Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they're saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 21 companies across 14 industries

Chemicals

PCBL Chemical

Healthcare

Advanced Enzymes

Chemcart India

Laurus Lab

FMCG

Sharat Industries

Sheela Foam

Tourism & Hospitality

Indian Hotels

TBO tek

Energy

Ravindra Energy

Metals

Jindal Steel

Hind Copper

Financial Services

Piramal Enterprises

Textiles

Bella Casa fashions

Auto Ancillary

Car trade

Pritika Engineering

Telecom

Vodafone Idea

Engineering & Capital Goods

Centrum Electronics

Gulf Oil Lubricants

Retail

FSN E-Commerce

Building Materials

Dalmia Bharat

Real Estate

Anant Raj

Chemicals

PCBL Chemical | Small Cap | Chemicals

PCBL Chemical (Phillips Carbon Black Limited) is primarily a manufacturer of carbon black, a key component in tires and other rubber products. It also produces specialty blacks, which are used as pigments in inks, plastics, and coatings.

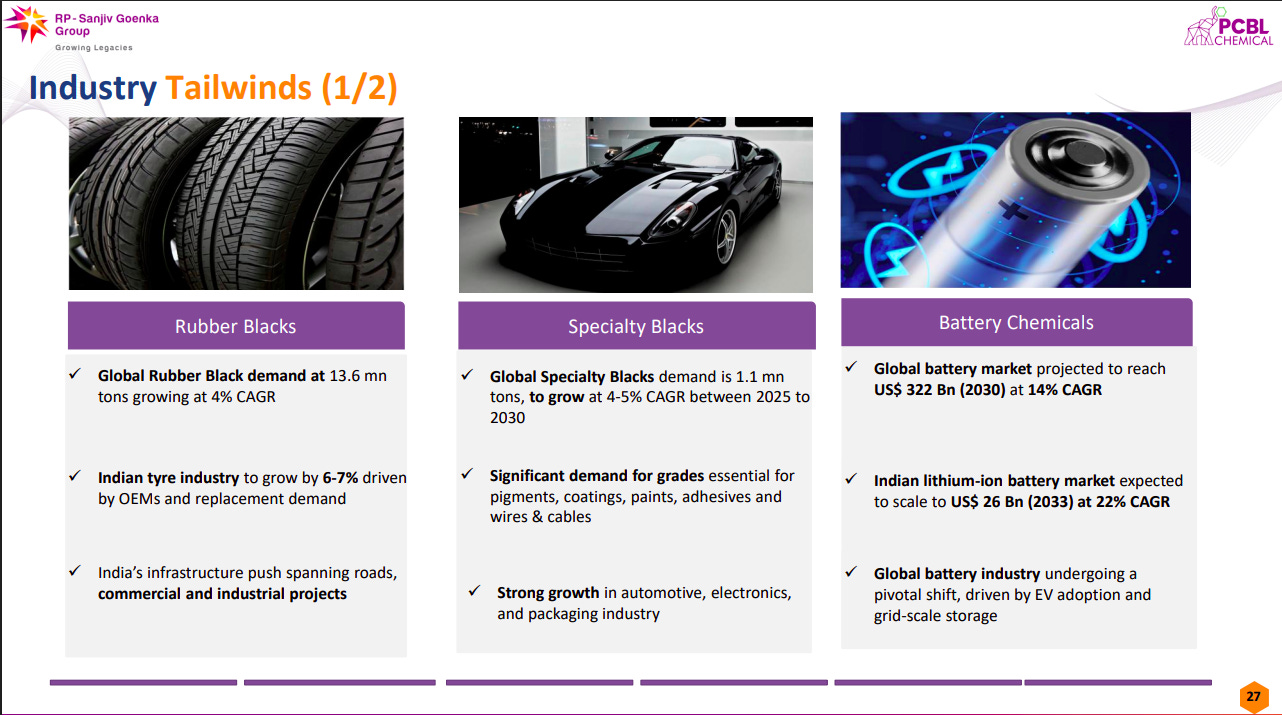

Global rubber black demand is set to grow at 4% CAGR, while India’s tyre industry expands 6–7% on OEM and replacement demand. Specialty blacks see strong growth in coatings, paints, and electronics, while the battery chemicals market is projected to boom with EV adoption, scaling to $322B globally and $26B in India by 2030–33.

Home care demand is rising with smart appliances and EDTA phase-outs favoring greener chemicals. Oil & gas consumption is increasing on geopolitical tensions and energy security, while water solutions benefit from Middle East desalination and African infrastructure. Application-specific solutions see demand from textiles, auto prep, and paper packaging modernization.

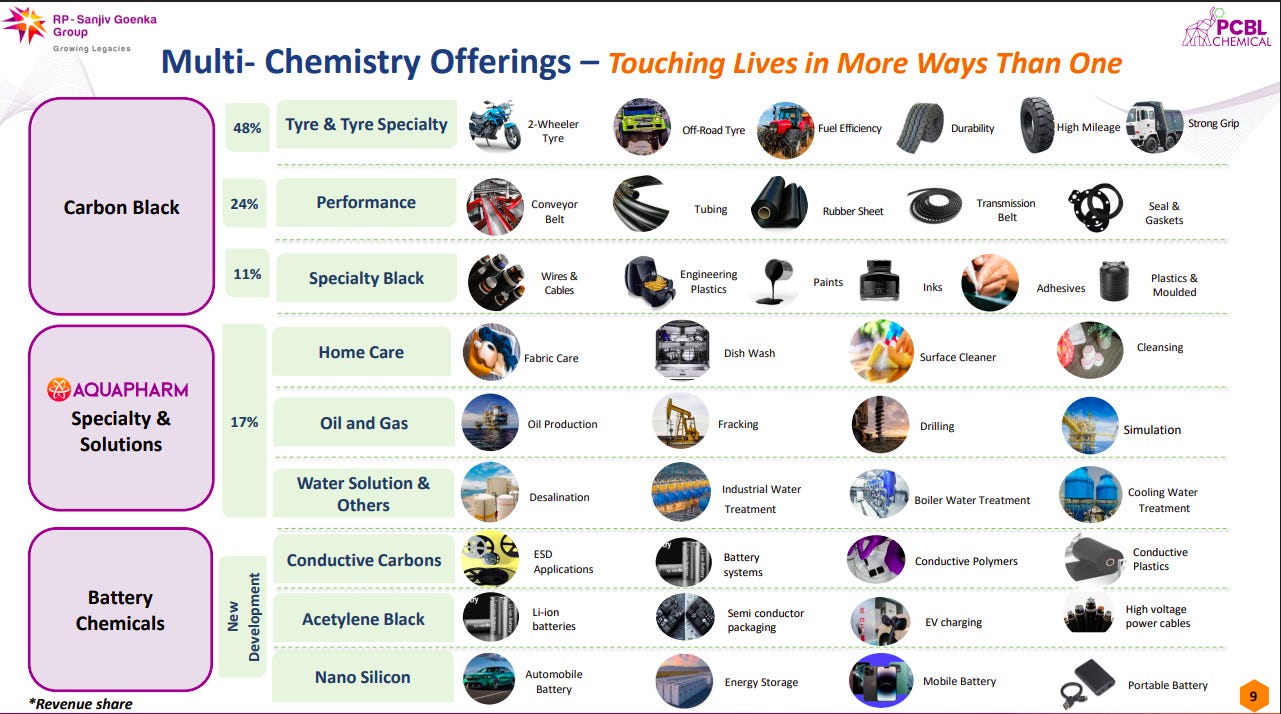

PCBL offers a diversified portfolio across carbon black (tyres, performance, specialty), specialty solutions (home care, oil & gas, water treatment), and battery chemicals (conductive carbons, acetylene black, nano silicon). These offerings support applications from tyres and industrial products to EV batteries and advanced electronics.

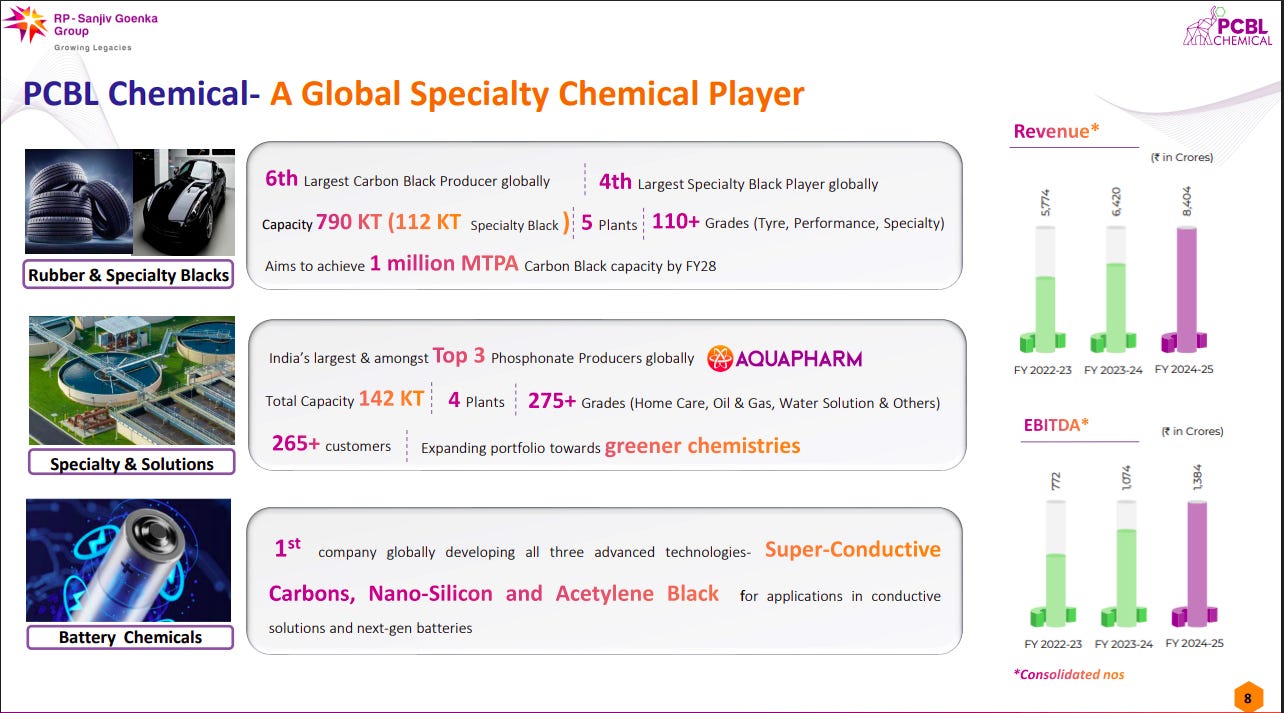

PCBL is the 6th largest carbon black and 4th largest specialty black producer globally, targeting 1 MTPA capacity by FY28. Its Aquapharm arm is among the top 3 phosphonate producers worldwide, and it is pioneering advanced battery technologies like super-conductive carbons, nano-silicon, and acetylene black. Revenue has grown from ₹5,774 Cr (FY23) to ₹8,404 Cr (FY25) with EBITDA rising to ₹1,384 Cr.

Healthcare

Advanced Enzymes | Small Cap | Healthcare

Advanced Enzymes Technologies Limited is a global leader in enzymes and probiotics manufacturing. They focus on developing enzyme-based solutions for healthcare, animal nutrition, and various industries.

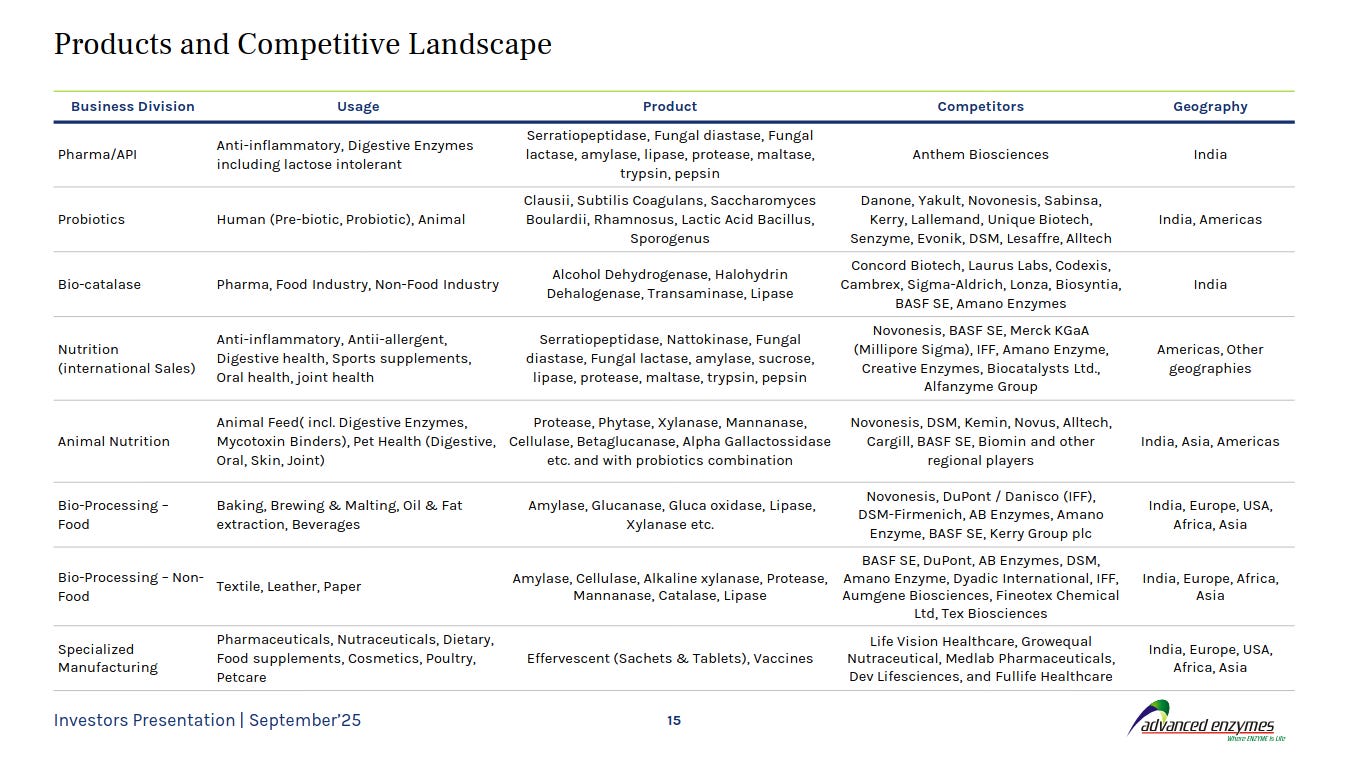

Advanced Enzymes operates across pharma, probiotics, bio-catalysis, nutrition, animal health, and specialized manufacturing. Competing with global majors like Novonesis, DSM, BASF, and Danone, it maintains a presence across India, Asia, the Americas, and Europe.

Enzyme demand is rising in human and animal healthcare, food processing, and industrial applications due to preventive health focus, sustainability, and clean-label trends. Probiotics, biocatalysis, and eco-friendly non-food enzymes are seeing especially strong adoption globally.

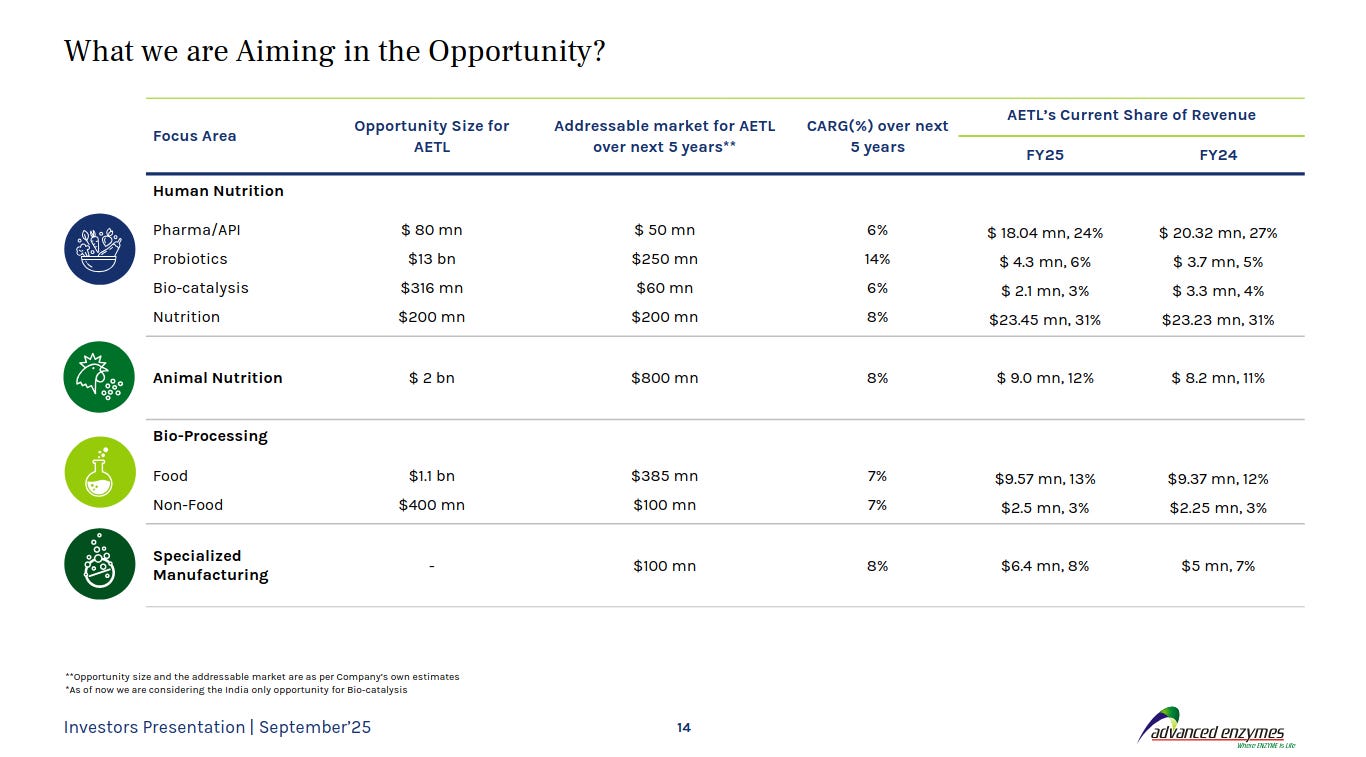

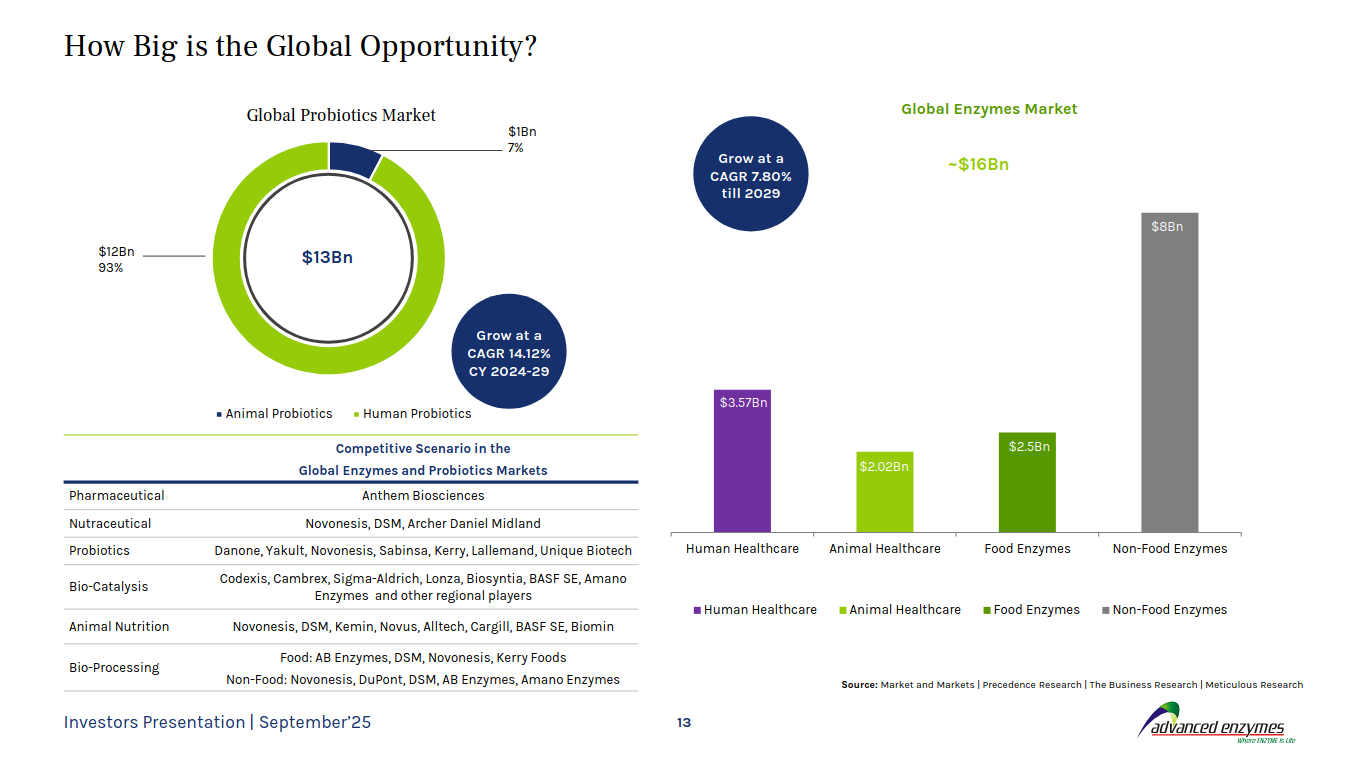

Advanced Enzymes sees a multi-billion-dollar opportunity across human nutrition, animal nutrition, and bio-processing, with probiotics ($13B market) as the largest growth driver. Its addressable markets over five years exceed $1.8B, with current revenue share strongest in human and animal nutrition.

