Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 10 companies across 8 industries.

Engineering & Capital Goods

Transformers and Rectifiers (India)

Elecon Engineering

Aztec Fluids & Machinery

Fertilizers

Krishana Phoschem

Chemicals

Bai-Kakaji Polymers

Retail

Avenue Supermarts

Miscellaneous

BharatRohan Airborne Innovations

Healthcare

Fortis Healthcare

Metals

Karbonsteel Engineering

Media & Entertainment

GTPL Hathaway

Engineering & Capital Goods

Transformers and Rectifiers (India) | Small Cap | Engineering & Capital Goods

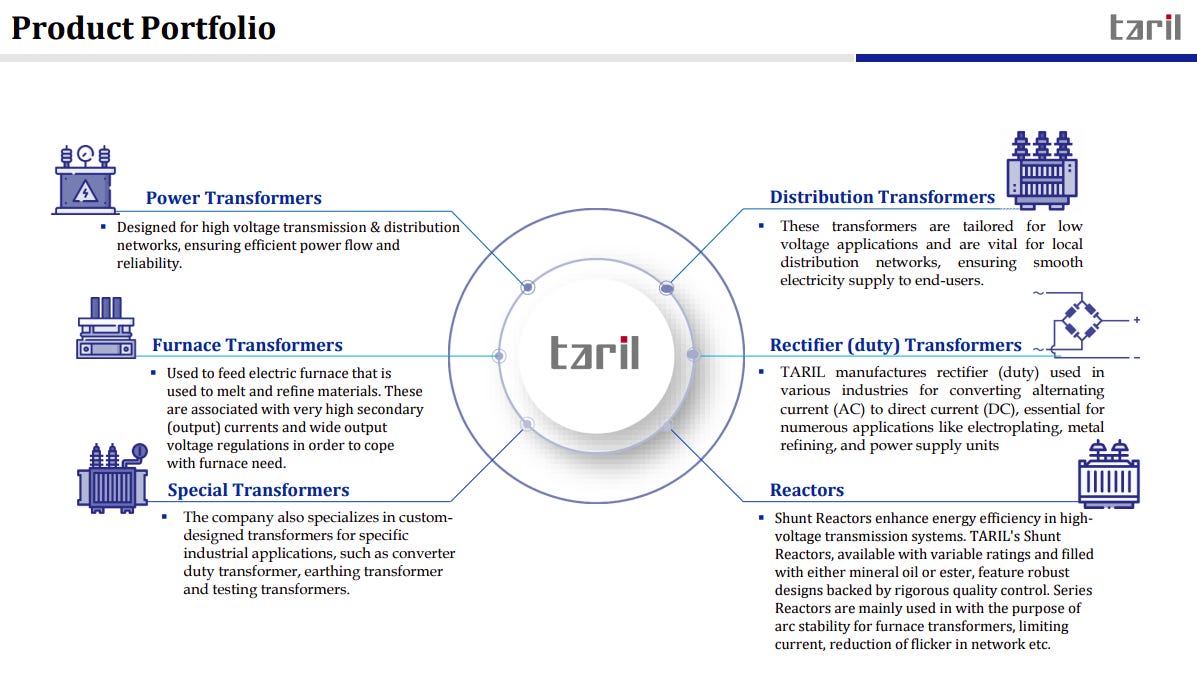

Transformers & Rectifiers (India) Limited, established in 1994, is a leading manufacturer of a wide range of transformers in India. With state-of-the-art infrastructure across three plants in Ahmedabad, the company produces high-quality power, distribution, furnace, and specialty transformers for both domestic and international markets.

A diversified and high-quality customer base across power, renewables, metals, infrastructure, and heavy engineering anchors long-term demand. Relationships with marquee public and private sector clients reinforce execution credibility and repeat order visibility.

Transformers are mission-critical across a wide range of industries including power transmission, metals, cement, railways, mining, and green energy. This broad application base reduces cyclicality and positions the business to benefit from multiple capex themes simultaneously.

A comprehensive portfolio spanning power, distribution, furnace, rectifier, special transformers, and reactors enables end-to-end solutions.The mix balances standard products with high-value, customized equipment, supporting margin resilience and technical differentiation.

Strong execution in niche, high-rating transformers highlights deep engineering capability and global competitiveness. Successful delivery and testing of some of the world’s largest and most complex transformers create a clear moat and export growth opportunity.

Elecon Engineering | Small Cap | Engineering & Capital Goods

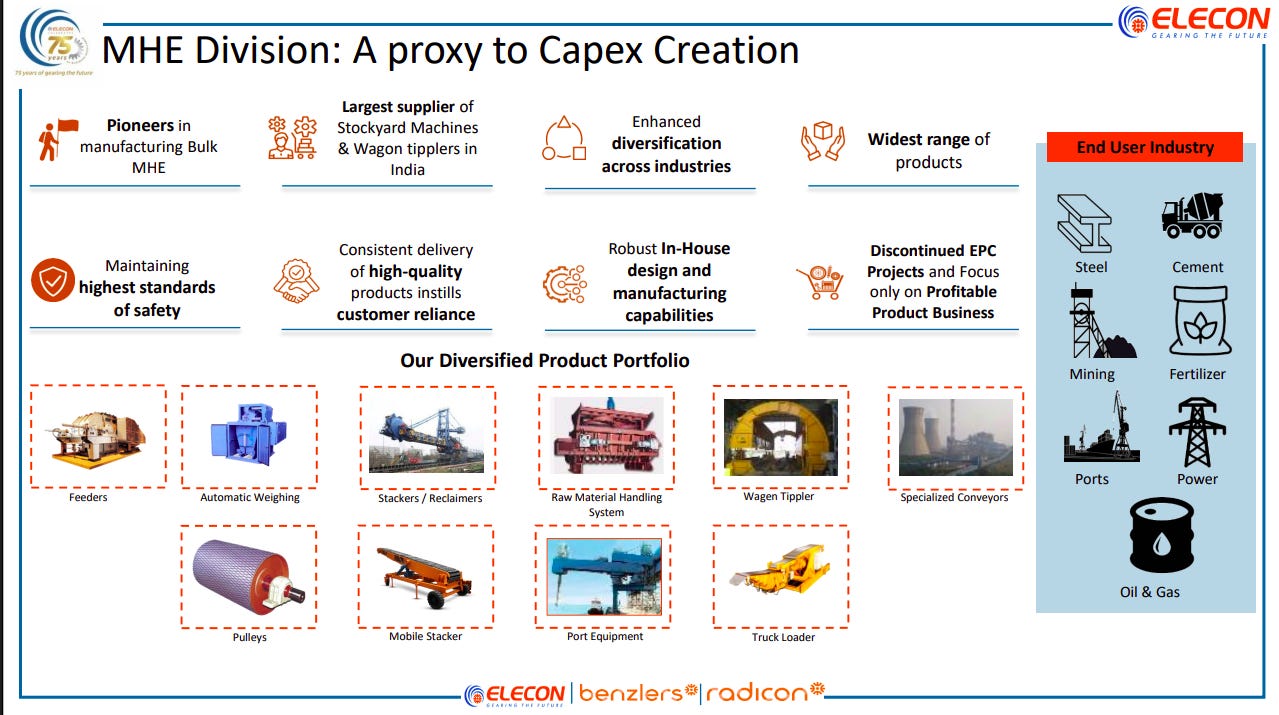

Elecon Engineering Company Ltd is a leading provider of power transmission solutions and material handling equipment. They serve various industries such as steel, fertilizers, cement, coal, and power stations in India and globally. With a focus on gear manufacturing, the company operates through divisions that specialize in power transmission solutions and material handling equipment. Additionally, they manufacture wind turbines through a unit located in Gujarat.

The MHE division is a direct play on industrial capex, backed by leadership in bulk material handling and deep in-house design and manufacturing capabilities. A diversified product suite and focus on profitable products position it well across steel, cement, mining, ports, power, and oil & gas.

ELECON serves a wide range of end industries including steel, cement, sugar, plastics, defence, mining, and power, reducing cyclicality risk. Industry-agnostic gear solutions enable access to new markets, support sustainable performance, and enhance resilience across business cycles.

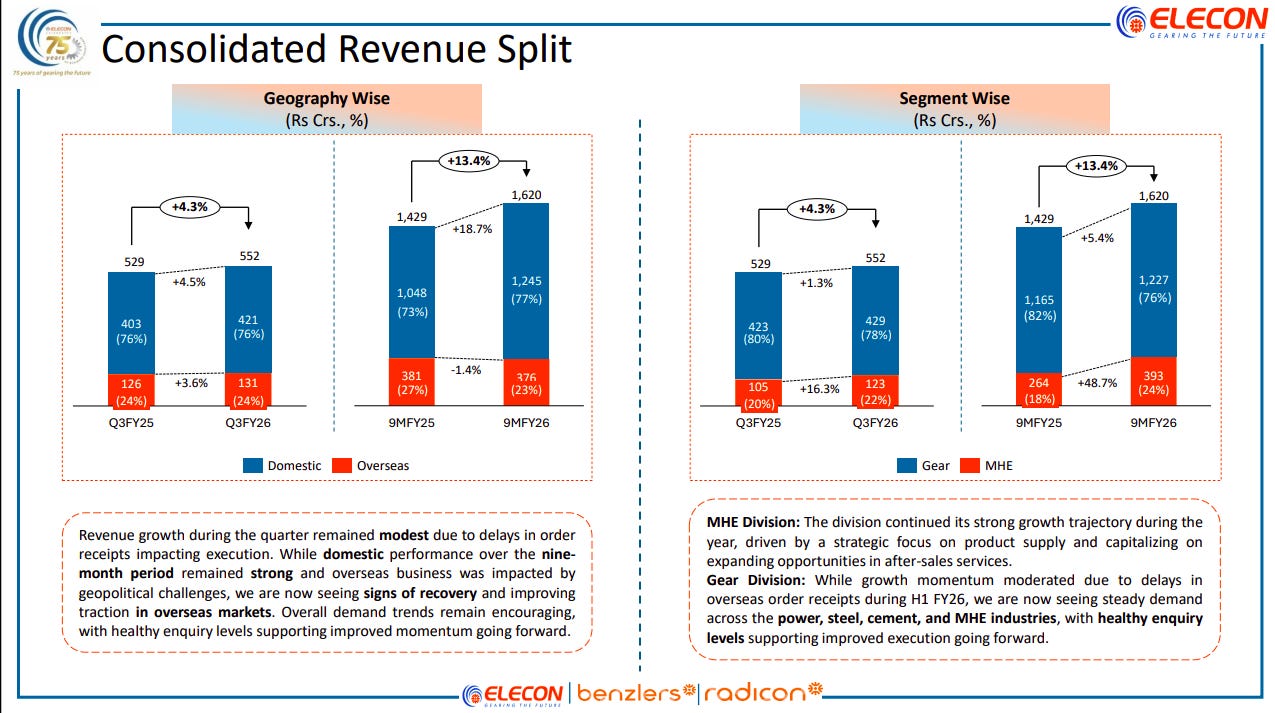

Revenue growth remains steady, led by strong domestic performance, while overseas markets show early signs of recovery after recent execution delays. Segment-wise, the MHE division is driving faster growth, with gears maintaining stable demand across core industries, supporting improved execution momentum ahead.

Aztec Fluids & Machinery | Nano Cap | Engineering & Capital Goods

Aztec Fluids & Machinery offers coding and marking solutions to various industries like personal care, food & beverages, pharmaceuticals, construction materials, metals, automotive, electronics, and more. Their product range includes inkjet printers, thermal transfer over printers, drop on demand printers, laser printers, inks, and consumables.

