Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 14 companies across 9 industries

Auto Ancillary

Studds Accessories Ltd.

Wardwizard Innovat.

Autoline Inds

Energy

CESC

Engineering & Capital Goods

DC Infotech and Comm Ltd

Virtuoso Optoele

Emmvee Photovoltaic

Agriculture

Kuantum Papers

Consumer Discretionary

Lenskart

Chemicals

Swashthik Plascon

FMCG

Apex Frozen Foods

Financial Services

General Ins. Corp

Yes Bank

Retail

D.P. Abhushan

Auto Ancillary

Studds Accessories Ltd. | Small Cap | Auto Ancillary

Studds Accessories designs, manufactures, markets, and sells two-wheeler helmets under brands ‘Studds’ and ‘SMK’, and accessories like luggage, gloves, and riding gear. It operates pan-India and exports to Americas, Asia, Europe, and other regions. Additionally, it manufactures helmets for Jay Squared LLC (’Daytona’) and O’Neal, catering to the US, Europe, and Australia markets.

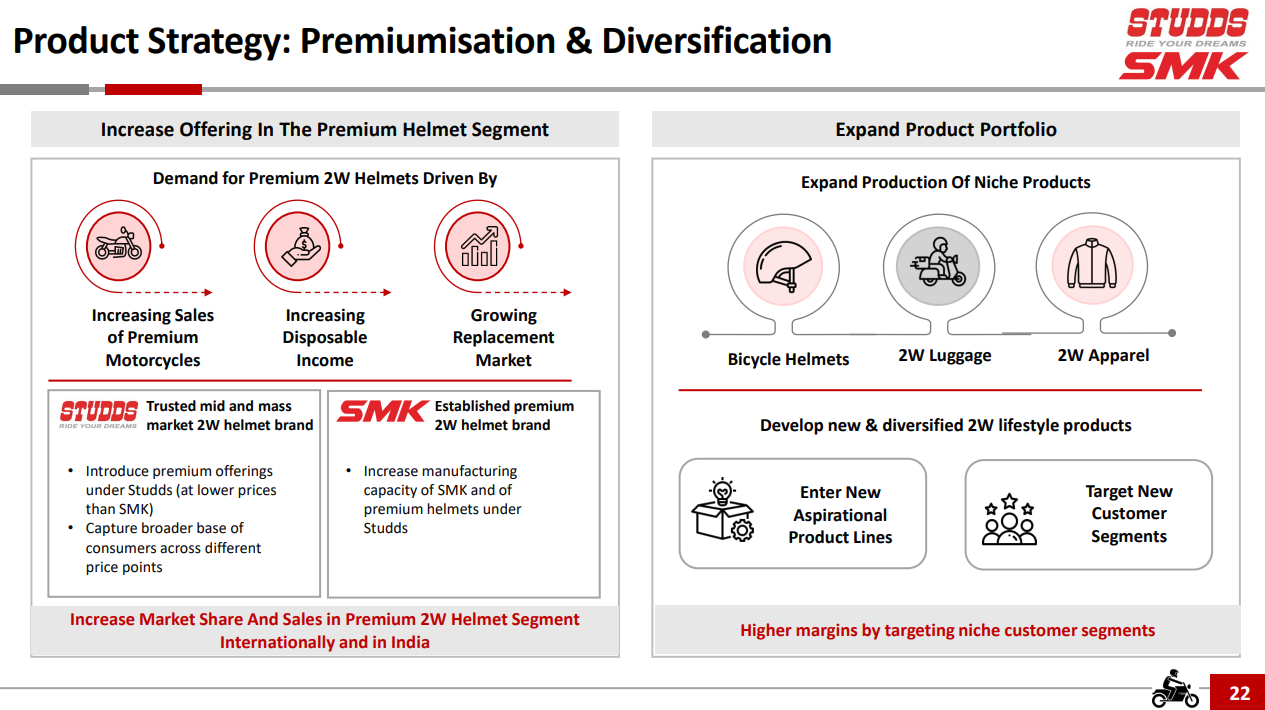

Studds is betting on two big moves to grow: pushing premium helmets and expanding into new product categories. On the premium side, the company plans to introduce higher-end offerings under the Studds brand (priced below SMK) while ramping up SMK’s manufacturing capacity. This lets them capture customers across different price points. At the same time, they’re diversifying beyond two-wheeler helmets into bicycle helmets, luggage, and riding apparel—targeting niche segments with potentially higher margins.

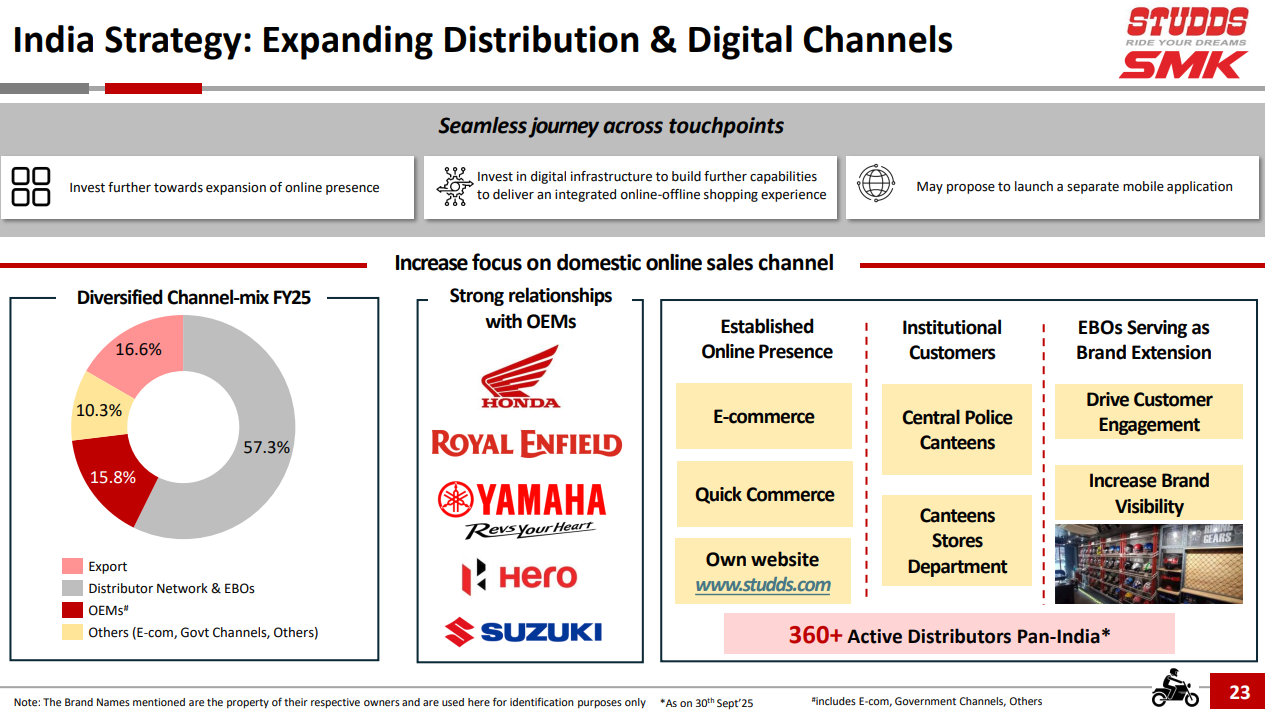

Studds is doubling down on its domestic distribution network while building out digital channels. The company already works with 360+ distributors across India and has strong OEM relationships with Honda, Royal Enfield, Yamaha, Hero, and Suzuki. Now, they’re focusing on e-commerce, quick commerce, and their own website to drive online sales. The plan includes investing in digital infrastructure and possibly launching a mobile app to create a seamless online-offline shopping experience for customers.