Chemcart India | Nano Cap | Healthcare

Chemkart India Ltd supplies high-quality food & health ingredients to B2B clients. It offers grinding, blending & packaging in Mumbai. Its product range includes amino acids, proteins, vitamins, herbal extracts, and sports nutrition.

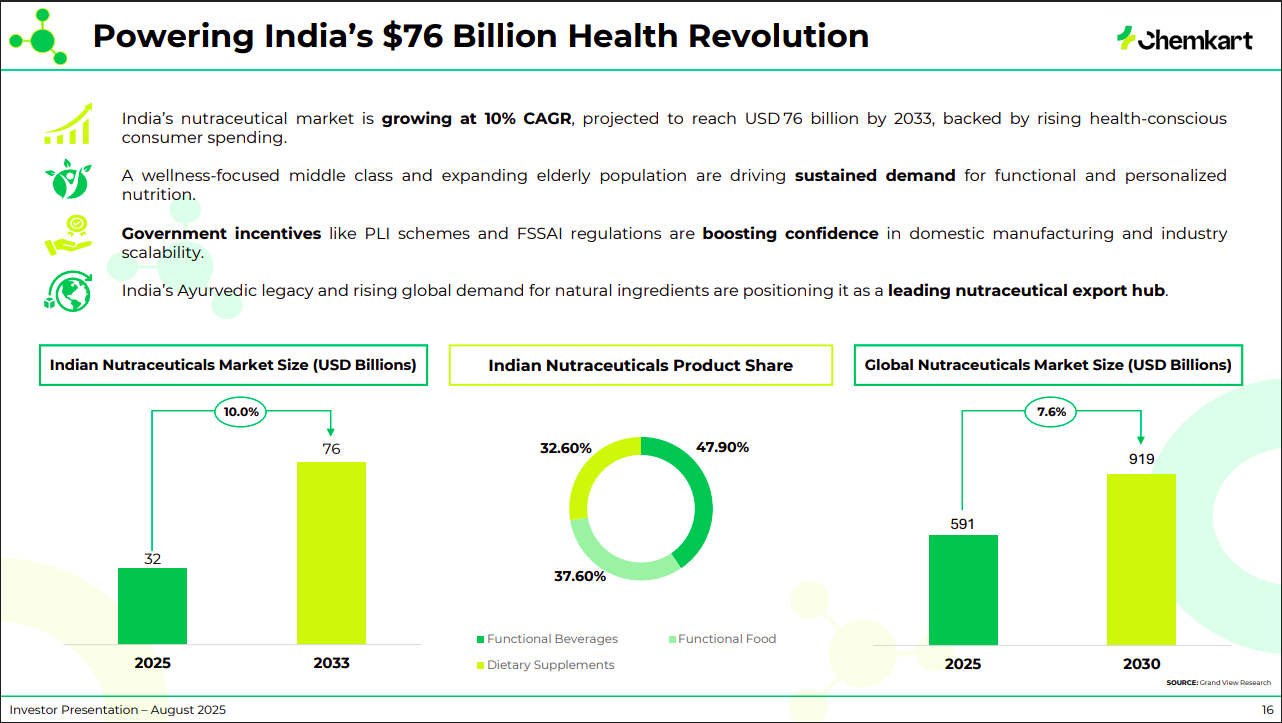

India’s nutraceutical market, growing at 10% CAGR, is projected to hit $76 billion by 2033, supported by rising health-conscious spending, a wellness-driven middle class, and government incentives. With strong Ayurvedic roots and increasing global demand for natural ingredients, India is positioned as a leading export hub.

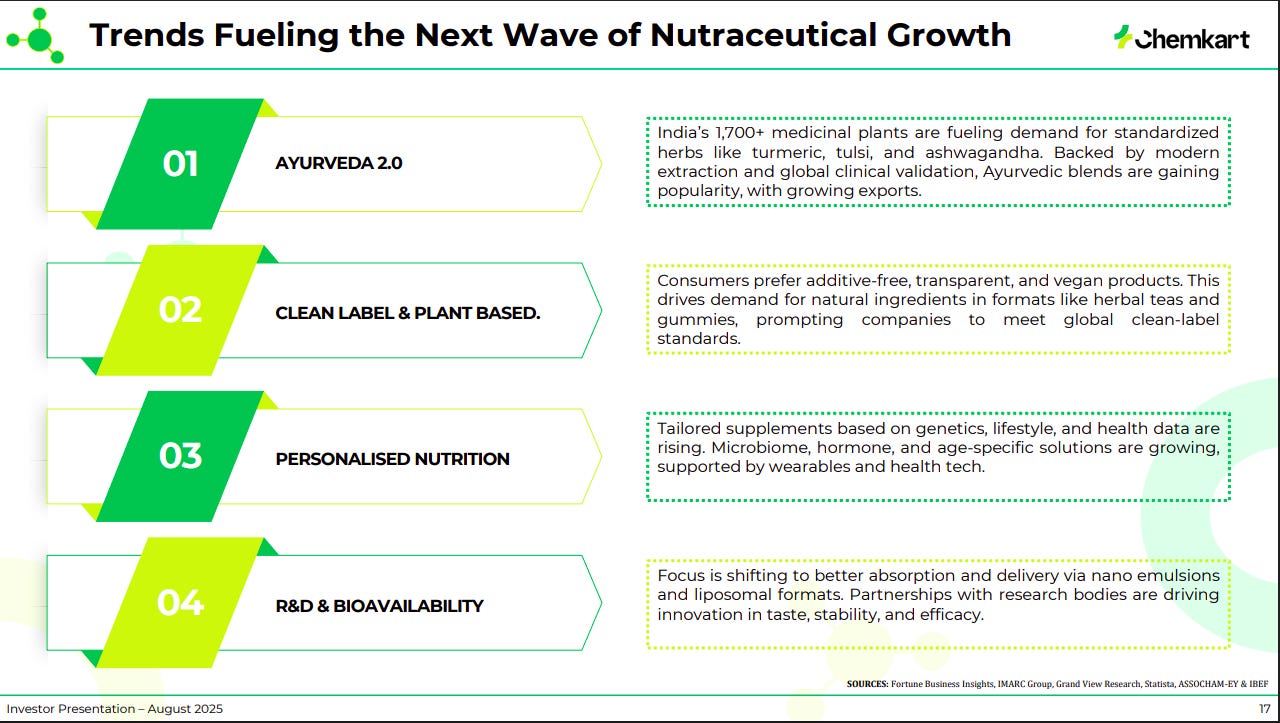

The next wave of nutraceutical growth will be driven by Ayurveda 2.0 with standardized herbal blends, clean-label plant-based products, and personalized nutrition backed by genetics and health data. Advances in R&D are also improving bioavailability and product efficacy through innovative delivery formats.

The global enzymes market is estimated at ~$16B, led by non-food enzymes (~$8B) and human healthcare ($3.6B), while probiotics alone form a $13B market growing at ~14% CAGR through 2029. Competition spans major global players like Novonesis, DSM, Danone, and BASF.

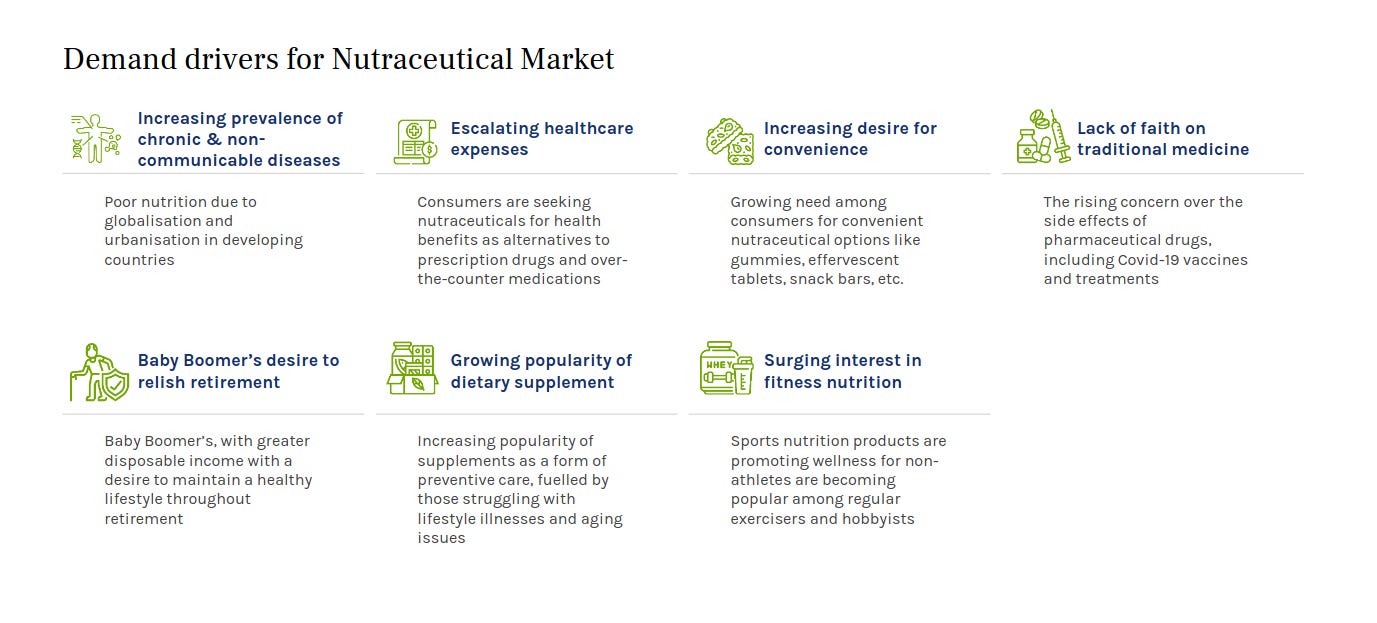

The nutraceutical market is driven by rising chronic diseases, healthcare costs, and demand for convenient formats like gummies and bars. Aging populations, fitness trends, and distrust of traditional medicine further accelerate supplement adoption.

Laurus Lab | Mid Cap | Healthcare

Laurus Labs Limited is a leading player in the global pharmaceutical industry, offering a wide range of Active Pharma Ingredients (API), Generic Finished dosage forms (FDF), and Contract Research services. The company focuses on innovation, quality, and affordability in developing medicines. With a strong presence in anti-retroviral, Hepatitis C, and Oncology drugs, Laurus Labs collaborates with top generic pharmaceutical companies worldwide and conducts dedicated R&D in high-growth areas.

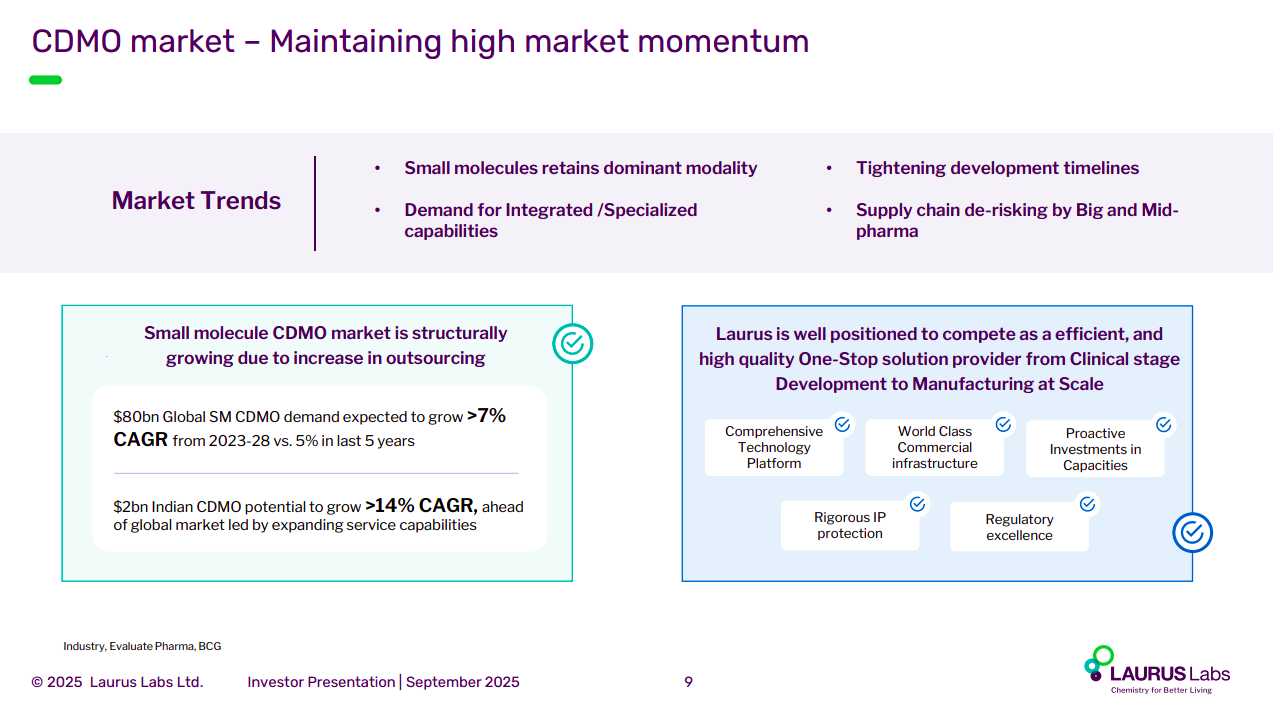

The global small molecule CDMO market is expected to grow at over 7% CAGR, while India’s $2 billion market is set to expand even faster at 14% CAGR, fueled by outsourcing and service expansion. Laurus Labs is well placed to benefit, offering end-to-end solutions with strong tech platforms, capacity investments, IP protection, and regulatory excellence.

FMCG

Sharat Industries | Micro Cap | FMCG

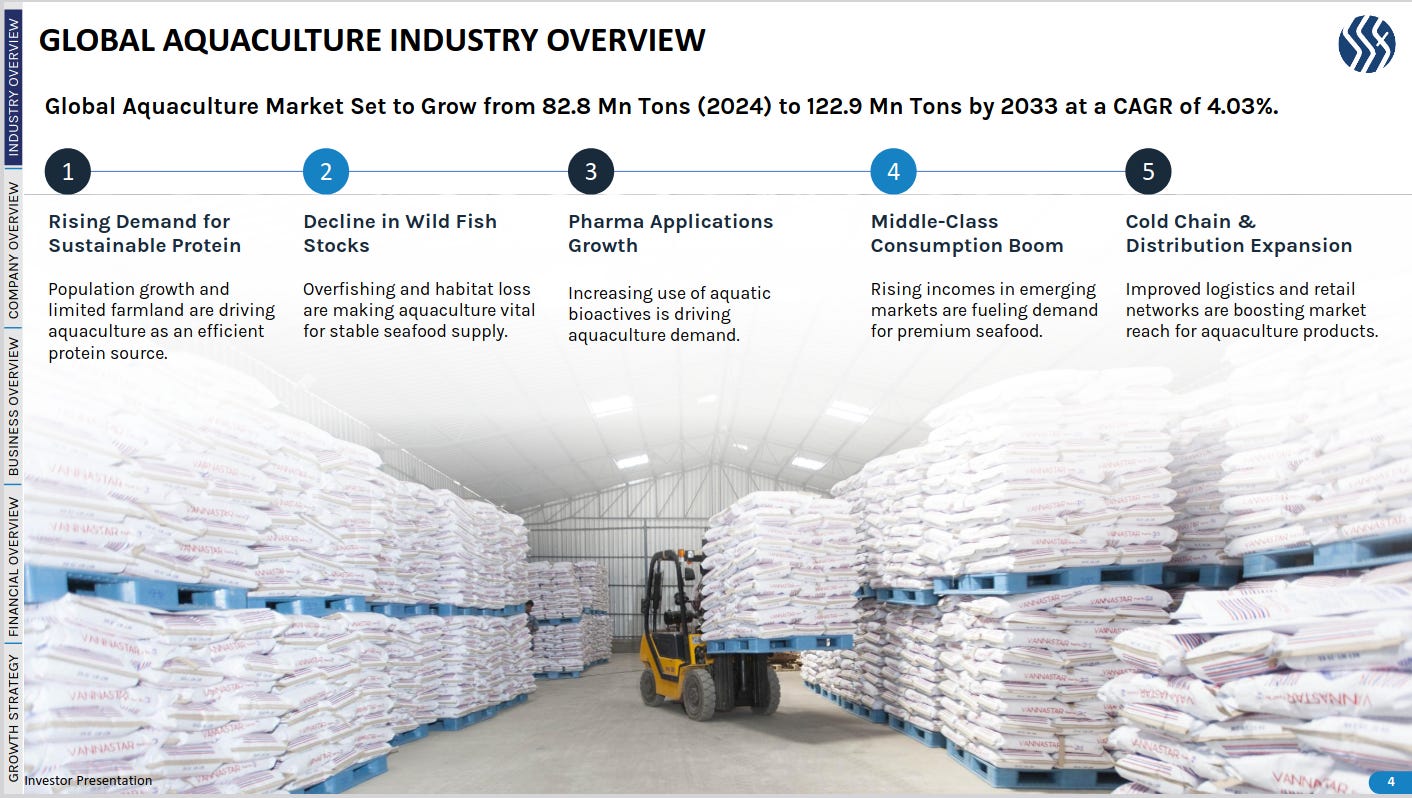

Sharat Industries Limited (SIL) is a fully integrated aquaculture company that focuses on the production of shrimp, which includes shrimp hatchery, farming, feed manufacturing, and processing.

