Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 17 companies across 11 industries.

Software Services

CMS infosystems

Healthcare

Aarti Drugs

Auto Ancillary

Minda Corporation

Belrise Industries

Jinkushal Industries Ltd.

Agriculture

Worth Peripherals

Textiles

Garware Technical Fibres

CPS Shapers

Consumer Durables

PG Electroplast

Engineering & Capital Goods

Skipper Ltd

Krishna Defence and Allied Industries

KSB

KEI Industries

Chemicals

Neogen Chemicals

Energy

Indian Oil Corporation

Financial Services

Nuvama Wealth

Metals

National Aluminium

Software Services

CMS infosystems | Small Cap | Software Services

CMS Infosystems provides cash logistics, ATM management, and remote monitoring solutions for banks, financial institutions, and organized retail. They handle services like managing cash in transit, ATM cash replenishment, retail cash management, and end-to-end asset and technology management, enabling financial inclusion and seamless payments across India.

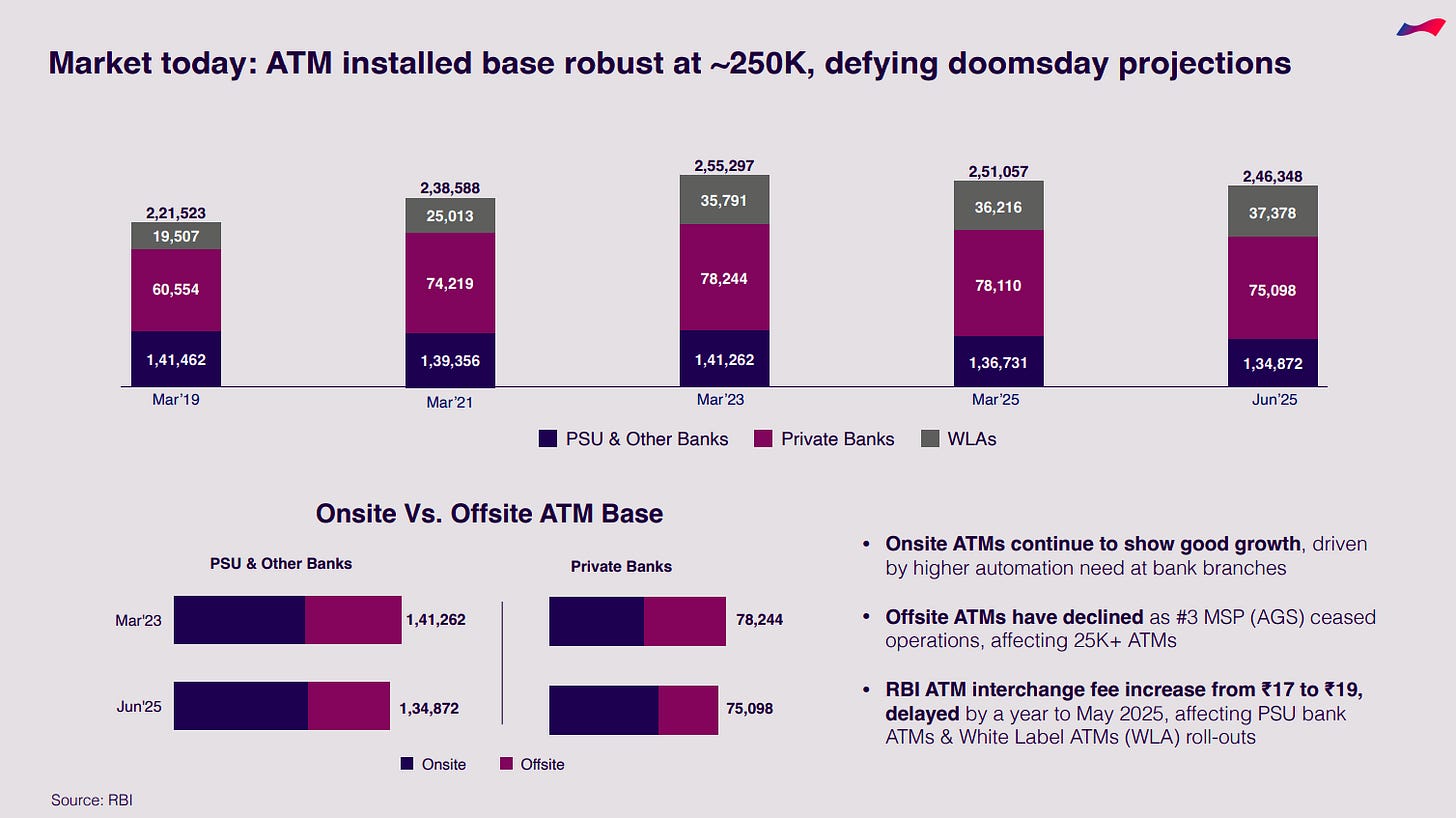

India’s ATM base remains strong at around 2.5 lakh units, defying expectations of decline. PSU and private banks hold the majority share, with white-label ATMs (WLAs) at ~37K as of June 2025. Onsite ATMs continue to expand due to branch automation, while offsite ATMs have dipped after a major service provider’s exit. The RBI’s delayed interchange fee hike to ₹19 is expected to support further rollout momentum by FY26.

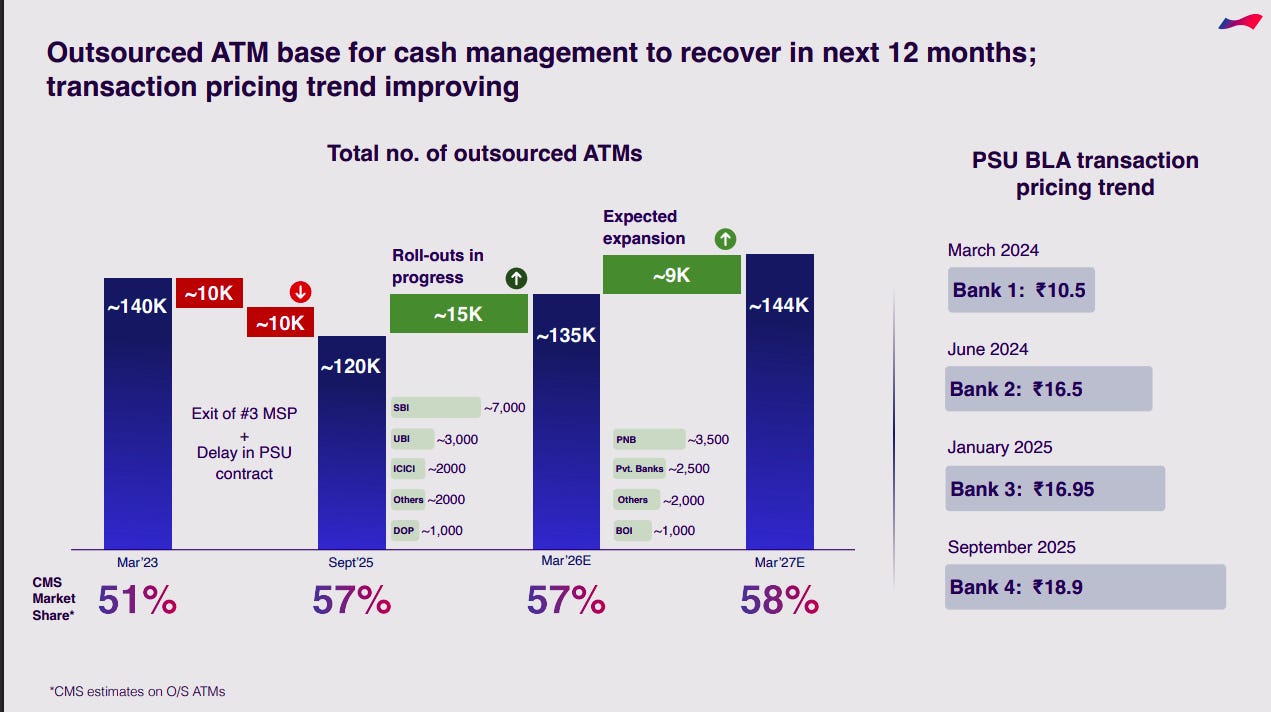

After a temporary decline caused by the exit of a major service provider and PSU contract delays, outsourced ATMs are projected to rebound from 1.2 lakh in Sept 2025 to 1.44 lakh by FY27. Rollouts from SBI, UBI, and ICICI drive near-term recovery, while PSU transaction pricing continues to rise—from ₹10.5 in March 2024 to ₹18.9 by Sept 2025.

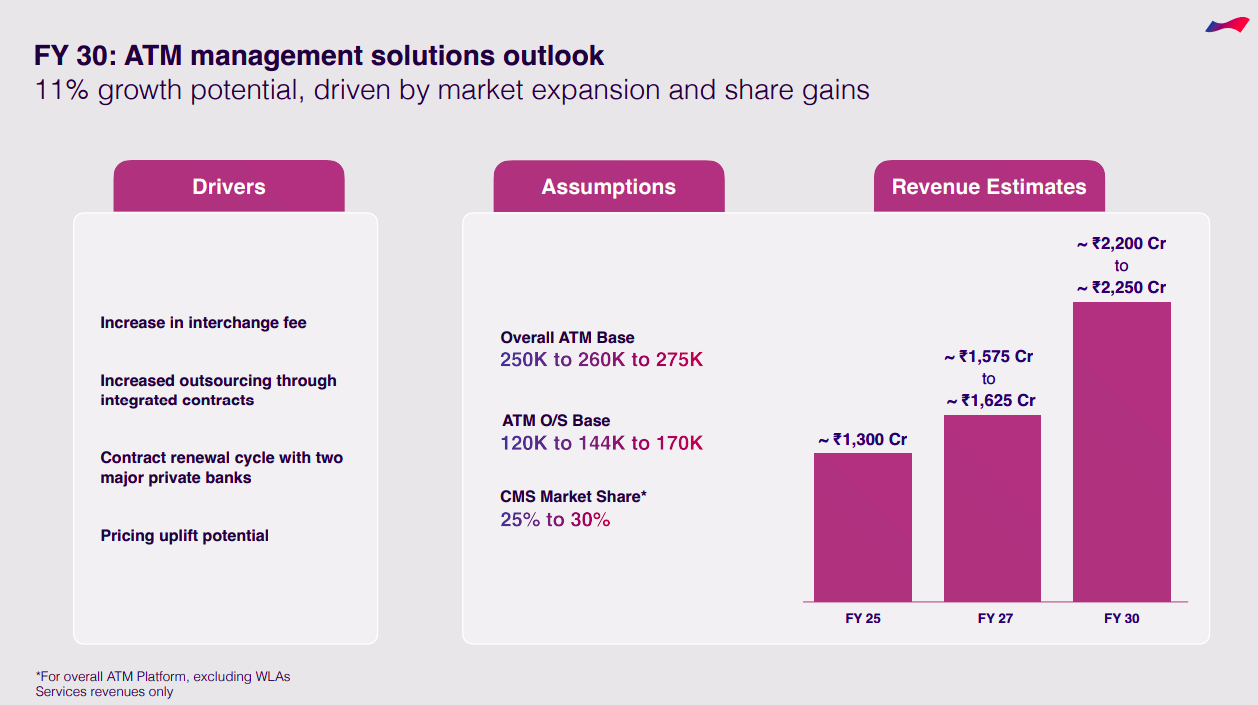

The ATM management business has an 11% growth runway, backed by higher interchange fees, contract renewals, and integrated outsourcing. With the total ATM base expected to rise to 2.75 lakh and outsourced ATMs to 1.7 lakh by FY30, revenues could grow from ₹1,300 crore in FY25 to ₹2,200–2,250 crore by FY30, with CMS targeting a 30% market share.

Retail and currency logistics also have an 11% CAGR potential, led by expanding branch networks and e-commerce growth beyond Tier-II cities. With retail touchpoints projected to increase from 2 lakh to 3 lakh and CMS’s market share at 43%, revenue is expected to rise from ₹640 crore in FY25 to ₹1,050–1,100 crore by FY30.

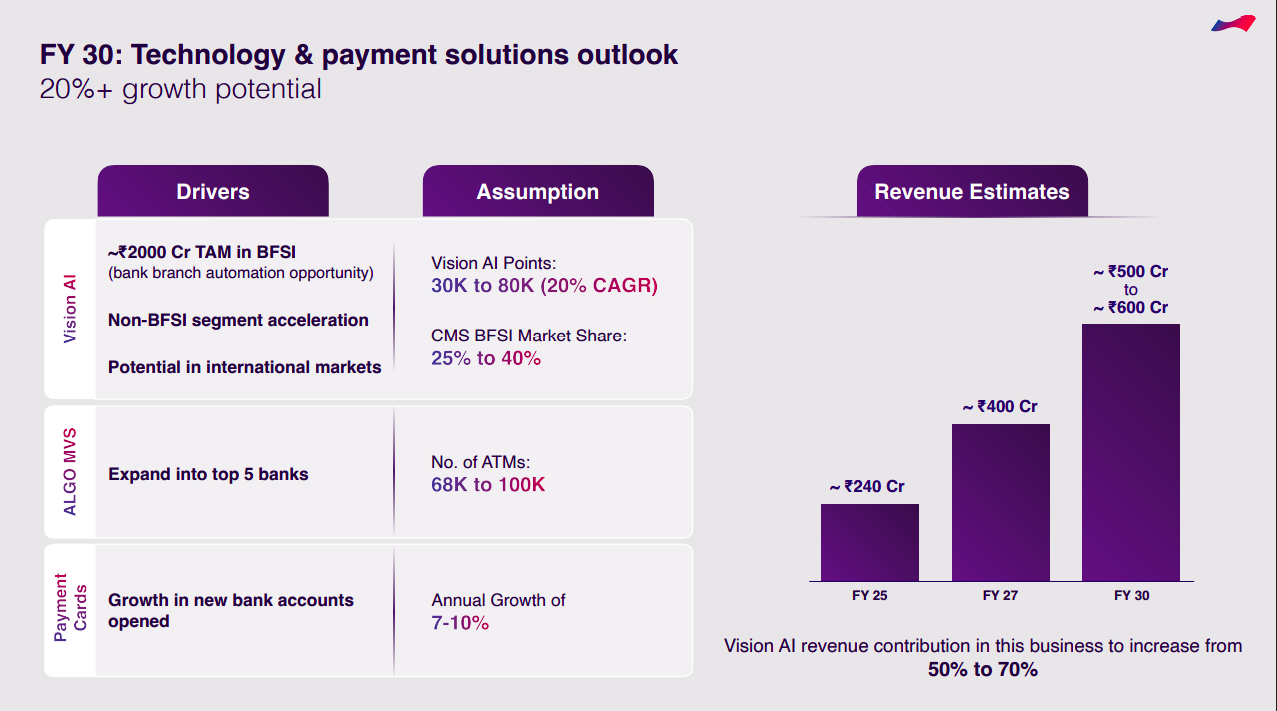

This segment is expected to grow over 20% annually, driven by Vision AI and ALGO MVS platforms. Vision AI points could expand from 30K to 80K, with BFSI market share rising to 40%. Revenue is estimated to grow from ₹240 crore in FY25 to ₹500–600 crore by FY30, with Vision AI contributing 70% of the total.

CMS is eyeing a ₹8,000 crore+ total addressable market across ATMs, branches, NBFCs, gold loans, retail, and infrastructure. The largest segment is infrastructure (₹5,000 crore TAM), followed by ATMs and branches (₹2,000 crore combined). Key clients include SBI, HDFC, ICICI, Hero, Adani, and BigBasket.

Retail remains underpenetrated, with only 2–6 lakh organized touchpoints out of 30–40 lakh total. Semi-urban and rural regions form 51% of the base, with strong cash circulation (₹4.2 million per point). Retail currency management points are growing at 15% CAGR, expected to reach 2 lakh by FY25.