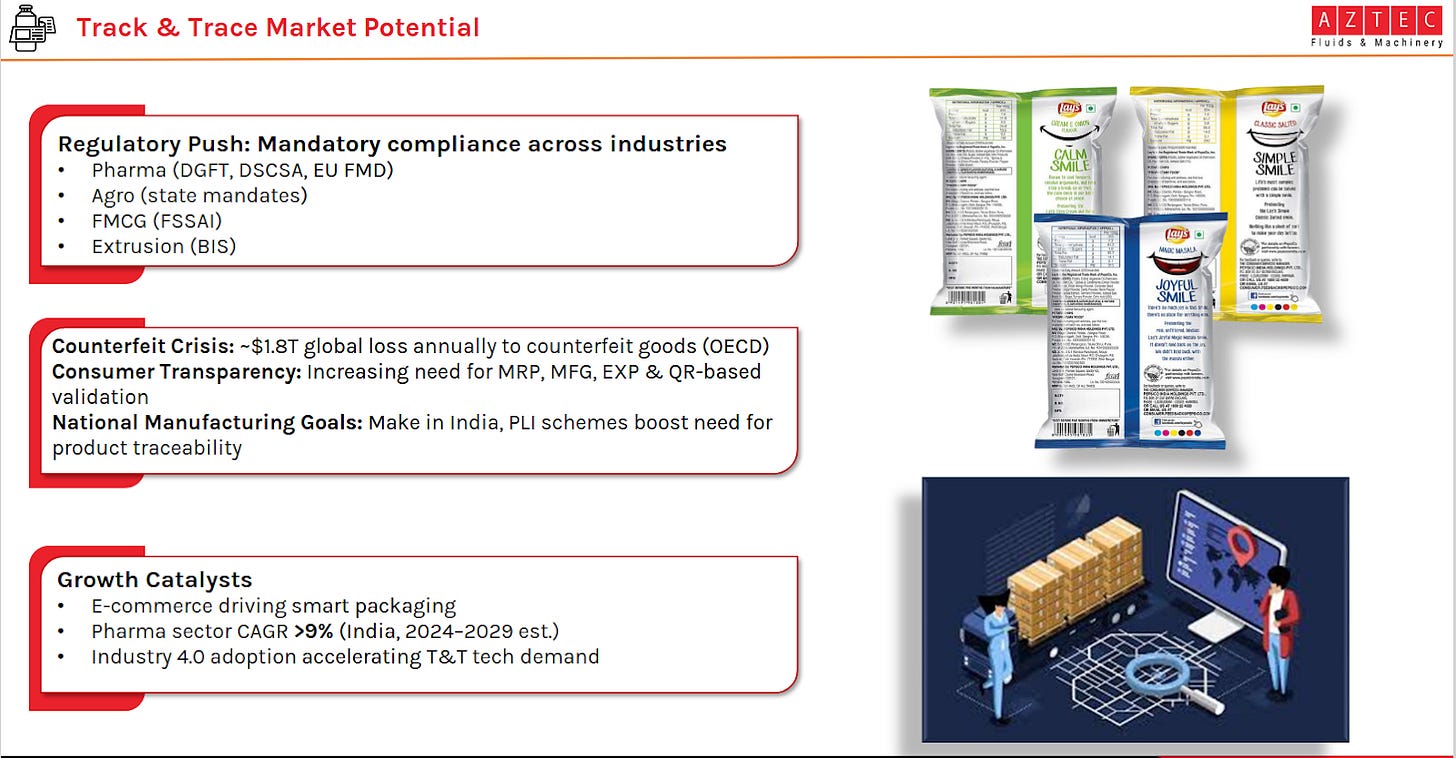

Track & trace adoption is being driven by mandatory regulations across pharma, agro, FMCG, and extrusion, alongside rising concerns around counterfeiting and consumer transparency. Make-in-India and PLI schemes further accelerate demand for traceability solutions. Growth is reinforced by e-commerce expansion, Industry 4.0 adoption, and strong pharma growth.

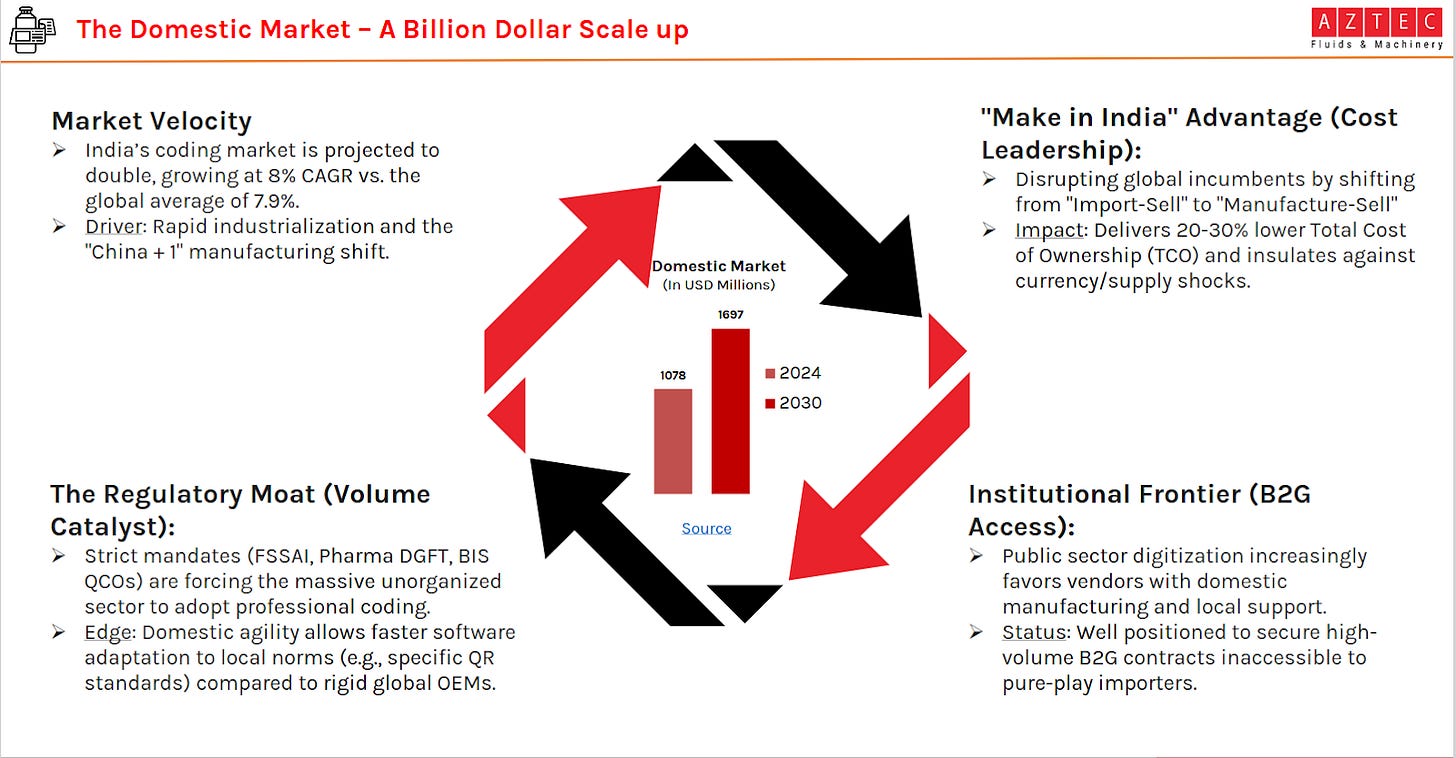

India’s coding and marking market is projected to double by 2030, growing at ~8% CAGR, supported by rapid industrialization and the China+1 shift. Local manufacturing delivers 20–30% lower total cost of ownership versus imports. Regulatory mandates and public-sector digitization create a strong volume moat and B2G opportunity.

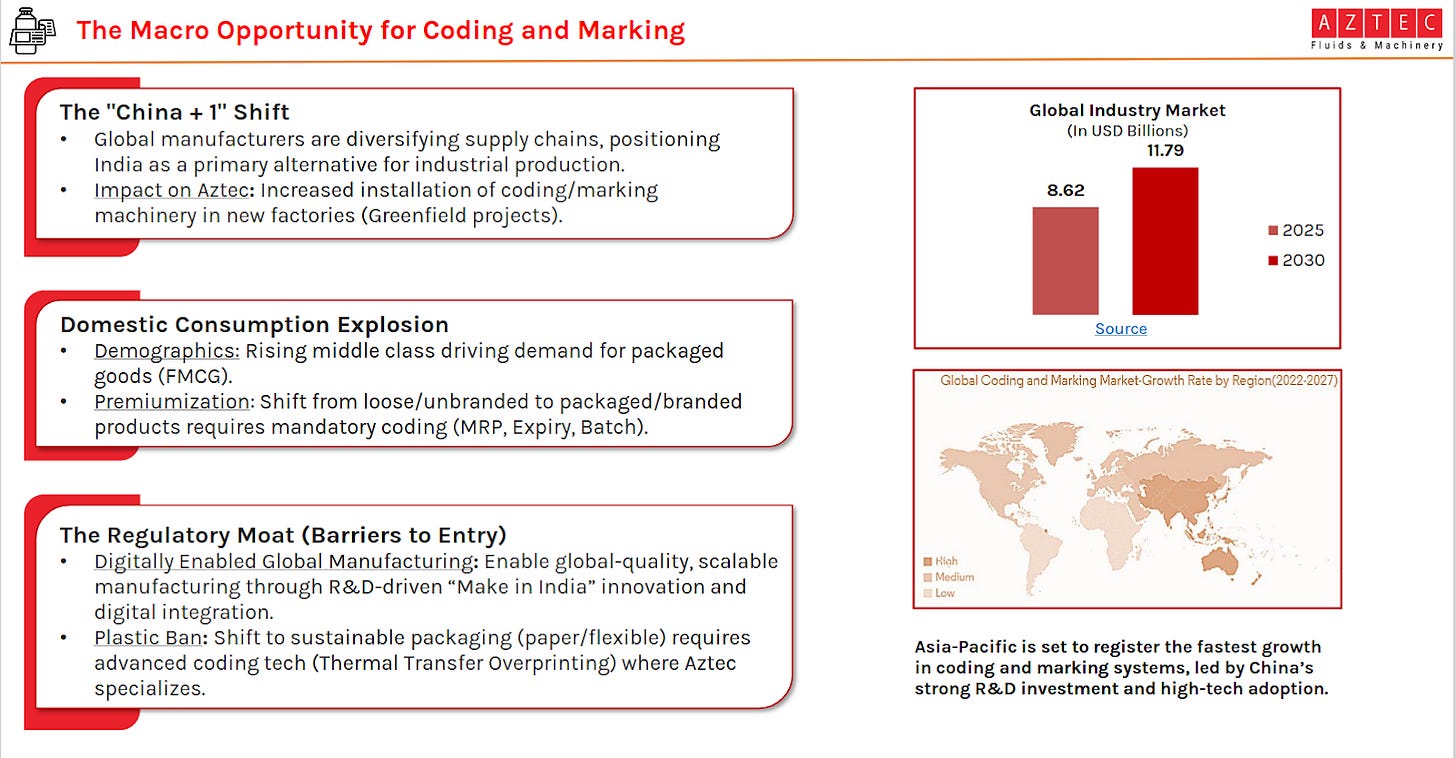

Global supply chain diversification and rising domestic consumption are structurally increasing demand for coding and marking equipment. Regulatory barriers, premiumization of FMCG, and sustainability-linked packaging shifts favor advanced coding technologies. Asia-Pacific is set to be the fastest-growing region, led by manufacturing and R&D intensity.

Coding and marking solutions have wide applicability across FMCG, food, beverages, healthcare, automotive, construction, textiles, and chemicals. This multi-sector exposure reduces cyclicality and expands addressable market opportunities. Broad industry coverage positions the business for scalable, diversified growth.

Fertilizers

Krishana Phoschem | Small Cap | Fertilizers

Krishana Phoschem is a company specializing in the manufacturing of specialized chemicals for the textile industry. Initially engaged in BRP production, it has expanded to include SSP and GSSP. The company now diversifies into intermediate dyes and other allied chemicals, providing products like H acid, E K acid, and PNCBOSA.