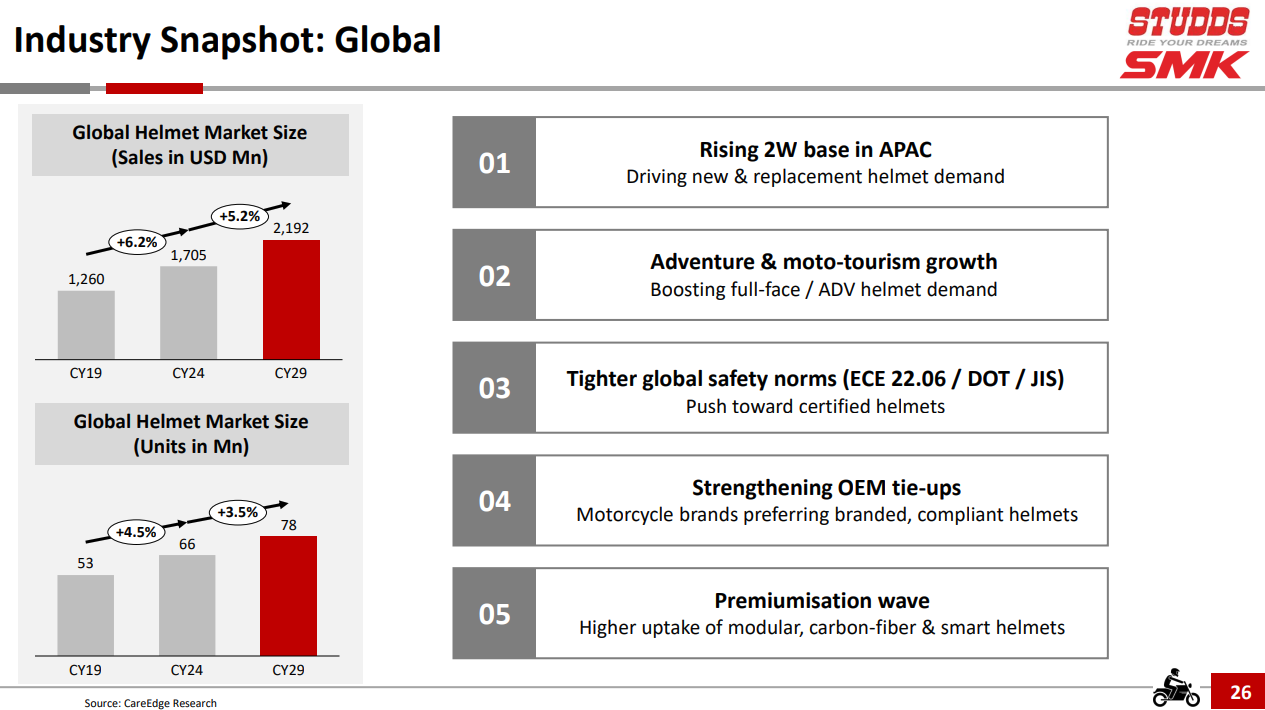

The global helmet market is projected to grow from $1,705 million in CY24 to $2,192 million by CY29, at about 5.2% annually. In volume terms, the market should expand from 66 million units to 78 million units. Growth is being driven by the expanding two-wheeler base in Asia-Pacific, rising adventure and moto-tourism trends boosting demand for full-face and ADV helmets, tighter global safety norms like ECE 22.06, stronger OEM partnerships preferring certified helmets, and a premiumisation wave pushing adoption of modular, carbon-fiber, and smart helmets.

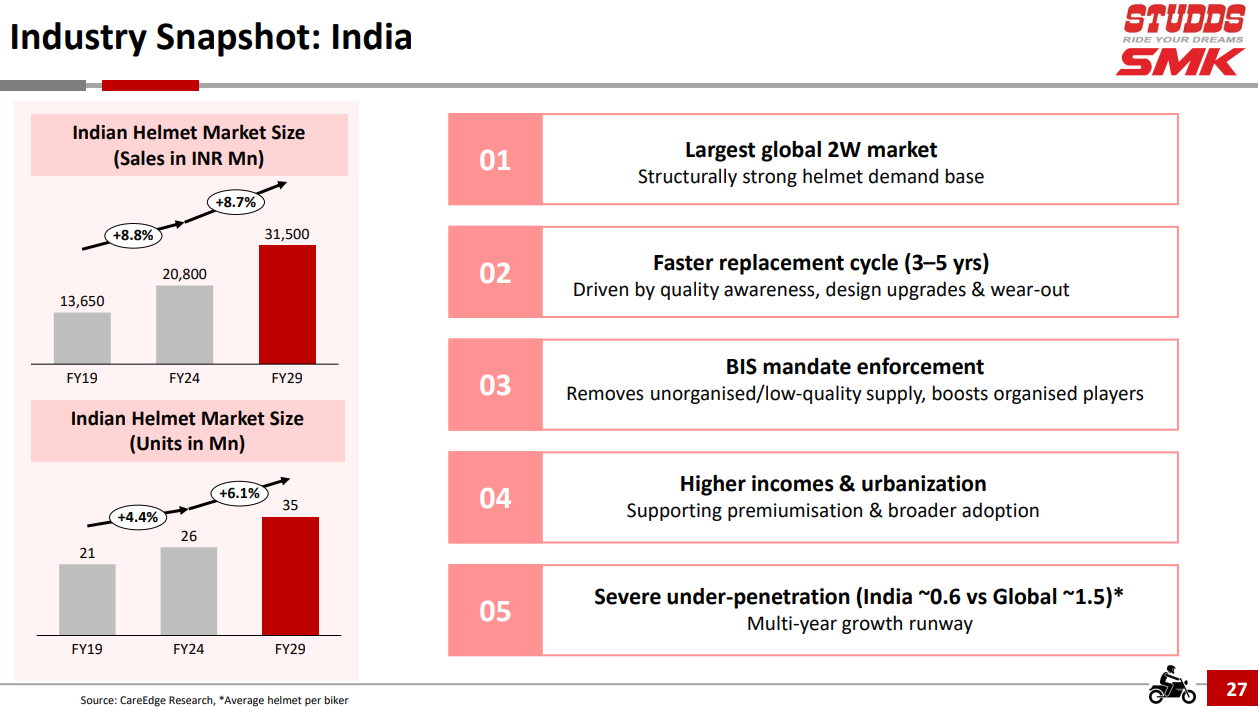

India’s helmet market is expected to grow from ₹20,800 million in FY24 to ₹31,500 million by FY29, at roughly 8.7% annually. Volume-wise, sales should rise from 26 million units to 35 million units over the same period. The key drivers include India being the world’s largest two-wheeler market, stricter BIS mandate enforcement pushing out low-quality players, severe under-penetration (India averages 0.6 helmets per biker versus 1.5 globally), faster replacement cycles of 3-5 years, and rising incomes supporting premiumisation.

Wardwizard Innovat. | Nano Cap | Auto Ancillary

Wardwizard Innovations & Mobility Limited is an Indian company that manufactures electric vehicles (EVs), including electric two-wheelers and e-rickshaws, under brands like Joy e-bike.

Electric two-wheelers dominate India’s EV market with a 56% share, driven by personal mobility and last-mile delivery demand. E-rickshaws come second at 21%, serving as affordable public transport in urban and semi-urban areas. EV sales have grown at roughly 63% CAGR since FY20, crossing 20 lakh units in FY25. India is targeting 80 million EVs on the road by 2030. Wardwizard operates in the two-wheeler and three-wheeler segments—exactly where adoption is strongest and growth potential is highest.