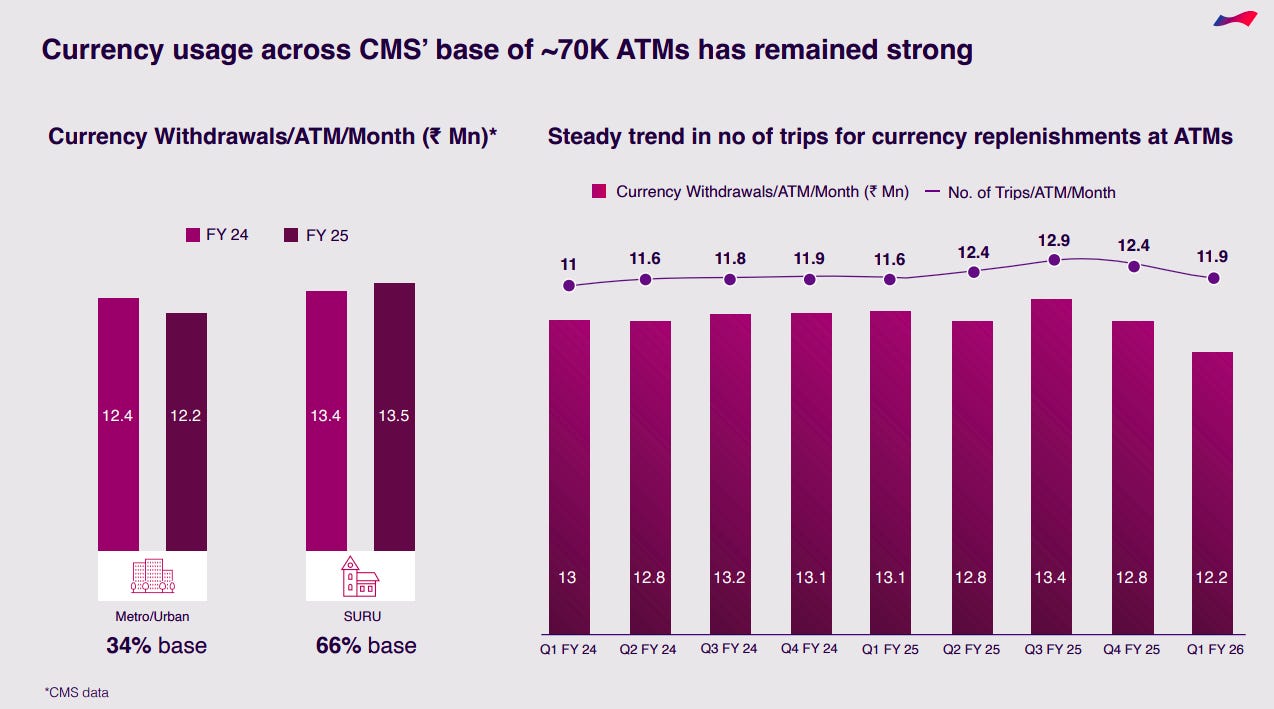

Cash withdrawals per ATM have stayed resilient, averaging ₹13.5 million per month in FY25, led by semi-urban and rural markets (66% base). The number of cash replenishment trips has remained steady at around 12 per month, highlighting stable ATM usage and strong currency circulation trends.

Healthcare

Aarti Drugs | Small Cap | Healthcare

Aarti Drugs manufactures and sells Active Pharmaceutical Ingredients (APIs), Pharma Intermediates, and Specialty Chemicals, and also produces Formulations through its subsidiary, Pinnacle Life Science.

Aarti Drugs is among the world’s largest producers of several key APIs, including Nimesulide, Ketoconazole, Tinidazole, and Metronidazole Benzoate. With 14 manufacturing facilities, over 80 finished products, and a monthly capacity of 5,088 MT, the company exports to 100+ countries, contributing ~35% of its revenue from exports.

The company operates across APIs, formulations, and specialty chemicals, supported by strong backward integration. It manufactures 50+ API molecules across major therapeutic areas, runs WHO-GMP and USFDA-approved formulation plants, and produces specialty chemicals like benzene and chloro-sulphonic derivatives, ensuring a vertically integrated and diversified business model.

Auto Ancillary

Minda Corporation | Small Cap | Auto Ancillary

Minda Corporation is a leading Indian manufacturer of advanced automotive components, supplying products like Mechatronics, Information and Connected Systems, and Plastics and Interiors for various vehicle segments, including 2- and 3-wheelers, passenger vehicles, and off-road vehicles.

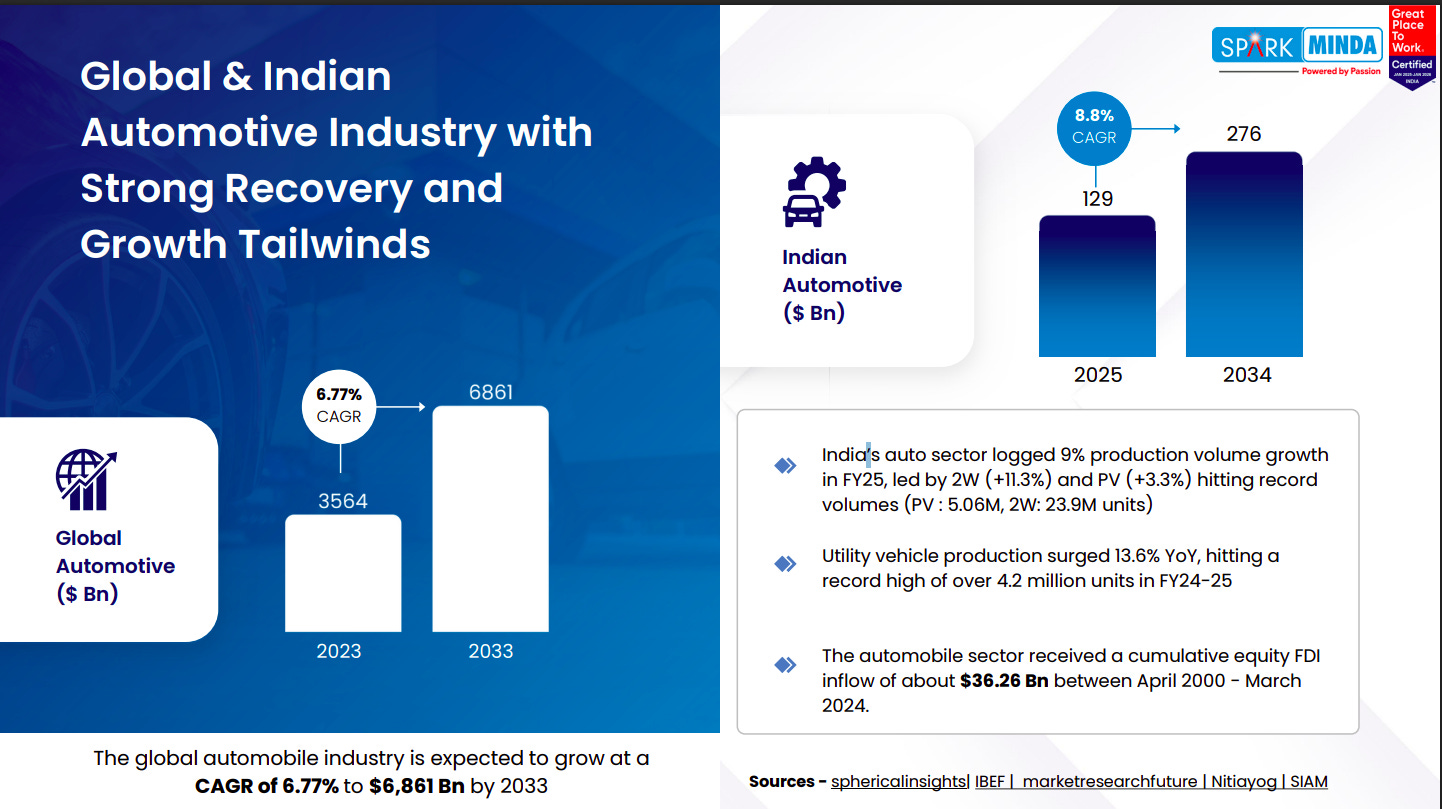

The global auto industry is projected to grow at a 6.77% CAGR to $6.86 trillion by 2033, while India’s market is set to double from $129 billion in 2025 to $276 billion by 2034. India’s auto production rose 9% in FY25, led by two-wheelers and passenger vehicles, supported by $36 billion in cumulative FDI inflows.

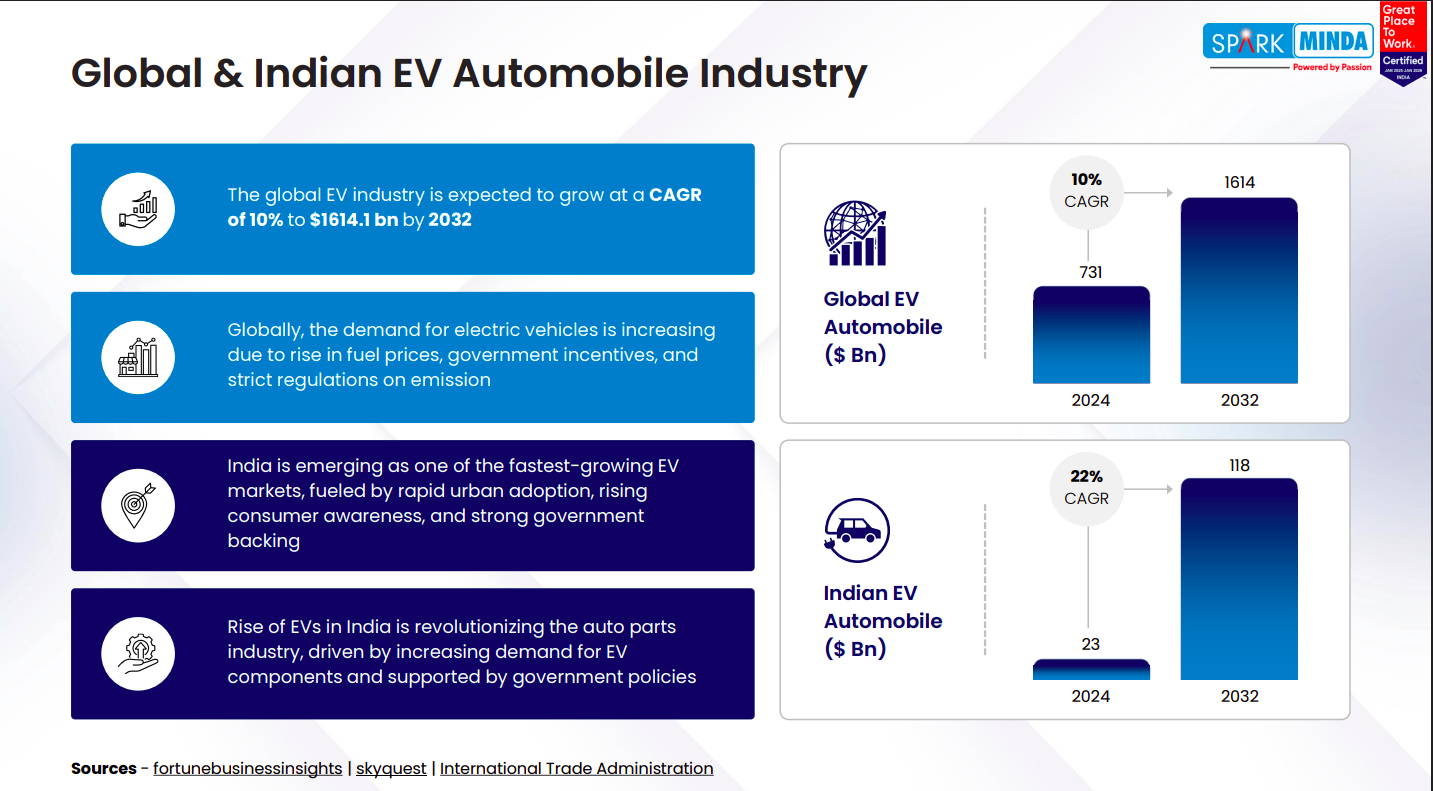

The global EV market is expected to reach $1.6 trillion by 2032, growing at 10% CAGR, driven by higher fuel costs, emission norms, and incentives. India’s EV industry, one of the fastest-growing globally, is projected to expand from $23 billion in 2024 to $118 billion by 2032, fueled by policy support and rising adoption.

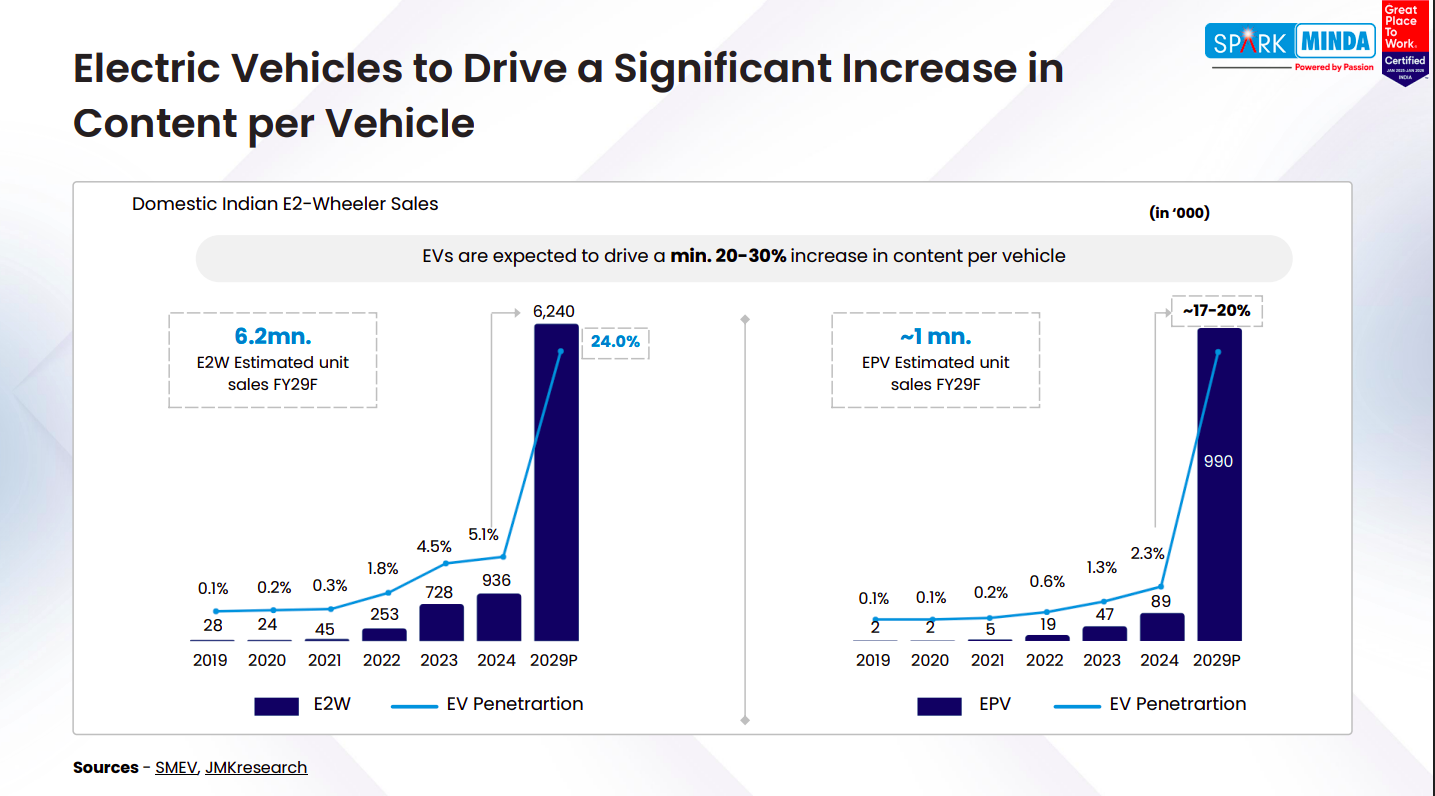

India’s EV adoption is expected to sharply increase by FY29, with 6.2 million electric two-wheelers and 1 million electric passenger vehicles projected to be sold. EV penetration could reach 24% for 2Ws and 17–20% for 4Ws, driving a 20–30% rise in content per vehicle for auto component makers.