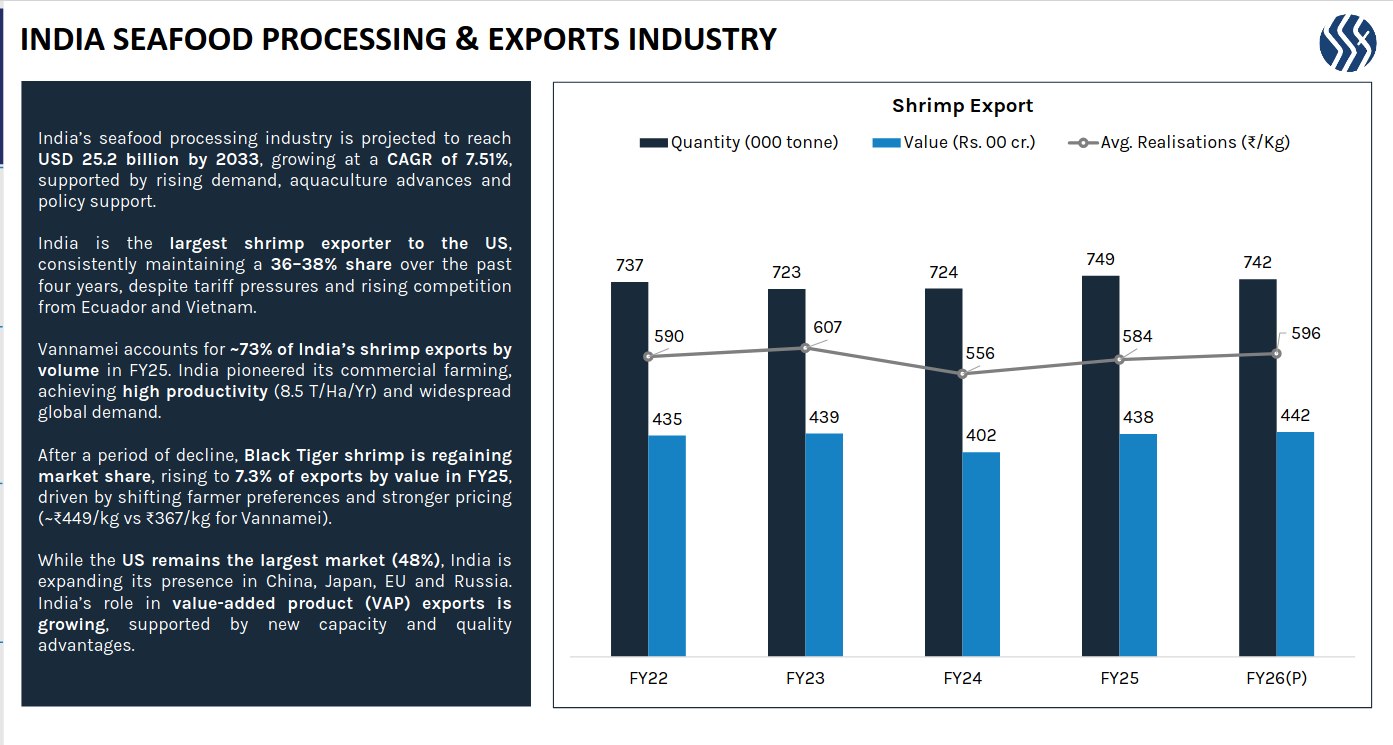

India’s seafood processing industry is projected to hit USD 25.2B by 2033 at a 7.5% CAGR, with shrimp exports dominating at ~73% of volumes. The US remains the largest buyer (48%), while India is expanding into China, Japan, EU, and Russia, aided by value-added products and rising Black Tiger shrimp share.

India’s aquaculture market is set to double from 14.4M to 28.8M tons by 2033 at a 7.6% CAGR. Key growth drivers include protein demand, climate impacts, tech adoption, cold chain/logistics, diversifying consumer preferences, and Andhra Pradesh’s dominance as an aquaculture hub.

The global aquaculture market will grow from 82.8M tons (2024) to 122.9M tons by 2033 at 4% CAGR. Growth is driven by rising protein demand, wild fish stock decline, pharma applications, middle-class consumption, and stronger cold chain networks.

Sheela Foam | Small Cap | FMCG

Sheela Foam is India's leading manufacturer and supplier of polyurethane (PU) foam and foam-based comfort products. Under the prominent Sleepwell brand, it sells mattresses, pillows, and other home comfort items, and also supplies technical and institutional foam.

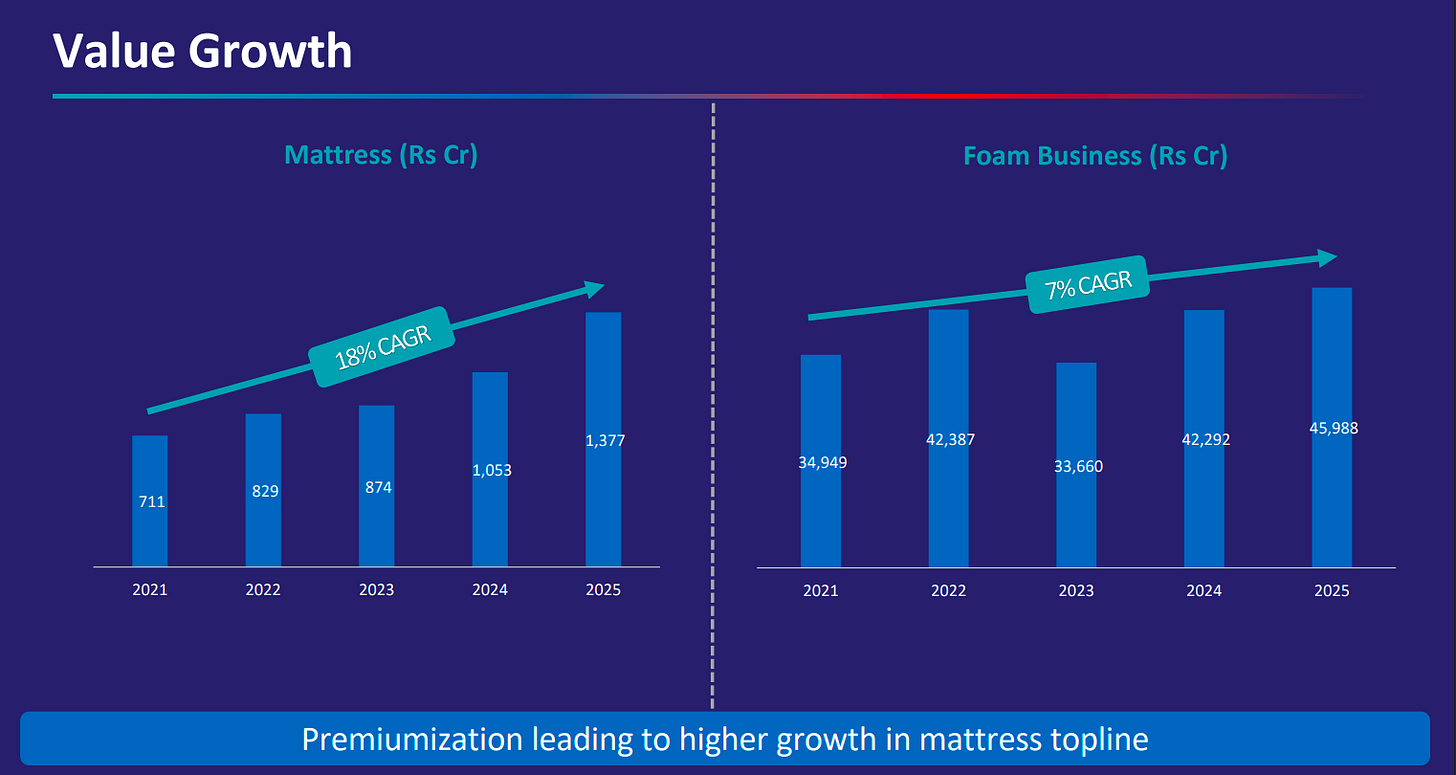

The mattress segment has grown rapidly at an 18% CAGR, rising from ₹711 crore in 2021 to ₹1,377 crore in 2025, outpacing the foam business which grew at 7% CAGR. Premiumization is driving stronger topline growth in mattresses compared to foam.

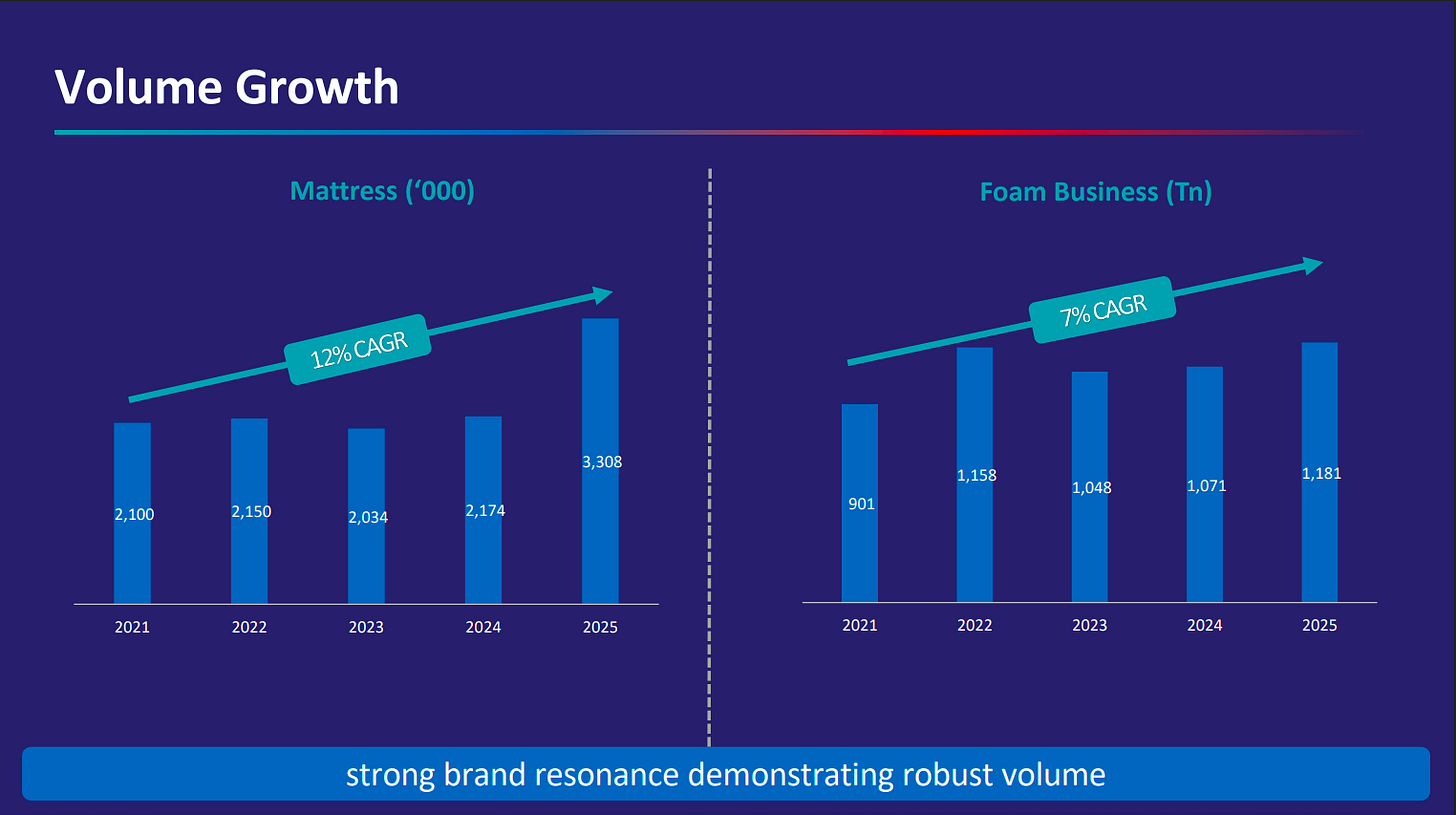

Mattress volumes have expanded at a 12% CAGR, increasing from 2.1 million units in 2021 to 3.3 million by 2025, showcasing strong brand resonance. Foam business volumes have grown more steadily at 7% CAGR, highlighting consistent but slower momentum.

The Indian modern mattress market is projected to double from ₹145–160 bn in 2024 to ₹270–300 bn by 2030, with the organized segment expected to rise from 30% to 45%. Growth is being fueled by e-commerce expansion, rising incomes, health awareness, and a clear shift toward premium and luxury segments.

Tourism & Hospitality

Indian Hotels | Large Cap | Tourism & Hospitality

Indian Hotels Company Limited (IHCL) is India's largest hospitality company, offering a diversified portfolio of hotels, resorts, palaces, and residences under brands like Taj, Vivanta, SeleQtions, Ginger, and Ama.

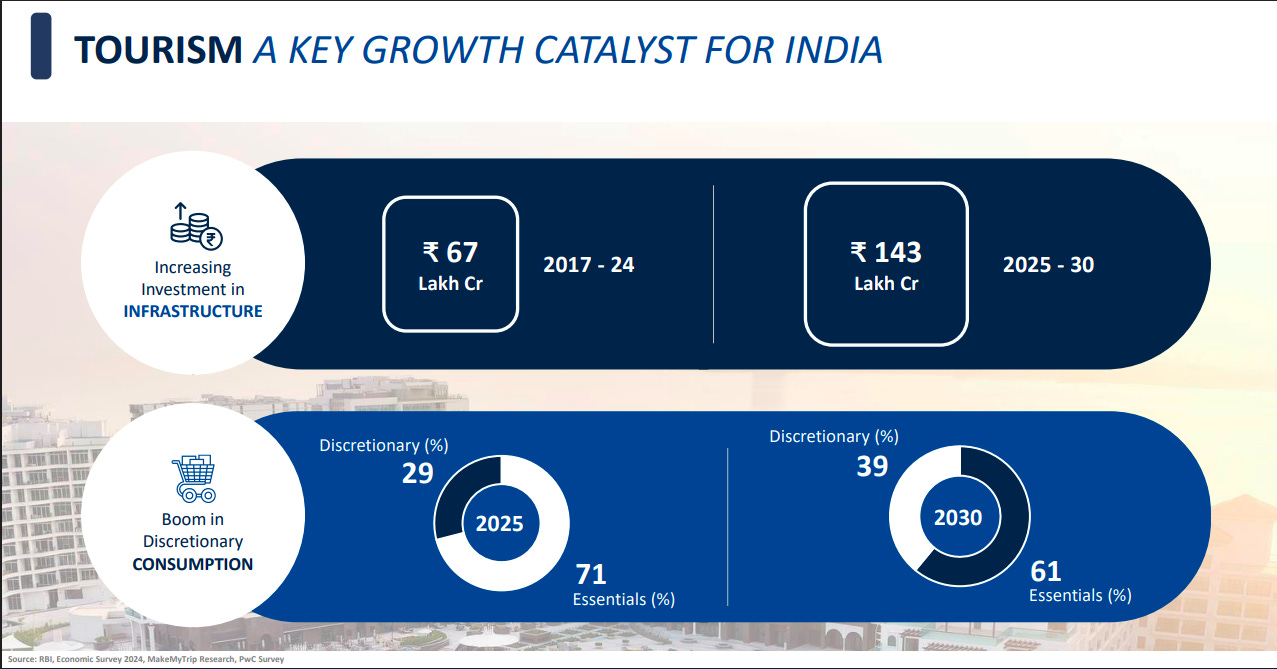

Tourism is positioned as a key driver for India’s economy, with infrastructure investment expected to more than double from ₹67 lakh crore (2017–24) to ₹143 lakh crore (2025–30). Rising discretionary consumption is set to increase from 29% in 2025 to 39% in 2030, highlighting growing consumer spending power.

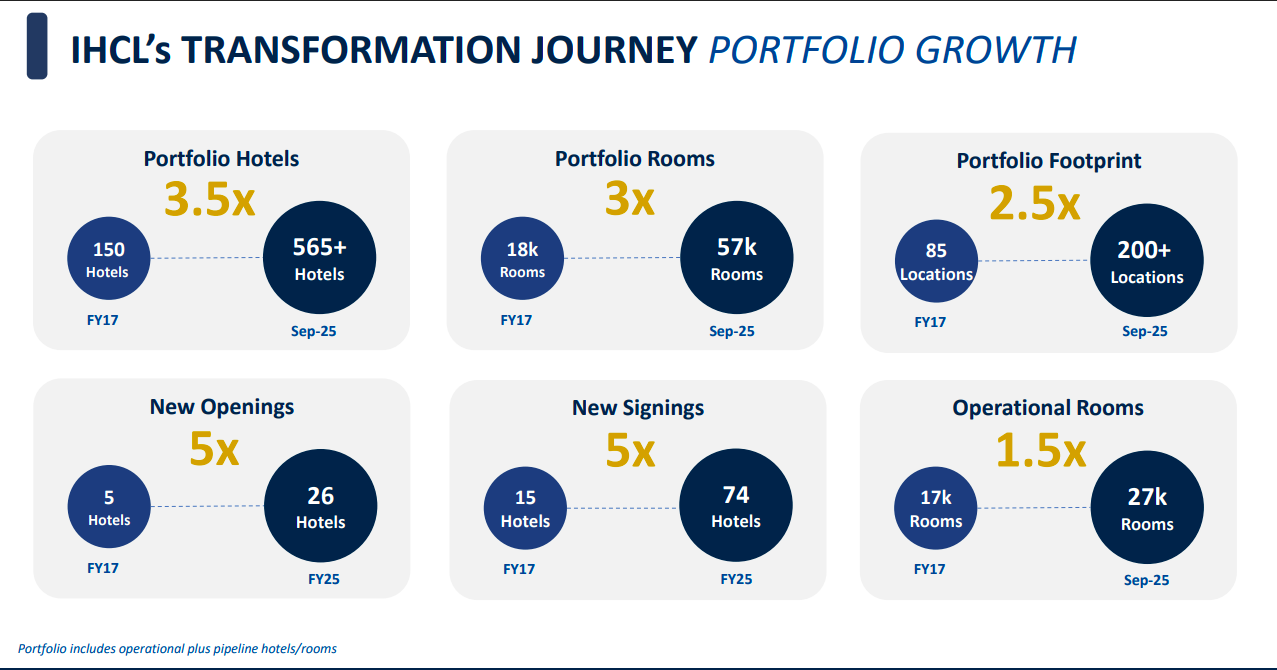

IHCL has expanded its portfolio from 150 hotels in FY17 to 565+ by Sep’25, with rooms tripling to 57k and footprint reaching 200+ locations. New hotel openings and signings have grown 5x, while operational rooms increased 1.5x, underscoring strong growth momentum.

