Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 18 companies across 9 industries.

Chemicals

Ester Industries

Auto Ancillary

Bosch

Exide Industries

Tata Motors passenger Vehicles

Eicher Motors

Metals

Godawari Power & Ispat Ltd. (GPIL)

Jindal Stainless

Engineering & Capital Goods

HPL Electric & Power

Finolex Cables

FMCG

Marico

Speciality Restaurants

Apex Frozen Foods

Jubilant FoodWorks

BCL Industries

Healthcare

Glenmark Pharma

Textiles

Dollar Industries

Building Materials

JSW Cement

Financial Services

General Ins. Corp

Chemicals

Ester Industries | Micro Cap | Chemicals

Ester Industries is a manufacturer of polyester films, specialty polymers, and engineering plastics. The company produces these materials for various sectors, including flexible packaging, textiles, and electronics. Its products are used in applications like food packaging, industrial packaging, and lidding for products like dairy and juices.

Products made using Loop’s recycled rDMT & rMEG target diverse industries like electronics, automotive, textiles, cosmetics, and packaging. These help companies launch sustainable products and meet decarbonization goals. Global DMT/MEG specialty chemical market is ~US$28 bn, growing at ~4% CAGR.

Polyester films serve a wide range of packaging-led applications—flexible packs, barrier films, twist wraps, lidding, shrink sleeves, holographics, cable insulation, soft-finish films, aesthetics, and labels. The versatility comes from durability, printability, and high-barrier properties.

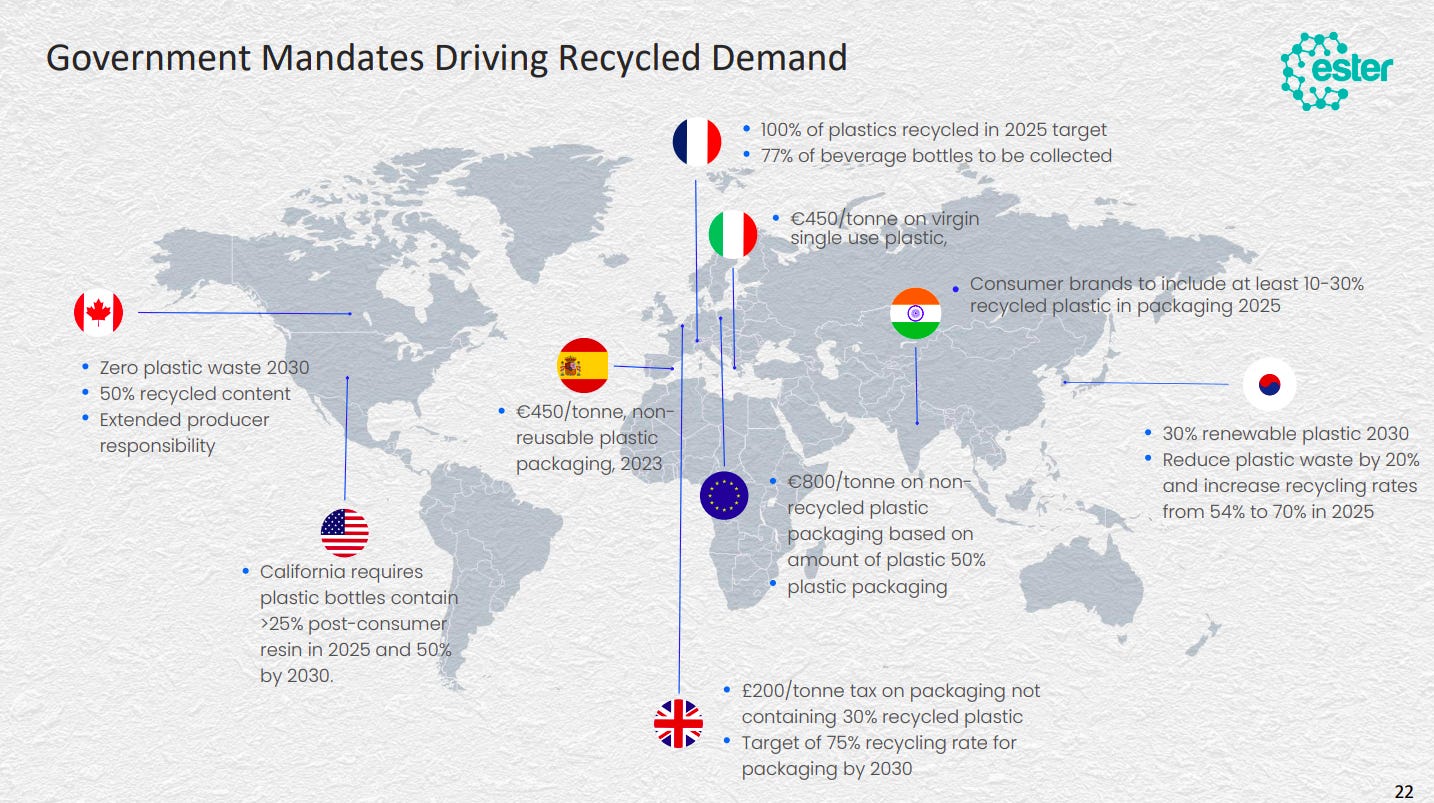

Countries globally are pushing aggressive recycling targets—EU taxes on virgin plastic, UK’s recycled-content tax, US/Canada mandates for post-consumer resin, and India’s 10–30% recycled packaging norms. These policies are accelerating demand for recycled plastics worldwide.

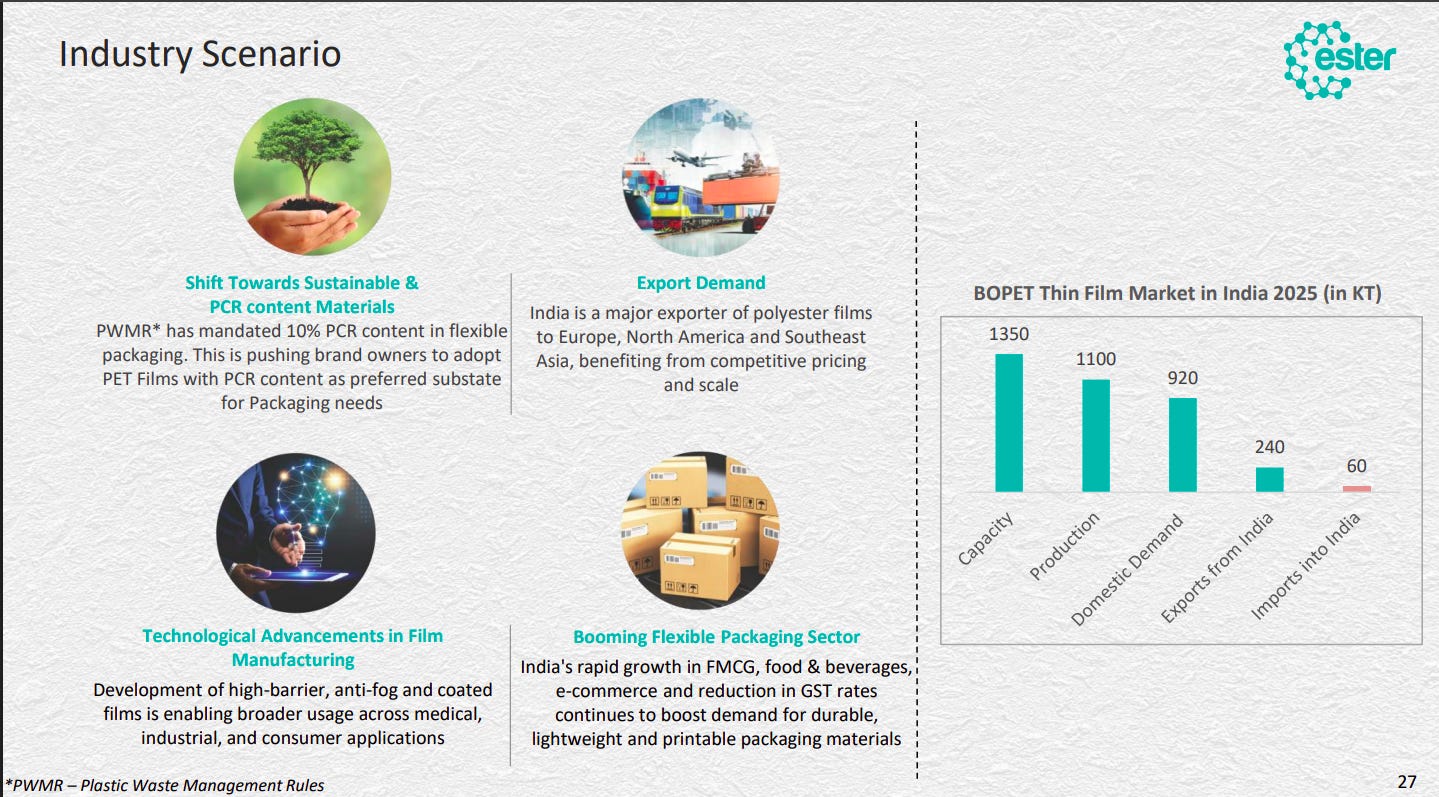

Shift toward sustainable, PCR-content films and strong export competitiveness are driving growth in India’s polyester film industry. Rising FMCG, e-commerce, and flexible packaging demand further strengthen the market. India’s BOPET capacity far exceeds domestic needs, enabling large export volumes.

Shift toward sustainable, PCR-content films and strong export competitiveness are driving growth in India’s polyester film industry. Rising FMCG, e-commerce, and flexible packaging demand further strengthen the market. India’s BOPET capacity far exceeds domestic needs, enabling large export volumes.

Auto Ancillary

Bosch | Large Cap | Auto Ancillary

Bosch Ltd is a technology and services company involved in four main sectors: Mobility Solutions, Industrial Technology, Consumer Goods, and Energy and Building Technology. It manufactures and trades in a wide range of products, including automotive components, power tools, home appliances, and security systems, and also provides engineering and business solutions

The slide shows steady long-term market growth of 3–4% CAGR (2024–2032) across autos, driven by rising EV penetration in passenger cars, LCVs, and two-wheelers. Hydrogen adoption gains traction in long-haul fleets, while EV momentum is supported by TCO benefits, PMP schemes, and falling battery prices.

Bosch highlights broad structural shifts: mobility faces stagnation and delayed tech transitions; consumer goods are pressured by aggressive Chinese competition; industrial technology remains weak and highly competitive; and energy/building tech struggles with a soft construction cycle, consolidation, and regulatory pressures.

Exide Industries | Small Cap | Auto Ancillary

Exide Industries is a leading battery manufacturing company that makes a wide range of lead-acid storage batteries for automotive, industrial, and other applications. The company manufactures batteries for sectors like power, telecom, infrastructure, railways, and defence.

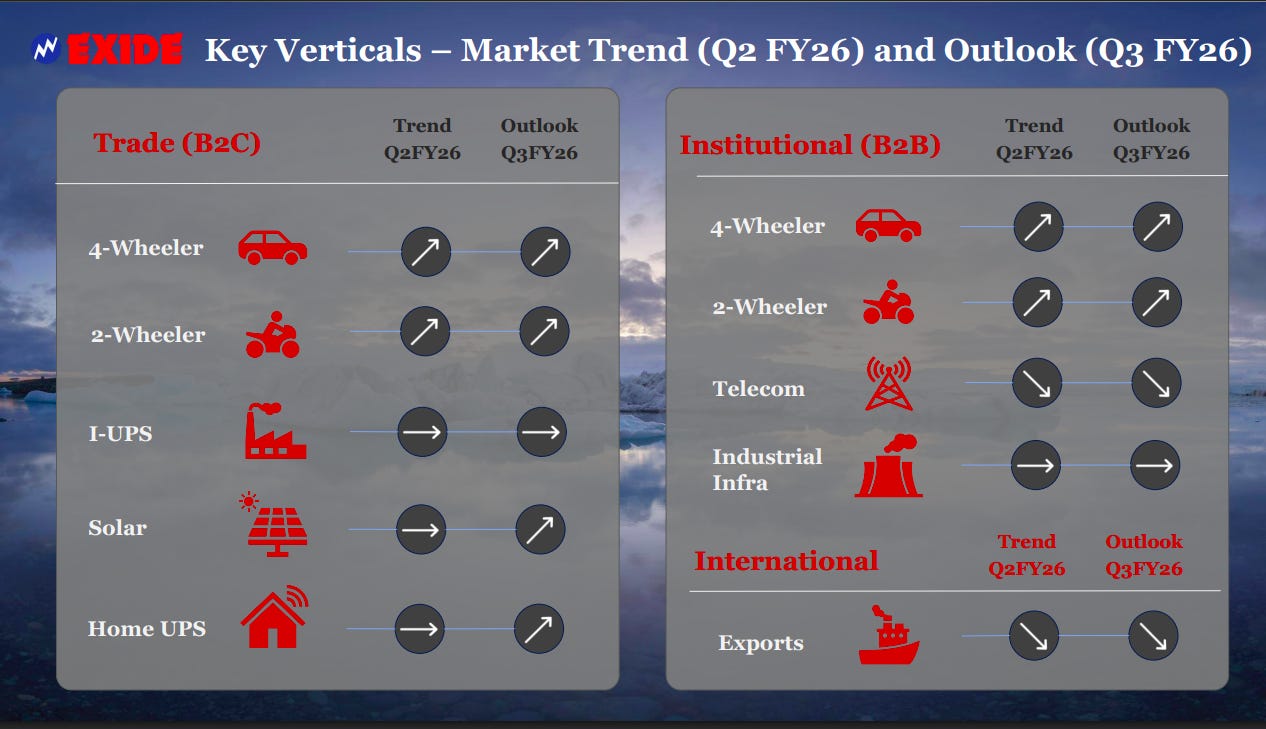

B2C and B2B segments show broad-based strength, with 4W/2W, Solar, Home UPS, and most institutional categories trending upward in Q2 and expected to stay strong in Q3. Only Exports remain weak with a declining trend expected to persist. Overall, domestic demand momentum continues to improve across verticals.

