Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 13 companies across 9 industries

Textiles

Varvee Global

Candour Techtex

Real Estate

Bigbloc Construction

Software Services

Tata Consultancy Services (TCS)

Consumer Durables

Srigee DLM

Fertilizers

Anya Polytech & Fertilizers

Chemicals

Lead Reclaim and Rubber Products

Vigor Plast India

Fineotex Chemical Ltd

Polyplex Corporation Ltd

Metals

Krishca Strapping Solutions

Media & Entertainment

Bodhi Tree Multimedia

Auto Ancillary

Carraro India

Textiles

Varvee Global | Nano Cap | Textiles

Varvee Global Limited (formerly Aarvee Denims & Exports), is a global player in the textile industry with a strong presence worldwide. The company, nurtured by experienced promoters from Arora & VB Group, showcases in-house manufacturing capabilities and cutting-edge technologies for stringent quality control. Its vertically integrated production process enables rapid response to market needs, offering diverse designs with swift turnaround times.

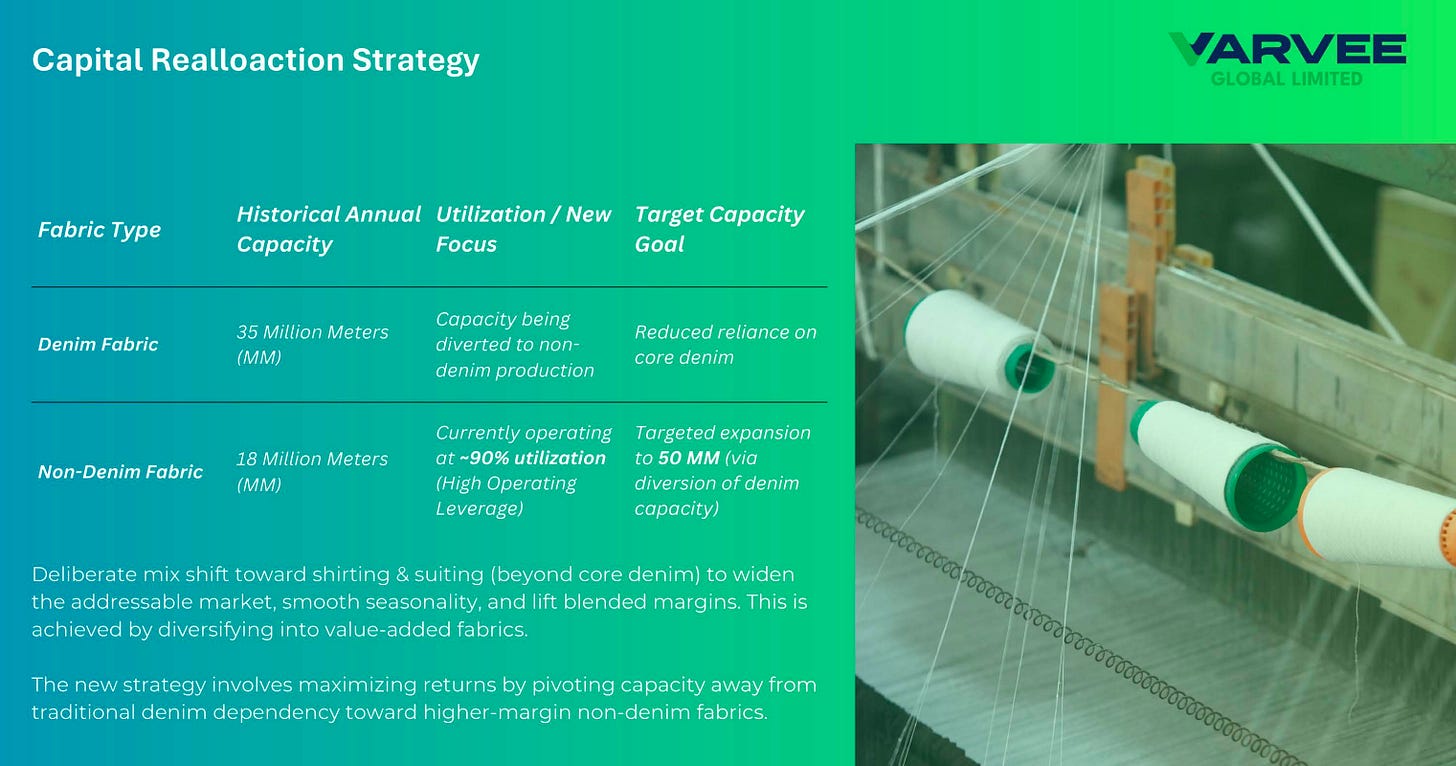

Varvee is reallocating capacity away from core denim toward higher-margin non-denim fabrics to reduce concentration risk and improve return on capital. Denim capacity of ~35 MM is being repurposed, while non-denim utilization is already ~90%, with a targeted expansion to 50 MM. The strategy aims to widen the addressable market, smooth seasonality, and lift blended margins through value-added fabrics.

India’s textile opportunity is expanding on the back of domestic demand, export momentum, and supportive trade policies. The Indian textile market is pegged at ~$147 bn in 2024 and could grow to ~$214–647 bn by 2033, while exports are targeted at $100 bn by FY31. Denim remains a large installed base, but diversification and free-trade access are key levers to capture long-term growth.

Candour Techtex | Nano Cap | Textiles

Chandni Textiles Engineering Industries Ltd is engaged in the manufacture of yarn and fabrics.The company has outsourced the manufacturing of velvet fabrics..The company also engagged in the business of Textile Division, Engineering Division.

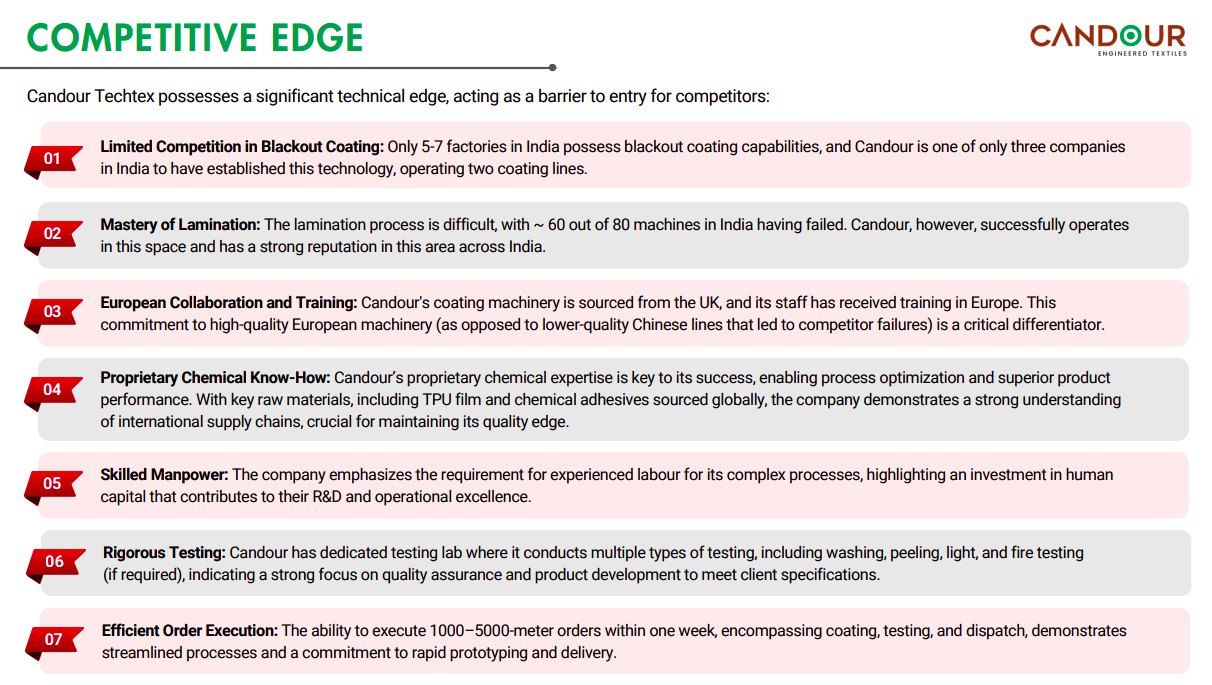

Candour Techtex has built a strong moat through rare blackout coating capability, deep lamination expertise, and proprietary chemical know-how. European machinery, skilled manpower, in-house testing, and rapid order execution together create high entry barriers and consistent quality leadership.

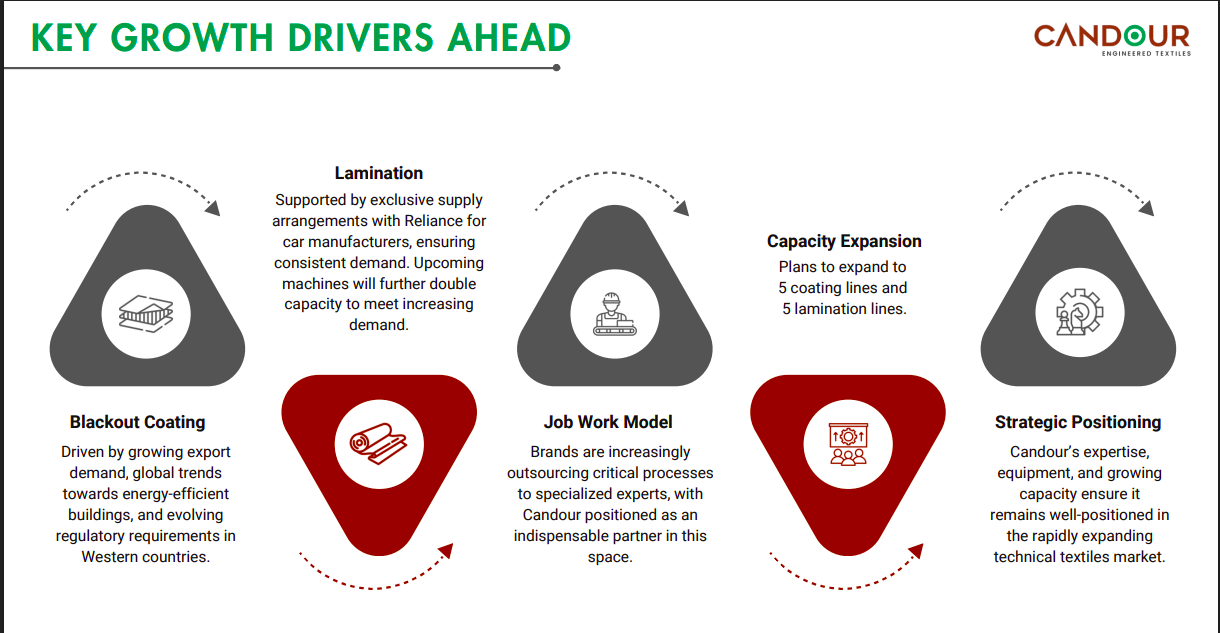

Growth is anchored in rising demand for blackout coatings, expanding lamination capacity, and increased outsourcing of specialized job work by global brands. Planned capacity expansion and strategic positioning strengthen Candour’s role as a critical supplier in technical textiles.