TBO tek | Small Cap | Tourism & Hospitality

TBO Tek is a global B2B (business-to-business) travel distribution platform that connects travel suppliers (like hotels and airlines) with travel buyers (like travel agencies and tour operators) through its technology platform. The company provides a seamless system for discovering, booking, and transacting with global travel inventory, simplifying the complexities of the travel business for all parties involved.

TBO has positioned itself in the premium outbound travel space, a lucrative segment within the global travel market. Out of the $1.9 trillion global travel market, outbound travel accounts for $1.36 trillion, and within this, the premium outbound segment alone is worth $912 billion. By focusing on this niche, TBO is targeting a high-value, fast-growing portion of global travel demand.

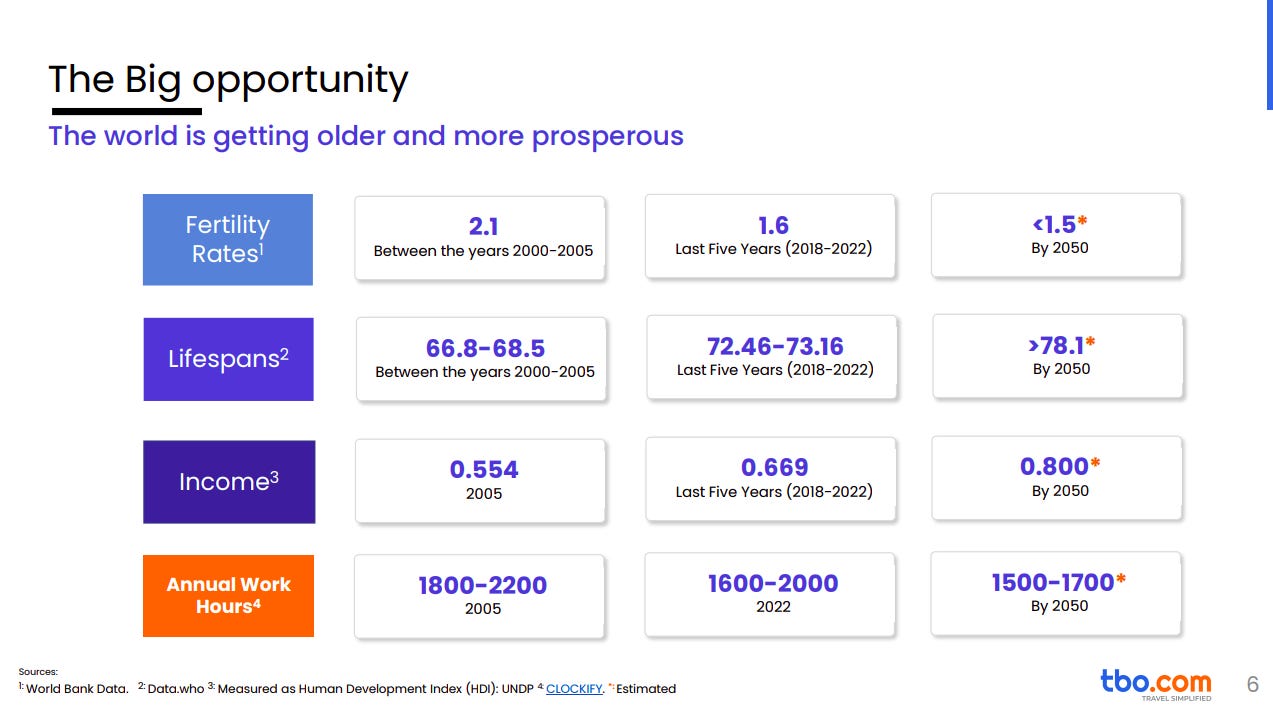

The world is undergoing a demographic and economic shift, creating a significant long-term opportunity for travel. Fertility rates are falling below replacement levels while lifespans are rising, with global life expectancy expected to exceed 78 years by 2050. At the same time, income levels measured by HDI are projected to rise to 0.8 by 2050 while work hours decline, meaning people will have more wealth, more free time, and a stronger desire to spend on experiences such as travel.

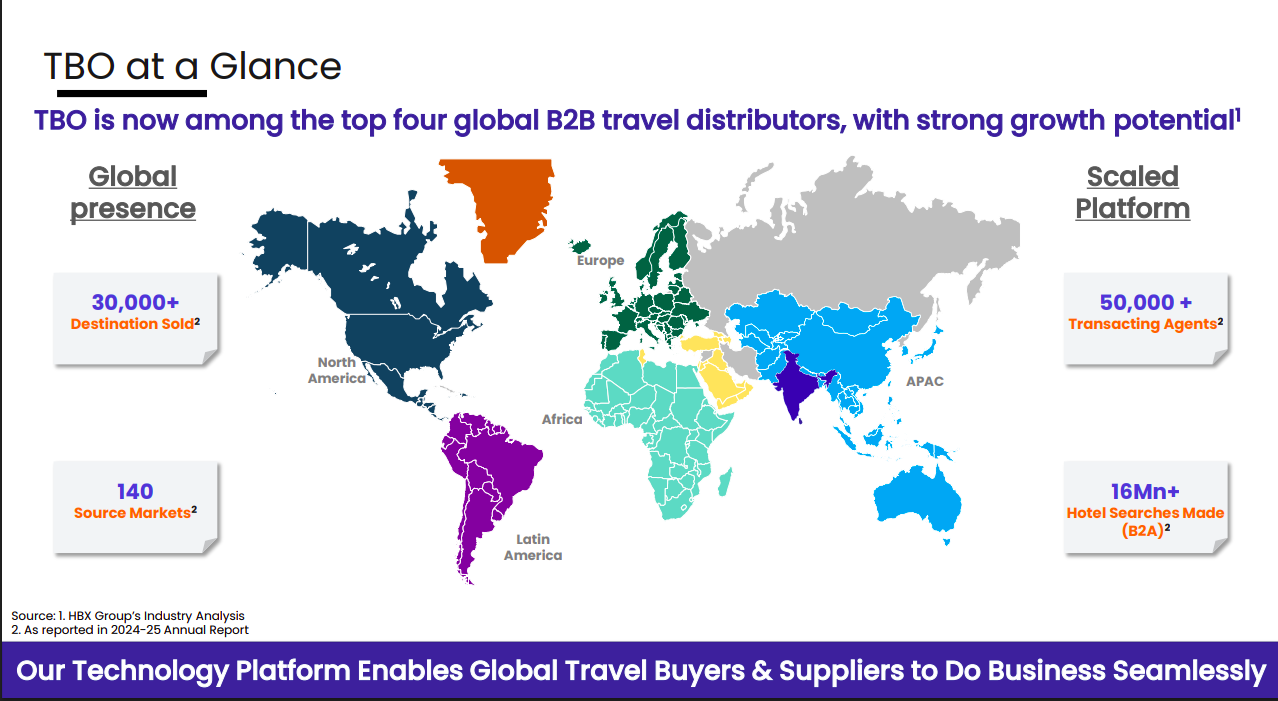

TBO has become one of the top four global B2B travel distributors with a strong and expanding platform. The company operates across 140 source markets, sells over 30,000 destinations, and is supported by a network of 50,000+ transacting agents. With more than 16 million hotel searches processed, TBO’s technology-driven model enables seamless connections between global travel buyers and suppliers, giving it significant scale and growth potential.

Energy

Ravindra Energy | Small Cap | Energy

Ravindra Energy is primarily involved in the solar energy sector, focusing on selling solar pumps, setting up ground-mounted and rooftop solar power generation plants, and generating and selling solar power. The company provides solar solutions for irrigation, petrol stations, and telecom towers.

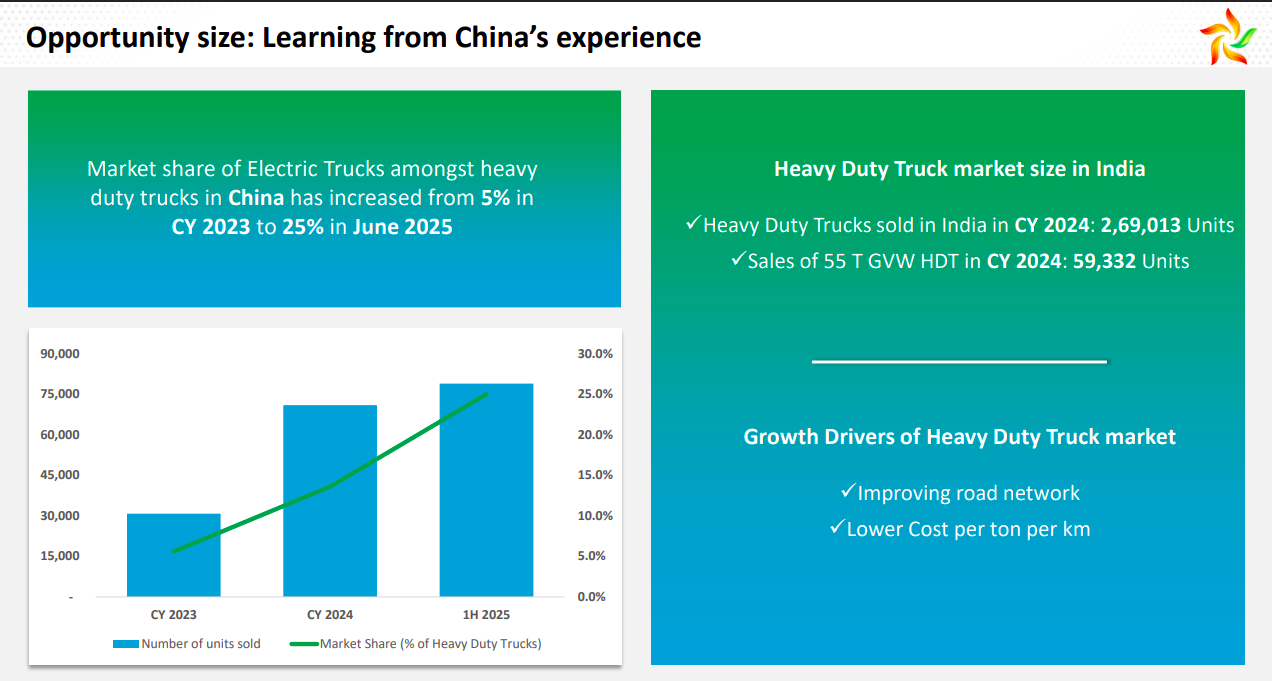

China’s electric truck share among heavy-duty trucks surged from 5% in 2023 to 25% by mid-2025, showing the rapid pace of adoption. In India, 2.69 lakh heavy-duty trucks were sold in 2024, including nearly 59,000 in the 55T category, with growth supported by better road infrastructure and lower transport costs.

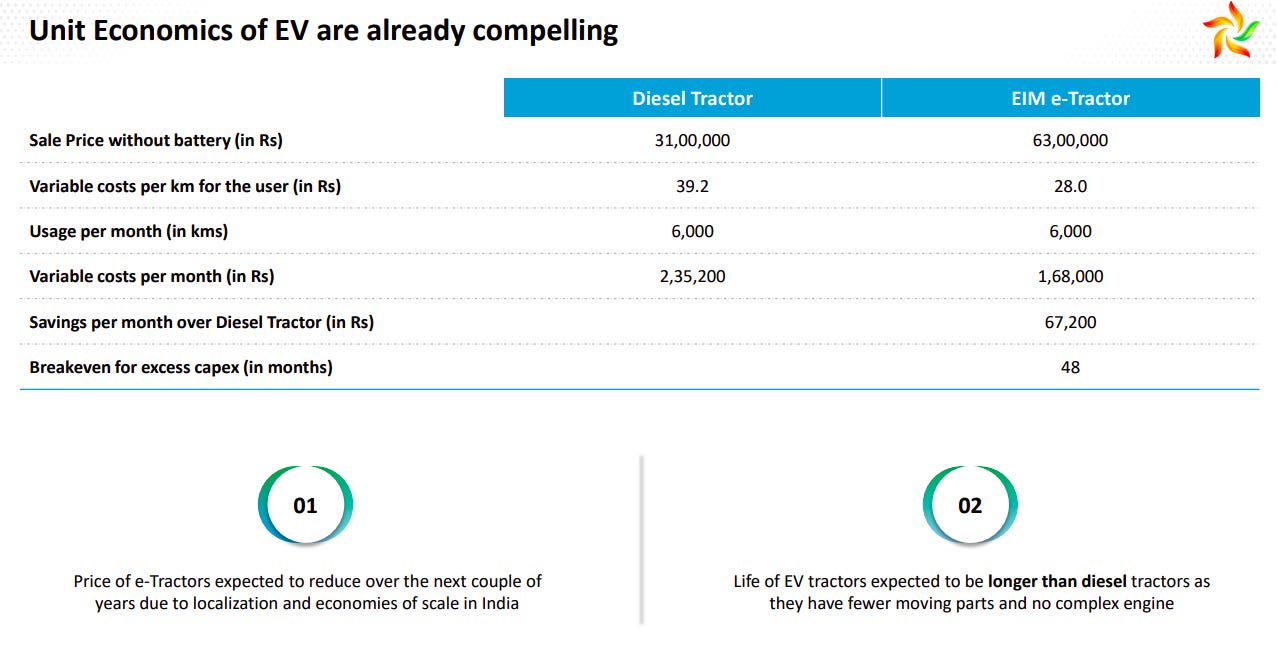

Despite higher upfront cost, EIM e-tractors offer lower running expenses at ₹28/km versus ₹39.2/km for diesel, saving operators ₹67,200 per month. This allows breakeven on the additional capex in just 48 months, with further benefits from localization and longer vehicle life.

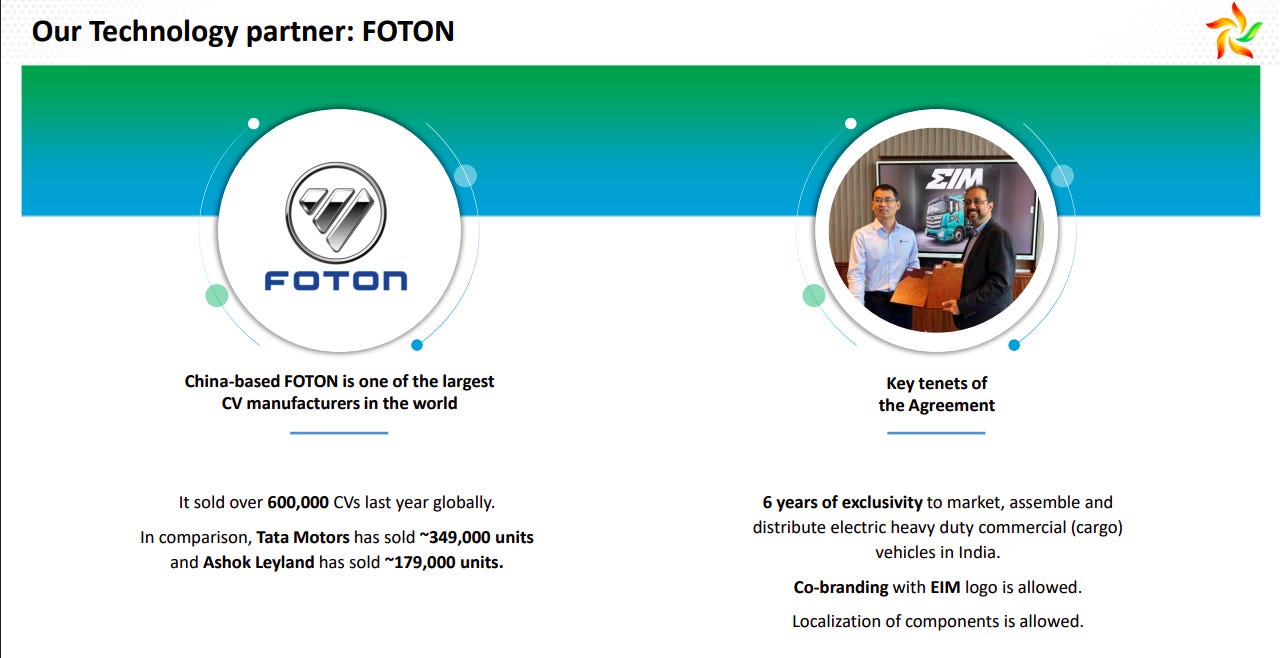

China’s FOTON, which sold over 600,000 commercial vehicles last year, has partnered with EIM, offering six years of exclusivity to assemble and distribute electric heavy-duty trucks in India. The deal allows co-branding, component localization, and leverages FOTON’s global scale compared to Indian peers like Tata Motors (349,000 units) and Ashok Leyland (179,000 units).

Metals

Jindal Steel | Large Cap | Metals

Jindal Steel is a major integrated producer of steel, with significant operations in the steel, mining, and power sectors, following a mine-to-metal business model. The company produces a wide range of steel products, including rails, structural steel, plates, and coils, for sectors like infrastructure and construction, and operates state-of-the-art facilities in India and abroad.

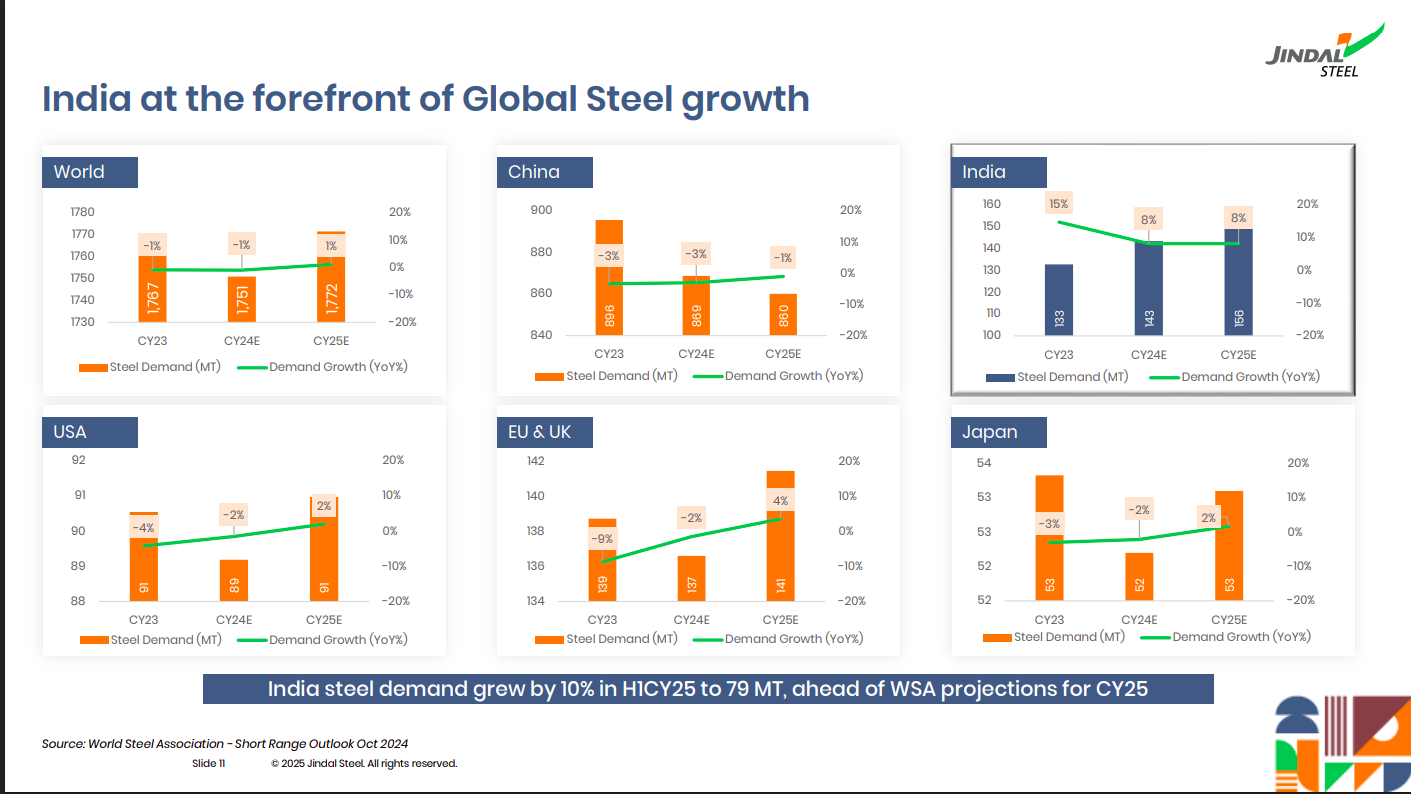

While global steel demand is largely flat and China continues to contract, India stands out with demand growth of 15% in 2023 and an estimated 8% CAGR through 2025. This makes India the key driver of global steel growth, even as developed markets like the US, EU, and Japan show sluggish or negative growth.