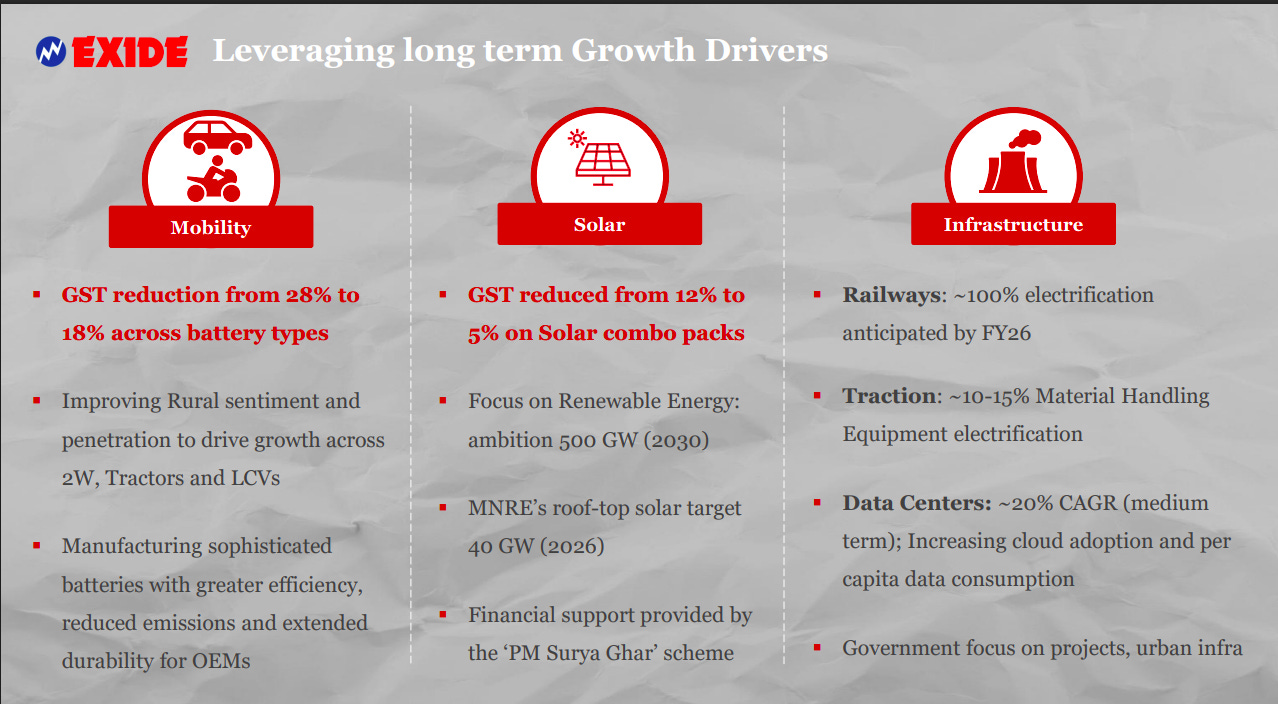

Long-term growth is supported by GST cuts, rising rural demand, and electrification across mobility. Solar expansion, government-backed schemes, and major infrastructure pushes—especially railways, traction, and data centers—are expected to structurally lift battery demand. These factors collectively strengthen Exide’s multi-vertical demand outlook.

Tata Motors Passenger Vehicles | Large Cap | Auto Ancillary

Tata Motors Passenger Vehicles (TMPV) is the new name for the entity that manages Tata’s domestic passenger vehicle and electric vehicle (EV) businesses, which was created after a demerger from its commercial vehicles business. This entity also includes the operations of Jaguar Land Rover (JLR). The split created two separate, publicly listed companies to allow each to focus on its own strategy and market.

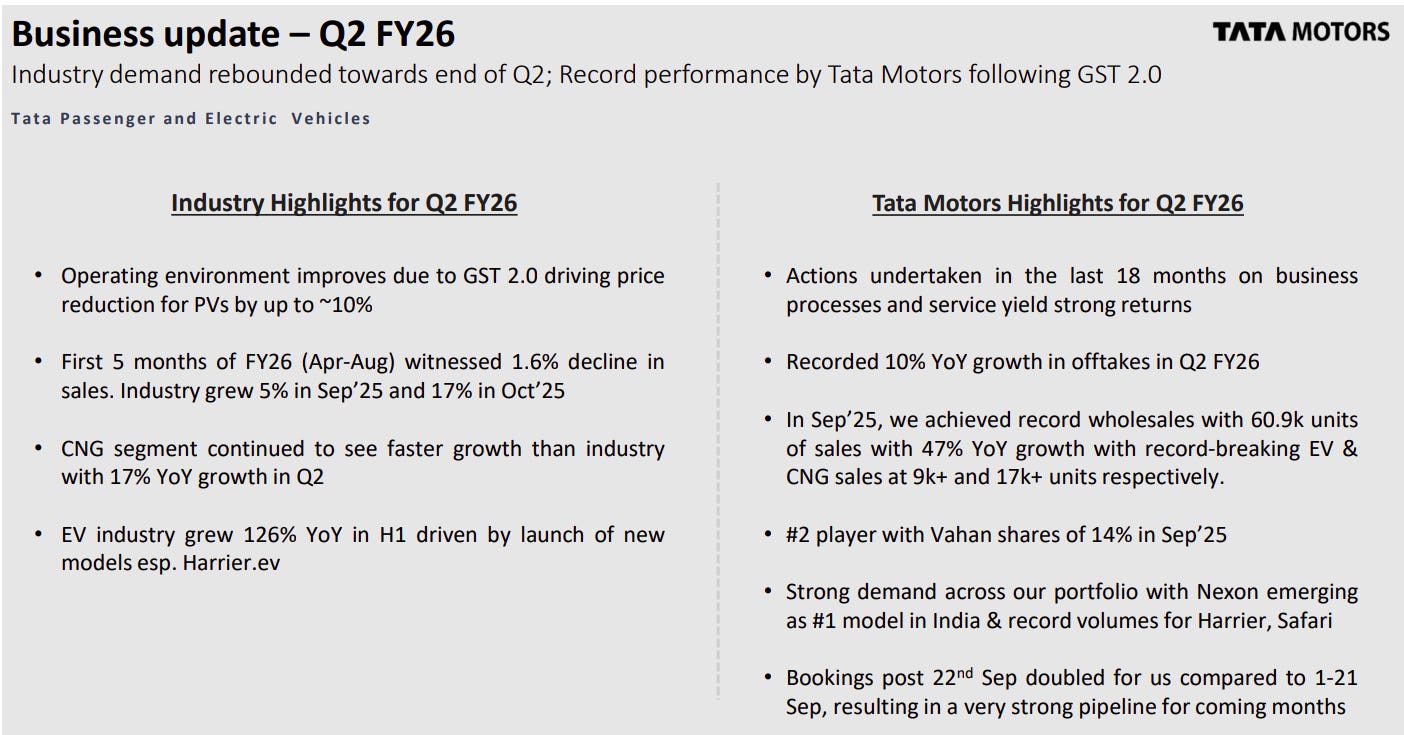

Industry demand recovered sharply toward the end of Q2, aided by GST 2.0 price cuts, improving sentiment, and strong CNG and EV growth. Tata Motors delivered a standout quarter with 10% YoY wholesales growth, record EV/CNG volumes, and strong traction across Nexon, Harrier.ev, and Safari, supported by a robust bookings pipeline.

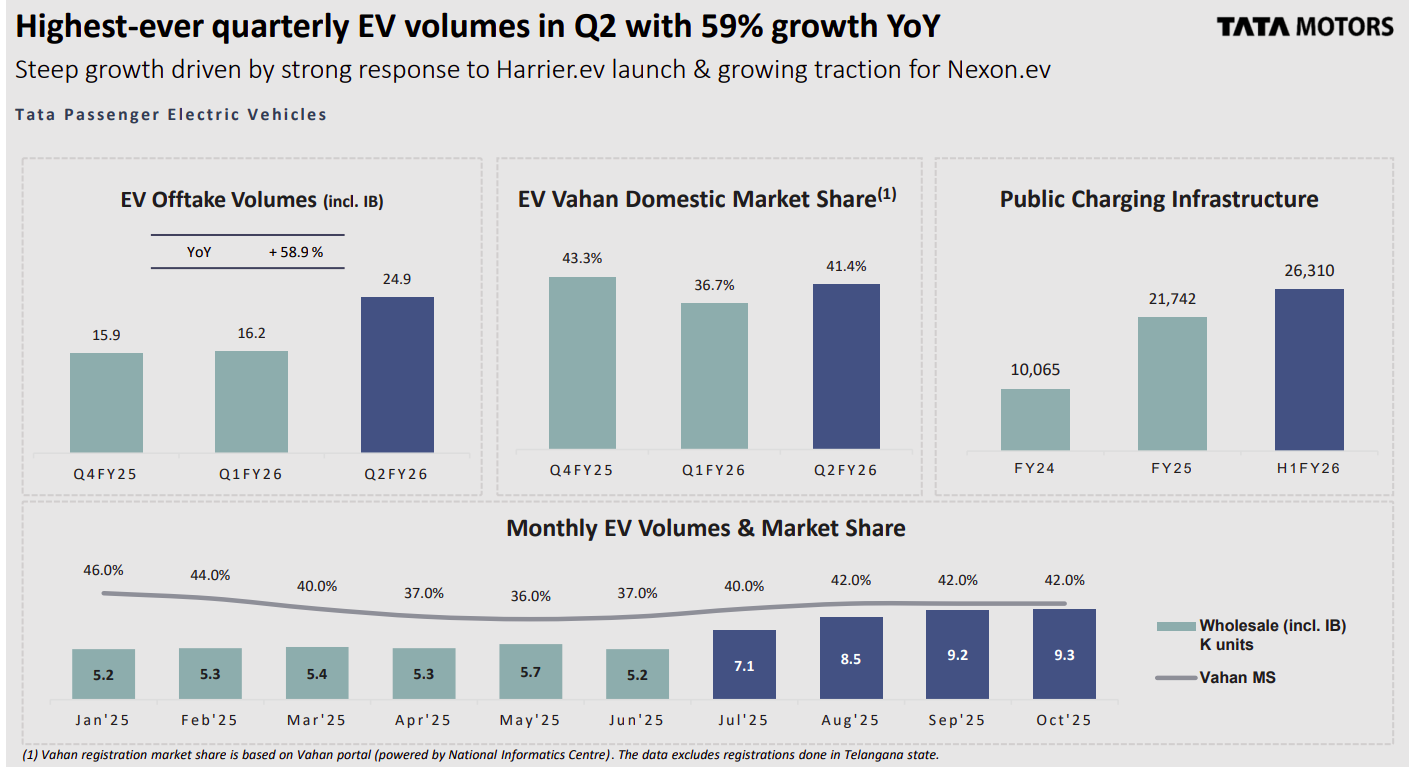

Tata Motors posted its highest-ever quarterly EV offtake at 24.9K units (+59% YoY), driven by new launches and accelerating demand. EV Vahan market share rose to 41.4% in Q2, while public charging infrastructure expanded rapidly to 26,310 points, supporting sustained EV momentum.

Eicher Motors | Large Cap | Auto Ancillary

Eicher Motors Limited, is a leading player in the Indian automobile industry and the global leader in middleweight motorcycles. Eicher has a joint venture with Sweden’s AB Volvo to create Volvo Eicher Commercial Vehicles Limited (VECV). VECV is engaged in truck and bus operations, auto components business, and technical consulting services business.

Royal Enfield continues to dominate India’s mid-size motorcycle segment with an 84% market share, supported by a strong product pipeline and consistent new model launches. Despite COVID-era disruptions, volumes have recovered sharply, touching 903k units in FY25 before normalizing in H1 FY26.

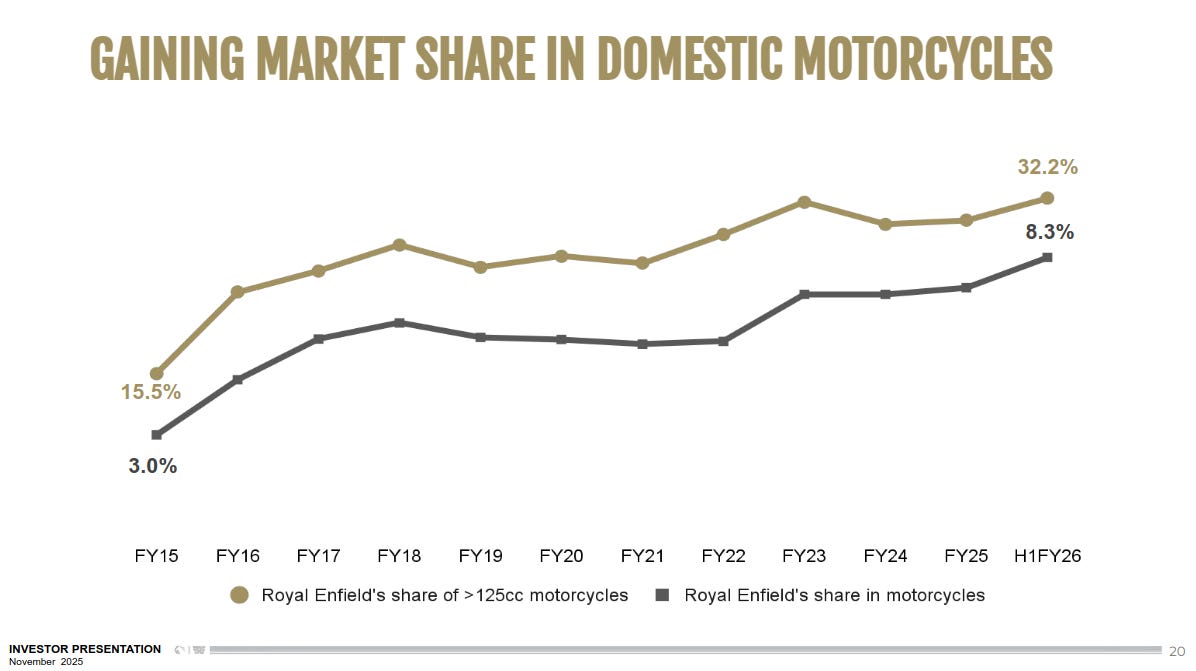

Royal Enfield has steadily expanded its share in the >125cc motorcycle segment from ~15% in FY15 to over 32% in H1 FY26. Its overall motorcycle market share has also climbed to 8.3%, reflecting strong brand pull and rising penetration in premium categories.

Metals

Godawari Power & Ispat Ltd. (GPIL) | Small Cap| Metals

Godawari Power & Ispat is mainly engaged in the business of Mining of Iron Ore and Manufacturing of Iron Ore Pellets, Sponge Iron, Steel Billets, Wire Rods, H.B. Wire and Ferro Alloys with generation of Electricity.

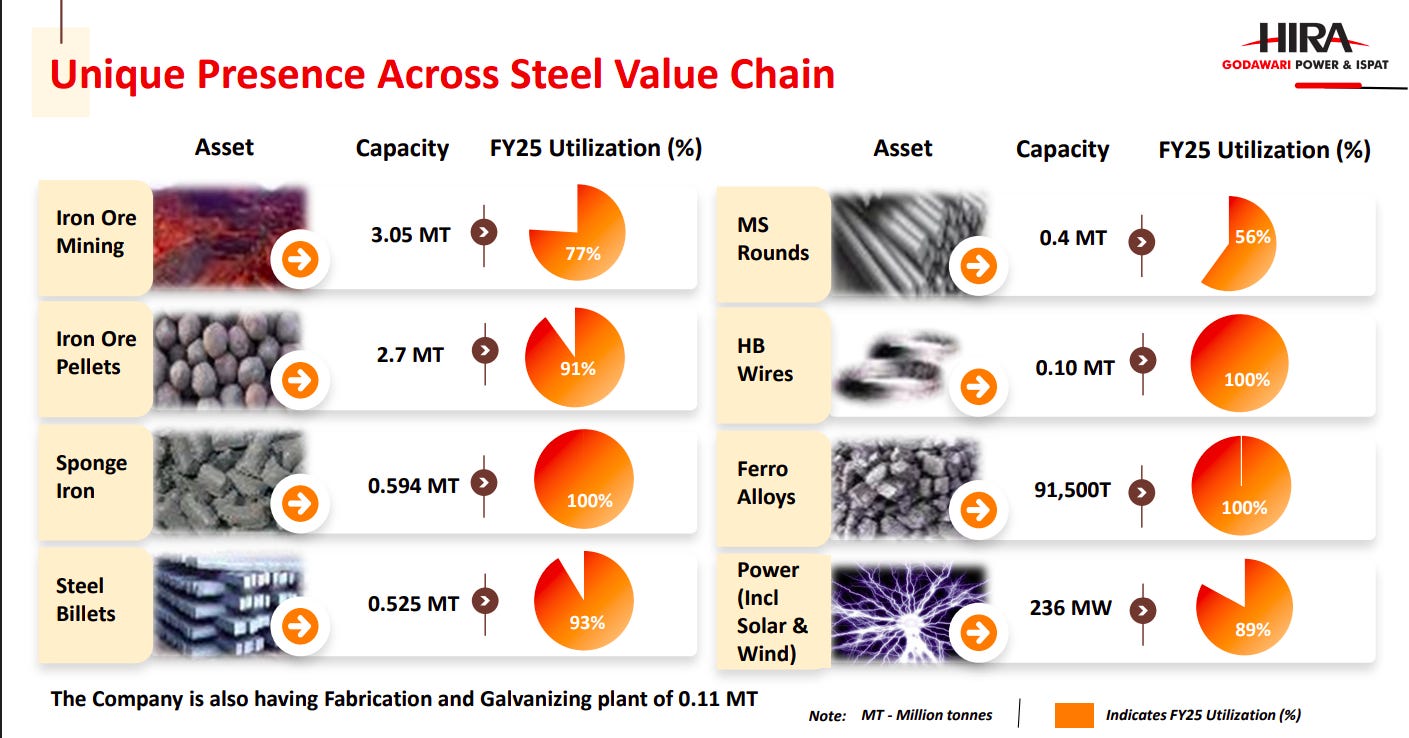

Hira operates across the full steel value chain — from iron ore mining and pellets to sponge iron, billets, ferro alloys, HB wires, MS rounds, and captive power — ensuring strong raw-material security and margin stability. FY25 utilisation levels are high (77–100%), reflecting strong demand, operational efficiency, and integrated cost advantages.