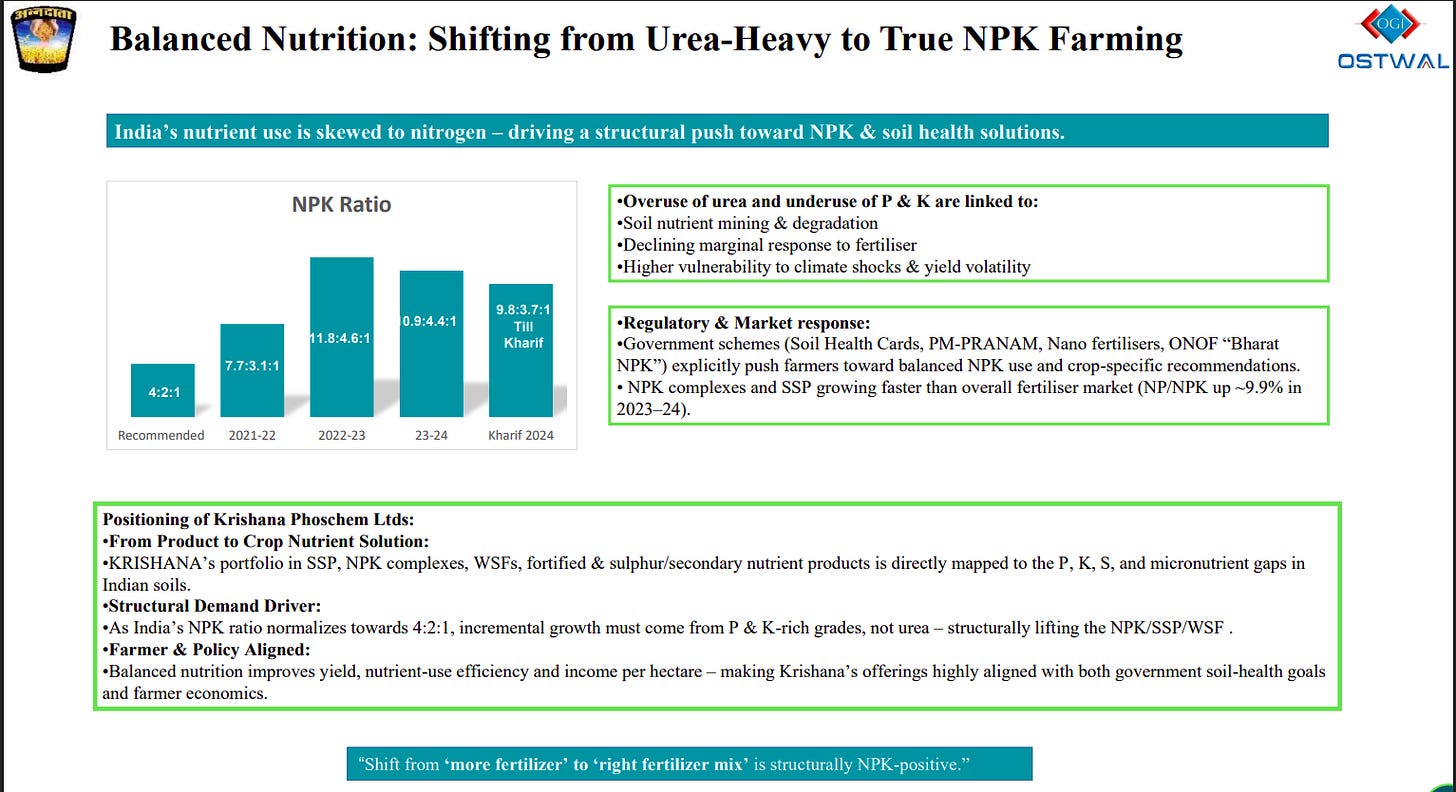

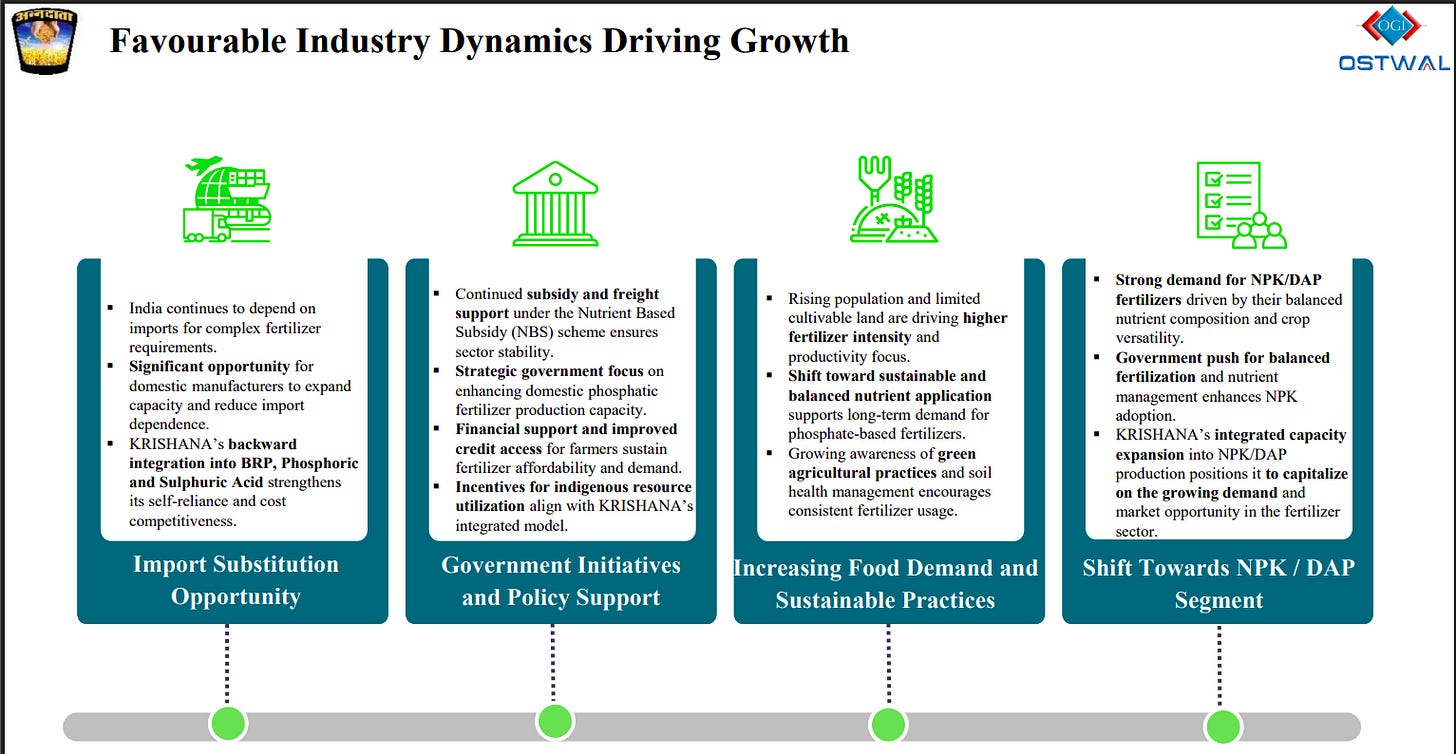

India’s fertilizer use remains skewed toward urea, leading to soil degradation and yield volatility, prompting a structural shift toward balanced NPK nutrition. Policy support and farmer economics are now aligned to drive higher adoption of P- and K-rich fertilizers. This transition structurally benefits NPK, SSP, and value-added nutrient solutions.

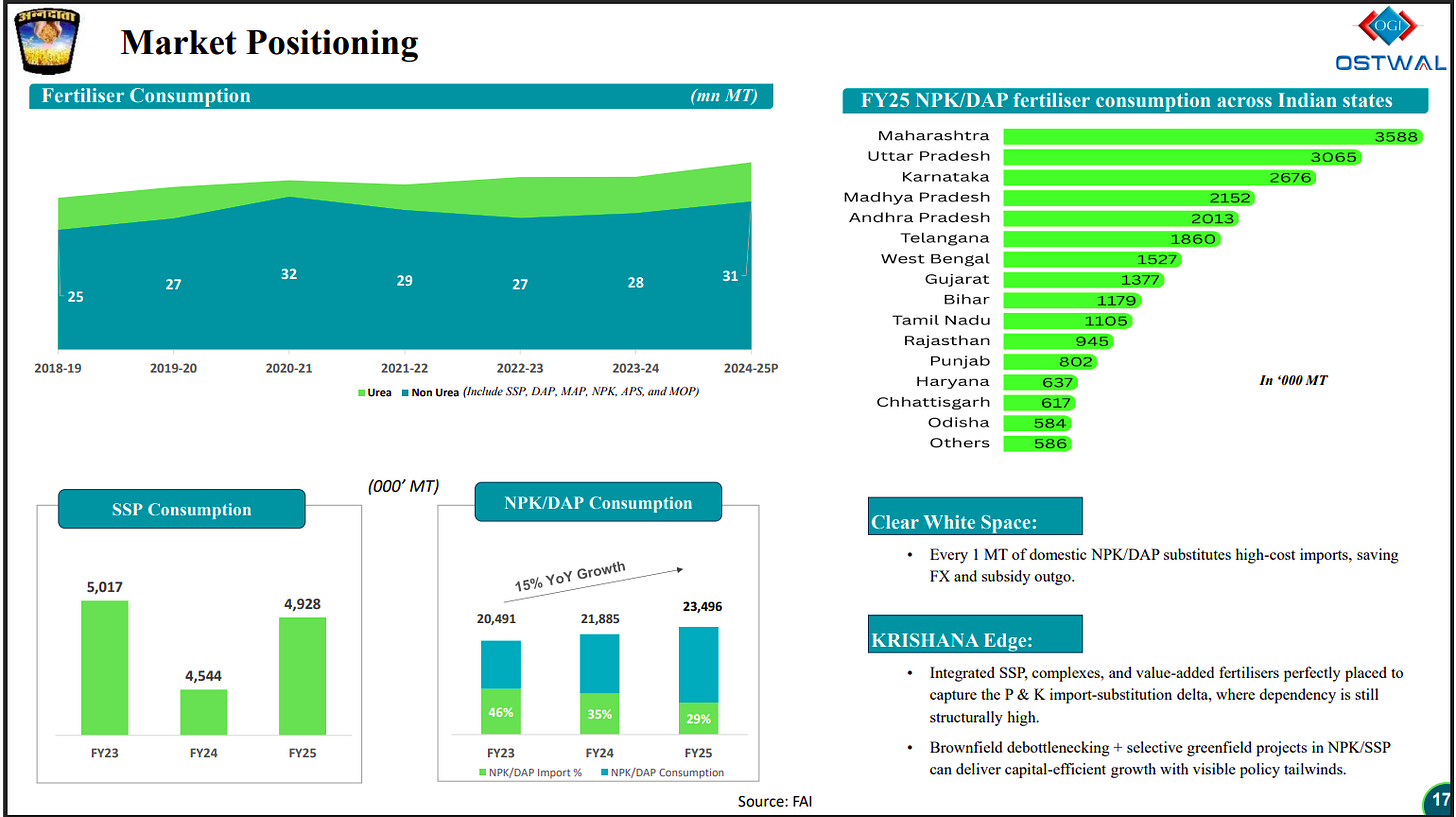

Non-urea fertilizer consumption is steadily rising, with NPK/DAP growing at ~15% YoY as import dependence declines. Large agricultural states like Maharashtra, UP, and Karnataka drive demand, highlighting a clear import-substitution opportunity. Domestic integrated players are well placed to capture this shift.