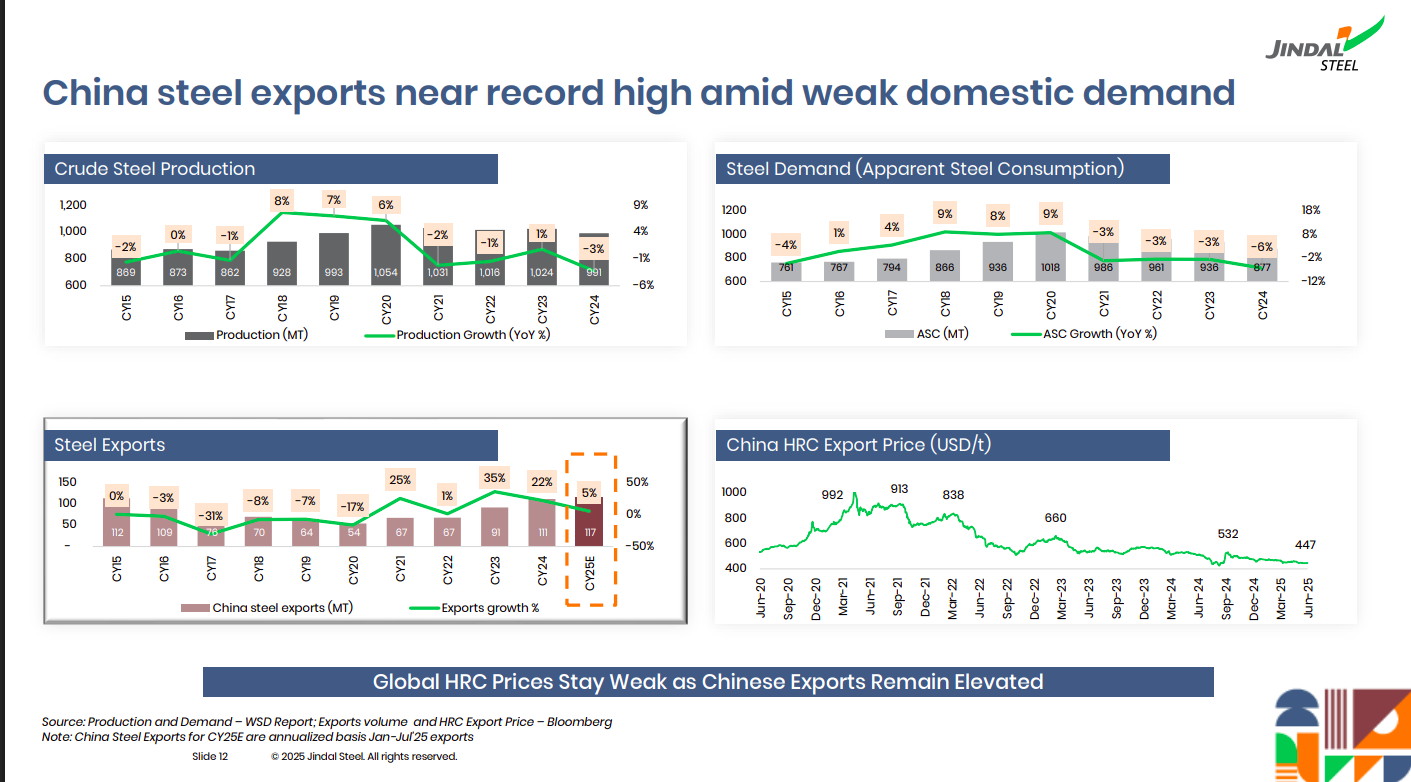

China’s domestic demand remains weak, with apparent steel consumption declining by 6% in 2024, pushing exports close to record highs of ~111 MT. Elevated exports have pressured global HRC prices, which have fallen sharply from over $900/t in 2021 to around $447/t by mid-2025.

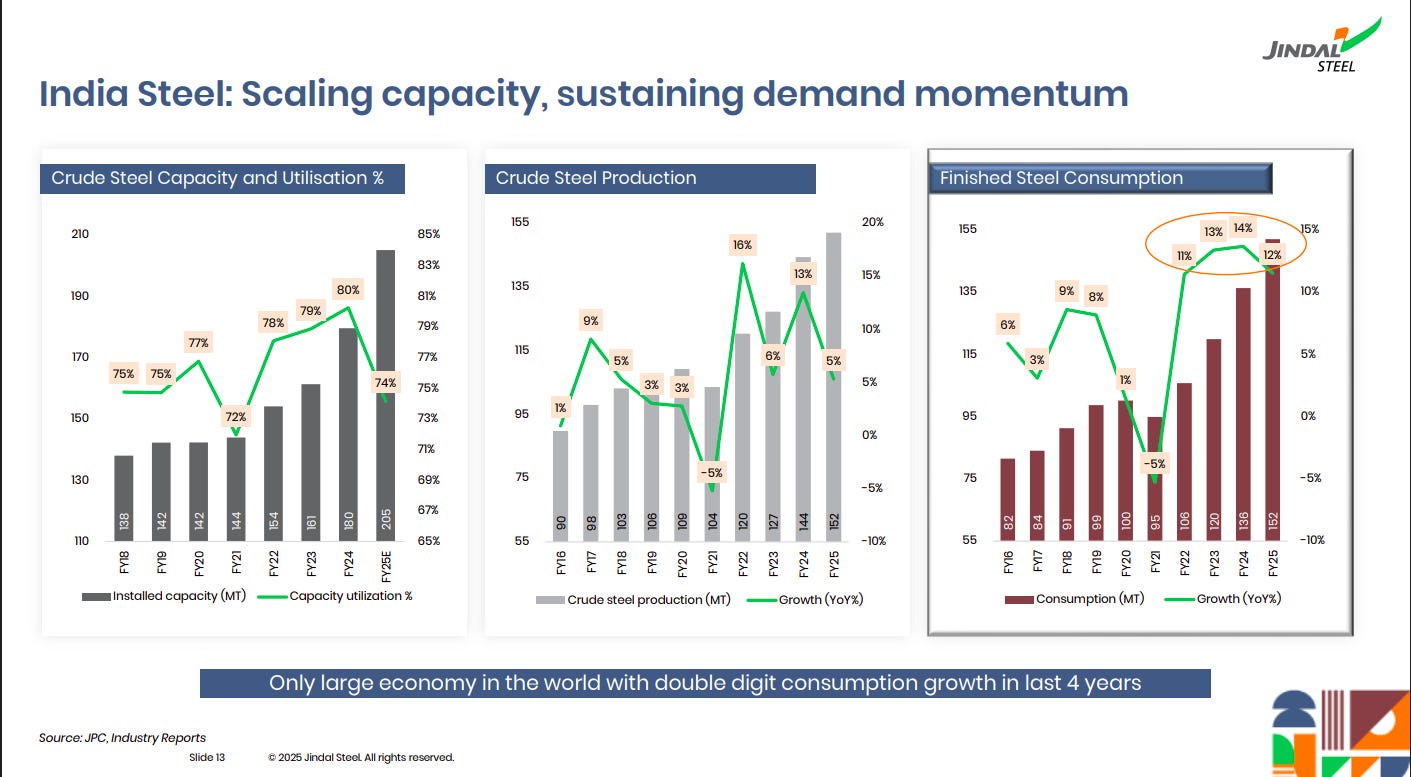

India has rapidly expanded crude steel capacity to 205 MT by FY25, with utilization levels around 74–80%. Finished steel consumption has grown at double digits for four consecutive years, reaching 152 MT in FY25, making India the only major economy sustaining such strong demand momentum.

Hind Copper | Small Cap | Metals

Hindustan Copper Limited (HCL), or "Hind Copper," is India's sole vertically integrated primary copper producer, engaged in the exploration, mining, beneficiation, smelting, and refining of copper ore and related products.

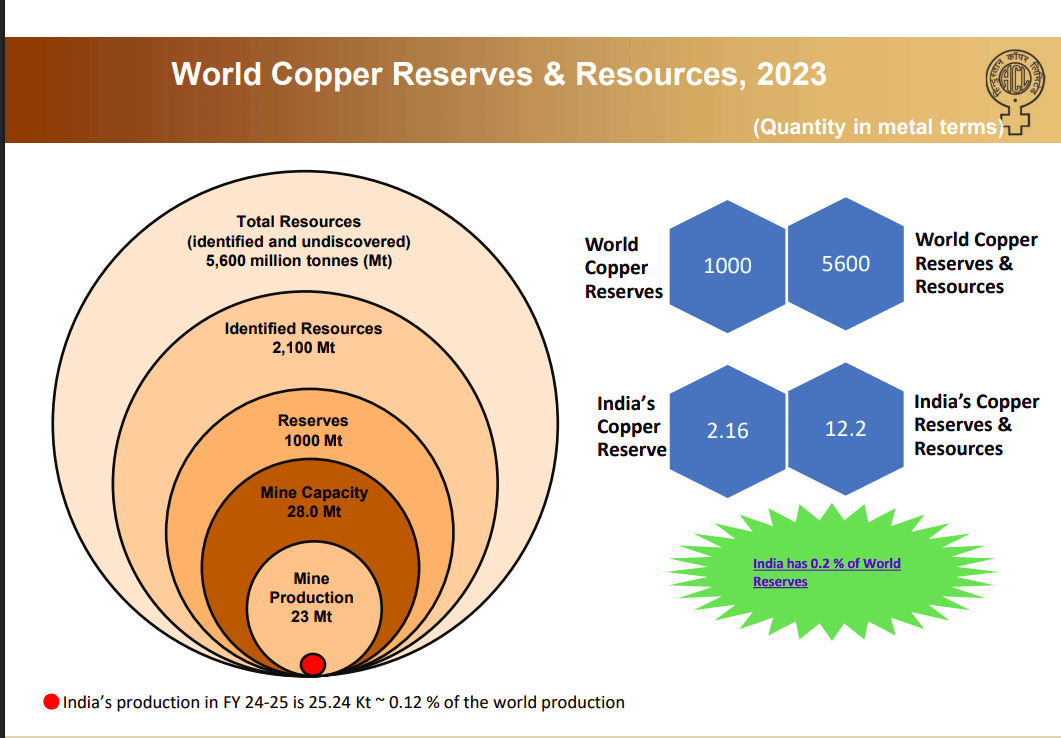

The world has around 1,000 million tonnes of copper reserves and 5,600 million tonnes of total resources, but India holds just 2.16 million tonnes, which is about 0.2% of global reserves. India’s copper reserves and resources together stand at 12.2 million tonnes, making its base extremely small compared to the world. Reflecting this, India’s copper production in FY25 is projected at only 25.24 Kt, a mere 0.12% of global output.

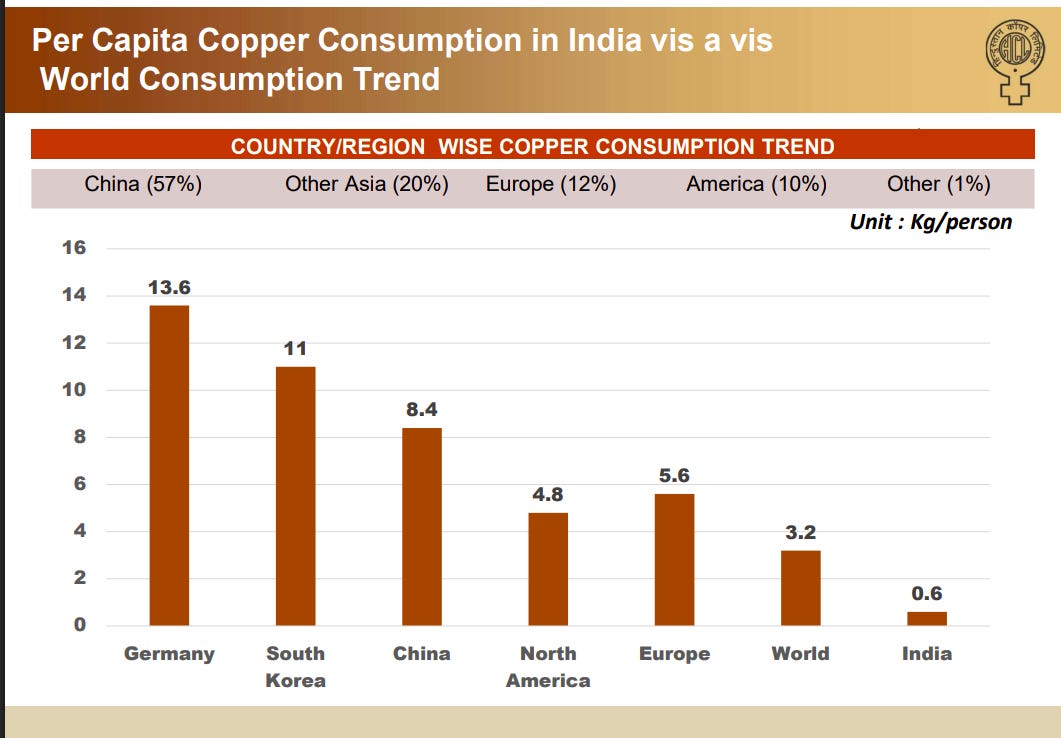

India’s per capita copper consumption is only 0.6 kg per person, far below the world average of 3.2 kg. In comparison, Germany consumes 13.6 kg, South Korea 11 kg, and China 8.4 kg per person, highlighting how underdeveloped India’s copper usage is. This gap shows the large growth potential for copper demand as India industrializes and urbanizes further.

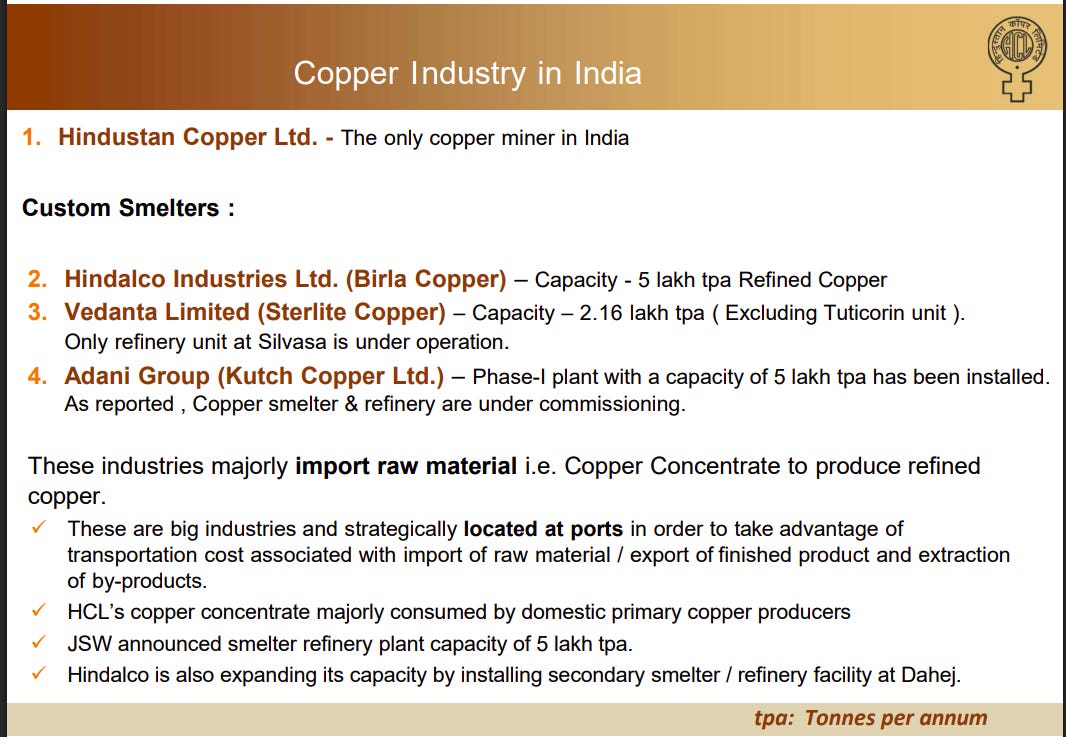

India’s copper mining is dominated by Hindustan Copper Ltd., the only domestic miner, while Hindalco, Vedanta, and Adani operate as custom smelters. These smelters largely rely on imported copper concentrate due to India’s limited reserves and are strategically located at ports to minimize logistics costs. With new capacity additions by players like Adani, Hindalco, and JSW, India is expanding its refining footprint even though raw material dependence remains high.