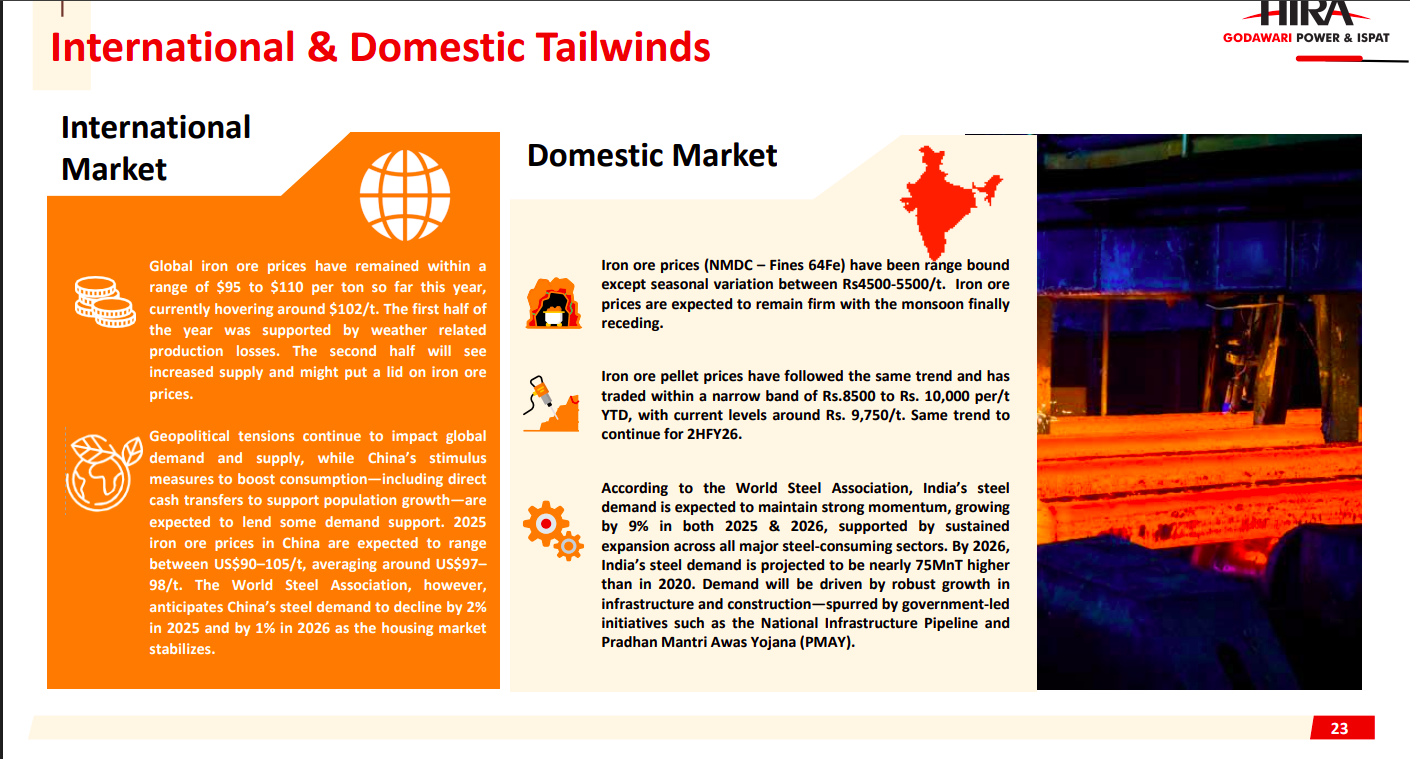

Global iron ore prices have stayed stable in the $95–$110/t band, while China’s muted demand outlook is partly offset by stimulus measures. In India, ore and pellet prices remain stable, and steel demand is projected to grow 9% in both 2025 and 2026, supported by infrastructure, construction, and government-led capex programmes.

Hira’s captive ore cost has remained steady at ~₹2,200–3,000/t over the last several years, significantly below volatile market ore prices. This long-term cost arbitrage provides a strong competitive edge, protects margins during commodity cycles, and ensures consistent profitability versus non-integrated peers.

\

Jindal Stainless | Mid Cap | Metals

Jindal Stainless Limited (JSL) is a major stainless steel conglomerate in India and globally.It leads in digital transformation in manufacturing through advanced technology solutions. As India’s largest producer of various stainless steel series, it offers a wide range of stainless steel products like coils, plates, sheets, and more.

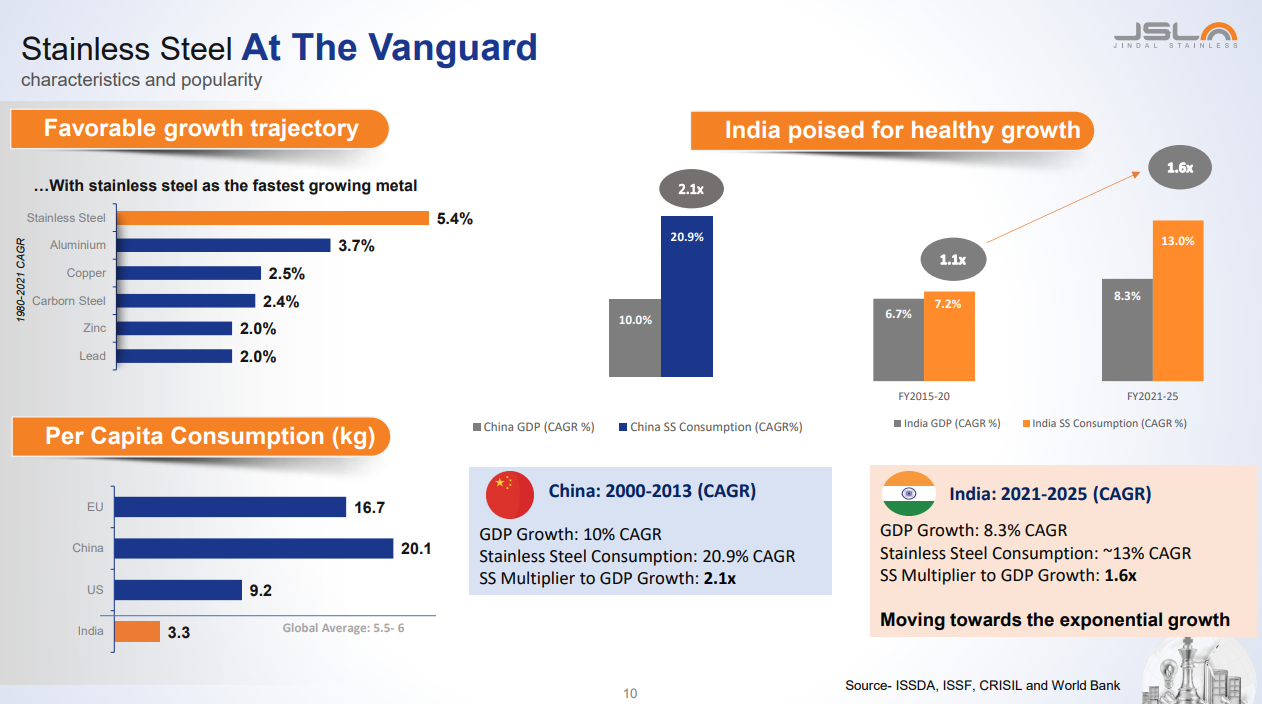

Stainless steel is emerging as the fastest-growing metal, expanding at 5.4% CAGR compared to other metals like aluminium and copper. India’s stainless steel consumption is set for healthy growth, with a 1.6x multiplier to GDP growth between FY21-25. The country is following a similar trajectory to China’s exponential growth phase, where stainless steel consumption grew 2.1 times faster than GDP. With India’s per capita consumption at just 3.3 kg compared to the global average of 5.5-6 kg, there’s significant room for expansion as the economy develops.

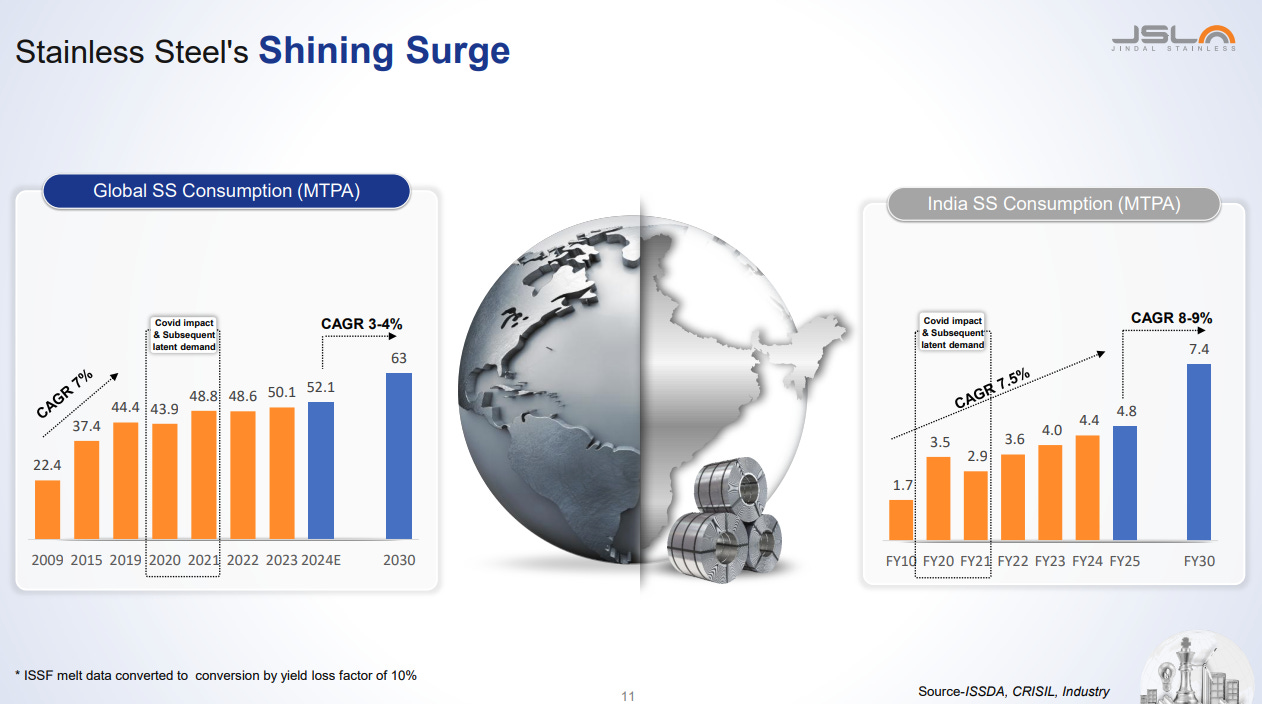

Global stainless steel consumption has grown from 22.4 million tonnes in 2009 to 52.1 million tonnes in 2024, with projections reaching 63 million tonnes by 2030. India’s consumption trajectory shows even stronger momentum, growing from 1.7 million tonnes in FY10 to 4.8 million tonnes in FY25, and expected to reach 7.4 million tonnes by FY30. Both markets experienced COVID-related disruptions followed by subsequent recovery and latent demand, with India demonstrating particularly robust growth rates of 8-9% CAGR.

JSL has evolved from heavy dependence on consumer durables (80% in 1998) to a well-diversified portfolio by 2023. The company’s sectoral mix—27% Architecture Building Construction, 31% Process, 20% Auto Railway Transport, 19% Consumer Durables, and 3% Others—contrasts sharply with both the broader Indian stainless steel industry and carbon steel industry. This diversification has delivered more consistent earnings, with JSL showing the lowest EBITDA/ton volatility (standard deviation of 0.40) compared to Indian steel peers (0.71-1.9) and global stainless steel companies (0.24-0.89).

Engineering & Capital Goods

HPL Electric & Power | Small Cap | Engineering & Capital Goods

HPL Electric & Power Limited is a leading electrical equipment manufacturer in India operating for the past 40 years. The Company has significant presence across five key product verticals of electric equipment – metering solutions, modular switches, switchgears, LED lighting and wires and cables. It caters to a wide spectrum of customer segments, such as power utilities, government agencies, and retail and institutional customers, with a strong brand recall as a trusted electrical brand.