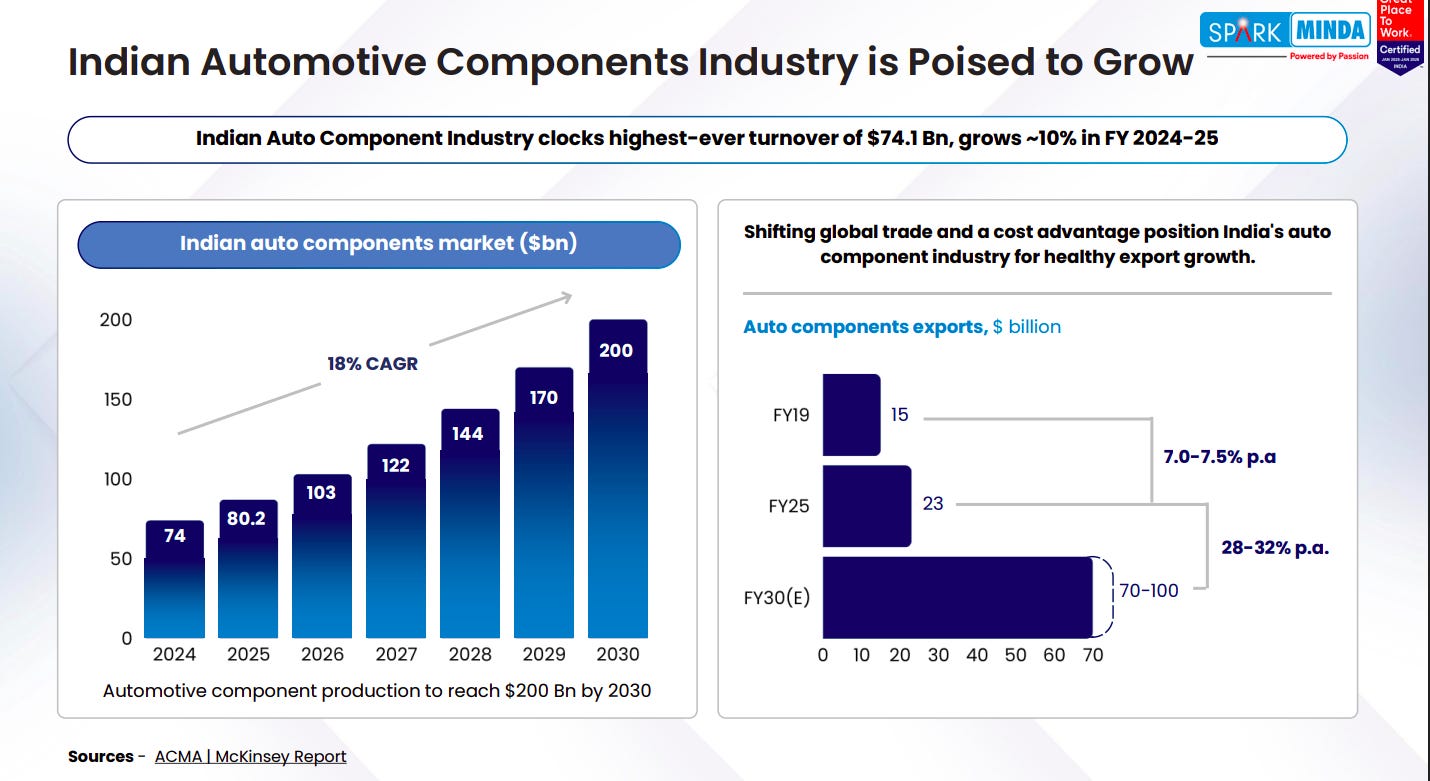

India’s auto component sector, currently valued at $74 billion, is poised to grow at 18% CAGR to $200 billion by 2030. Exports are projected to jump from $23 billion in FY25 to $70–100 billion by FY30, driven by global supply chain shifts and India’s cost competitiveness.

Growth in India’s auto industry is supported by a rising middle class (500M+ by 2030), policy incentives for EVs and local manufacturing, and a global shift toward electrification. Government initiatives like PLI schemes and e-bus deployment, alongside $500B+ in global EV investments, are accelerating the transition to cleaner mobility.

Belrise Industries | Small Cap | Auto Ancillary

Belrise Industries is an Indian company that manufactures a wide range of automotive components, including metal chassis systems, polymer parts, and suspension systems, for two-wheelers, three-wheelers, and four-wheelers, catering to both ICE and electric vehicle (EV) segments. The company also engages in the overseas trading of commodities like metals and lithium-ion batteries and has recently expanded into the defence and aerospace sectors.

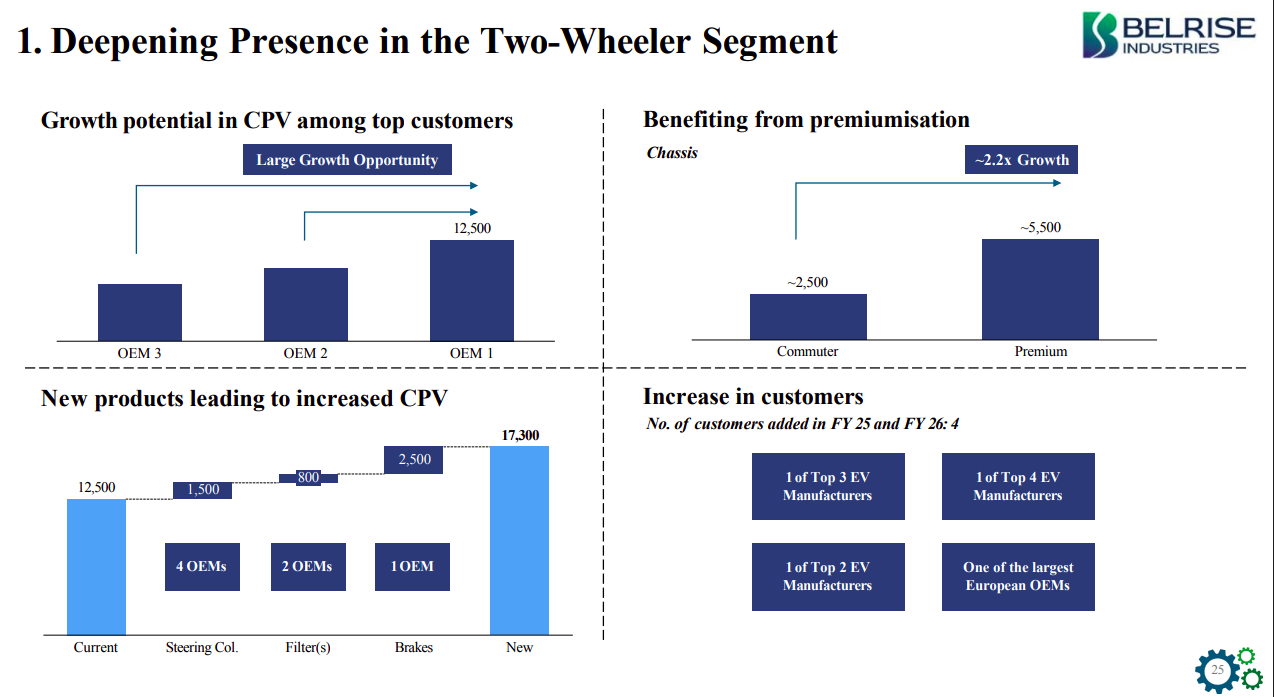

Belrise is strengthening its presence in the 2W market by increasing content per vehicle (CPV) among top OEMs. The company’s CPV with leading customers is projected to grow from 12,500 to 17,300 through new product additions like steering columns, filters, and brakes. Premiumisation is driving ~2.2x CPV growth in the chassis category as the share of premium bikes rises. Belrise also added four new customers in FY25–26, including top global EV and European OEMs.

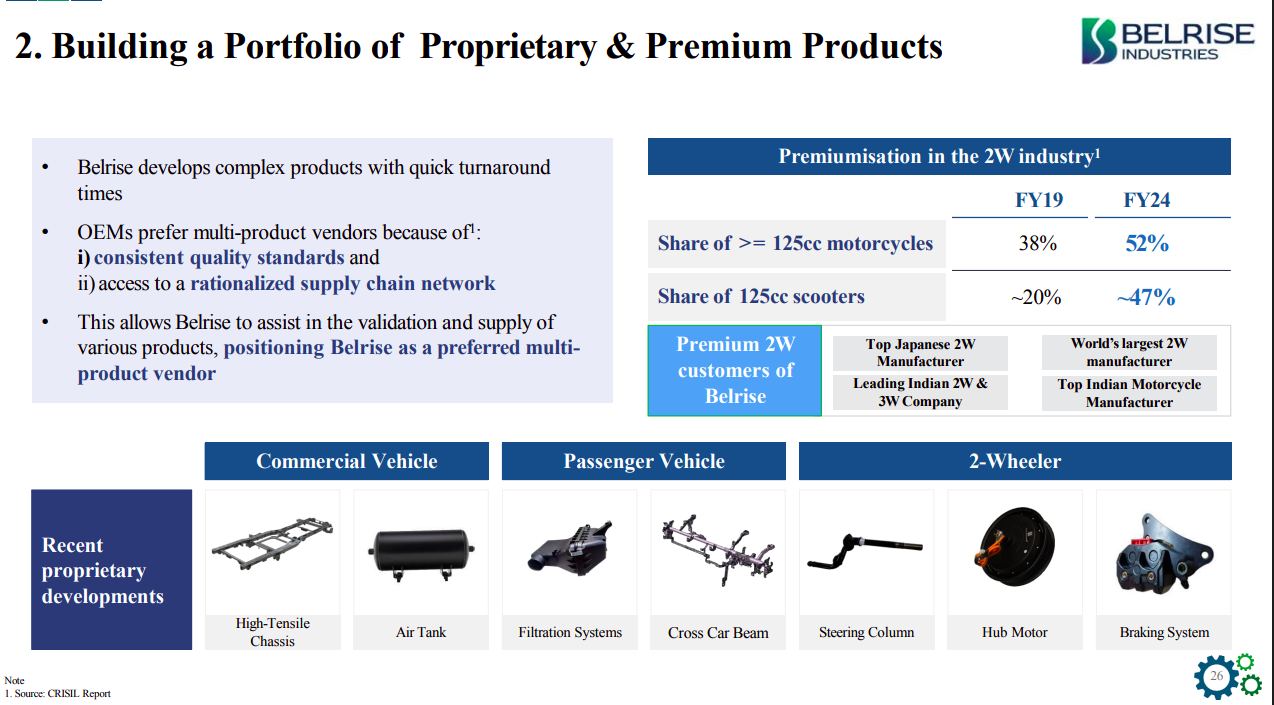

Belrise focuses on complex, quick-turnaround products and is preferred by OEMs for its quality consistency and integrated supply chain. The company benefits from the premiumisation trend—125cc+ motorcycles now form 52% of sales (vs. 38% in FY19). Key 2W customers include top global and Indian manufacturers. Recent proprietary product developments span commercial vehicles (high-tensile chassis, air tanks), passenger vehicles (filtration systems, cross car beams), and 2Ws (hub motors, braking systems).

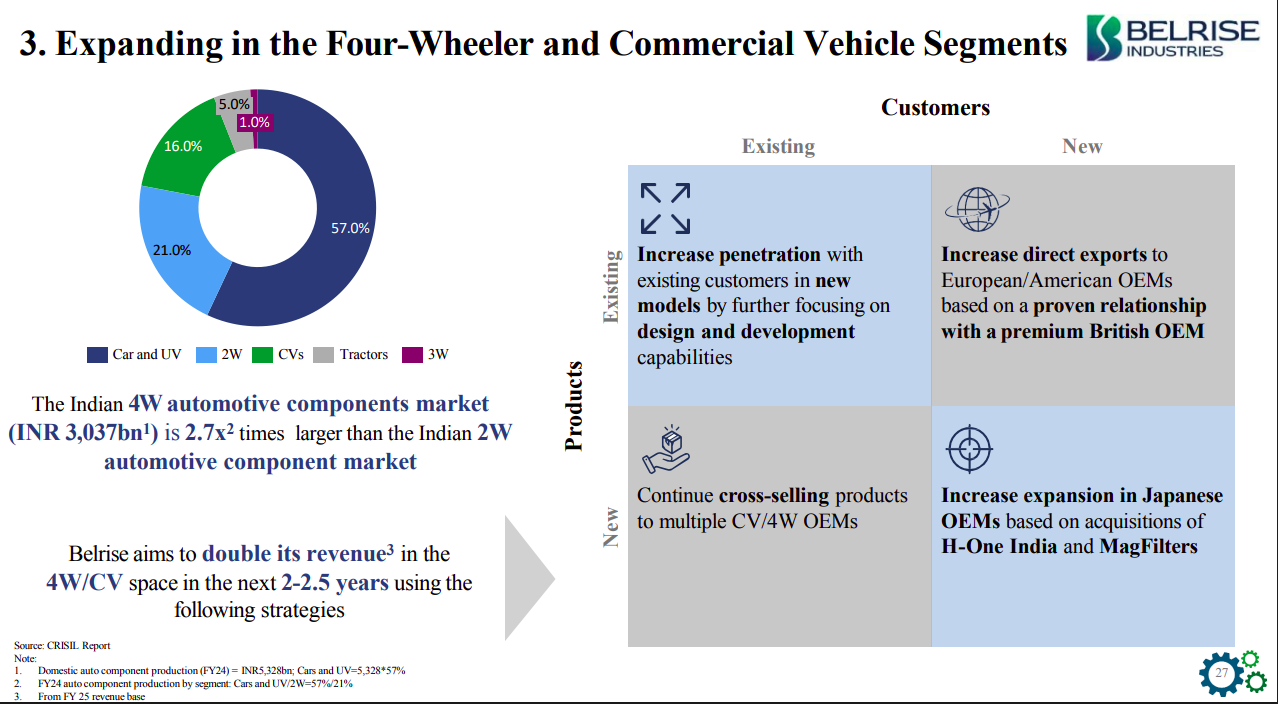

The Indian 4W components market is ₹3,037 billion—2.7x the 2W segment. Belrise plans to double its 4W/CV revenue in 2–2.5 years by expanding within existing OEMs, cross-selling new products, and exporting to European/American OEMs. It also aims to grow in Japan via H-One India and MagFilters acquisitions, leveraging its strong British OEM relationship to drive new customer wins.

Belrise is moving up the value chain—from component supplier to system supplier—by handling larger assemblies and integrating multiple parts. It is the largest sheet metal and fabricated parts supplier to a top Indian 2W & 3W maker and recently began supplying complete chassis systems for a Japanese OEM’s 100cc model. This shift strengthens customer stickiness and positions Belrise as a long-term partner for complex vehicle sub-assemblies.

Jinkushal Industries Ltd. | Nano Cap | Auto Ancillary

Jinkushal Industries Limited is an export trading company supplying construction machinery globally. It is the largest non-OEM construction machine exporter from India, with a 6.9% market share.

Rising new machinery prices and supply chain constraints are pushing demand for refurbished and used equipment due to their lower capital costs and faster availability. The shift aligns with circular economy goals—reducing waste, extending machine life, and cutting carbon emissions. Growth in equipment leasing (CAGR >10%) is boosting circulation of quality used machines, while online marketplaces are improving liquidity and transparency in used equipment transactions.

Backhoe loaders, used for excavation and loading, form a core segment of the global construction equipment market. The market grew from $3.61 billion in 2019 to $4.44 billion in 2023 (5.3% CAGR). Urbanization, infrastructure development, and the multi-functional utility of backhoes continue to drive demand, especially in developing economies. With rising infrastructure investment, Jinkushal Industries’ HexL backhoe line (launched 2024) is well-positioned for strong volume growth.

The global used construction equipment market is expanding from $132.4 billion in 2024 to $177.2 billion by 2029, growing at ~6% CAGR. Infrastructure buildouts in emerging markets and 20–50% cost savings versus new machines are key growth catalysts. Faster delivery timelines, higher machine availability, and the growth of equipment leasing and digital sales platforms are further accelerating adoption, making used machinery a mainstream choice in construction and industrial operations.

Agriculture

Worth Peripherals | Nano Cap | Agriculture

Worth Peripherals manufactures and sells corrugated boxes and their accessories for various industries, including FMCG, textiles, electronics, and retail. They produce different types of corrugated products, such as regular slotted containers (RSCs), die-cut boxes, and multi-color boxes.