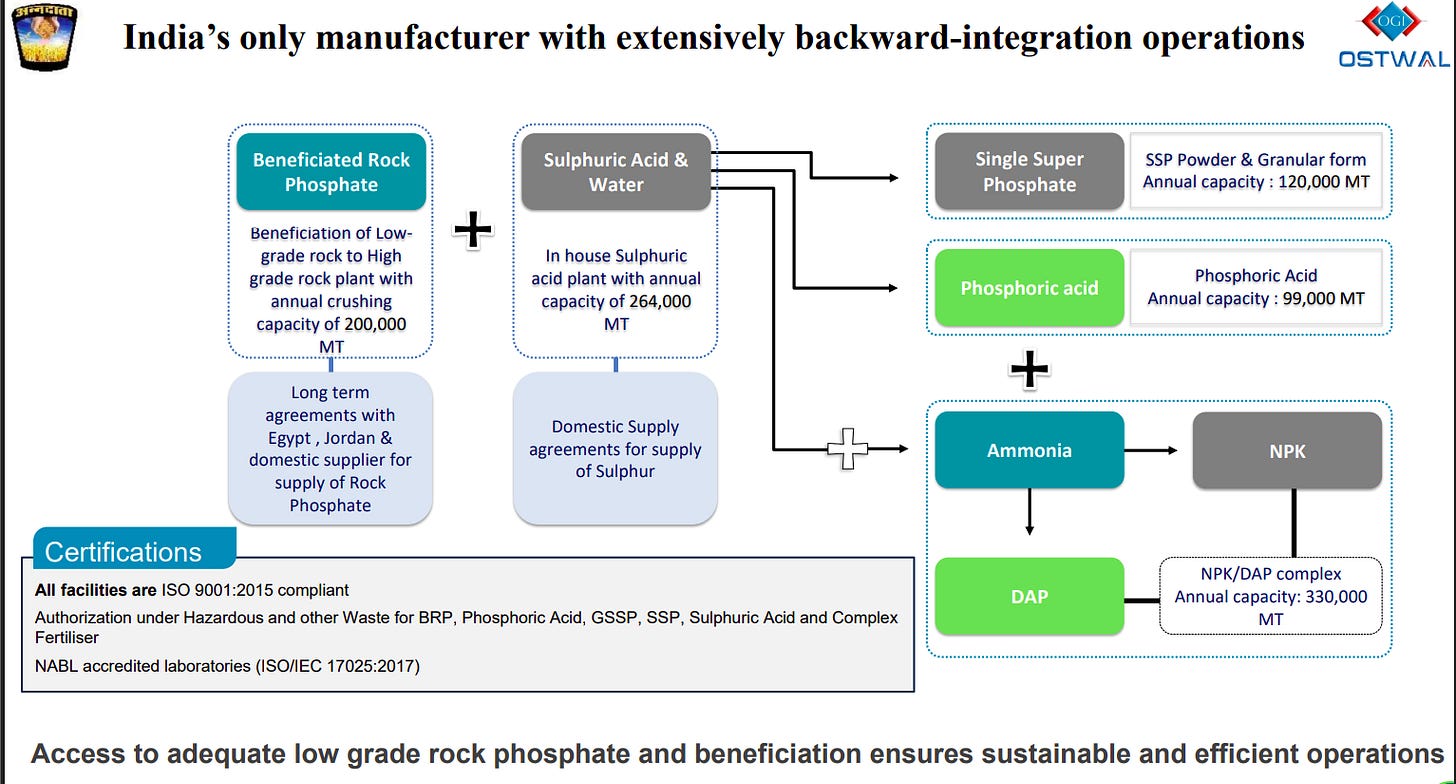

Extensive backward integration across rock phosphate, sulphuric acid, phosphoric acid, SSP, DAP, and NPK ensures cost control, supply security, and margin stability. Long-term sourcing agreements and in-house capacities reduce import risk. This integration creates a durable competitive advantage in complex fertilizers.

Strong policy support, rising food demand, and sustainability-led farming practices are accelerating the shift toward balanced fertilization. Import substitution, subsidies, and nutrient efficiency initiatives provide long-term demand visibility. Integrated NPK/DAP capacity expansion is well aligned with these structural tailwinds.

Chemicals

Bai-Kakaji Polymers | Nano Cap | Chemicals

Bai-Kakaji Polymers Ltd. is an Indian manufacturer of PET preforms, plastic caps and closures used in water, carbonated beverages, juices and dairy packaging. The company focuses on advanced molding technology to deliver consistent quality and low-rejection packaging solutions across India.

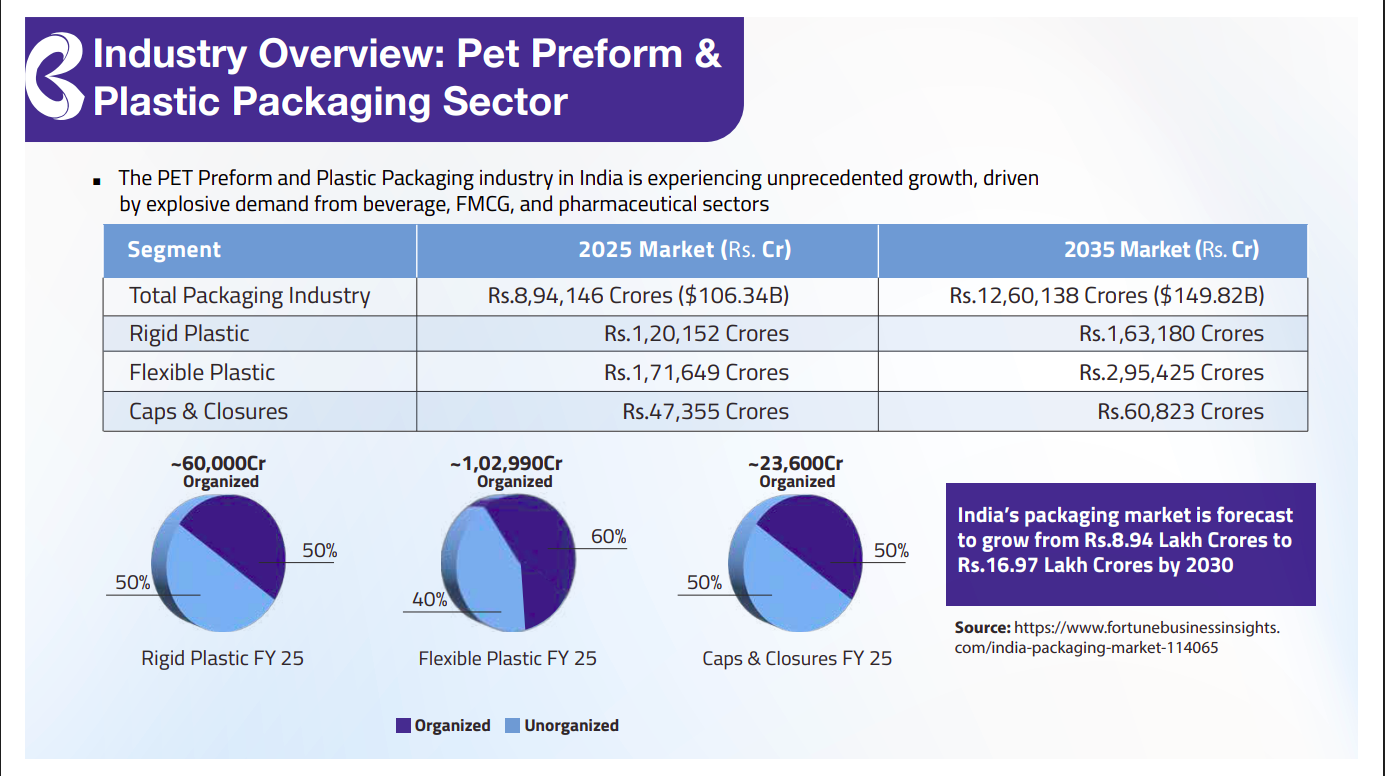

India’s packaging segments—PET preforms, caps & closures, rigid and flexible packaging—are set for strong multi-year growth, with the total addressable market doubling from ₹3.6 lakh crore in 2025 to ~₹7.7 lakh crore by 2035. Flexible packaging is the fastest-growing segment, driven by consumption and retail expansion.

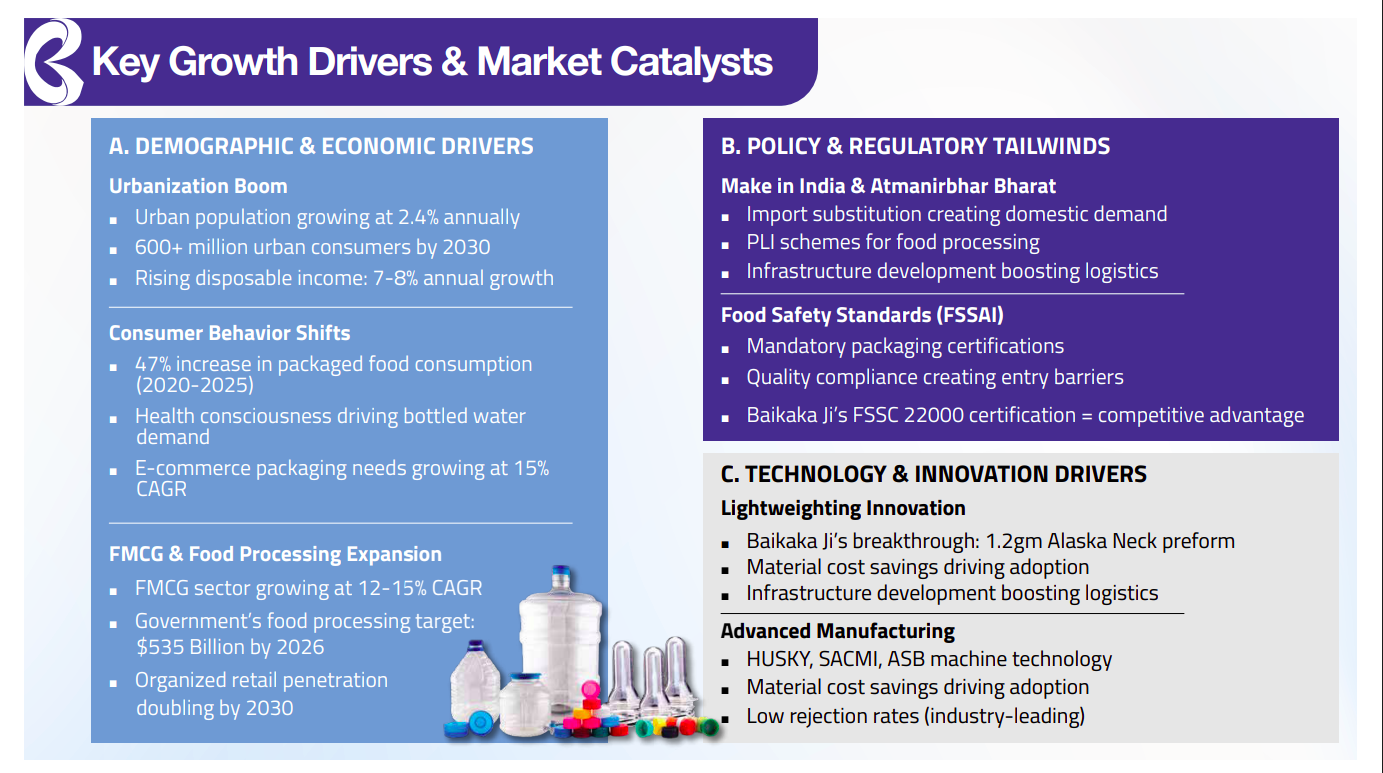

Urbanization, rising disposable incomes, and shifts toward packaged food and e-commerce are driving sustained demand growth. Policy tailwinds (PLI, Make-in-India, FSSAI norms) and technology-led lightweighting and advanced manufacturing further strengthen entry barriers and scalability.