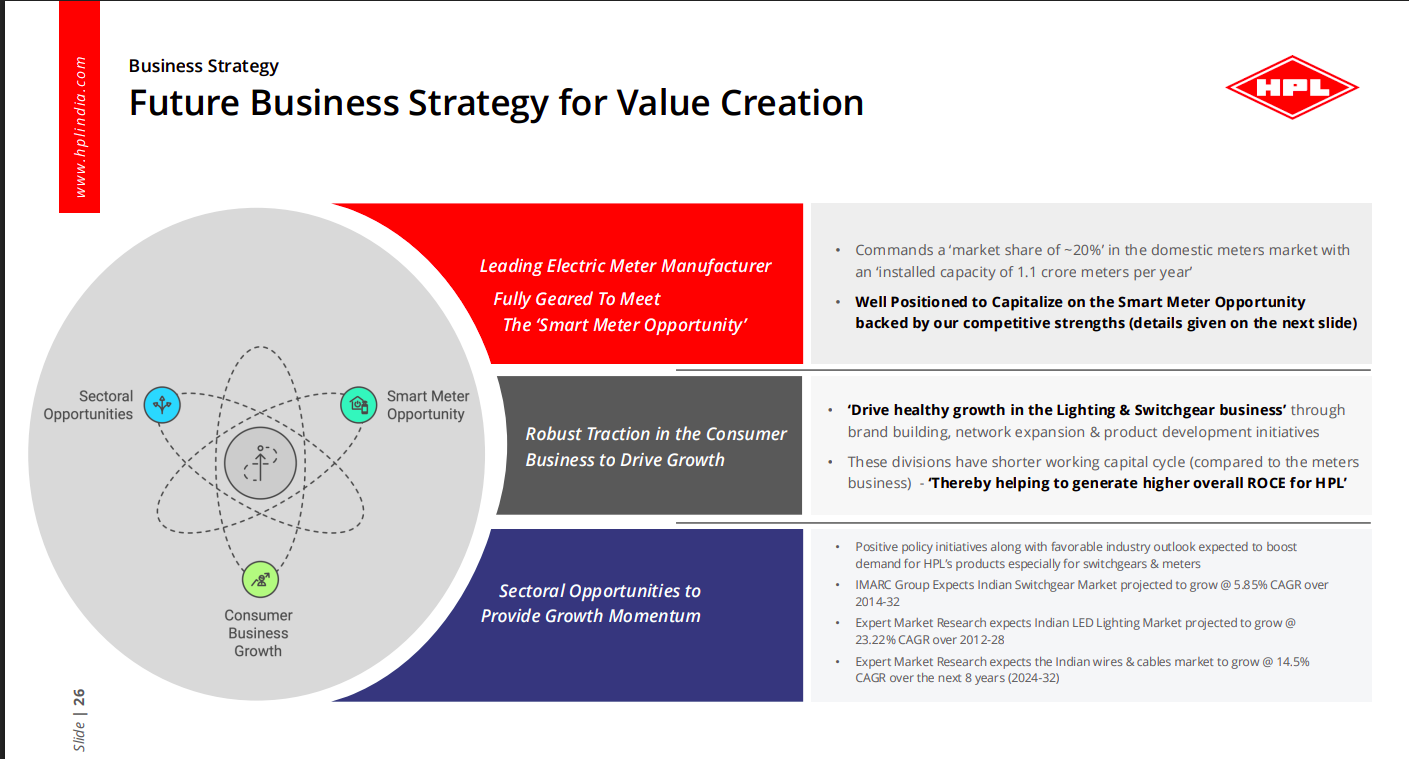

HPL plans to drive value through three engines: leveraging its leadership in electric meters to capture the large smart-meter opportunity, accelerating growth in consumer-facing lighting & switchgear, and tapping sectoral tailwinds across wires, cables, and LED lighting. Strong market share, supportive policy, and faster-working-capital consumer divisions position the company for sustained ROCE improvement.

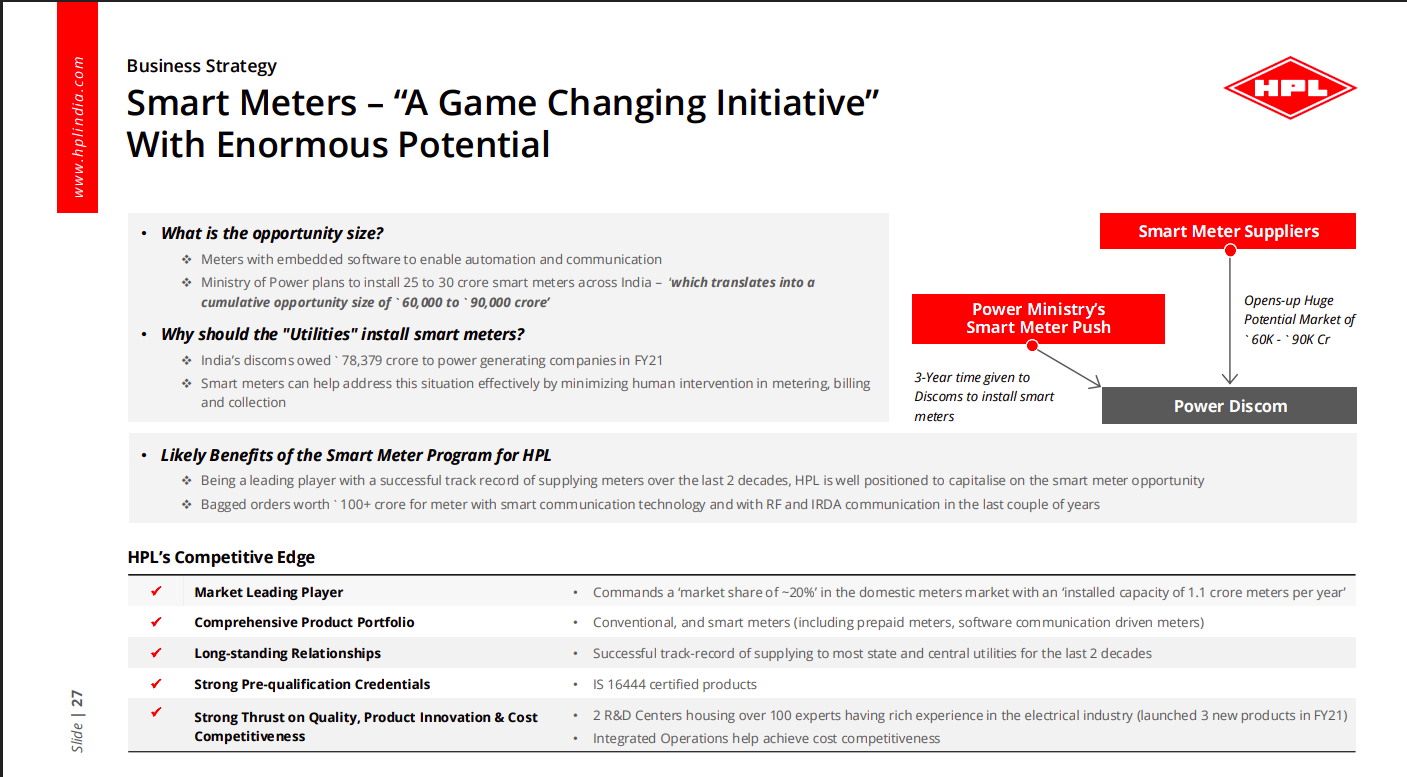

India’s aggressive smart-meter rollout (25–30 crore meters; ₹60,000–90,000 crore opportunity) creates a massive multi-year demand pool for players like HPL. With strong credentials, long-standing utility relationships, and proven smart-communication technology, HPL is well placed to win orders and gain from utilities’ push to reduce losses and improve billing efficiency.

Finolex Cables | Small Cap | Engineering & Capital Goods

Finolex Cables Limited is a leading manufacturer of electrical and telecommunication cables in India. Operating for more than 50 years, Finolex has been able to maintain its leadership position as one of the most diversified wires and cables companies in the country. Besides manufacturing a wide variety of wires and cables, Finolex has also forayed into the manufacturing of Fast-Moving Electrical Goods (FMEG) and home appliances.

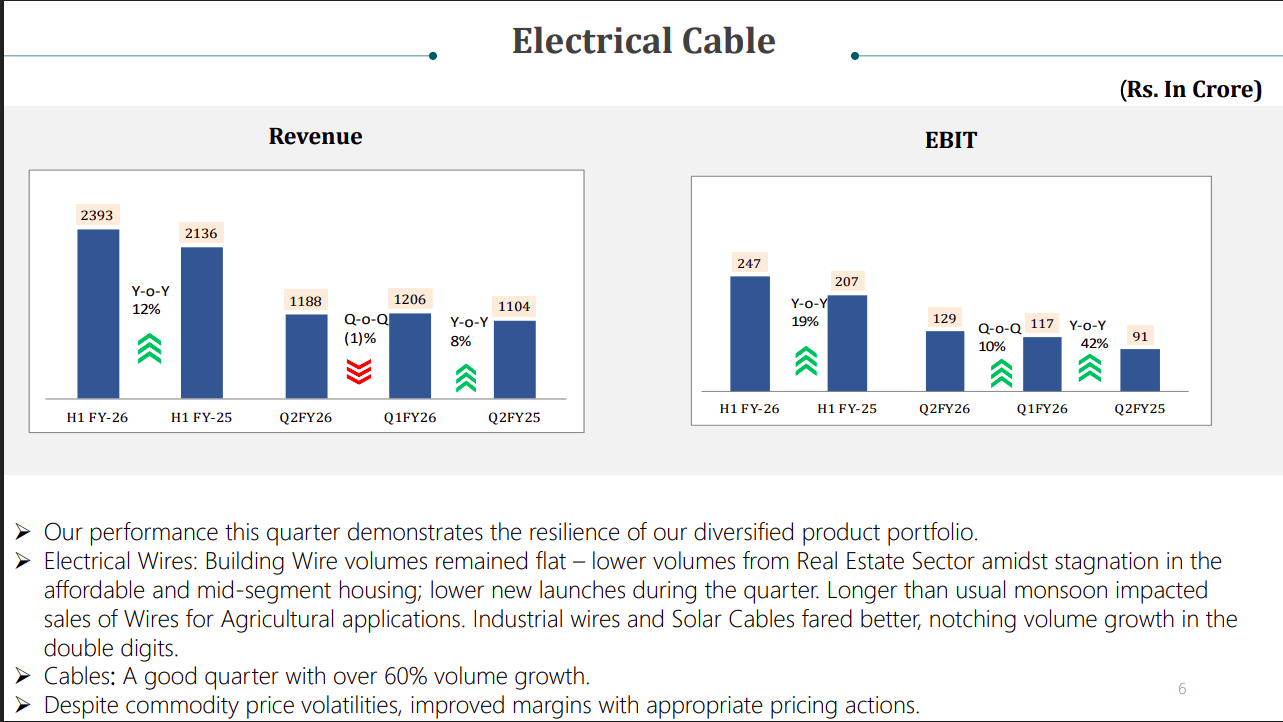

Electrical Cable revenue grew 12% YoY to ₹2,393 crore in H1 FY26, with EBIT up 19% YoY to ₹247 crore. Strong performance in industrial and solar cables offset weakness in real estate-linked building wires, aided by better pricing and over 60% volume growth in cables.

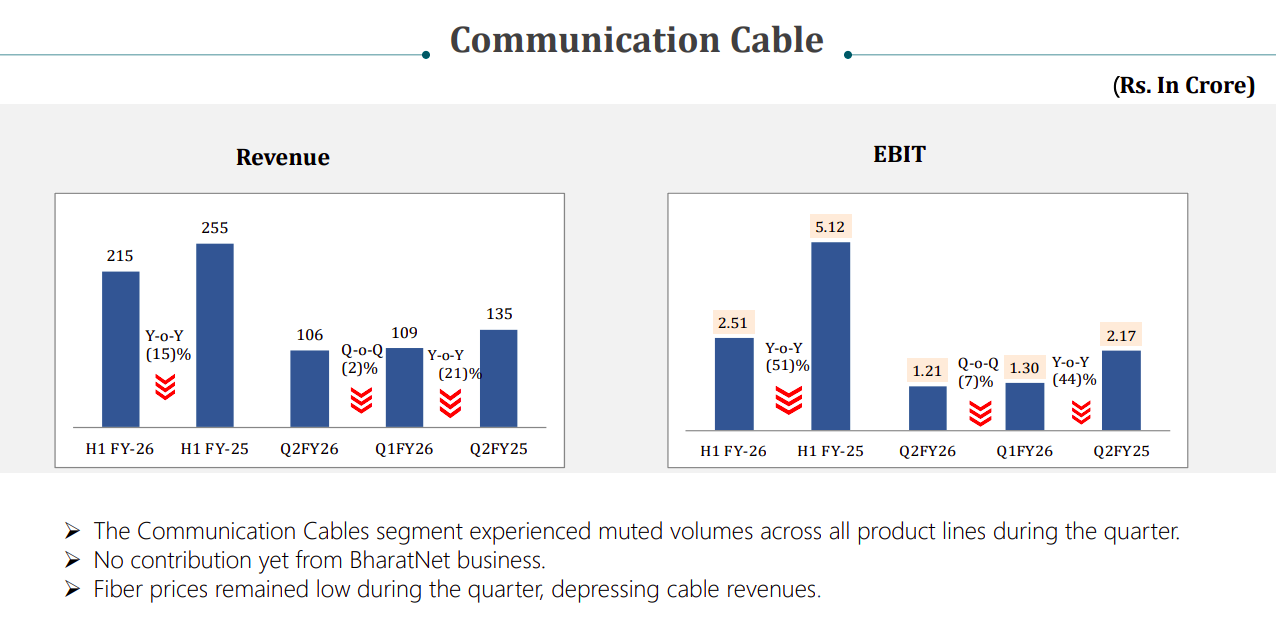

Communication Cable revenue declined 15% YoY to ₹215 crore, with EBIT dropping 51% YoY due to muted volumes and persistently low fiber prices. The segment saw no contribution from BharatNet projects, which continues to weigh on growth.

FMCG

Marico | Mid Cap | FMCG

Marico Limited is one of India’s leading consumer goods companies operating in global beauty and wellness categories. It is present in over 25 countries across emerging markets of Asia and Africa. It nurtures leading brands across categories of hair care, skin care, edible oils, healthy foods, male grooming and fabric care.

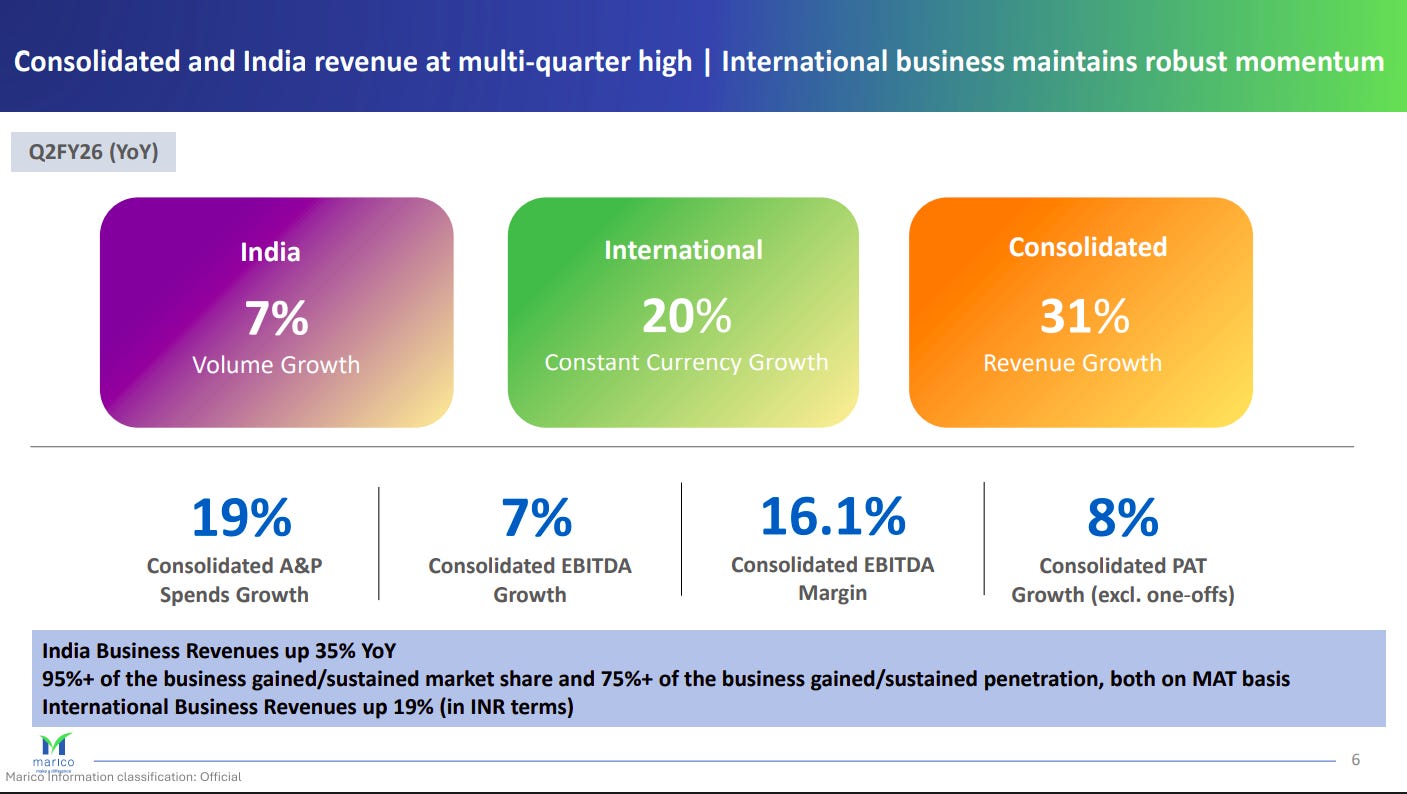

Consolidated revenue grew 31% YoY, led by 20% constant-currency growth in international markets and 7% volume growth in India. EBITDA margin held strong at 16.1%, with 8% PAT growth despite increased A&P spends.