Autoline Inds | Nano Cap | Auto Ancillary

Autoline Industries Limited specializes in the manufacturing of sheet metal components, assemblies, and sub-assemblies such as Foot Control Modules, Parking Brakes, hinges, cab stays, cab tilts, and exhaust systems for leading OEMs in the automotive industry. With a wide range of over 3,000 products for passenger cars, commercial vehicles, and non-auto segments, the company operates through five manufacturing sites equipped with in-house design, engineering services, and a commercial tool room.

India’s auto component industry is projected to triple from its current size to $200 billion by 2030. The growth will be driven by OEM sales, domestic aftermarket demand, and exports—all expected to rise steadily through the decade. Passenger vehicles and two-wheelers will continue to dominate the market mix. The sector is also seeing up to $7 billion in planned investments by FY27-28 to localize 28 critical components like EV motors and battery systems, reducing import dependence and strengthening India’s position under the ‘China Plus One’ strategy.

Energy

CESC | Small Cap | Energy

CESC Limited, India’s first integrated electrical utility company established in 1899, operates in Kolkata and Howrah. It supplies safe and reliable electricity to millions of customers in West Bengal and has power generation projects nationwide.

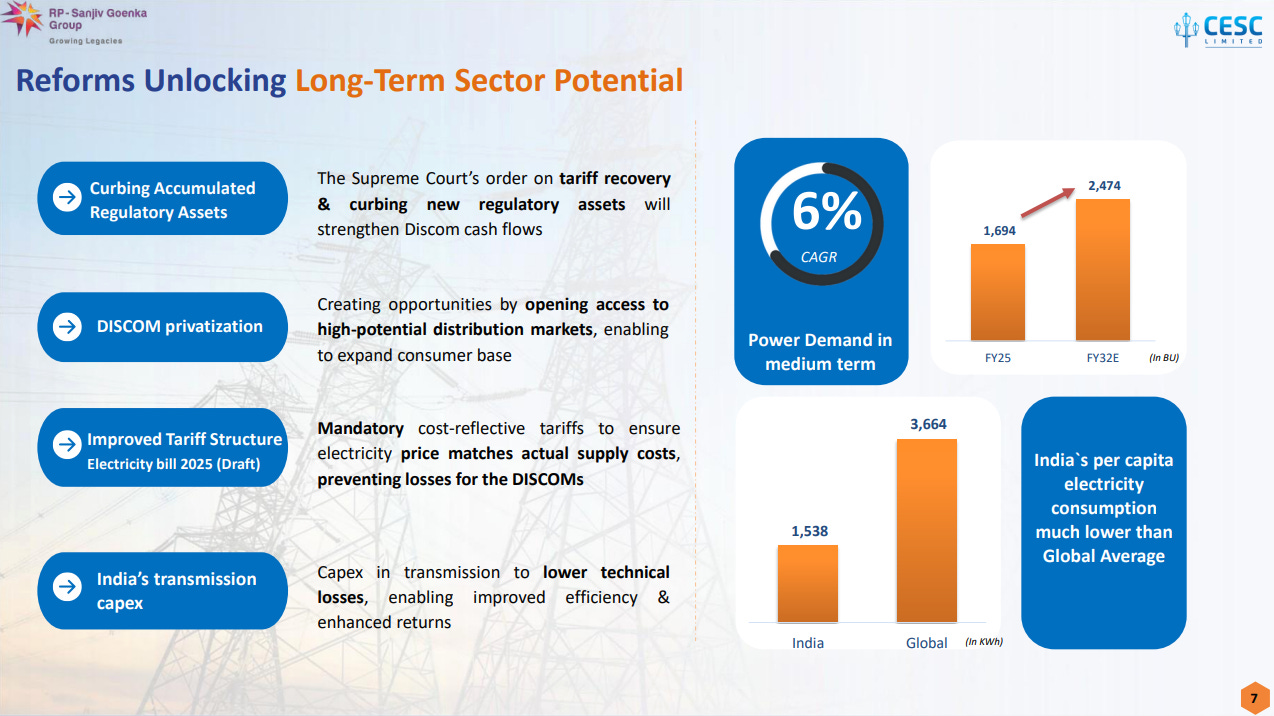

India’s power sector is getting a regulatory makeover that should benefit well-run utilities. The Supreme Court has ordered tariff recovery measures that will curb new regulatory assets and strengthen discom cash flows. Discom privatization is opening access to high-potential distribution markets, while the draft Electricity Bill 2025 mandates cost-reflective tariffs so electricity prices actually match supply costs. More capex on transmission will help lower technical losses. The demand outlook is strong too—power consumption is expected to grow at 6% CAGR from 1,694 BU in FY25 to 2,474 BU by FY32, and India’s per capita consumption at 1,538 kWh is still well below the global average of 3,664 kWh.

India’s energy mix is shifting decisively towards renewables. By 2032, renewable energy is projected to account for 44% of total electricity generation, up from just 20% in 2022, with solar leading the charge. The country has committed to building 500 GW of non-fossil energy capacity by 2030, meeting 50% of energy needs from renewable sources, and cutting carbon intensity by 45%. Hydro, pumped storage, battery storage, and nuclear energy will play critical supporting roles in enabling this transition. Coal-based generation will grow only modestly, while solar and wind capacity additions are set to accelerate sharply over the coming decade.

Renewable energy investment is becoming increasingly attractive in India. The country is on track for two-thirds of its installed capacity to come from clean energy by FY32, with renewables projected to grow from 132 GW in FY20 to 596 GW. Average tender sizes have been steadily rising, and minimum tariffs for hybrid and wind-solar projects have improved profitability for developers. RPO mandates are also increasing—from 30% in FY25 to 43% by FY30—making renewable capacity a regulatory necessity for discoms. With the government targeting 50 GW of annual capacity additions and favorable policy support, the sector has strong tailwinds.

Engineering & Capital Goods

DC Infotech and Comm Ltd | Nano Cap | Engineering & Capital Goods

DC Infotech and Communication Limited is a company involved in the reselling and distribution of computers and peripherals. They follow a broad-based distribution model, dealing with multiple brands and products such as networking, security, desktop virtualization, digital signage, and various IT solutions.

India’s network equipment market was worth $3.39 billion in 2023 and is expected to grow to $4.92 billion by 2030 at a 5.5% CAGR. Hardware dominates this space, accounting for over 55% of the market and growing the fastest. The market serves a wide range of end users—from telecom operators and enterprises to BFSI, healthcare, and government. Government initiatives like the PLI scheme and National Manufacturing Policy are expected to give this sector a further push.