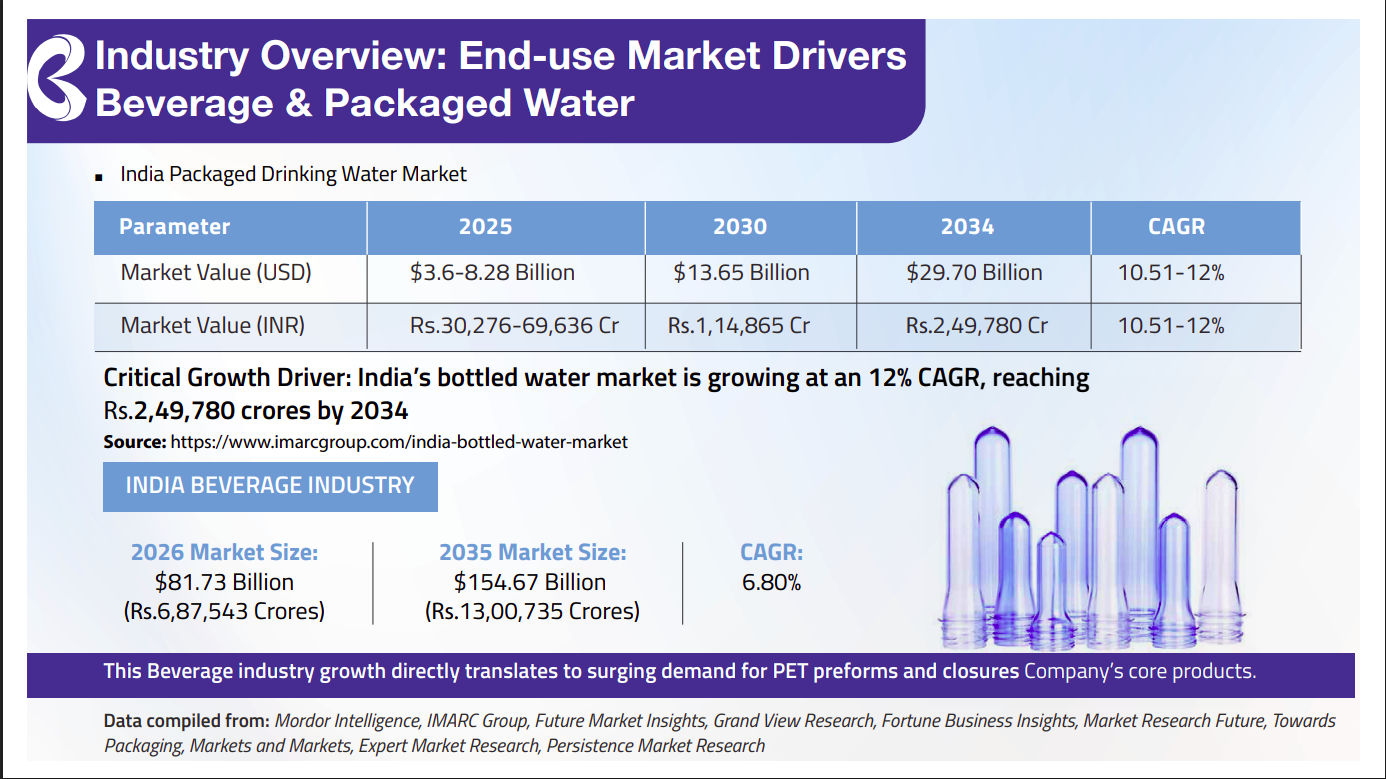

India’s bottled water market is growing at ~12% CAGR, projected to reach ~₹2.5 lakh crore by 2034. This rapid expansion directly boosts demand for PET preforms and closures, making beverages a core structural demand driver for packaging players.

India’s overall packaging market is expected to grow from ~₹8.9 lakh crore in 2025 to ~₹12.6 lakh crore by 2035, led by rigid and flexible plastics. Rising formalization and organized market share gains create long-term opportunities for scaled, compliant manufacturers.

Retail

Avenue Supermarts | Large Cap | Retail

Avenue Supermarts (ASL) is a one-stop supermarket chain in India offering a wide range of home and personal products under one roof at competitive prices. Each DMart store stocks food, toiletries, beauty products, garments, kitchenware, home appliances, and more to meet the diverse needs of Indian families, focusing on providing good products at great value.

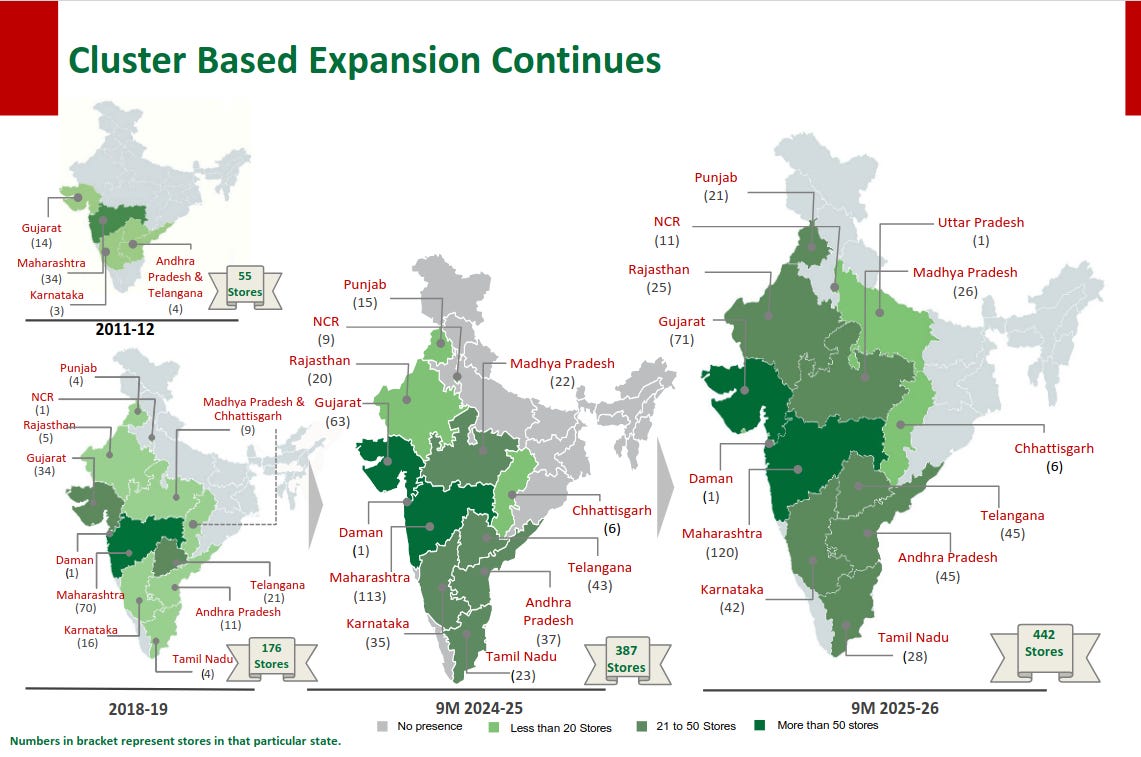

The company has steadily expanded its store footprint through a cluster-led strategy, growing from 55 stores in FY12 to 442 stores by 9M FY26. Expansion has been deepest in Maharashtra, Gujarat, Andhra Pradesh, Telangana, and Karnataka, strengthening regional density and operational leverage.

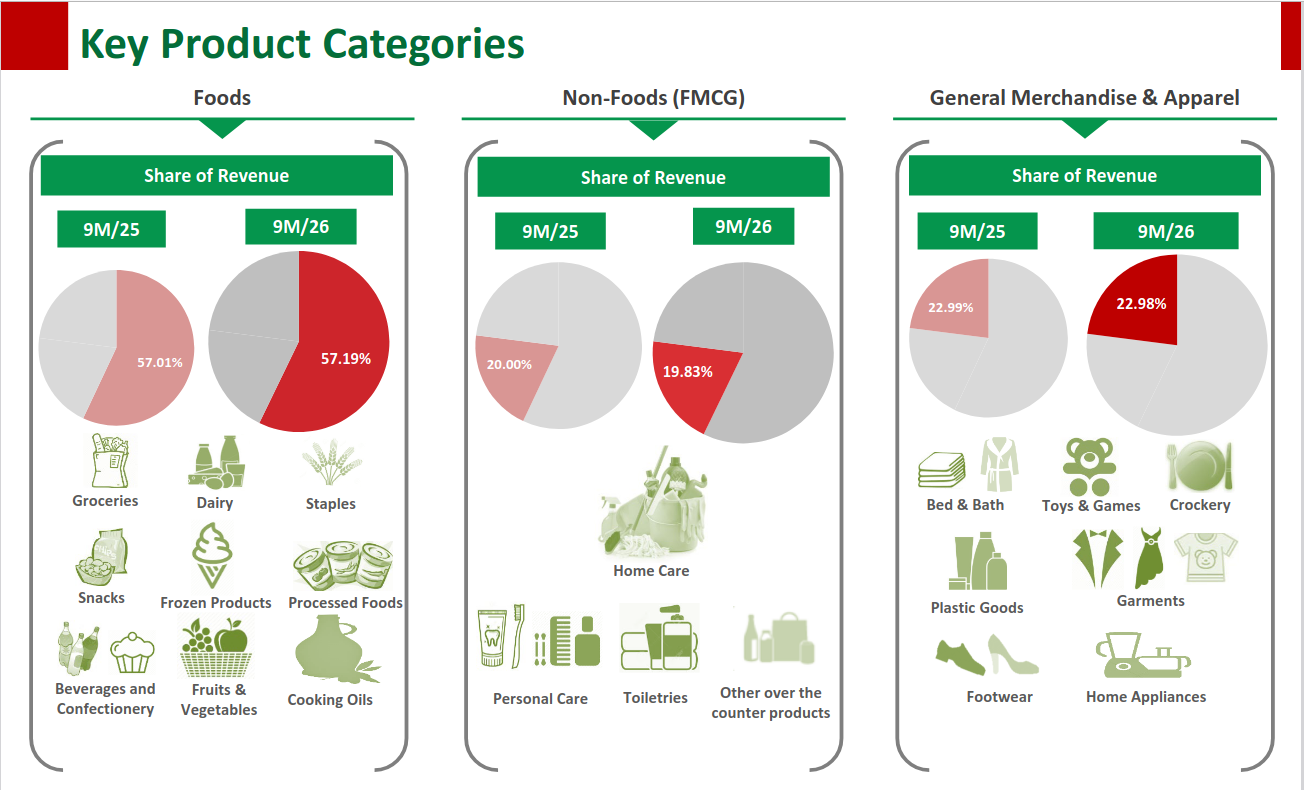

Foods remain the largest revenue contributor at ~57% in both 9M FY25 and 9M FY26, led by groceries, staples, and fresh categories. Non-food FMCG contributes ~20%, while General Merchandise & Apparel accounts for ~23%, reflecting a stable and well-diversified category mix.

Miscellaneous

BharatRohan Airborne Innovations | Nano Cap | Miscellaneous

BharatRohan Airborne Innovations provides drone-enabled crop monitoring, branded agricultural inputs, and integrated management practices. The company delivers tech-driven, sustainable solutions that empower farmers and enhance the agricultural value chain.

Indian farmers lose over ₹500 billion annually due to pests, diseases, and nutrient deficiencies, driven by lack of timely scientific advisory and weak crop health assessment. In addition, residue non-compliance has led to significant export rejections, especially in the EU.

