Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 16 companies across 10 industries.

Engineering & Capital Goods

Nelcast

Dairy Products

Dodla Dairy

Software Services

Route Mobile

Real Estate

Max Estates

Energy

Acme Solar Holdings

Power Grid Corporation of India

GAIL (India)

Adani Power

Financial Services

Niva Bupa Health Insurance

City Union Bank

Retail / FMCG

Westlife Development

Vaibhav Global

Stovekraft

Auto Ancillary

Hyundai Motor India

Tourism & Hospitality

Le Travenues Technology (ixigo)

Building Materials

Ambuja Cement

Engineering & Capital Goods

Nelcast | Micro Cap | Engineering & Capital Goods

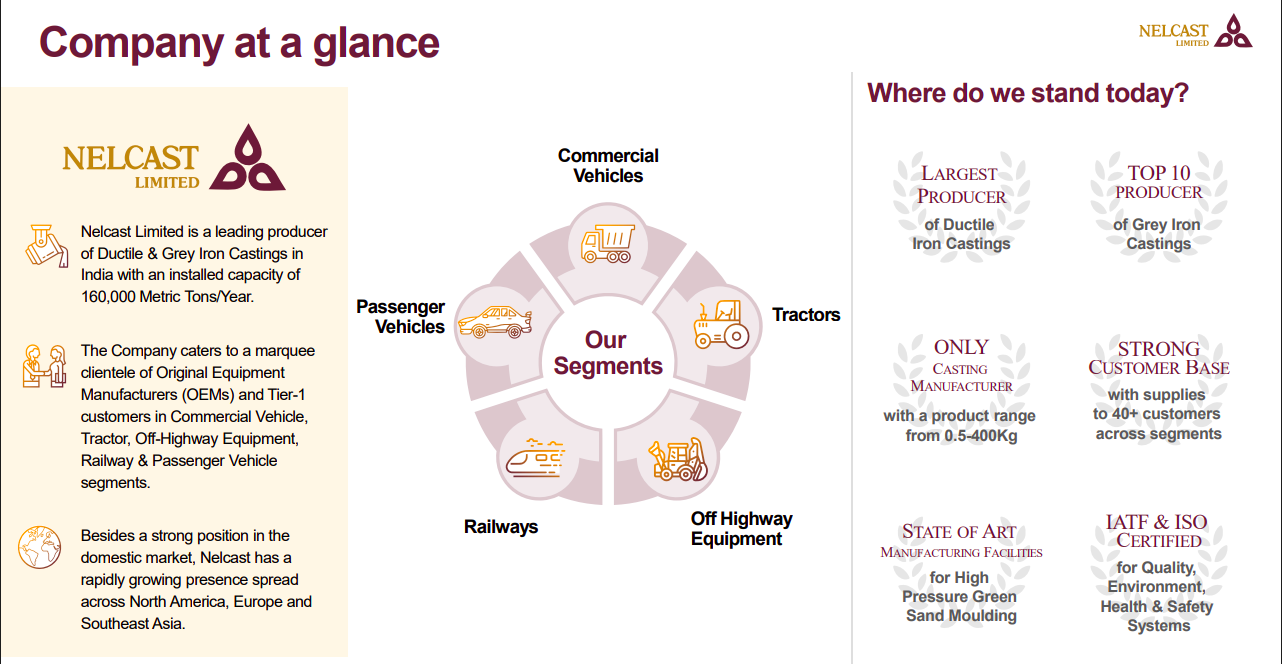

Nelcast is the Largest Jobbing Foundry in India for the manufacturing of Ductile & Grey Iron Castings. The company’s products cater to the Global Automotive, Tractor, Construction, Mining, Railways and General Engineering sectors.

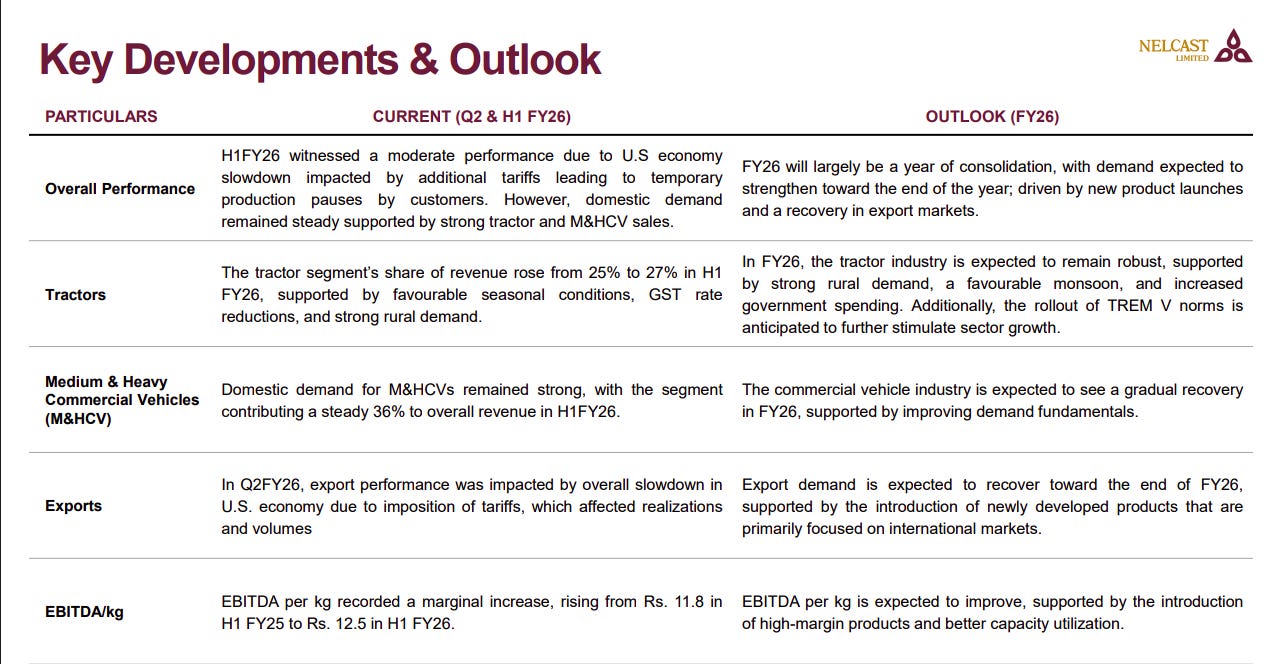

H1 FY26 saw moderate performance due to U.S. slowdown and tariff-related export impact, but domestic demand stayed resilient led by tractors and heavy commercial vehicles. Management expects demand to strengthen in H2 FY26 driven by new product launches, monsoon-supported rural demand, government spending, and recovery in export markets, with EBITDA/kg expected to improve on margin-accretive products and better capacity utilization.

Nelcast is one of India’s largest producers of ductile and grey iron castings with 160,000 TPA capacity, serving leading OEMs across commercial vehicles, tractors, passenger vehicles, off-highway equipment, and railways. It is the largest ductile iron casting producer and a top-10 grey iron casting player, supplying 40+ global customers, backed by state-of-the-art automated foundry technology and ISO/IATF certifications.

Dairy Products

Dodla Dairy | Small Cap | Dairy Products

Dodla Dairy Limited is an integrated dairy company based in south India, with operations across Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, and Maharashtra. They derive revenue from milk and dairy-based VAPs in the branded consumer market.

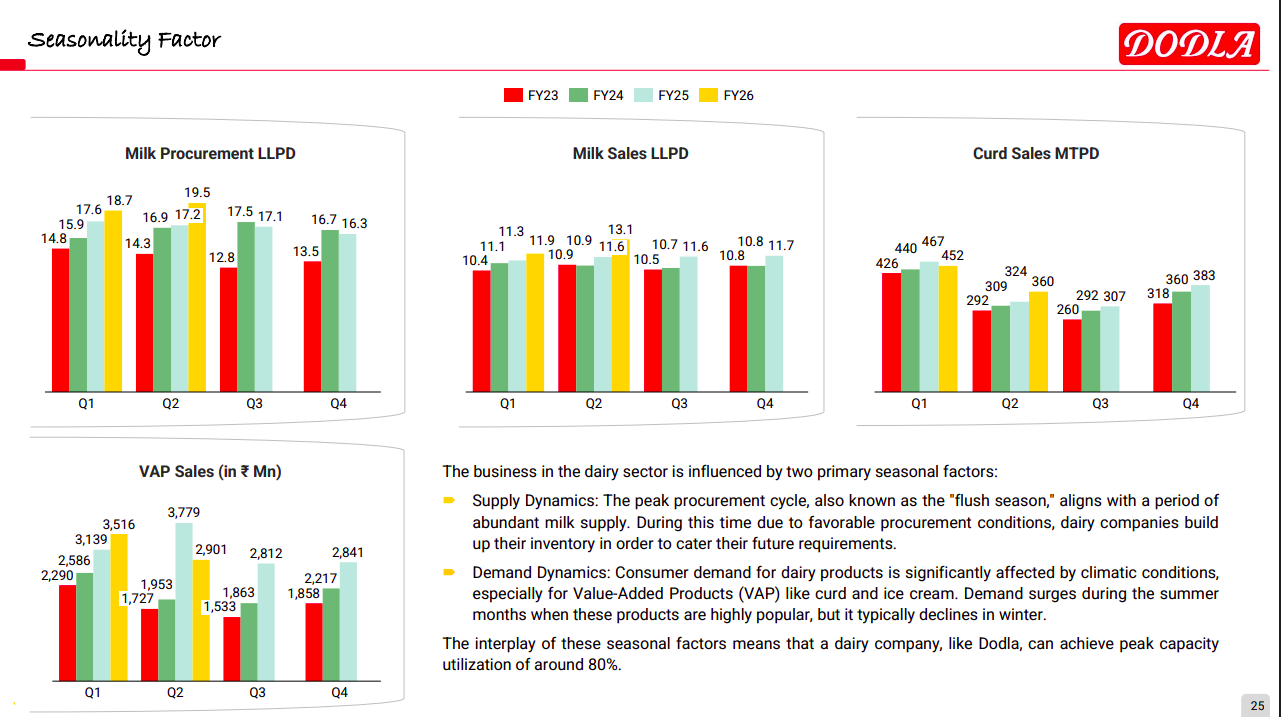

Milk procurement and sales at Dodla follow a clear seasonal pattern, with peak sourcing in Q2 during the flush season and stronger demand for value-added products like curd in summer months. VAP sales typically dip in winter. This seasonality drives capacity utilization trends, with dairy players operating near peak levels (~80%) during high-demand periods.

Software Services

Route Mobile Ltd | Small Cap | Software Services

Route Mobile Limited offers a cloud-communication platform as a service to enterprises and mobile network operators. Their solution integrates front-end and back-end components to access a vast network of MNOs globally for SMS and voice communication. Additionally, the platform supports OTT business messaging and RCS, providing multiple communication channels for enterprises to engage stakeholders effectively.

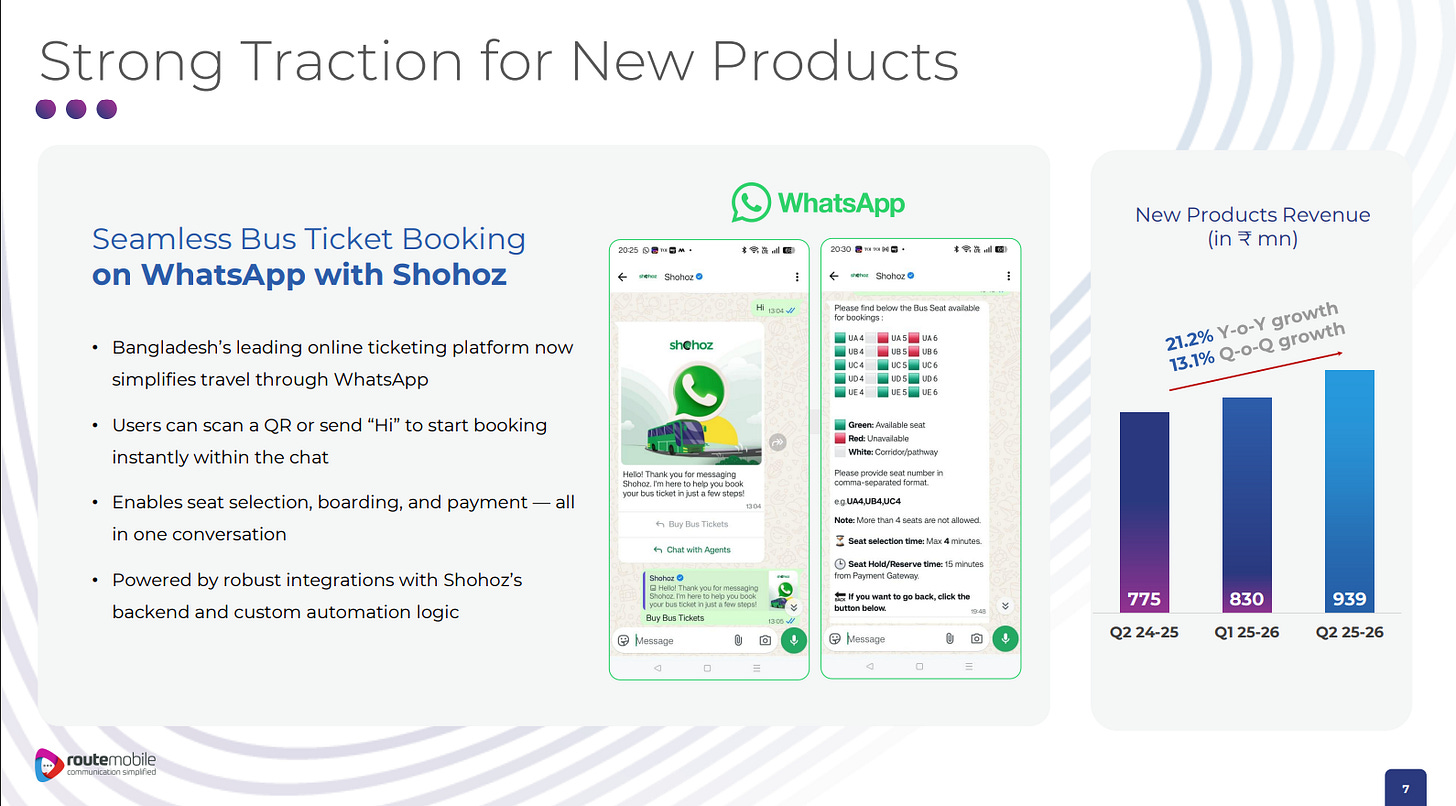

Route Mobile is seeing strong uptake for its new conversational solutions — like this WhatsApp-based ticketing integration with Bangladesh’s Shohoz, which lets users book, pay, and board buses directly within chat. The segment is driving steady momentum, with new product revenue up 21% YoY and 13% QoQ.