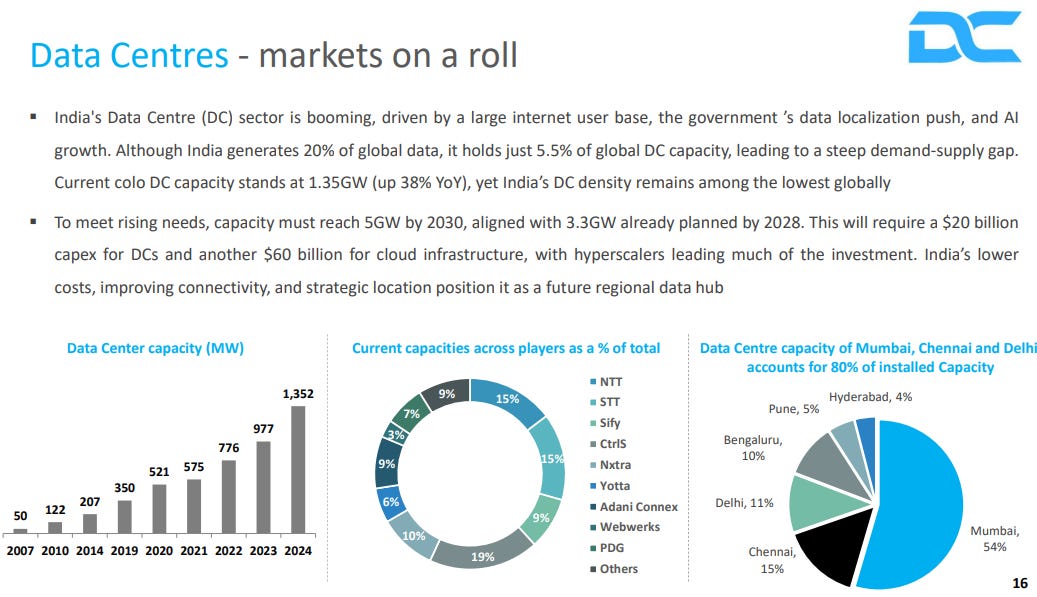

India’s data centre sector is booming. The country generates 20% of global data but holds just 5.5% of global data centre capacity—that’s a massive demand-supply gap. Current colocation capacity stands at 1.35 GW (up 38% YoY), but to meet rising demand, this needs to scale to 5 GW by 2030. That means roughly $20 billion in capex for data centres and another $60 billion for cloud infrastructure. Mumbai alone accounts for 54% of installed capacity, with Chennai and Delhi making up most of the rest.

Global Capability Centres (GCCs) in India have come a long way since the 1980s, when companies like Texas Instruments set up shop here for low-cost IT work. Today, India hosts over 1,700 GCCs, and they’re no longer just about cost savings—they’re driving R&D, data analytics, and AI. GCC revenue has grown from $12 billion in FY10 to $64.6 billion in FY24 and is projected to hit $110 billion by FY30. India’s deep talent pool and strong tech ecosystem are the key reasons behind this shift.

Engineering R&D (ER&D) GCCs in India have evolved from basic IT support to complex engineering and innovation work. Revenue in this segment more than doubled—from $16.3 billion in FY19 to $36.4 billion in FY24—growing at a 17.4% CAGR. Automotive GCCs are a big part of this story, with revenue expected to rise from $3 billion in FY23 to $9 billion by FY30. The growth is being driven by AI adoption, faster product cycles, and India’s strength in software, hardware, and automotive engineering.

Virtuoso Optoele | Small Cap | Engineering & Capital Goods

Virtuoso Optoelectronics Limited is a manufacturing company specializing in high volume, large-scale production of consumer & industrial products. With a diverse product portfolio, they aim to improve lives through innovative products. Their solutions cater to small to medium-sized companies seeking performance optimization.

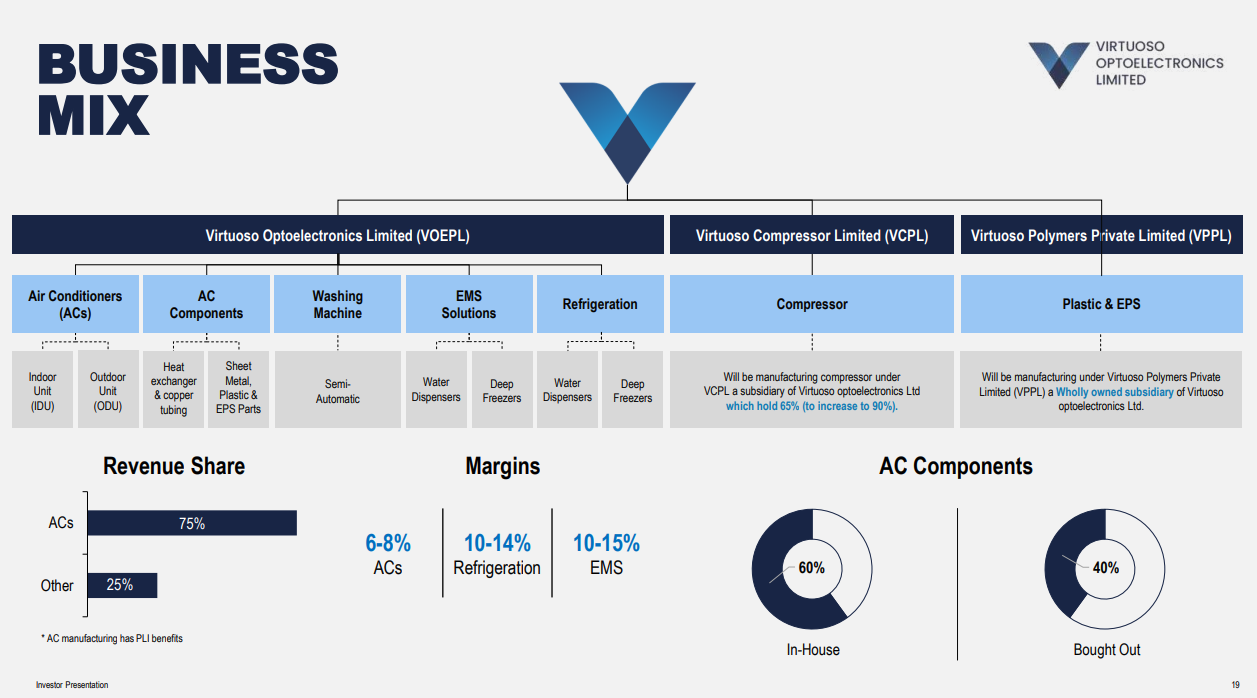

Virtuoso Optoelectronics operates through three entities. The main company (VOEPL) manufactures air conditioners, AC components, washing machines, EMS solutions, and refrigeration products like water dispensers and deep freezers. Compressors will be produced through Virtuoso Compressor Limited (VCPL), a subsidiary where VOEPL holds 65% stake (set to increase to 90%). Plastic and EPS components come from Virtuoso Polymers Private Limited (VPPL), a wholly-owned subsidiary.

ACs dominate the revenue mix at 75%, with other segments contributing 25%. Margins differ across segments—ACs at 6–8%, refrigeration at 10–14%, and EMS at 10–15%. For AC components, the company makes 60% in-house and sources 40% externally.

Emmvee Photovoltaic | Small Cap | Engineering & Capital Goods

Emmvee Photovoltaic Power Ltd, founded in 2007, is India’s second largest integrated solar PV module and cell maker with module and cell capacity. It produces TOPCon and Mono PERC modules, ALMM-listed, serving major IPPs and C&I clients.