Bangladesh and MENA drove strong double-digit constant-currency growth, up 22% and 27% respectively. Vietnam showed modest improvement at 6%, while South Africa remained soft but is expected to recover in H2.

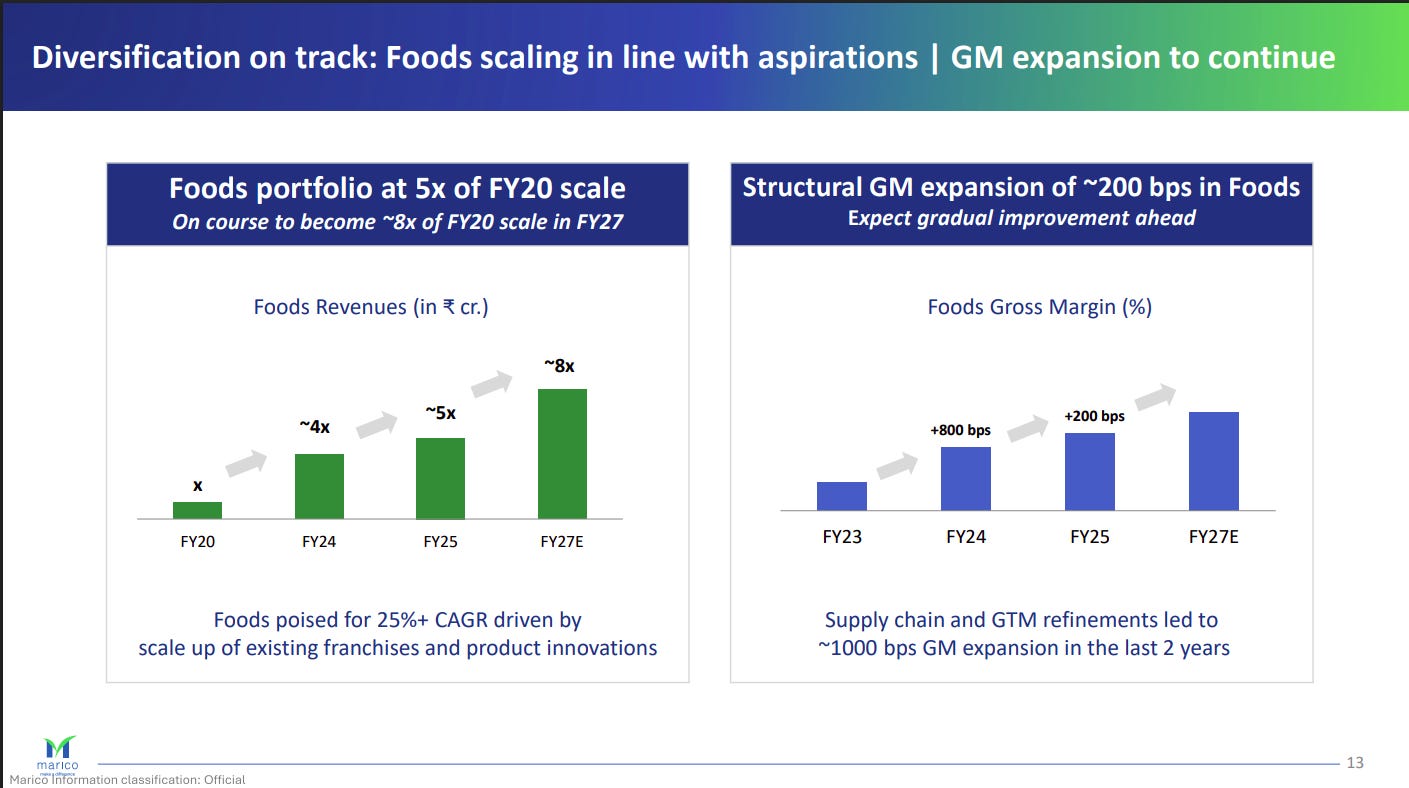

Marico’s Foods segment has grown ~5x since FY20 and is on track for ~8x scale by FY27. Structural gross margin expansion (~1000 bps already achieved) is expected to continue with another ~200 bps improvement ahead.

Parachute posted flattish volumes but strong value growth due to pricing, while Saffola saw stable volumes and 19% value growth. Value-Added Hair Oils accelerated with 16% value growth and steady market share gains.

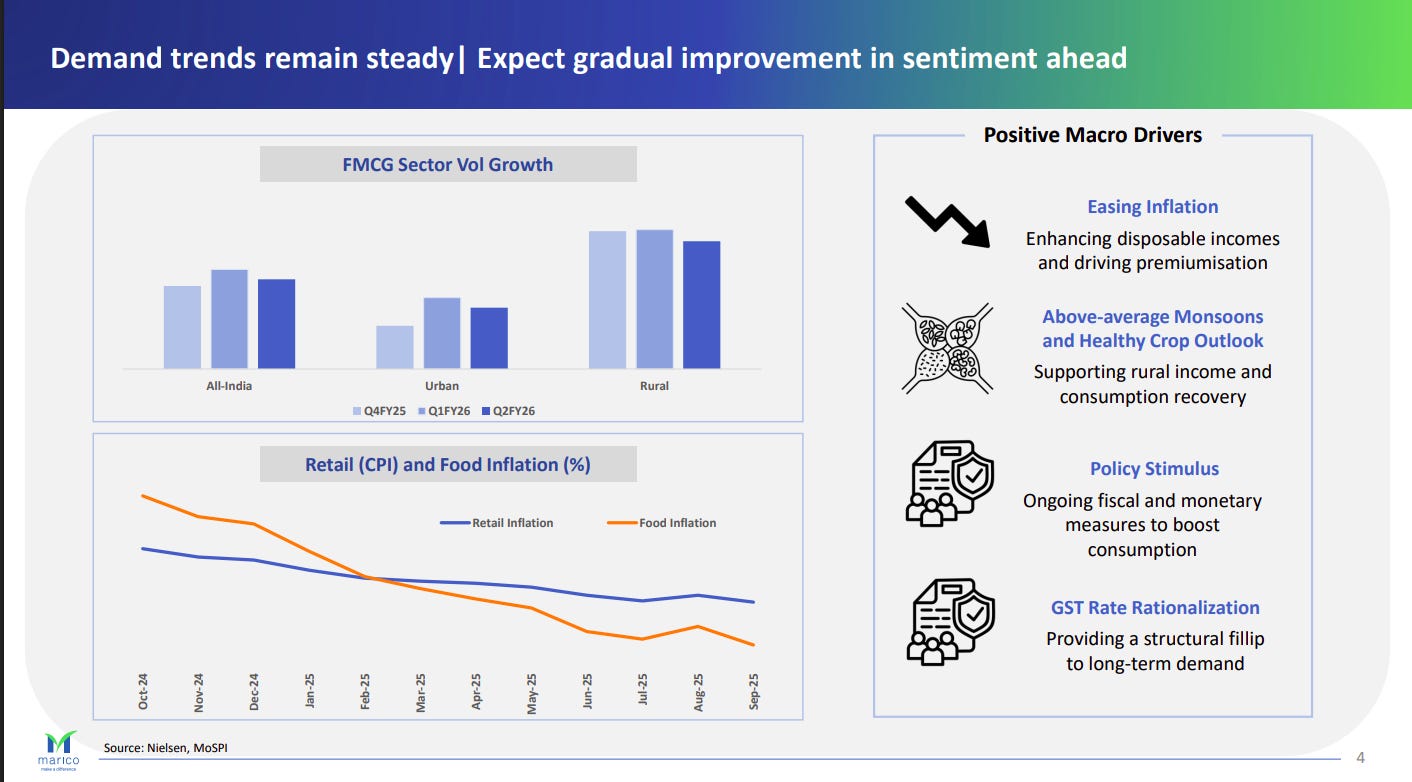

FMCG sector volumes remain steady across urban and rural markets, supported by easing inflation and softer food prices. Better monsoons, policy support, and GST rate rationalisation are expected to further lift consumption.

Speciality Restaurants | Micro Cap | FMCG

SRL operates specialty restaurants in Fine Dining and Casual Dining. It has various brands, including Fine Dining, Casual Dining, Resto Bar, Cloud kitchens, and Confectioneries. Currently, SRL has 124 outlets (112 owned units + 12 Franchisee Units ) across 14 Indian cities, and international locations in London, Oman, and Dubai.

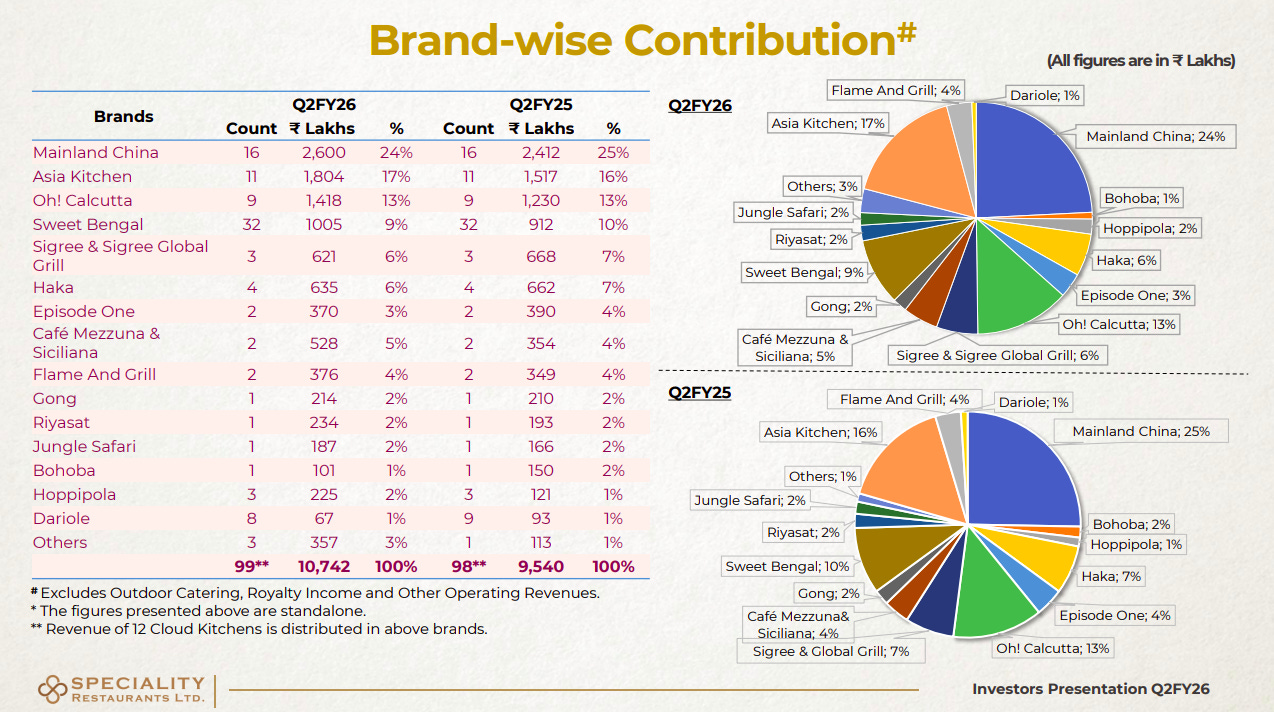

Mainland China, Asia Kitchen, and Oh! Calcutta continue to drive the bulk of revenues, contributing over 50% of Q2FY26 sales. The revenue mix remains broadly stable YoY, with only minor shifts across smaller brands. Total brand-level revenue rose to ₹107.42 crores from ₹95.40 crores last year.

Dine-in remains the dominant channel, contributing ~76% of restaurant sales, with steady improvement YoY. Delivery continues to hold a stable 24% share, supported by consistent demand. Overall restaurant revenue rose to ₹9,641 lakhs in Q2FY26 vs ₹8,524 lakhs last year.

Apex Frozen Foods | Micro Cap | FMCG

AFFL is engaged in processing and preserving fish, crustaceans, and molluscs, primarily dealing in processed frozen shrimp on a B2B basis. Its distributors supply these products to HORECA (Hotels, Restaurants, Cafés) and departmental stores in the USA, European Union, and China. Additionally, AFFL sells shrimp seeds to farmers.

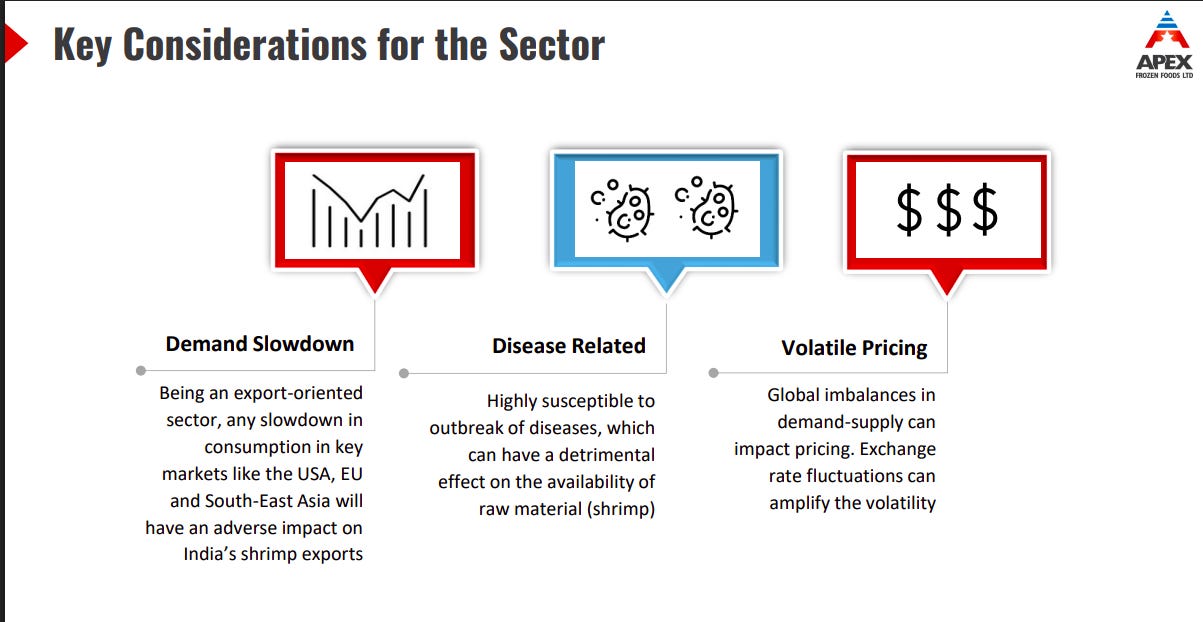

The shrimp export sector faces three structural challenges: weakening global demand, high vulnerability to disease outbreaks, and sharp pricing volatility driven by global supply imbalances and currency fluctuations. These factors collectively pressure margins and export stability.