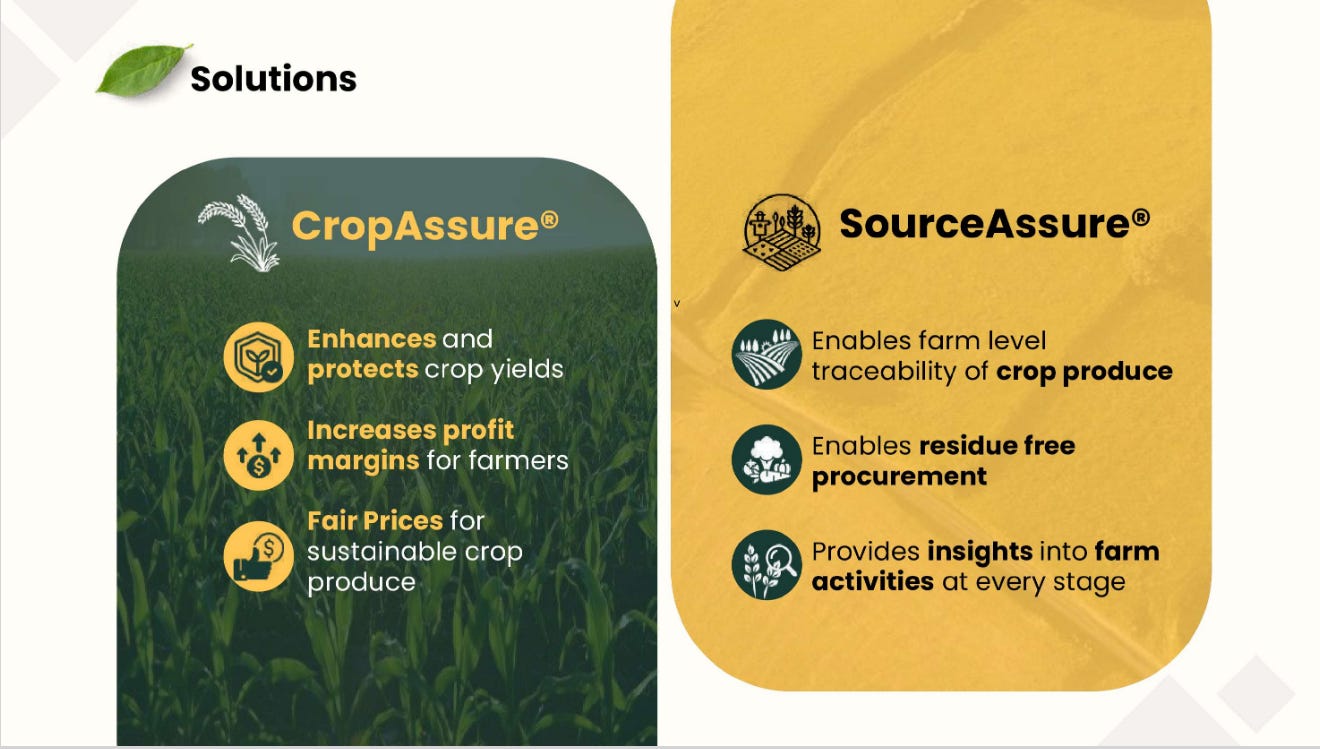

CropAssure focuses on improving farm productivity by protecting yields, increasing farmer margins, and ensuring fair pricing. SourceAssure complements this by enabling end-to-end traceability, residue-free procurement, and real-time visibility into farm activities for buyers.

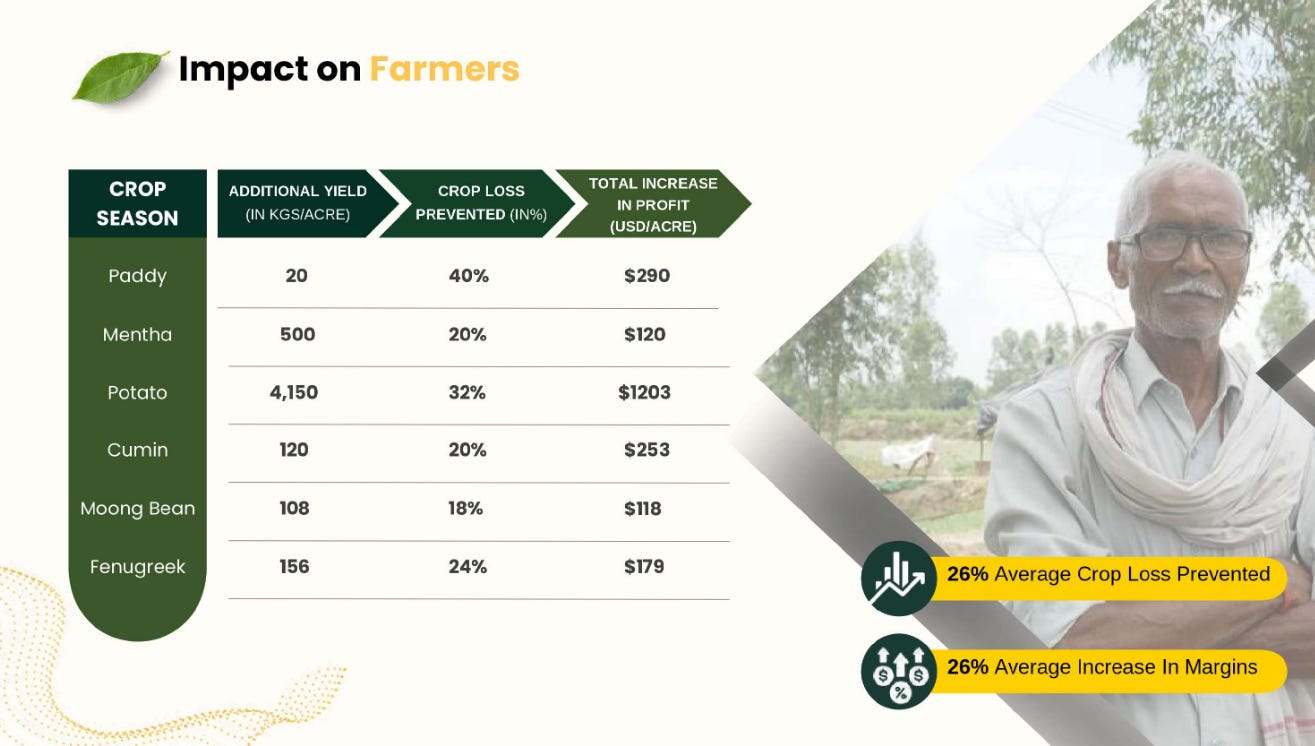

The solutions deliver measurable on-ground impact, with higher yields, reduced crop losses, and improved profitability across crops like paddy, potato, cumin, and mentha. On average, farmers see ~26% crop loss prevention and ~26% increase in margins per acre.

Healthcare

Fortis Healthcare | Mid Cap | Healthcare

Fortis Healthcare is a prominent integrated healthcare provider operating multi-specialty hospitals and diagnostics centers. The company has implemented next-generation security solutions to ensure secure network access, application protection, and continuous monitoring as part of its information security commitment.

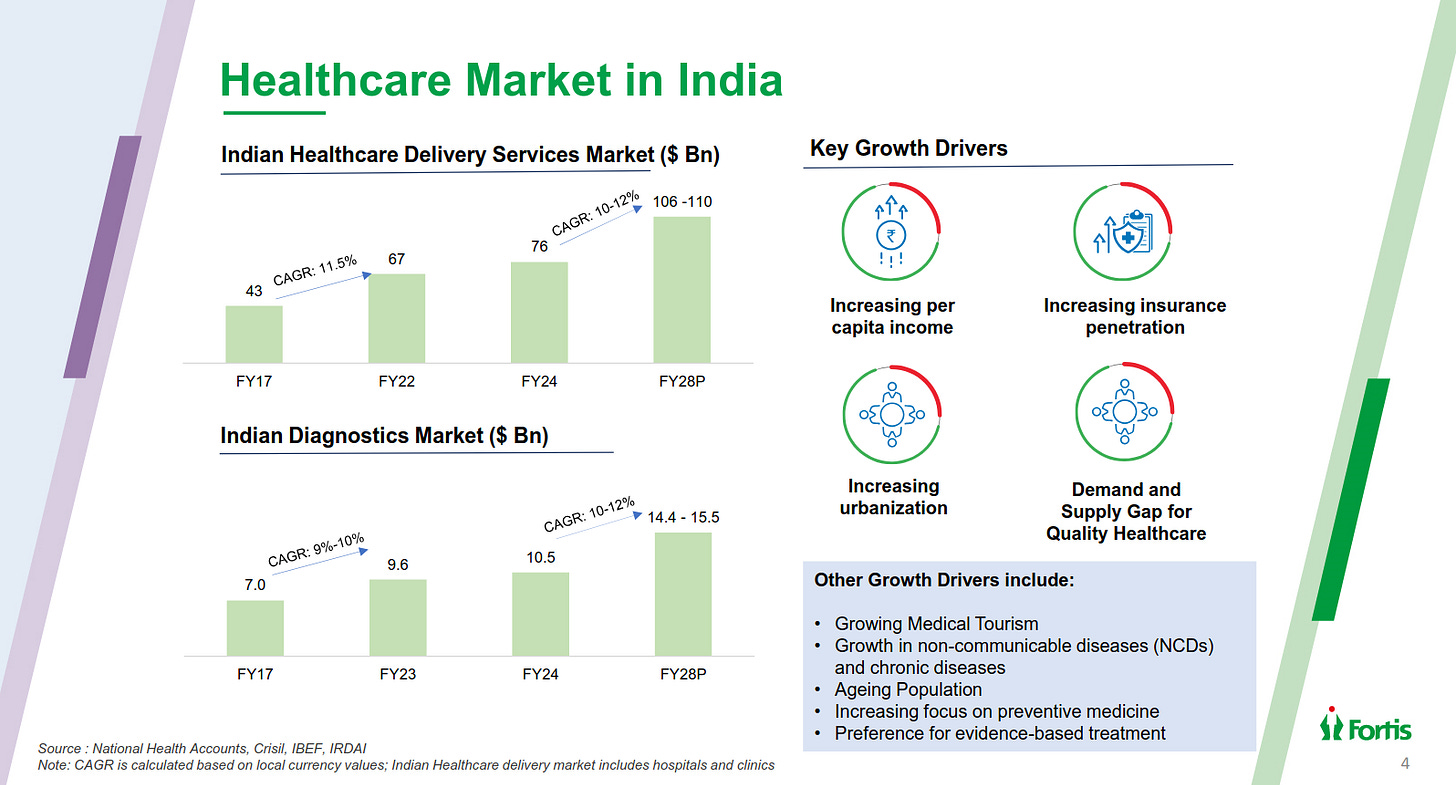

India’s healthcare delivery market is projected to grow from ~$76B in FY24 to $106–110B by FY28, implying a 10–12% CAGR, while diagnostics grows at a similar pace. Growth is underpinned by income growth, insurance penetration, medical tourism, ageing population, and rising NCD prevalence, structurally favoring scaled private hospital operators.