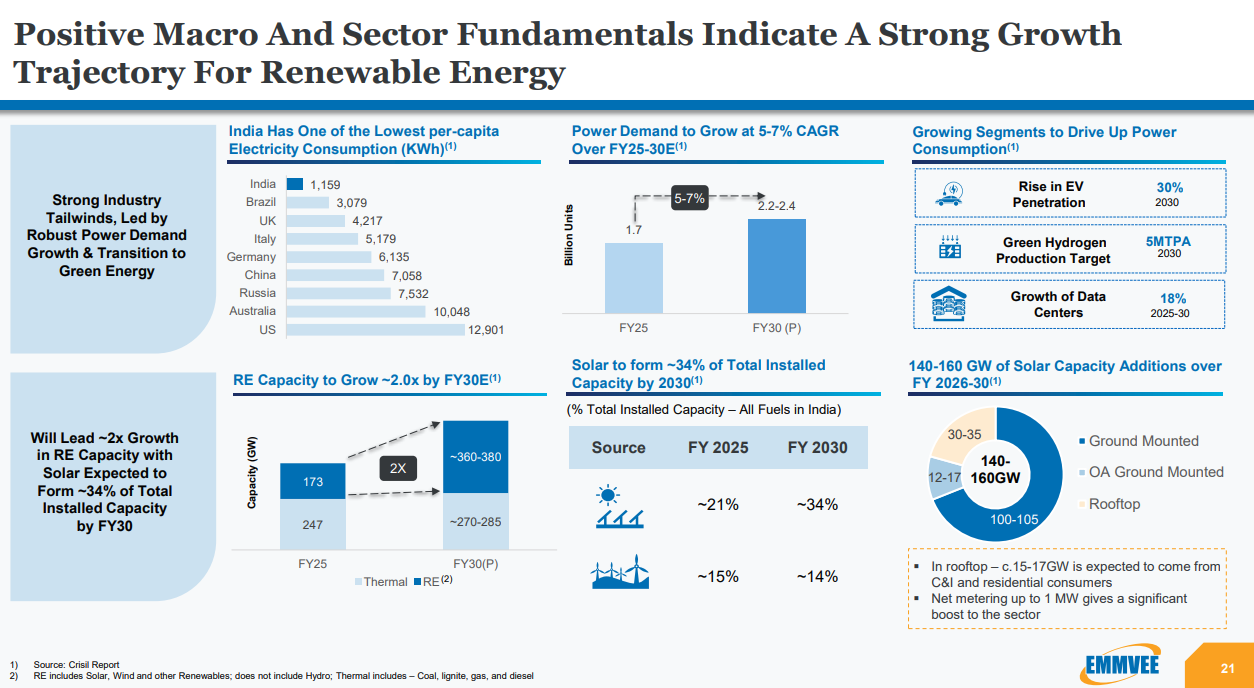

India has one of the lowest per-capita electricity consumption globally at 1,159 KWh, compared to 12,901 KWh in the US. Power demand is projected to grow at 5-7% CAGR over FY25-30, rising from 1.7 trillion units to 2.2-2.4 trillion units.

Renewable energy capacity is expected to double from 173 GW in FY25 to 360-380 GW by FY30. Solar’s share of total installed capacity is projected to increase from 21% to 34% by 2030. The presentation projects 140-160 GW of solar capacity additions over FY26-30, broken down as 100-105 GW ground-mounted, 12-17 GW open access ground-mounted, and 30-35 GW rooftop installations.

Key demand drivers include rising EV penetration (targeting 30% by 2030), green hydrogen production targets (5 MTPA by 2030), and data center growth (18% during 2025-30).

India has imposed a Basic Custom Duty of approximately 40% on modules and 27.5% on cells. The ALMM (Approved List of Models and Manufacturers), Production Linked Incentive scheme, Domestic Content Requirements, PM-KUSUM, and other government schemes create a supportive environment for domestic manufacturers.

On the international front, the US has imposed tariffs on Chinese solar imports (approximately 60% combined) due to the Uyghur Forced Labor Protection Act and trade restrictions. Southeast Asian nations (Vietnam, Cambodia, Malaysia, Thailand) also face US tariffs ranging from 15%-3,571% on allegations of dumping.

India’s import dependence for solar modules has already dropped from 65% in FY20 to 35% in FY25, and is projected to fall to just 1-5% by FY30. The technology mix is shifting rapidly toward TOPCon, which grew from just 3% of capacity in March 2024 to 21% by March 2025.

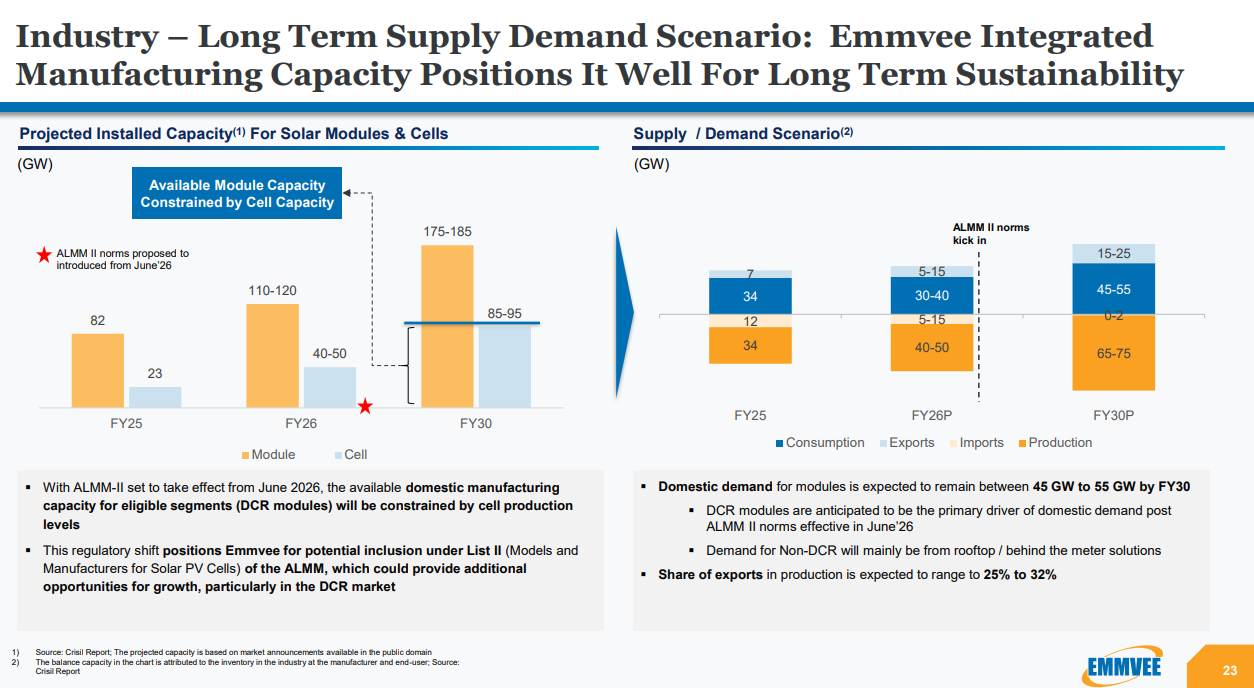

Projected installed capacity for modules is expected to grow from 82 GW in FY25 to 175-185 GW by FY30, while cell capacity is projected to increase from 23 GW to 85-95 GW.

When ALMM-II norms take effect from June 2026, the available domestic manufacturing capacity for DCR (Domestic Content Requirement) modules will be constrained by cell production levels. Integrated manufacturers like Emmvee are well-positioned for this shift.

On the demand side, domestic consumption is expected to reach 45-55 GW by FY30, with exports comprising 25-32% of production. DCR modules will be the primary driver of domestic demand post-ALMM II implementation, while non-DCR demand will mainly come from rooftop and behind-the-meter solutions.

Emmvee’s integrated cell and module manufacturing capability positions it for potential inclusion under List II of ALMM, providing growth opportunities particularly in the DCR market.

Agriculture

Kuantum Papers | Micro Cap | Agriculture

Kuantum Papers Limited, formerly ABC Paper Limited, is an India-based company. The Company is engaged in the manufacturing and selling of writing and printing paper.

India accounts for about 5% of global paper production and is the fastest-growing paper market in the world. The industry is expected to grow at 4–5% annually until 2030, with consumption projected to rise from around 22 million tons today to over 35 million tons by 2035. Packaging boards dominate the domestic market at 55%, while writing and printing paper—Kuantum’s focus area—holds 25%.

India’s per capita paper consumption is just 15–16 kg, far below the global average of 57 kg, which signals significant room for growth. Demand is being driven by expanding e-commerce (boosting packaging needs), rising corporate use of copiers and computers, government spending on education, and the shift away from single-use plastics toward paper alternatives.