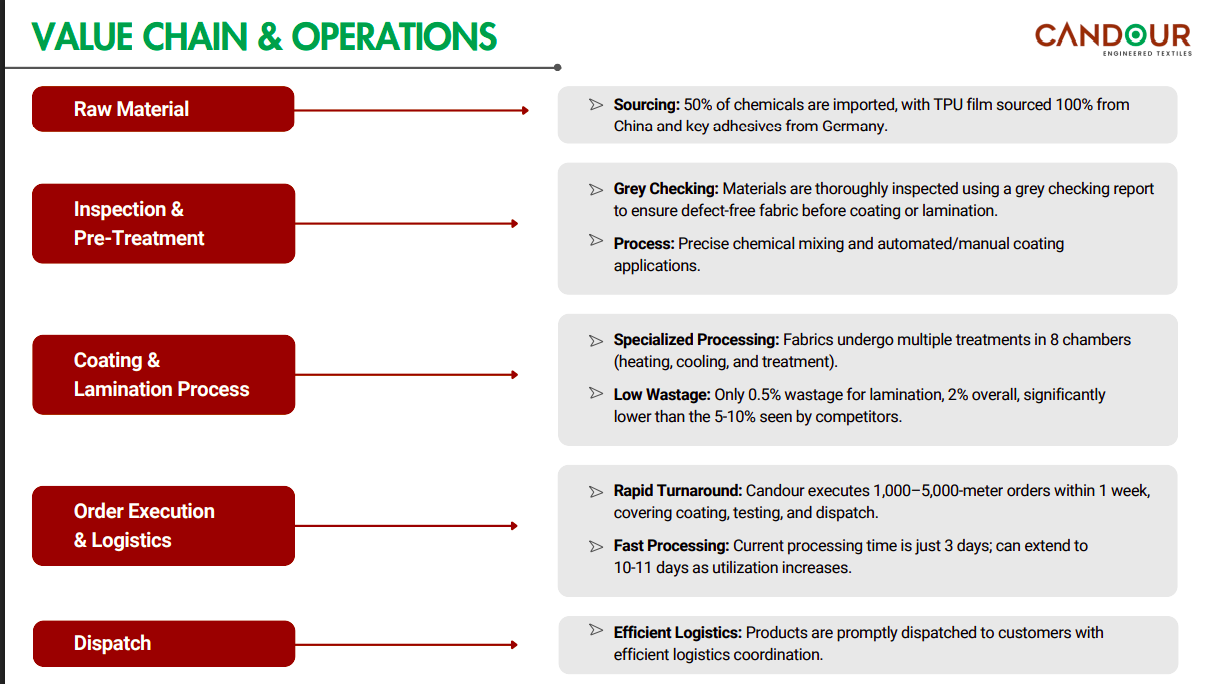

Candour operates a tightly controlled, low-wastage value chain from imported raw materials to specialized multi-chamber processing and rapid dispatch. Efficient logistics, fast turnaround times, and minimal wastage translate into superior operational efficiency versus peers.

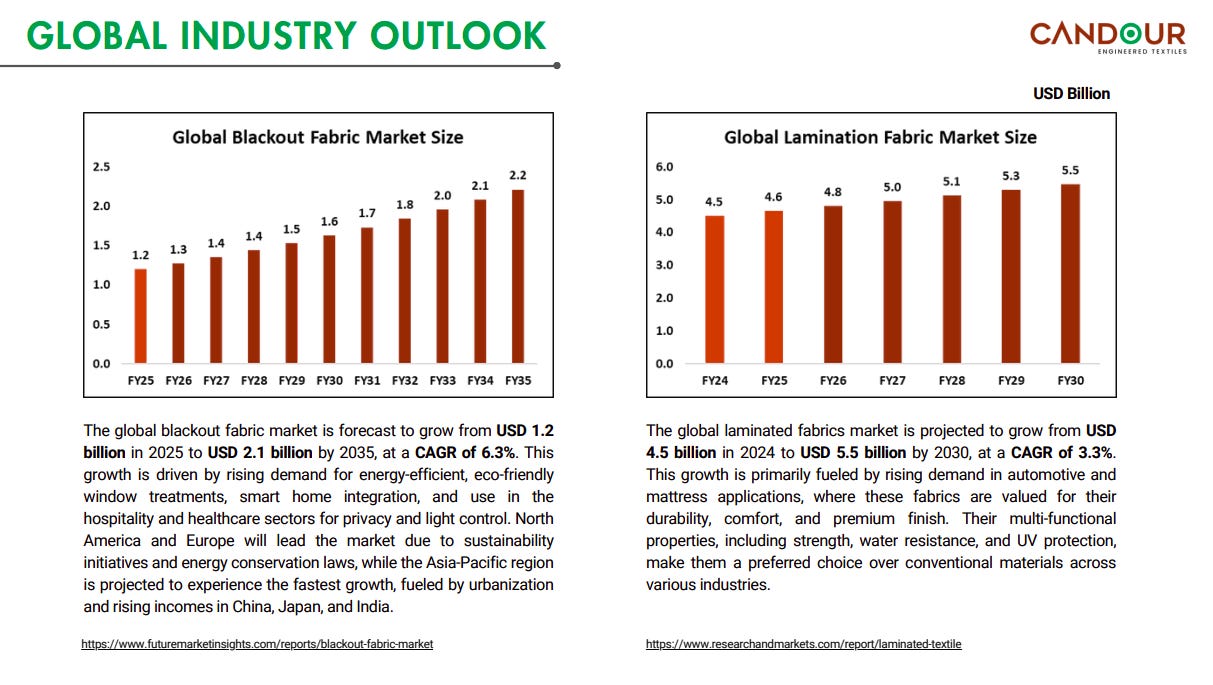

The global blackout fabric market is expected to grow at ~6.3% CAGR through FY35, driven by energy efficiency, smart homes, and hospitality demand. Laminated fabrics also show steady growth, supported by automotive, mattress, and premium application use cases, with Asia-Pacific as the fastest-growing region.

Real Estate

Bigbloc Construction | Micro Cap | Real Estate

Bigbloc Construction, established in 2015 in Gujarat, specializes in manufacturing Aerated Autoclaved Concrete (AAC) blocks. AAC blocks are known for their strength, low weight, insulation properties, fire resistance, and eco-friendliness. After acquiring the AAC Block Division of Mohit Industries, Bigbloc Construction emphasizes producing high-quality building materials like AAC blocks and bricks.

The company has a well-diversified client base across real estate developers, construction companies, corporates, brand partners, and government entities. This diversification reduces dependency on any single segment while providing exposure to residential, commercial, and infrastructure-led demand cycles.

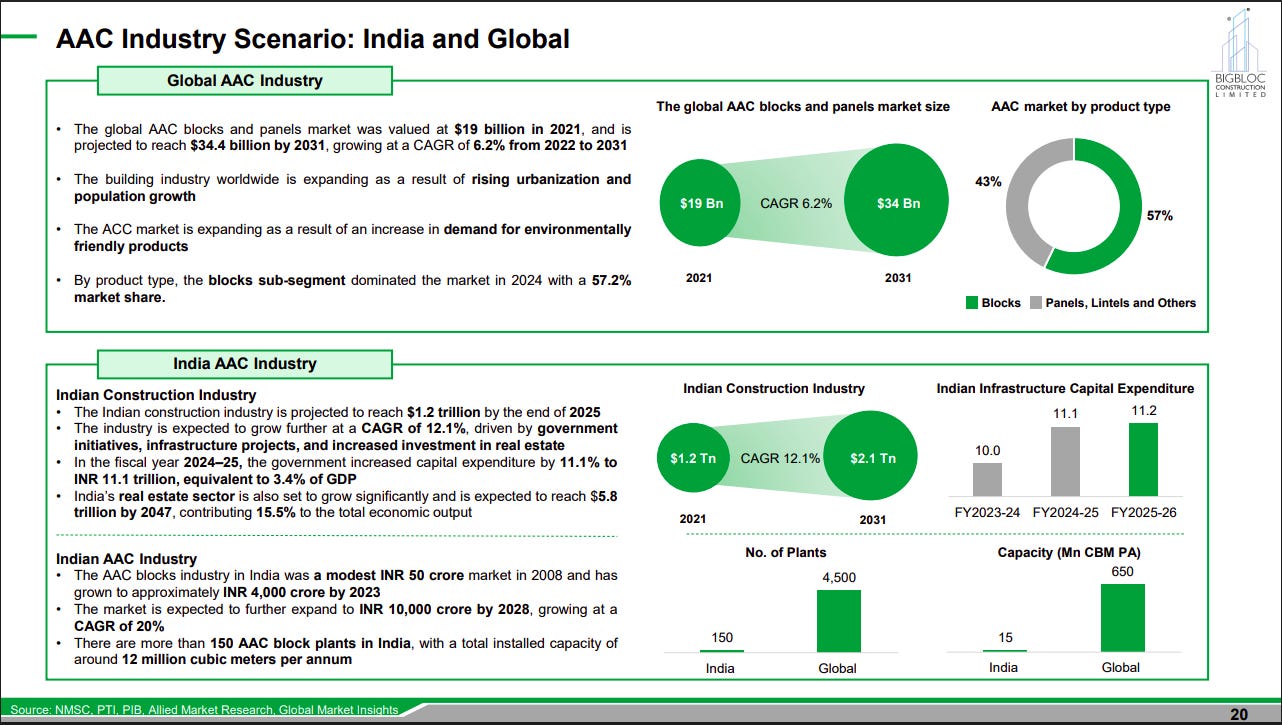

The global AAC market is growing steadily, driven by urbanization, sustainability needs, and demand for eco-friendly construction materials, with blocks dominating product mix. In India, strong infrastructure spending, rising real estate investments, and rapid capacity additions are driving high-growth potential for AAC adoption.

AAC manufacturing is capital-intensive but organized, with scale advantages favoring larger players and capacity concentration among the top companies. Proximity to consumption centers is critical due to logistics costs, which limit plant size, radius, and scalability despite strong end-market demand.