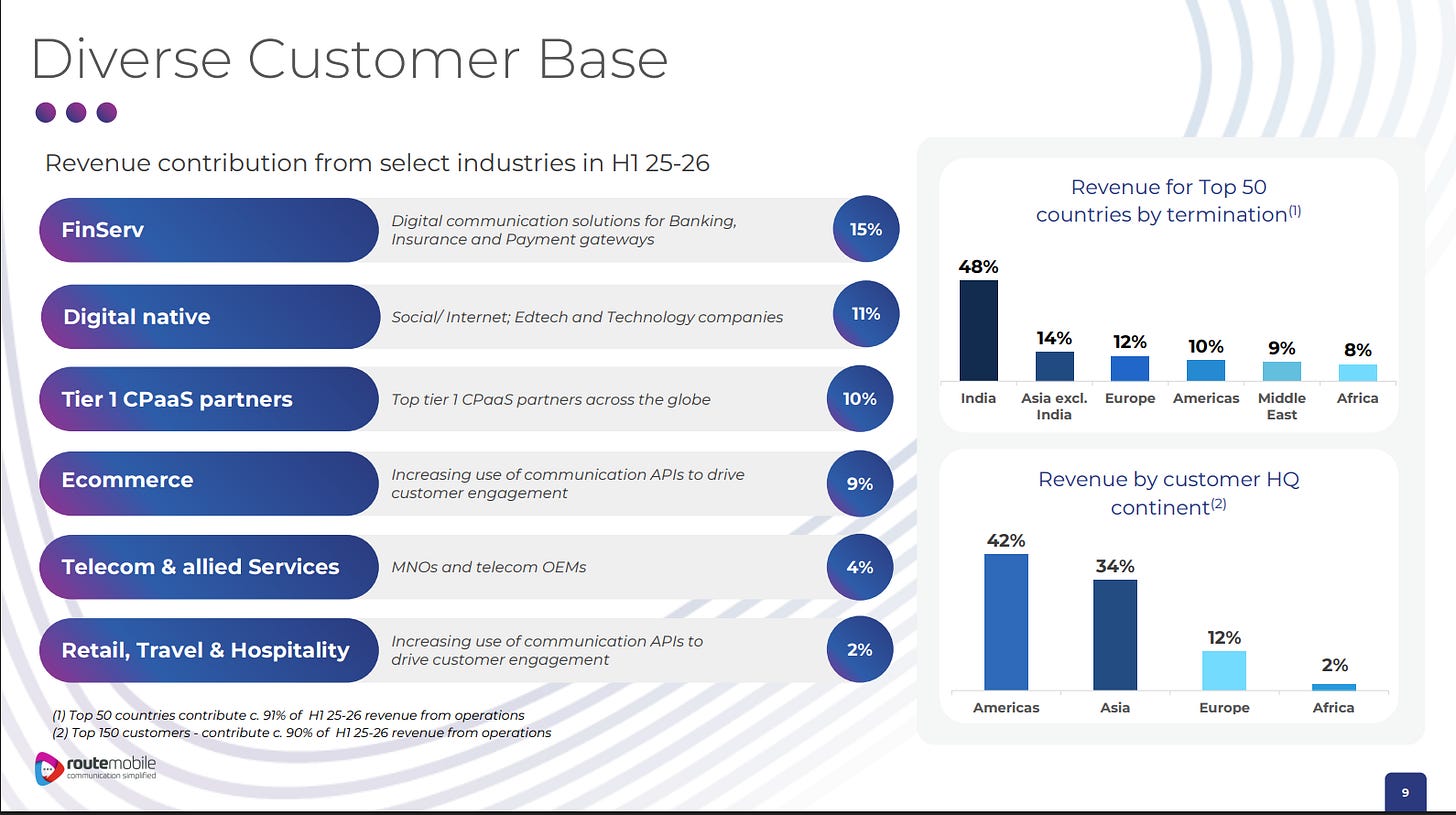

Route Mobile’s customer base spans industries and continents — with financial services, digital-first firms, and global CPaaS partners driving growth. While India contributes nearly half of revenue by termination, the Americas (42%) and Asia (34%) dominate when measured by customer headquarters, underscoring a truly global footprint.

Real Estate

Max Estates | Small Cap | Real Estate

This is the real estate development arm of Max Group. Company is a leading Real Estate player in Delhi - NCR.

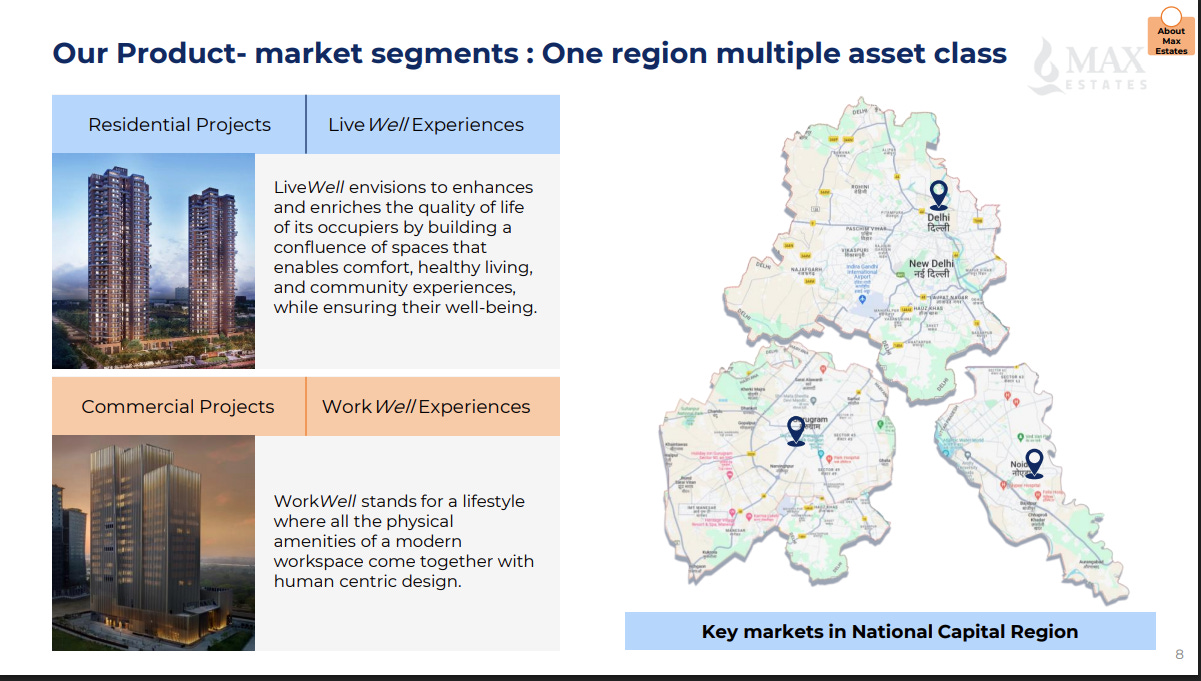

Max Estates is positioning itself as a premium, NCR-focused developer spanning both residential and commercial real estate. Its “LiveWell” and “WorkWell” concepts aim to deliver holistic living and workspace experiences across Delhi, Gurugram, and Noida — combining design, community, and well-being in one ecosystem.

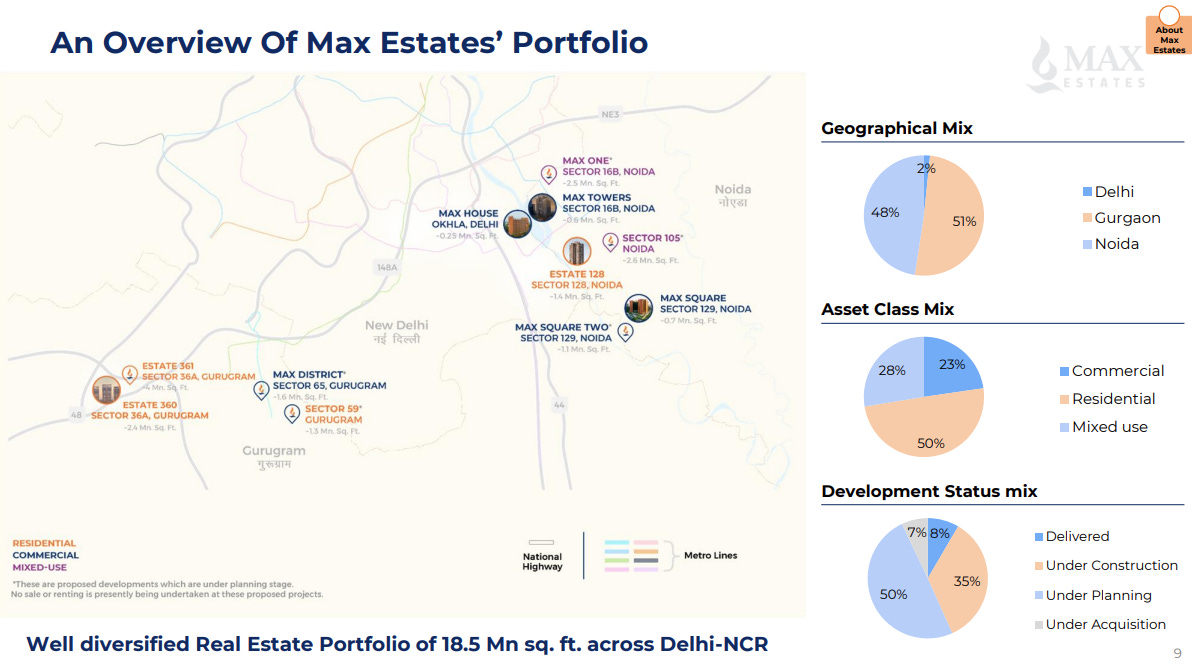

Max Estates’ 18.5 mn sq. ft. NCR portfolio balances geography and asset class — with projects spread across Delhi, Gurugram, and Noida, and an even mix of residential, commercial, and mixed-use developments. Nearly half of its assets are already delivered or under construction, reflecting a steady build-out of its premium real estate pipeline.

Max Estates’ long-standing partnership with New York Life, the largest mutual life insurer in the U.S., has deepened over time — with cumulative commitments now touching ₹1,800 crore across multiple projects. The collaboration underscores steady institutional confidence in Max’s commercial real estate strategy and its NCR-focused growth pipeline.

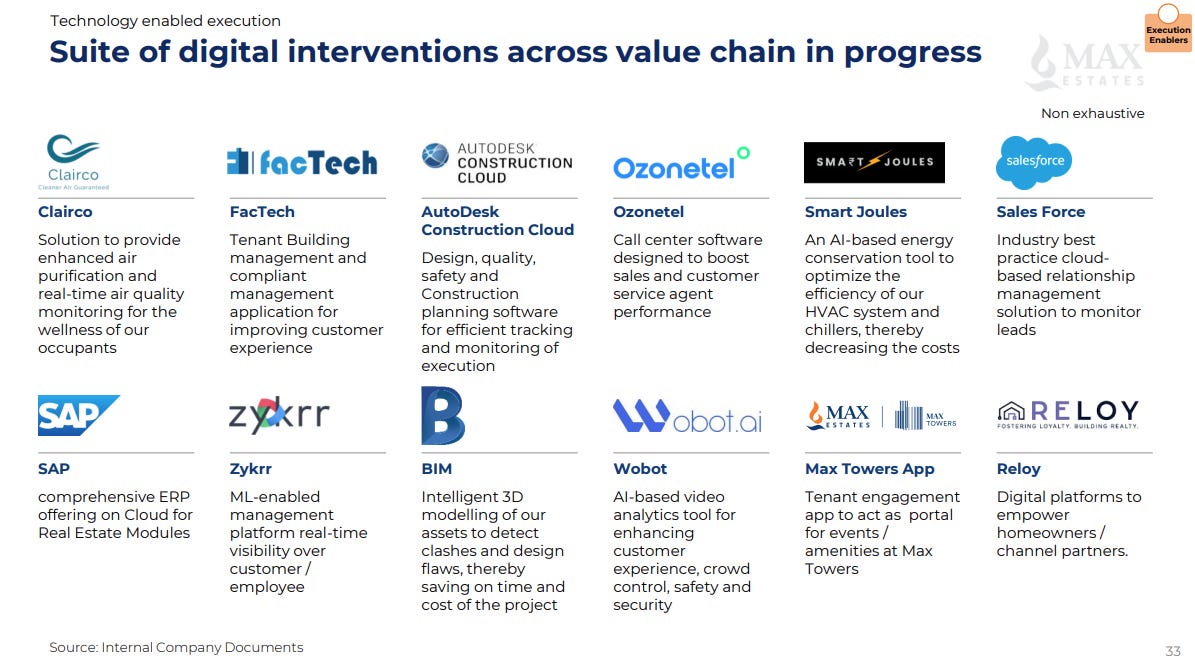

Max Estates is digitising every link in its real estate value chain — from design and construction to tenant engagement and energy efficiency. Its growing tech stack spans tools like SAP, AutoDesk, Smart Joules, Salesforce, and Wobot, reflecting a data-driven approach to building smarter, more efficient spaces.