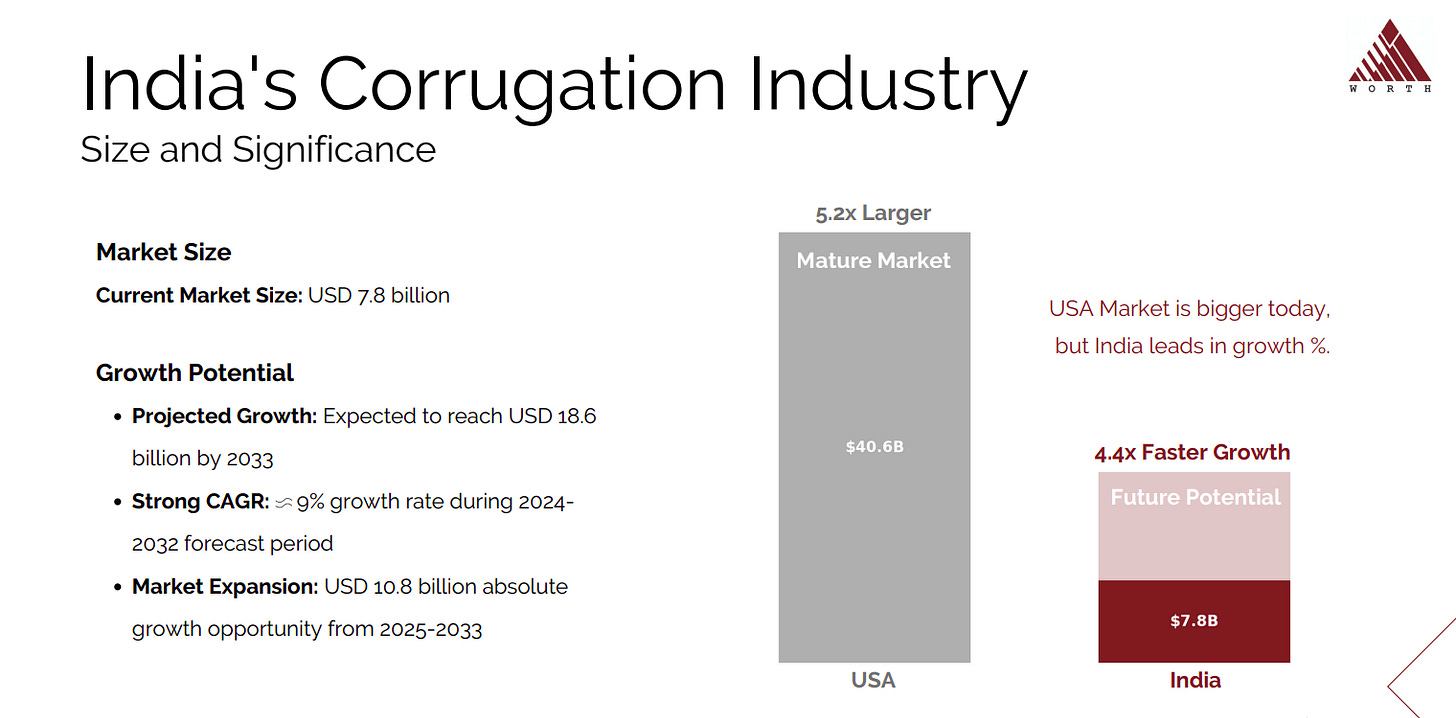

India’s corrugated packaging industry is valued at USD 7.8 billion and is projected to grow at a robust 9% CAGR, reaching USD 18.6 billion by 2033. Though the U.S. market remains larger at USD 40.6 billion, India’s market is expanding 4.4x faster, creating a USD 10.8 billion growth opportunity over the next decade.

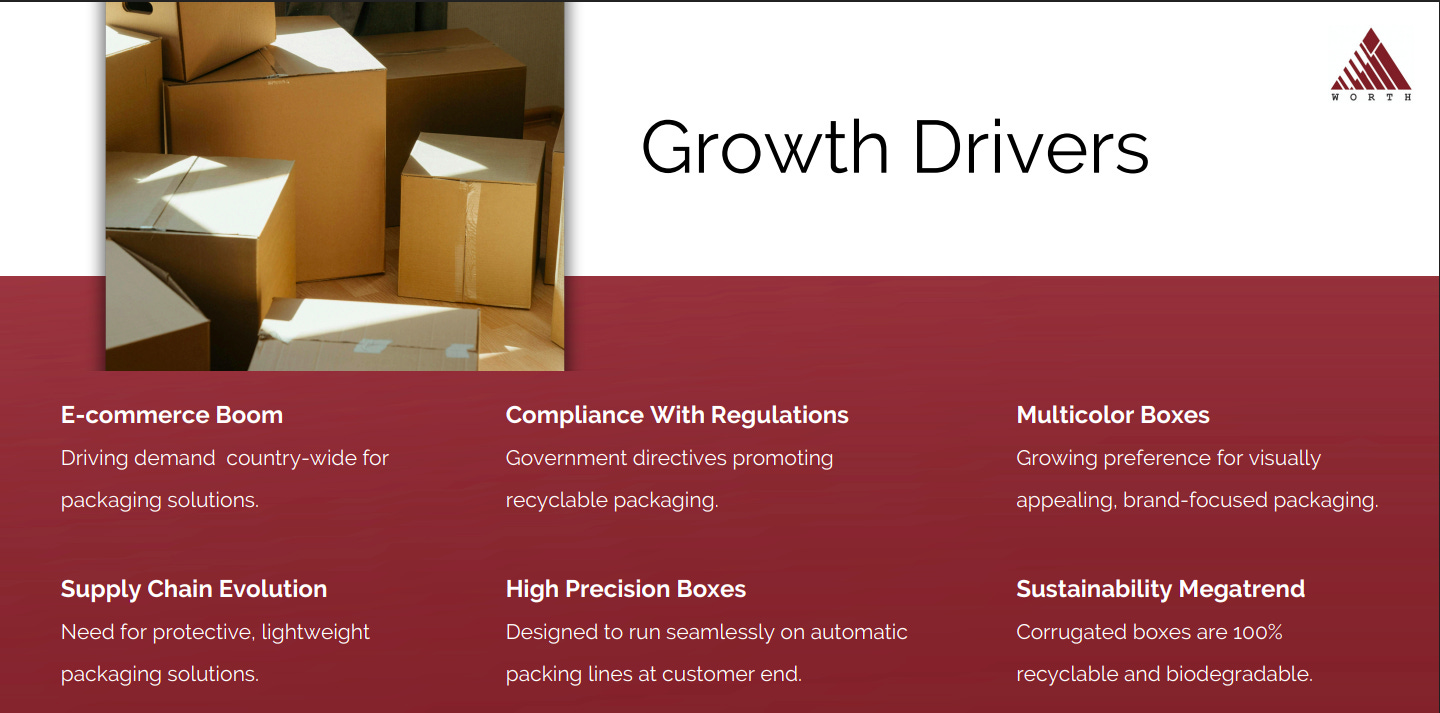

Key demand drivers include India’s booming e-commerce sector, evolving supply chains needing lightweight packaging, and government regulations promoting recyclable materials. Additional momentum comes from rising demand for multicolor, high-precision boxes and a strong sustainability push toward 100% recyclable corrugated packaging.

The company caters to a wide range of sectors such as FMCG, food and beverages, e-commerce, agriculture, alco-beverages, personal care, pharmaceuticals, and healthcare — highlighting the broad industrial dependence on corrugated packaging solutions.

Textiles

Garware Technical Fibres | Small Cap | Textiles

Garware Technical Fibres is a global manufacturer and supplier of technical textiles, specializing in high-performance products like aquaculture cage nets, fishing nets, sports nets, safety nets, agricultural nets, coated fabrics, synthetic ropes, and geosynthetics.

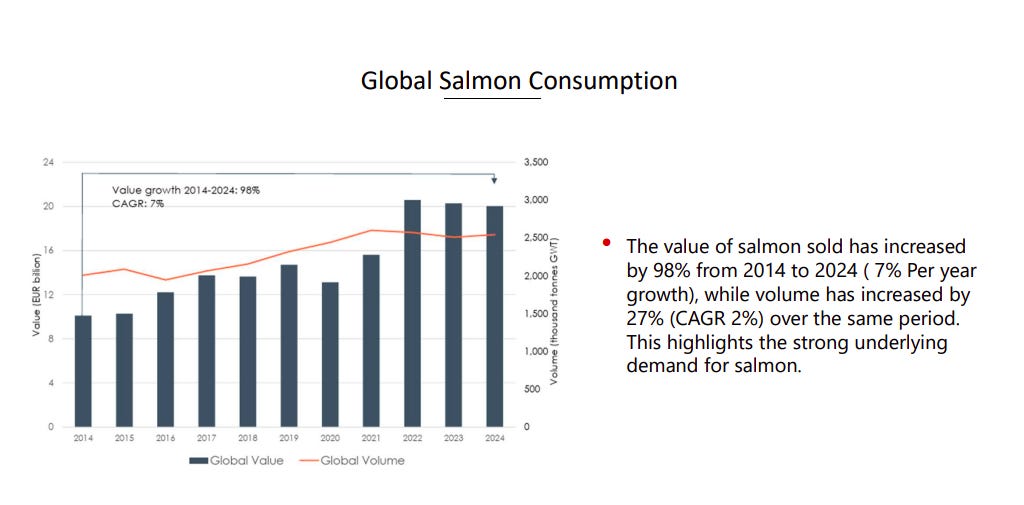

Global salmon sales have surged 98% in value from 2014 to 2024 (7% CAGR), while volumes grew 27% (2% CAGR), underscoring strong demand despite slower volume expansion. This reflects higher prices and a growing consumer preference for salmon globally.

Farmed salmon now dominates global supply, reaching 2.8 million tonnes (GWT) in 2024, while wild salmon catch remains limited between 450,000–1,000,000 tonnes. Atlantic salmon forms the bulk of farmed production, highlighting aquaculture’s critical role in meeting demand.

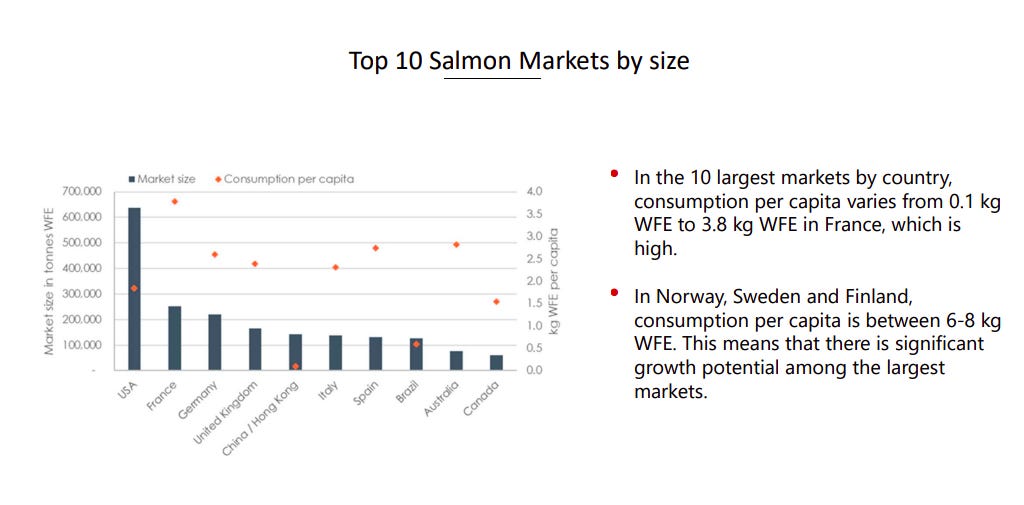

The U.S. is the largest salmon market, followed by France, Germany, and the U.K. Per capita consumption varies widely—from 0.1 kg in some regions to 3.8 kg in France. Nordic countries such as Norway and Sweden show much higher consumption (6–8 kg), signaling untapped potential in larger markets.

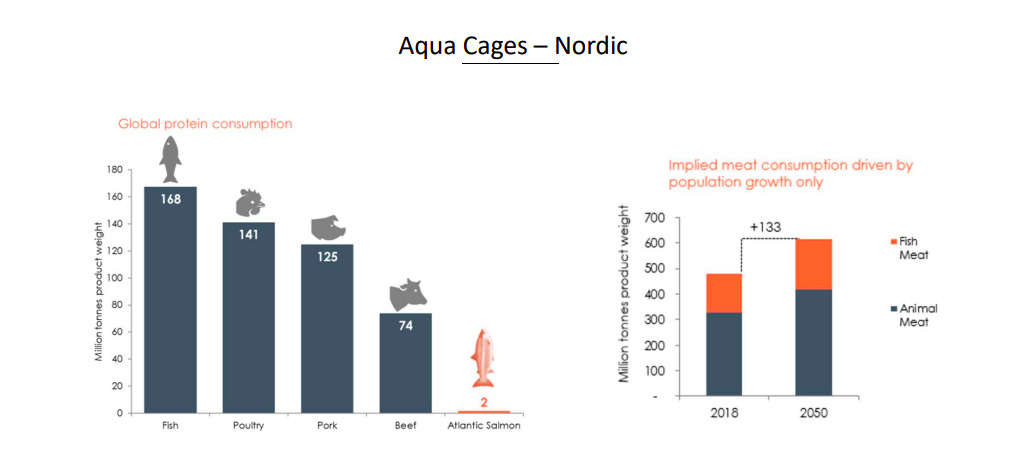

Fish remains the top source of global protein at 168 million tonnes, ahead of poultry and pork. With population growth alone, meat consumption is expected to rise by 133 million tonnes by 2050, solidifying fish’s role in meeting future protein needs.

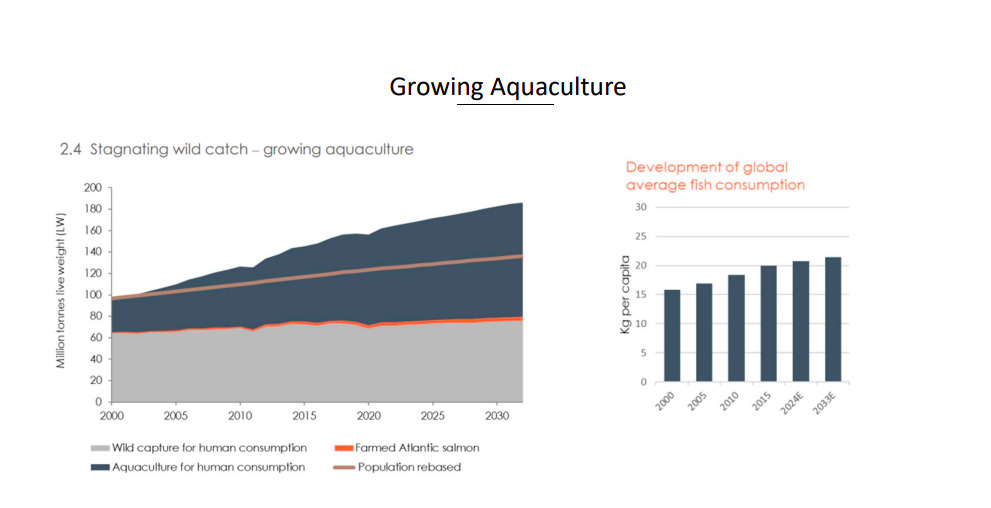

While wild fish catch has plateaued, aquaculture continues to expand, especially in farmed salmon. Global fish consumption per capita has climbed steadily, expected to exceed 25 kg by 2030, reflecting aquaculture’s growing share in the global food system.