India’s seafood exports have grown consistently over the past decade, with frozen shrimp emerging as the dominant contributor. In FY25, the U.S. accounted for 42% of shrimp exports, followed by China and the EU, highlighting India’s strong reliance on key global markets.

Jubilant FoodWorks | Mid Cap | FMCG

Jubilant FoodWorks Limited (JFL/Company) is part of the Jubilant Bhartia Group and is one of the India’s largest food service Company. The Company holds the master franchise rights for two international brands, Domino’s Pizza and Dunkin’ Donuts addressing two different food market segments and now has Popeyes in its food segment. The Company also launched its first homegrown brand – Hong’s Kitchen in Chinese cuisine segment.

Domino’s expanded aggressively in FY26, adding 242 net new stores to reach 2,321 outlets across India. City presence rose from 447 to 500 cities, with 53 new cities entered in the last year, signalling strong geographic expansion.

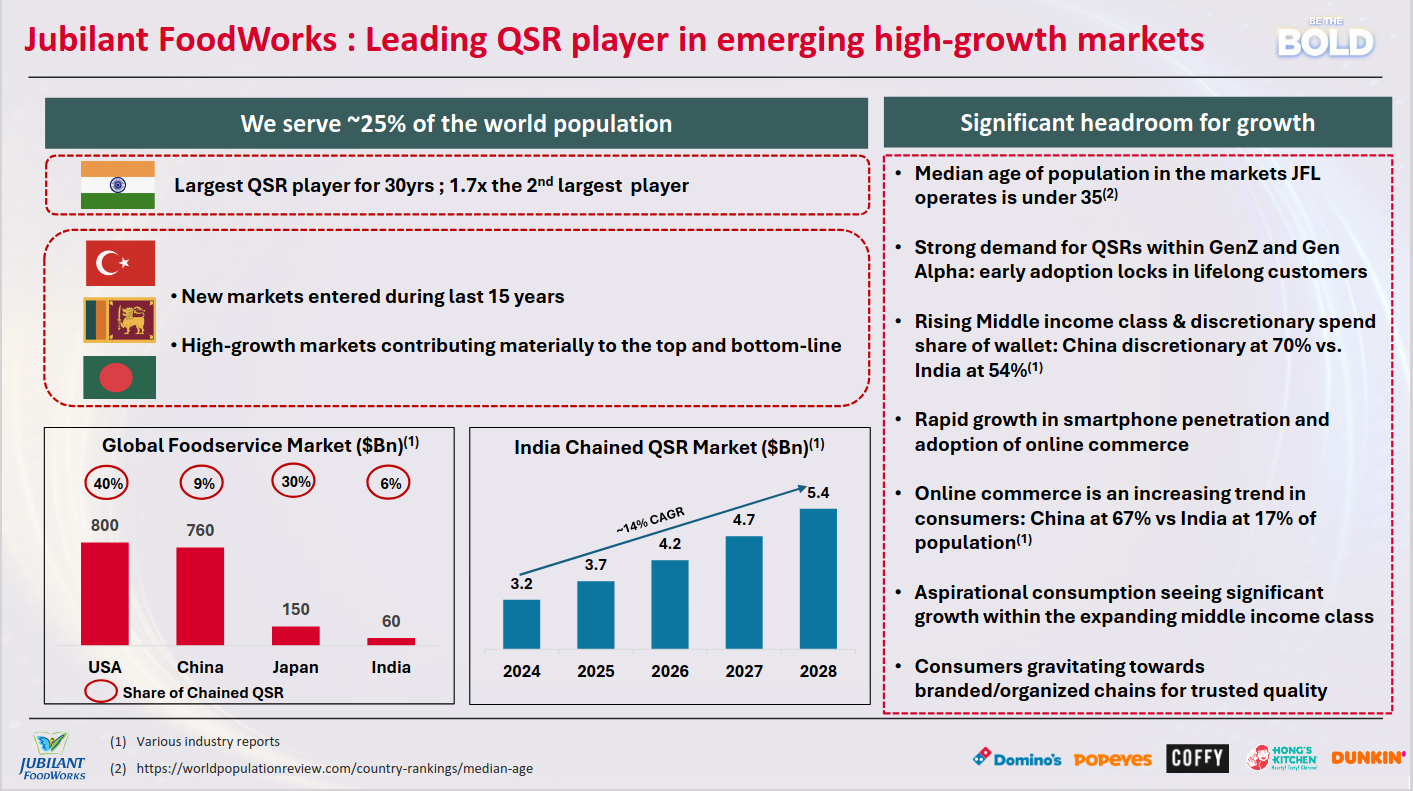

Jubilant FoodWorks operates across India, Turkey, Sri Lanka and Bangladesh, reaching markets that serve ~25% of the world’s population. With a young demographic, rising discretionary spending and rapid digital adoption, the QSR opportunity continues to grow, supported by India’s ~14% CAGR chained QSR market trajectory.

BCL Industries | Micro Cap | FMCG

BCLIL is one of the largest agro-processing manufacturing companies in India with grain procurement expertise. It has a presence in ENA and IMIL segment being a grain-based Ethanol producers

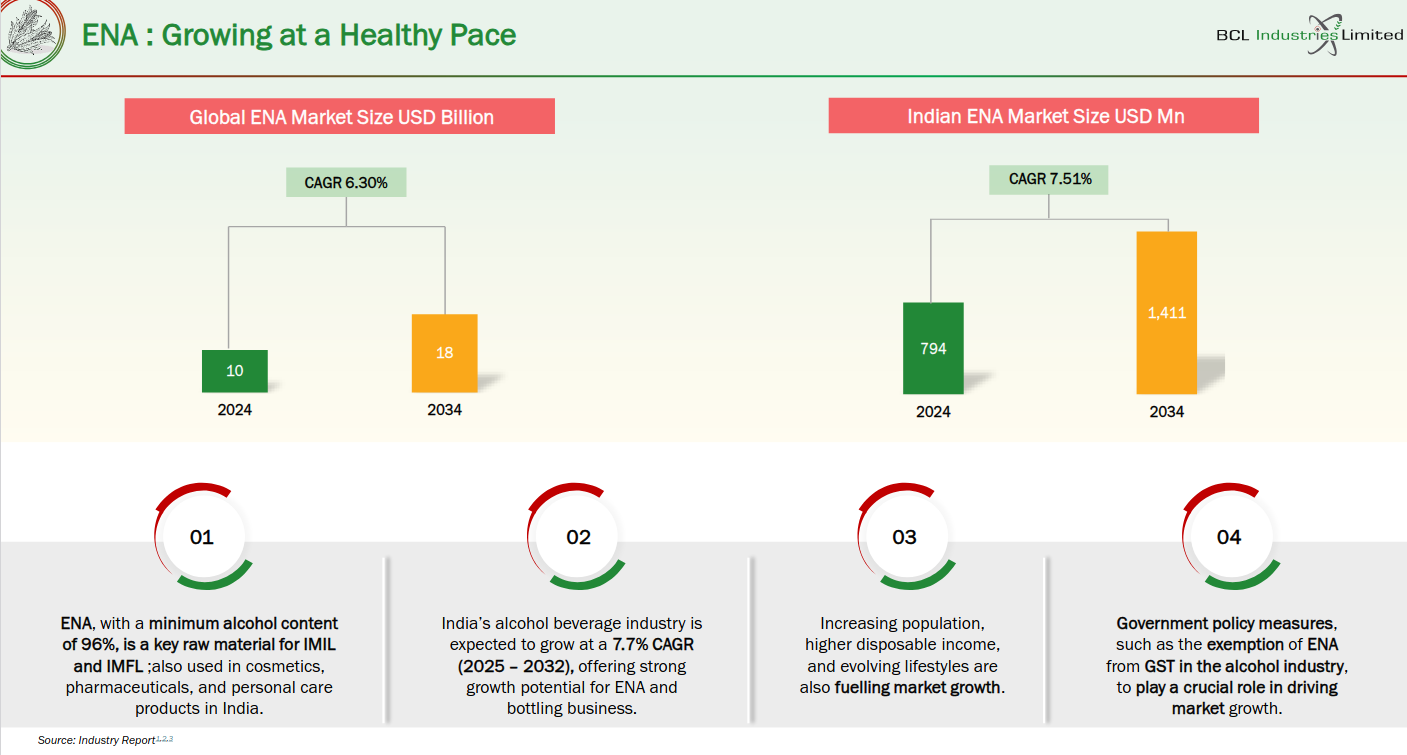

The global ENA market is set to grow from USD 10B (2024) to USD 18B (2034), while India’s ENA market expands from USD 794M to USD 1.4B, supported by rising alcohol consumption, higher disposable incomes and stronger policy incentives. ENA remains a key raw material for IMFL/IMIL, cosmetics and pharma, benefiting from structural long-term demand.

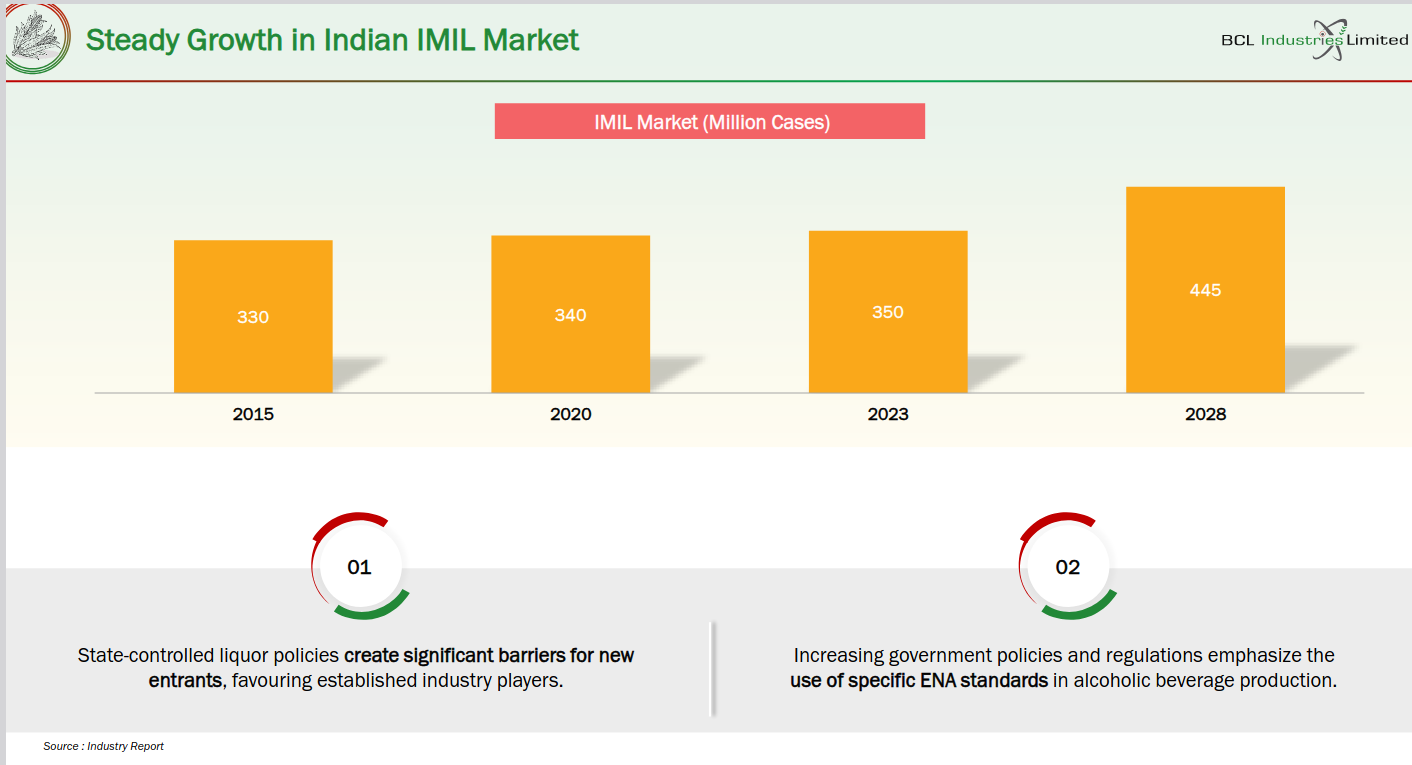

India’s IMIL market shows steady expansion from 330M cases in 2015 to an expected 445M cases by 2028. State-controlled regulations create high entry barriers, while stricter ENA standards and supportive policies reinforce industry stability and growth.

Healthcare

Glenmark Pharma | Mid Cap | Healthcare

Glenmark Pharmaceuticals Ltd is a global research-led pharmaceutical company with presence across generics, Specialty and OTC business with operations in over 80 countries.

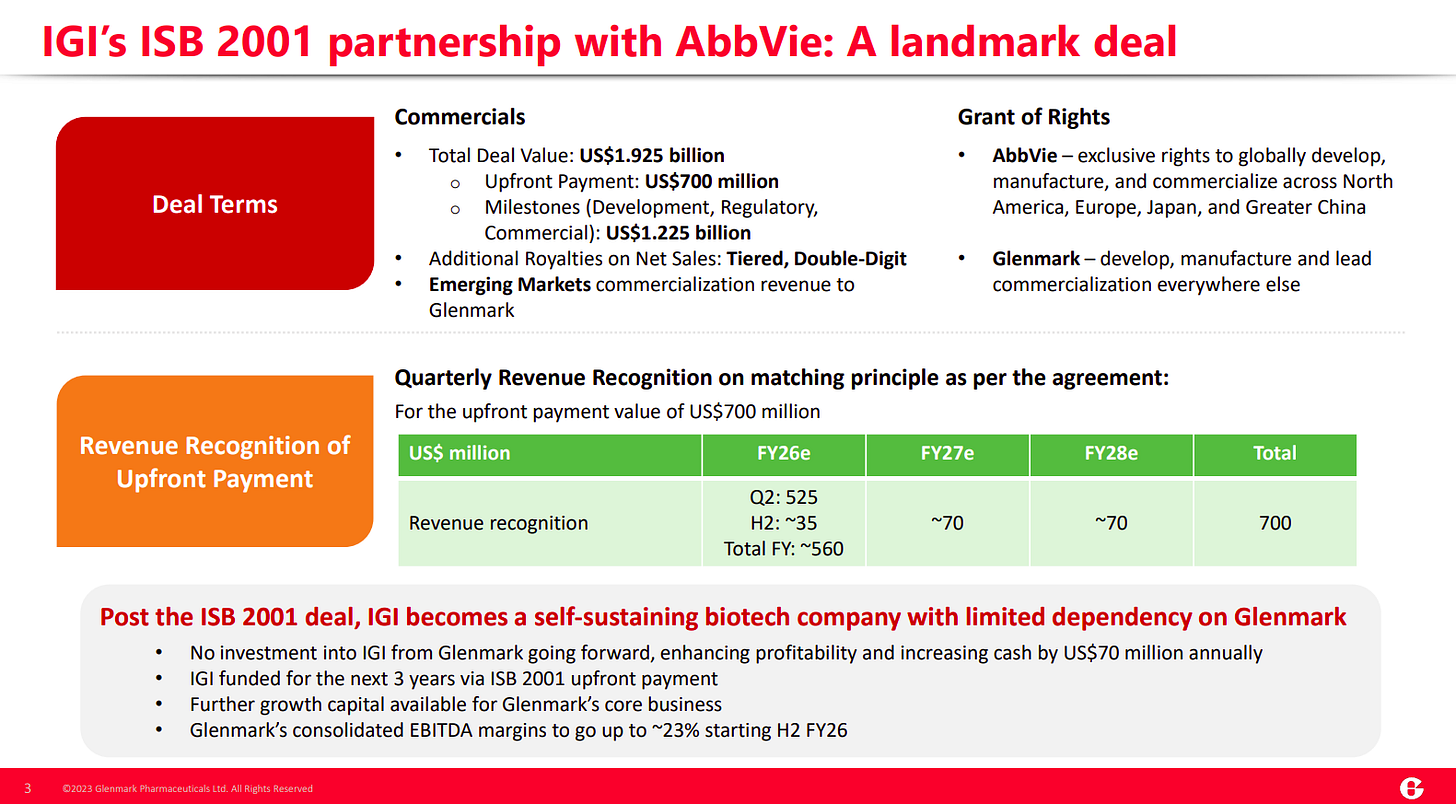

Glenmark has finally unlocked value from its long-loss-making biotech subsidiary — striking a $1.9 billion licensing deal with AbbVie for its cancer asset ISB 2001. The hefty $700 million upfront turns Ichnos Glenmark Immuno-oncology (IGI) into a self-funded business, lifts group margins, and gives Glenmark a clean runway without needing to bankroll biotech losses anymore.