Consumer Discretionary

Lenskart | Mid Cap | Consumer Discretionary

Lenskart Solutions is a technology-driven eyewear company involved in designing, manufacturing, branding, and retailing eyewear products. It offers prescription glasses, sunglasses, contact lenses, and accessories under multiple brands. The company primarily operates in India, Southeast Asia, Japan, and the Middle East, focusing on an integrated approach to eyewear solutions.

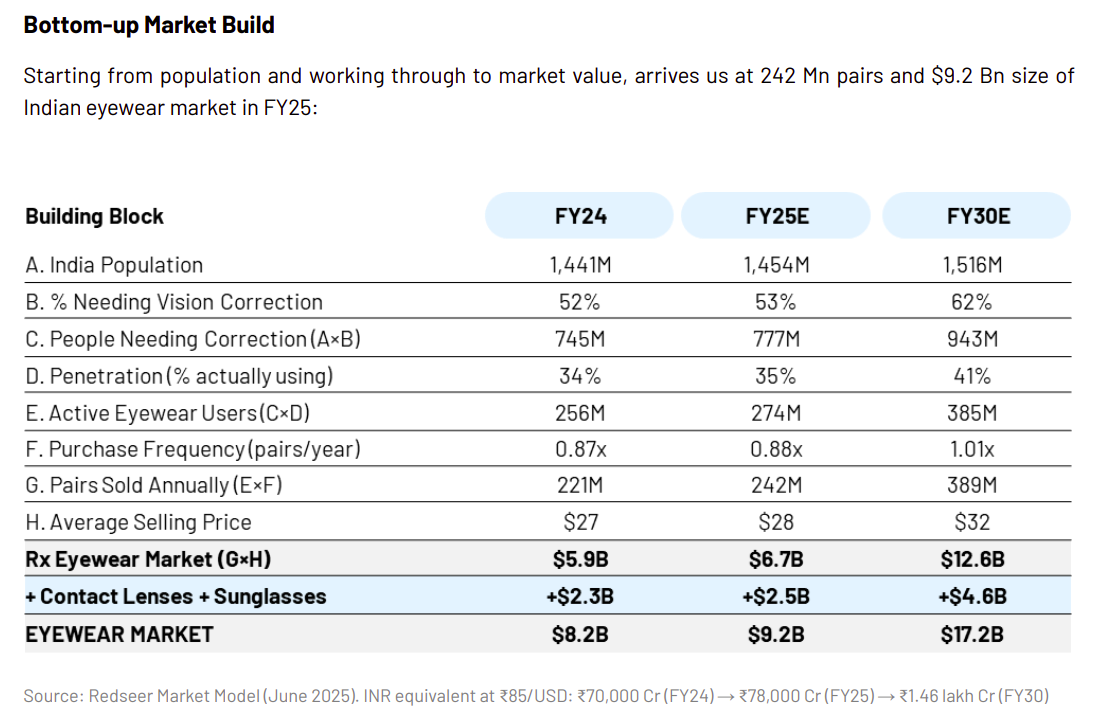

Lenskart pegs India’s eyewear market at $9.2 billion in FY25, built bottom-up from how many Indians actually need vision correction — and how few of them currently wear glasses. With penetration still at just 35%, the market is massively under-served and set to nearly double by FY30.

Lenskart’s data shows that adding more stores in the same city doesn’t cannibalize sales — it actually creates new demand. Between FY21 and FY26, store count tripled while revenue per store nearly doubled, proving the brand benefits from density, not dilution.

Chemicals

Swashthik Plascon | Nano Cap | Chemicals

Swashthik Plascon Limited specializes in manufacturing a wide range of PET Bottles and PET Preforms for various applications including pharmaceutical, liquor, FMCG, household, dishwashing, and repellent dispensers. They use advanced technology and 100% virgin food-grade material in their Continuous Injection Stretch Moulding Machines.

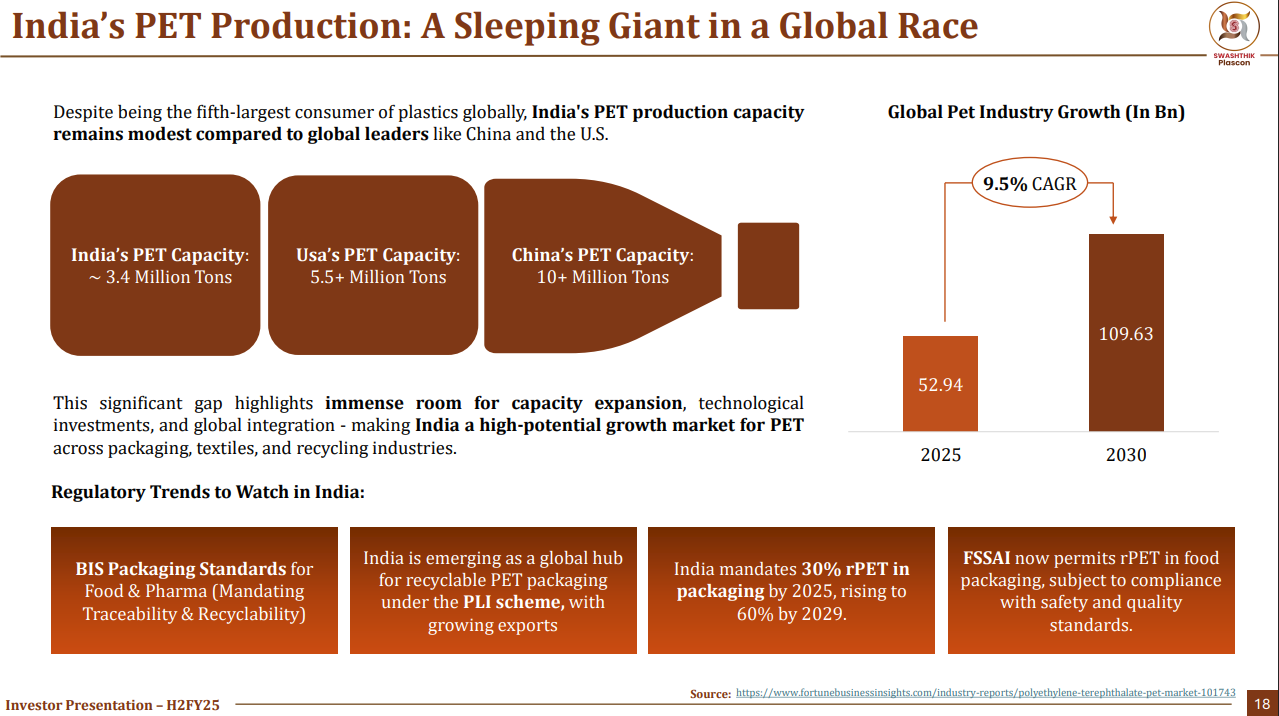

India is the fifth-largest consumer of plastics globally, but its PET production capacity is still modest at around 3.4 million tons—far behind China (10+ million tons) and the US (5.5+ million tons). This gap signals significant room for capacity expansion and investment. The global PET industry is expected to grow from $52.94 billion in 2025 to $109.63 billion by 2030 at a 9.5% CAGR. On the regulatory front, India is pushing sustainability hard—mandating 30% recycled PET (rPET) in packaging by 2025, rising to 60% by 2029, with FSSAI now permitting rPET in food packaging.

