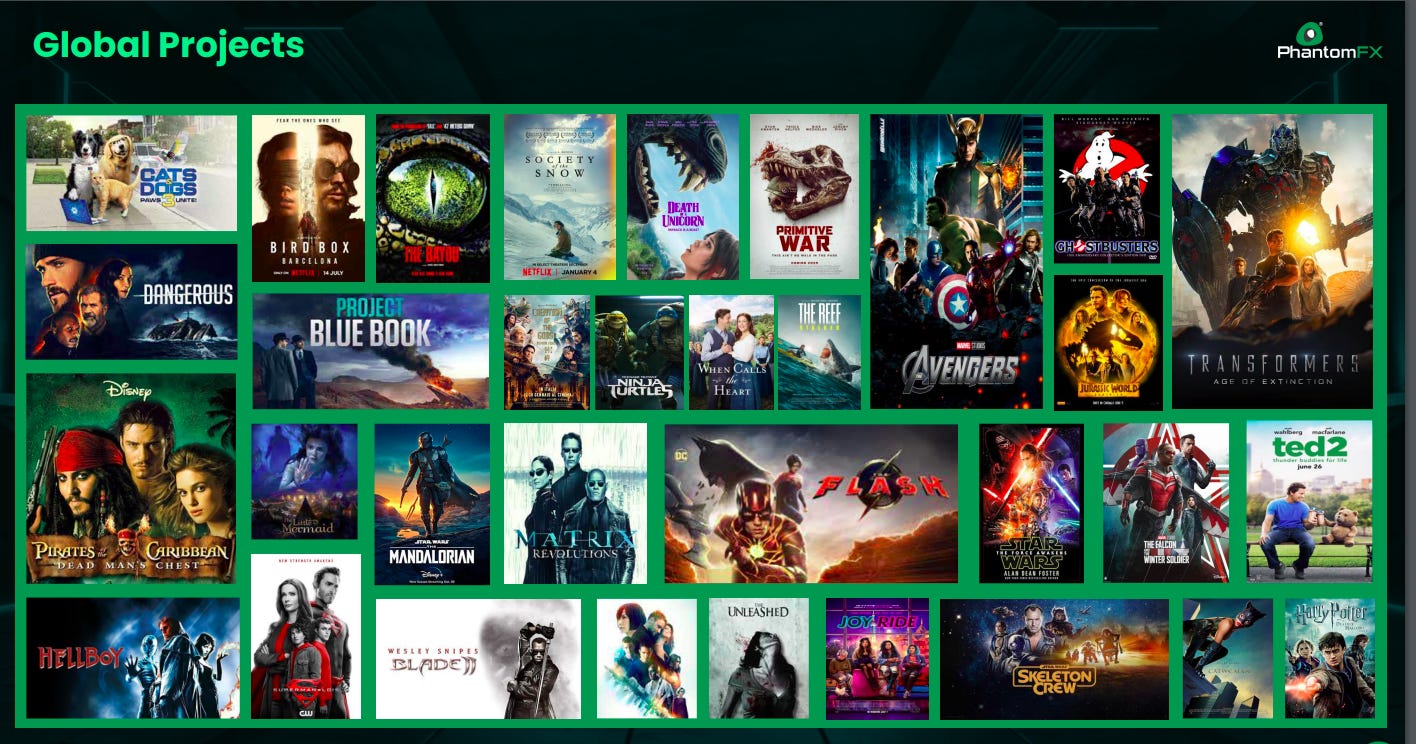

The studio’s global portfolio spans iconic titles like Avengers, Pirates of the Caribbean, Transformers, Ninja Turtles, Matrix Revolutions, Flash, and more—demonstrating strong international credibility.

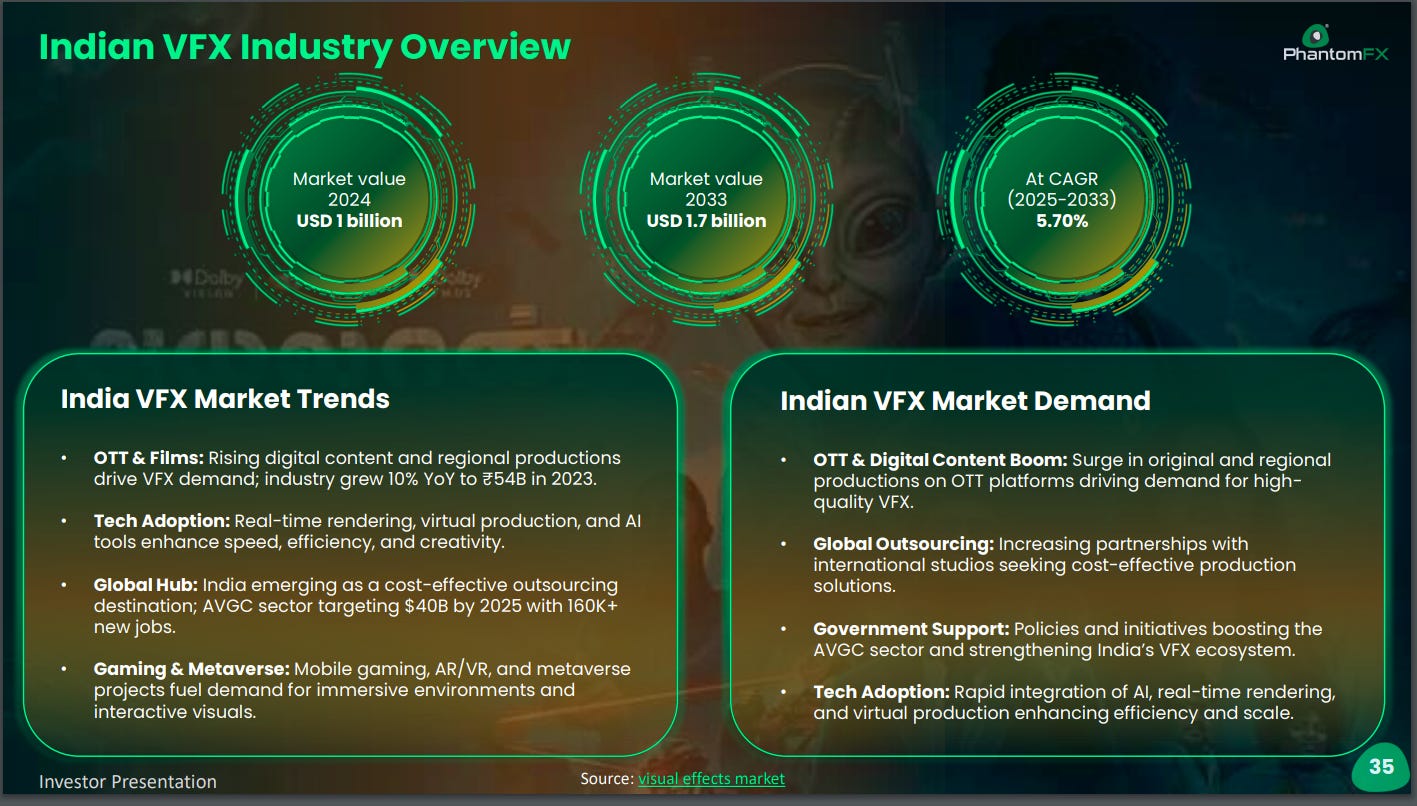

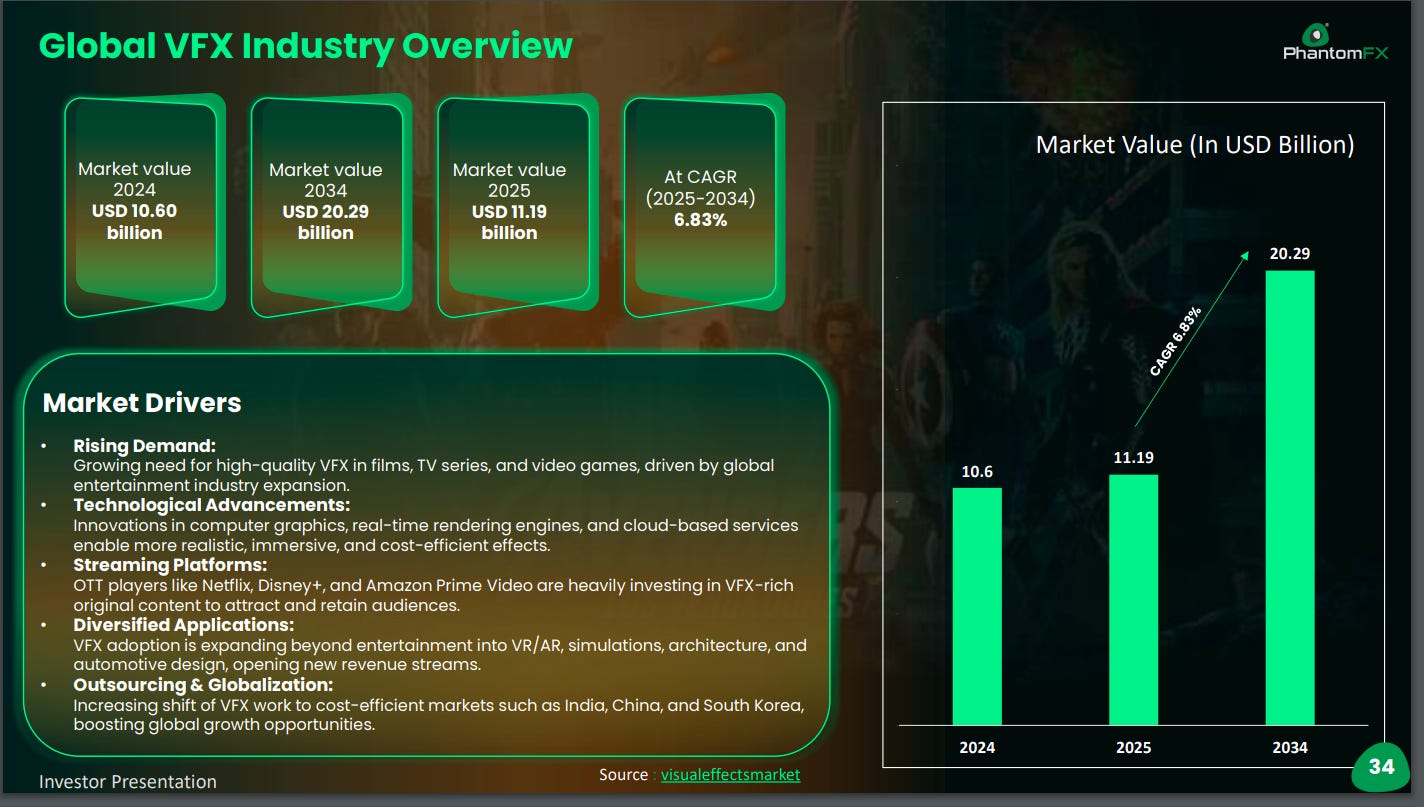

India’s VFX market is valued at USD 1B (2024) and set to reach USD 1.7B by 2033. OTT growth, tech adoption, gaming, and global outsourcing are driving momentum along with supportive AVGC policies.

The global VFX industry is projected to grow from USD 10.6B (2024) to USD 20.29B (2034) at a 6.8% CAGR. Demand is powered by streaming, gaming, technological advancements, and expanding outsourced production.

Engineering & Capital Goods

De Neers Tools | Nano Cap | Engineering & Capital Goods

DE Neers Tools Limited is a well-known hand tools supplier in India, offering a wide range of products including Spanners, Wrenches, Pliers, and more. They specialize in providing Safety Tools like Non-Sparking Tools, Insulated Steel Tools, and Titanium Tools.

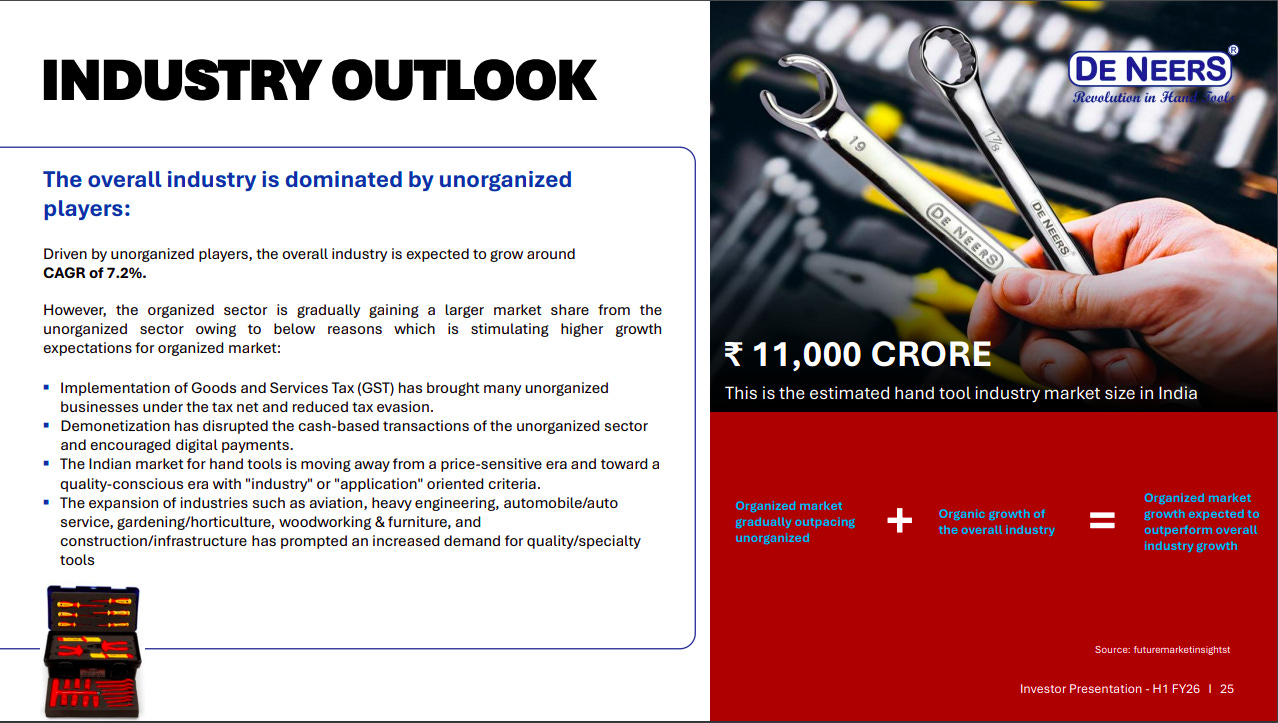

The Indian hand tools industry is ~₹11,000 crore and still dominated by unorganized players, but the organized segment is steadily gaining ground thanks to GST, demonetization, and a shift toward quality-driven usage. Rising industrial activity across sectors like auto, aviation, infrastructure, and construction is expected to accelerate organized-market growth ahead of the overall industry.