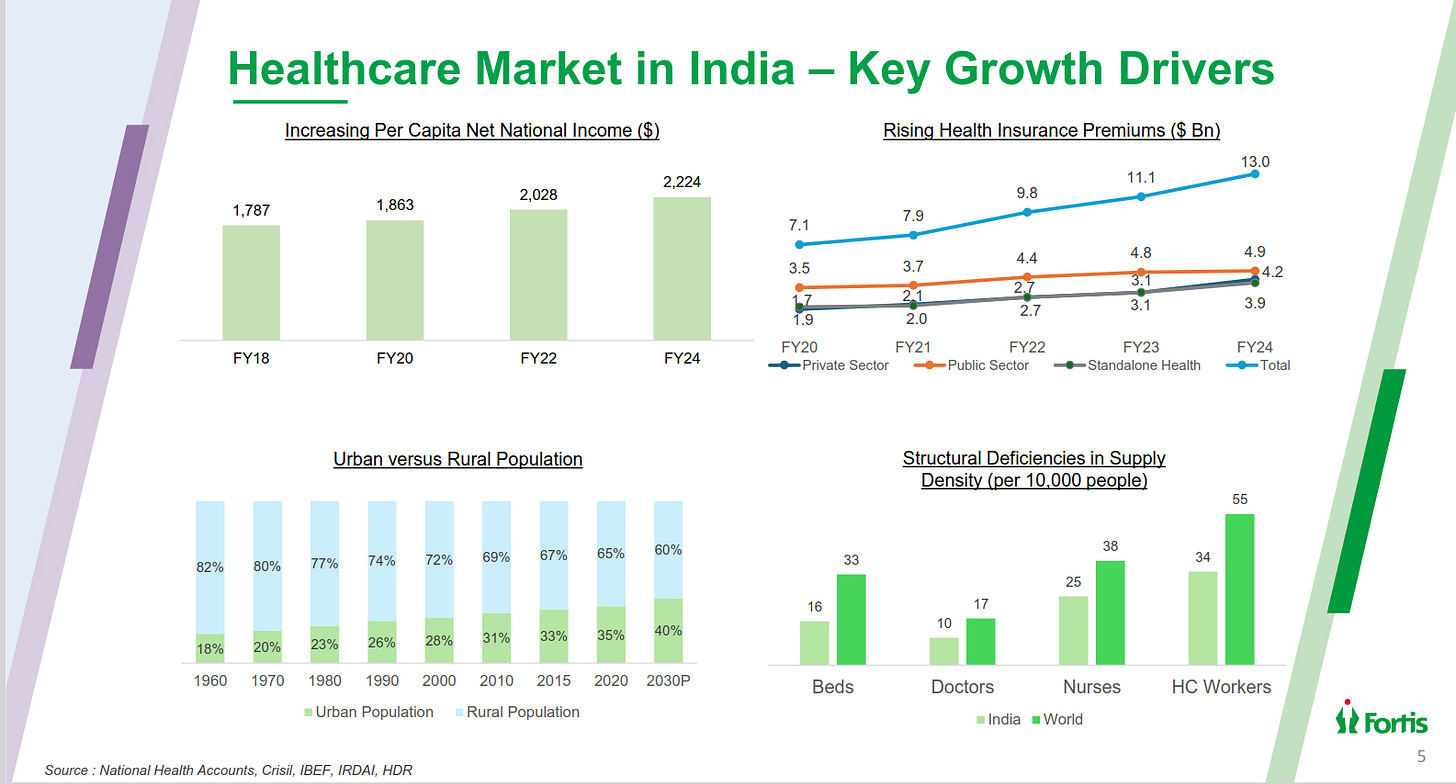

India’s healthcare demand is being driven by rising per-capita income, increasing insurance penetration, and rapid urbanization, expanding the paying patient base.At the same time, structural supply gaps in beds, doctors, and nurses versus global benchmarks create a sustained need for private hospital capacity expansion.

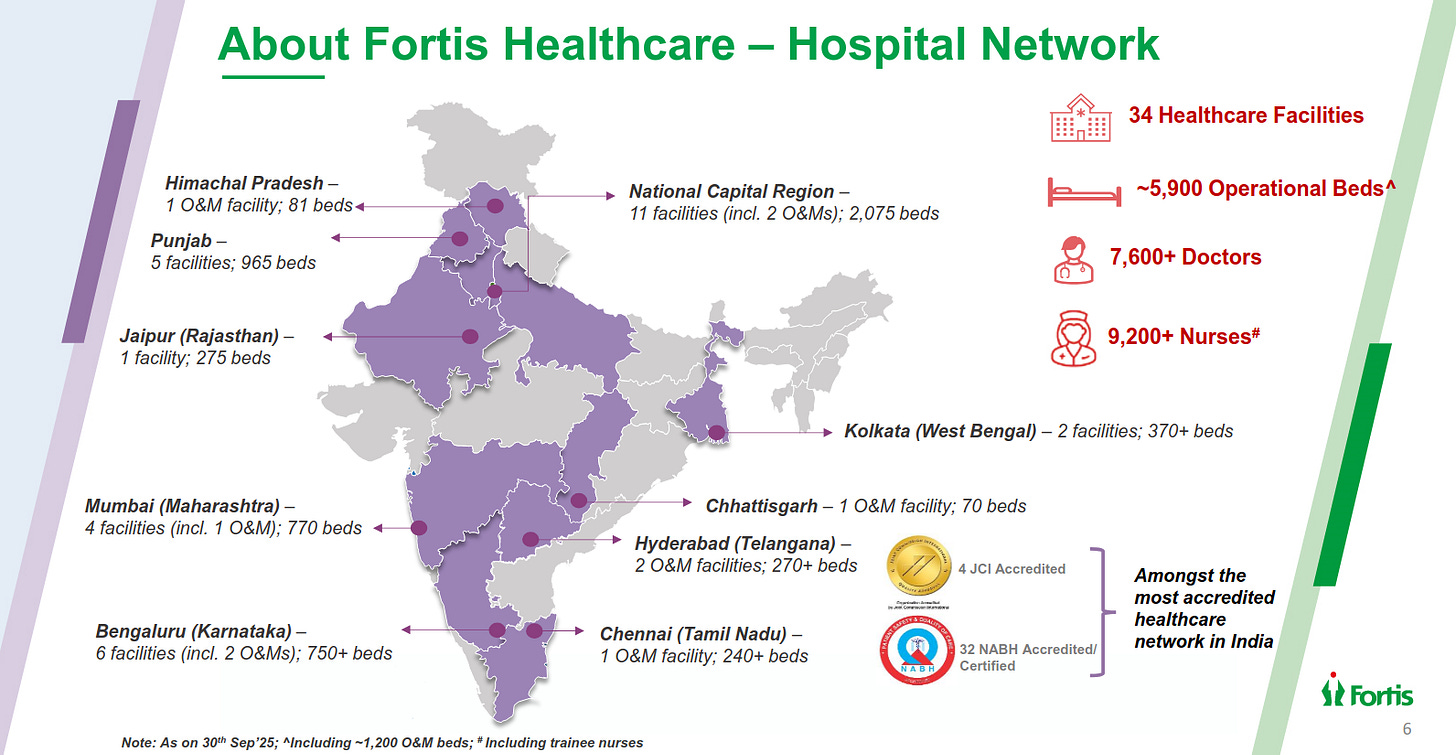

Fortis operates a large, pan-India hospital network with 34 healthcare facilities and ~5,900 operational beds, anchored in key metro clusters like NCR, Mumbai, Bengaluru, and Chennai. The network is supported by 7,600+ doctors and 9,200+ nurses, with strong clinical credentials, including JCI and NABH accreditations, positioning Fortis among India’s most trusted healthcare providers.

Metals

Karbonsteel Engineering | Nano Cap | Metals

Karbonsteel Engineering specializes in the design, fabrication, and assembly of heavy and precision steel structures for diverse industrial and infrastructure projects. They deliver customized solutions across sectors including steel plants, railway bridges, oil & gas plants, and chemical plants.

Structural steel demand is being driven by infrastructure expansion, smart cities, and the Make in India push. Rising usage across bridges, railways, PEBs, and industrial complexes is supported by policy targets for higher per-capita steel consumption and manufacturing exports.

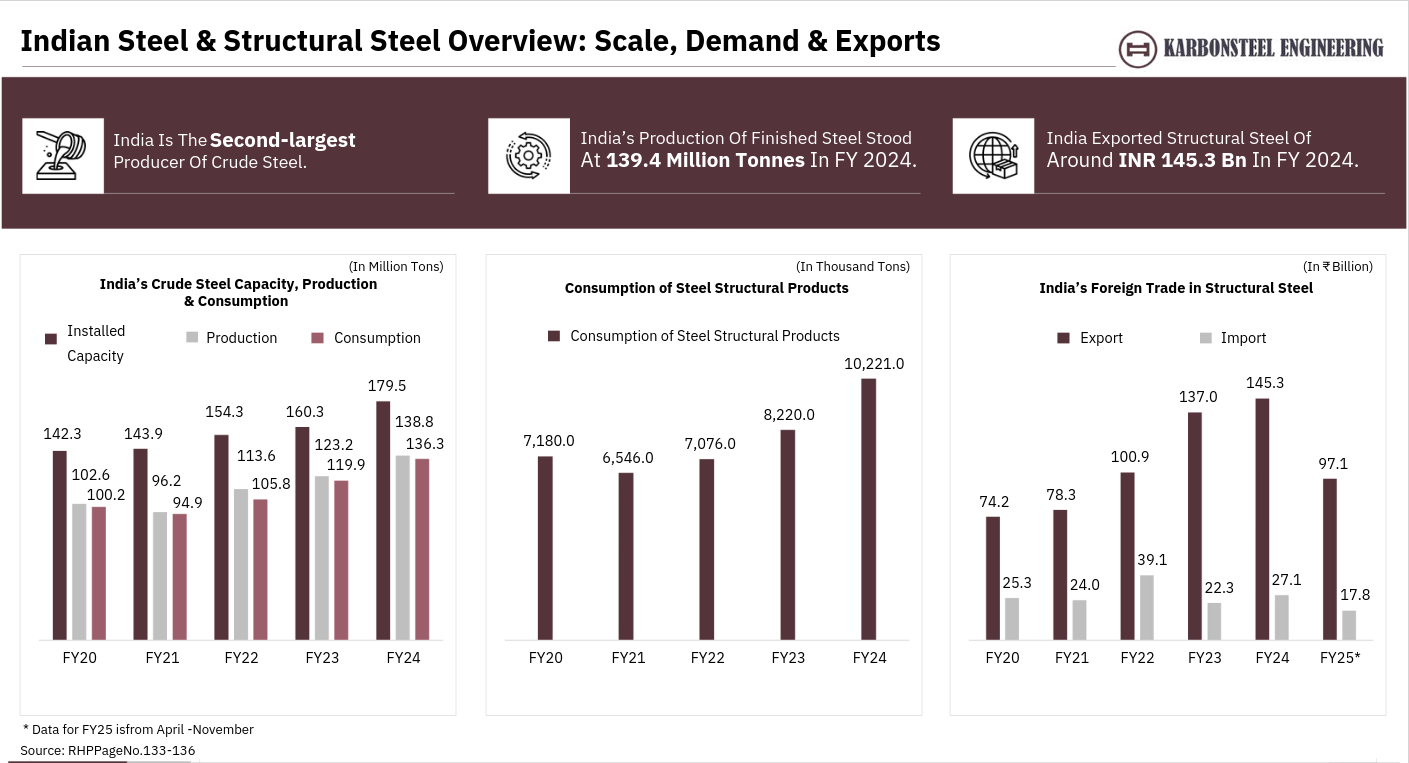

India is the world’s second-largest crude steel producer, with finished steel output at ~139 million tonnes in FY24. Structural steel consumption and exports have grown steadily, with exports reaching ~₹145 billion, highlighting India’s rising global competitiveness.

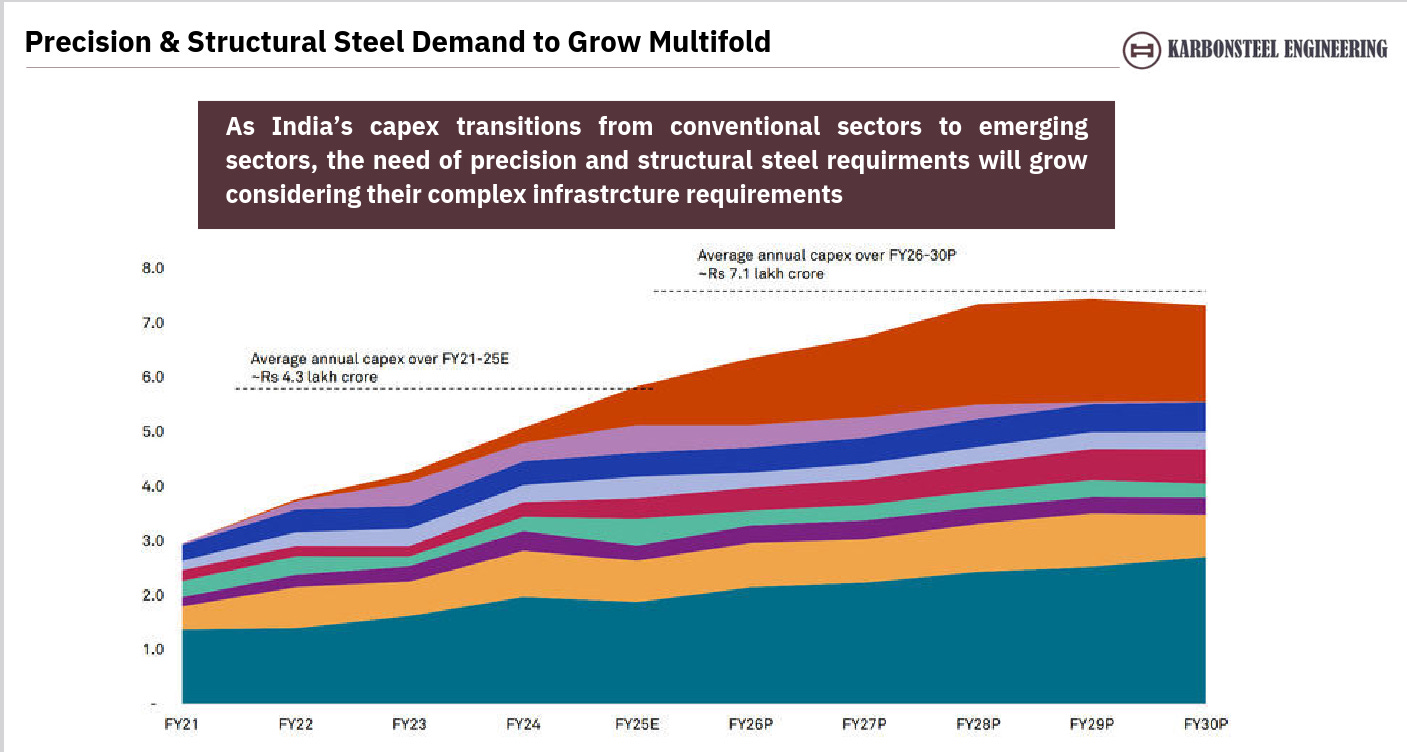

As capex shifts toward complex infrastructure and emerging sectors, demand for precision and structural steel is accelerating. Higher average annual capex over FY26–30 is expected to materially lift steel intensity across power, transport, and industrial projects.