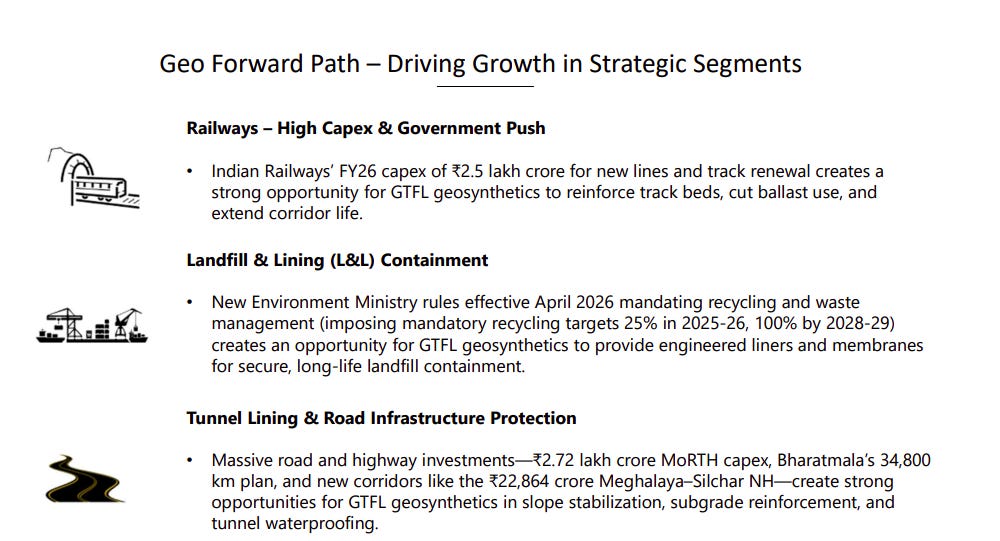

GTFL is poised to benefit from major infrastructure initiatives—₹2.5 lakh crore in railway capex for track renewals, new landfill containment regulations from FY26 mandating recycling, and ₹2.72 lakh crore in highway and tunnel investments under Bharatmala and MoRTH. These create strong tailwinds for geosynthetics in reinforcement, containment, and waterproofing applications.

CPS Shapers | Nano Cap | Textiles

CPS Shapers Limited manufactures a variety of shapewear for both men and women. Their compression garments are made from a blend of cotton, polyester, and spandex, offering a graduated compression effect.

The shapewear market is being propelled by rapid e-commerce growth, which is expected to hit $299 billion by 2029, and an online retail segment expanding 2.5x faster than offline channels. India’s large market potential—set to become the world’s second-largest e-commerce hub by 2034—combined with growing consumer awareness of high-quality products, is fueling demand. With the Indian shapewear market projected to grow 9% annually (2023–2028), entry barriers remain high, favoring experienced brands.

Globally, the innerwear market is projected to reach $140 billion by 2032 (5% CAGR), while India’s innerwear segment will more than double to $19.25 billion by 2033 (6.7% CAGR). The global shapewear market is also set to expand from $2.4 billion in 2022 to $3.8 billion by 2031 (5.5% CAGR). With India’s shapewear industry still in its early stages, growing at 9% annually, organized players like Dermawear are well-positioned to capture significant market share as consumer demand and online penetration accelerate.

Consumer Durables

PG Electroplast | Small Cap | Consumer Durables

PGEL is a diversified Electronic Manufacturing Services and Plastic Injection Molding company catering to leading OEMs in Consumer Electronics and Automotive Industry.

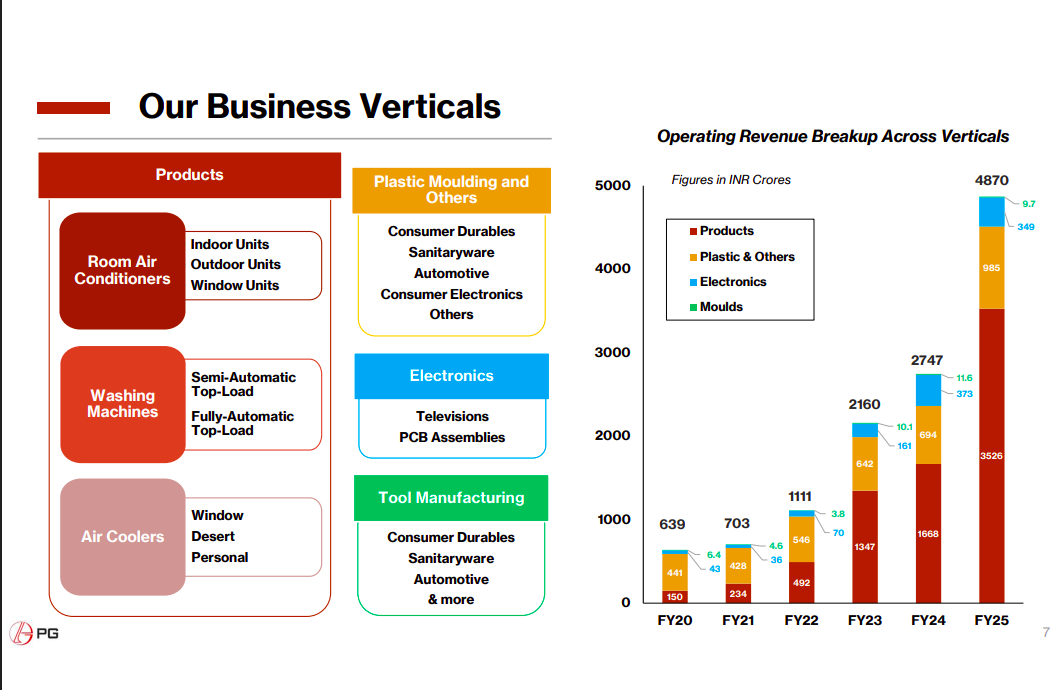

PG Electroplast operates across four key segments—Products (air conditioners, washing machines, air coolers), Plastic Moulding, Electronics (TVs, PCB assemblies), and Tool Manufacturing. Revenue has surged from ₹639 crore in FY20 to ₹4,870 crore in FY25, led by strong growth in product and electronics divisions.

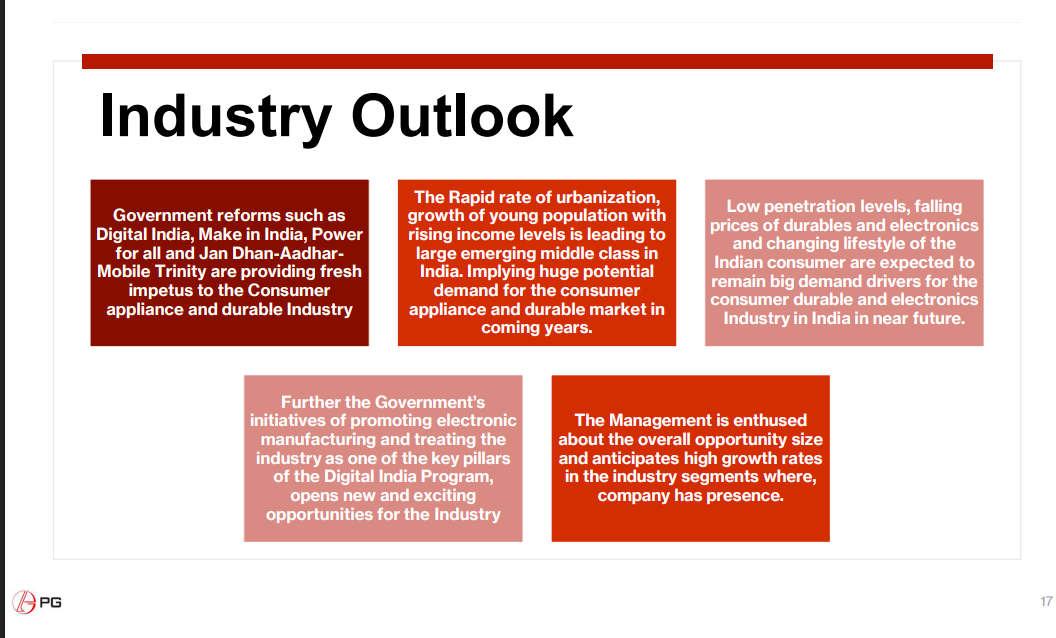

Government initiatives like Make in India, Digital India, and PLI schemes are boosting domestic electronics and appliance manufacturing. Rising urbanization, income growth, and low product penetration levels point to sustained demand in consumer durables and electronics over the coming years.

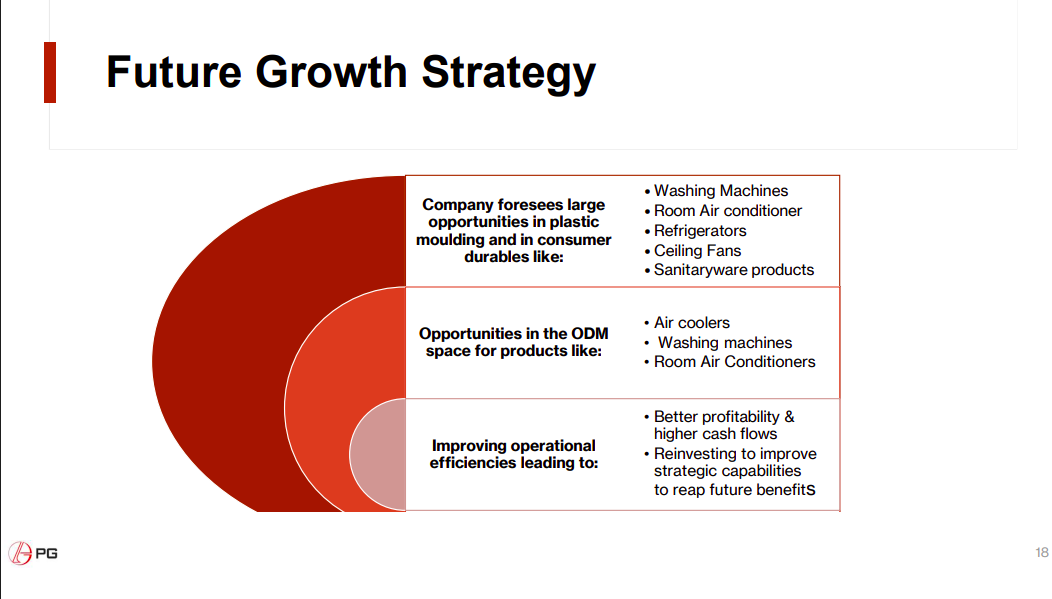

The company plans to expand in plastic moulding and consumer durables such as washing machines, air conditioners, and refrigerators, while leveraging ODM opportunities in air coolers and washing machines. Focus on operational efficiencies aims to enhance profitability and reinvest in strategic growth.

PG Electroplast serves diverse industries including air conditioners, washing machines, televisions, air coolers, automotive components, bathroom fittings, and consumer electronics—reflecting a broad manufacturing and product capability base.

Engineering & Capital Goods

Skipper Ltd | Small Cap | Engineering & Capital Goods

Skipper Ltd. is involved in the manufacturing of power transmission and distribution structures, as well as polymer products like pipes and fittings. It also takes on large-scale infrastructure projects, including engineering, procurement, and construction (EPC) services.

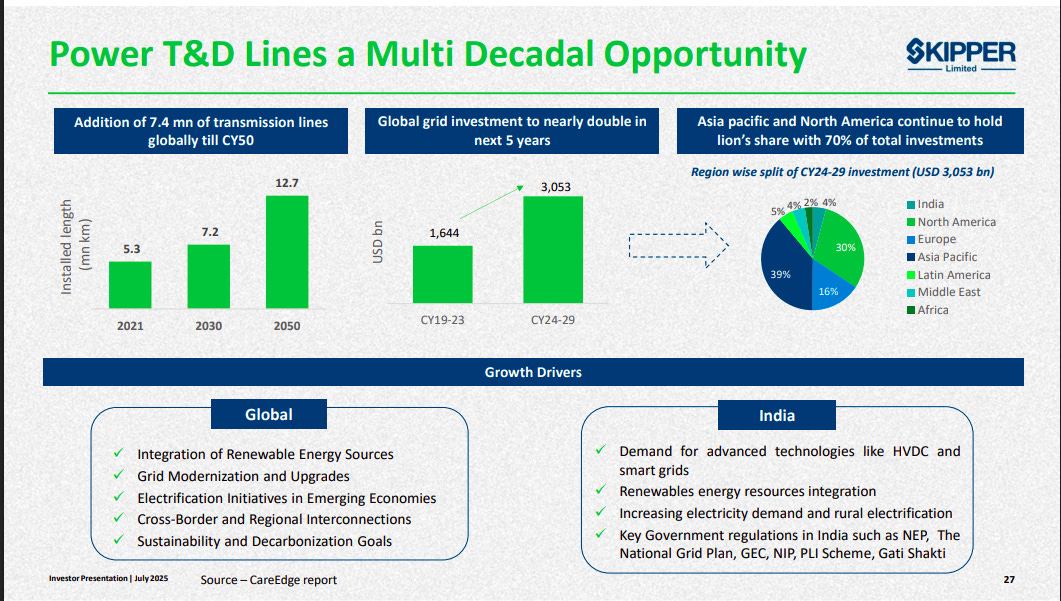

Global transmission infrastructure is set for massive expansion, with 7.4 million km of new lines expected by 2050 and investments nearly doubling to $3 trillion by 2029. Asia-Pacific and North America will lead with 70% of total spending, driven by renewable integration, grid modernization, and decarbonization goals.

India is entering a ₹9.2 trillion high-voltage transmission capex cycle under NEP FY22–32, adding over 1.9 lakh ckm of new lines and 33 GW of HVDC links. Interregional capacity will rise 40% to 168 GW by 2032, with PGCIL leading the surge as overall network and transformation capacity expand sharply.

New transmission infrastructure is vital for connecting remote renewable sources, ensuring reliable and efficient power flow. It supports grid stability, reduces losses, enables decentralization, and strengthens resilience against climate and demand shocks.

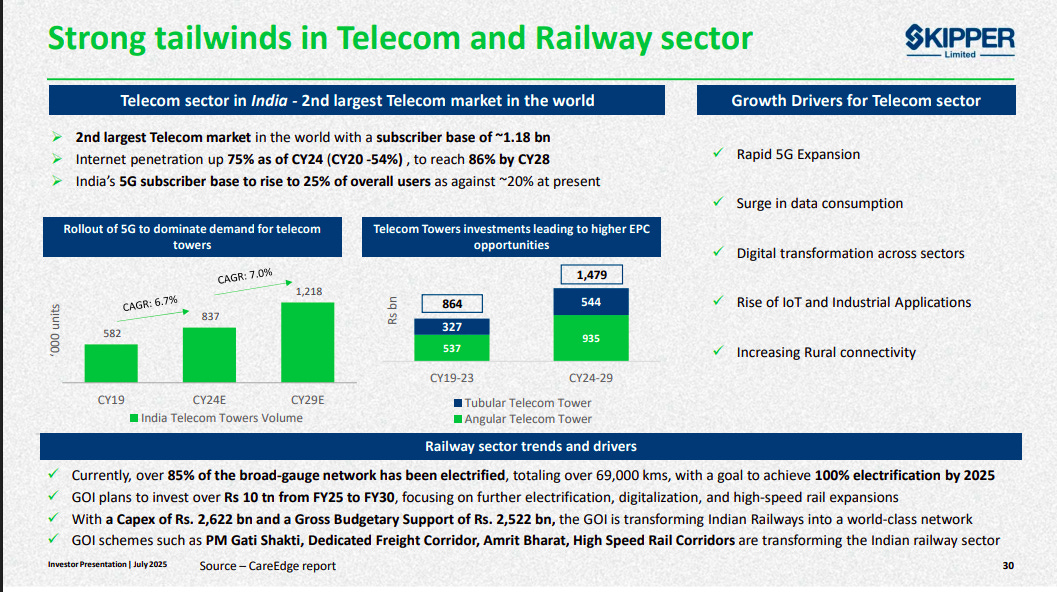

India’s telecom sector, the world’s second largest, is set for rapid expansion with 5G rollout driving tower demand and EPC investments. Meanwhile, Indian Railways aims for 100% electrification by 2025, backed by ₹10 trillion in planned investments and major government initiatives like Gati Shakti and Dedicated Freight Corridors.

India’s CPVC pipes market is projected to more than double to ₹799 billion by 2029, driven by infrastructure schemes like Jal Jeevan Mission, AMRUT, and Swachh Bharat. The shift from metal to polymer pipes, focus on micro-irrigation, and rising water conservation awareness are fueling sustained growth.

Krishna Defence and Allied Industries | Micro Cap | Engineering & Capital Goods

Krishna Defence and Allied Industries Limited offers a wide range of products used in Defence industry for Indian Armed Forces, Dairy Equipment products to facilitate procurement, processing, distribution of milk, Kitchen Equipment Products to serve midday meals in large organizations and have also forayed into manufacturing of homeland security products to be used in defence industry for Indian Armed Forces.