AAC growth is being fueled by sustainability regulations, restrictions on red clay bricks, government housing initiatives, and policy-driven shifts toward green building materials. Rising costs of traditional bricks and regulatory support are accelerating the transition toward AAC blocks across India.

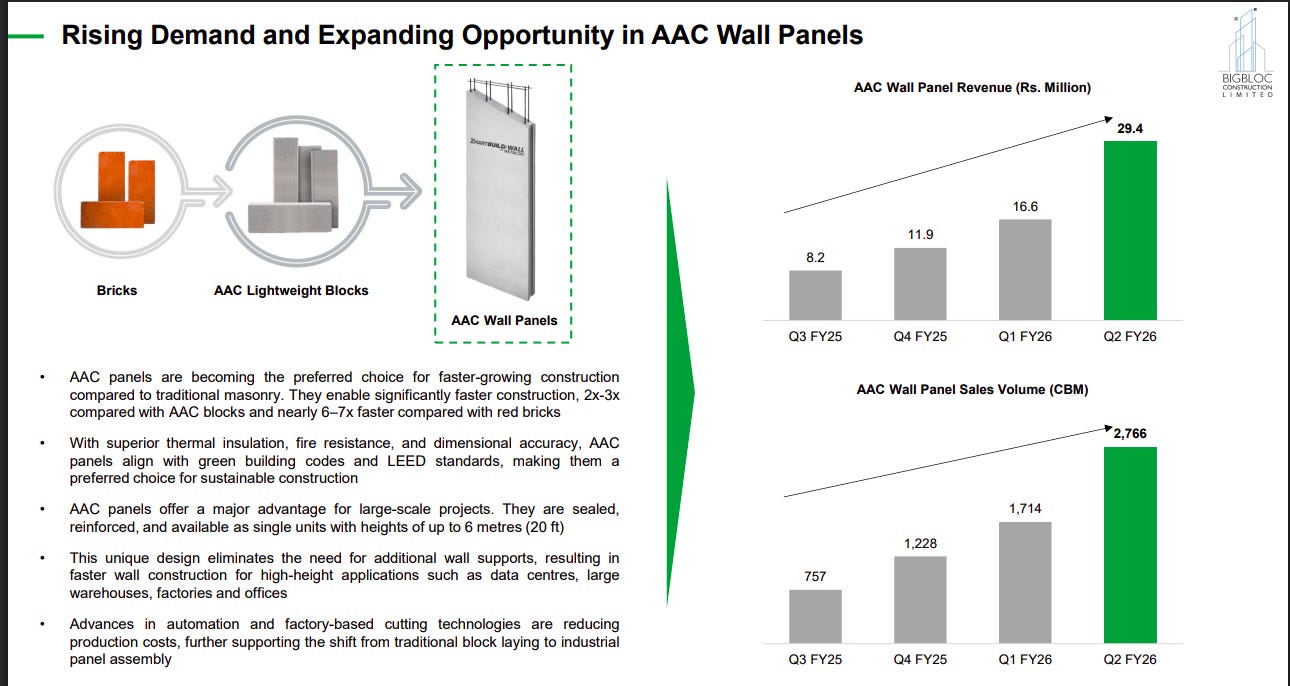

AAC wall panels are gaining traction due to significantly faster construction speeds, superior insulation, fire resistance, and suitability for large-scale projects. Rapid growth in revenues and volumes highlights increasing adoption in warehouses, factories, data centers, and high-rise developments.

Software Services

Tata Consultancy Services (TCS) | Large Cap | Software Services

Tata Consultancy Services (TCS) is a global IT services company with deep industry expertise. They offer a wide range of services including application development, digital transformation, AI, data and cloud services, engineering, cybersecurity, and products. TCS has been a trusted partner for many global businesses in their transformation journeys.

The slide highlights a broad AI partnership ecosystem spanning hyperscalers, enterprise software, domain leaders, deep-tech firms, and AI-native startups. This multi-layered partner strategy enables faster scaling, deeper industry solutions, and end-to-end AI deployment across client environments.

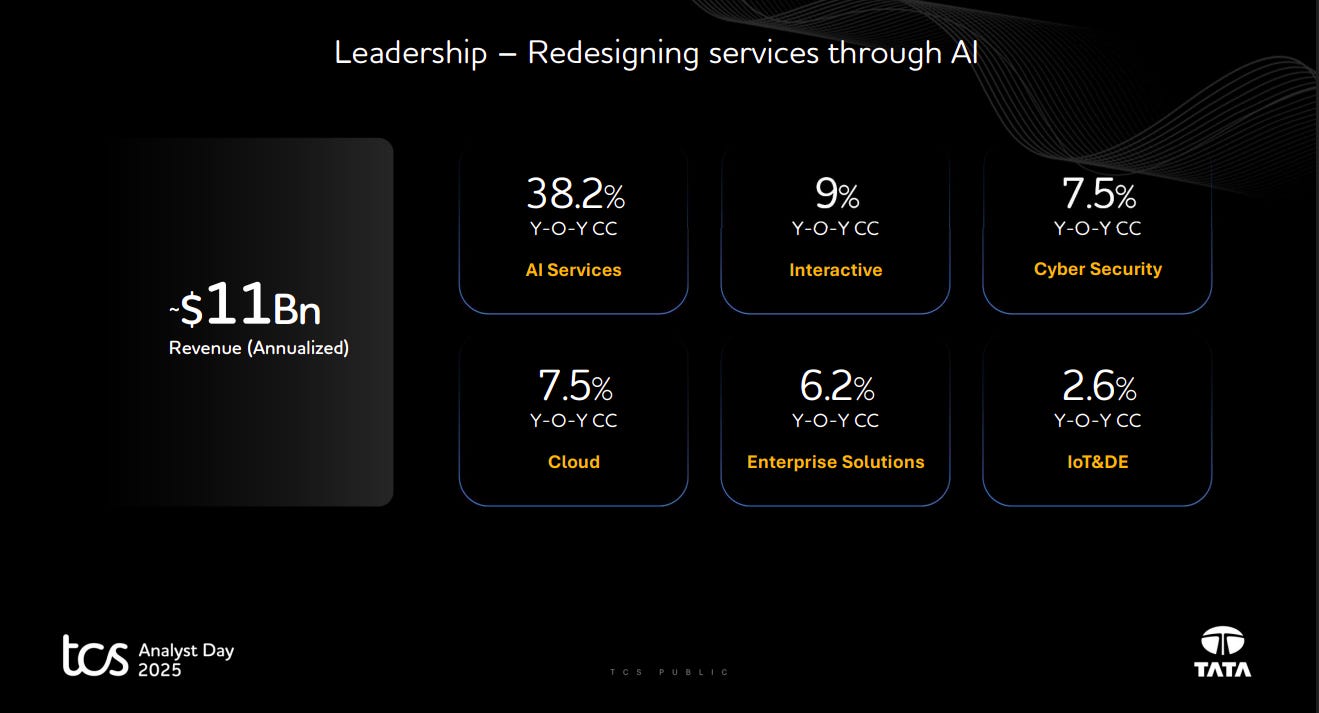

AI is emerging as the fastest-growing service line, with AI services growing ~38% YoY, far outpacing traditional segments like cloud and enterprise solutions. With ~$11 billion in annualized revenue, the mix shift underscores AI’s central role in driving growth and service transformation.

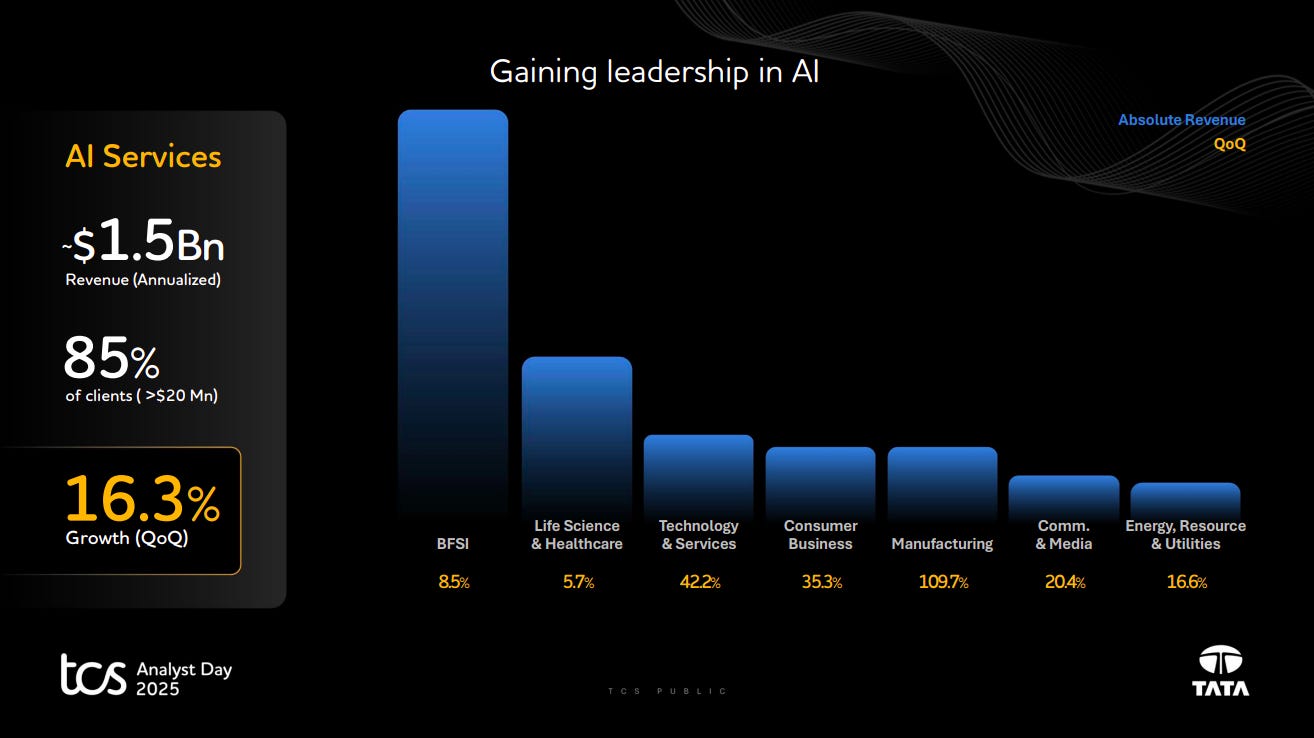

AI services have scaled to ~$1.5 billion in annualized revenue, with strong QoQ growth of 16.3% and deep penetration across large clients. BFSI leads adoption, while manufacturing, technology services, and consumer businesses are seeing rapid AI-driven growth, signaling broad-based enterprise traction.