Textiles

Dollar Industries | Small Cap | Textiles

Dollar Industries is a leading manufacturer of branded innerwear and outerwear, holding a 15% share in the Indian hosiery market. The company aims to expand its offerings in the premium and super-premium segments while maintaining its leadership in the hosiery industry.

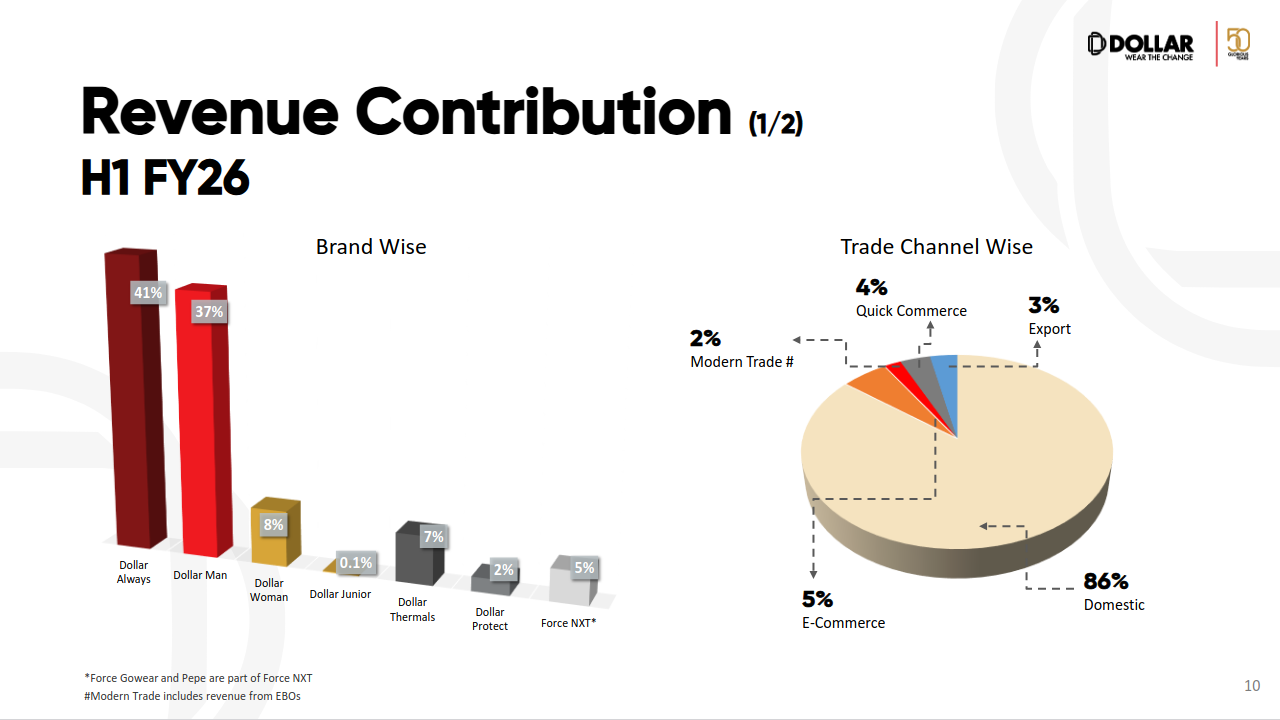

Dollar’s revenue is heavily concentrated in two brands—Dollar Always (41%) and Dollar Man (37%), with smaller contributions from Women, Thermals, and Force NXT. On the channel side, Domestic trade dominates at 86%, while e-commerce, modern trade, exports, and quick commerce remain small but emerging streams.

Dollar is repositioning itself with six new category identities, refreshed logos, and celebrity endorsements to broaden appeal beyond men’s innerwear. Early results show improved brand recall and better alignment with diverse consumer segments, though women’s wear still contributes only 8%.

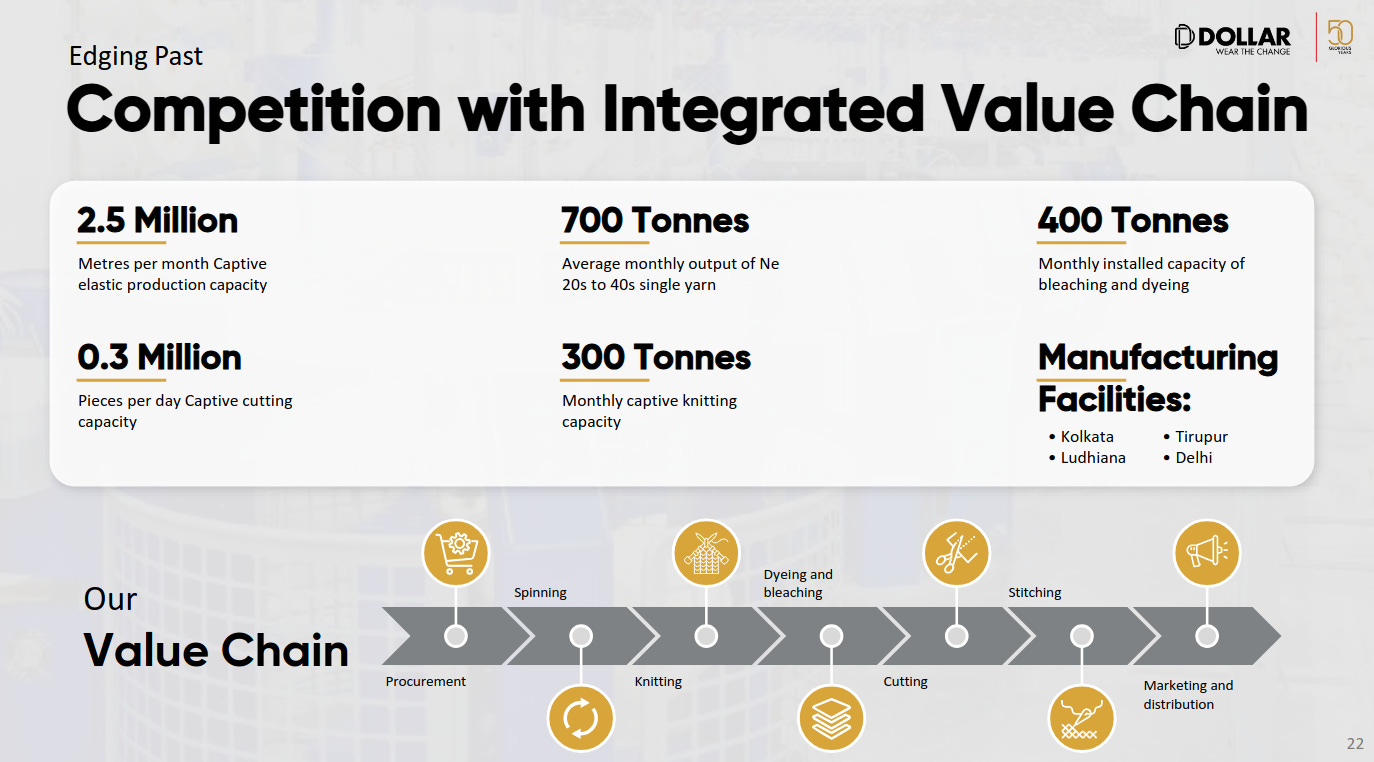

Dollar highlights a strong end-to-end integrated value chain with captive capacity across spinning, knitting, dyeing, cutting, and stitching, enabling scale, cost efficiency, and quality control. Manufacturing facilities across Kolkata, Ludhiana, Tirupur, and Delhi further strengthen execution and competitiveness.Dollar highlights a strong end-to-end integrated value chain with captive capacity across spinning, knitting, dyeing, cutting, and stitching, enabling scale, cost efficiency, and quality control. Manufacturing facilities across Kolkata, Ludhiana, Tirupur, and Delhi further strengthen execution and competitiveness.

Building Materials

JSW Cement | Small Cap | Building Materials

JSW Cement is a leading Indian manufacturer of green cement, known for its sustainability and use in major infrastructure projects

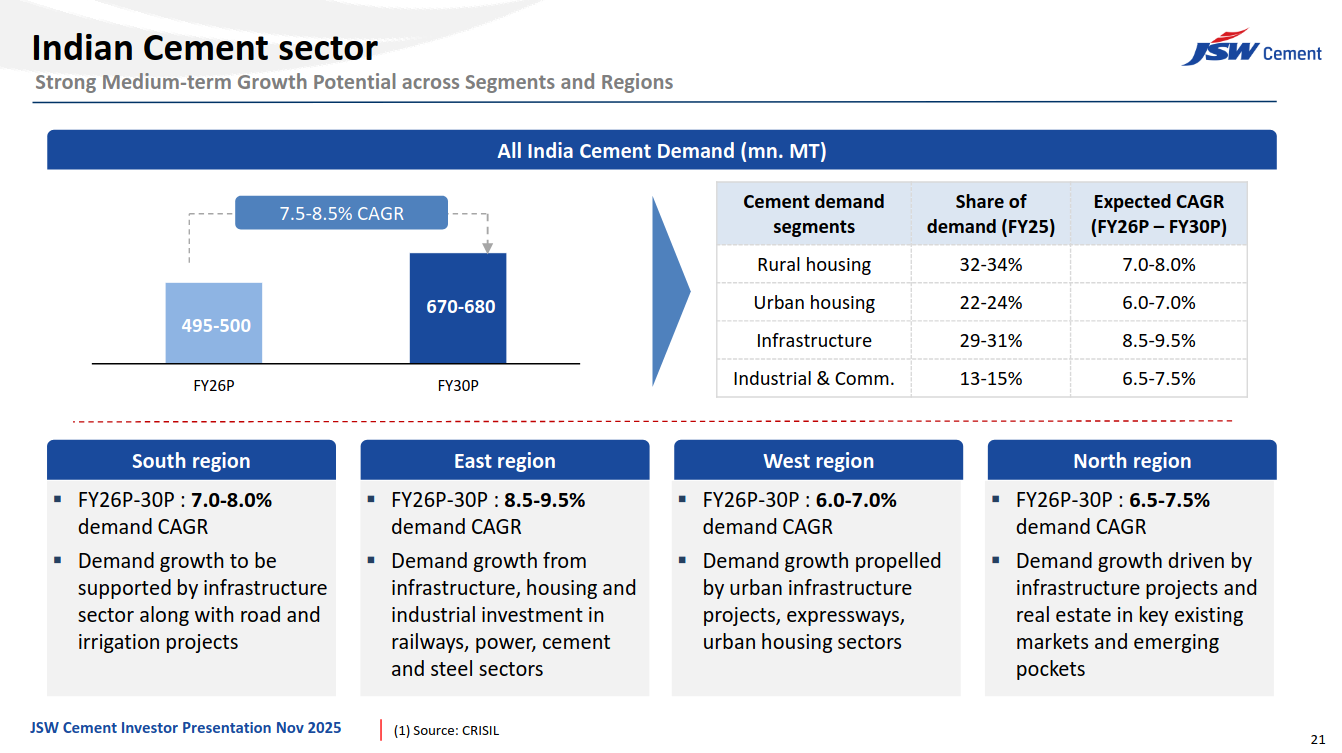

India’s cement demand is expected to grow at 7.5–8.5% CAGR from FY26 to FY30, rising from ~500 MT to ~670–680 MT. Growth is broad-based across rural housing, urban housing, infrastructure, and industrial segments, with the East and South regions leading demand expansion.

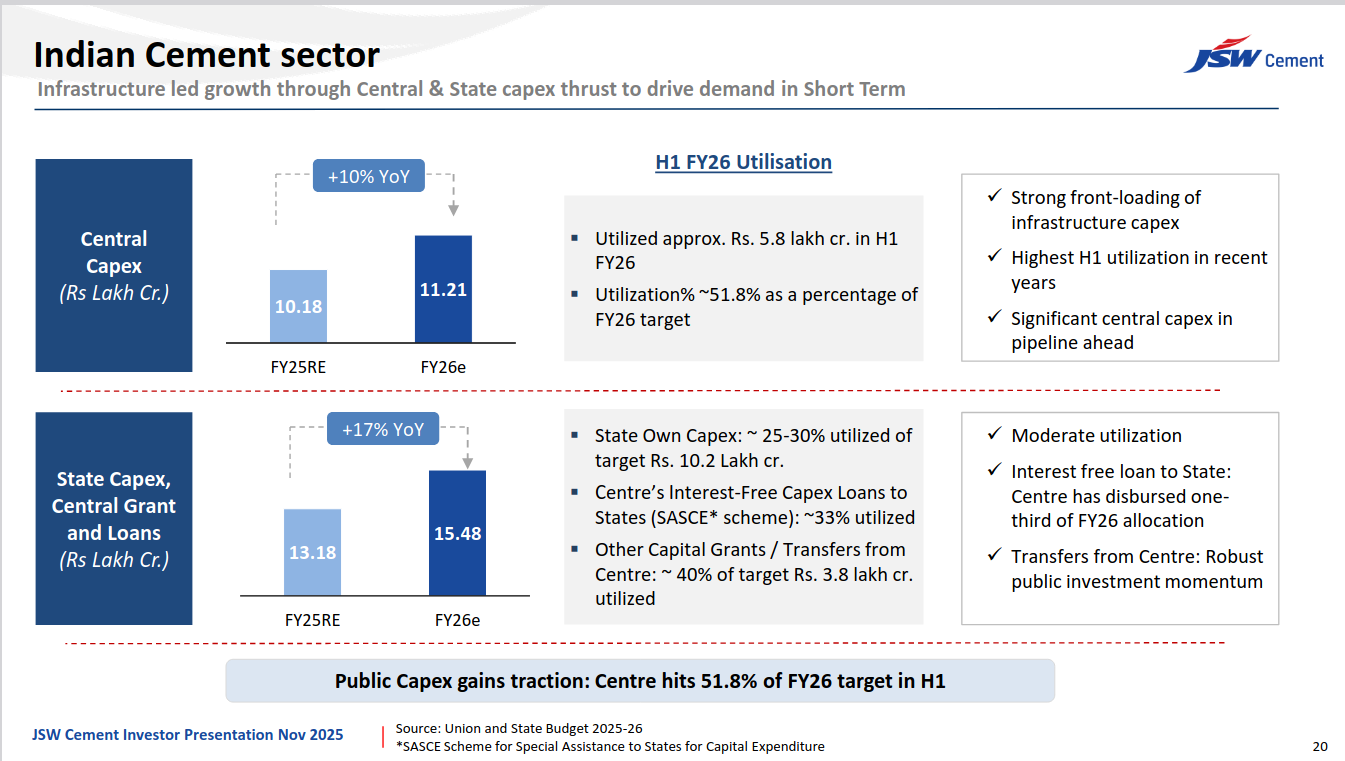

Central and state capex momentum is strong, with H1 FY26 utilisation at ~52%, the highest in recent years. Robust front-loading of capex, interest-free loans to states and strong infrastructure spending continue to support near-term cement demand.