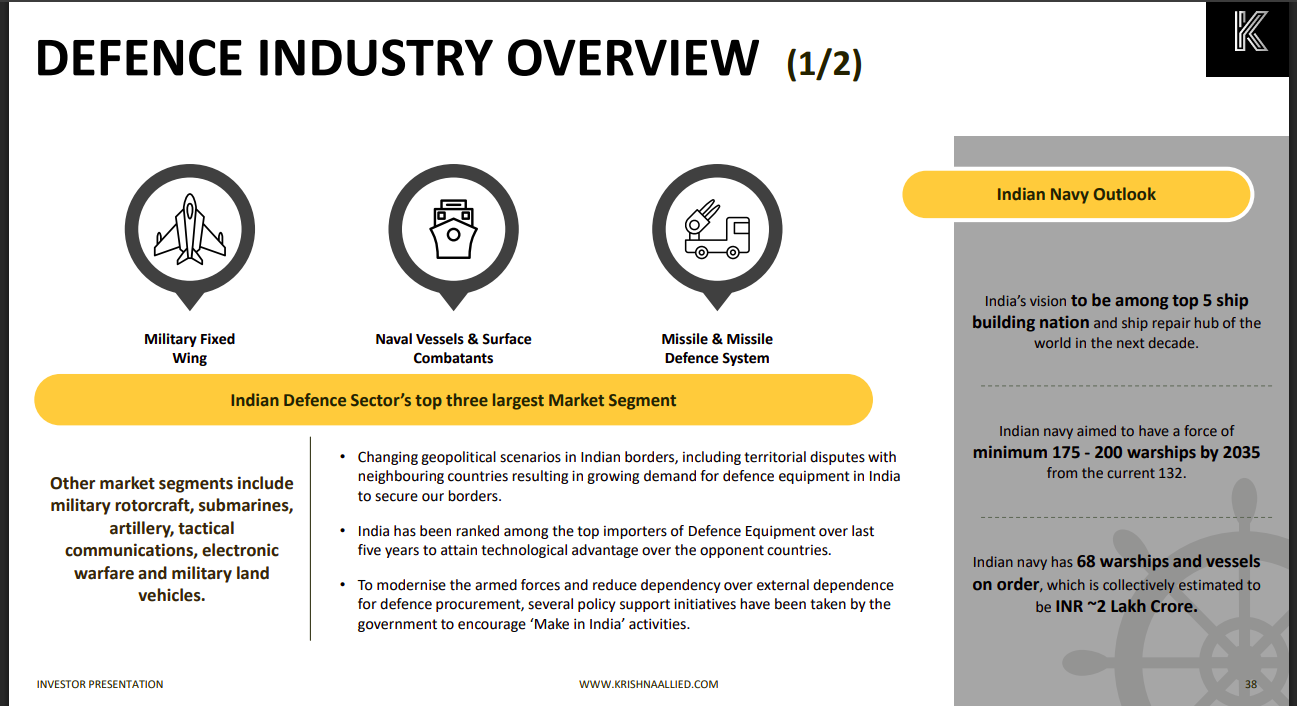

India’s defence sector is expanding rapidly, led by key segments like military aircraft, naval vessels, and missile systems. Geopolitical tensions and a strong push for indigenization are driving demand, with the Indian Navy targeting 175–200 warships by 2035 and 68 vessels already on order worth about ₹2 lakh crore.

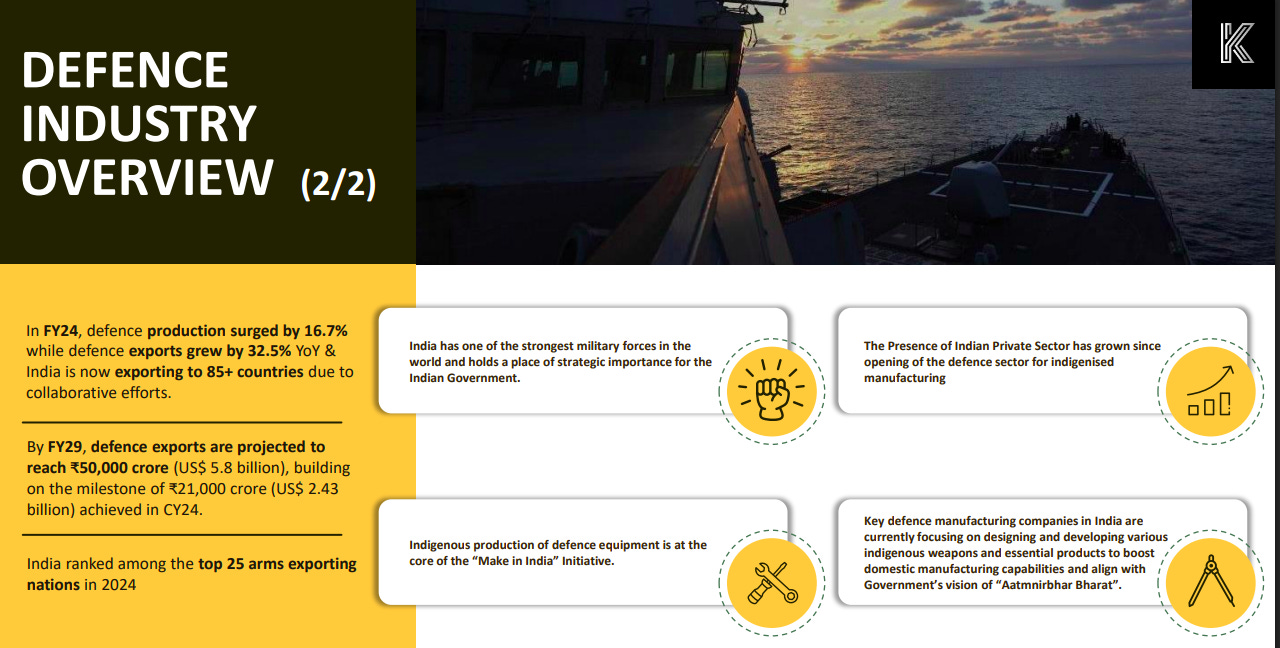

In FY24, defence production rose 16.7% and exports surged 32.5%, reaching 85+ countries. With exports projected to hit ₹50,000 crore by FY29, India now ranks among the top 25 arms exporters. Indigenous manufacturing and private-sector participation are accelerating under the government’s “Aatmanirbhar Bharat” and “Make in India” initiatives.

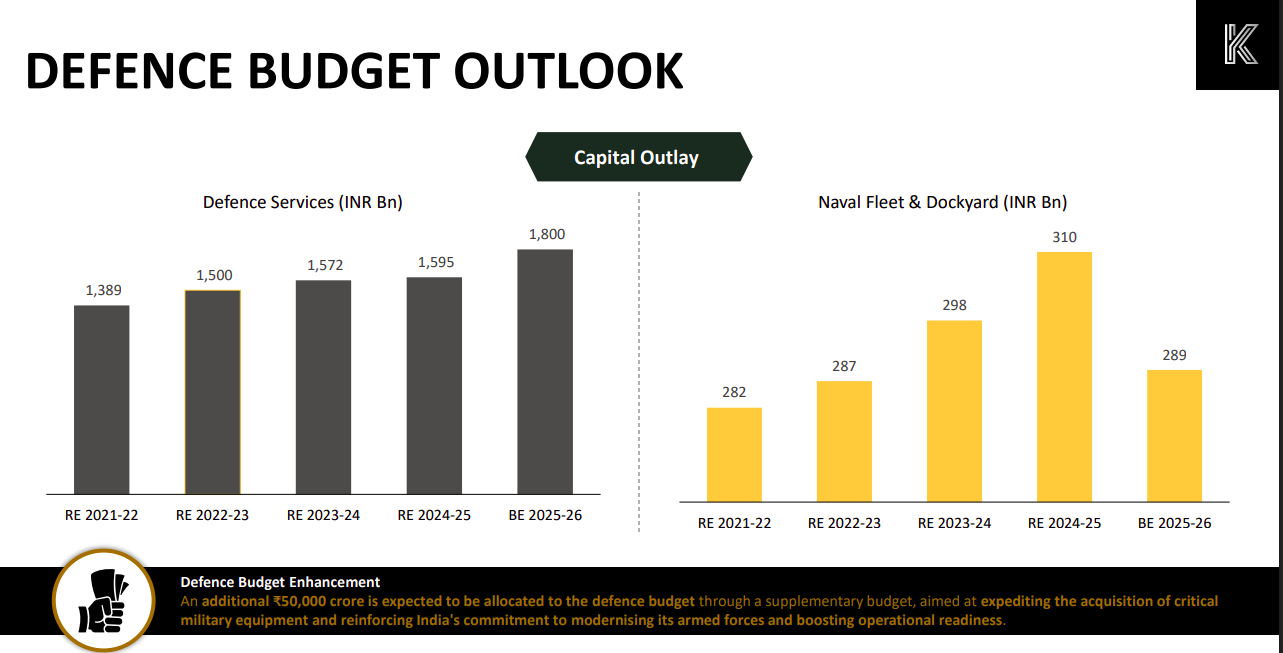

India’s defence capital outlay has steadily risen from ₹1.39 trillion in FY22 to a projected ₹1.8 trillion in FY26, with an additional ₹50,000 crore planned for modernization. Naval fleet spending remains strong, highlighting a focus on shipbuilding and maritime capability enhancement.

Massive policy support and capacity expansion are boosting India’s defence ecosystem. With ₹8.45 trillion in approved acquisitions and ₹2.35 trillion in upcoming shipbuilding orders, shipyards like Mazagon Dock, Cochin Shipyard, and GRSE are scaling up operations. Rising defence budgets and coastline expansion further strengthen Krishna Defence’s growth opportunity in naval infrastructure.

KSB | Small cap | Engineering & Capital Goods

KSB Limited, founded in 1960 and headquartered in Pune, Maharashtra, is a leading manufacturer of pumps and industrial valves globally. With technical expertise in various types of pumps and valves, the company specializes in a wide range of products including Centrifugal End Suction Pumps, High Pressure Multistage Pumps, industrial valves, and more. KSB has invested in state-of-the-art facilities and technologies to cater to the demands of centrifugal pumps and industrial valves in India.

India’s GDP growth consistently outpaces global rates (7.8% vs 2.8% in 2025-26 Q1), with inflation under control and manufacturing PMI holding steady above 50. The capex data is particularly striking - total investment jumping from 140 Bn € to 307 Bn € over 5 years, with private capex doubling. This sets a strong foundation for industrial equipment demand.

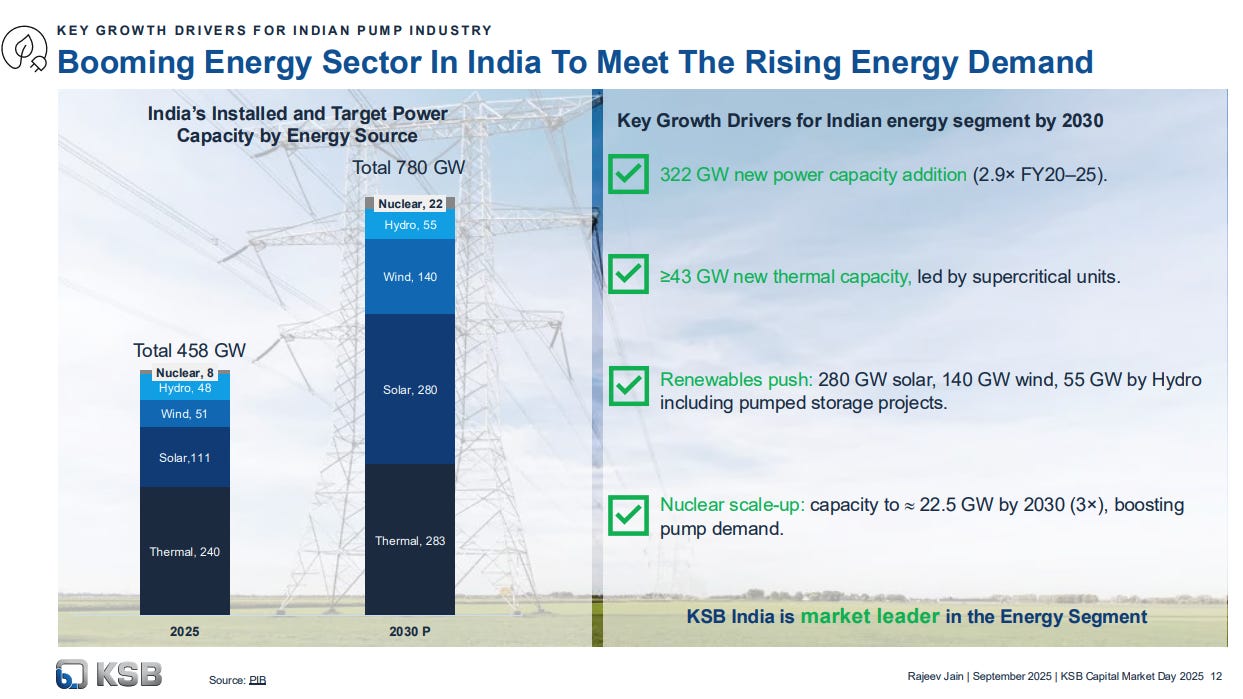

India needs 322 GW of new power capacity in 5 years. While adding 43 GW of traditional thermal plants, the real story is renewable energy - 420 GW of solar/wind/hydro capacity. For KSB, this means huge demand for pumps in both conventional power plants and renewable projects.

While solar pumps grabing headlines, grid-connected pumps will actually see bigger absolute growth (tripling from 0.6 to 1.8 Bn €). The market is driven by fundamental needs - more irrigation coverage, better irrigation efficiency, and rising food demand. KSB has 6-7% market share here with room to grow.

KEI Industries | Mid cap | Engineering & Capital Goods

KEI Industries Limited offer a wide range of products from housing wires to Extra High Voltage cables, and also provide EPC services for power and transmission projects. KEI is renowned for being one of the few manufacturers of EHV cables in India.

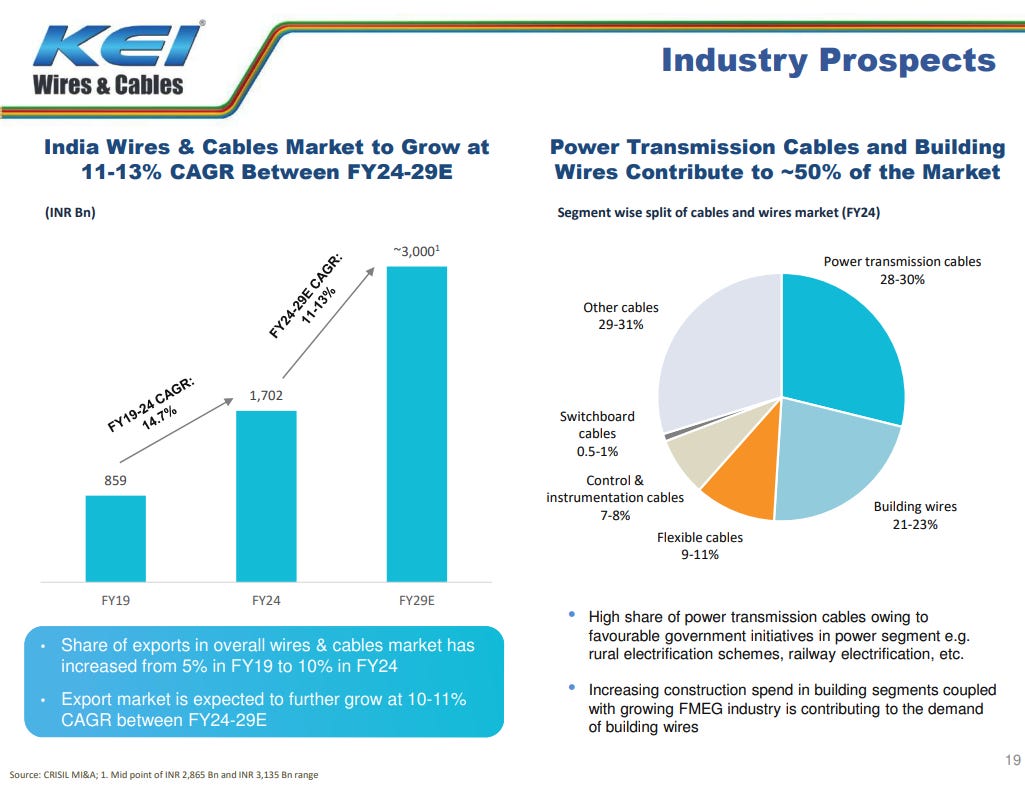

The Indian wires and cables market is set to nearly double from ₹1,702 billion in FY24 to ₹3,000 billion by FY29E, driven by massive infrastructure investments in power transmission, renewable energy expansion, and booming construction activity. Power transmission cables and building wires dominate at 50% market share, while exports have grown from 5% to 10% of the market, positioning KEI well to capitalize on this structural growth story.