Energy

Acme Solar Holdings | Small Cap | Energy

ACME Solar Holdings is a leading renewable energy company in India, specializing in solar, wind, hybrid, and firm and dispatchable renewable energy projects. They handle the entire project lifecycle from development to operation and maintenance, generating revenue by selling electricity to government-backed off-takers.

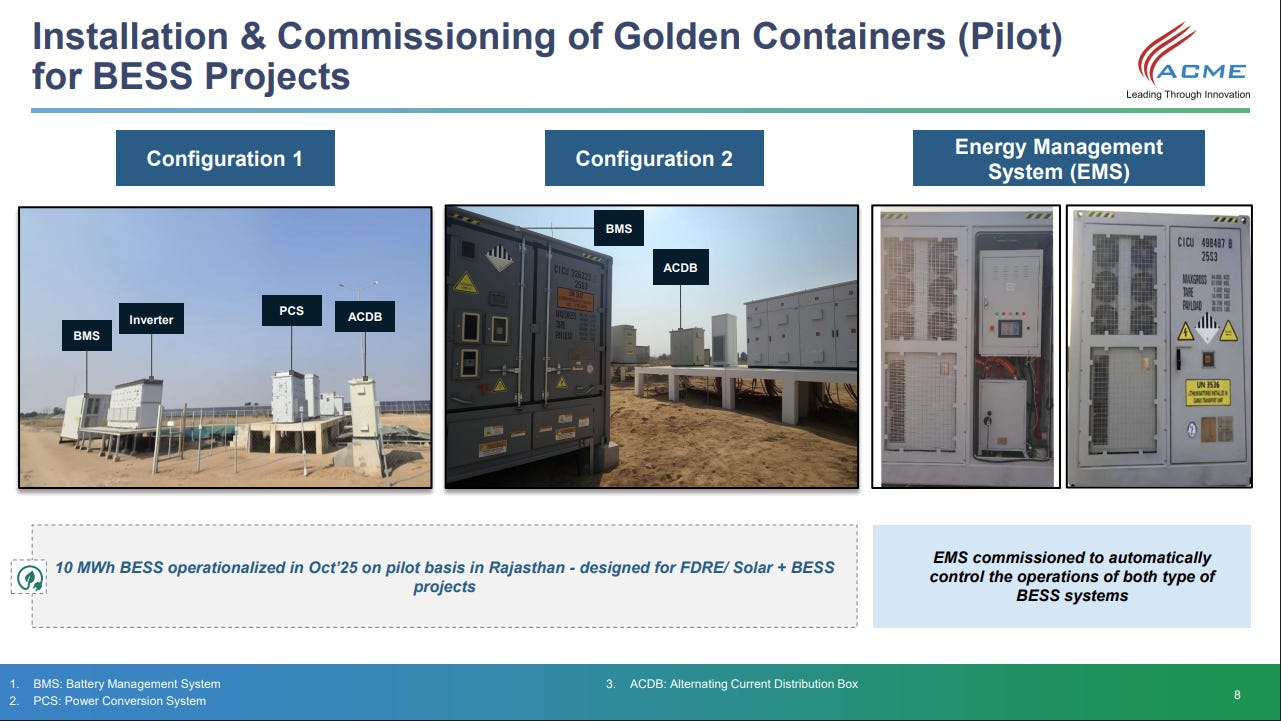

Acme Solar has begun pilot operations for its 10 MWh Battery Energy Storage System (BESS) in Rajasthan — a key step toward integrating storage with solar and renewable projects. The setup, featuring dual configurations and an automated Energy Management System, marks progress in optimizing hybrid power operations for future large-scale deployment.

Power Grid Corp | Large Cap | Energy

Power Grid Corporation Of India operates a transmission network for power distribution and has diversified into telecom services by utilizing its transmission infrastructure. The company also offers consultancy services in areas such as power transmission, sub transmission, and distribution management.

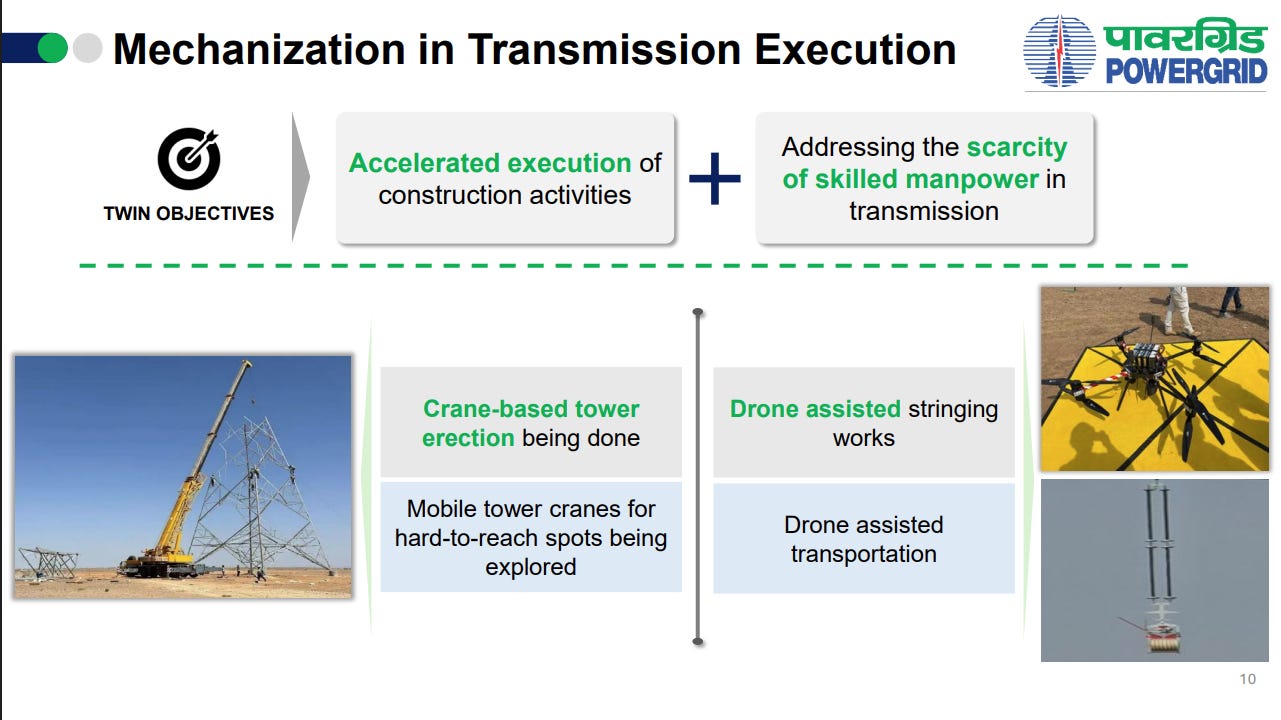

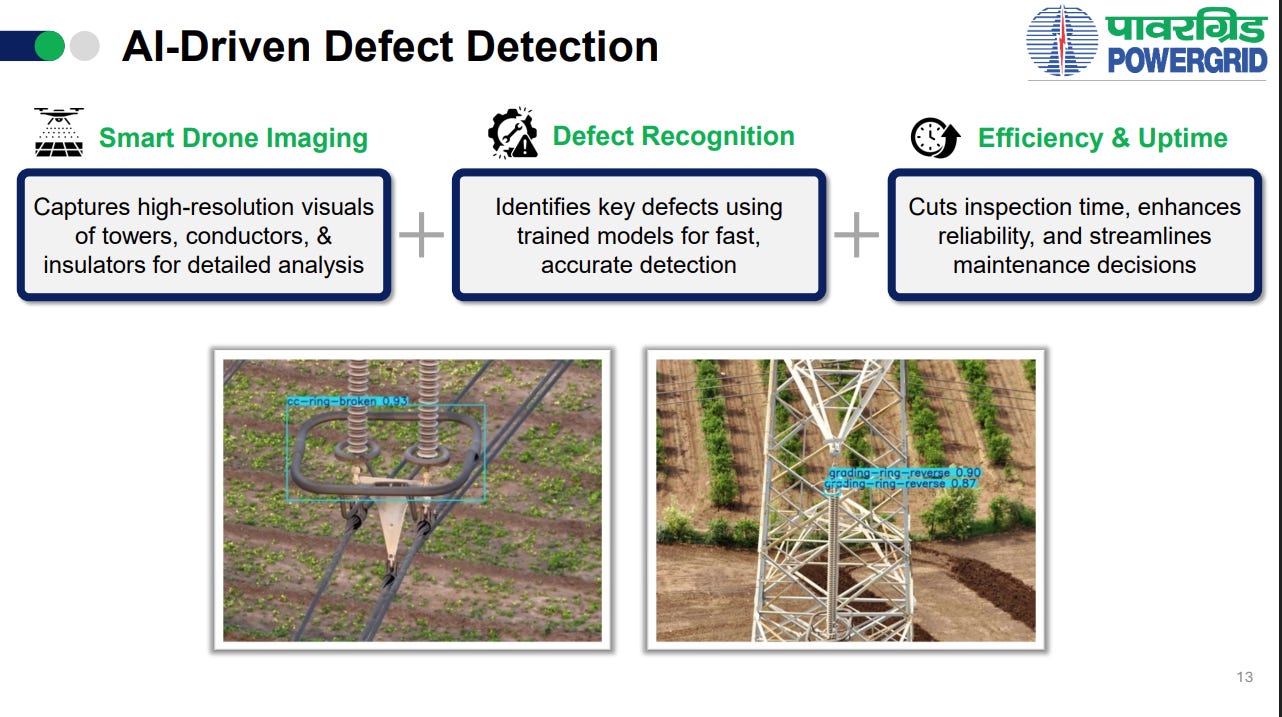

Power Grid is accelerating transmission execution through technology — from crane and drone-assisted tower construction to AI-driven defect detection. These digital tools are cutting inspection times, easing manpower challenges, and improving reliability across India’s power infrastructure network.

GAIL (India) | Large Cap | Energy

GAIL (India) is the country’s largest state-owned natural gas company, involved in gas processing, transmission, and distribution. It also engages in LPG production, petrochemicals, oil and gas exploration, renewable energy, and green hydrogen projects.

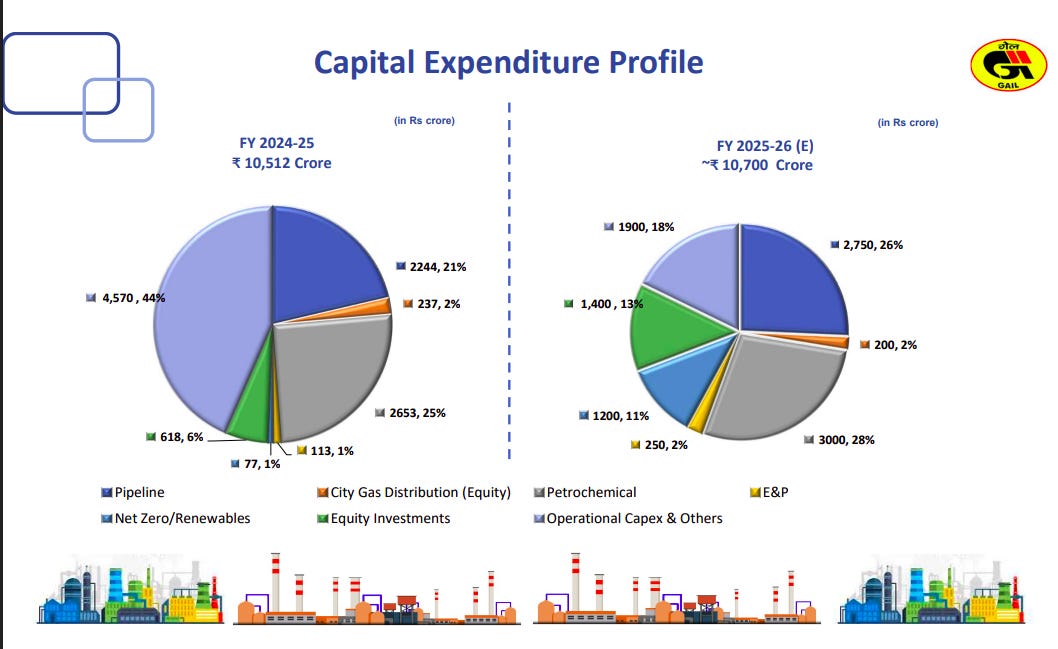

GAIL plans ~₹10,700 crore capex in FY26, broadly in line with FY25 levels. The investment remains infrastructure-heavy, with pipelines (26%) and petrochemicals (28%) as the biggest allocations, followed by net-zero/renewables and E&P. Focus continues on strengthening gas transmission backbone while scaling downstream value chain and clean energy.