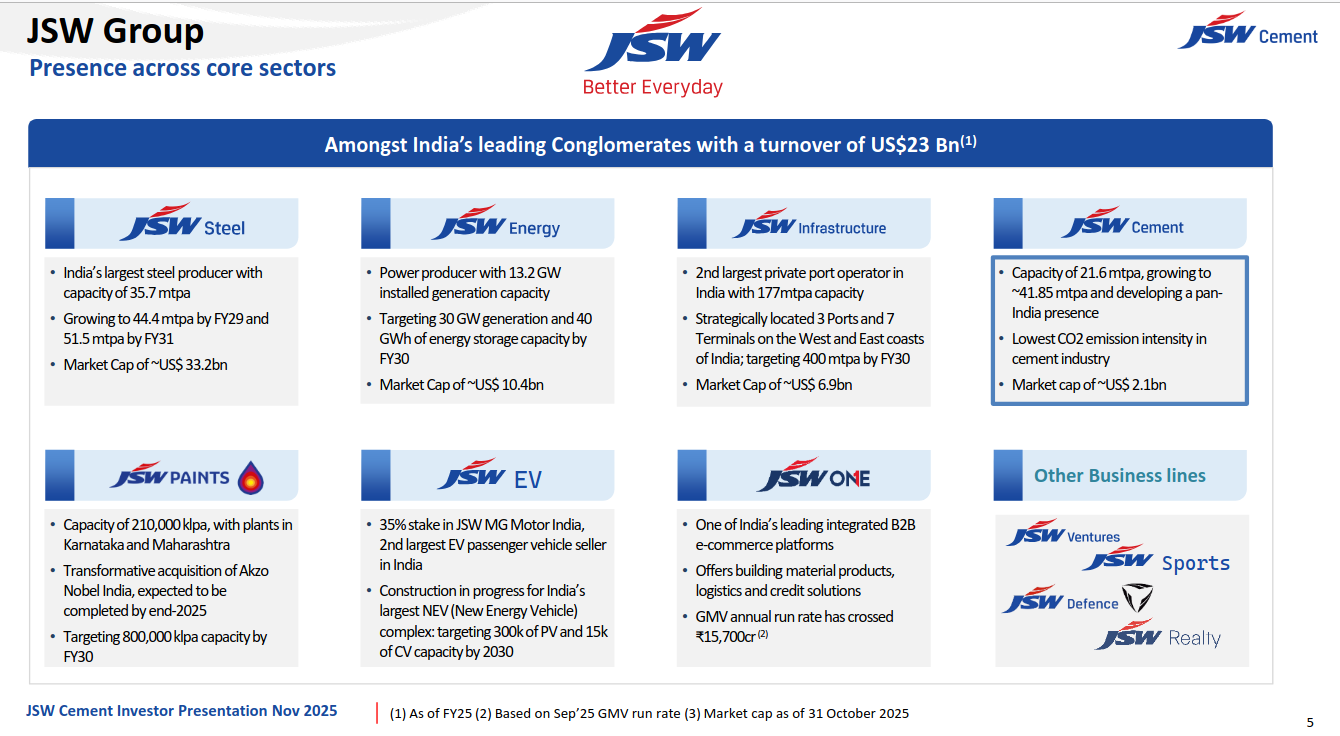

JSW Group spans steel, energy, infrastructure, cement, paints, EVs and digital B2B platforms, with a combined turnover of US$23 billion. The group is scaling aggressively across sectors—from renewable power and ports to EV manufacturing and e-commerce—strengthening its integrated industrial ecosystem.

Financial Services

General Ins. Corp | Mid Cap | Financial Services

General Insurance Corporation of India is the sole reinsurer in the domestic market, providing reinsurance across various business lines including property, marine, motor, and life insurance. It leads treaty programmes and facultative placements for domestic companies, and is expanding its presence in the Afro-Asian region by leading reinsurance programs for insurance companies in SAARC countries, South East Asia, Middle East, and Africa.

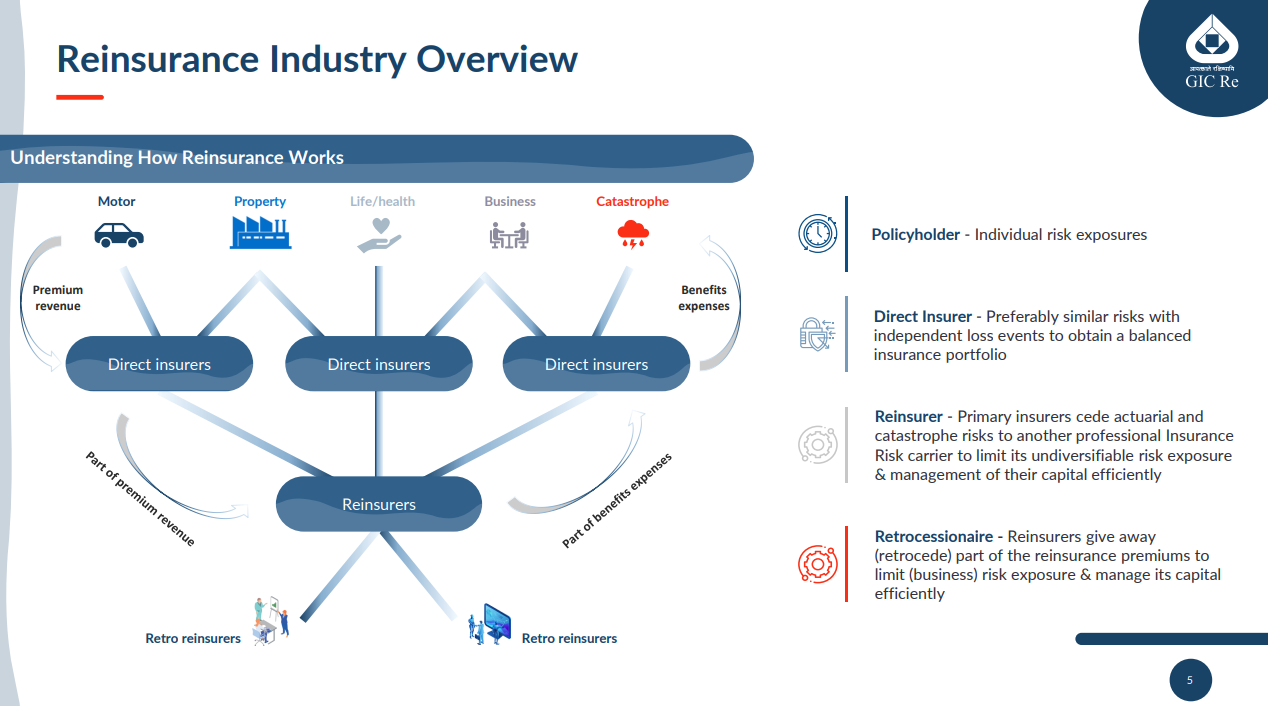

Risk flows through multiple layers in the reinsurance ecosystem. Policyholders buy coverage for motor, property, life/health, business, and catastrophe risks from direct insurers. These insurers then cede portions of their risk to reinsurers, who help manage large-scale exposures and catastrophic events. Reinsurers can further transfer some risks to retrocessionaires for additional protection. Premium revenue flows upward through each layer while benefits expenses flow back down, creating a global safety net that spreads risk across multiple parties.

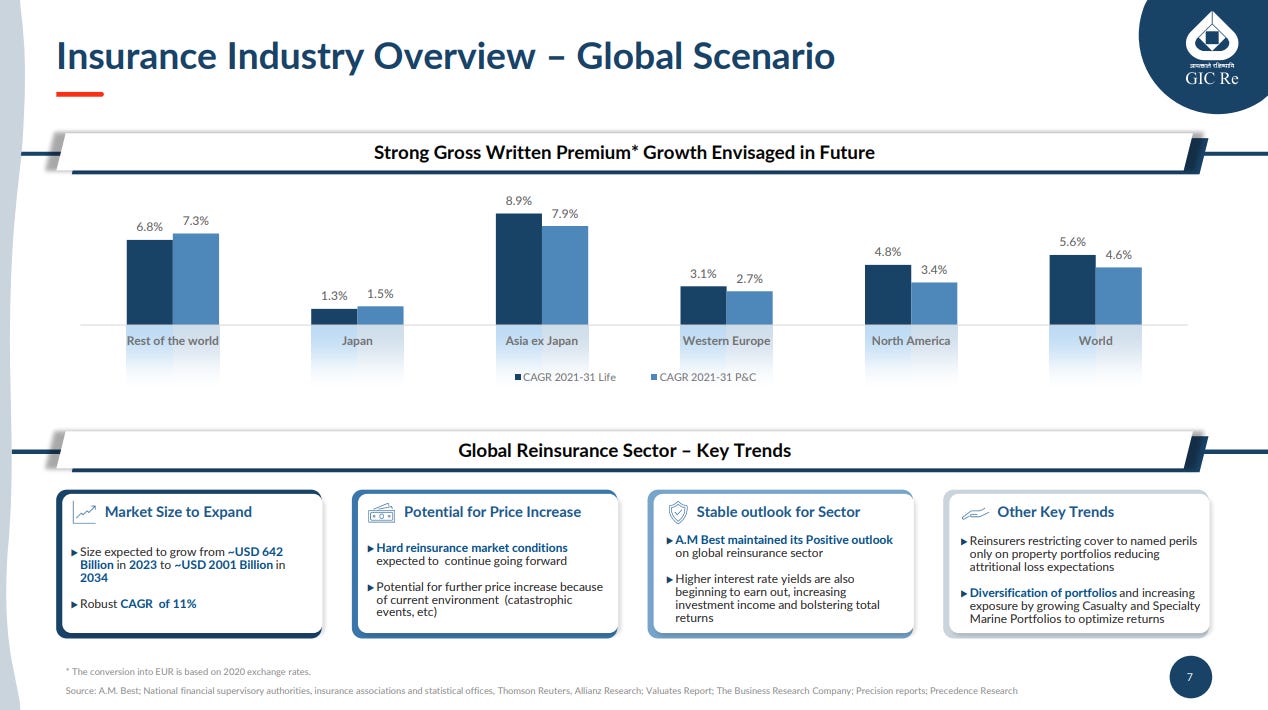

Global insurance shows strong growth ahead, with Asia excluding Japan leading at 8.9% annually for life insurance and 7.9% for property & casualty between 2021-2031. Developed markets like Japan and Western Europe show slower growth. The reinsurance sector is projected to expand from $642 billion in 2023 to $2,001 billion by 2034. A.M. Best maintains a positive outlook, and reinsurers are diversifying into casualty and specialty marine portfolios while restricting property coverage to named perils only.

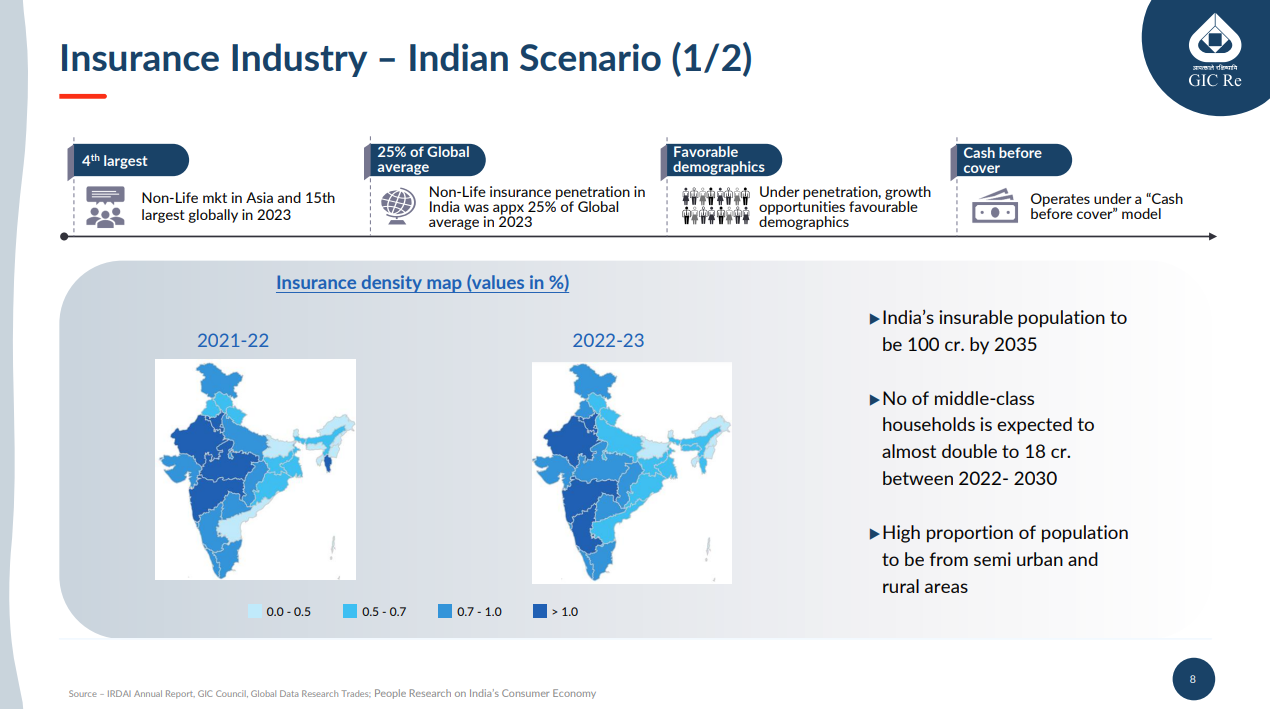

India ranks 4th in Asia and 15th globally for non-life insurance, but penetration remains just 25% of the global average. Heat maps show insurance density varies widely across Indian states between 2021-22 and 2022-23. The demographic tailwinds are strong: India’s insurable population will reach 100 crore by 2035, middle-class households will nearly double to 18 crore between 2022-2030, and much growth will come from semi-urban and rural areas. India operates on a “cash before cover” model.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher, Kashish & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.