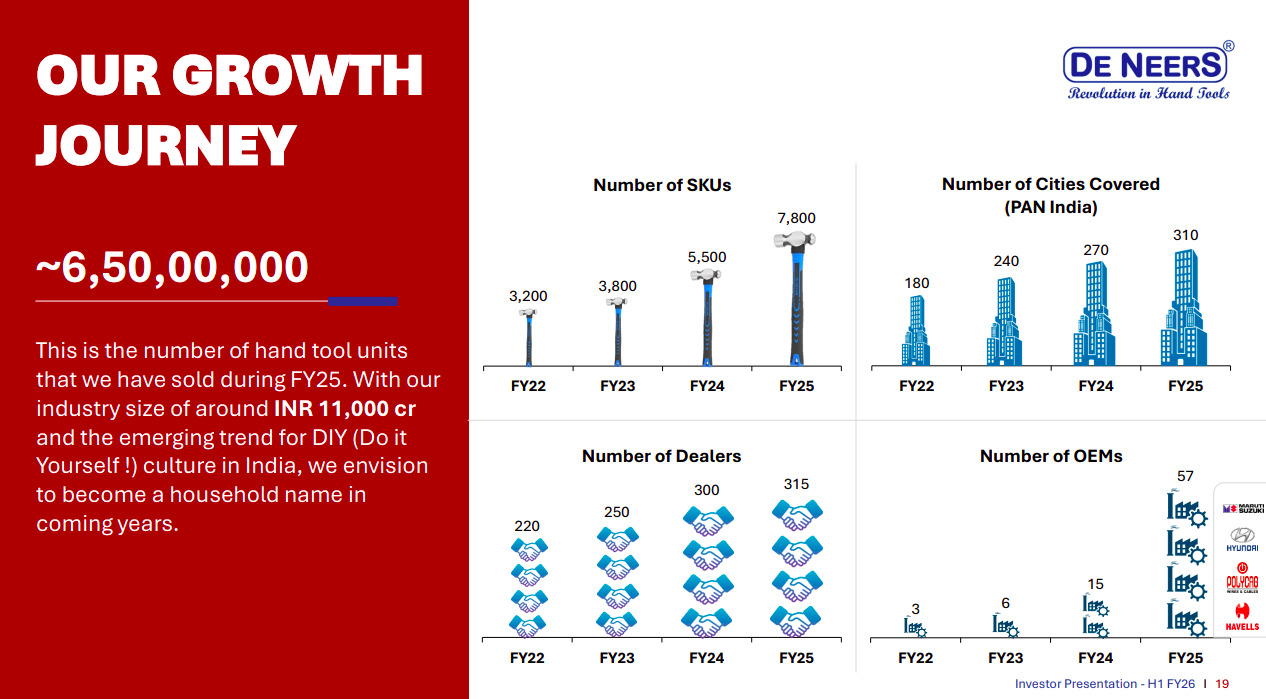

De Neers sold ~6.5 crore hand-tool units in FY25, supported by 7,800 SKUs, 310-city distribution, 315 dealers, and 57 OEM partnerships. With a large ₹11,000 crore market and growing DIY demand in India, the company aims to transform into a household brand in the coming years.

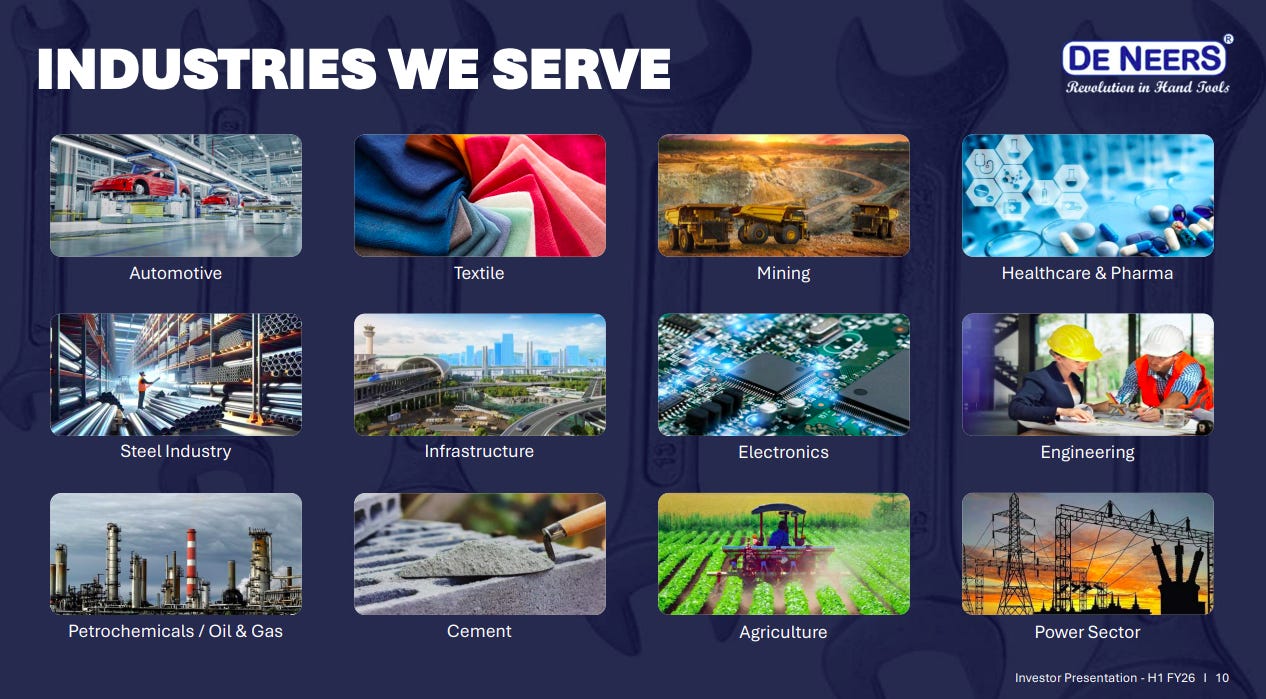

De Neers supplies tools across 12 critical sectors—from automotive, textiles, mining, healthcare, and engineering to oil & gas, cement, and power. This diversified industry presence enables steady and resilient demand across India’s industrial ecosystem.

Markolines Pavement Technologies | Nano Cap | Engineering & Capital Goods

Markolines Traffic Controls Limited is a leader in providing innovative and technology-driven solutions for Highway Operations & Maintenance. With vast experience, the company offers superior services in the (O&M) domain through its three main categories: Highway Operations, Highway Maintenance, and Specialized Maintenance Services.

Markolines operates across three core verticals—highway maintenance, specialized maintenance, and specialized construction services. These segments cover end-to-end road upkeep, pavement strengthening, and tunneling/structural works.

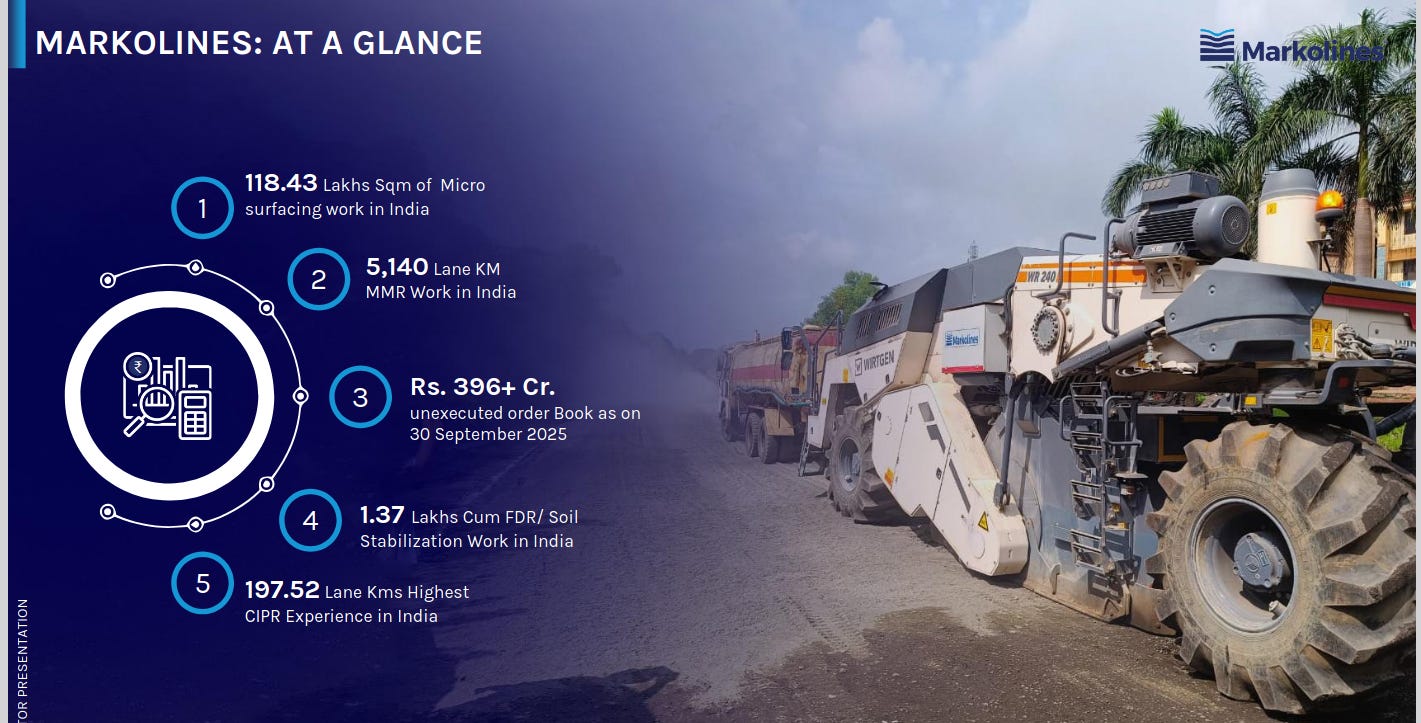

The company has executed large-scale micro-surfacing, MMR, and soil stabilization works across India, supported by 197+ lane-km of CIPR experience. A strong unexecuted order book of over ₹396 crore underlines steady future visibility.

As of Sept 2025, Markolines holds a ₹396.31 crore confirmed order book, led by specialized construction and MMR projects. Additionally, a pipeline of ₹600+ crore offers strong medium-term growth momentum.

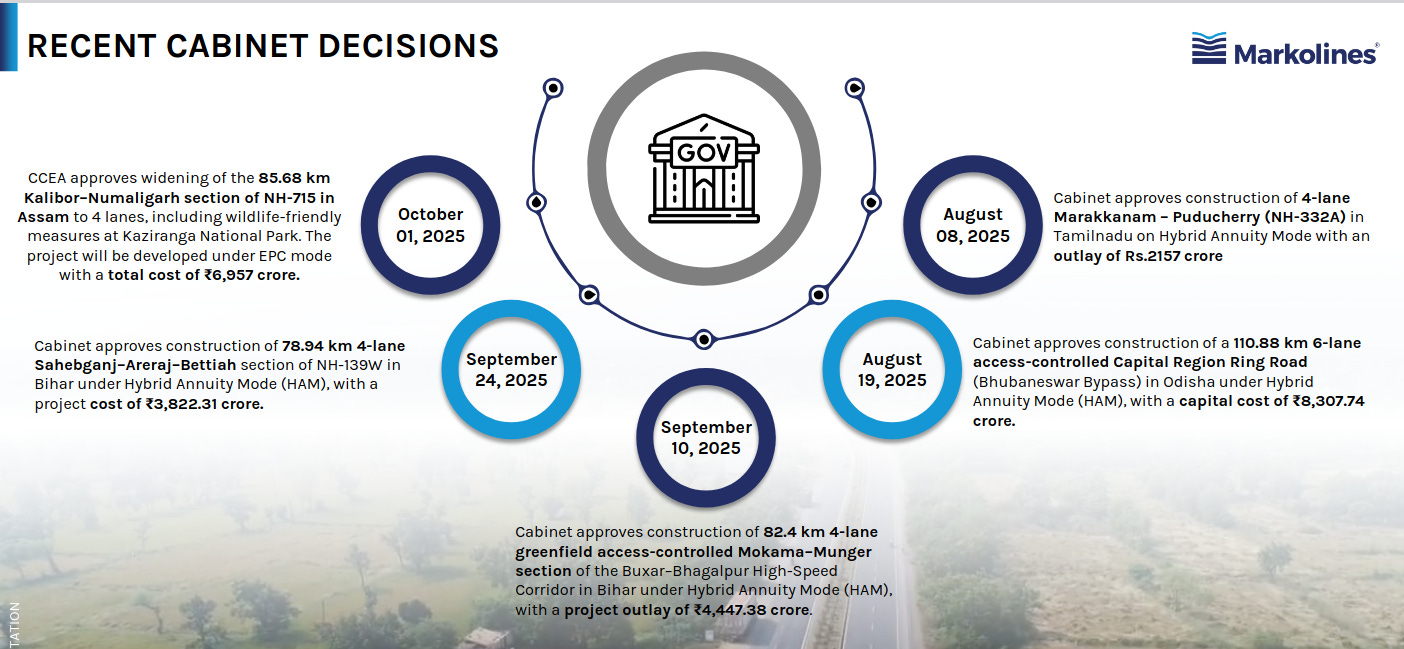

Government approvals for major national highway expansions—across Assam, Bihar, Tamil Nadu, and Odisha—signal robust infrastructure spending. These large EPC/HAM projects create strong upcoming opportunities for maintenance and construction service providers.