The company has executed a wide range of large and complex projects across metros, railways, industrial plants, and heavy engineering. This diversified project portfolio demonstrates strong execution capability in precision fabrication and high-spec structural solutions.

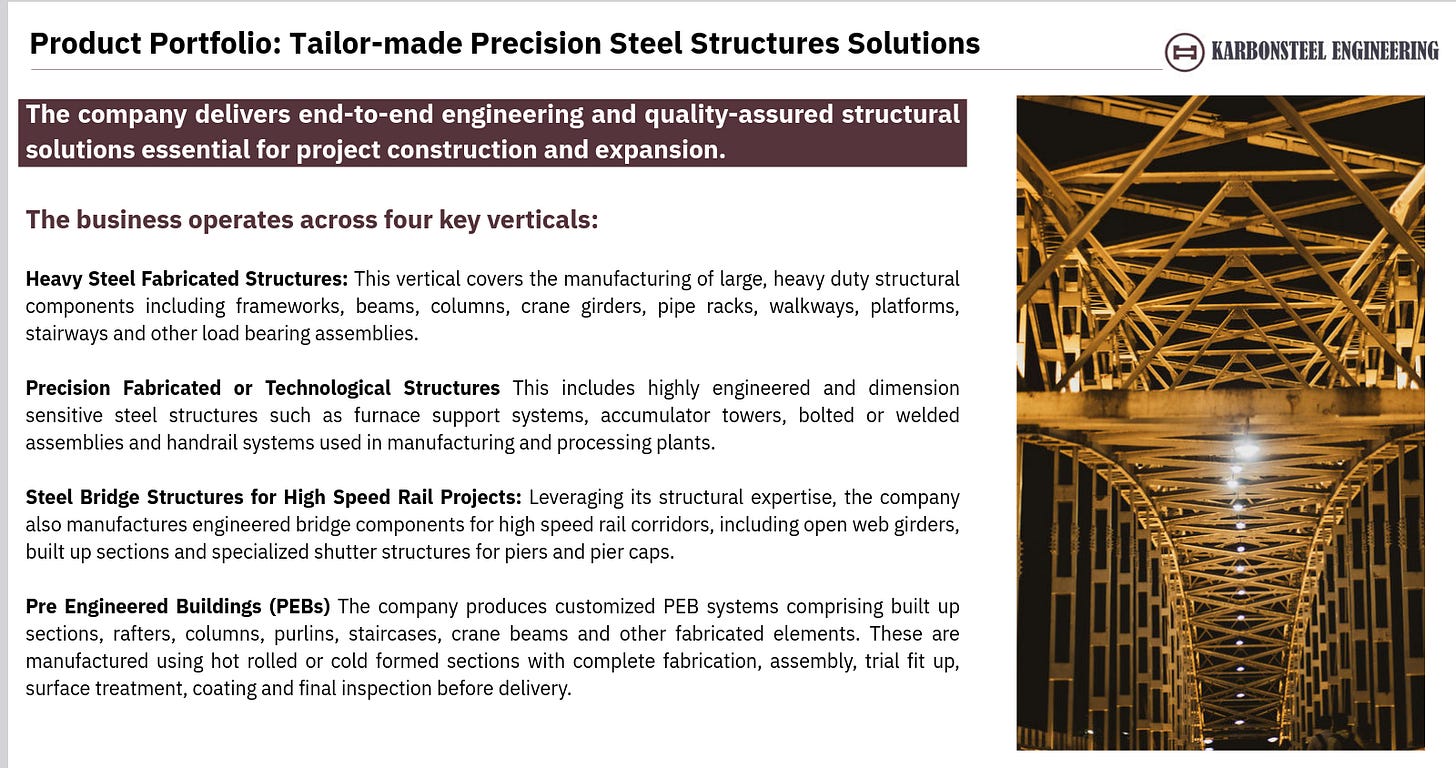

The company offers end-to-end engineered structural solutions across heavy fabrication, precision structures, bridges, and PEBs.Its integrated capabilities support customized, high-quality steel structures critical for infrastructure, manufacturing, and expansion projects.

Media & Entertainment

GTPL Hathaway | Micro Cap | Media & Entertainment

GTPL Hathway is a leading regional Multiple System Operator (MSO) in India, providing cable television and broadband services.

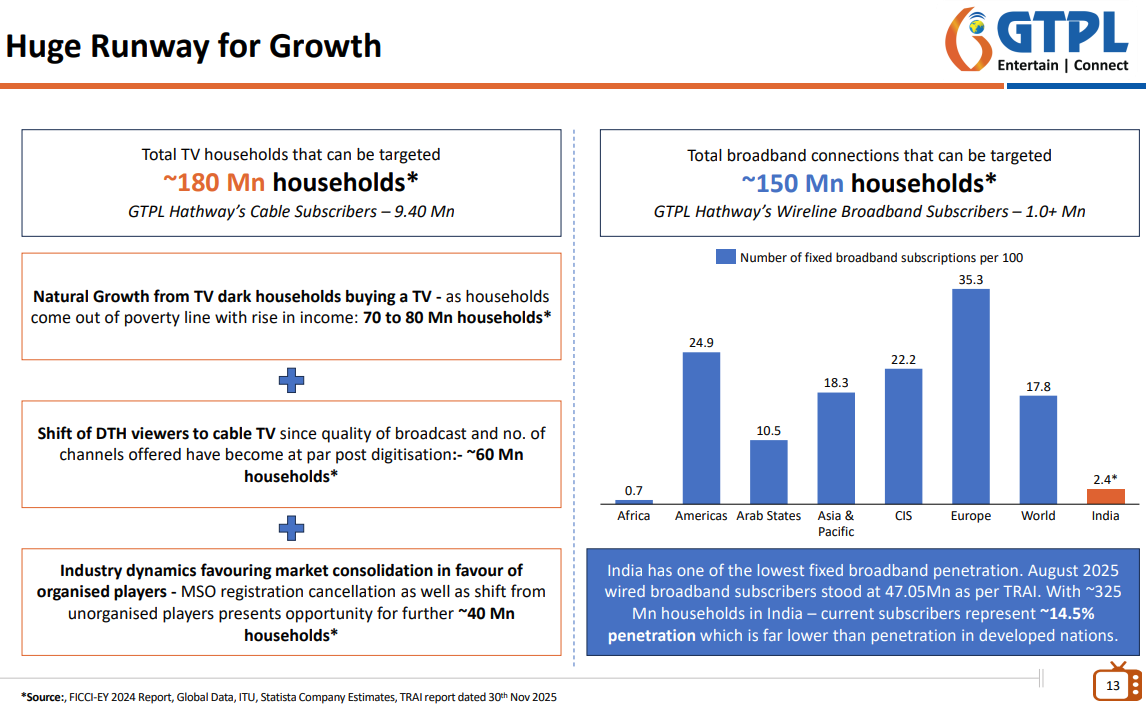

GTPL Hathway sees a total addressable market of around 180 million households for cable TV. Growth can come from three sources: TV-dark households buying their first TV (70-80 million), DTH users switching to cable post-digitisation (60 million), and consolidation shifting subscribers from unorganised players (40 million). On broadband, India’s fixed-line penetration is just 2.4 per 100 people — among the lowest globally and far behind Europe’s 35. Only about 14.5% of Indian households have wired broadband, leaving a massive runway for GTPL to grow its 1 million+ subscriber base in a market of 150 million potential homes.

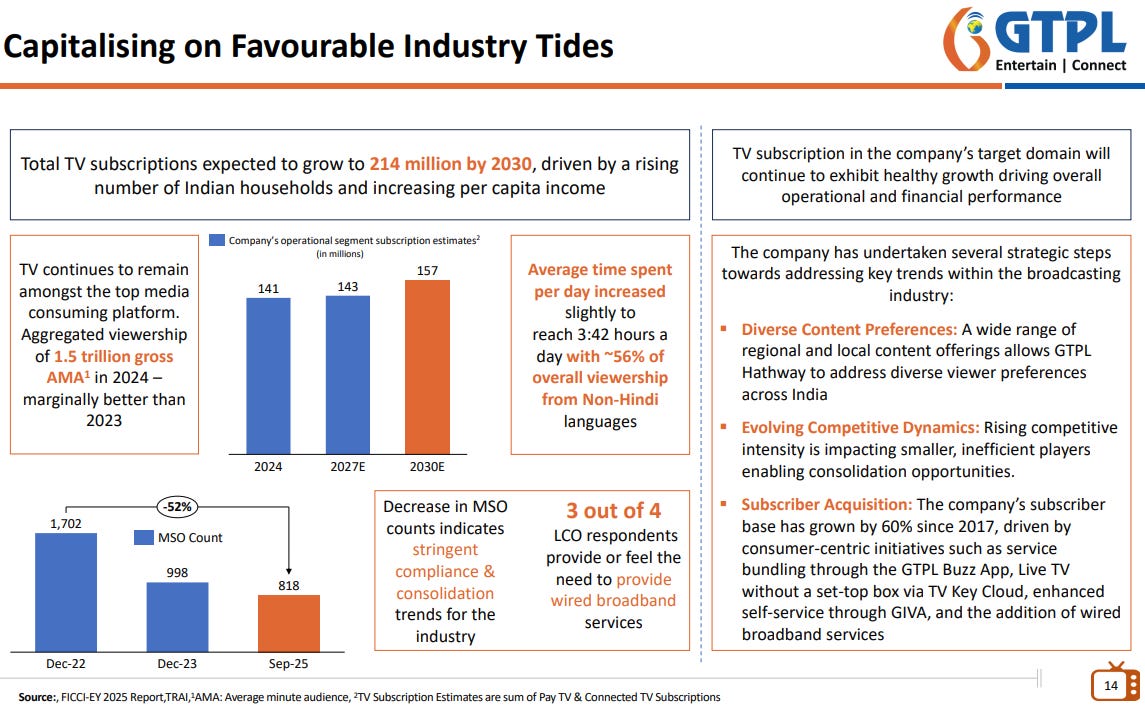

TV subscriptions in India are expected to grow from 141 million in 2024 to 157 million by 2030, driven by rising households and incomes. Viewers spend nearly 4 hours a day watching TV, with 56% of viewership coming from non-Hindi languages — a segment where GTPL has strong regional content. The industry is consolidating rapidly, with MSO count dropping 52% since December 2022 as stricter compliance weeds out smaller players. On the broadband front, 3 out of 4 local cable operators now feel the need to offer wired broadband services. GTPL has grown its subscriber base 60% since 2017 through bundled services, the GTPL Buzz App, and TV Key Cloud.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.