Consumer Durables

Srigee DLM | Nano Cap | Consumer Durables

Srigee DLM provides end-to-end plastic manufacturing solutions with a design-driven approach to enhance functionality and manufacturability. They serve both OEM and ODM clients, offering comprehensive services in the plastic manufacturing industry.

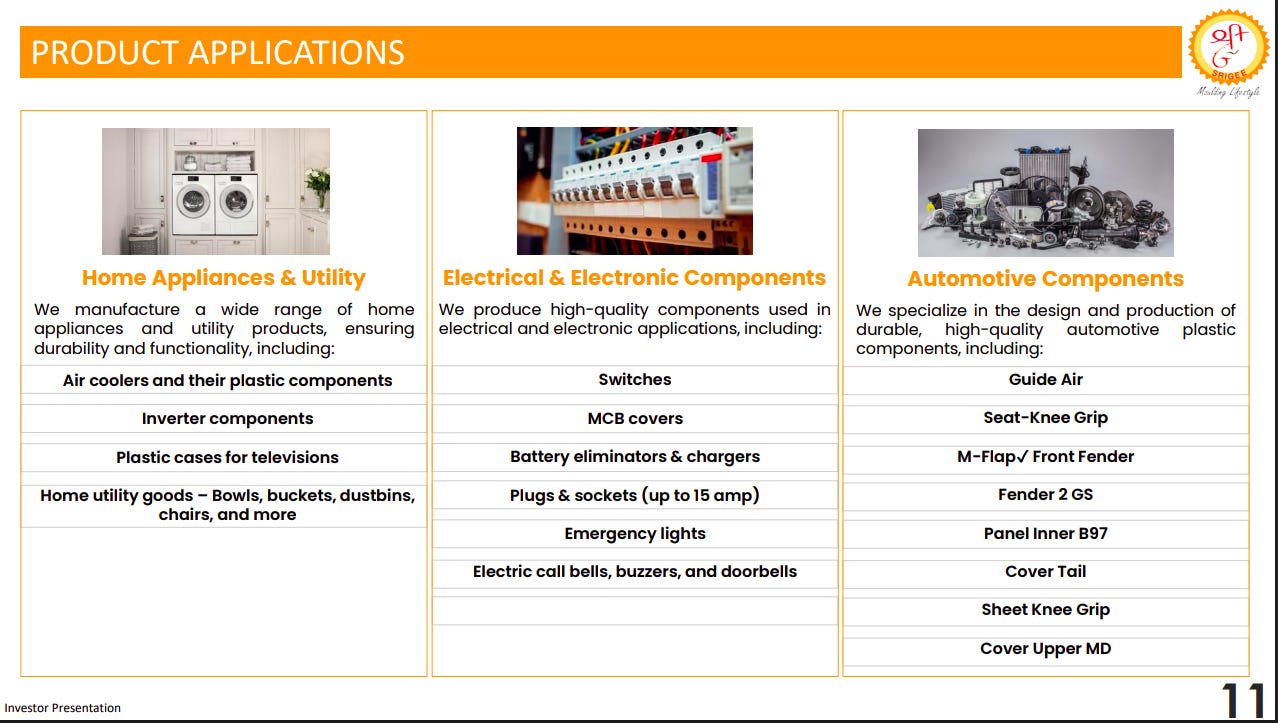

The company has a diversified product portfolio spanning home appliances, electrical & electronic components, and automotive parts. This breadth reduces dependence on any single segment while leveraging plastic molding and component design capabilities across multiple end-markets.

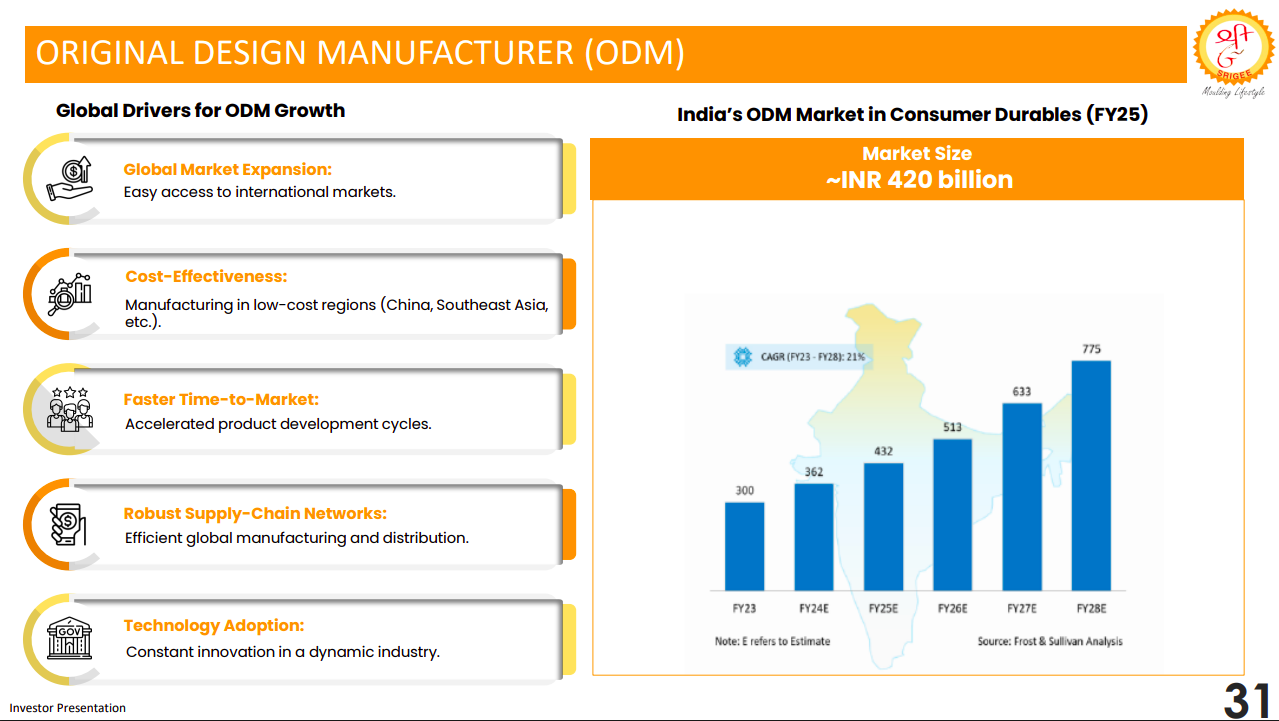

The ODM opportunity is driven by global outsourcing, cost efficiency, faster time-to-market, and strong supply-chain integration. India’s consumer durables ODM market, estimated at ~₹420 billion, is growing rapidly with a ~21% CAGR, creating a long runway for scale and value addition.

India’s consumer electronics and appliances market is set to more than double by 2025, supported by rising incomes, urbanization, export growth, and policy support like Make in India. Structural trends such as affordability, domestic manufacturing, and new product categories continue to expand the addressable market.

Fertilizers

Anya Polytech & Fertilizers | Nano Cap | Fertilizers

Anya Polytech & Fertilizers specializes in manufacturing high-quality HDPE & PP bags, Zinc sulphate Fertilizers, and Micronutrient Mixtures. Additionally, the company trades in various agricultural products like SSP, Organic Potash, and Cattle feed.

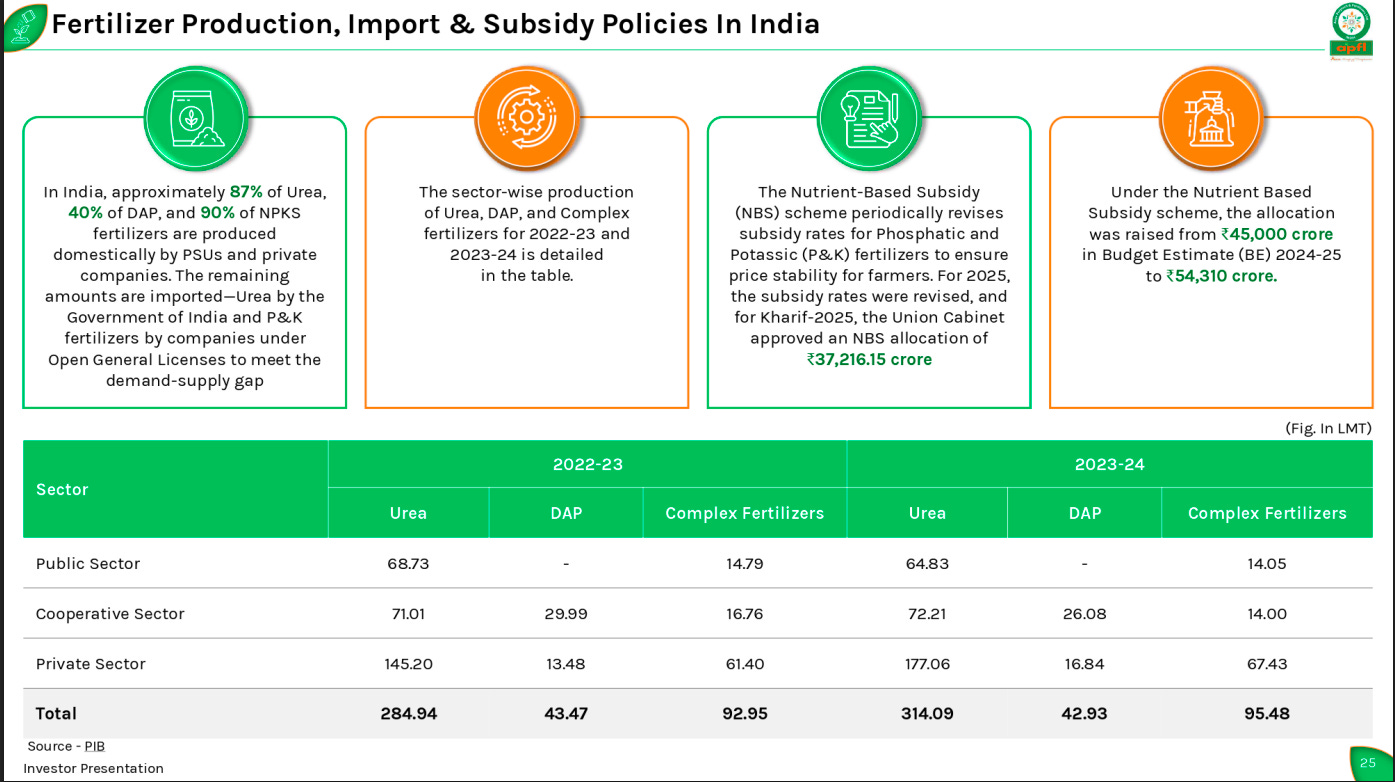

India produces the bulk of its urea, DAP, and NPK fertilizers domestically, with imports used to bridge demand gaps. Under the Nutrient-Based Subsidy regime, allocations have risen meaningfully, with FY25 support exceeding ₹54,000 crore to ensure price stability for farmers amid fluctuating input costs.