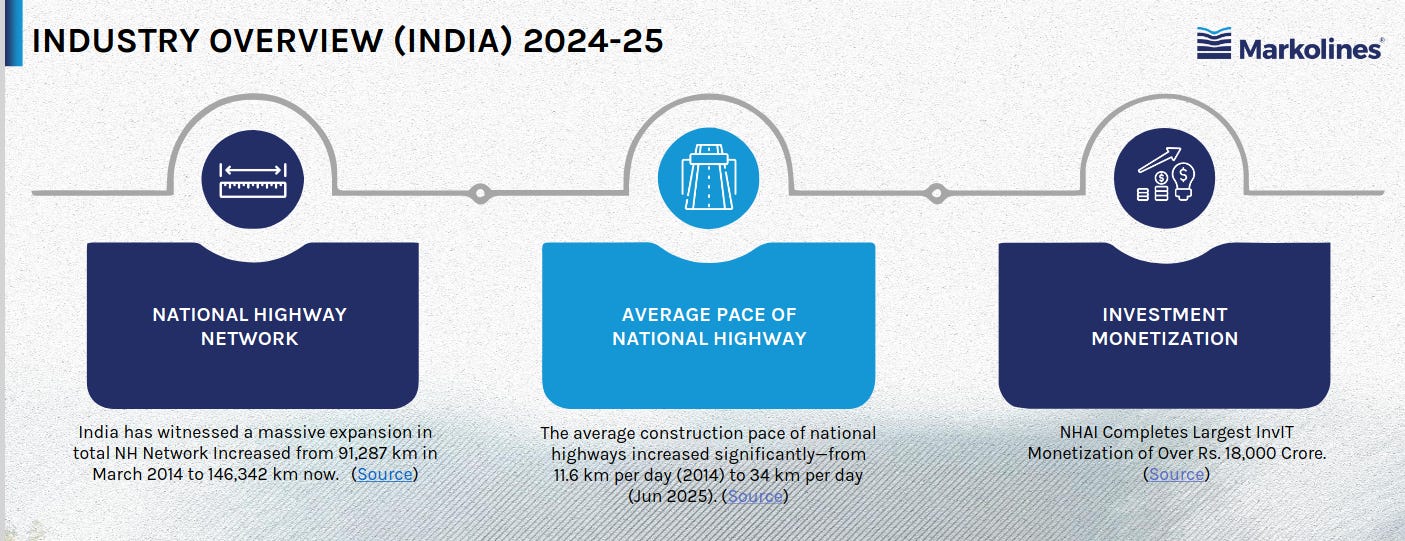

India’s national highway network has expanded sharply to 146,342 km, with construction pace accelerating to 34 km/day. Monetization initiatives like NHAI’s ₹18,000 crore InvIT strengthen funding for future road infrastructure.

Services

Felix Industries | Nano Cap | Services

Felix Industries, based in Ahmedabad, Gujarat, operates in the environmental conservation sector. Their services include Water and Waste Water Recycling, Industrial Piping, Nano Products, and E-waste Recycling. With a focus on industries like steel, chemical, pharmaceutical, and more, Felix is a government-approved e-waste recycling company with one of the largest capacities in India.

Felix operates across India and Oman with strong manufacturing bases and over 100+ delivered projects. The company serves a wide spectrum of industries—from textiles and pharmaceuticals to power plants and FMCG—supported by its headquarters in Ahmedabad and strategic presence in Muscat/Samail. The map highlights deep penetration across Indian states and the Middle East.

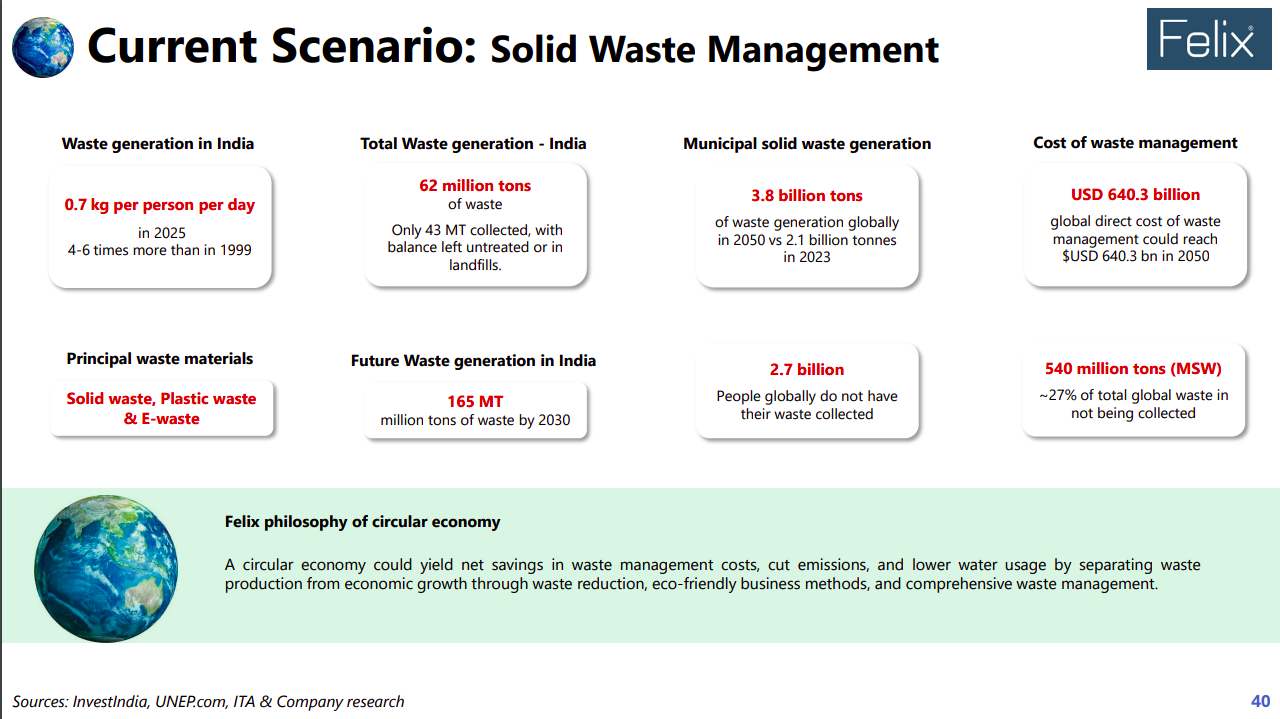

India generates 62 million tons of waste annually, with a significant share left uncollected, while global municipal waste is projected to hit 3.8 billion tons by 2050. Key waste streams include solid, plastic, and e-waste, and India’s waste volume is expected to reach 165 MT by 2030. Felix promotes circular economy principles to reduce waste and enhance sustainability.

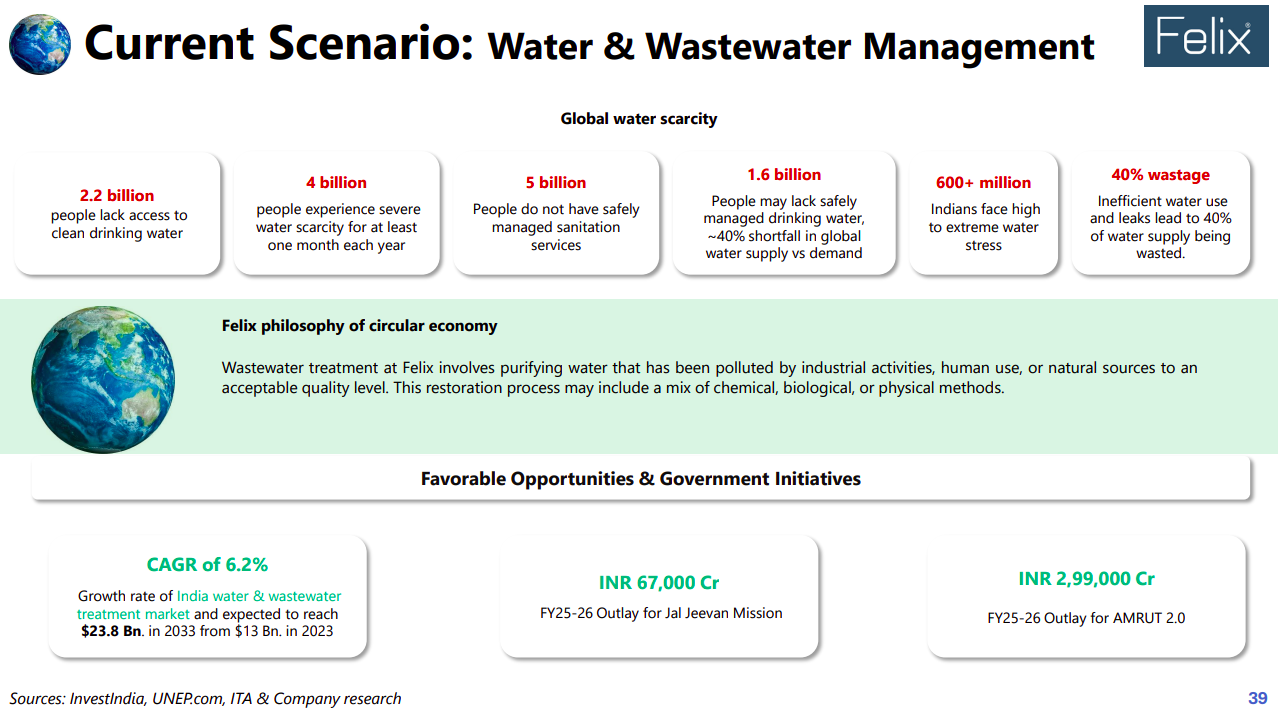

Global water scarcity affects billions, with India facing extreme water stress and high wastage from inefficient systems. The wastewater treatment market in India is growing at 6.2% CAGR, supported by major government programs like Jal Jeevan Mission and AMRUT 2.0. Felix focuses on circular solutions that purify and restore polluted water through chemical, biological, and physical methods.

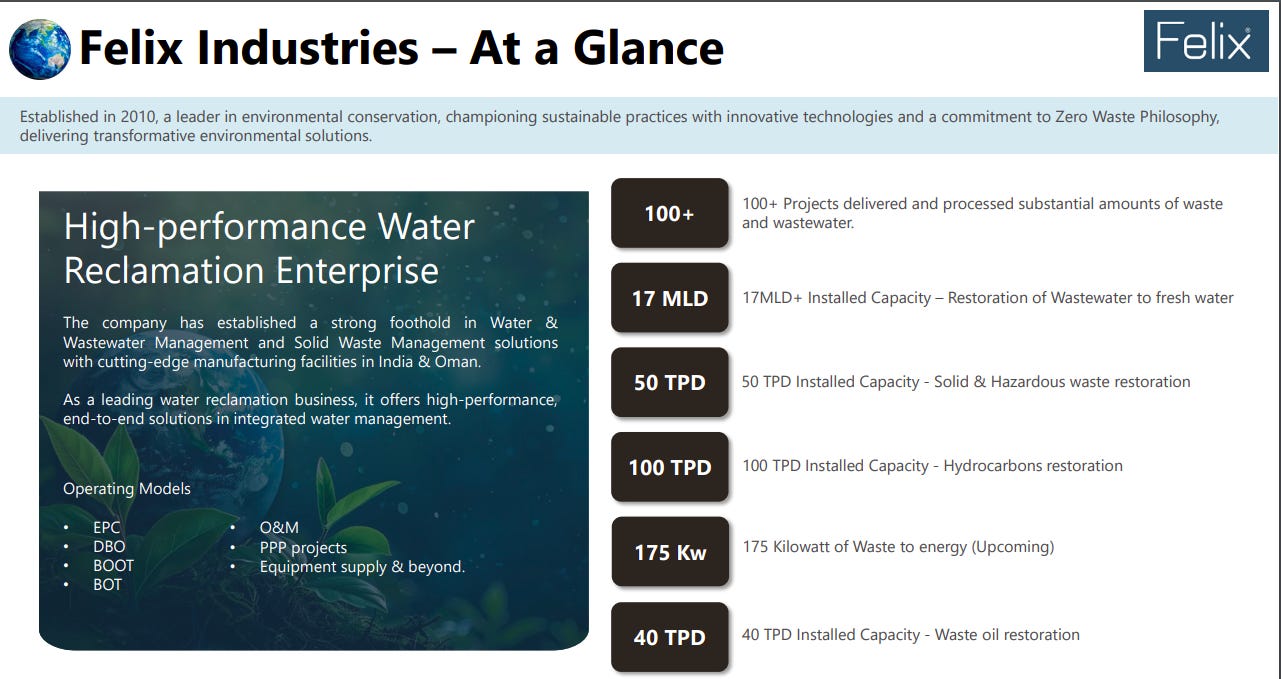

Felix is a leading high-performance water reclamation enterprise with 100+ projects and strong capacities across wastewater, solid waste, hydrocarbons, and waste-to-energy. Facilities in India and Oman support EPC, O&M, BOT/BOOT, and PPP models for integrated water management. The company’s installed capacities include 17 MLD wastewater restoration and multiple TPD capabilities across hazardous, hydrocarbon, and waste oil treatment.

Chemicals

Aeron Composite | Nano Cap | Chemicals

Aeron Composite manufactures and supplies Fiber-Reinforced Polymer (FRP) products, which are strong, lightweight, and corrosion-resistant materials made from a polymer matrix reinforced with fibers like fiberglass

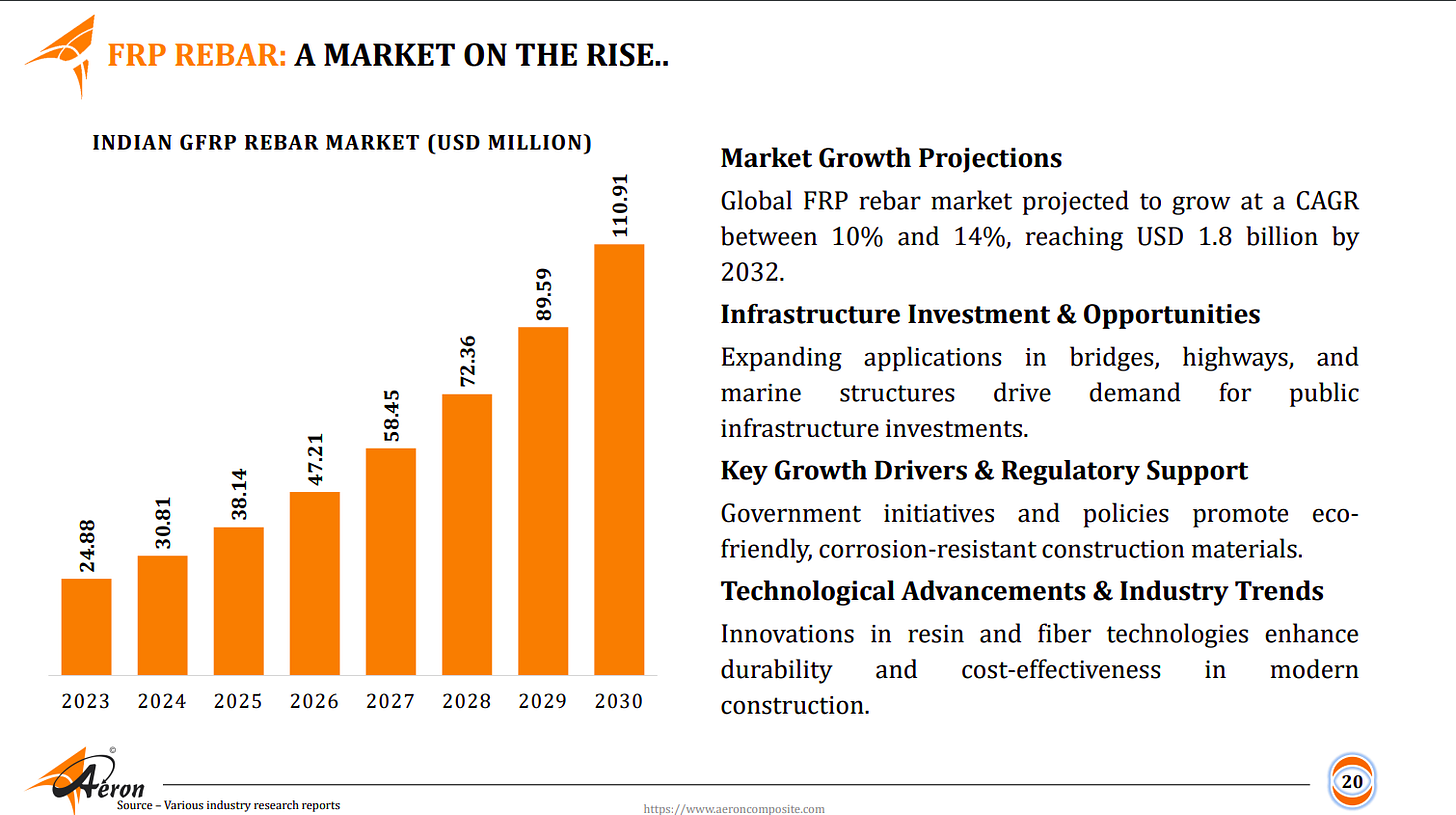

India’s GFRP rebar market is growing rapidly, projected to more than quadruple by 2030, driven by infrastructure expansion and demand for corrosion-resistant materials. Global policy support and technological innovation are further accelerating adoption across construction projects.