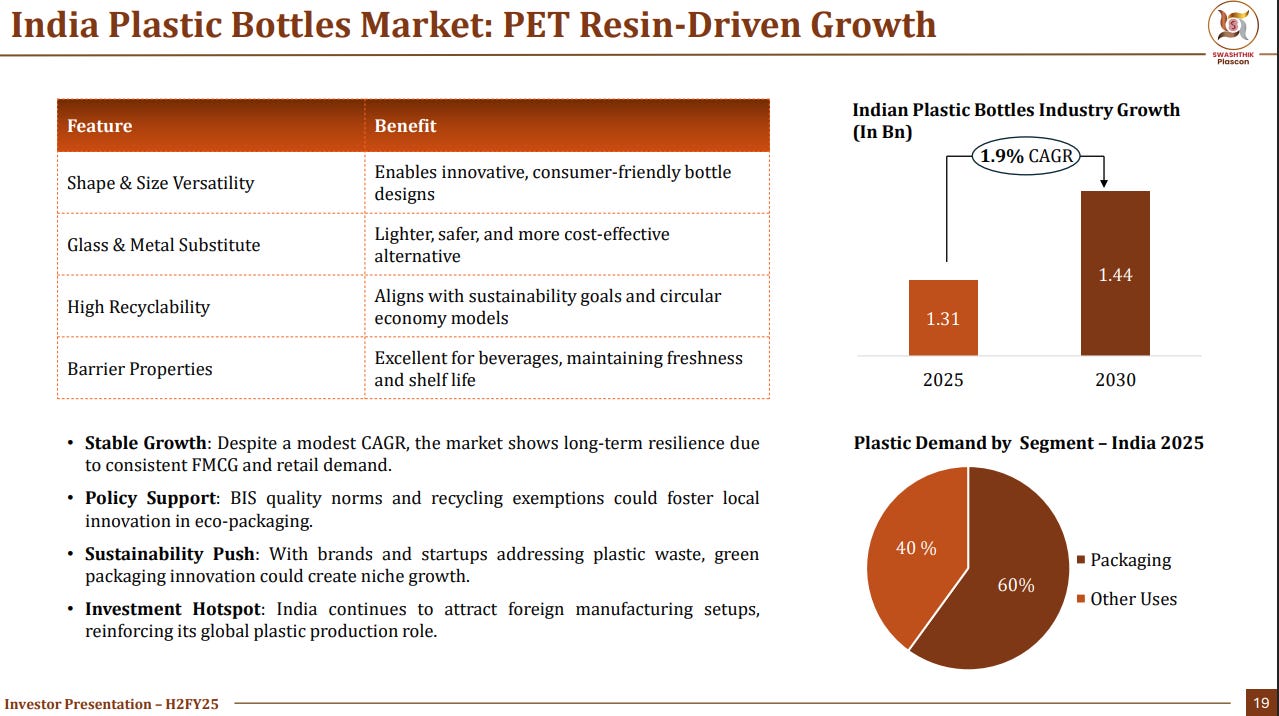

India’s plastic bottles market is expected to grow from $1.31 billion in 2025 to $1.44 billion by 2030 at a modest 1.9% CAGR. Packaging accounts for 60% of plastic demand in the country, with PET being a preferred material due to its versatility, recyclability, and ability to replace heavier glass and metal alternatives. Demand remains resilient thanks to consistent consumption from FMCG and retail sectors. The market is also seeing innovation in green packaging, supported by BIS quality norms and growing interest from foreign manufacturers setting up shop in India.

FMCG

Apex Frozen Foods |Micro Cap | FMCG

Apex Frozen Foods Limited is a leading exporter of processed L. Vannamei and Black Tiger shrimp, with a strong presence in the value chain. The company has strategically focused on backward integration and value addition, positioning itself as a premier supplier of high-quality shrimp.

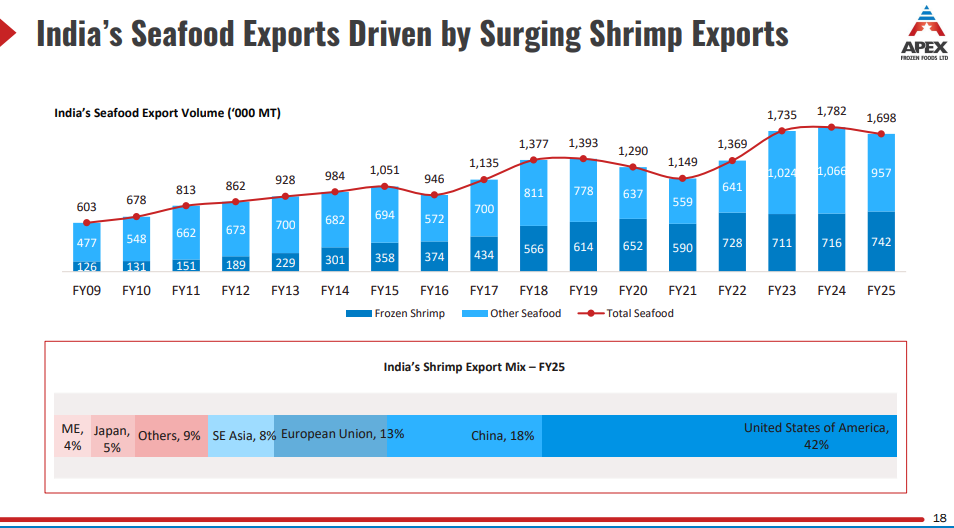

Frozen shrimp has become the backbone of India’s seafood export story. Over the past 17 years, shrimp exports have grown from just 126,000 MT in FY09 to 742,000 MT in FY25—nearly a 6x jump. While other seafood categories have remained largely flat, shrimp now accounts for the bulk of India’s total seafood shipments. The USA is the biggest buyer, taking in 42% of India’s shrimp exports, followed by China at 18% and the European Union at 13%.

Financial Services

General Ins. Corp | Mid Cap | Financial Services

General Insurance Corporation of India is the sole reinsurer in the domestic market, providing reinsurance across various business lines including property, marine, motor, and life insurance. It leads treaty programmes and facultative placements for domestic companies, and is expanding its presence in the Afro-Asian region by leading reinsurance programs for insurance companies in SAARC countries, South East Asia, Middle East, and Africa.

India’s insurance market is massively under-penetrated. At just 2.8% for life and 1% for non-life, penetration levels are well below global averages — signalling huge room for growth. The general insurance industry has been compounding at 12% since FY22, with gross written premiums now at ₹3.1 lakh crore in FY25. The retention ratio of insurers has also been climbing steadily, reaching 74.7% in FY25. Reinsurance premiums in India are expected to touch ₹99,275 crore by FY26, and the broader general insurance market is projected to grow at nearly 10% annually through 2028. GIC Re, with its strong financials and deep market expertise, is well-placed to ride this wave and maintain its leadership position.

Yes Bank | Mid Cap | Financial Services

Yes Bank is a publicly held bank offering diverse products, services, and digital solutions for Retail, MSME, and corporate clients. Regulated by the Banking Regulation Act, 1949, it leverages multiple forms of capital—Financial, Natural, Social, Human, Manufactured, and Intellectual—to create value and drive business growth.

India is projected to grow at 6.6% in 2025 and 6.2% in 2026 according to the IMF—comfortably ahead of other advanced and emerging economies. The RBI pegs FY26 GDP growth at 6.8%. Despite global headwinds like US tariffs, the economy remains resilient, powered by strong consumption, a rural upswing, government schemes like PLI, and recent GST 2.0 reforms benefiting sectors like retail, MSMEs, and auto.

India’s retail inflation has stayed largely within the RBI’s 2-6% target range. CPI inflation averaged 4.6% in FY25 and dropped to a multi-year low of 0.25% in October 2025, helped by GST cuts and contained food prices. The RBI has revised its FY26 inflation forecast down to 2.6%. For banks, this has created room for rate cuts—the repo rate is now at a 3-year low of 5.5%, and the CRR cut is expected to release ₹2.5 lakh crore into the system.