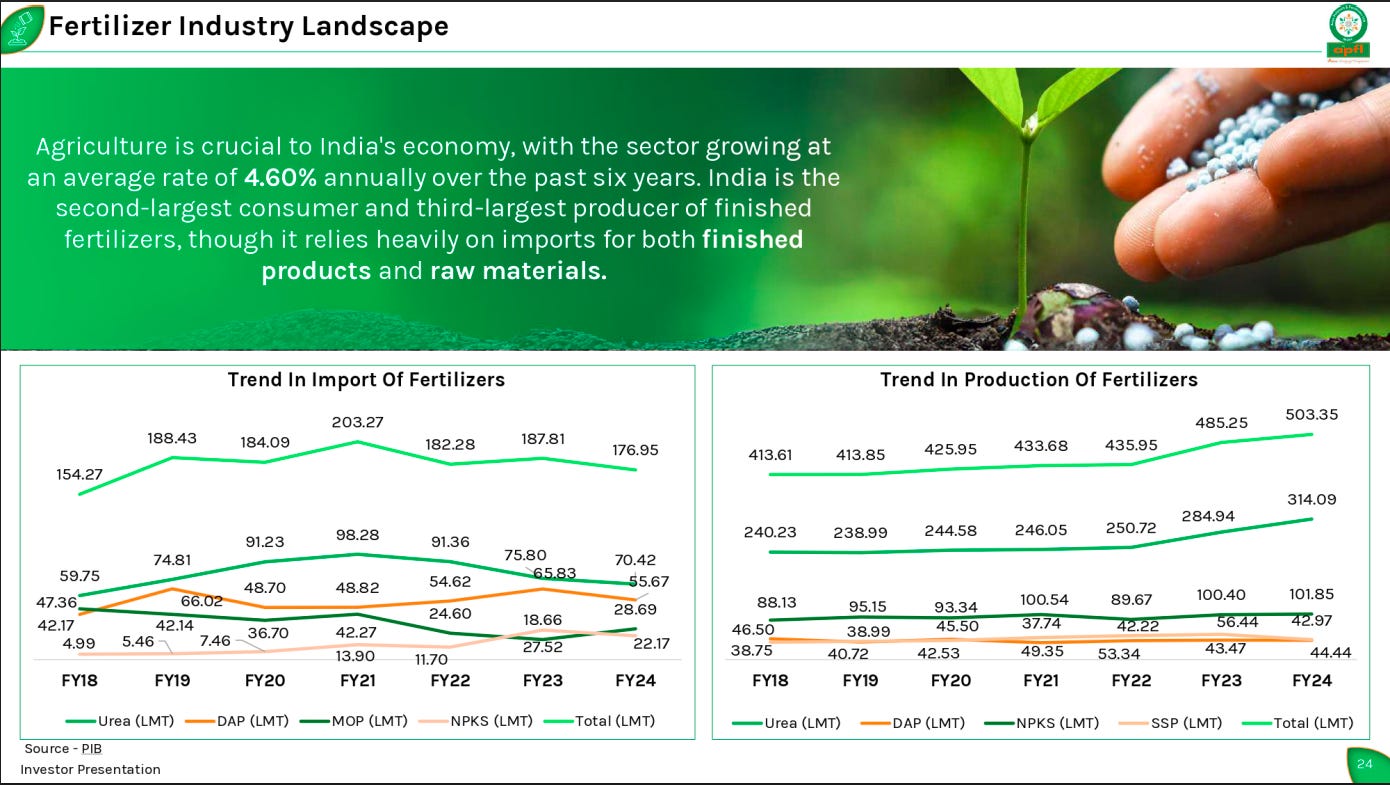

India is a major global player in fertilizers, ranking among the top consumers and producers, but remains import-dependent for key raw materials. While fertilizer imports have moderated recently, domestic production has steadily increased, reflecting policy support and capacity additions.

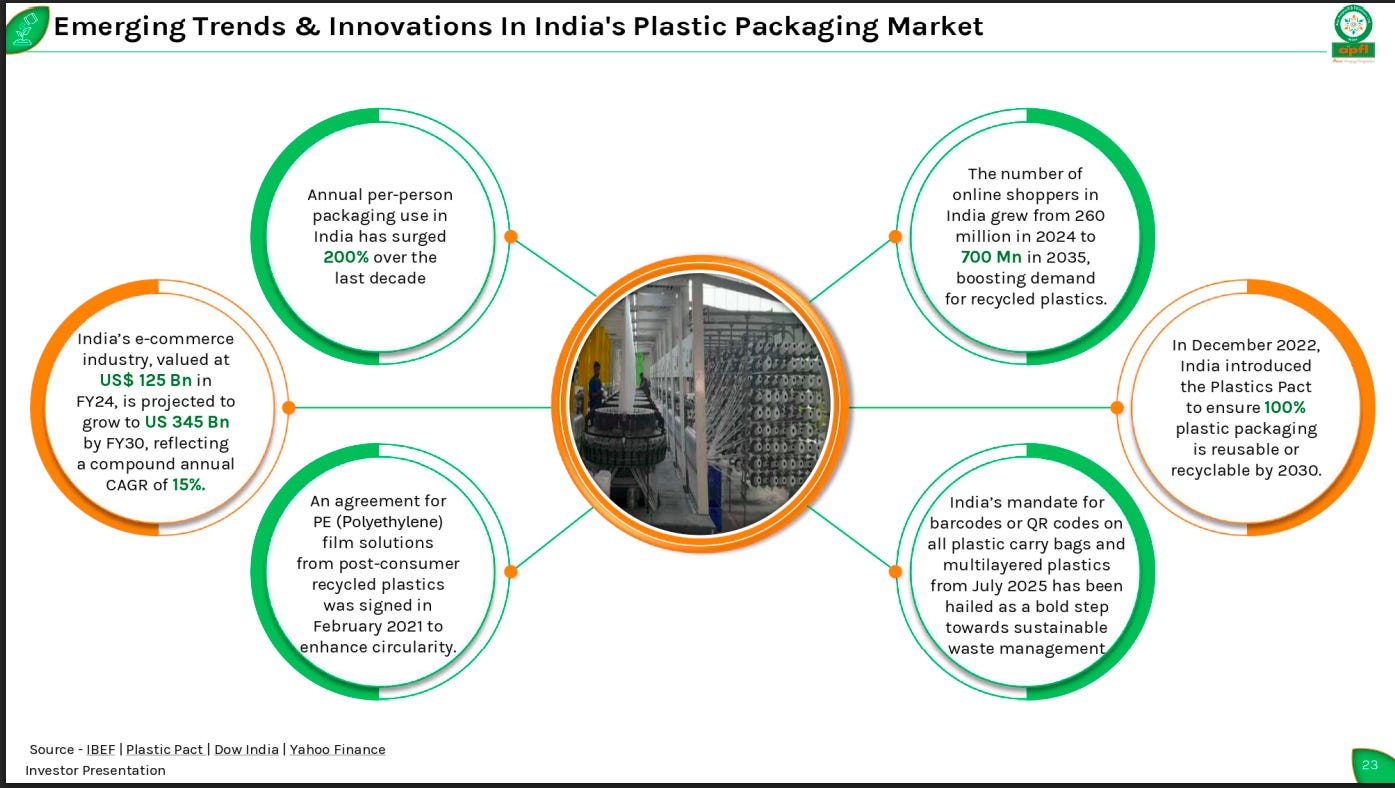

Plastic packaging demand is being driven by rapid e-commerce growth, rising per-capita packaging usage, and stricter sustainability regulations. Policy measures such as the Plastics Pact and mandatory recyclability norms are accelerating the shift toward recycled and circular plastic solutions.

India’s plastic packaging market is on a steady growth path, supported by food packaging, flexible plastics, and expanding digital consumption. Sustainability initiatives, innovation in eco-friendly materials, and diversified end-use applications continue to reinforce long-term demand growth.

Chemicals

Lead Reclaim and Rubber Products | Nano Cap | Chemicals

Lead Reclaim And Rubber Products Limited is a manufacturer of premium quality reclaimed rubber, crumb rubber powder, and rubber granules. The company offers a diverse product range including various grades of whole tyre reclaim rubber, butyl reclaim rubber, and natural reclaimed rubber. It serves OEMs, Tier I automotive companies, distributors, and dealers, with a presence in international markets like Sri Lanka, Argentina, Turkey, and China through merchant exporters.

The company offers a diversified reclaimed rubber portfolio across whole tyre, butyl tube, and natural tube reclaim grades, catering to both performance and sustainability needs. These products deliver cost efficiency, faster processing, and strong durability, making them suitable substitutes for virgin rubber across multiple industries.

Reclaimed rubber finds wide application across conveyor belts, tube manufacturing, automobiles, rubber parts, tyres, construction materials, agriculture equipment, and footwear. This broad end-use exposure reduces dependence on any single sector while supporting steady, multi-industry demand.