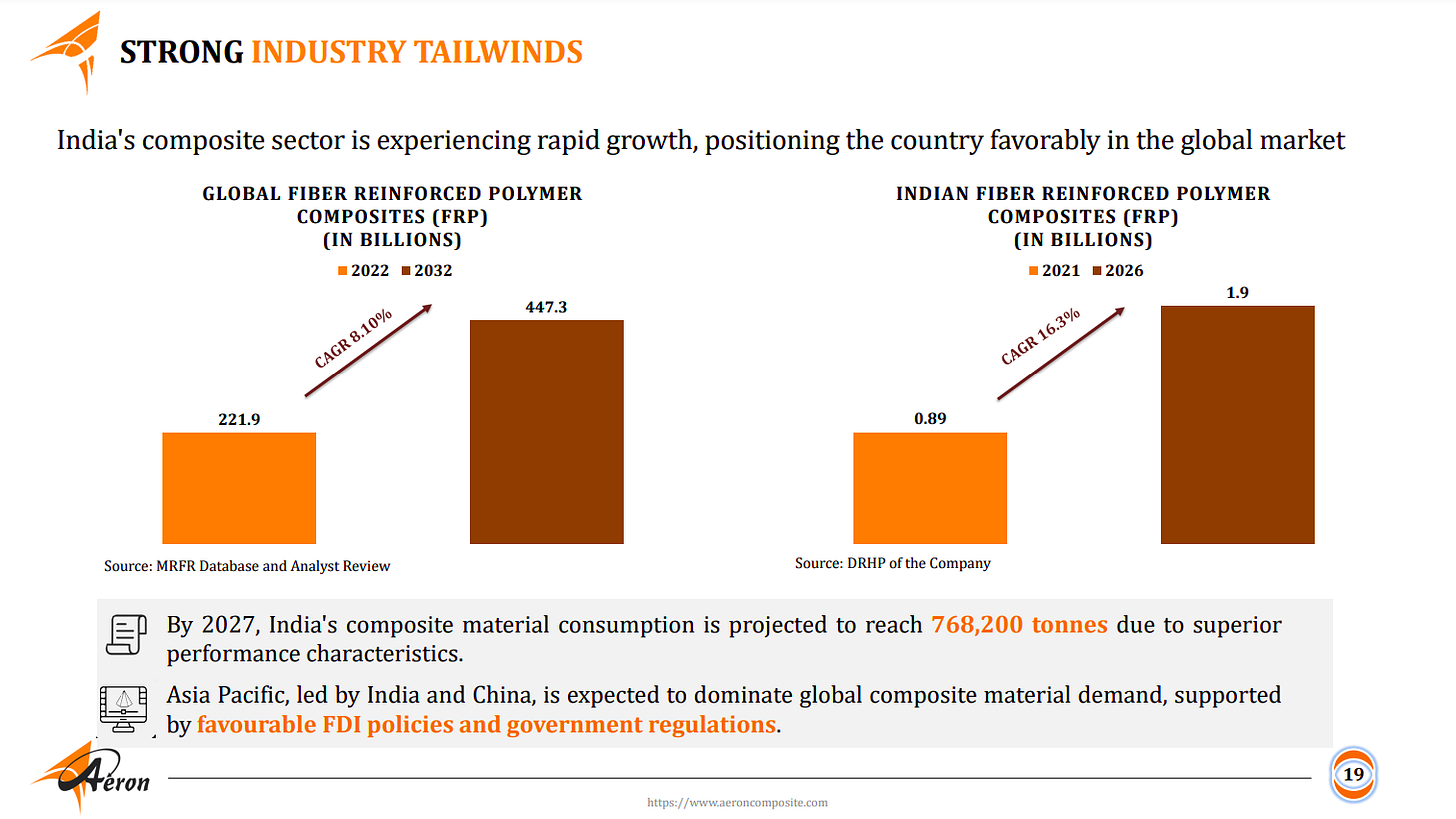

Both global and Indian FRP composite markets are set for strong double-digit growth, supported by better performance characteristics and rising consumption. India is emerging as a major demand hub, helped by favourable FDI policies, government support, and Asia-Pacific manufacturing leadership.

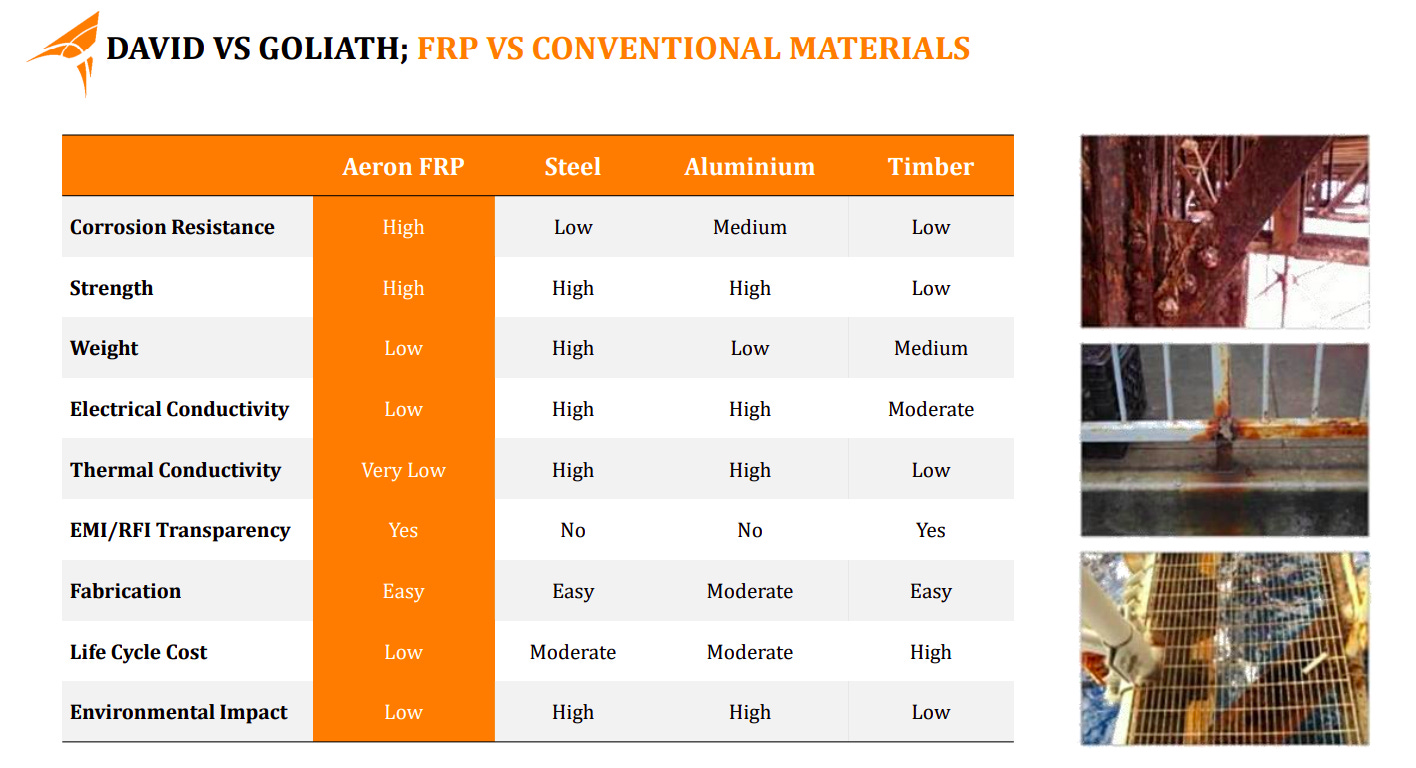

FRP significantly outperforms steel, aluminium, and timber across corrosion resistance, weight, thermal/electrical conductivity, and lifecycle cost. Its ease of fabrication and low environmental impact make it a superior alternative for modern industrial and infrastructure applications.

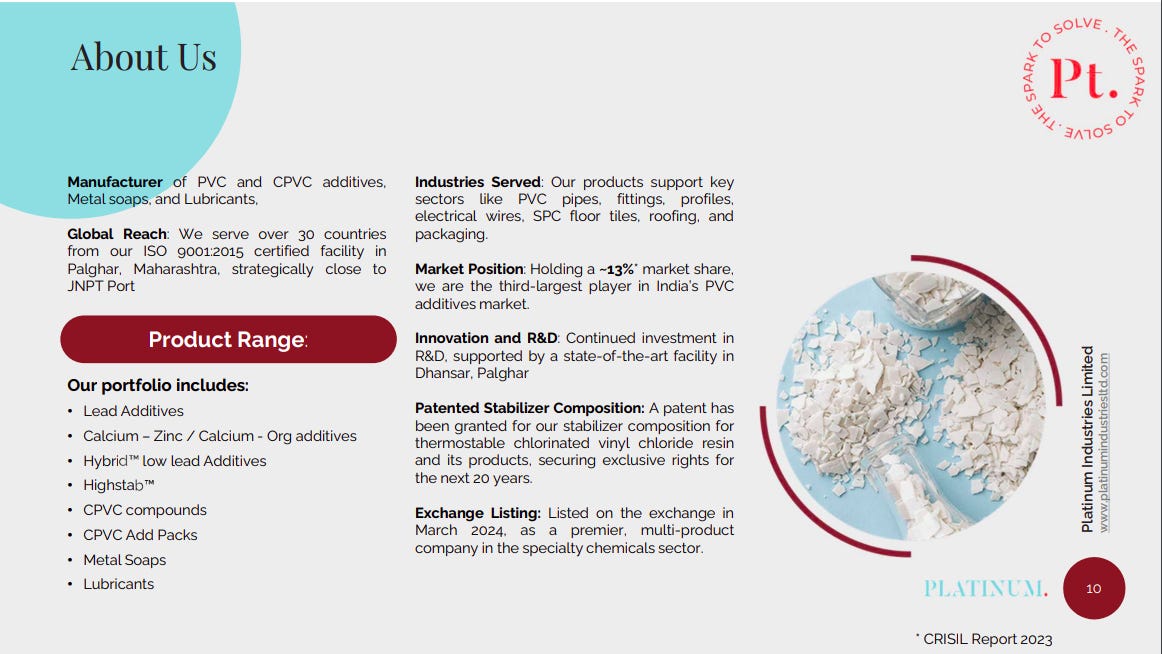

Platinum Industries | Small Cap | Chemicals

Platinum Industries is a multi-product company specializing in the manufacturing of stabilizers such as PVC stabilizers, CPVC additives, and lubricants. Their products cater to various applications like PVC pipes, fittings, electrical wires, SPC floor tiles, and more within the speciality chemicals industry.

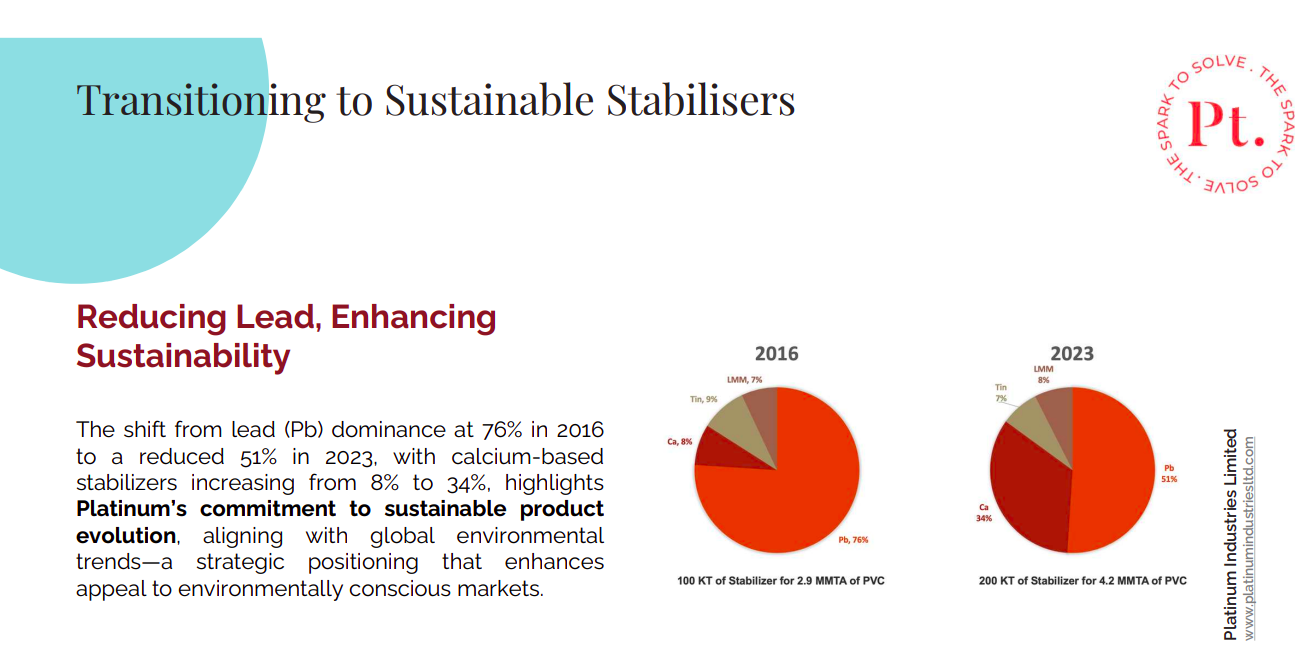

The slide highlights the industry’s shift away from lead-based stabilizers, with Pb share reducing from 76% in 2016 to 51% in 2023 and calcium-based stabilizers rising sharply. This reflects Platinum’s commitment to sustainable, eco-friendly product evolution aligned with global environmental trends.