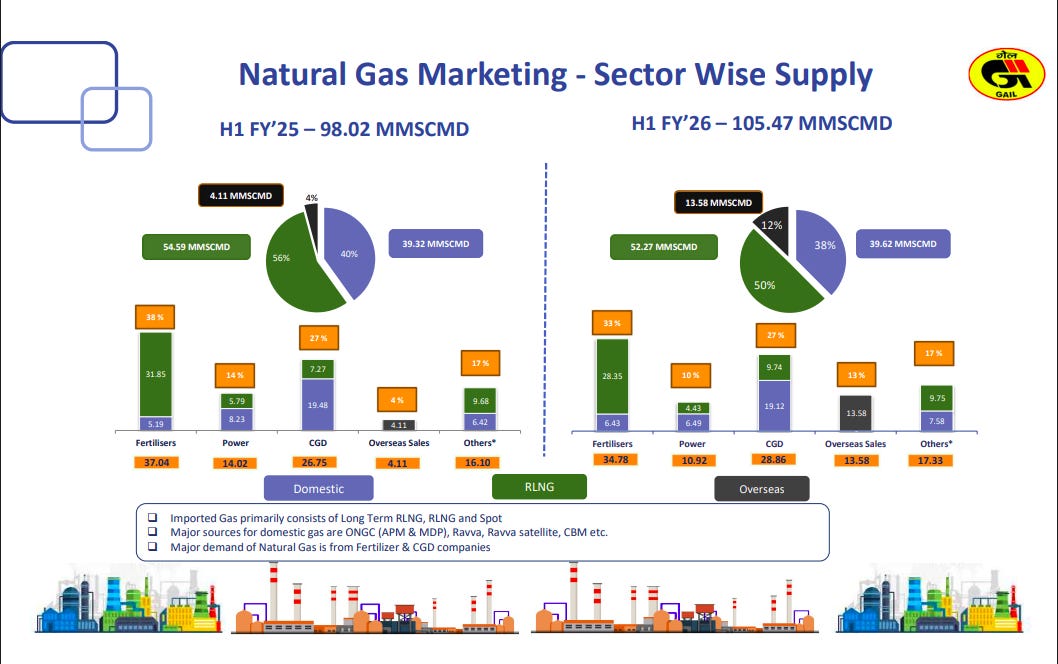

Gas sales rose to 105.5 MMSCMD in H1 FY26 (vs 98 MMSCMD YoY) with fertilizer and CGD segments contributing nearly two-thirds of demand. RLNG share improved, supported by higher overseas volumes (13.6 MMSCMD vs 4.1 MMSCMD YoY). Sector mix remains stable, with fertilizers, power, CGD, and industrials driving consumption.

Adani Power | Large Cap | Energy

Adani Power Limited (APL) is India’s largest private sector thermal power producer, operating across multiple states. The company focuses on leveraging technology and innovation to make India a power-surplus nation, ensuring the supply of quality and affordable electricity nationwide.

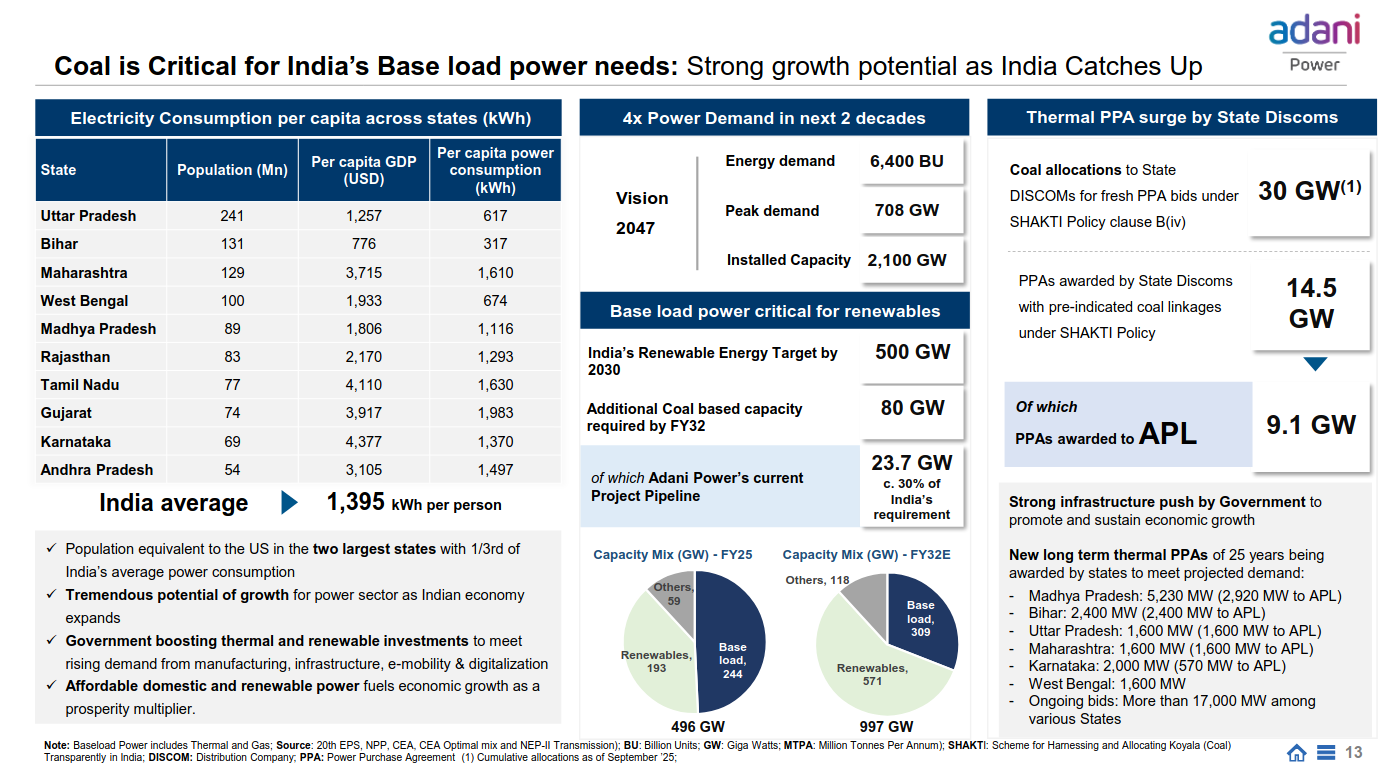

India’s per-capita electricity use is still ~1,395 kWh — far below developed economies — signaling long-term power demand growth as states industrialize. With renewables scaling to 500 GW by 2030, coal remains essential for baseload, requiring ~80 GW additional capacity by FY32, of which Adani Power has ~30% pipeline share. State DISCOMs are awarding long-term PPAs under SHAKTI, with ~9.1 GW already secured by APL, supporting multi-year growth visibility.

Financial Services

Niva Bupa Health Insurance | Small Cap | Financial Services

Niva Bupa Health Insurance is a leading standalone health insurer in India, specializing in the retail health market. They offer personal accident and travel insurance in addition to health coverage, aiming to provide every Indian with the confidence to access top healthcare services.

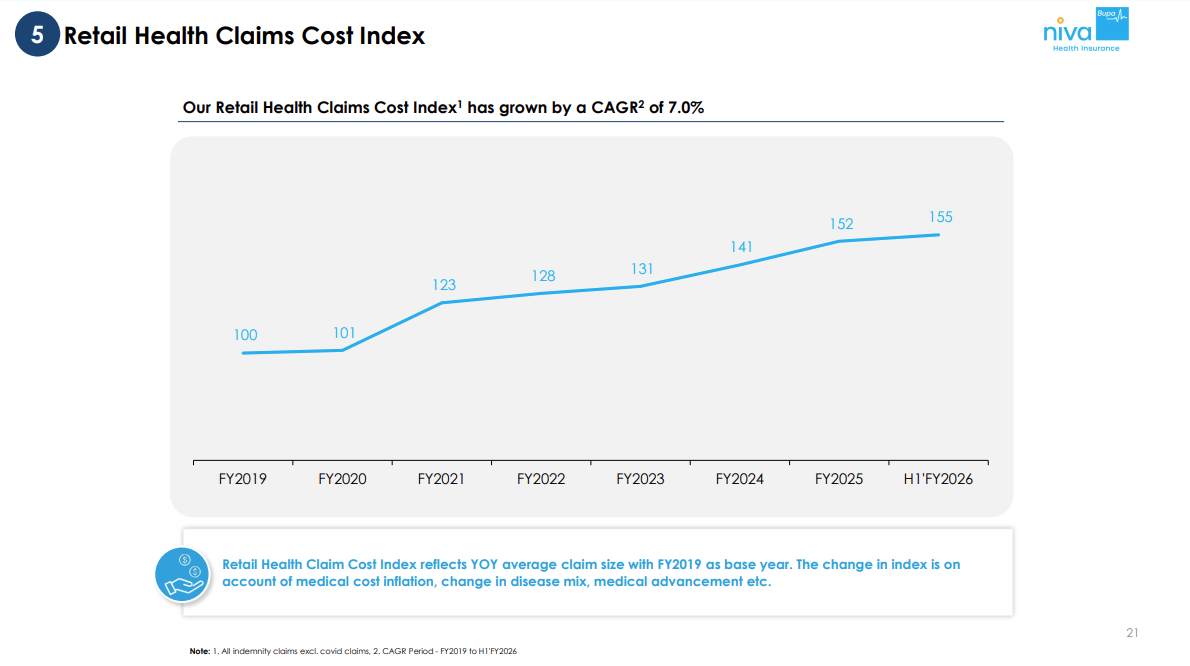

Niva Bupa’s Retail Health Claims Cost Index has risen steadily — growing at a 7% CAGR since FY2019 — reflecting the combined impact of medical inflation, evolving disease patterns, and advances in healthcare. The trend highlights how treatment costs continue to outpace general inflation across India’s health insurance landscape.

]

City Union Bank | Small Cap | Financial Services

City Union Bank Limited, a premier private sector bank established in 1904 in India, has grown from a regional bank to a well-established institution in the Delta District Thanjavur. It offers various banking services including commercial banking and treasury operations through its four business segments.

City Union Bank’s asset quality continues to strengthen — with gross NPAs down to 2.42% and net NPAs at just 0.9% as of September 2025. The steady decline from FY21 levels underscores disciplined underwriting and effective recoveries despite a challenging credit environment.

Retail

Westlife Development | Small Cap | FMCG

Westlife Development Limited, a part of B.L. Jatia Group, is a major player in India’s QSR sector. Through its subsidiary Hardcastle Restaurants Pvt. Ltd., it focuses on setting up and managing QSR outlets. Operating under a master franchisee agreement with McDonald’s Corporation, WDL finances operations and real estate interests, while receiving support from McDonald’s in technical and operational aspects.

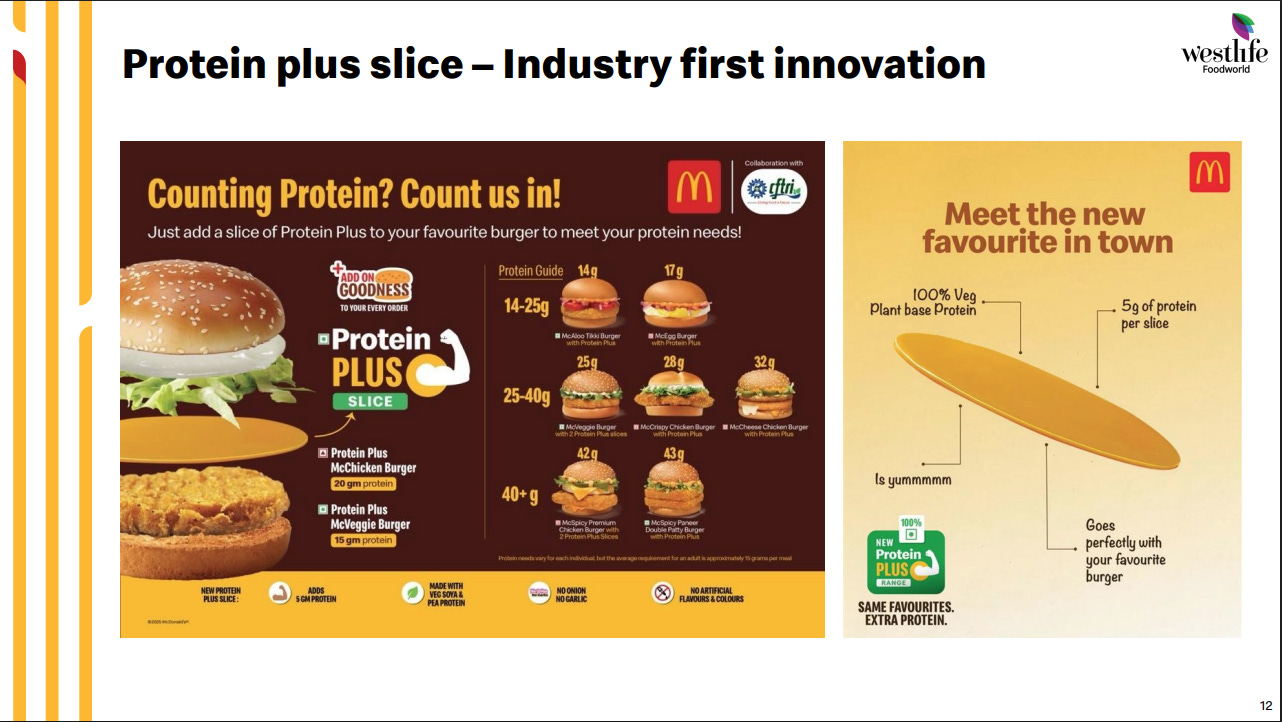

Westlife is tapping into India’s growing protein-conscious consumer trend with an industry-first innovation — the Protein Plus Slice, a 100% vegetarian add-on that boosts protein content in McDonald’s burgers without changing their taste or price appeal.