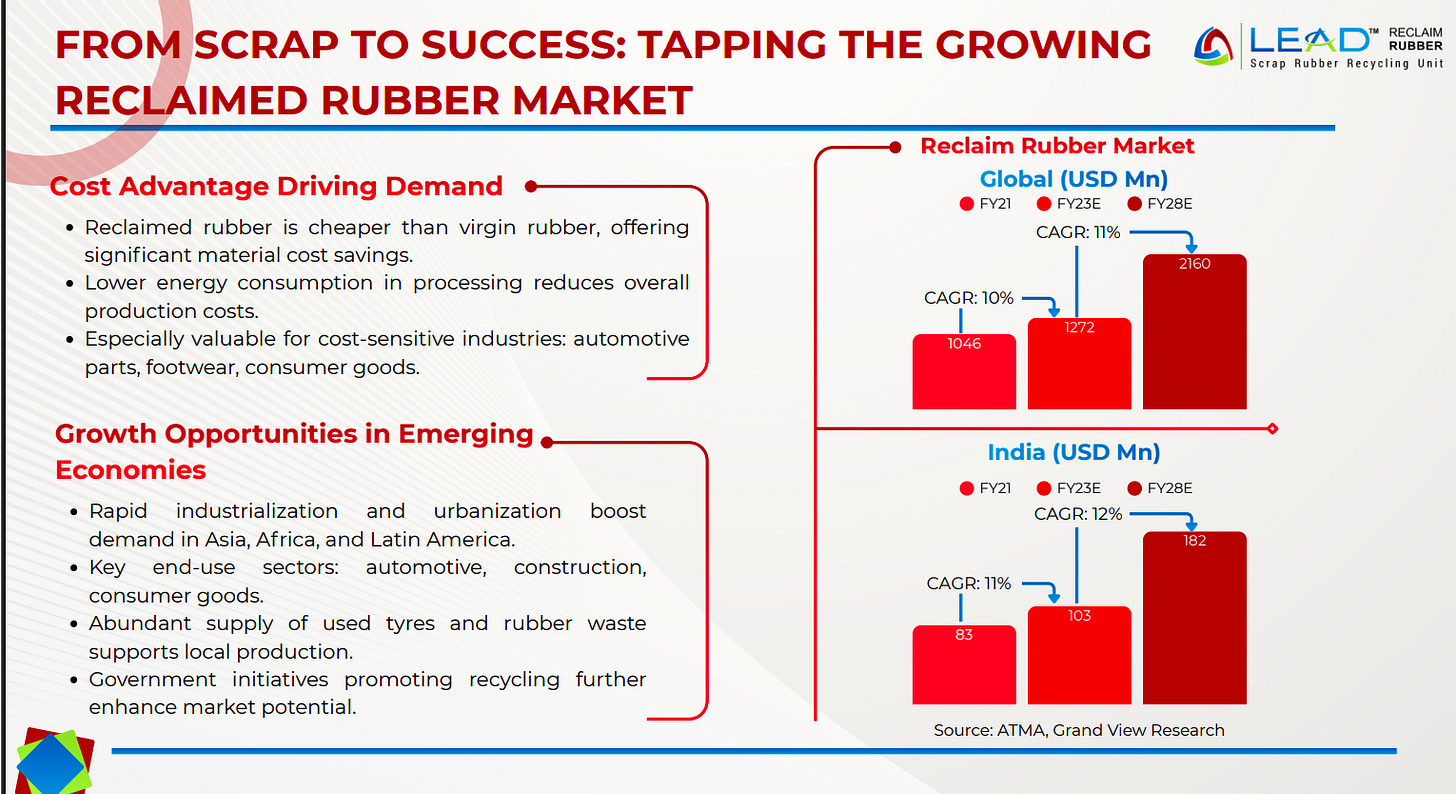

Demand for reclaimed rubber is driven by its significant cost advantage over virgin rubber and lower energy intensity, especially in price-sensitive industries. The global market is expected to grow at ~11% CAGR, while India is projected to expand faster at ~12% CAGR, supported by urbanization, recycling policies, and abundant scrap tyre availability.

Vigor Plast India | Nano Cap | Chemicals

Vigor Plast India specializes in manufacturing and supplying a wide range of PVC, uPVC, and cPVC pipes and fittings for plumbing, irrigation, and SWR management. They cater to both rural and urban markets, offering long-lasting solutions for water distribution, wastewater management, and drainage.

Demand for plastic pipes and fittings in India is diversified across agriculture, plumbing & water supply, sewage & drainage, and industrial applications. Agriculture (44%) and plumbing (39%) together form the bulk of demand, supported by irrigation modernization, housing growth, and large government programs like Jal Jeevan Mission and AMRUT 2.0.

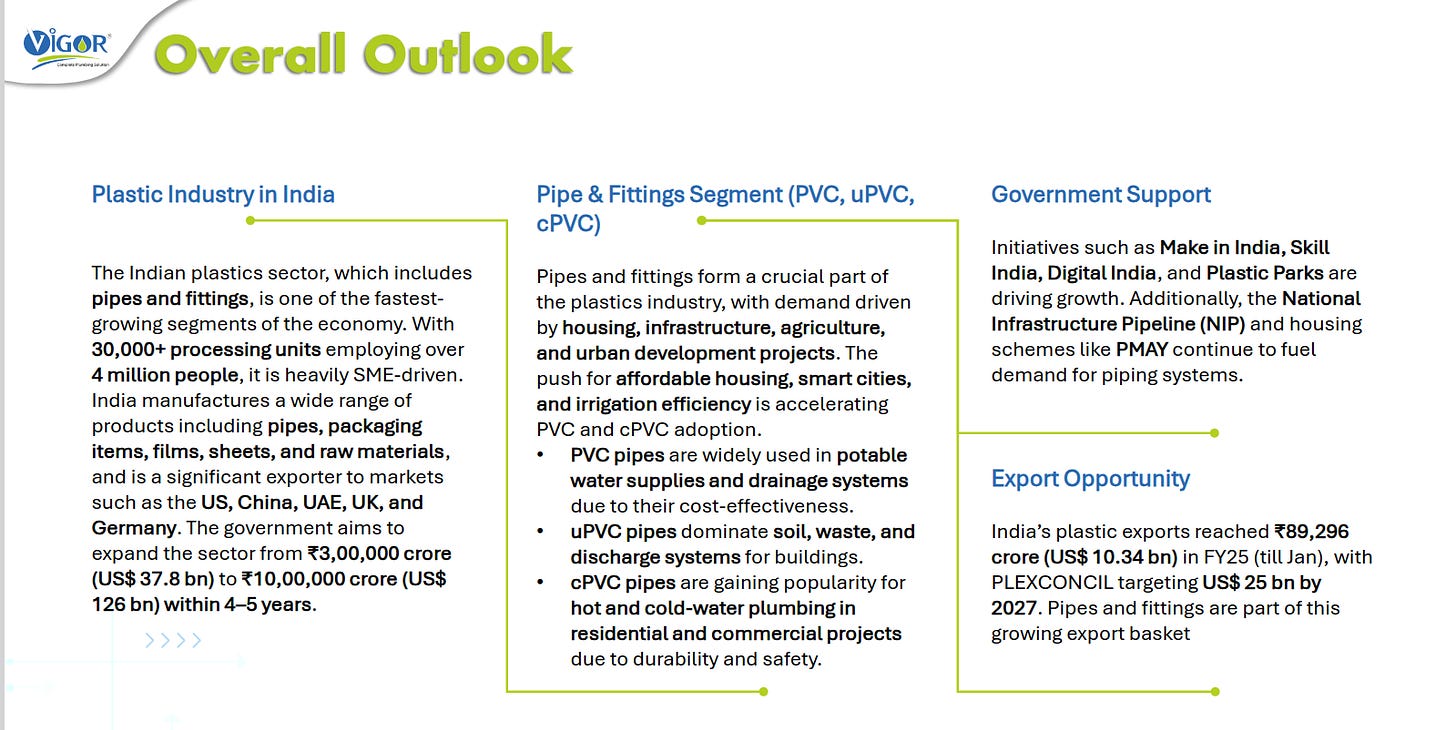

India’s plastics and pipes industry is among the fastest-growing manufacturing segments, driven by housing, infrastructure, agriculture, and urban development. Strong government support through Make in India, PMAY, NIP, and rising export opportunities continues to accelerate adoption of PVC, uPVC, and CPVC piping systems.

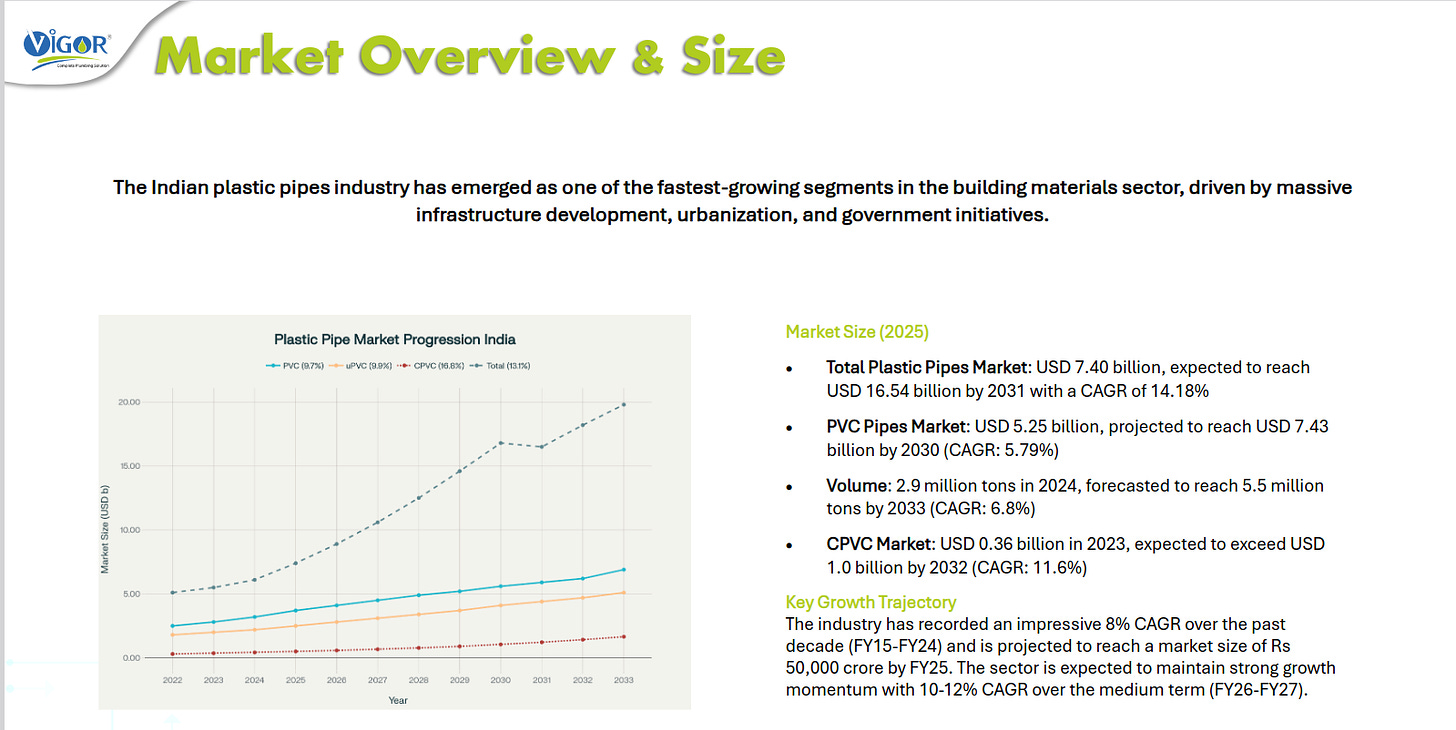

The Indian plastic pipes market stood at about USD 7.4 billion in 2025 and is projected to more than double by 2031, led by infrastructure expansion and urbanization. PVC remains the dominant segment, while CPVC is growing faster due to rising demand for safe hot- and cold-water plumbing in residential and commercial projects.