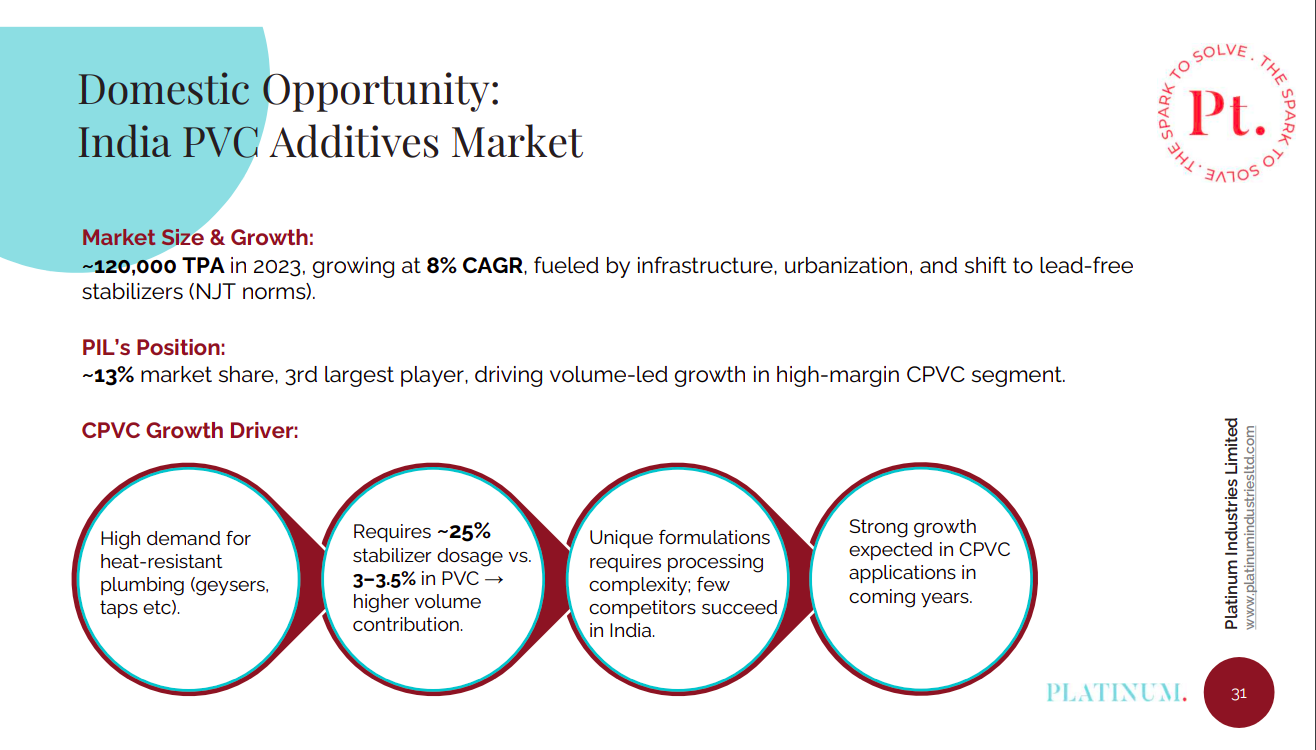

India’s PVC additives market is ~120,000 TPA growing at 8% CAGR, driven by urbanization, infrastructure growth, and a shift to lead-free stabilizers. With ~13% market share, Platinum is the 3rd largest player, well-positioned to capture high-margin CPVC growth supported by strong end-use demand and complex formulations.

The calcium-based stabilizer market is expected to grow from USD 1B (2022) to USD 1.3B by 2029, supported by global sustainability push. Platinum leads with eco-friendly solutions, strong R&D, and products that reduce toxic emissions by up to 60%, serving 30+ countries across multiple industries.

Platinum Industries manufactures PVC/CPVC additives, metal soaps, and lubricants, serving 30+ countries from its ISO-certified Mumbai facility. With ~13% market share and strong R&D backed by patented stabilizer technology, the company is one of India’s top PVC additive players and a newly listed specialty chemicals firm.

Energy

Oil India | Mid Cap | Energy

Oil India Limited (OIL) is a prominent Exploration & Production company in the oil and gas industry, tracing its origins back to the significant oil discovery in India in 1889. As a Maharatna Company under the Government of India, OIL plays a key role in the exploration, development, and production of crude oil, natural gas, LPG, along with activities in transportation and renewable energy generation.

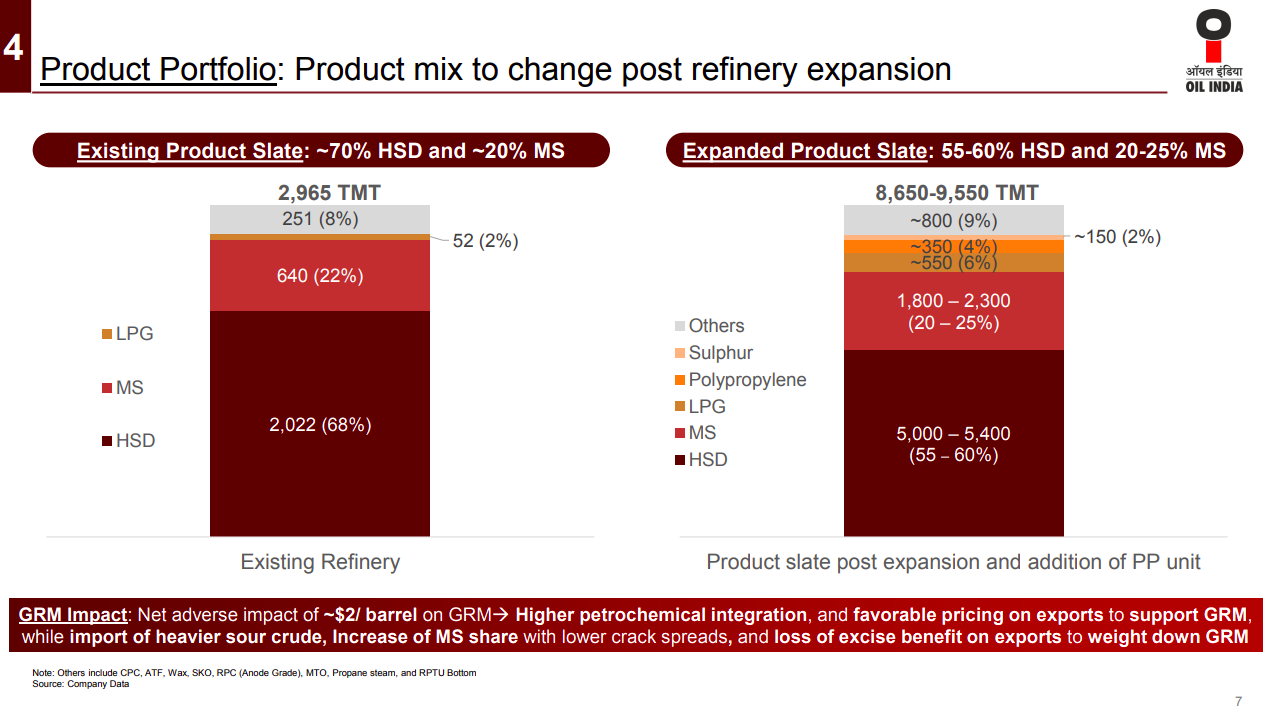

Oil India’s product slate will shift significantly after refinery expansion, reducing HSD share from ~70% to ~55–60% and increasing MS to ~20–25%. New revenue streams like polypropylene, sulphur and other petrochemicals get added, improving integration. GRM impact remains mixed: higher petrochemical integration and export pricing help, while heavier crude imports and loss of excise benefits drag margins.

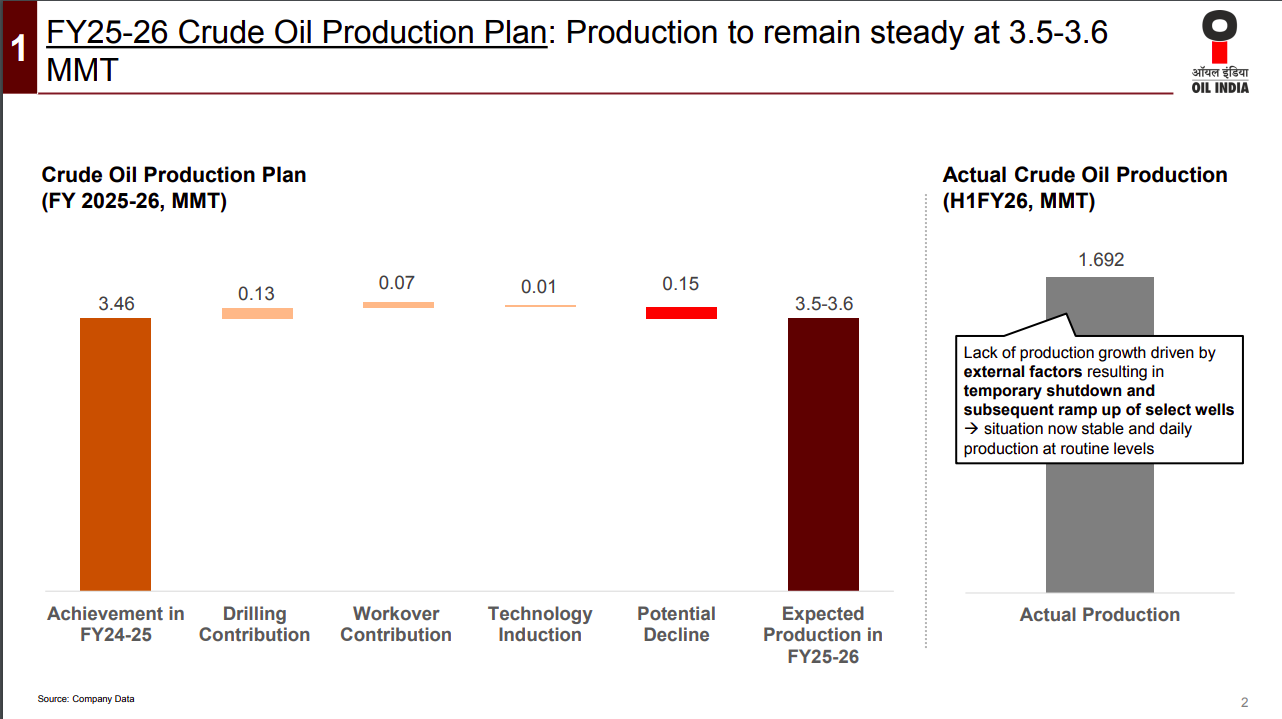

Oil India expects crude output to remain steady at 3.5–3.6 MMT despite marginal gains from drilling, workover and new technology. A planned 0.15 MMT decline offsets part of the improvement, keeping production broadly flat. Actual H1FY26 output (1.692 MMT) was affected by temporary shutdowns, but operations have now stabilised.

Neyveli Lignite | Small Cap | Energy

NLC India Limited is a Navratna Government of India Enterprise, under the administrative control of Ministry of Coal. The company is engaged in the business of mining of Lignite, Coal and generation of power by using lignite as well as Renewable Energy Sources and consultancy. The company possesses an extensive heritage and has played a substantial role in advancing the mining and energy sector, thereby bringing illumination to millions of People throughout the Nation.

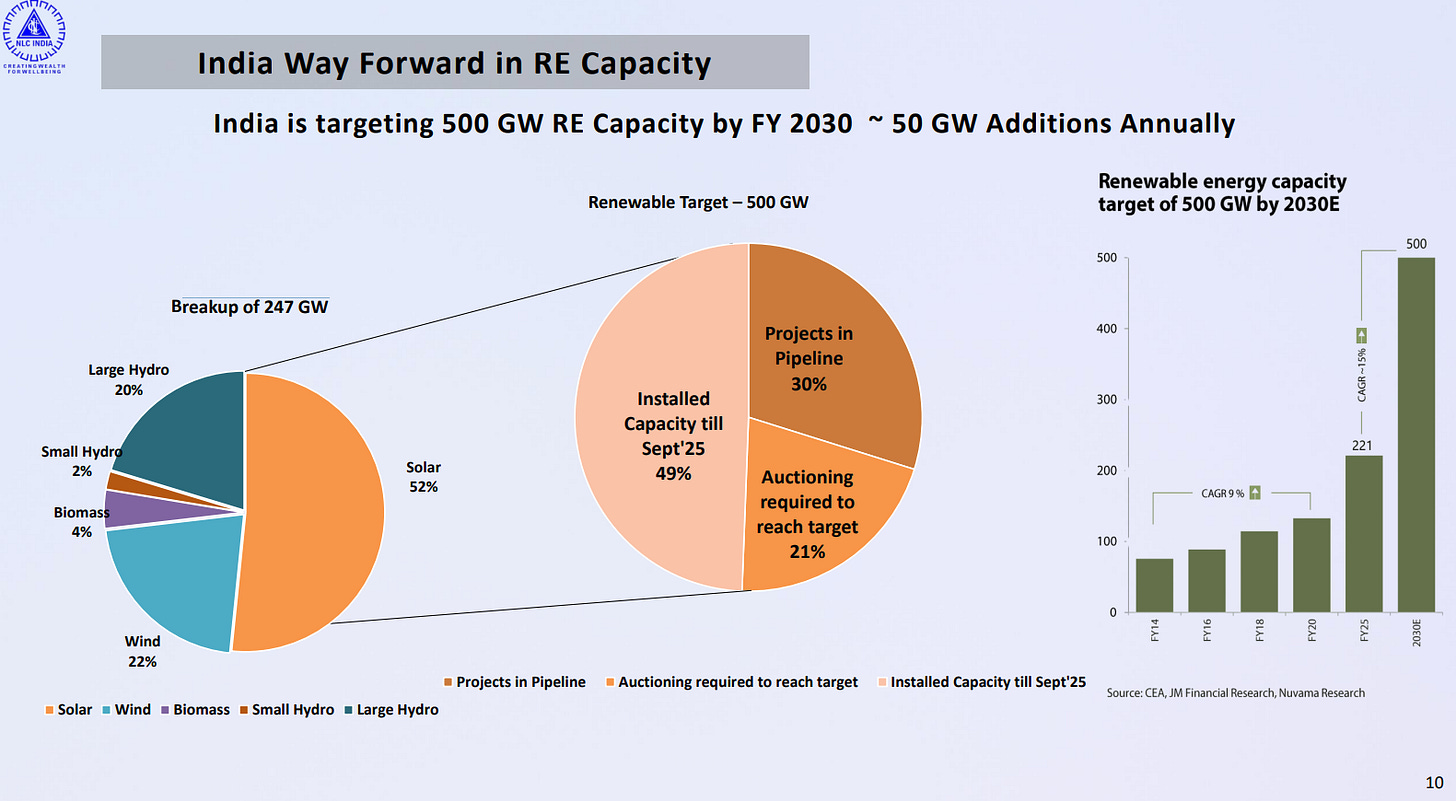

India is targeting 500 GW of renewable energy capacity by 2030, which means adding roughly 50 GW every year. As of September 2025, the country has already installed 247 GW (49% of the target), with another 148 GW in the pipeline (30%), and still needs to auction projects for the remaining 105 GW (21%). Solar dominates the renewable mix at 52%, followed by large hydro at 20% and wind at 22%. The chart shows India has been steadily growing its renewable capacity with a 9% CAGR, moving from around 100 GW in FY16 to an expected 500 GW by 2030.