Chemicals

Neogen Chemicals | Small Cap | Chemicals

Neogen Chemicals is a specialty chemical manufacturer focusing on bromine and lithium-based compounds, including advanced intermediates for the pharmaceutical, agrochemical, and engineering sectors, as well as Grignard Reagents. The company also manufactures lithium-ion battery electrolyte solutions and offers custom synthesis and contract manufacturing services.

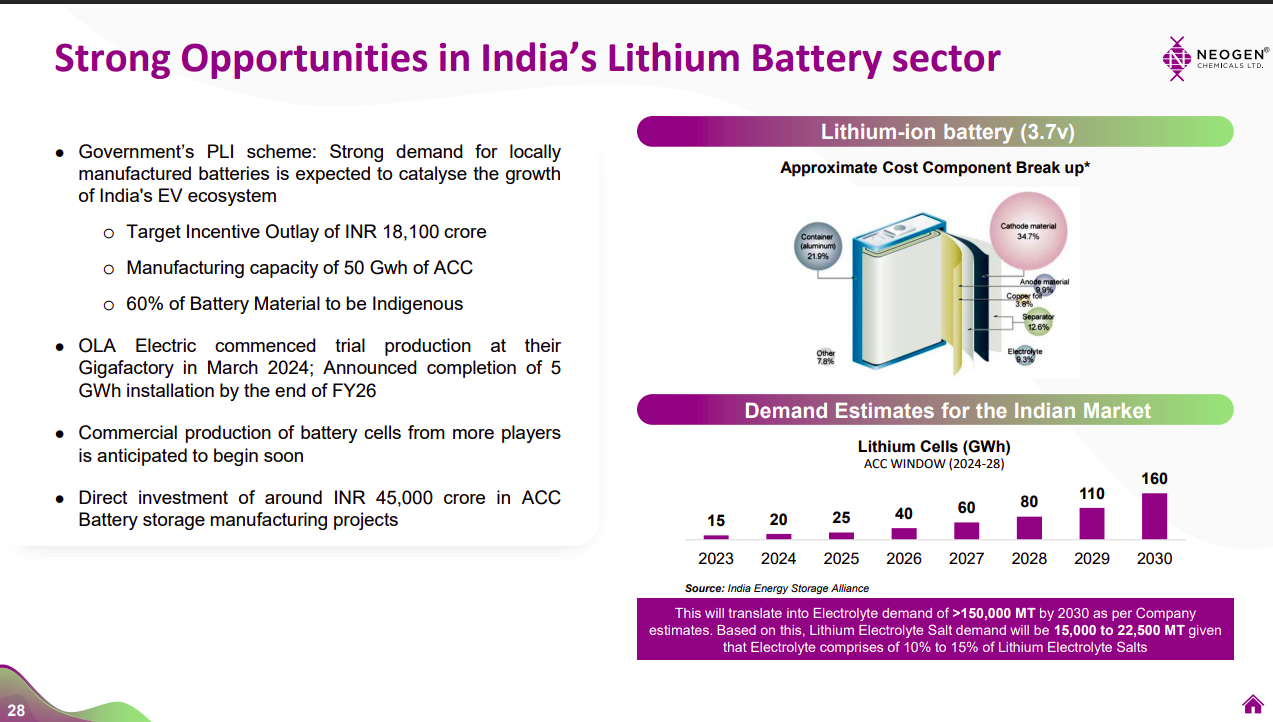

India’s EV push, backed by the ₹18,100 crore PLI scheme and 50 GWh battery manufacturing target, is creating strong lithium chemical demand. With major investments like Ola’s Gigafactory and ₹45,000 crore in ACC projects, lithium cell demand could reach 160 GWh by 2030, driving over 150,000 MT of electrolyte needs.

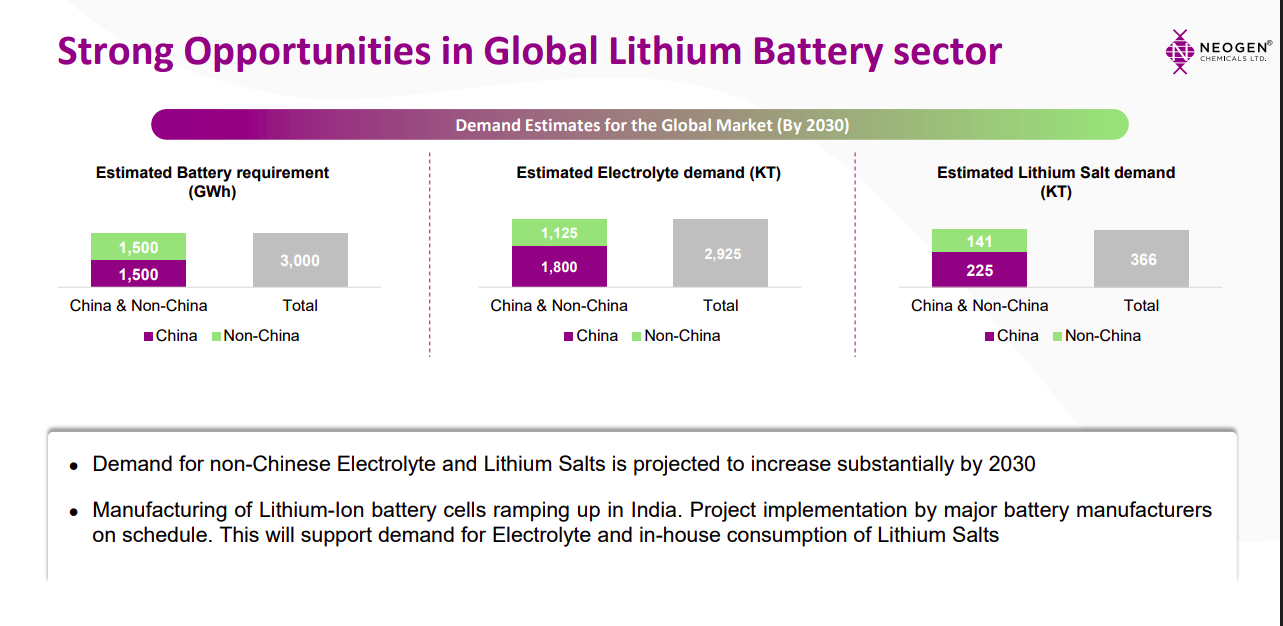

Global lithium battery demand is expected to reach 3,000 GWh by 2030, with electrolyte demand of 2.9 million tonnes and lithium salt demand of 366 KT. Growth outside China is accelerating as new manufacturing capacity and non-Chinese supply chains scale up.

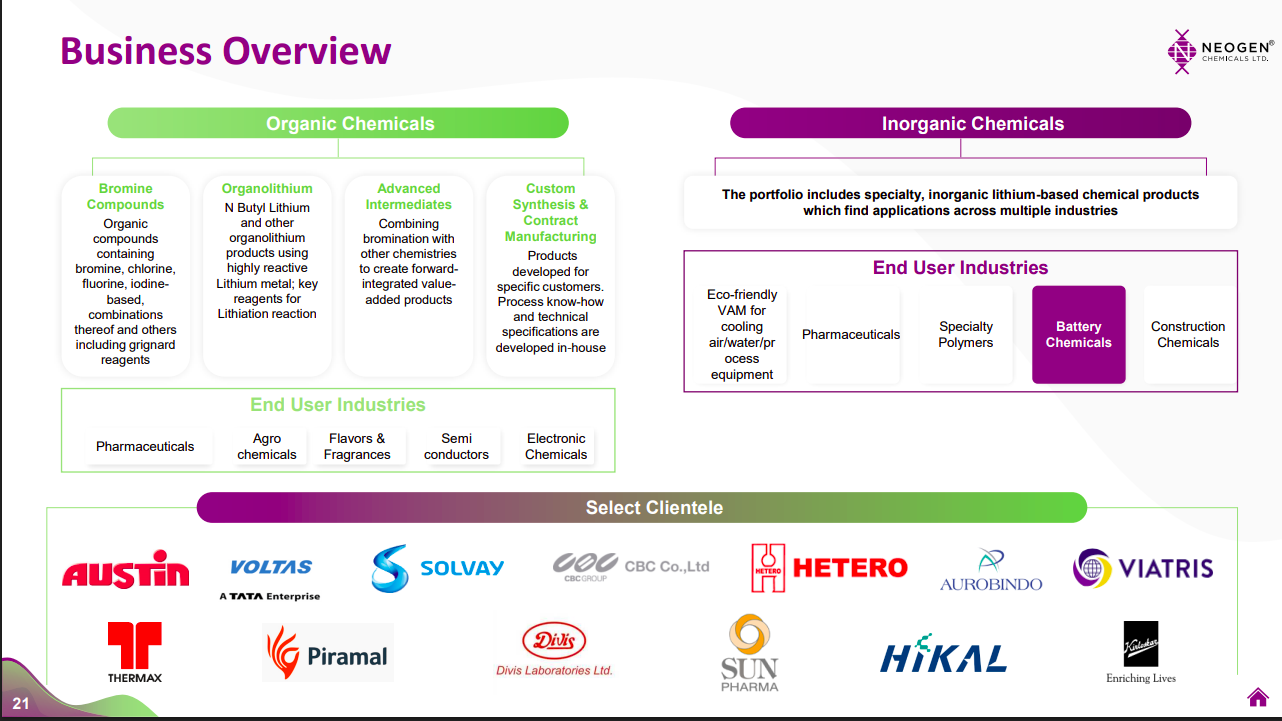

Neogen operates across organic and inorganic chemicals, offering bromine, organolithium, and specialty lithium-based products for industries like pharma, agrochemicals, semiconductors, and batteries. Its marquee clients include Voltas, Solvay, Hetero, Piramal, Sun Pharma, and Divi’s Labs.

Neogen’s business is seasonally stronger in the October–March period, driven by higher European orders and HVAC-linked lithium chemical demand in Q4. Agrochemical demand peaks during the crop season in H2, so investors should compare quarterly results on a year-on-year basis.

Energy

Indian Oil Corporation | Large Cap | Energy

Indian Oil Corporation Limited (IOCL) is a major Indian energy company involved in the entire hydrocarbon value chain, including refining crude oil, transporting products via pipelines, marketing petroleum, petrochemicals, and natural gas.

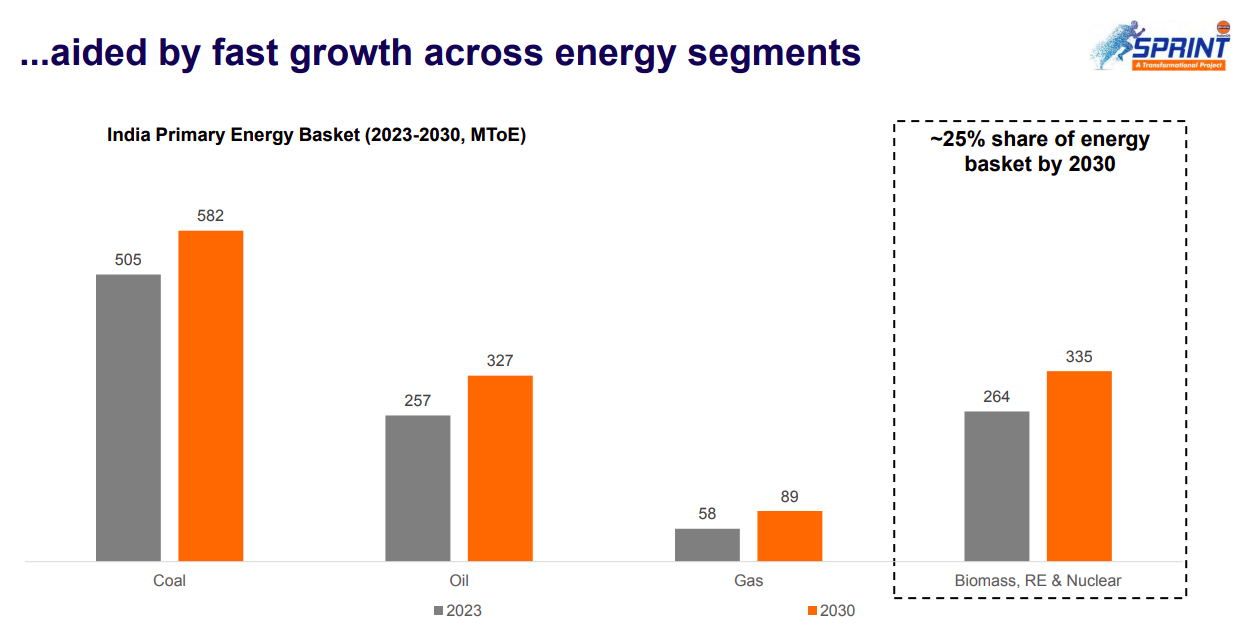

India’s primary energy demand is projected to expand sharply across all segments by 2030. Coal remains dominant, growing from 505 to 582 MToE, followed by oil at 327 MToE and gas at 89 MToE. Biomass, renewables, and nuclear energy together are expected to form ~25% of India’s total energy mix by 2030, rising from 264 to 335 MToE — signaling the gradual diversification of the country’s energy basket.

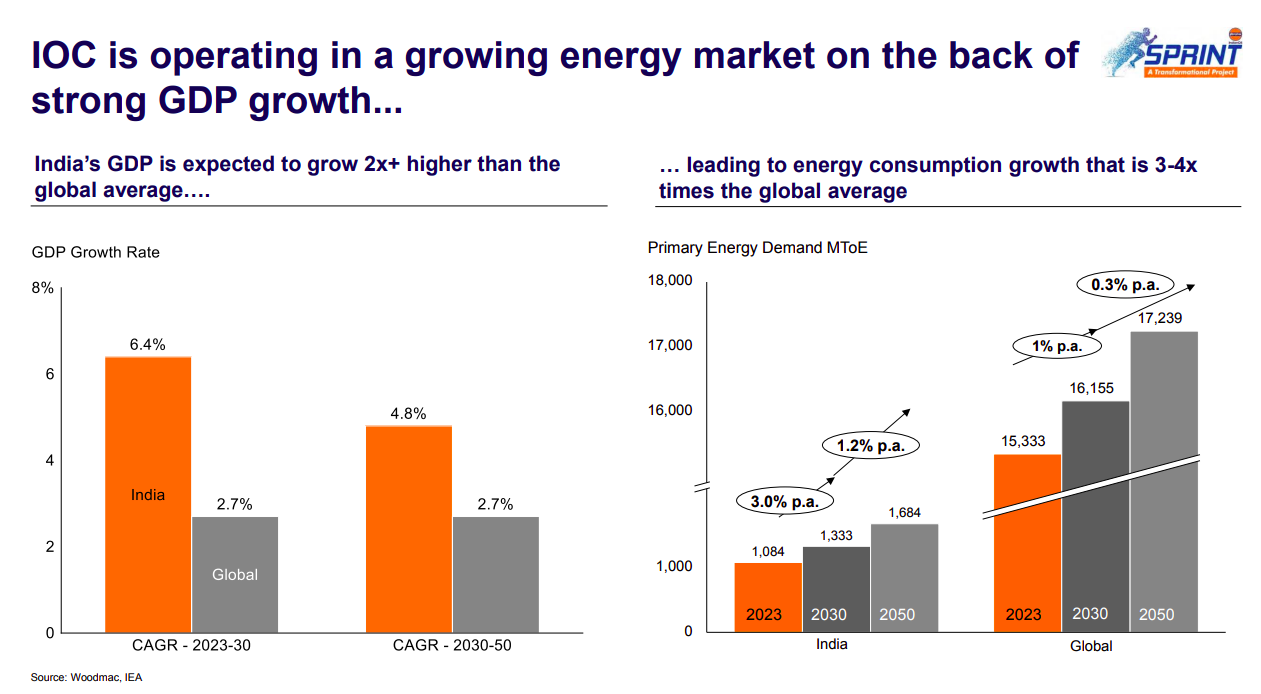

India’s GDP is set to grow more than twice the global average, with a CAGR of 6.4% between 2023–30 versus 2.7% globally. This robust economic growth will drive energy consumption that’s 3–4x faster than the world average. India’s primary energy demand is expected to rise from 1,084 MToE in 2023 to 1,333 MToE by 2030, and 1,684 MToE by 2050, compared to global demand growth from 15,333 to 17,239 MToE over the same period.