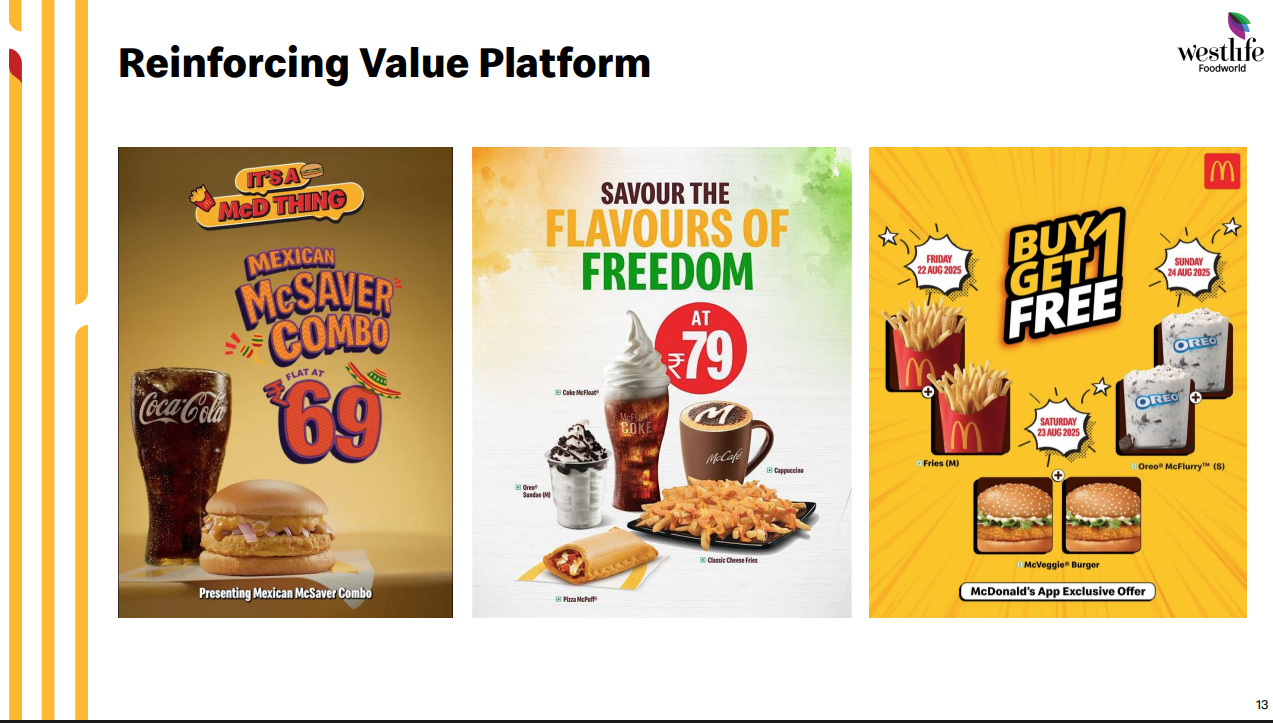

Westlife continues to double down on its value-led positioning, keeping McDonald’s accessible through limited-period combos, festival offers, and app-exclusive deals. The focus remains on driving frequency and affordability without diluting the brand’s indulgence appeal.

Vaibhav Global | Small Cap | Retail

Vaibhav Global Limited is a retailer of fashion jewelry and lifestyle accessories, operating the Liquidation Channel in the US and Jewelry Channel in the UK. The company offers a variety of jewelry products including colored gemstones, accessories, and fashion jewelry through television shopping and online platforms.

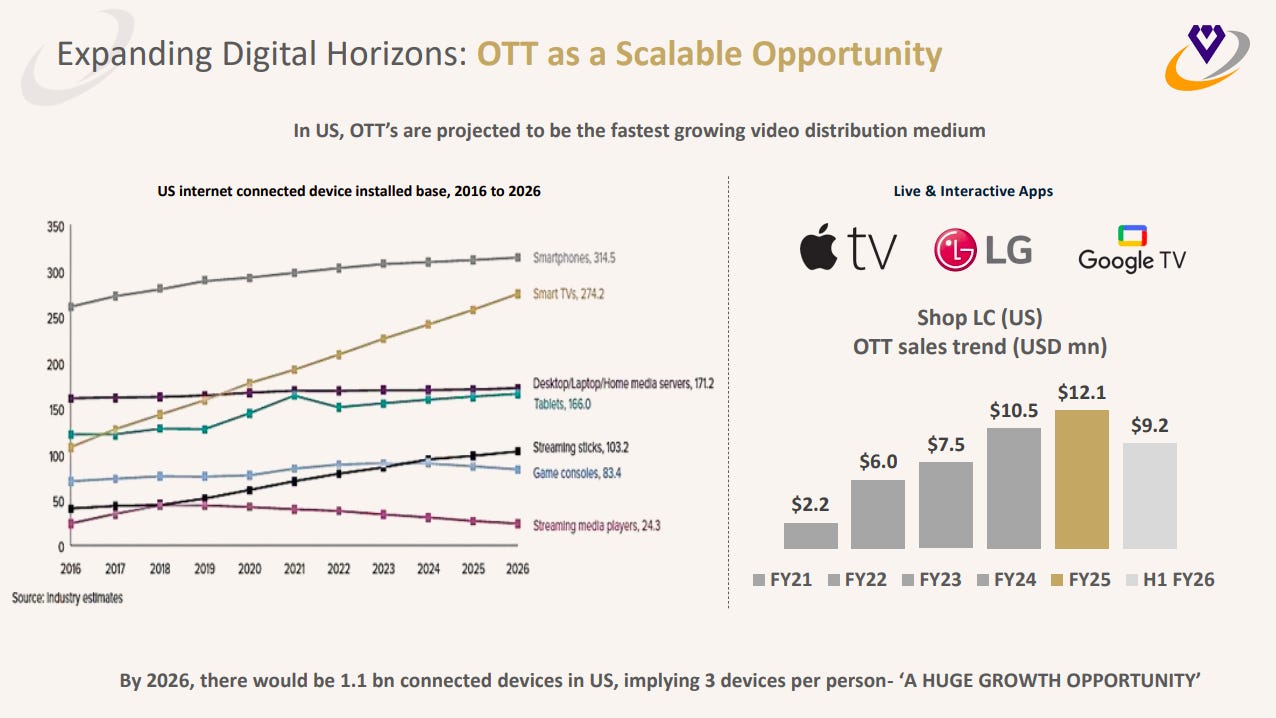

OTT is emerging as a major growth engine, with US connected devices expected to hit 1.1 bn by 2026, driving massive digital video consumption. Shop LC’s OTT revenue has scaled rapidly from $2.2M in FY21 to $12.1M in FY25, supported by partnerships with Apple TV, LG, and Google TV. This shift positions the business strongly to capture younger, digital-first audiences.

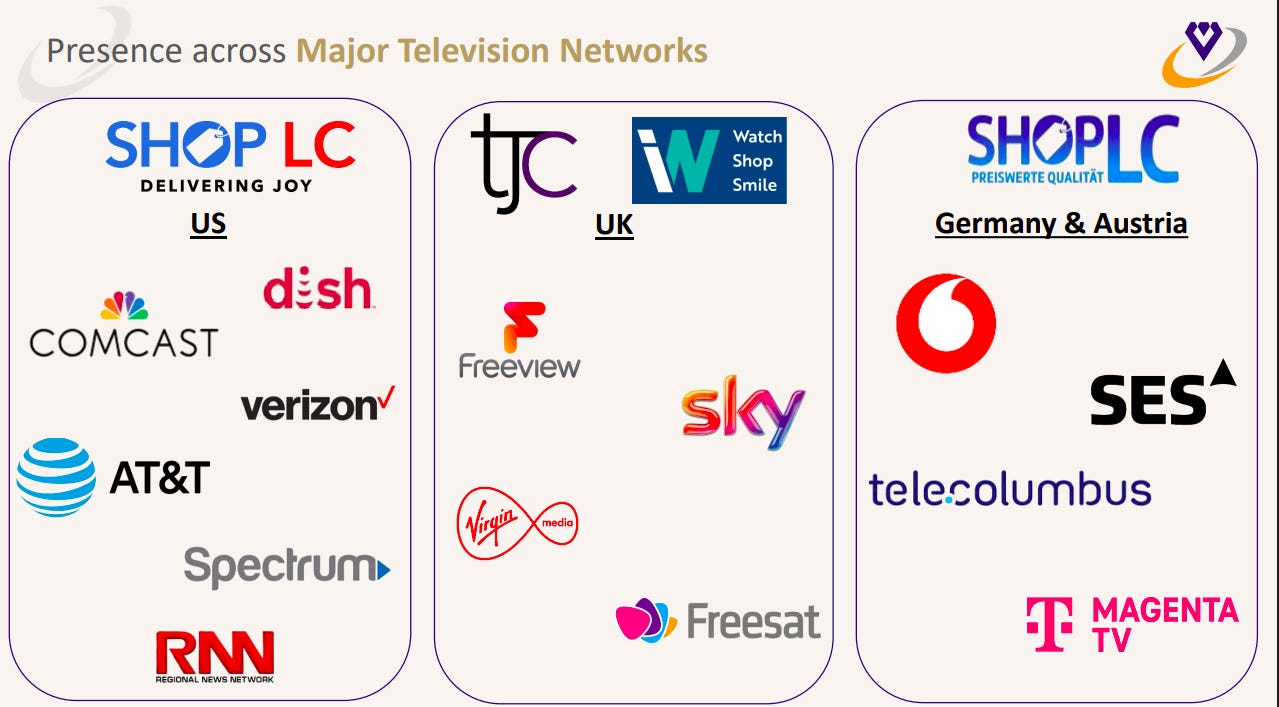

The company has deep distribution across major TV networks in the US, UK, Germany and Austria, including Comcast, Dish, Sky, Virgin Media, Vodafone and Magenta TV. This broad footprint ensures strong household reach and brand visibility across key developed markets. It reinforces the firm’s established retail channel strength while complementing its OTT push.

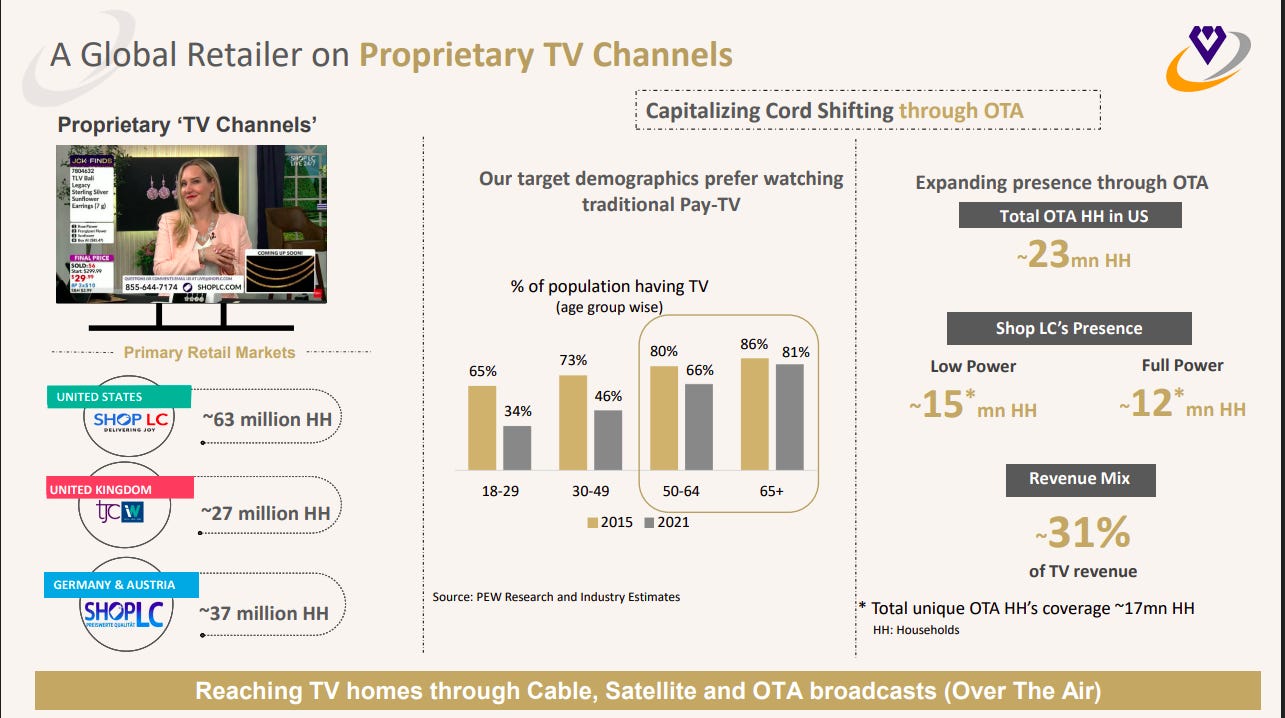

Proprietary TV networks reach ~127 million households across the US, UK, Germany and Austria, enabling high-engagement retail selling. Despite cord-cutting trends, older demographics still prefer Pay-TV, while the company is expanding via OTA broadcast, covering ~17M US homes and contributing ~31% of TV revenue. This dual model protects legacy audiences while scaling new distribution channels.