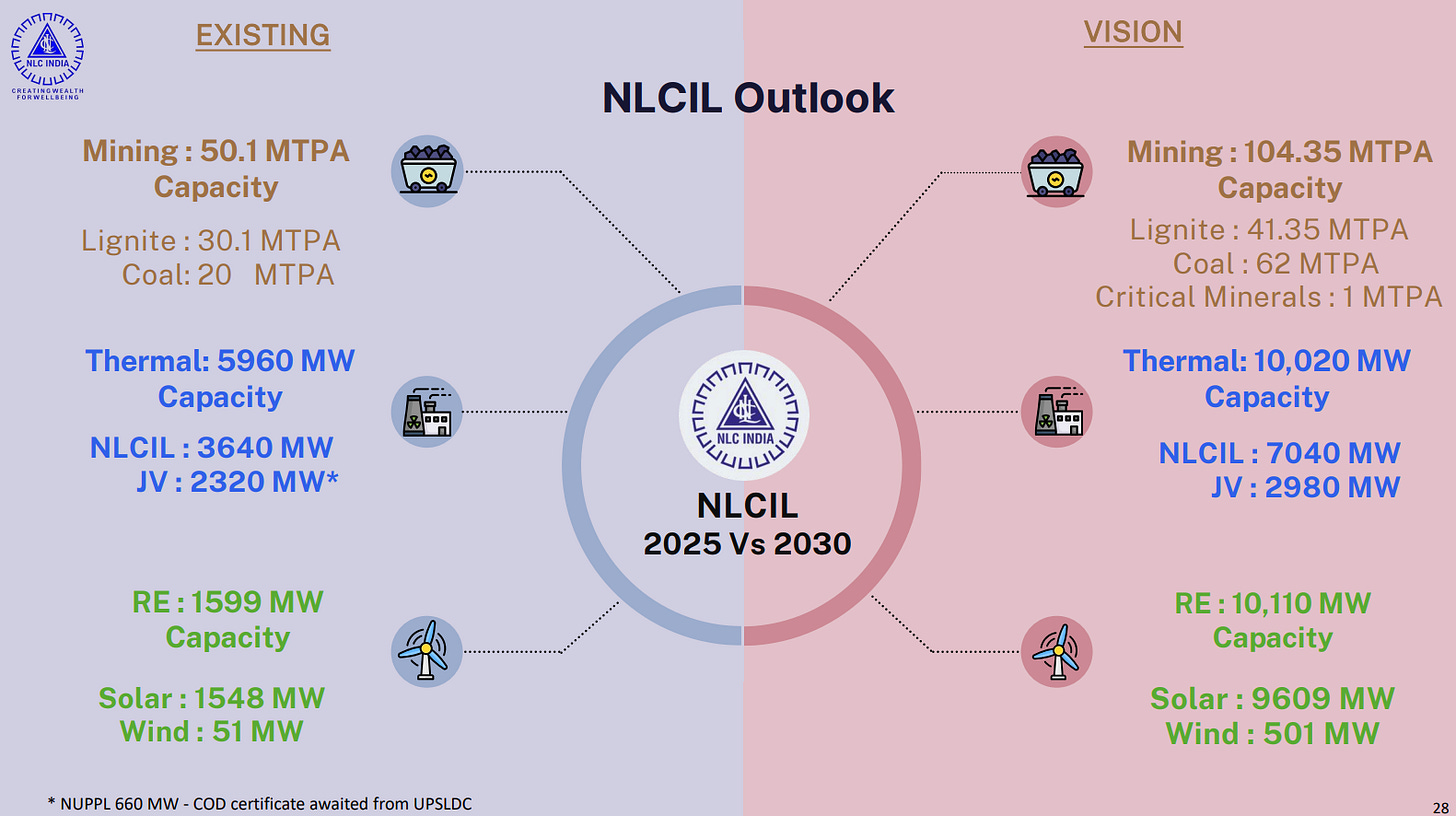

NLC plans to more than double its mining capacity from 50.1 MTPA to 104.35 MTPA (including lignite, coal, and critical minerals). Thermal power capacity will increase from 5,960 MW to 10,020 MW. The most dramatic expansion is in renewables—from 1,599 MW currently to 10,110 MW by 2030, with solar growing from 1,548 MW to 9,609 MW and wind from 51 MW to 501 MW. This represents NLC’s transformation into a more balanced energy company with significant renewable capacity alongside its traditional thermal and mining operations.

Telecom

Tejas Networks | Small Cap | Telecom

Tejas Networks Limited specializes in designing, developing, and selling high-performance products to various industries including telecommunications service providers, internet service providers, utility companies, defense companies, and government entities. Their products are utilized in high-speed communication networks for carrying voice, data, and video traffic over optical fiber, offering programmable software-defined hardware architecture for easy development and upgrades. The company’s products are widely deployed in networks of global network operators across multiple countries.

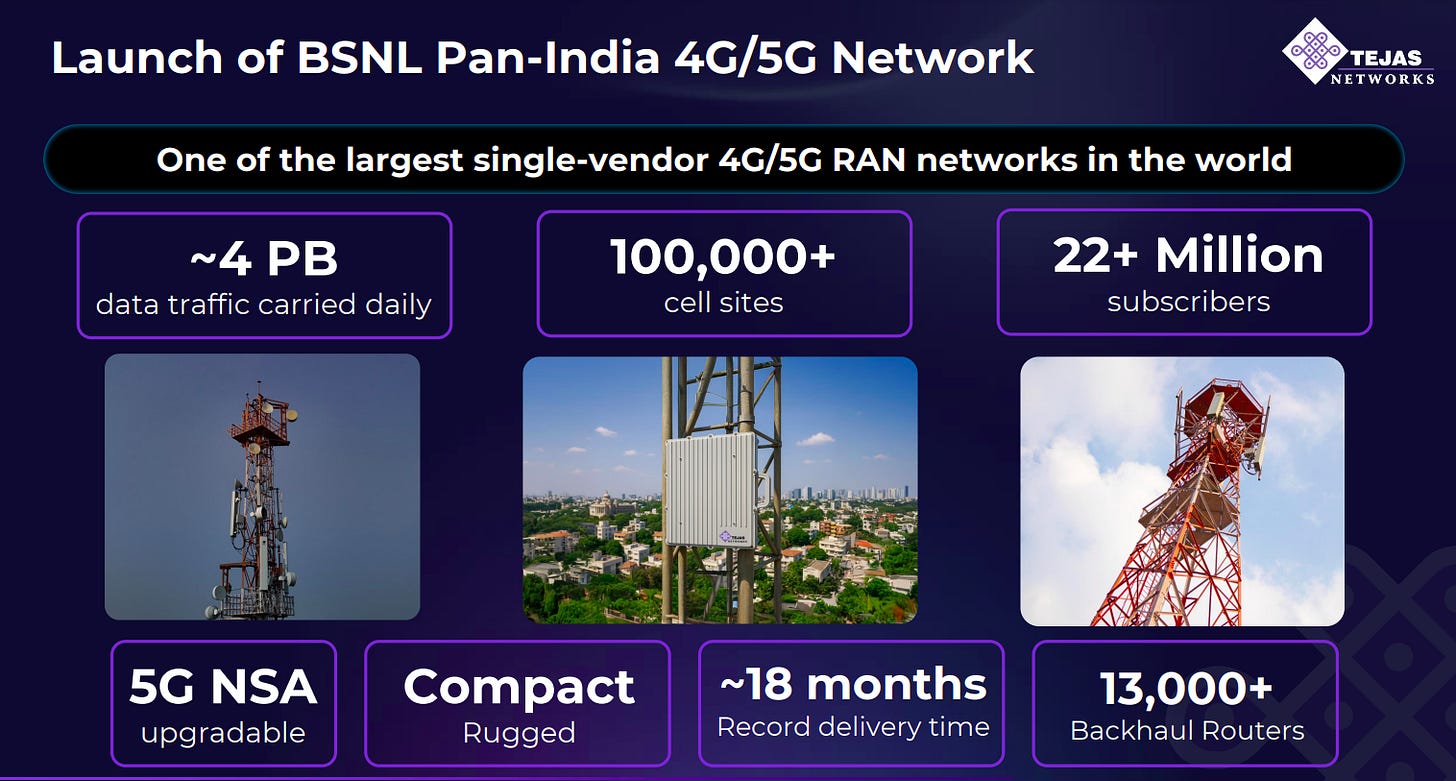

Tejas has deployed one of the world’s largest single-vendor 4G/5G RAN networks for BSNL, powering 4PB+ daily traffic across 100,000+ cell sites. The rollout supports 22M+ subscribers with 13,000+ backhaul routers, compact rugged hardware, and 5G-ready architecture delivered within ~18 months.

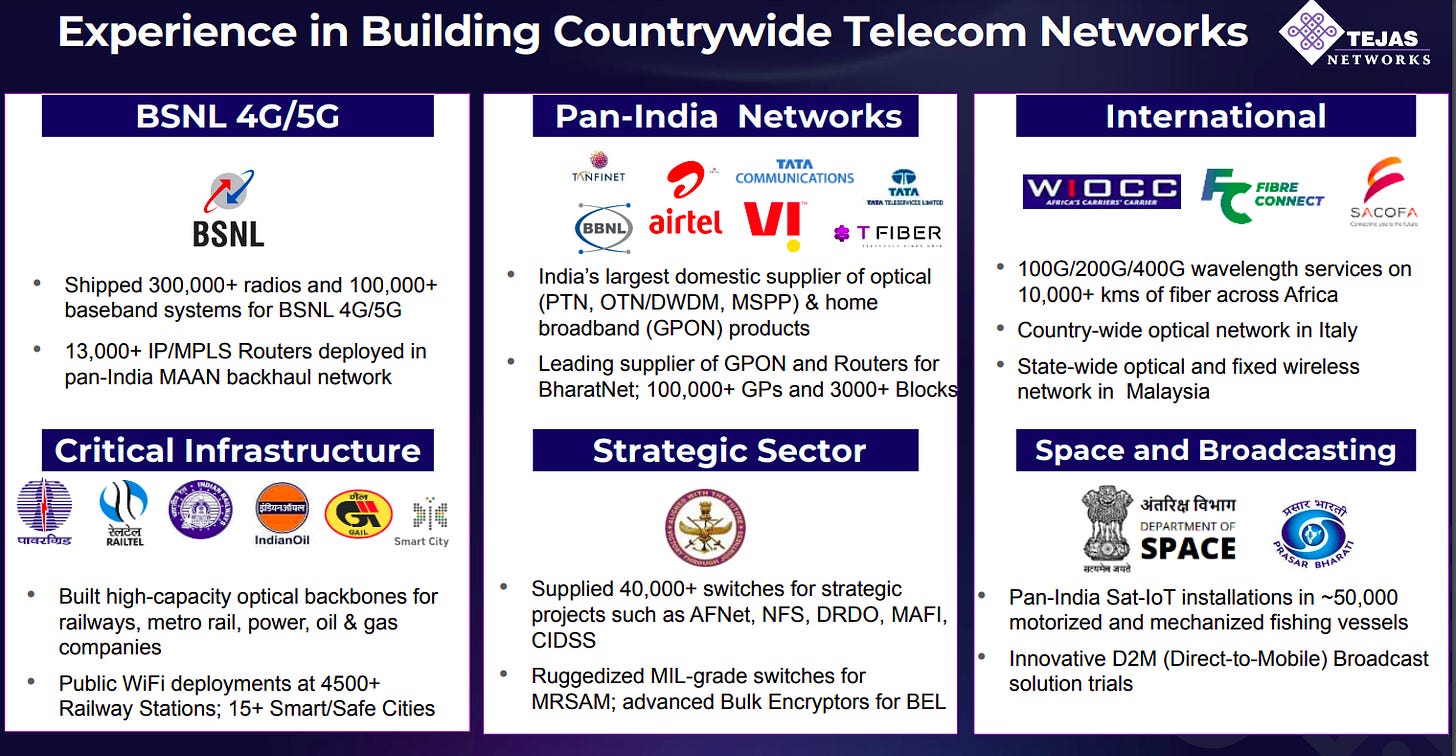

Tejas serves BSNL, private telcos, and global operators with radios, routers, GPON, OTN, and DWDM products. Its footprint spans critical infrastructure (railways, power, oil & gas), strategic defence networks, and international deployments across Africa, Italy, and Malaysia.