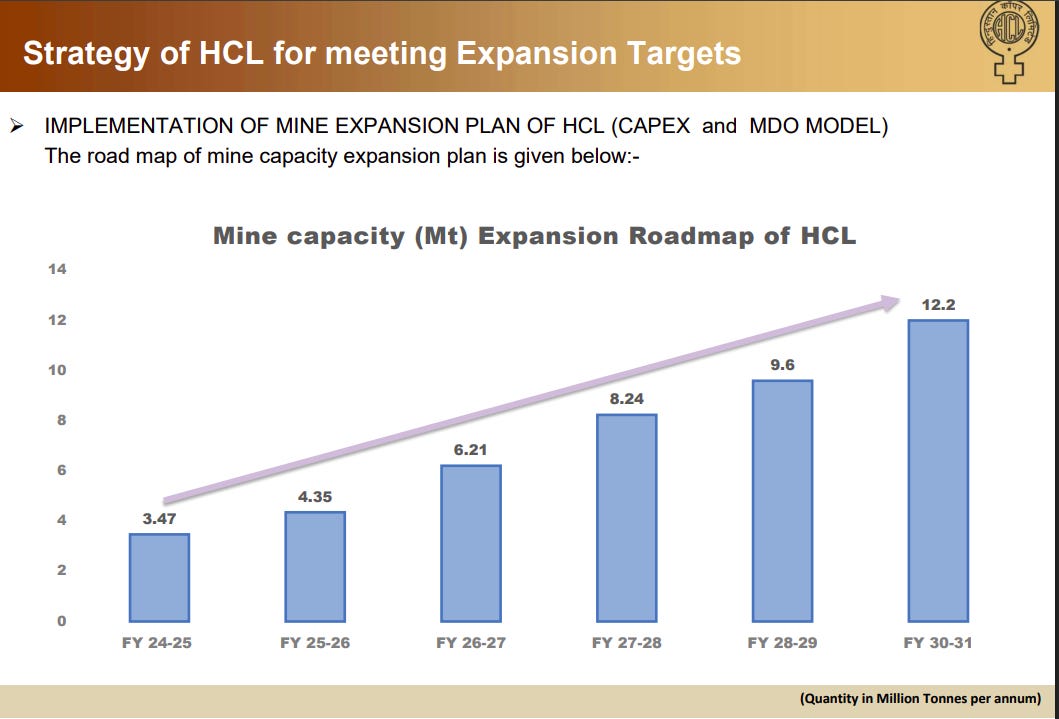

Hindustan Copper has laid out an ambitious expansion plan to scale its mine capacity from 3.47 million tonnes in FY25 to 12.2 million tonnes by FY31. This nearly fourfold increase will be achieved through significant capital expenditure and the use of mine developer-operator models. The strategy is aimed at strengthening India’s domestic copper supply base and reducing reliance on imports.

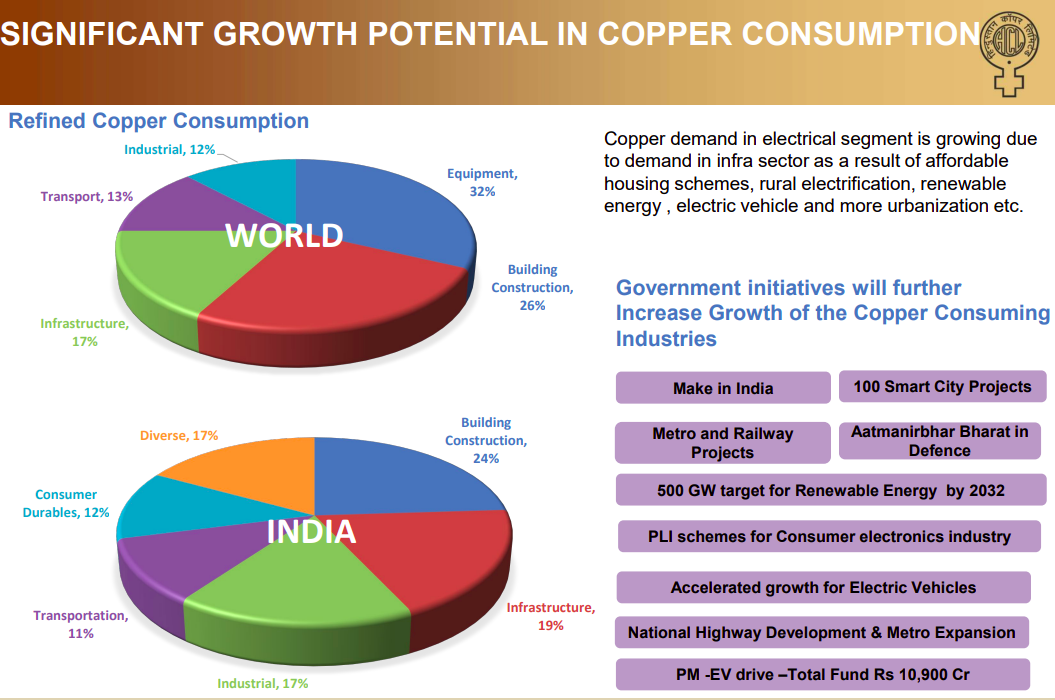

Globally, refined copper demand is concentrated in equipment and construction, while in India it is driven more by building, infrastructure, and industrial sectors. With the government pushing initiatives such as Make in India, Smart Cities, renewable energy, metro and railway projects, and EV adoption, India’s copper demand is set for rapid growth. These structural drivers highlight the long runway for copper consumption as the country modernizes and transitions towards clean energy.

Financial Services

Piramal Enterprises | Small Cap | Financial Services

Piramal Enterprises Limited is classified as a Non-Banking Finance Company - Middle Layer engaged in providing comprehensive financing solutions across various sectors including real estate and non-real estate verticals. The company offers wholesale and retail funding opportunities, housing finance, structured debt, senior secured debt, construction finance, and corporate lending.

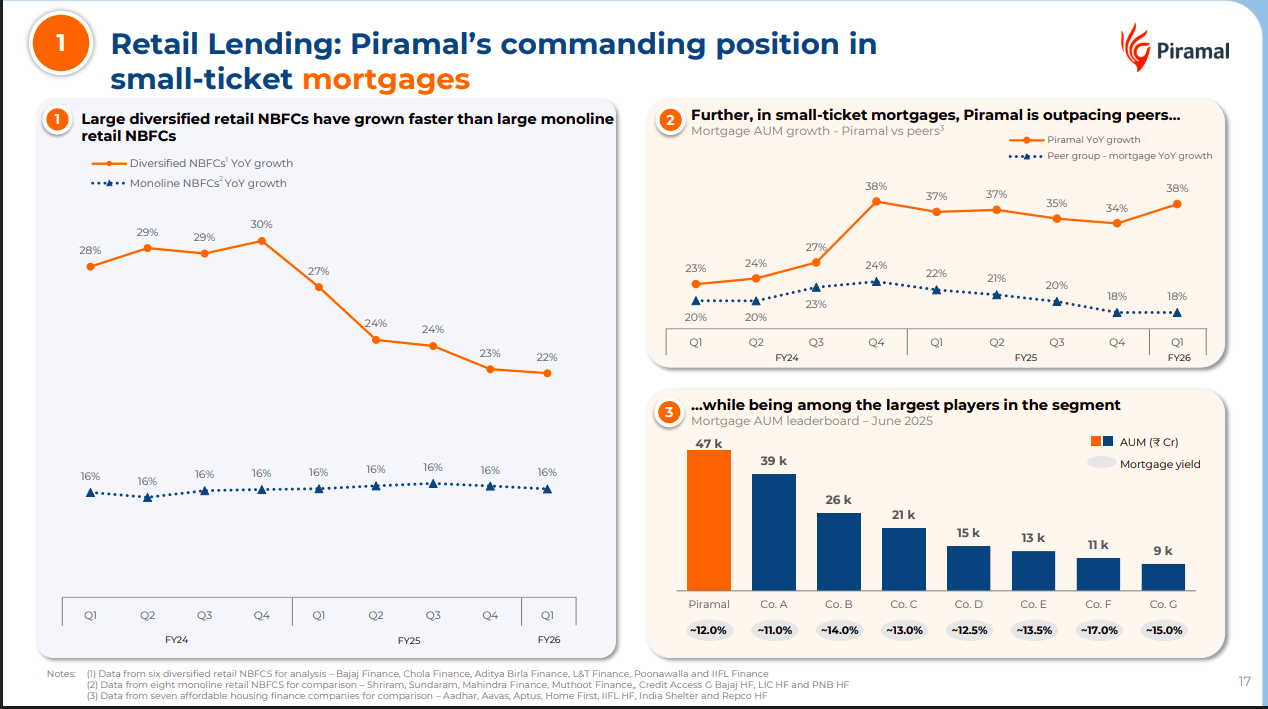

Piramal is outpacing peers in small-ticket mortgages, with AUM growth of 38% versus 18% for the peer group, positioning it among the largest players in the segment. With ₹47k crore mortgage AUM and yields around 12%, Piramal leads the pack against diversified NBFCs growing at slower rates.

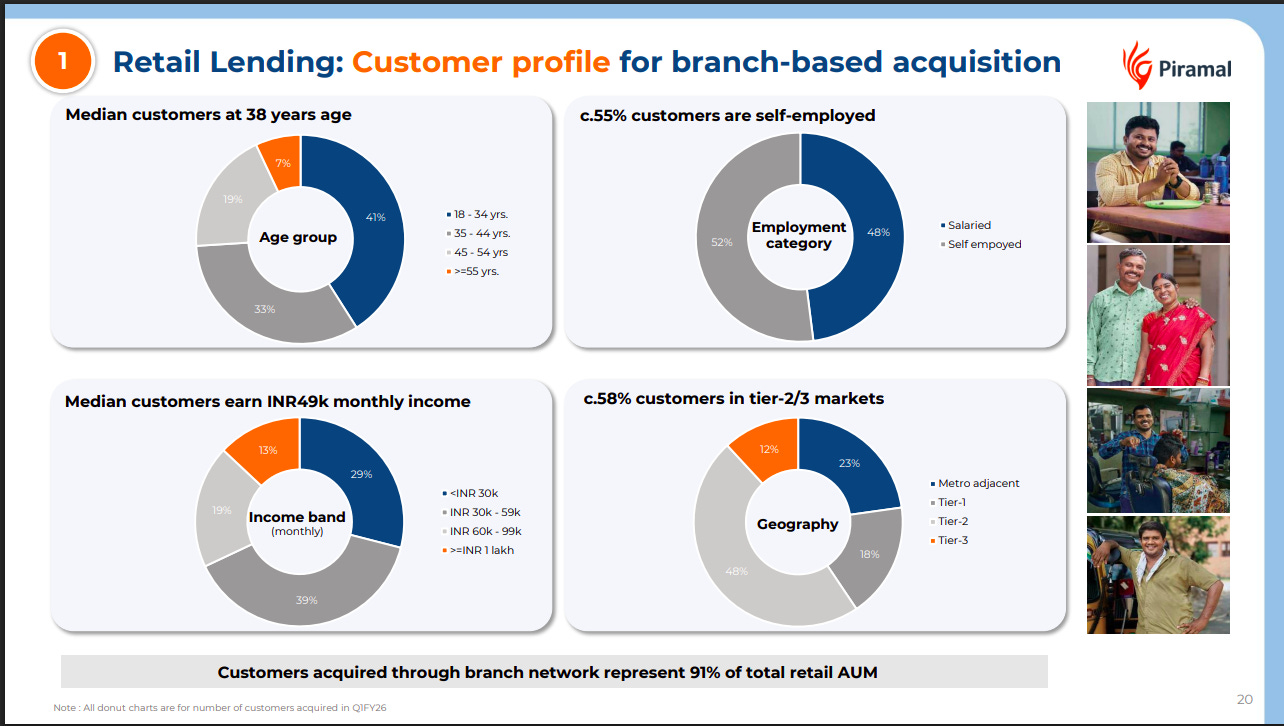

Piramal’s retail lending customers have a median age of 38, with 55% self-employed and a median income of ₹49,000 per month. About 58% are based in tier-2/3 markets, highlighting the company’s focus on underpenetrated geographies where branch-based acquisition drives 91% of its retail AUM.

Textiles

Bella Casa fashions | Micro Cap | Textiles

Bella Casa Fashion & Retail are engaged in the business of manufacturing of Bed sheets, Quilts, other home furnishing textile items, printed/dyed furnishing fabrics and garments.

India’s fast fashion industry is at an inflection point, projected to grow from about USD 10 billion in FY24 to USD 50 billion by FY31, clocking a CAGR of over 25%. While overall fashion retail expanded just 6% in FY24, fast fashion outpaced the market with robust annual growth of 30–40%. Bella Casa has strategically pivoted so that over 90% of its business now comes from apparel ODM, leveraging strengths in rapid design, lean manufacturing, timely delivery, and responsiveness to trends. With a production capacity of 2 crore pieces annually, strong working capital discipline, and ongoing modernization, the company is well positioned to meet rising demand and execute efficiently at scale.

Auto Ancillary

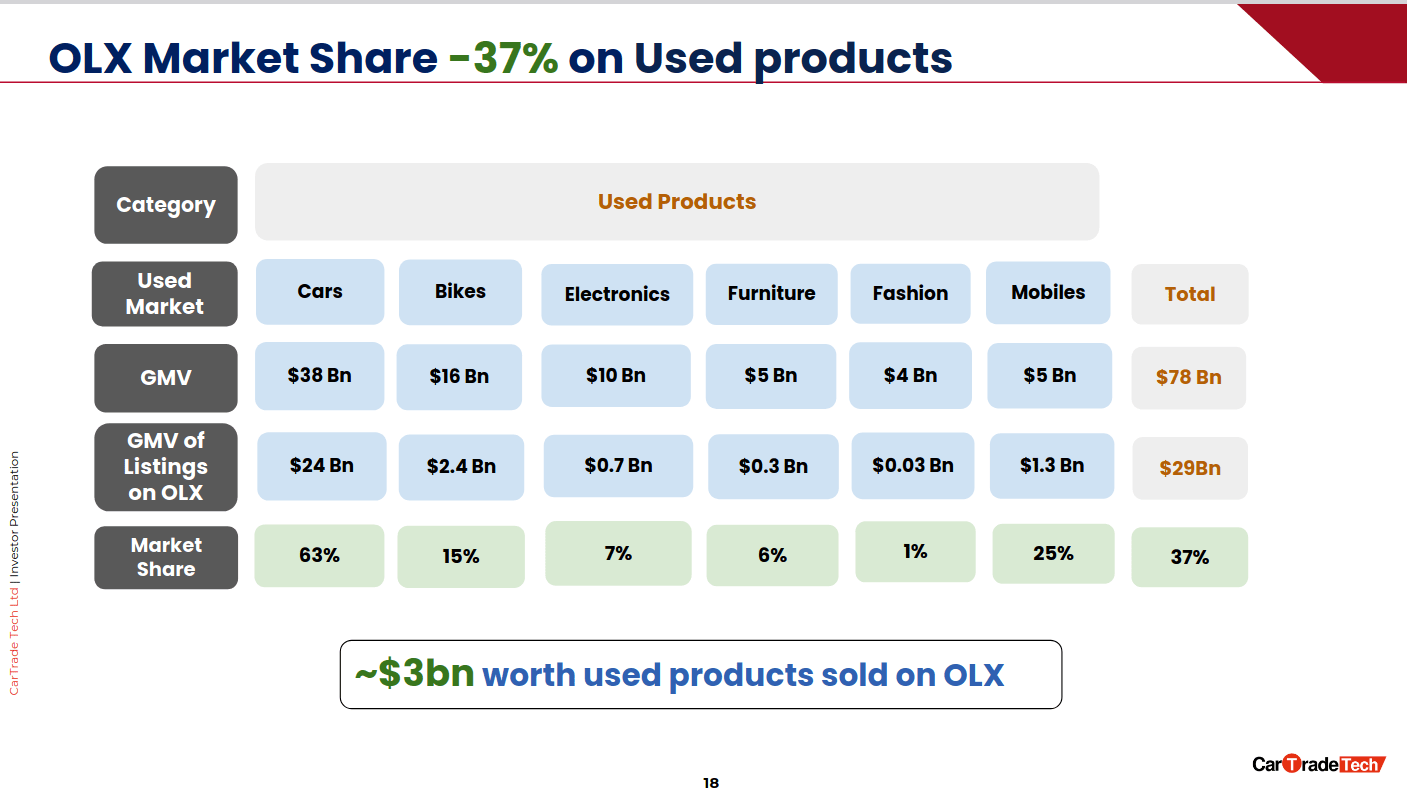

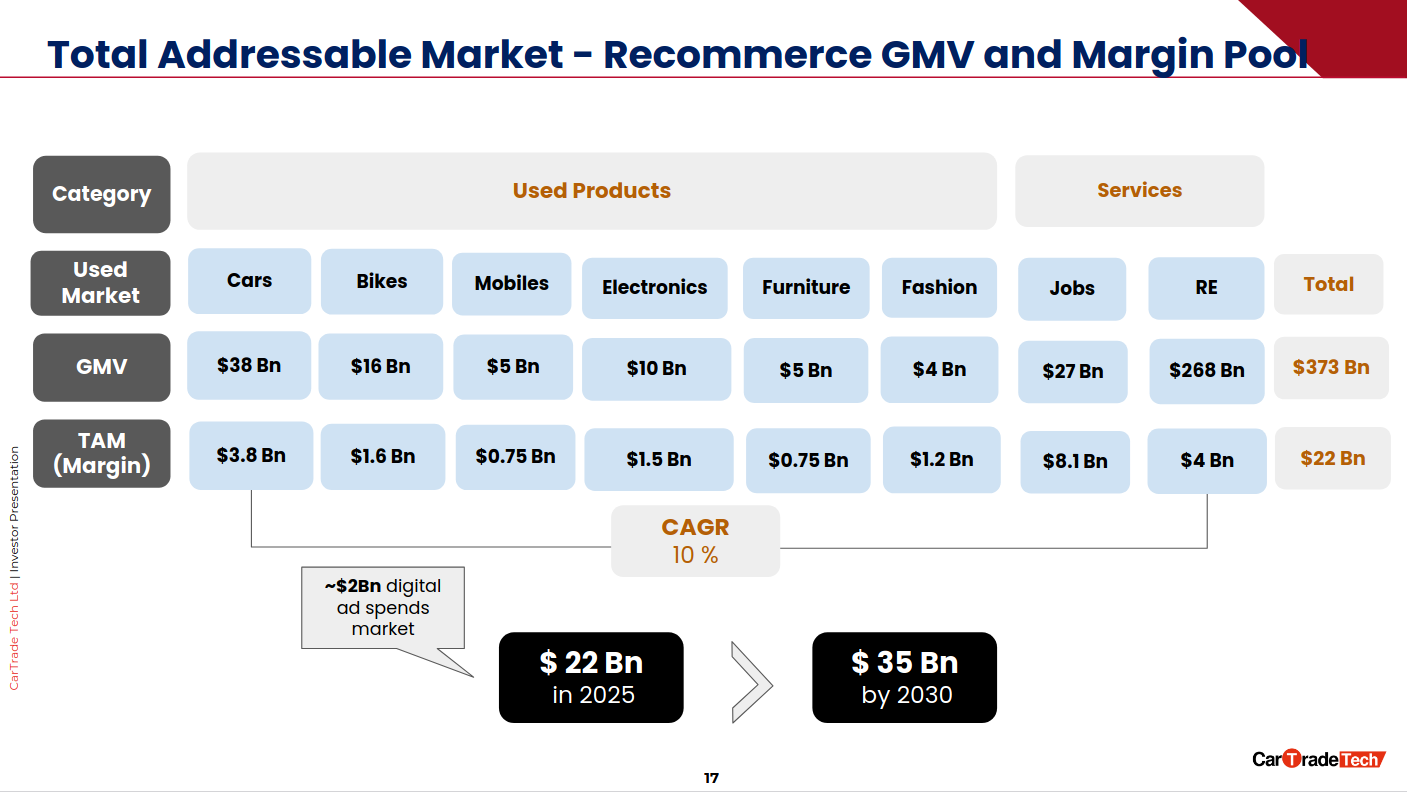

Car trade | Small Cap | Auto Ancillary

CarTrade Tech is a multi-channel online platform provider for the automotive industry, connecting buyers and sellers of new and used vehicles through its brands like CarWale, CarTrade, and BikeWale. It offers a digital ecosystem that facilitates various automotive transactions, including buying, selling, financing, and marketing.