Fineotex Chemical Ltd. | Small Cap | Chemicals

Fineotex Chemical Ltd is engaged in the manufacturing of Specialty Chemicals and Enzymes for various industries .The company manufactures and trade in Specialty Chemicals and Enzymes for Textile & Garment Industry, Construction Industry, Leather Industry, Water Treatment Industry, Paint Industry Agrochemicals, Adhesives and others.

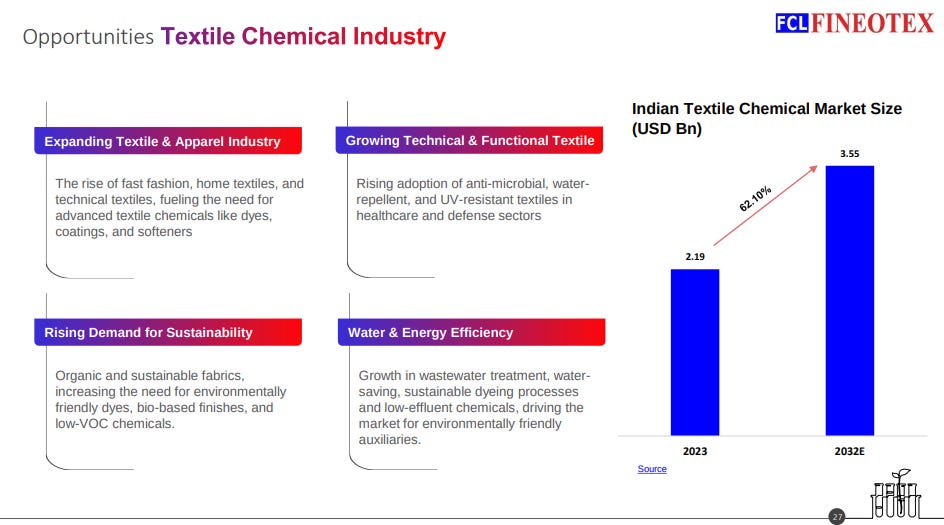

The Indian textile chemical market is set to grow at a strong 62% CAGR, from $2.19 billion in 2023 to $3.55 billion by 2032E. This growth is being driven by four key trends: the expanding textile and apparel industry, which needs advanced chemicals like dyes, coatings, and softeners; the rise of technical and functional textiles with anti-microbial, water-repellent, and UV-resistant properties for healthcare and defense; increasing demand for sustainable fabrics pushing eco-friendly dyes and low-VOC chemicals; and a focus on water and energy efficiency through wastewater treatment, sustainable dyeing, and low-effluent chemicals. These shifts are creating significant opportunities for textile chemical companies like Fineotex.

Polyplex Corporation Ltd. | Small Cap | Chemicals

Polyplex Corporation Limited is a global leader in the manufacturing of polyester films with two plants in India. It offers a wide range of thin and thick PET films with various surface properties for diverse applications. The company also produces BOPP, Blown PP/PE, and CPP films in advanced facilities, along with value-added products through downstream capabilities like Metallizing and Holography.Polyplex Corporation Limited is a global leader in the manufacturing of polyester films with two plants in India. It offers a wide range of thin and thick PET films with various surface properties for diverse applications. The company also produces BOPP, Blown PP/PE, and CPP films in advanced facilities, along with value-added products through downstream capabilities like Metallizing and Holography.

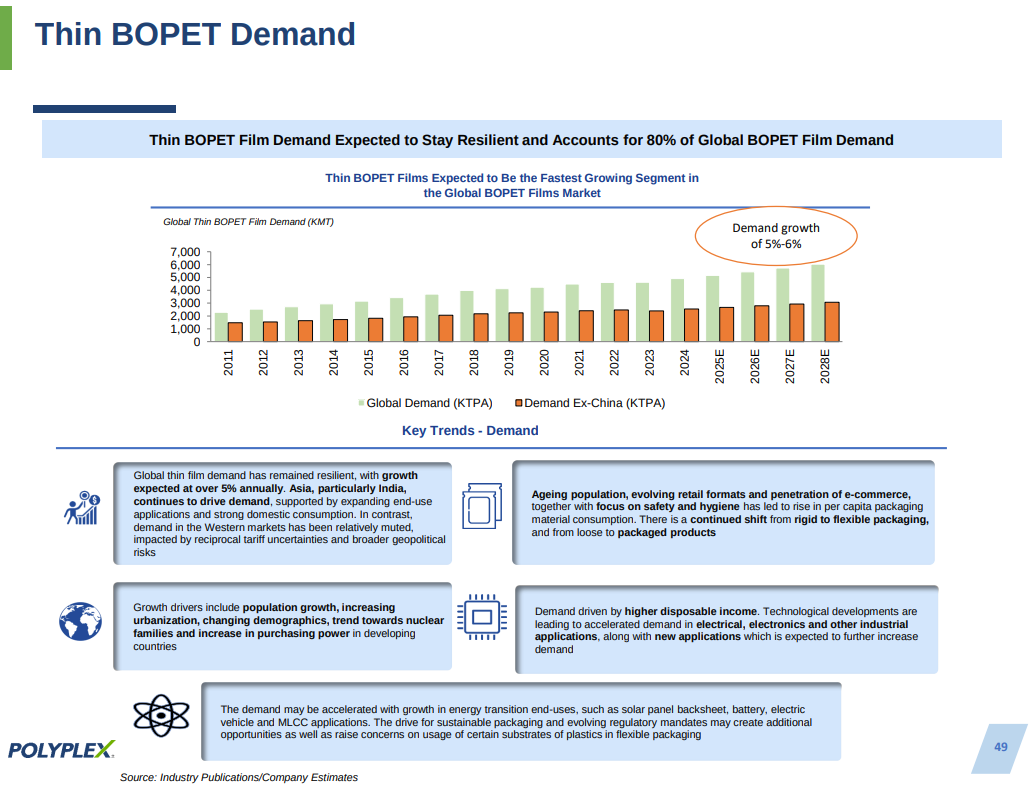

Thin BOPET film demand is expected to remain resilient, accounting for 80% of global BOPET film demand and growing at 5-6% annually. The chart shows global thin BOPET film demand (in kilotons per annum) has been steady, with demand ex-China also showing consistent growth from 2011 to 2028E. Key demand drivers include population growth, urbanization, the shift to nuclear families, and increased purchasing power in developing countries, which are fueling diverse applications and strong domestic consumption. On the packaging front, aging populations, evolving retail formats like e-commerce, and a focus on safety and hygiene are driving a shift from rigid to flexible packaging and from loose to packaged products. Additionally, higher disposable incomes are boosting demand in electrical, electronics, and other industrial applications, while energy transition needs like solar panels and electric vehicles, along with sustainable packaging mandates, are creating new opportunities.

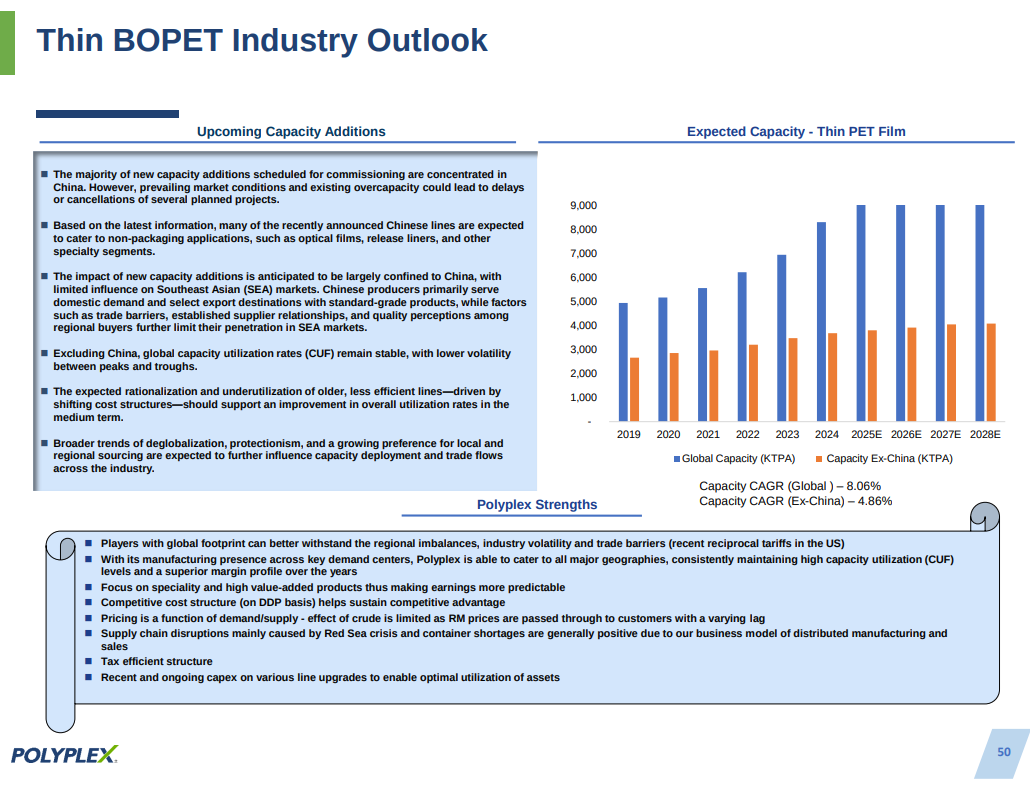

The thin BOPET industry outlook shows global capacity growing at 8.06% CAGR, while capacity ex-China is expected to grow at 4.86% CAGR through 2028E. Most new capacity additions are concentrated in China, but prevailing market conditions and existing overcapacity could lead to delays or cancellations of planned projects—many recently announced Chinese lines are expected to cater to non-packaging applications like specialty films and release liners. The impact of new capacity is largely confined to China, with limited influence on Southeast Asian markets, as Chinese producers primarily serve domestic demand and select export destinations with standard-grade products. Excluding China, global capacity utilization rates remain stable with lower volatility, and the rationalization of older, less efficient lines driven by shifting cost structures should support improved utilization rates in the medium term. Polyplex highlights several strengths: their global footprint helps them withstand regional imbalances and trade barriers, they focus on specialty and high value-added products for more predictable earnings, their competitive cost structure provides pricing advantages, and supply chain disruptions from events like the Red Sea crisis are generally positive for their distributed manufacturing model.