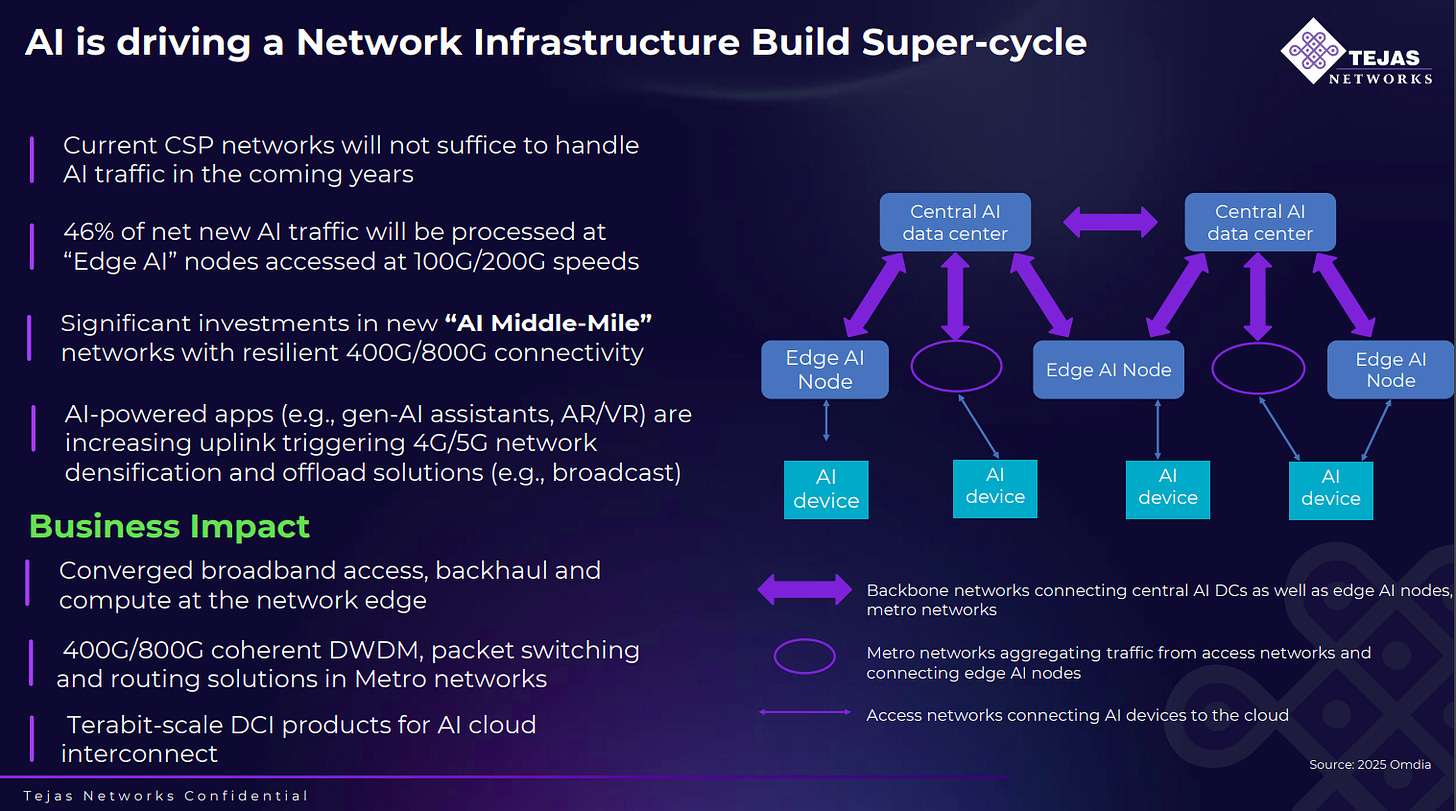

AI workloads will overwhelm legacy networks, pushing demand for new 100G/200G edge nodes and 400G/800G middle-mile connectivity. This drives major investments in metro/backbone networks, boosting demand for Tejas’ DWDM, packet switching, router, and DCI platforms.

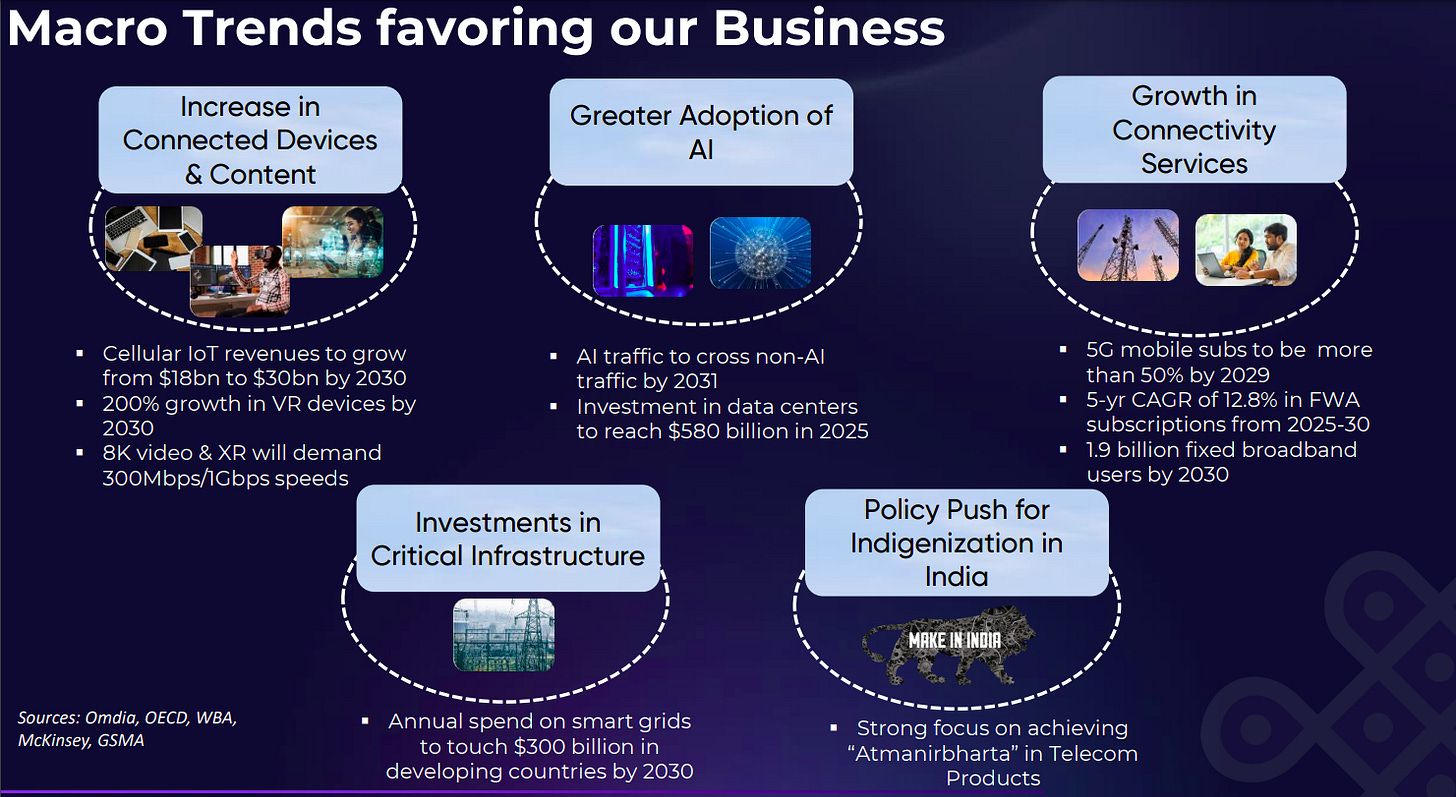

Growth in connected devices, AI adoption, 5G penetration, and fixed broadband is accelerating global bandwidth needs. Rising infrastructure investment and India’s strong indigenization push (Make in India) create a multi-year structural tailwind for Tejas’ networking portfolio.

FMCG

Jubilant Foodworks | Mid Cap | FMCG

Jubilant FoodWorks Limited (JFL) is India’s largest and fastest growing food service company. The company is a food service company and engaged in retail sales of food through two strong international brands, Domino’s Pizza and Dunkin’ Donuts addressing different food market segments.

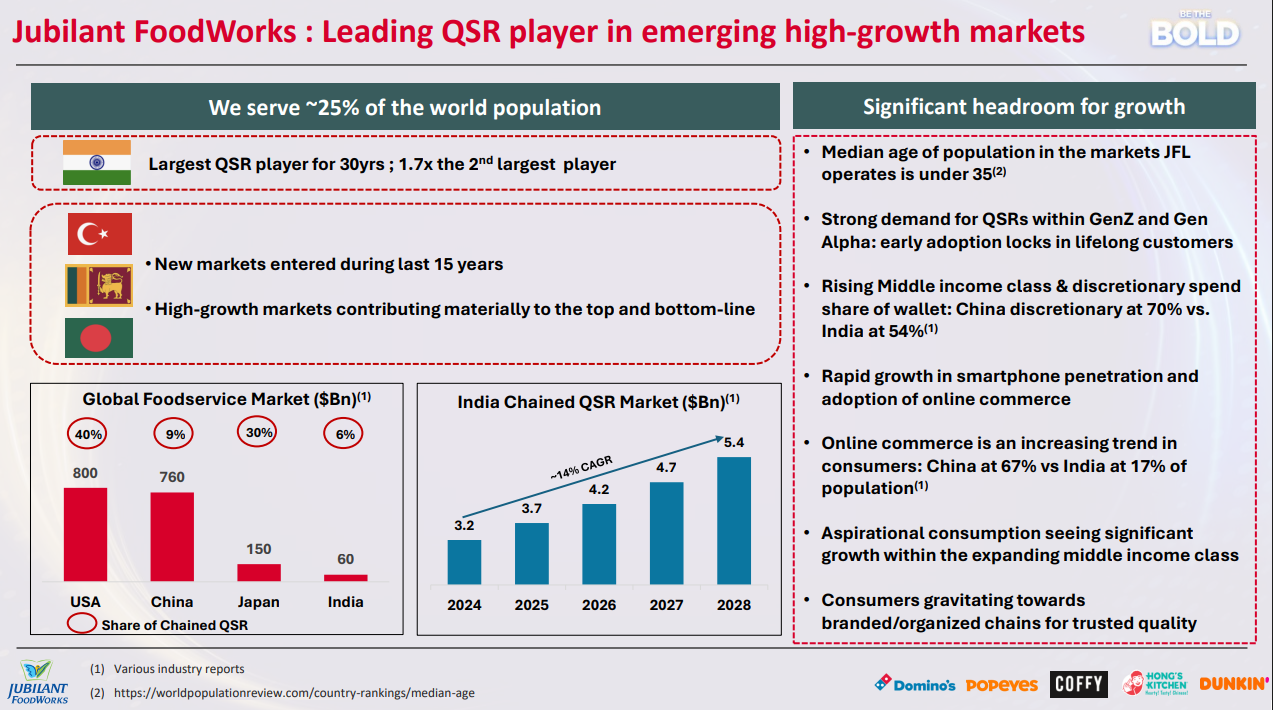

Jubilant FoodWorks operates in large, young, fast-growing markets with strong consumption tailwinds, giving it significant runway for expansion. The global QSR opportunity is huge, India’s chained QSR market is set to nearly double by 2028, and rising incomes, online adoption, and aspirational consumption are driving long-term demand for branded QSR chains.

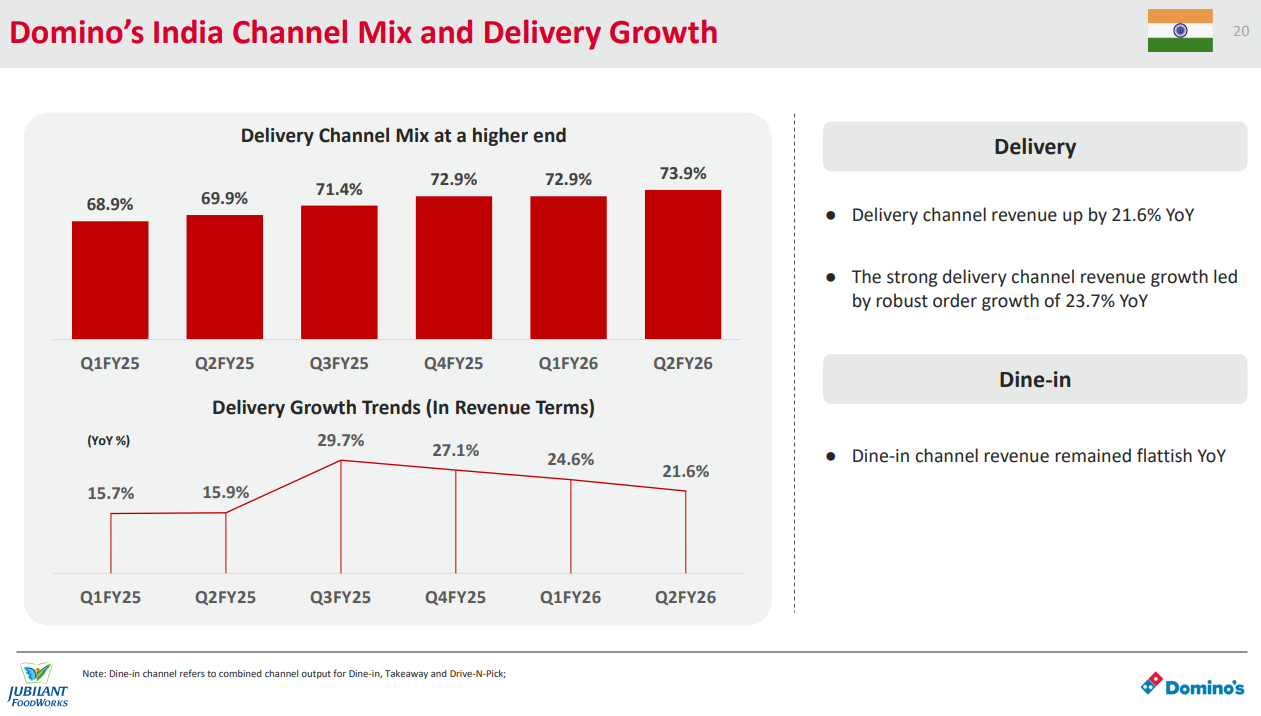

Domino’s business in India is increasingly dominated by delivery, which now makes up nearly three-quarters of all revenue and continues to grow strongly (up 21.6% YoY). Delivery is driving the entire channel mix, while dine-in remains essentially flat.

Westlife Foodworld | Small Cap | FMCG

Westlife Development Limited, is a major player in India’s QSR sector. Through its subsidiary Hardcastle Restaurants Pvt. Ltd., it focuses on setting up and managing QSR outlets. Operating under a master franchisee agreement with McDonald’s Corporation, WDL finances operations and real estate interests, while receiving support from McDonald’s in technical and operational aspects.

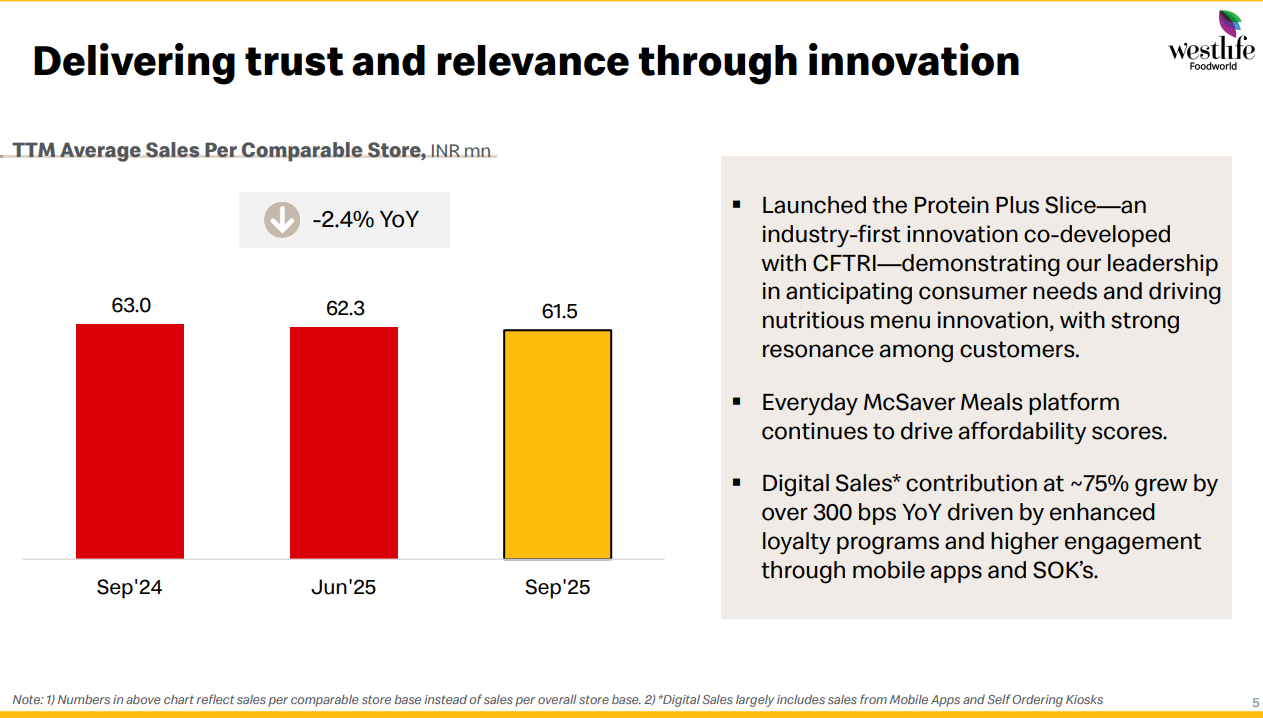

Westlife’s like-for-like sales are basically flat to slightly down, with TTM sales per comparable store drifting from ₹63.0 mn to ₹61.5 mn — signalling negative SSSG rather than growth.