Stovekraft | Small Cap | Consumer Durable

Stovekraft Limited is the largest kitchen appliances company in India, offering premium kitchen solutions. Their range includes pressure cookers, non-stick cookware, cook tops, mixer grinders, chimneys, and hobs. They have a strong global presence in markets like Middle East, Kenya, USA, Sri Lanka, and more. Stovekraft’s prestigious clients include Walmart and Big Lots. With manufacturing facilities in Bangalore and Himachal Pradesh, they have established a strong foothold in the industry.

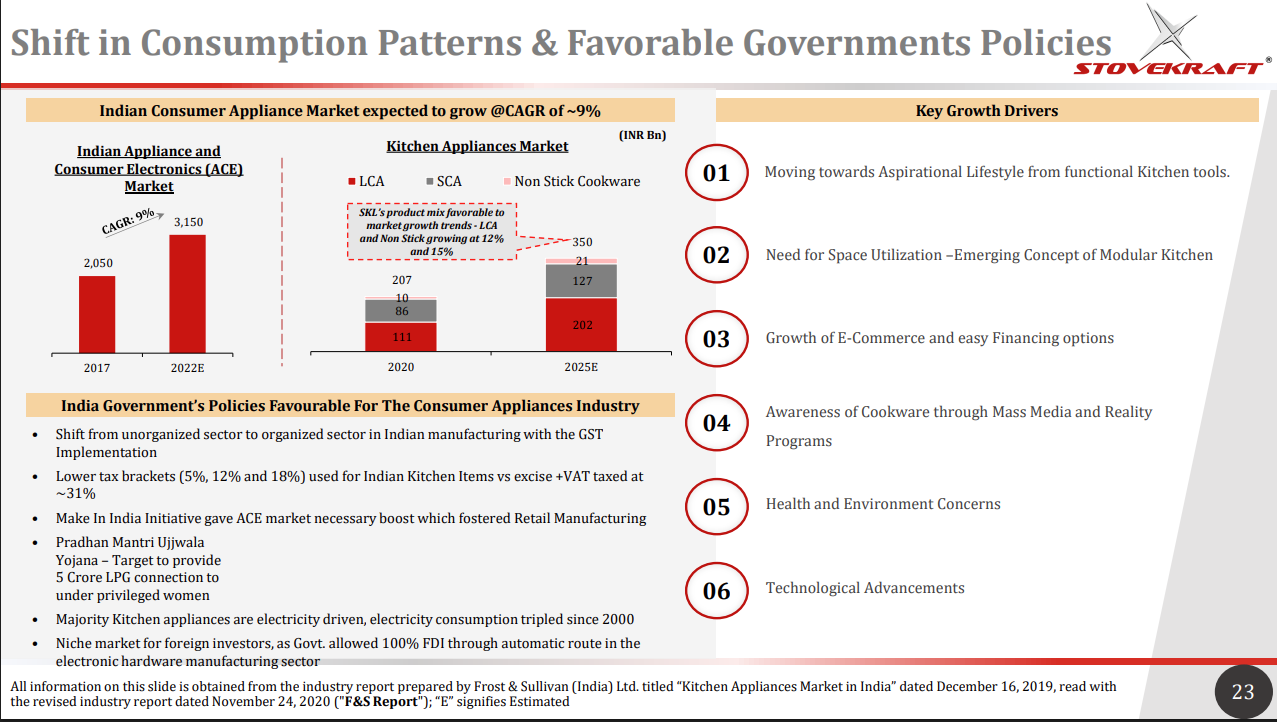

Stove Kraft highlights how rising incomes, modular kitchens, and supportive government policies are reshaping India’s consumer appliance market, which is growing at ~9% CAGR. With low GST rates, Make in India incentives, and the e-commerce boom, the company’s mix in large and non-stick cookware is well aligned to capture this demand shift.

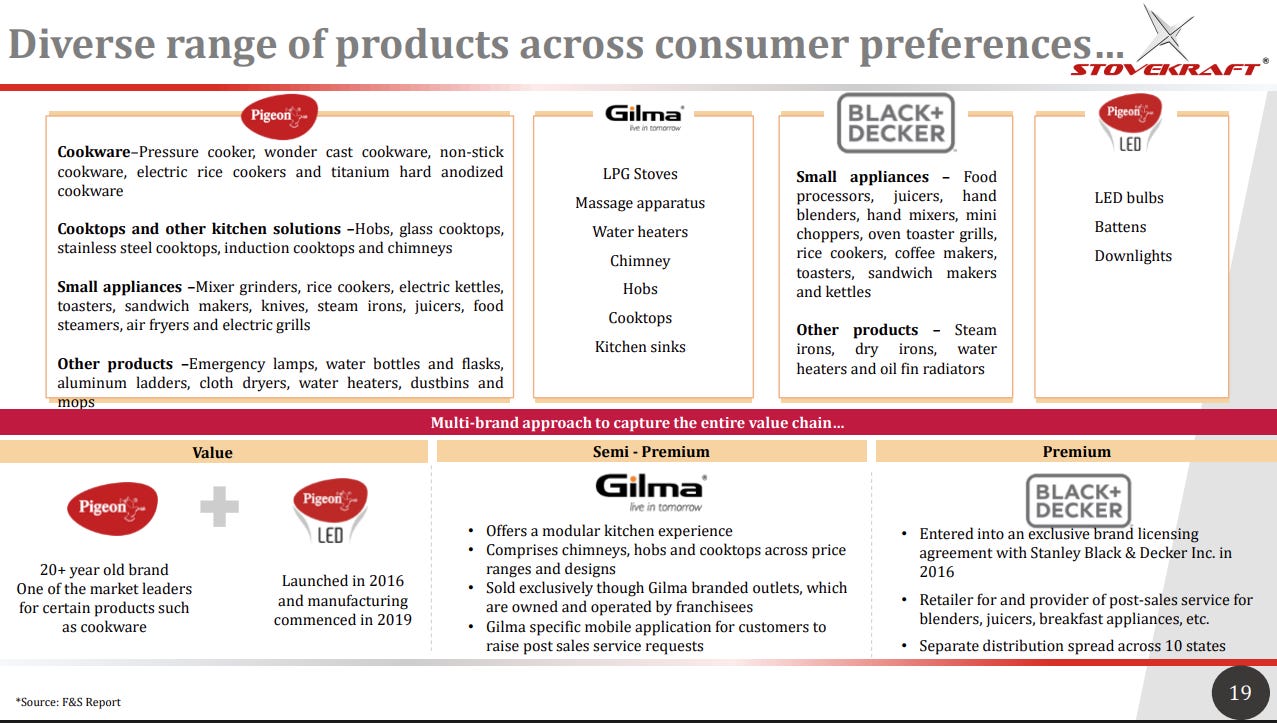

Stove Kraft’s multi-brand strategy—with Pigeon, Gilma, and Black+Decker—covers the full value spectrum from mass to premium. This diversified portfolio across cookware, kitchen solutions, and small appliances helps the company tap a wide range of consumer needs and price points in India’s evolving home appliance market.

Auto Ancillary

Hyundai Motor India | Large Cap | Auto Ancillary

Hyundai Motor India, a subsidiary of Hyundai Motor Company, specializes in manufacturing and selling four-wheeler passenger vehicles and parts like transmissions and engines. The company operates in India and globally, producing components for its own use and sales.

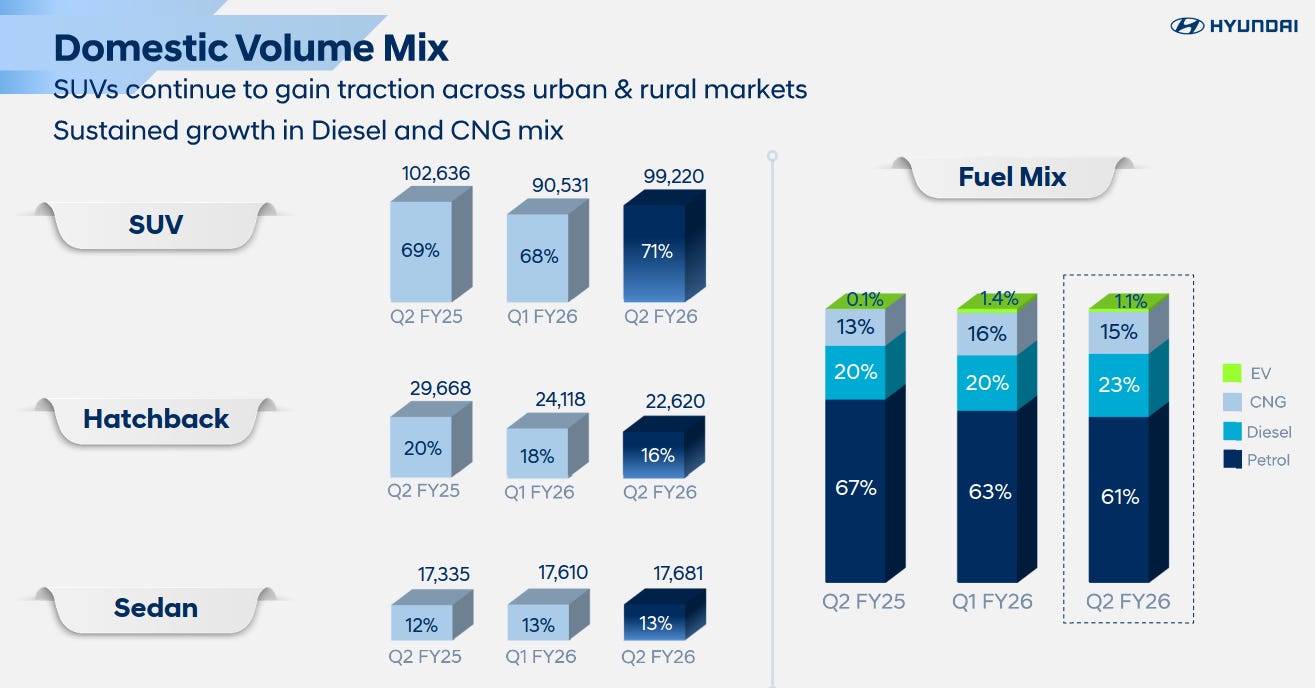

SUVs continue to dominate Hyundai’s India mix, rising to 70% share in H1 FY26 from 68% last year, while hatchbacks declined to 17% and sedans held steady at ~13%.Fuel mix shows Petrol share dropped to 62% (from 70%) as CNG rose sharply to 22% and EVs reached 1.3%, indicating growing alternate-fuel adoption

SUV share strengthened further to 71% in Q2 FY26, with hatchbacks moderating to 16% and sedans steady at 13%.Fuel mix shift continues—CNG rose to 23% and diesel to 15%, while petrol declined to 61% and EV share edged to 1.1%, showing gradual diversification away from petrol-led sales.

Tourism & Hospitality

Le Travenues Technology | Small Cap | Tourism & Hospitality

Le Travenues Technology, incorporated in 2006 in New Delhi, operates the online platform www.ixigo.com and ixigo mobile app. The platform offers real-time information and booking services for trains, airlines, buses, hotels, and cabs, catering to the travel industry.