India’s credit-to-GDP ratio stands at 55% in 2024, still trailing advanced and emerging market averages—signalling significant headroom for future growth. On financial inclusion, the RBI’s Financial Inclusion Index has risen from 54 in 2021 to 67 in 2025, driven by schemes like PMJDY, which now covers around 56 crore beneficiaries. About 80% of the population now has bank accounts, with 55% of PMJDY account holders being women.

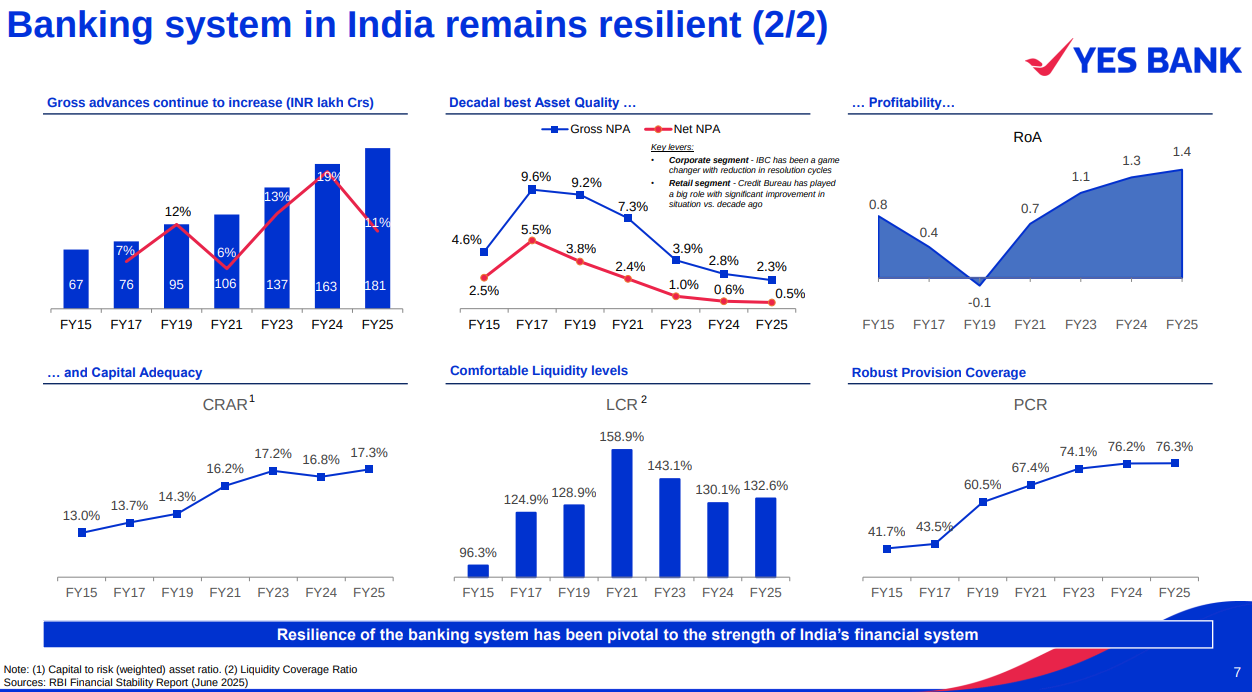

Gross advances have grown steadily to ₹181 lakh crore in FY25, while asset quality has improved sharply—gross NPAs have dropped from 9.6% in FY17 to 2.3% in FY25. Return on Assets has climbed to 1.4%, capital adequacy (CRAR) stands at 17.3%, and provision coverage is now over 76%. Liquidity remains comfortable with an LCR of 132.6%. Indian banks are well-capitalised, profitable, and sitting on clean balance sheets.

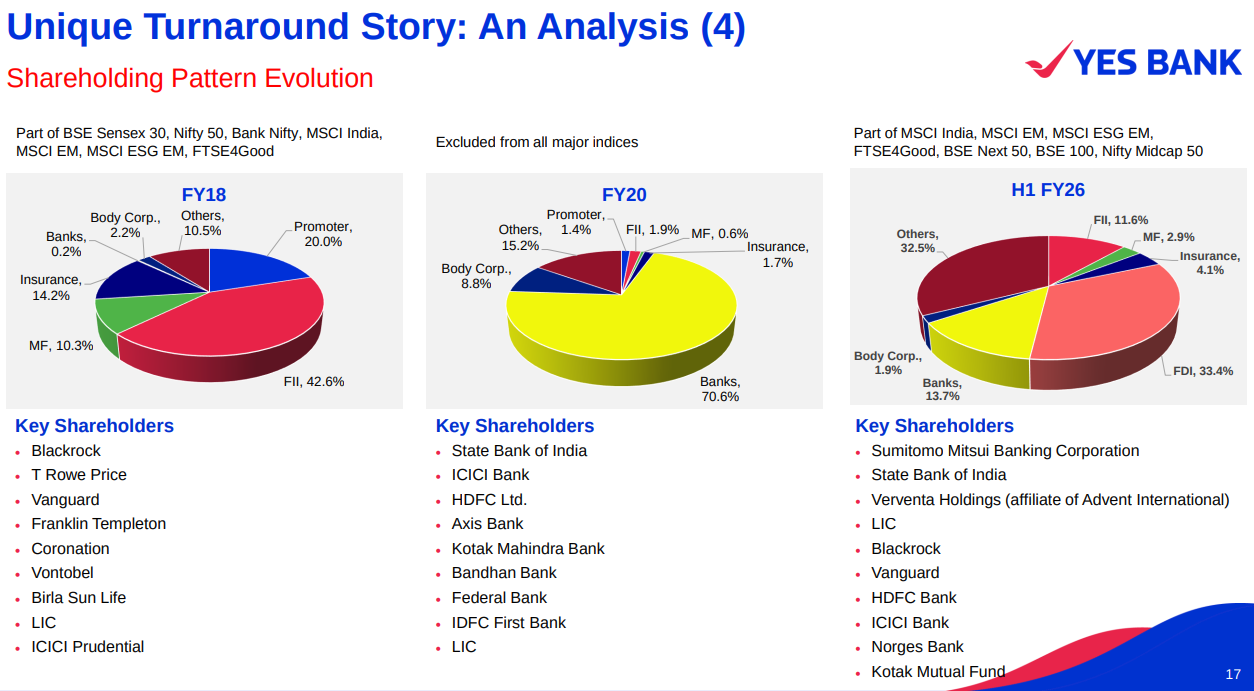

YES Bank’s shareholding has shifted dramatically across three phases: pre-crisis (FY18), crisis (FY20), and recovery (H1 FY26). In FY18, the bank was part of major indices like Nifty 50 and Bank Nifty, with FIIs holding over 42%. By FY20, after the moratorium, it was excluded from all major indices, with banks holding over 70% of the stock. Today, SMBC is the largest shareholder at 24.2%, followed by SBI and Advent. The stock is back in MSCI India, MSCI EM, and FTSE4Good—a clear sign of restored investor confidence.

Retail

D.P. Abhushan | Small Cap | Retail

DP Abhushan Ltd was Incrporated in the year of 2017. The company is in the business activity of Trading Of Jewellery Of Gold,Silver And Other Precious Or Base Metal and Manufacture Of Jewellery Of Gold,Silver And Other Precious Of Base Metal. The company’

India’s domestic jewellery market is on a strong growth trajectory, expected to nearly triple from $50 billion in FY20 to $140 billion by FY28. Gold dominates the fine jewellery segment, making up around 85% of the market, while non-gold categories like diamond and silver are growing even faster at 18% CAGR. Bridal wear remains the biggest demand driver, accounting for 55% of jewellery purchases, followed by daily wear at 35%. Rising incomes, urbanisation, and a growing middle class are fuelling this expansion.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Kashish & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.

Good one 😀

Nice article