Metals

Hindalco | Large Cap | Metals

Hindalco Industries is a leading company in the aluminium and copper industries. It operates in multiple countries with a variety of established units. The company’s segments include Aluminium, producing hydrate, alumina, aluminum products, and Copper, manufacturing copper rods, cathodes, sulfuric acid, and other products. Hindalco is a major player in the global copper rod market and specializes in high-margin, high-growth specialty alumina products.

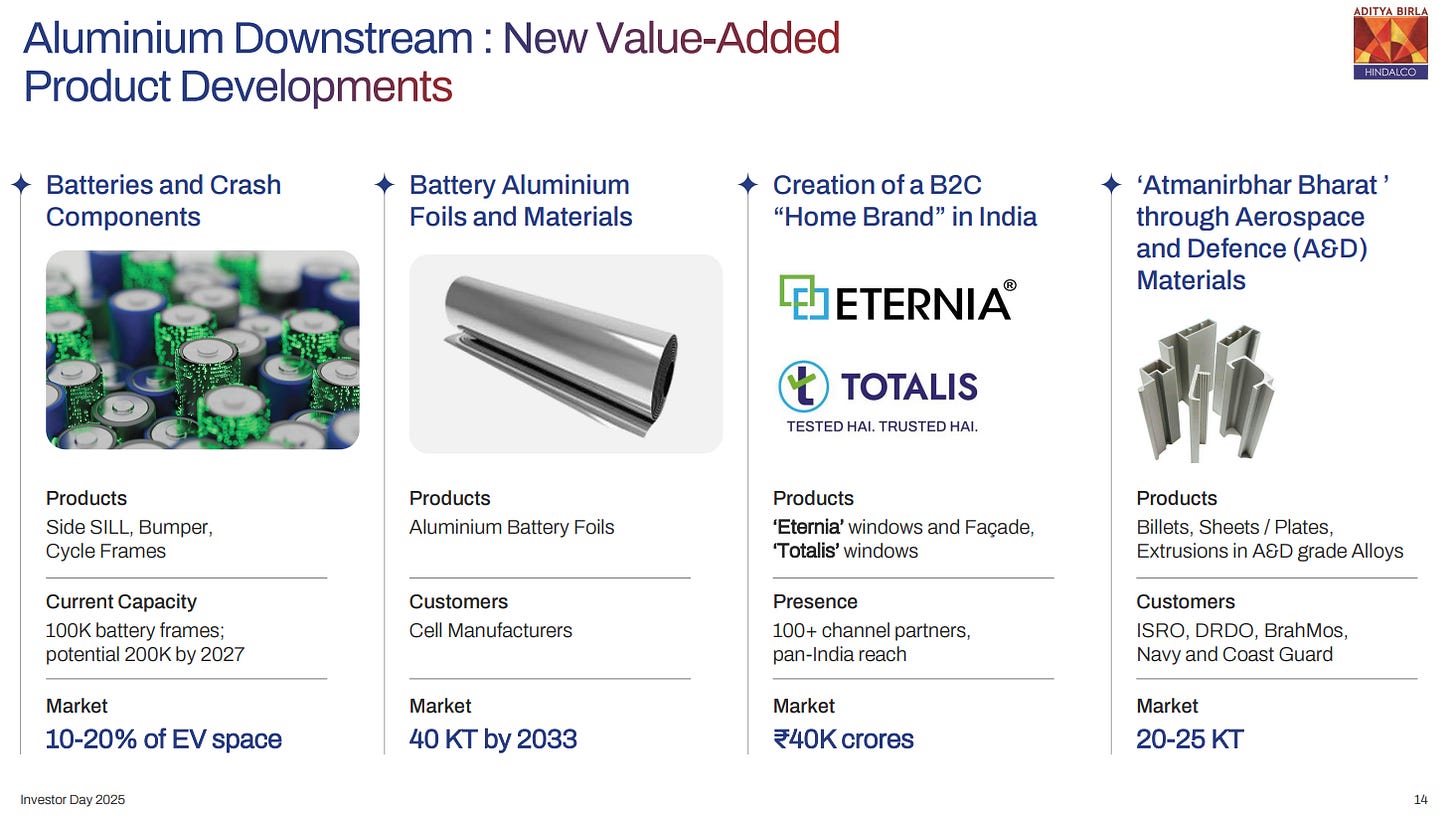

Hindalco is expanding into four new product areas in aluminium downstream. They’re making batteries and crash components for EVs (currently 100,000 battery frames with potential to reach 200,000 by 2027), developing battery aluminium foils for cell manufacturers (targeting a 40 KT market by 2033), creating B2C home brands called ‘Eternia’ and ‘Totalis’ for windows and facades (in a ₹40,000 crore market), and supplying aerospace and defence materials to organizations like ISRO and DRDO (20-25 KT market). These moves show Hindalco’s push into higher-margin, specialized products beyond traditional aluminium.

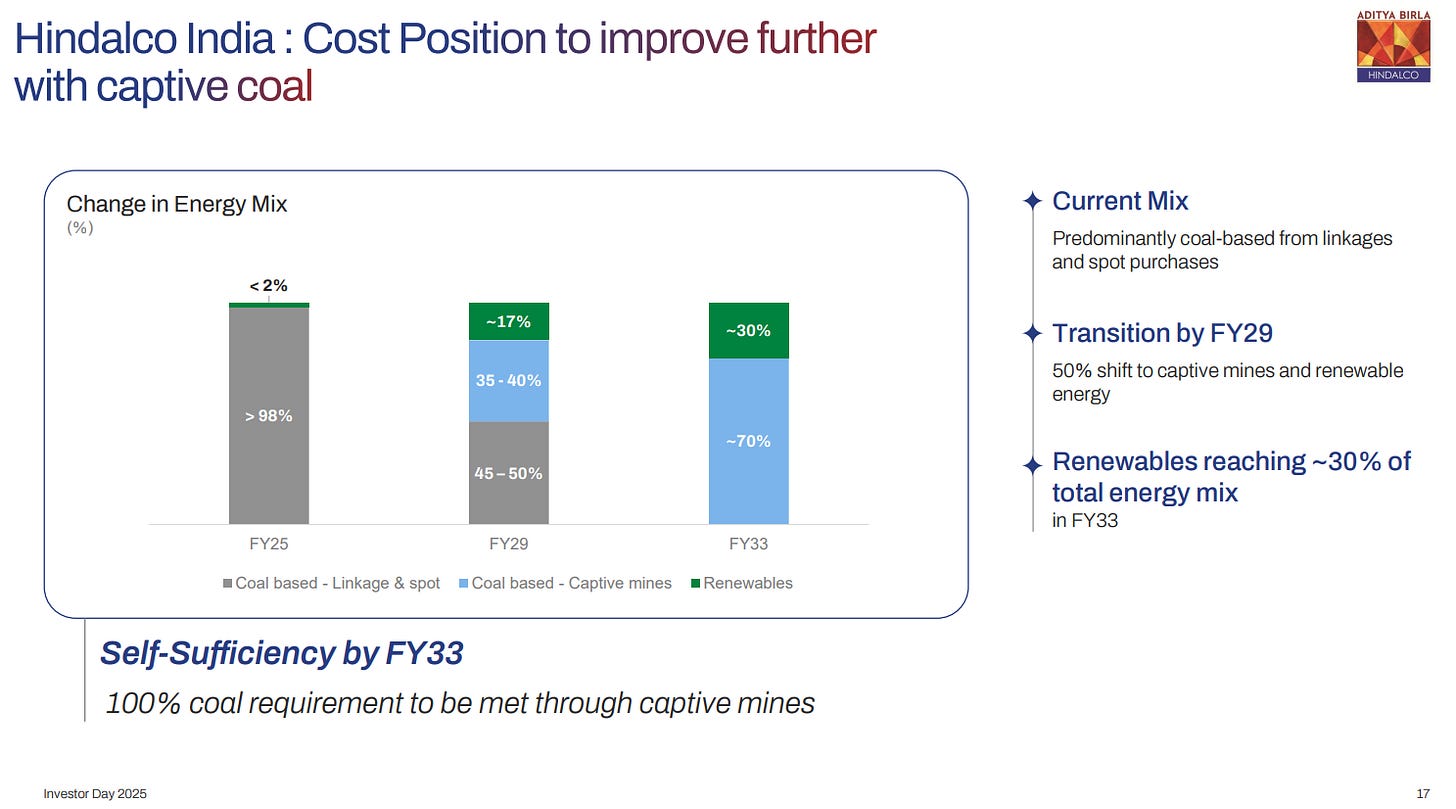

Hindalco is dramatically changing its energy mix to cut costs. Currently, over 98% of their energy comes from coal linkages and spot purchases, with less than 2% from renewables. By FY29, they’ll shift to 45-50% captive coal mines and 35-40% renewables. By FY33, they plan to meet 100% of coal needs through their own captive mines and increase renewables to about 30% of total energy. This shift from buying coal on the market to mining it themselves should significantly improve their cost position and margins.

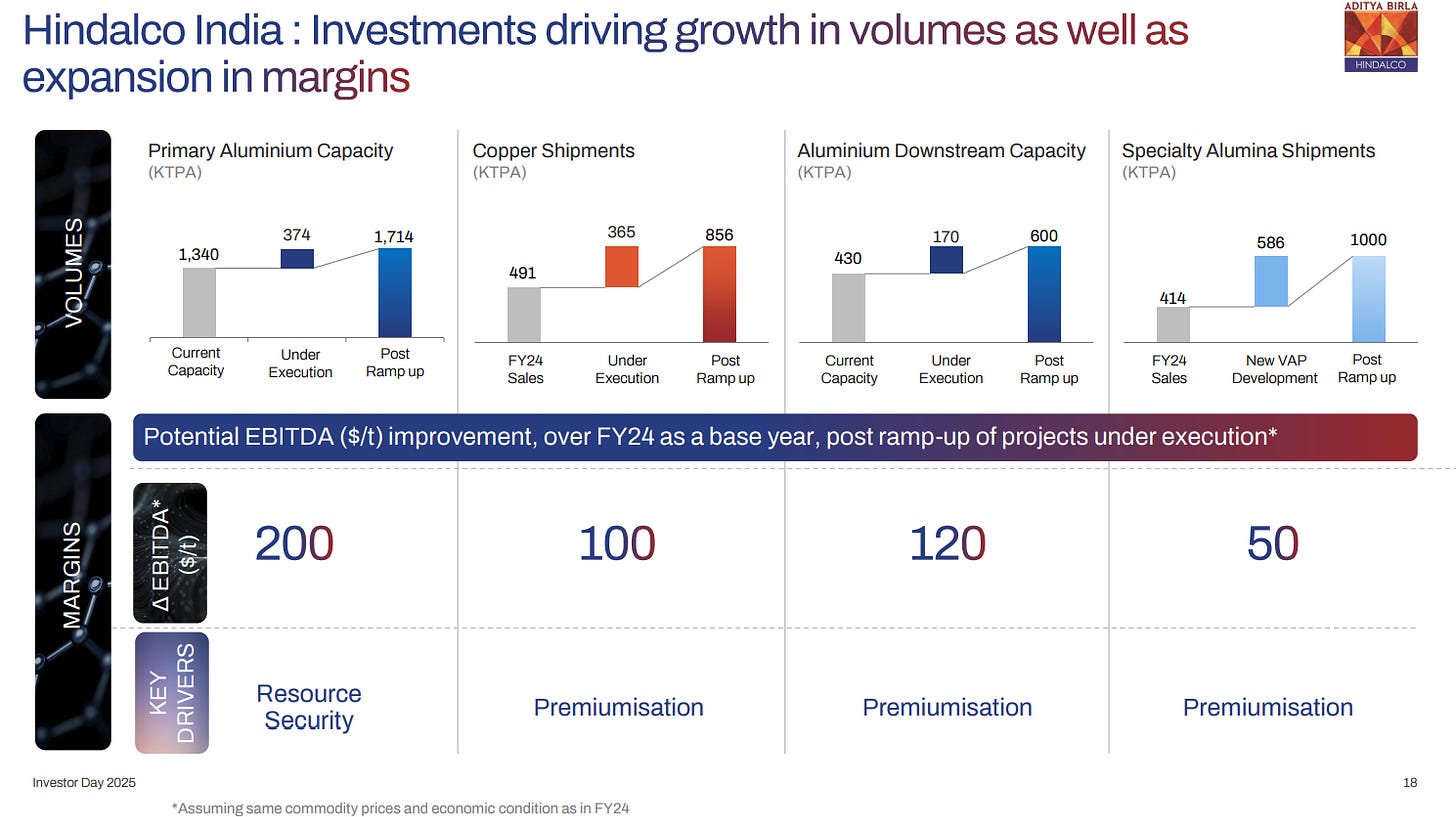

Hindalco’s investments will boost both production volumes and profit margins. Primary aluminium capacity will grow from 1,340 KTPA to 1,714 KTPA (with potential EBITDA improvement of $200/tonne through resource security). Aluminium downstream will expand from 430 KTPA to 600 KTPA ($120/tonne improvement via premiumization), copper shipments from 491 KTPA to 856 KTPA ($100/tonne improvement), and specialty alumina from 414 KTPA sales to 1,000 KTPA ($50/tonne improvement). The key message: their growth projects aren’t just about making more—they’re about making more money per tonne through better products and lower costs.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher, Kashish, Krishna & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.