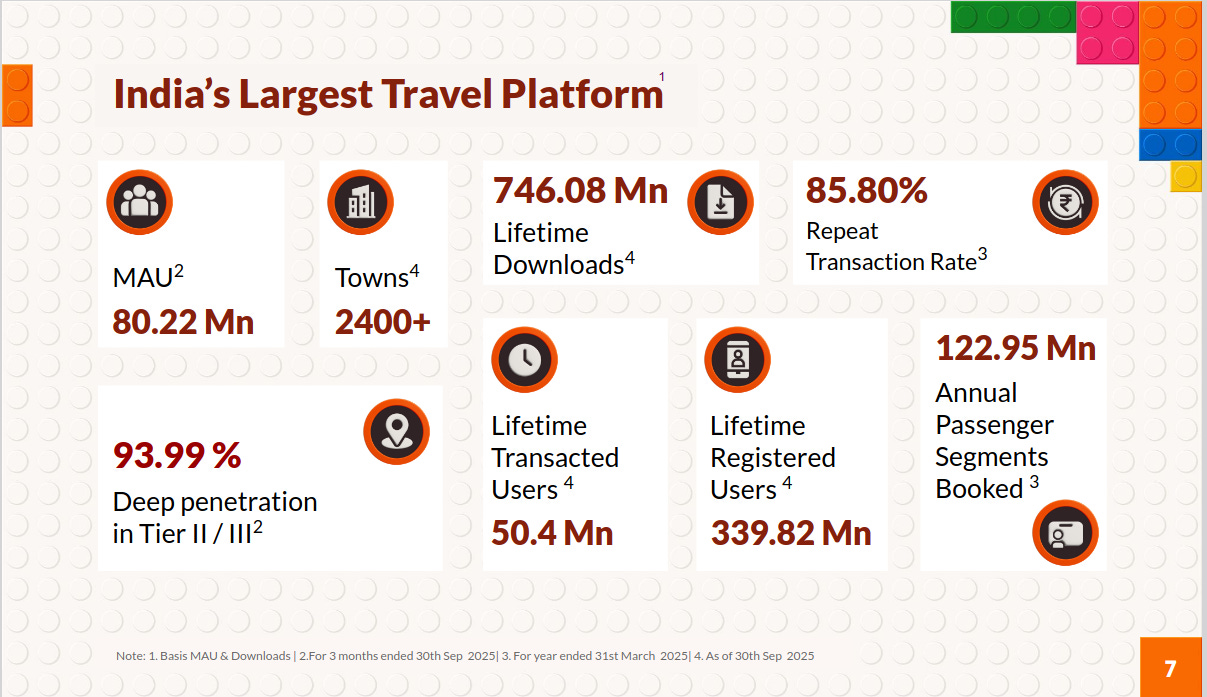

The platform has 80.2M MAUs, 746M+ lifetime downloads, and 339M registered users, showcasing massive scale. Strong Tier-II/III penetration (~94%) and an 85.8% repeat rate highlight deep market engagement. With 50M+ transacting users and 123M+ annual passenger bookings, it leads India’s online travel space

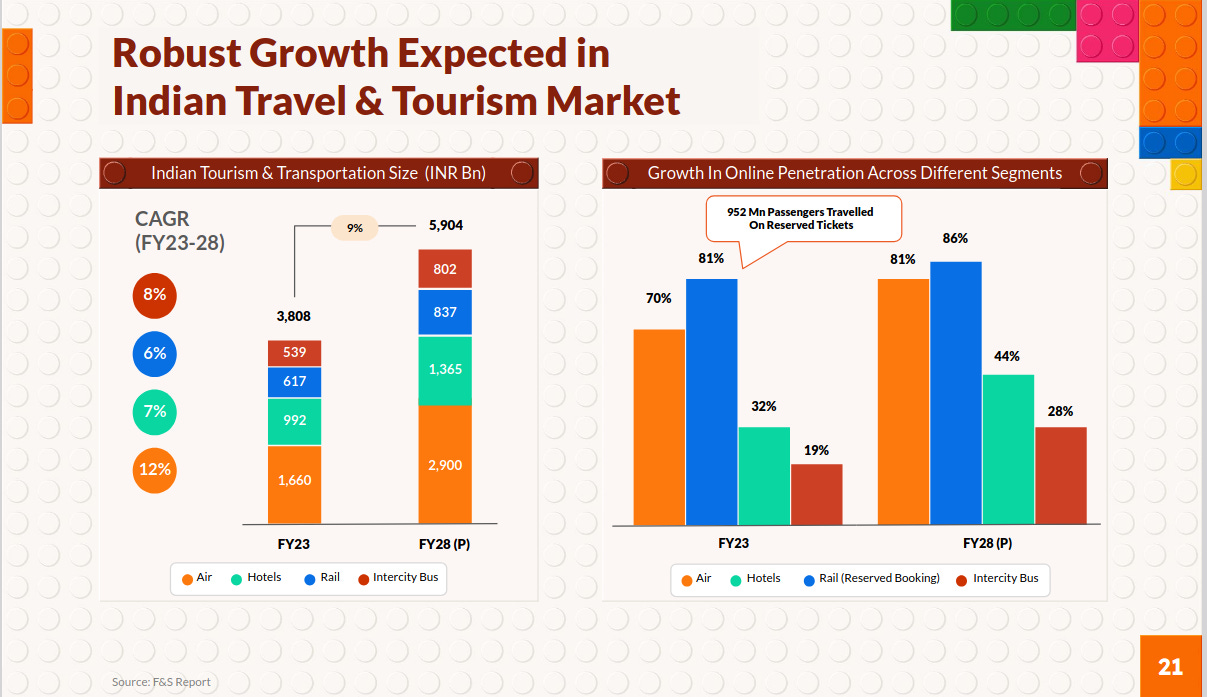

India’s travel and tourism market is projected to grow from ₹3.8T in FY23 to ₹5.9T by FY28 (9% CAGR), led by air, hotels, rail, and intercity buses. Online penetration will continue rising across all travel modes, riding on increasing digital adoption and rising mobility demand.

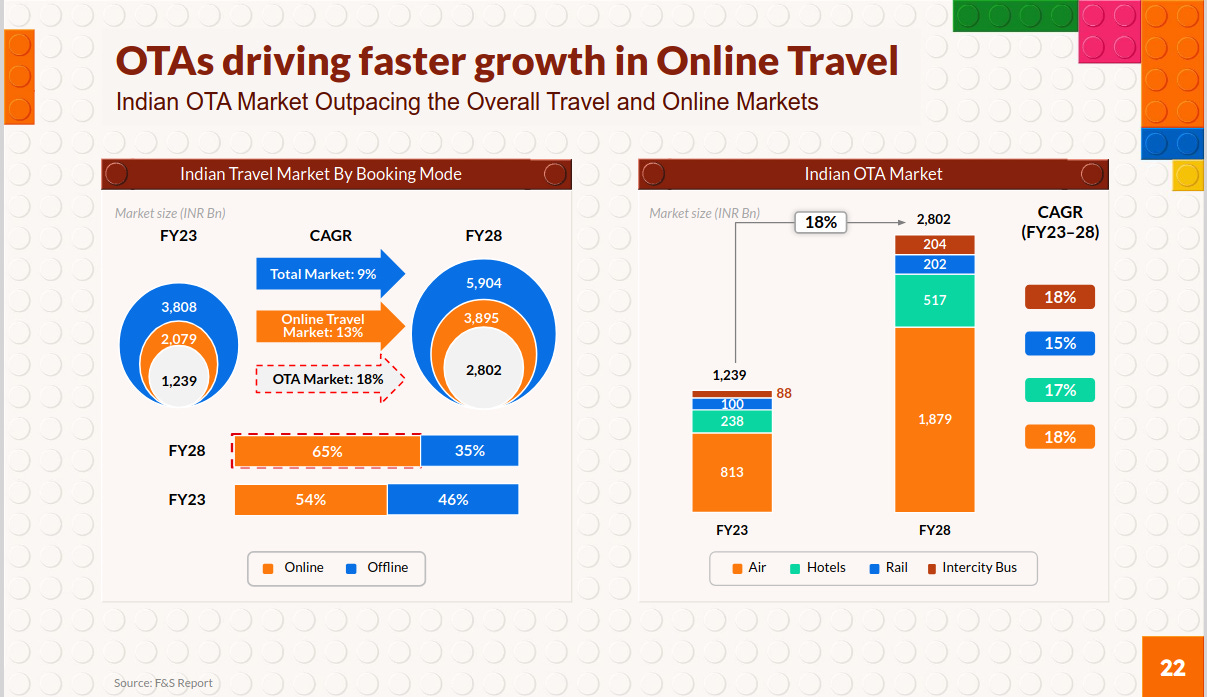

Online travel is expanding faster than the overall market—OTA segment growing at 18% CAGR vs 9% industry CAGR. Online share of bookings is expected to jump from 54% in FY23 to ~65% by FY28, driven by rising digital ticketing in air, hotels, rail, and bus travel.

Building Materials

Ambuja Cement | Large Cap | Cement

Ambuja Cements Limited, a leading company in the cement industry in India and a member of the Adani Group, focuses on providing sustainable and environment-friendly cement solutions. It operates multiple manufacturing plants and has set industry standards for responsible resource use and conservation, being certified water positive over eight times.

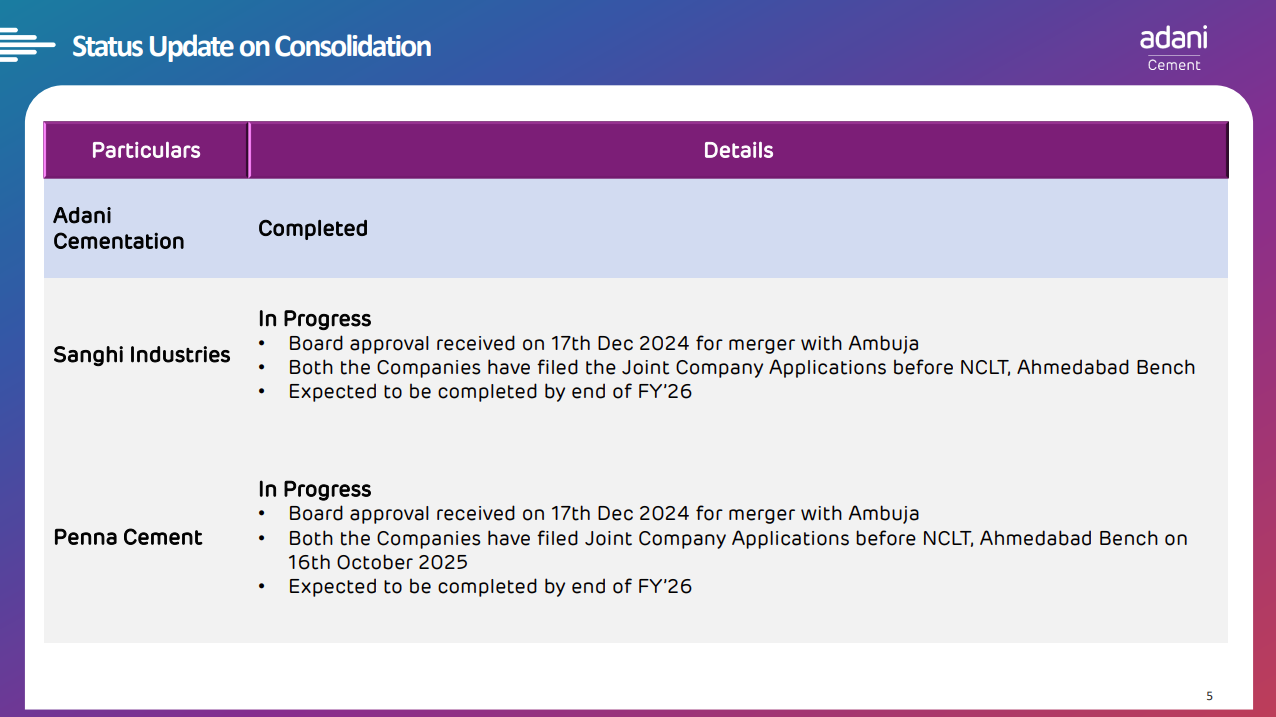

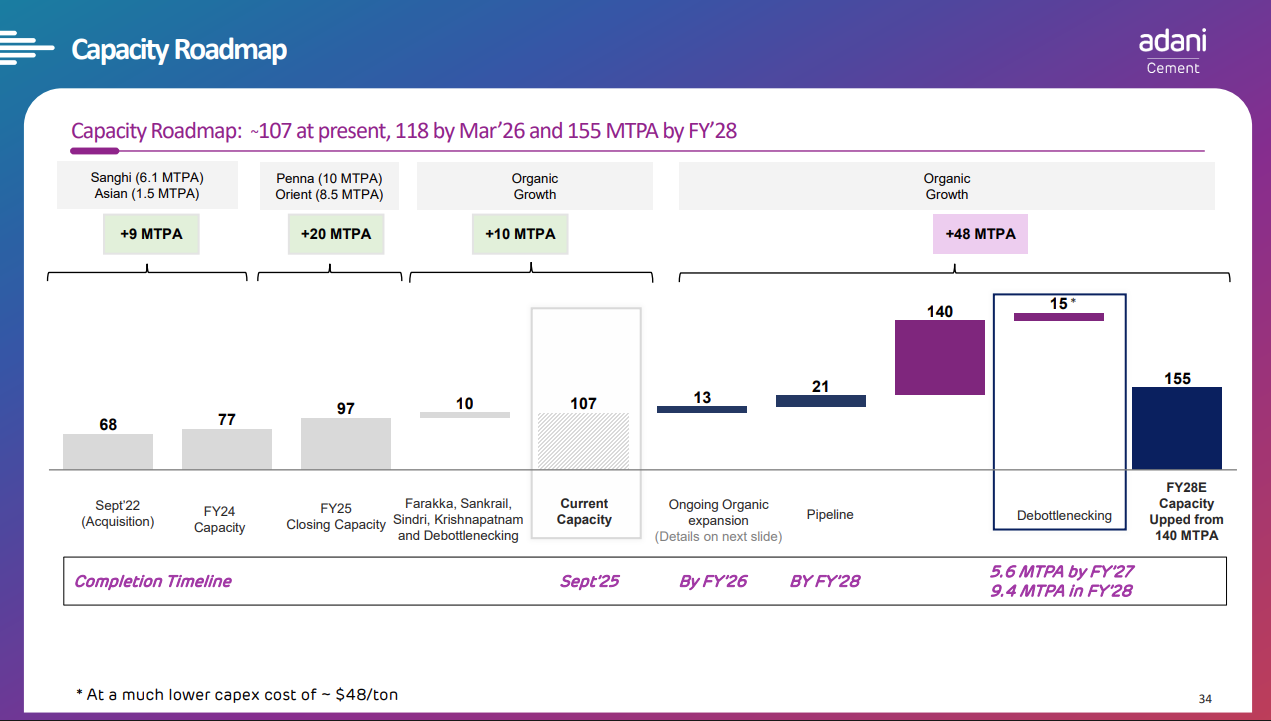

Ambuja Cement’s consolidation drive under the Adani Group is progressing steadily — with Sanghi Industries and Penna Cement mergers underway and expected to close by FY26. The integration aims to create a unified, large-scale cement platform under the Ambuja brand.