[Presentation (1)] [Presentation (2)]

Google Auto searches grew 41% between April 2024 and August 2025, but CarWale and BikeWale outperformed with 57% traffic growth. Platforms are benefiting from being referenced as authoritative sources by ChatGPT and Google AI, making them important traffic hubs.

OLX accounts for $29B of the $78B used products market, giving it a 37% share. Its strength lies in cars with a 63% share, while bikes, mobiles, and electronics contribute smaller but notable portions, with overall sales crossing ~$3B on the platform.

The recommerce market stands at $373B GMV with $22B margin pools, expected to grow at 10% CAGR to $35B by 2030. Cars, jobs, and real estate dominate margin opportunities, alongside a ~$2B digital ad spend market supporting platform monetization.

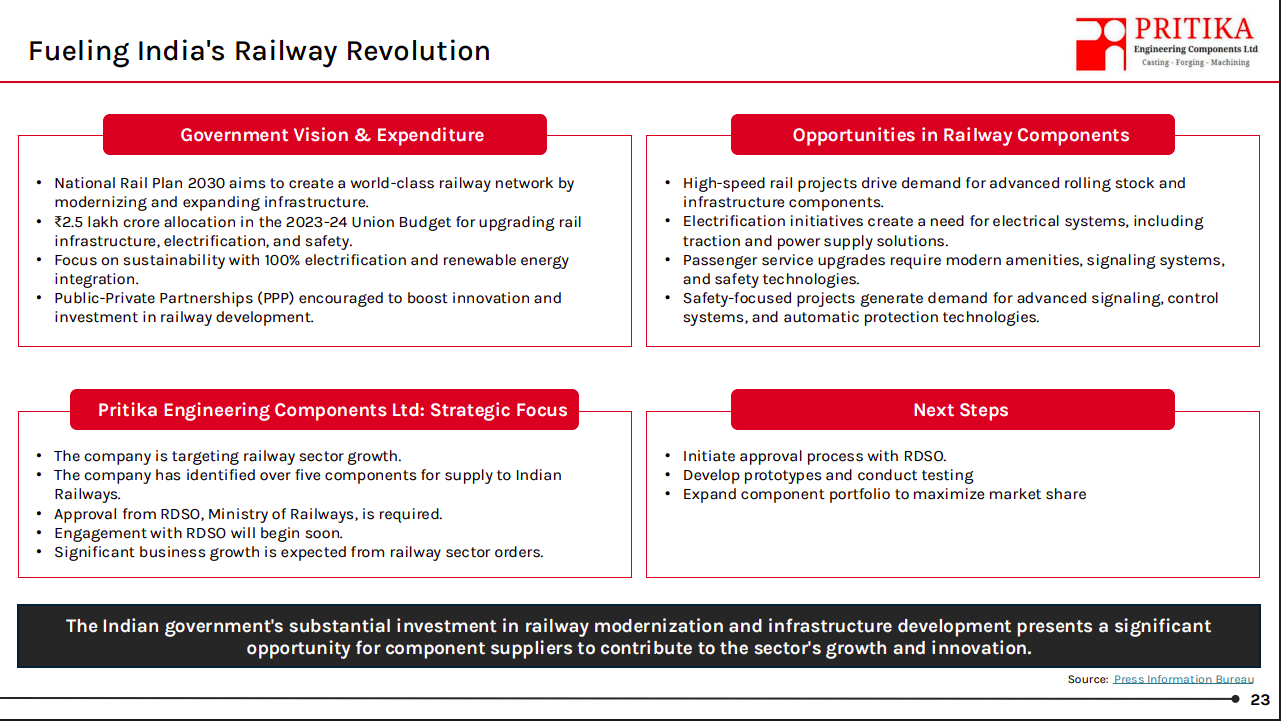

Pritika Engineering | Nano Cap | Auto Ancillary

Pritika Engineering is a leading manufacturer of precision-machined components and castings, particularly for the tractor, commercial vehicle, and industrial sectors.

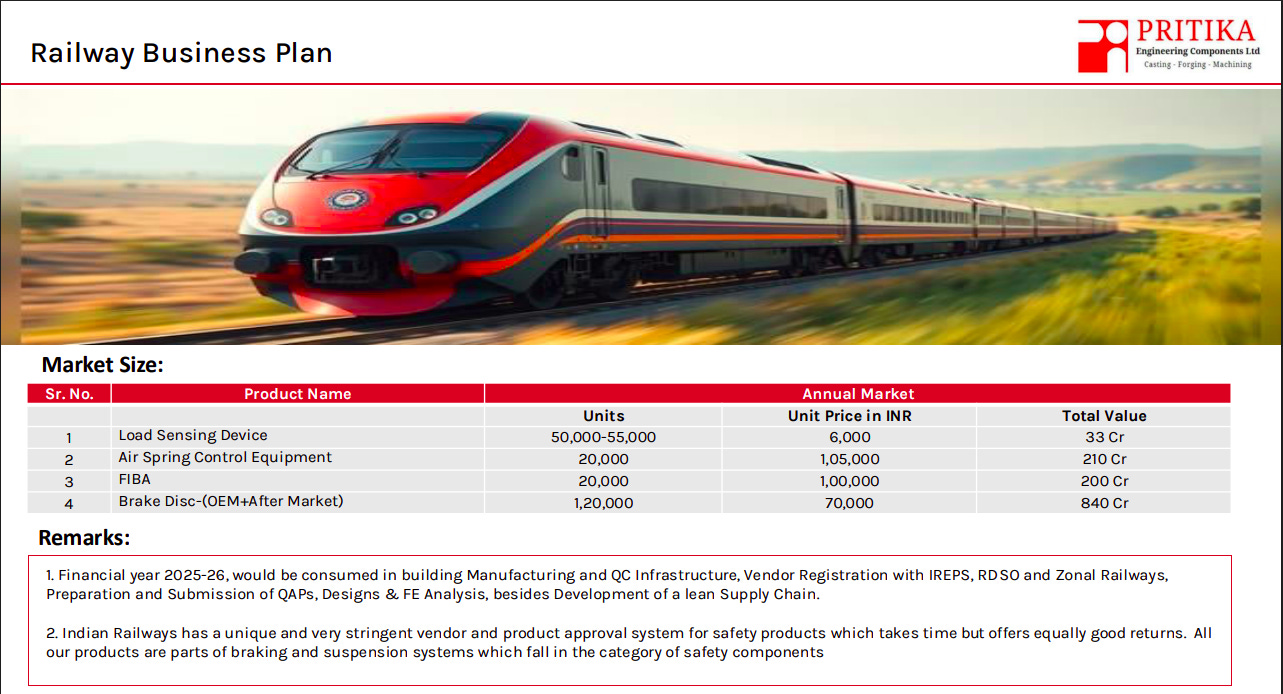

The Indian government’s ₹2.5 lakh crore railway modernization push, with 100% electrification and PPP-driven innovation, is creating strong demand for advanced components. Pritika Engineering is targeting this opportunity with multiple products for Indian Railways, aiming to scale through RDSO approvals, prototyping, and portfolio expansion.

Pritika’s railway product portfolio, including load sensing devices, air spring control equipment, FIBA, and brake discs, represents an annual market opportunity of over ₹1,280 crore. While the stringent vendor approval process will take time, these safety-critical components ensure sustainable long-term growth once approved.

Telecom

Vodafone Idea | Mid Cap | Telecom

Vodafone Idea (Vi) is an Indian telecom company that provides voice and data services, including 2G, 3G, 4G, and 5G connectivity, to individual consumers and businesses. The company offers a range of mobile services, digital solutions, and entertainment content under its brand name "Vi".

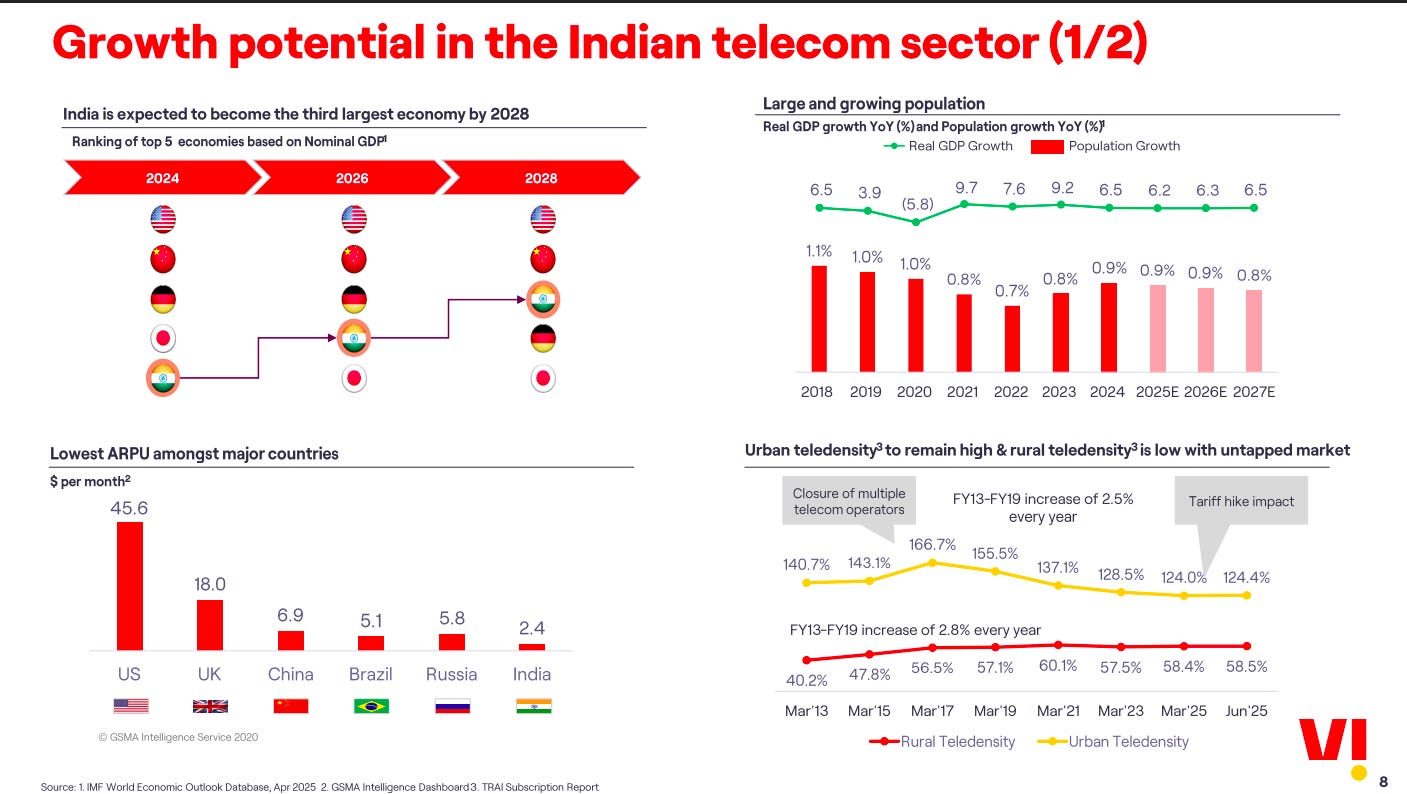

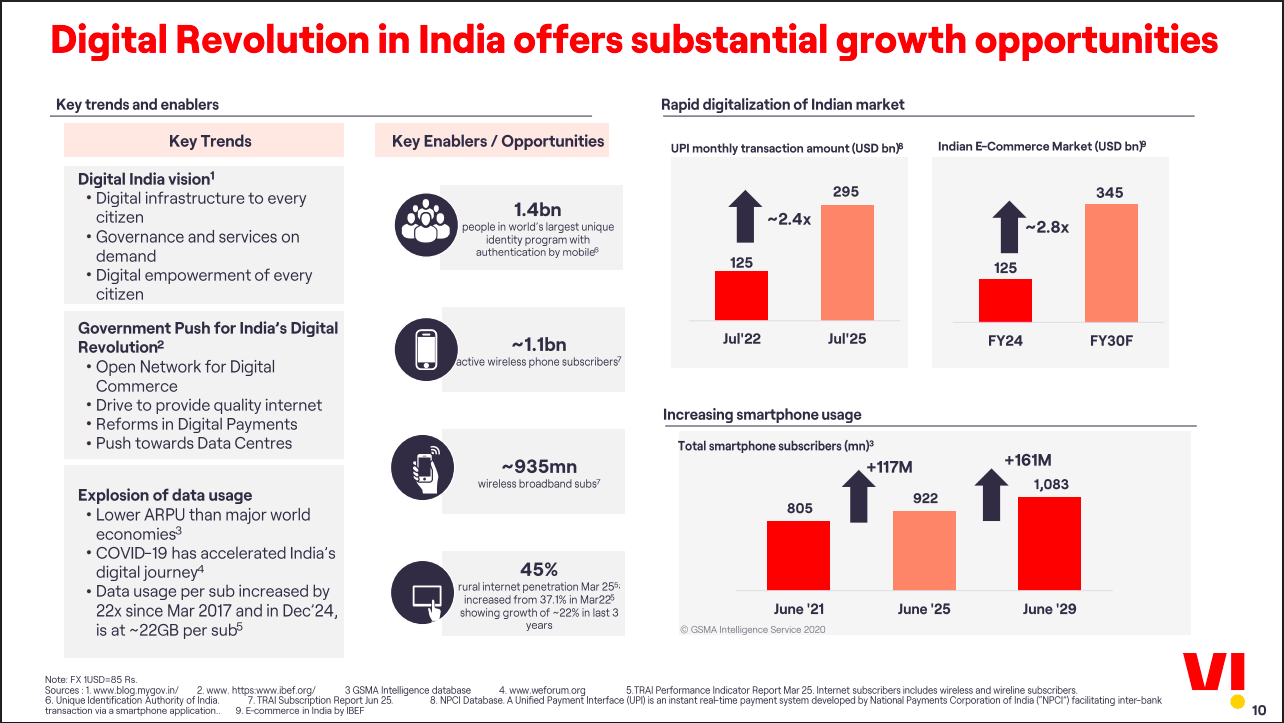

India is set to become the world’s third-largest economy by 2028, with strong GDP and population growth underpinning telecom demand. Despite being one of the lowest ARPU markets globally, rural tele-density remains underpenetrated, offering significant headroom for growth.

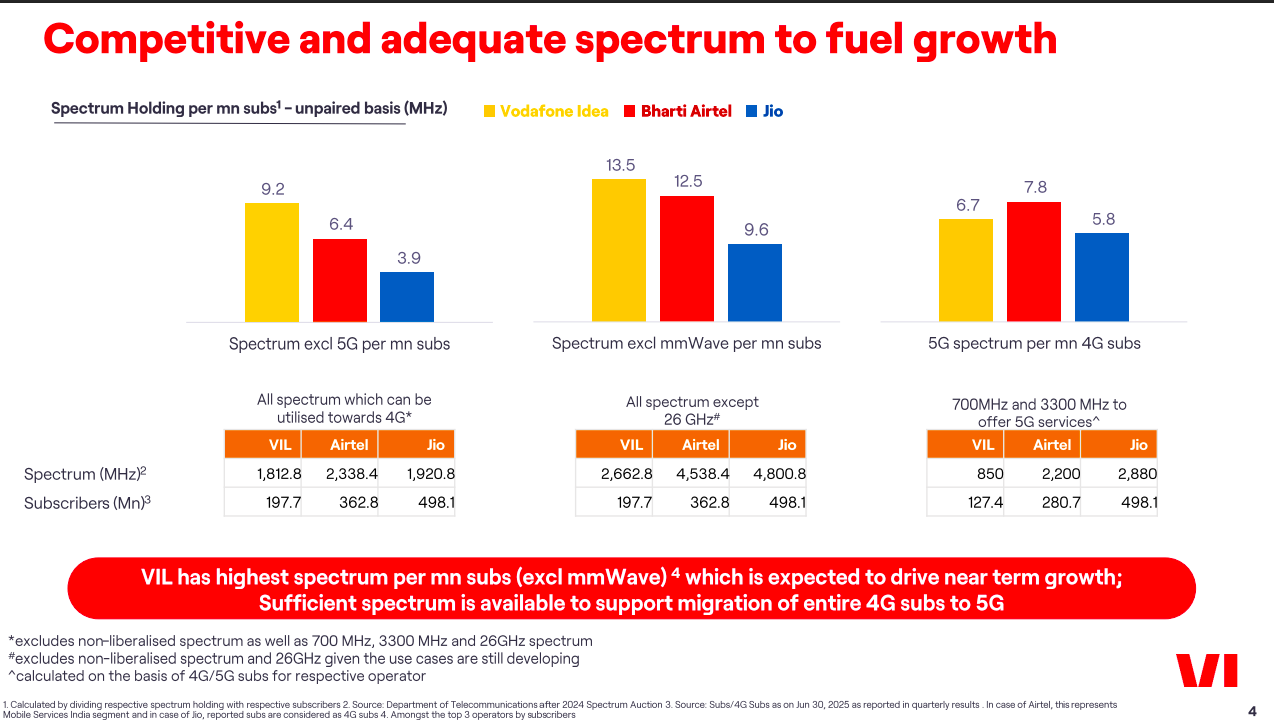

Vodafone Idea holds the highest spectrum per subscriber (excl. mmWave), giving it a strong base to migrate 4G users to 5G. Adequate spectrum across operators ensures competitiveness, with VIL positioned to leverage its relative spectrum strength for near-term growth.

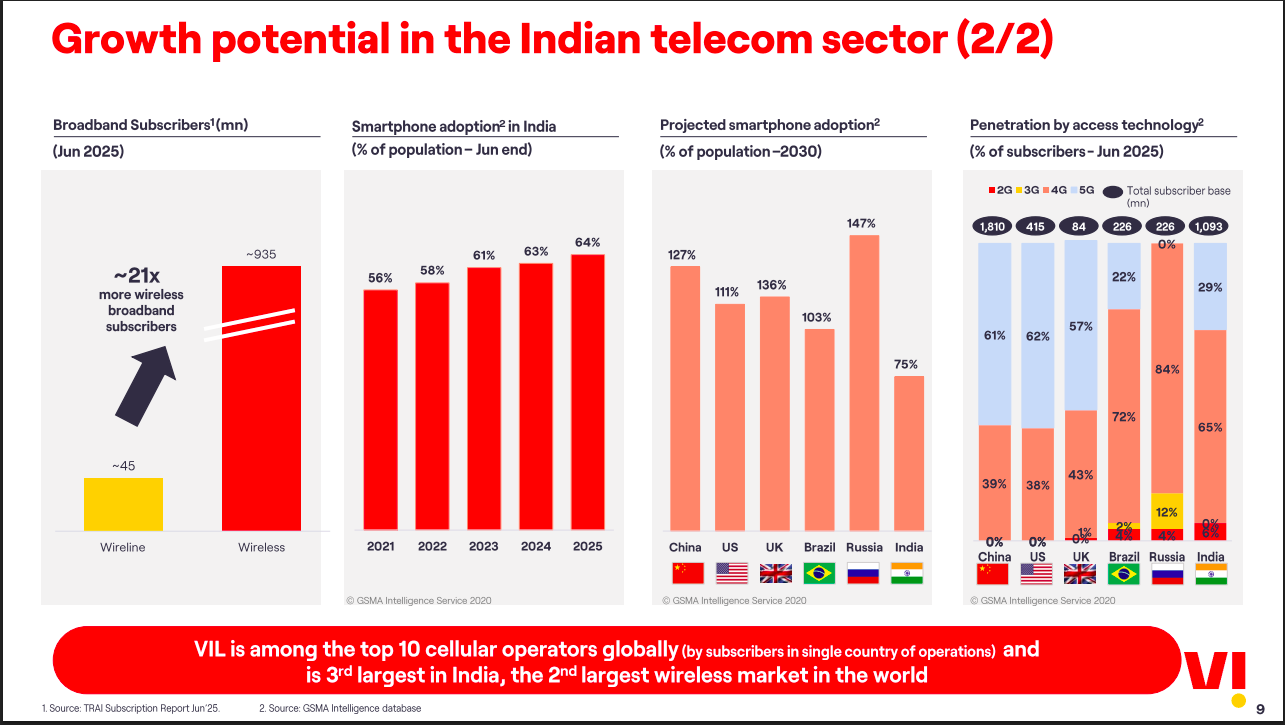

India’s ~935M wireless broadband users dwarf wireline subscribers by 21x, with smartphone adoption expected to climb from 64% in 2025 to 75% by 2030. The country’s shift to 4G/5G and rising smartphone penetration will drive continued expansion in the telecom market.