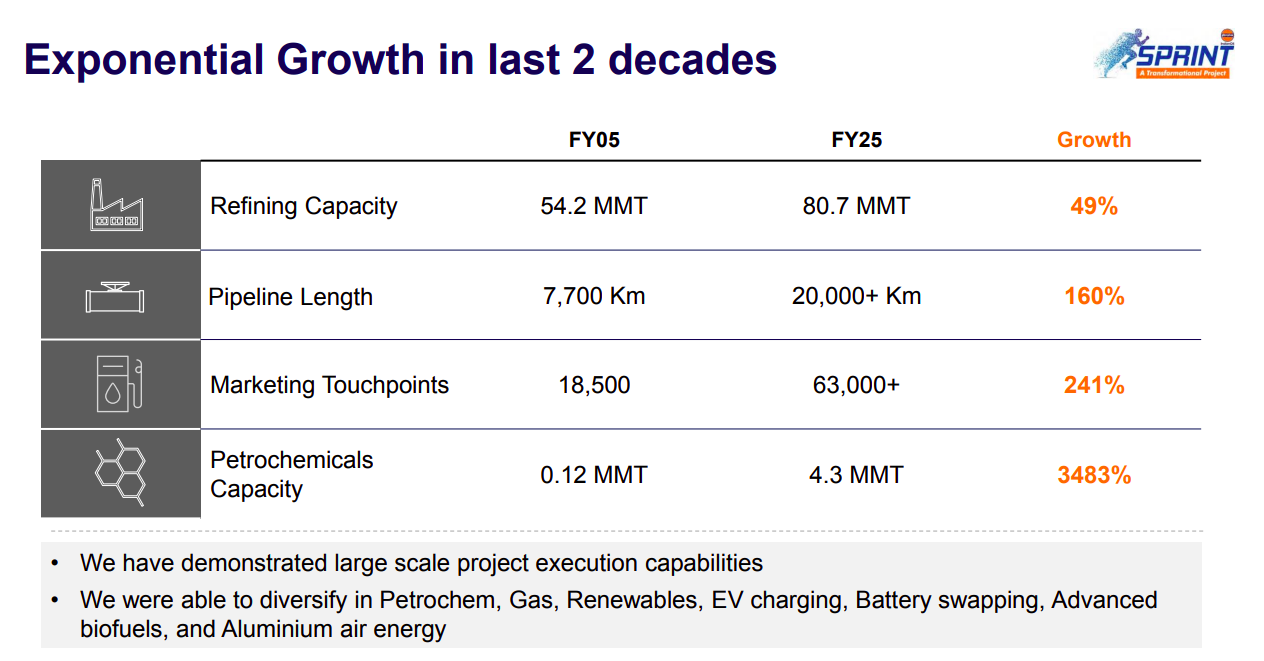

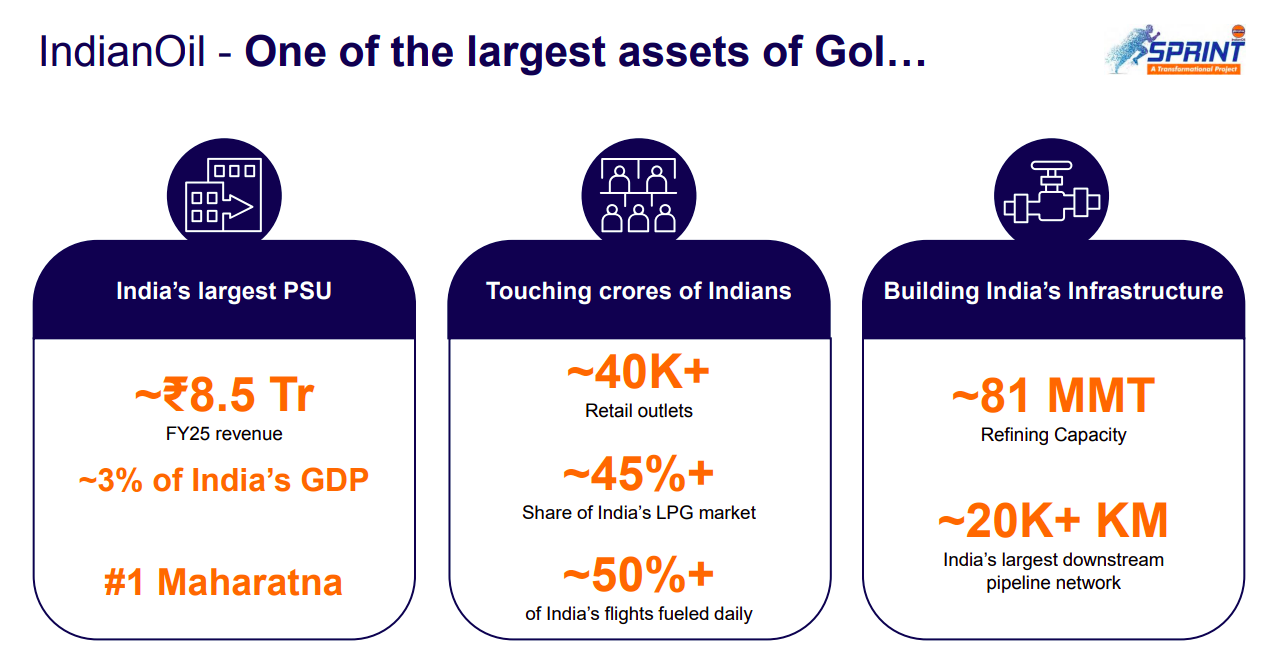

Indian Oil has scaled its operations significantly since FY05 — refining capacity up 49% to 80.7 MMT, pipeline network up 160% to over 20,000 km, and retail touchpoints up 241% to more than 63,000. The biggest leap came in petrochemicals, up 3,483% to 4.3 MMT. This growth highlights IOC’s large-scale project execution and diversification into petrochemicals, renewables, EV charging, and advanced energy technologies like biofuels and aluminum-air batteries.

IndianOil remains one of India’s largest public sector enterprises, contributing ~₹8.5 trillion in FY25 revenue — nearly 3% of the nation’s GDP. With over 40,000 retail outlets, it supplies 45% of India’s LPG market and fuels half of all daily flights. Backed by 81 MMT refining capacity and a 20,000+ km downstream pipeline network, IOC is both a critical national energy provider and a key infrastructure backbone for India’s growth.

Financial Services

Nuvama Wealth | Small cap | Financial Services

Nuvama Wealth is engaged in broking and trading of equity securities, derivatives, and currencies on Indian stock exchanges, catering to institutional and non-institutional clients, including retail customers. The company’s Institutional Equities segment offers equity sales, research, and trading services to institutional clients, covering both securities and futures contracts.

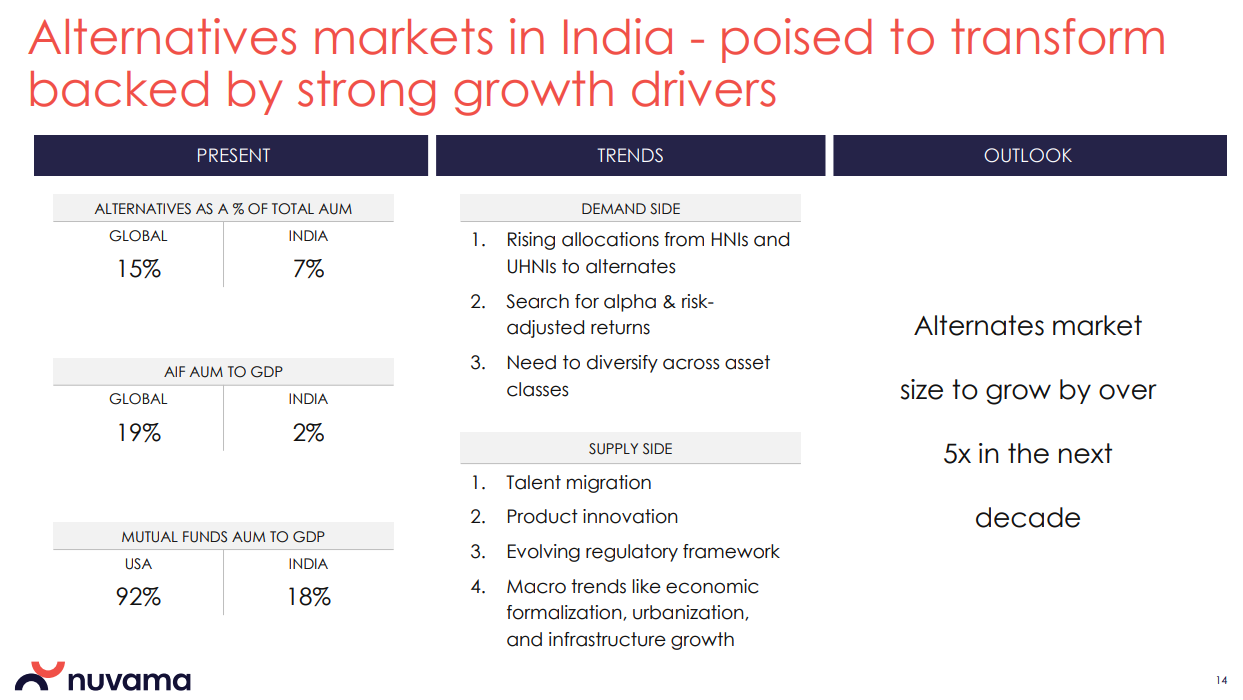

India’s wealth management market is significantly underpenetrated compared to the US across all metrics - wealth to GDP (4.5x vs 6.5x), financial wealth share (25% vs 70%), and professionally managed wealth (15% vs 75%). The growth drivers are clear: Indians are getting wealthier and shifting from traditional assets to investment products, while needing more professional advice. The projection of tripling wealth under management in 5 years seems aggressive but plausible given the low base.

There’s an even larger opportunity gap in alternatives. India’s AIF (Alternative Investment Fund) penetration is just 2% of GDP versus 19% globally, and alternatives represent only 7% of total AUM versus 15% globally. The projected 5x growth in alternatives over the next decade appears reasonable, given the massive gap with global standards and the increasing sophistication of Indian HNI and UHNI investors seeking portfolio diversification beyond traditional assets.

Metals

National Aluminium | Mid cap | Metals

National Aluminium Company Ltd. (NALCO) is a major Indian company involved in the mining of bauxite, refining it into alumina, and smelting it into aluminum, as well as generating its own power. As a Navratna company under the Ministry of Mines, NALCO also produces various aluminum products like rolled products and special alloys, and exports its goods.

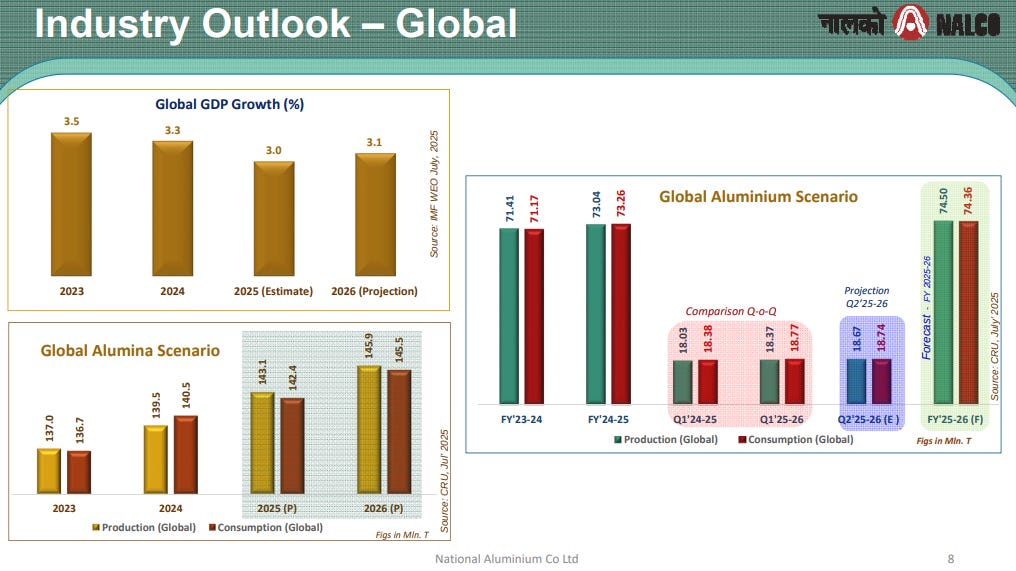

Global GDP growth is expected to slow slightly from 3.3% in 2024 to 3.0% in 2025, reflecting a cautious global economic environment.

The global alumina market remains stable with both production and consumption growing moderately, showing a steady supply-demand balance.

In the aluminium sector, global production and consumption are almost aligned, indicating a balanced market outlook with limited price volatility expected.

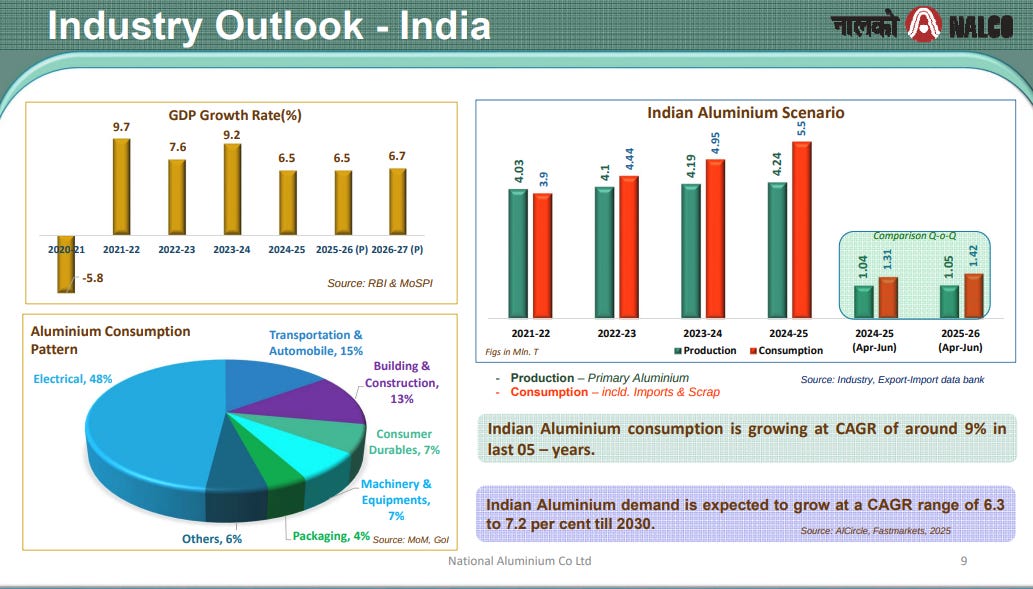

India’s GDP growth remains robust, projected around 6.5–6.7% over FY25–26, underscoring strong economic fundamentals.

Domestic aluminium consumption has been growing at a ~9% CAGR over the past five years, driven by power (48%), transport (15%), and construction (13%) sectors.

Production is also rising steadily, but demand growth continues to outpace it, indicating scope for capacity expansion.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

We started a new experiment - Plotlines!

Plotlines is an extension of our Chatter newsletter. While most financial analysis focuses on quarterly results and near-term changes, Plotlines takes a different approach. We analyze executive commentary from earnings calls and investor presentations to identify long-term, structural shifts that will shape industries for years to come.

Instead of chasing headlines, we look for strategic pivots, evolving competitive dynamics, and fundamental changes in how companies allocate capital. Each week, we’ll highlight the most significant “plotlines” from recent corporate communications, focusing on comments that signal permanent changes in market structure, technology adoption, or business models.

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.

Couldn't find pgel

Consumer durables was missing.