Metals

Krishca Strapping Solutions | Nano Cap | Metals

Krishca Strapping Solutions Limited, a startup manufacturing Steel Straps and Seals, aims to offer total packaging solutions to the steel industry. With commercial production starting in March 2020 at its Chennai plant, the company is dedicated to crafting high-calibre products at a good value. They prioritize consistent quality by employing leading-edge, standardized manufacturing processes to deliver the best quality and service to their customers.

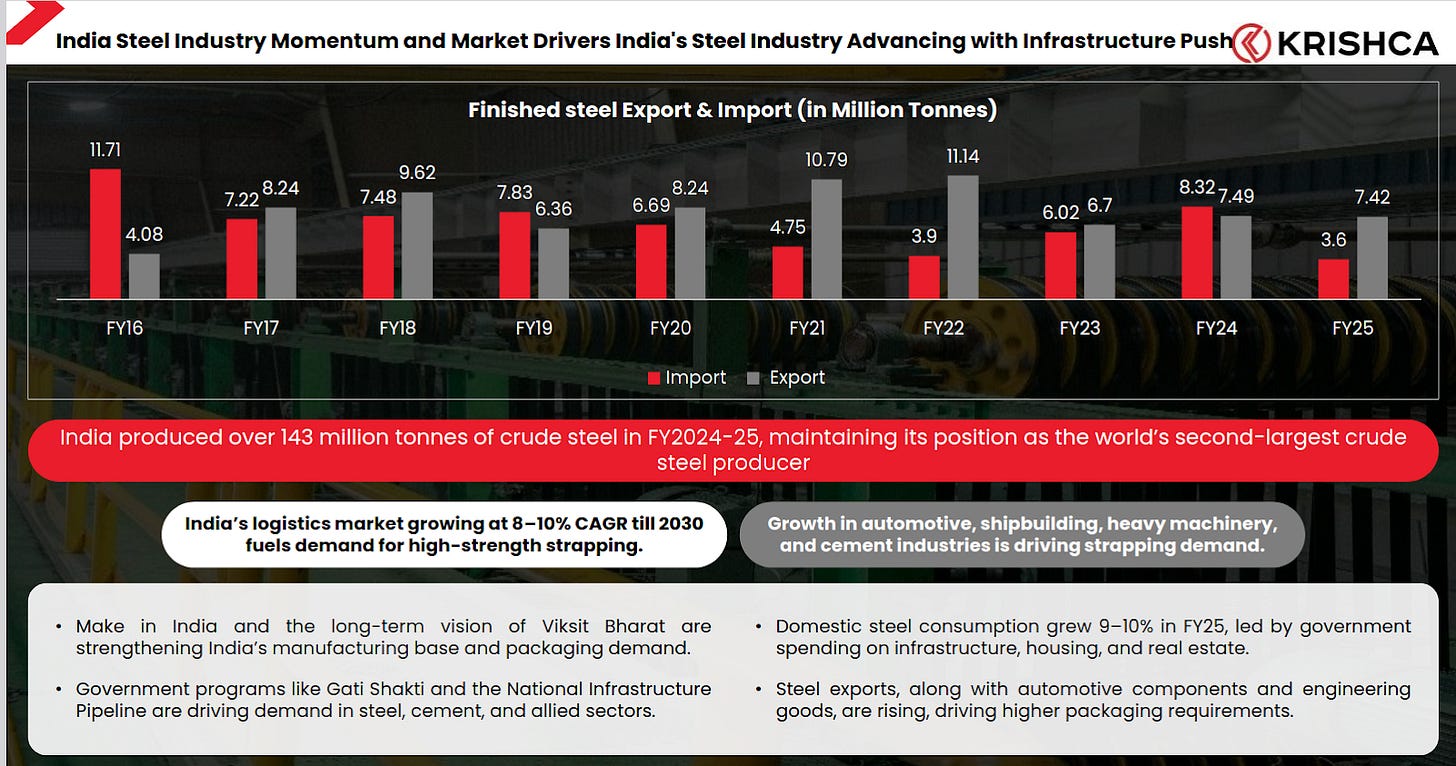

India’s steel industry continues to gain momentum, supported by strong infrastructure spending, rising domestic consumption, and steady export demand. Finished steel imports have moderated while exports remain resilient, with India producing over 143 million tonnes of crude steel in FY25, reinforcing its position as the world’s second-largest producer.

Krishca has built strong credibility across steel, metals, glass, packaging, and industrial manufacturing, with a diversified client base that includes leading global and Indian corporates. Long-standing relationships with industry leaders underline product reliability, scale, and execution capability.

The company offers a comprehensive range of industrial packaging materials and tools, spanning strapping solutions, protective materials, and automation systems. This integrated portfolio enables end-to-end packaging solutions for heavy, high-volume industrial applications.

Krishca is the first Indian company to introduce a lead-free heat-treatment line for steel strapping, backed by over 7 years of operations, 200+ clients, and 30,000 MT annual capacity. Strong financial metrics, a growing order book, and healthy returns highlight operational scale and profitability.

Media & Entertainment

Bodhi Tree Multimedia | Nano Cap | Media & Entertainment

Bodhi Tree Multimedia Limited’s (formerly known as Bodhi Tree Multimedia Private Limited) business model is B2B, wherein the primary business activity includes content production for television, films and digital platforms. It has been in the forefront of creating differentiated and edgy content through its distinct line-up of shows.

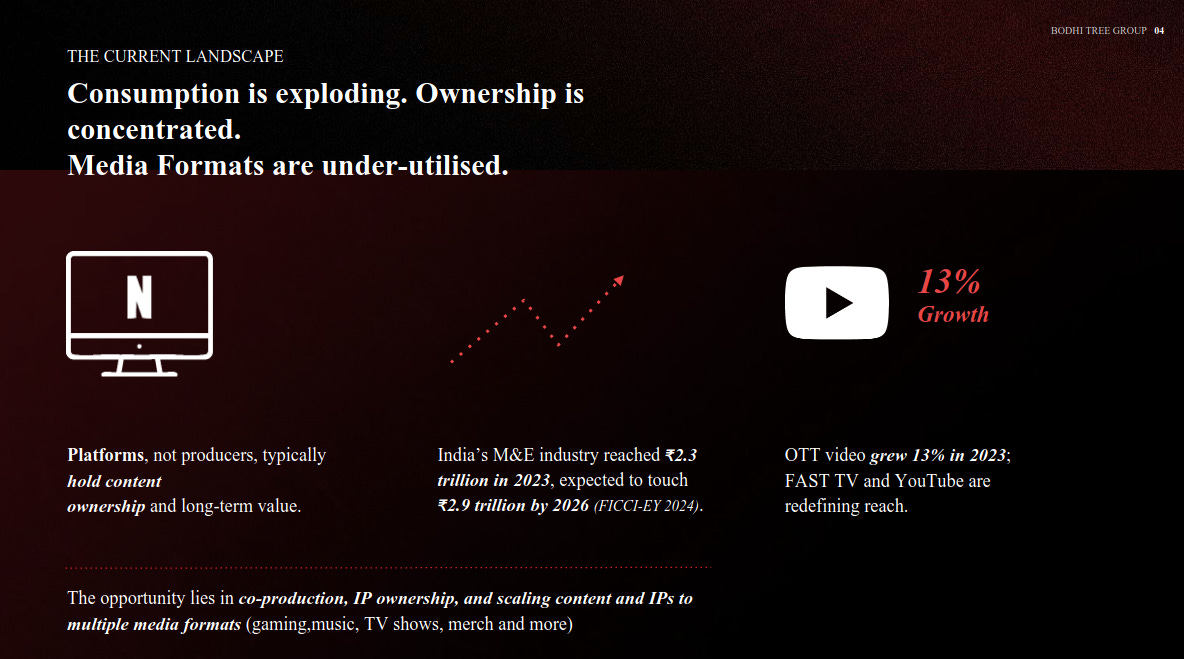

India’s media consumption is surging, but content ownership remains concentrated with platforms rather than creators. The M&E industry hit ~₹2.3 trillion in 2023 and is heading towards ₹2.9 trillion by 2026, with OTT video growing 13% and YouTube/FAST TV redefining reach.

YouTube is India’s largest video platform, capturing ~92% of online video consumption and ~38% of OTT revenue share. With ₹210 billion already invested in the creator economy and users spending 72+ minutes daily, it has become a central growth engine for creators and IP-led businesses.

India’s OTT market is projected to reach $13B by 2030 (23% CAGR), with SVOD subscribers expected to hit 160 million by 2027. Creator-led content and FAST TV now account for over 40% of video consumption, signalling a shift towards IP ownership and scalable franchises.

India generated ~50,000 hours of new content in 2024, yet less than 1% of this IP is owned by its creators. This sharp mismatch highlights a structural opportunity for studios focused on IP ownership, franchising, and long-term value creation.

Auto Ancillary

Carraro India | Small Cap | Auto Ancillary

Carraro India Ltd. is a leading manufacturer of precision gears, transmissions, and drivetrains for automotive and industrial applications. A subsidiary of Carraro Group, it focuses on delivering high-performance solutions for global markets with advanced technology and innovation.

Carraro India has been making critical parts for tractors and construction vehicles for over 25 years—things like axles, transmission systems, and gears. They’re the leading supplier in non-captive agricultural tractor transmissions and hold a 60-65% market share in non-captive construction vehicle transmissions. The company operates two manufacturing facilities, has a 54-member R&D team, and serves marquee OEM customers with around 1,650 employees. Financially, they’ve grown sharply from FY22 to FY25: total income rose 20% to ₹18,234 million, EBITDA more than doubled to ₹1,864 million, and profit after tax nearly quadrupled to ₹881 million. This is the Carraro Group’s first industrial hub outside Italy, highlighting India’s growing importance in their global operations.

Carraro India supplies components to two main sectors: agricultural vehicles and construction vehicles. In agriculture, they serve tractors and harvesters, while in construction, they cater to equipment like backhoe loaders, compact wheel loaders, soil compactors, self-loading concrete mixers, telescopic boom handlers, and forklifts. The revenue split for H1 FY26 shows agricultural tractors and construction vehicles contribute almost equally—44.1% and 44.9% respectively—with the remaining 11% coming from other segments. On the geographic front, 61.9% of their revenue comes from the domestic market, while 38.1% is from exports.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.