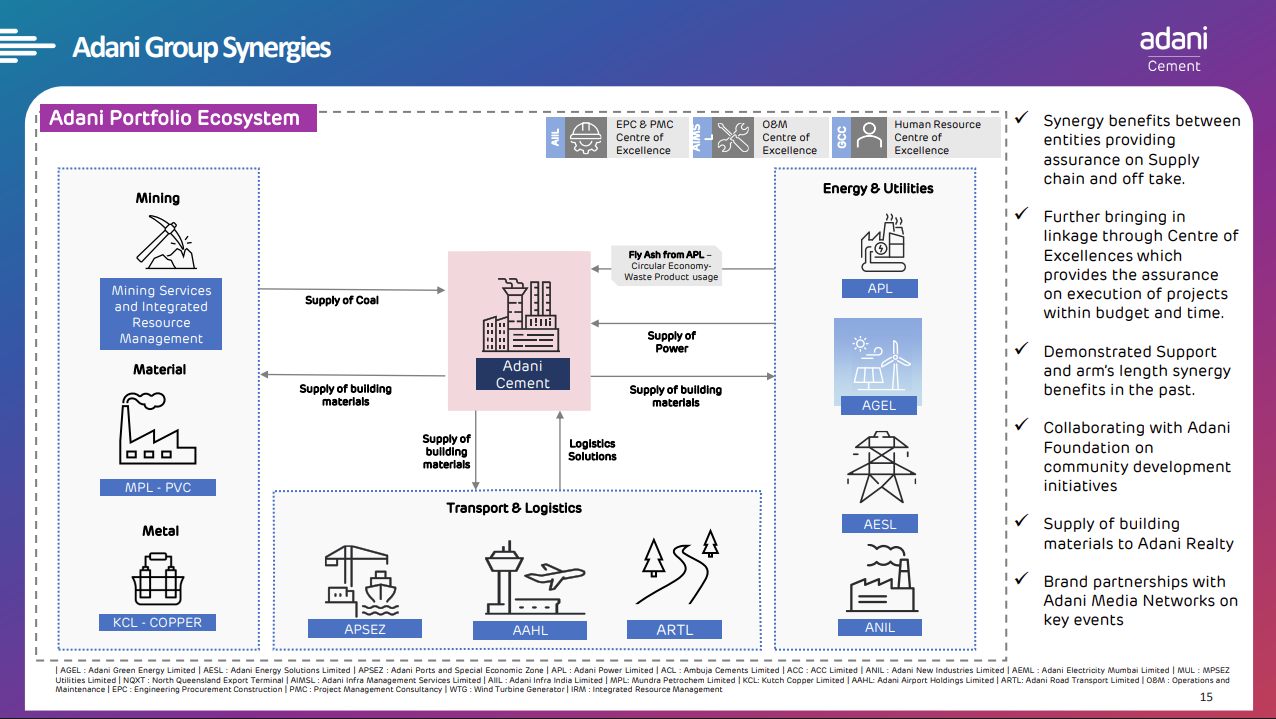

The slide maps out Adani Cement’s integration within the larger Adani Group ecosystem, leveraging synergies across energy, mining, logistics, and materials. From coal and fly ash supply to transport and power support, these linkages enable efficiency, cost control, and sustainability across the cement value chain.

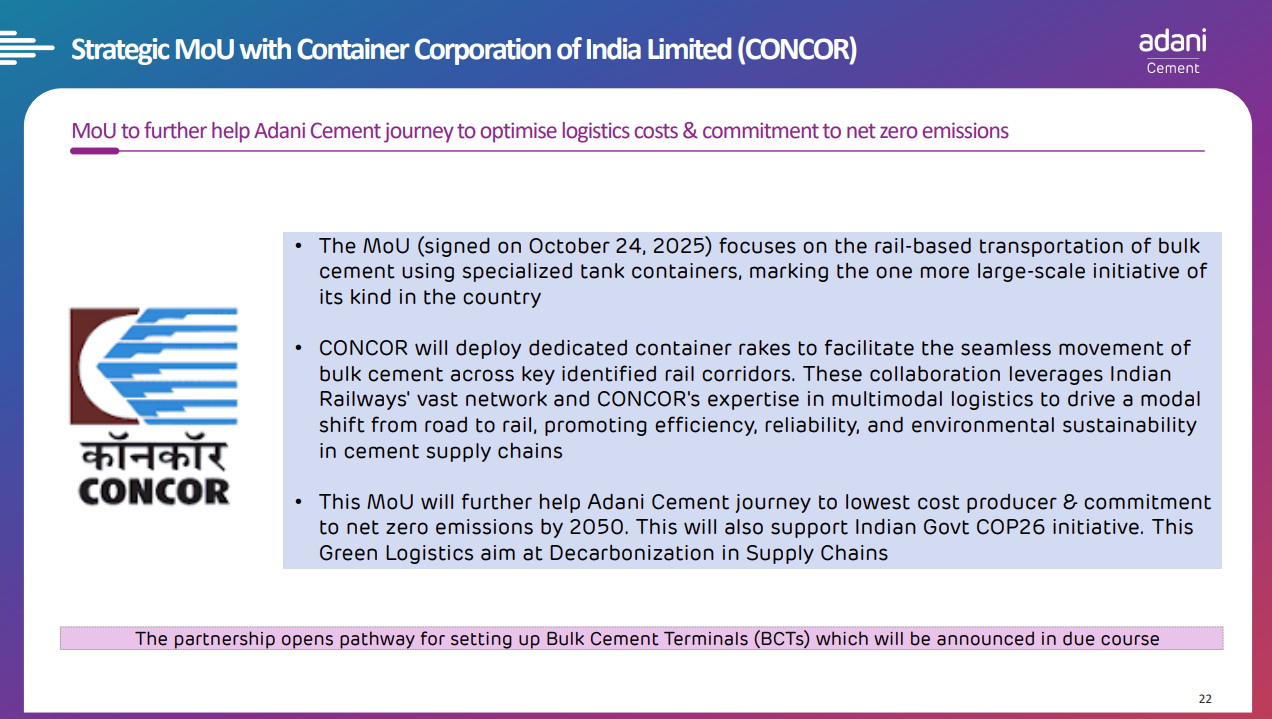

Adani Cement has signed a strategic MoU with CONCOR to transport bulk cement via specialized rail containers — a first-of-its-kind move in India. The partnership aims to cut logistics costs, shift freight from road to rail, and advance the company’s net-zero and green logistics goals.

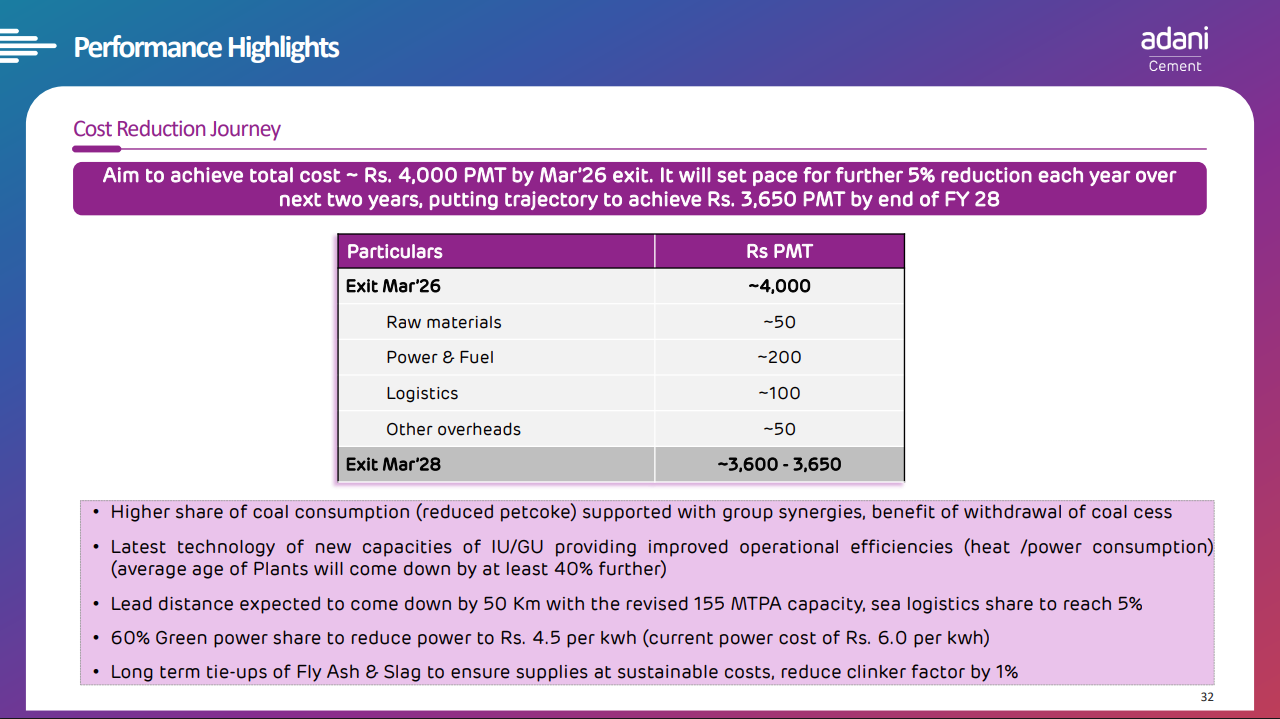

Adani Cement is targeting a sharp efficiency-led cost reduction — aiming to bring total production costs down to ₹4,000 per tonne by FY26, and further to ₹3,650 by FY28. The savings will be driven by greener power, shorter lead distances, improved plant efficiency, and long-term tie-ups for raw materials like fly ash and slag.

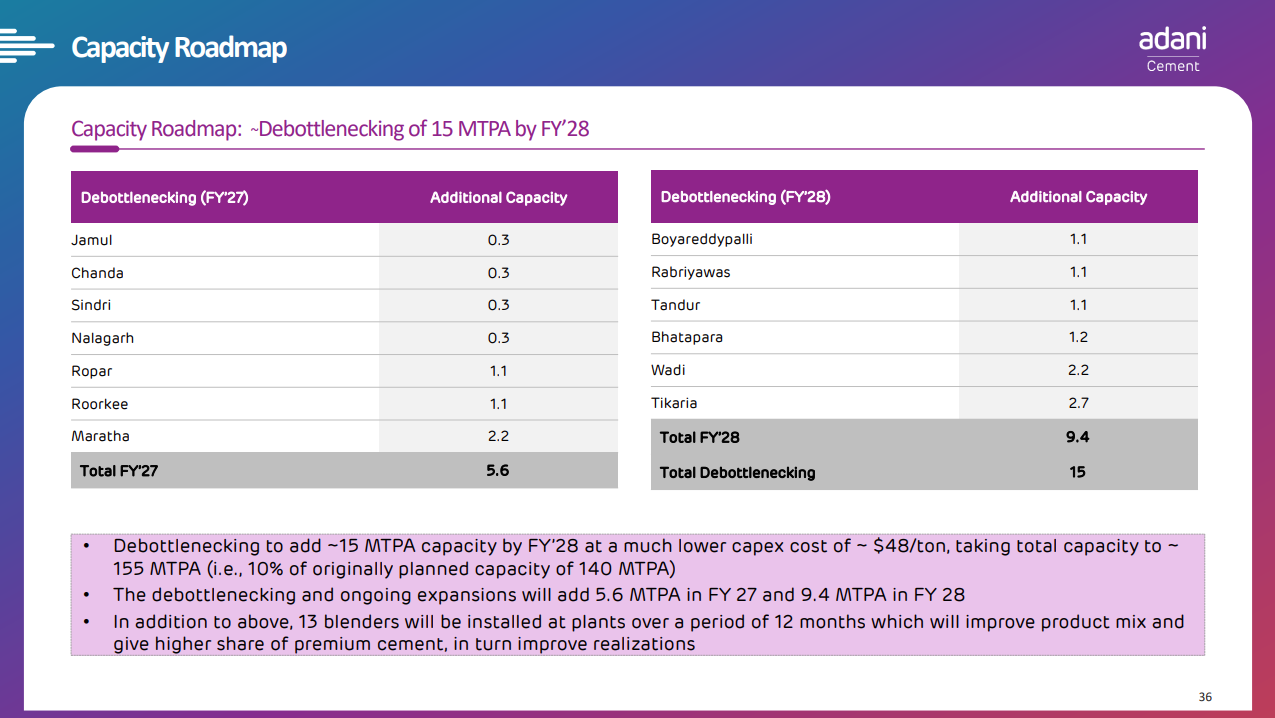

Adani Cement plans to unlock 15 MTPA of additional capacity by FY28 through low-cost debottlenecking, expanding its total capacity to 155 MTPA at just ~$48 per tonne. The initiative, spread across multiple plants, aims to boost premium cement output and improve realizations without heavy capex.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Kashish.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.