Government initiatives like Digital India, ONDC, and digital payments reforms are accelerating connectivity and data usage, with mobile data consumption up 22x since 2017. UPI transactions and e-commerce are scaling rapidly, while smartphone users are projected to rise by over 275M between 2021–2029.

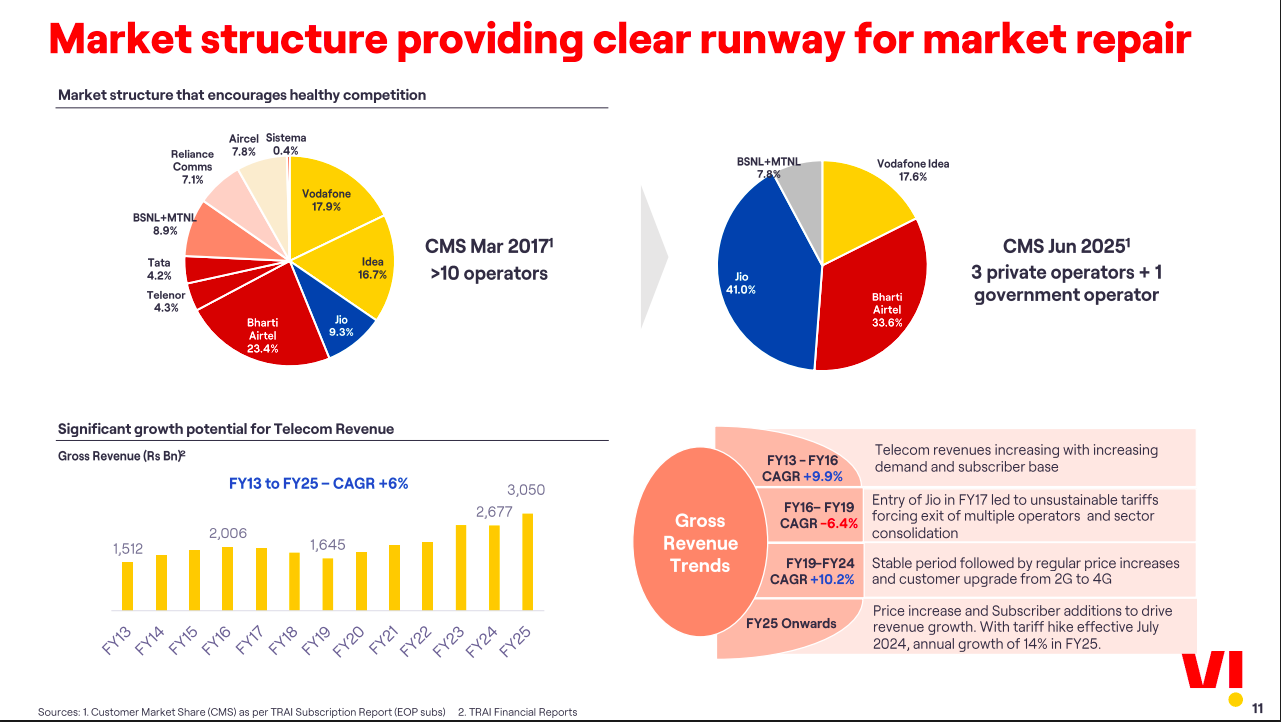

India’s telecom sector has consolidated from 10+ operators in 2017 to just 3 private players and 1 government operator by 2025. Revenues have rebounded post-consolidation, growing at 10% CAGR since FY19, with tariff hikes and 4G/5G upgrades expected to drive further growth.

Engineering & Capital Goods

Centrum Electronics | Small Cap | Engineering & Capital Goods

Centum Electronics is an Indian Electronics System Design and Manufacturing (ESDM) company that designs, manufactures, and exports electronic products and systems for critical applications in the Defence, Space, Aerospace, Industrial, Medical, and Communications sectors.

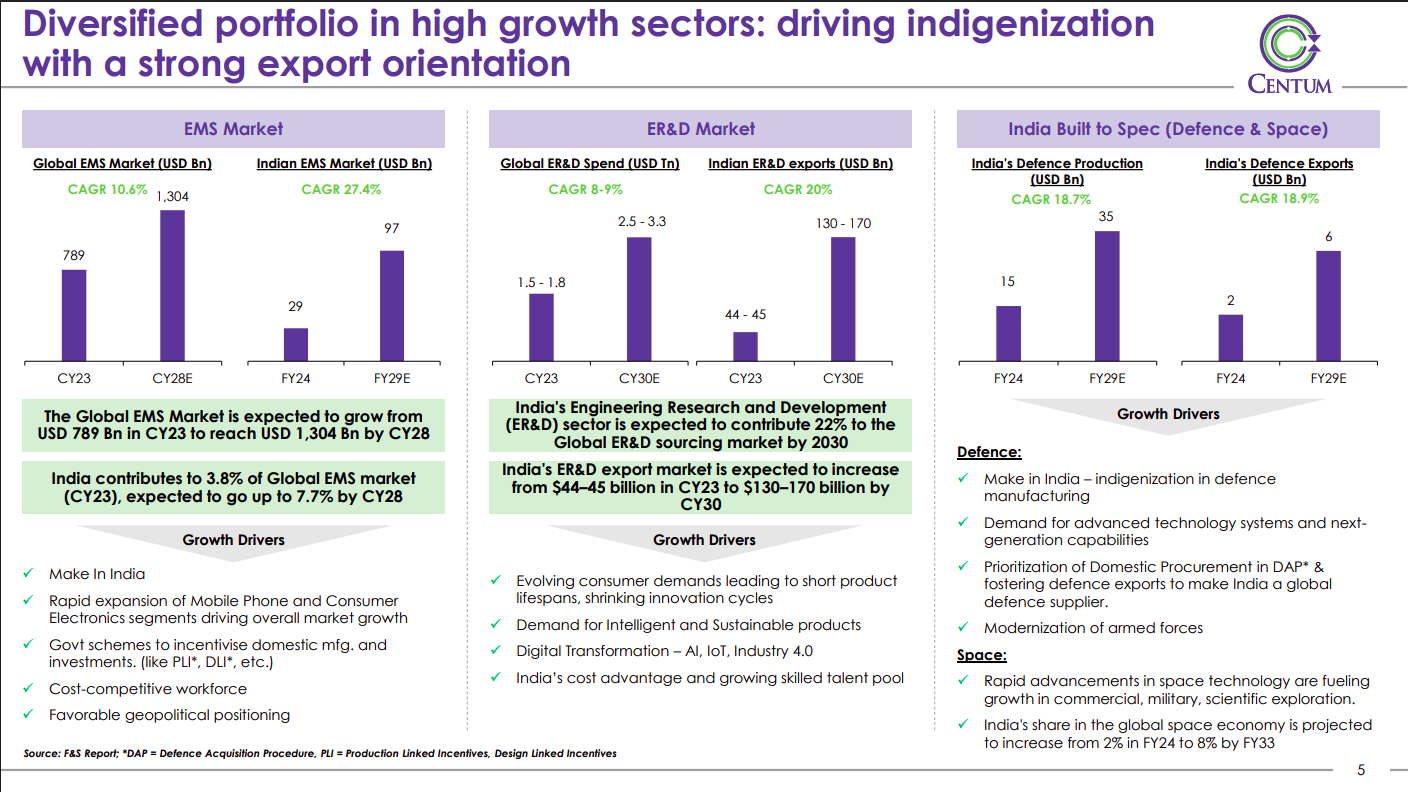

The global EMS market is projected to grow from USD 789B in 2023 to USD 1,304B by 2028, with India’s share nearly doubling to 7.7%.

India’s ER&D exports are expected to triple to USD 130–170B by 2030, driven by digital transformation and cost advantages.

Defence and space production in India is set to expand sharply, with defence output reaching USD 35B and exports USD 6B by FY29, backed by Make in India and space advancements.

Gulf Oil Lubricants | Small Cap | Engineering & Capital Goods

Gulf Oil Lubricants India Limited (GOLIL) is a leading company in India specializing in the manufacturing, marketing, and trading of automotive and non-automotive lubricants and related fluids.

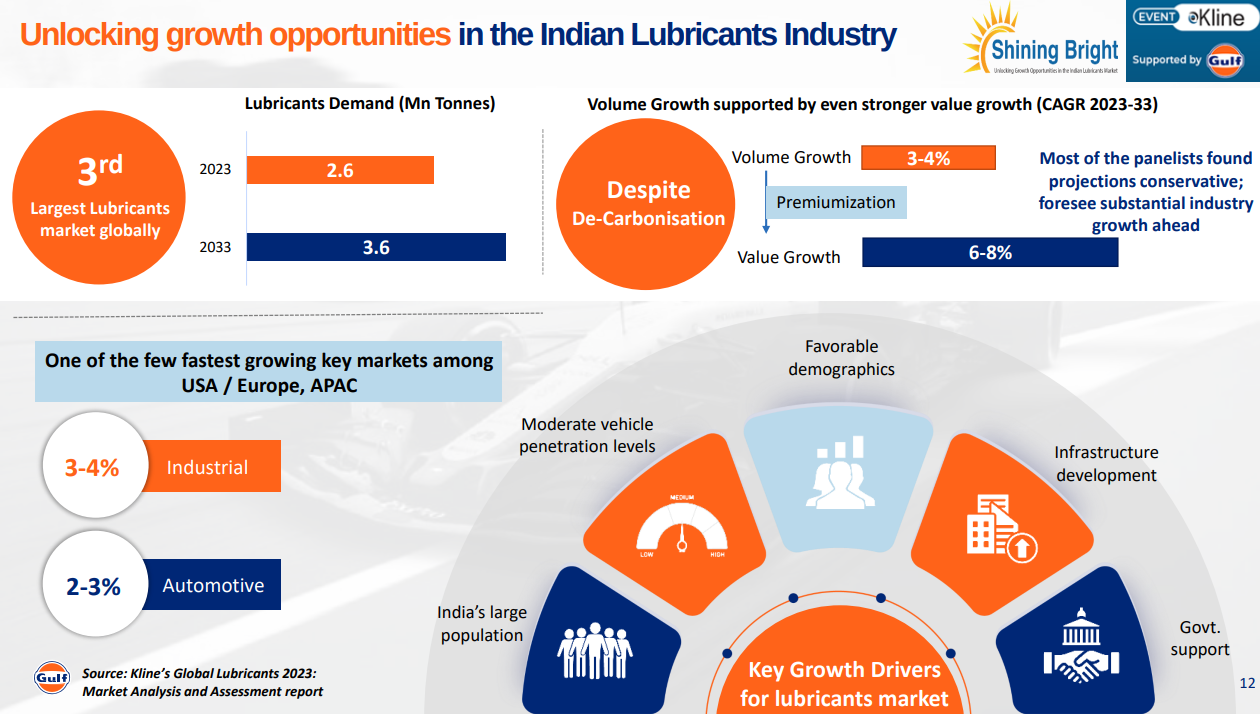

India's lubricants market is attractive for investors despite the global shift toward electric vehicles. As the world's third-largest lubricants market, India is expected to grow from 2.6 million tonnes in 2023 to 3.6 million tonnes by 2033, with volume growing 3-4% annually and value growing even faster at 6-8% due to premiumization. The growth is driven by India's large population with low vehicle penetration, favorable demographics, rising incomes, infrastructure development, and government support, making it one of the fastest-growing lubricants markets globally.

India's massive infrastructure investment of Rs 143 trillion between 2024-2030 is the primary growth driver. Government initiatives like "Make in India," along with the development of roads, ports, airports, and industrial corridors, are creating substantial demand for specialised industrial lubricants, including hydraulic oils, metalworking fluids, rubber process oils, premium oils, and greases across sectors like mining, metals, textiles, cement, manufacturing, and power generation.

Retail

FSN E-Commerce | Mid Cap | Retail

FSN E-Commerce Ventures Ltd. is the Indian parent company of Nykaa, a major consumer technology platform for beauty, personal care, and fashion products. Operating primarily through the Nykaa platform and physical stores, the company offers a wide range of products, including its own private-label brands like Nykaa Cosmetics and Kay Beauty.

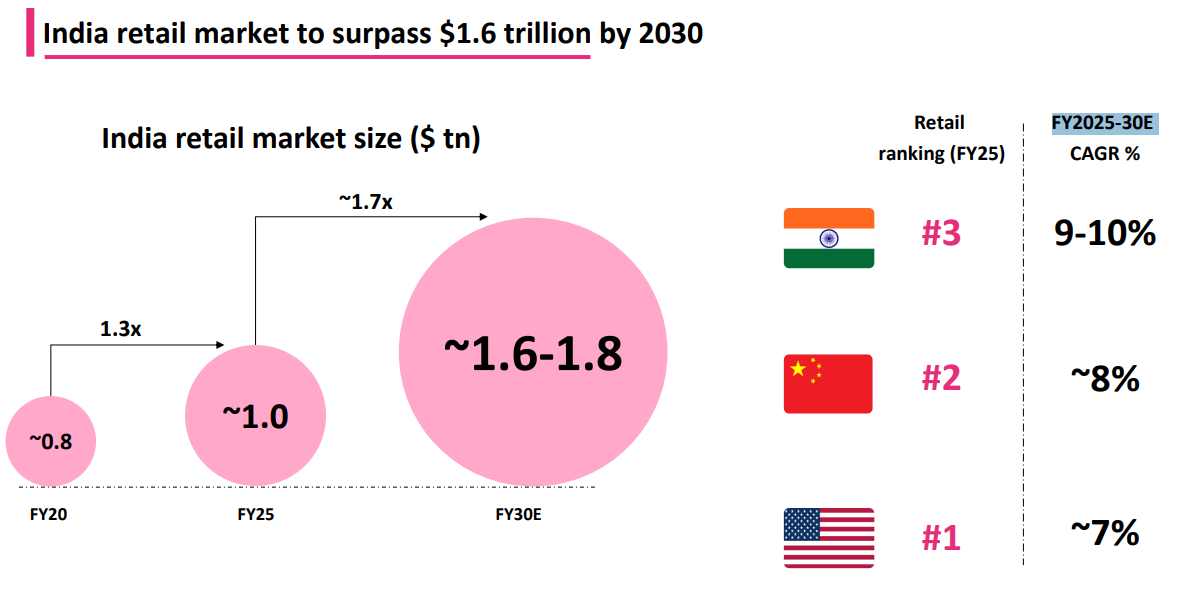

India's entire retail market (both online and offline shopping) is rapidly expanding. The market was worth about $800 billion in 2020, reached $1 trillion in 2025, and is expected to grow to $1.6-1.8 trillion by 2030. India is growing faster than major economies like China and the US, with annual growth rates of 9-10% compared to their 7-8%. This positions India to potentially become one of the top 3 largest retail markets globally.

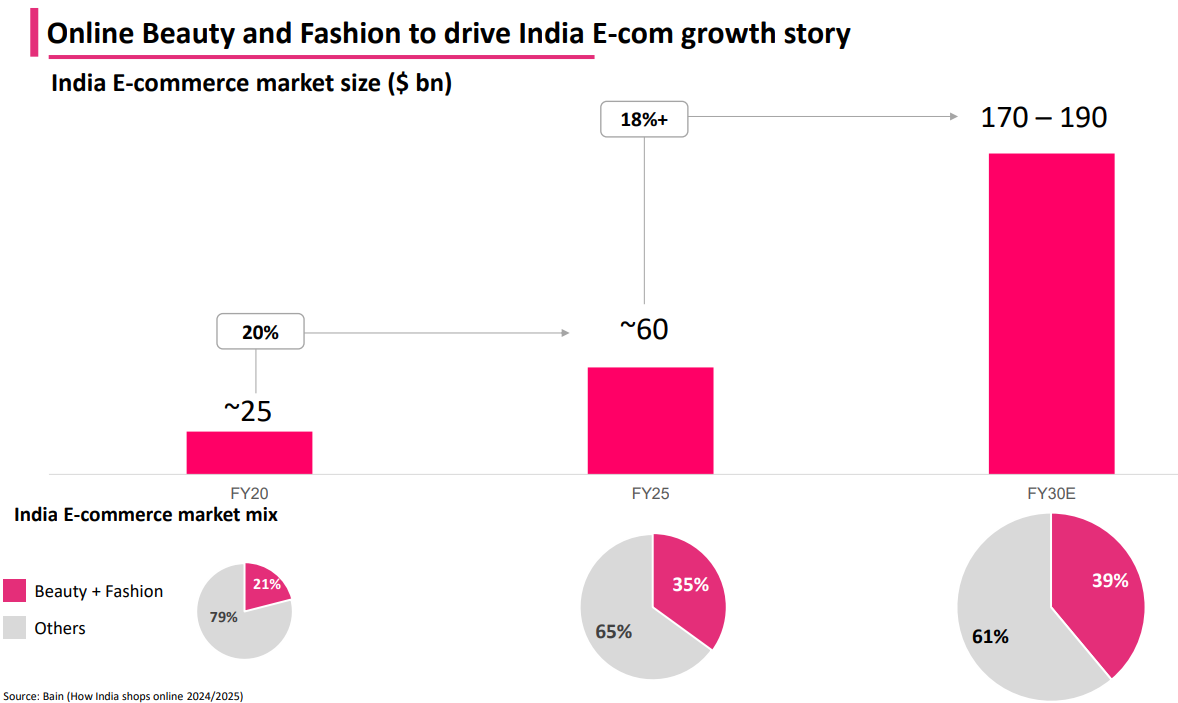

Beauty and fashion products are becoming the biggest drivers of India's online shopping boom. While India's total e-commerce market is expected to grow from $60 billion to $170-190 billion by 2030, beauty and fashion's share of this pie is expanding significantly - from 35% today to 39% by 2030. This means these lifestyle categories are growing even faster than the already rapid overall e-commerce growth.

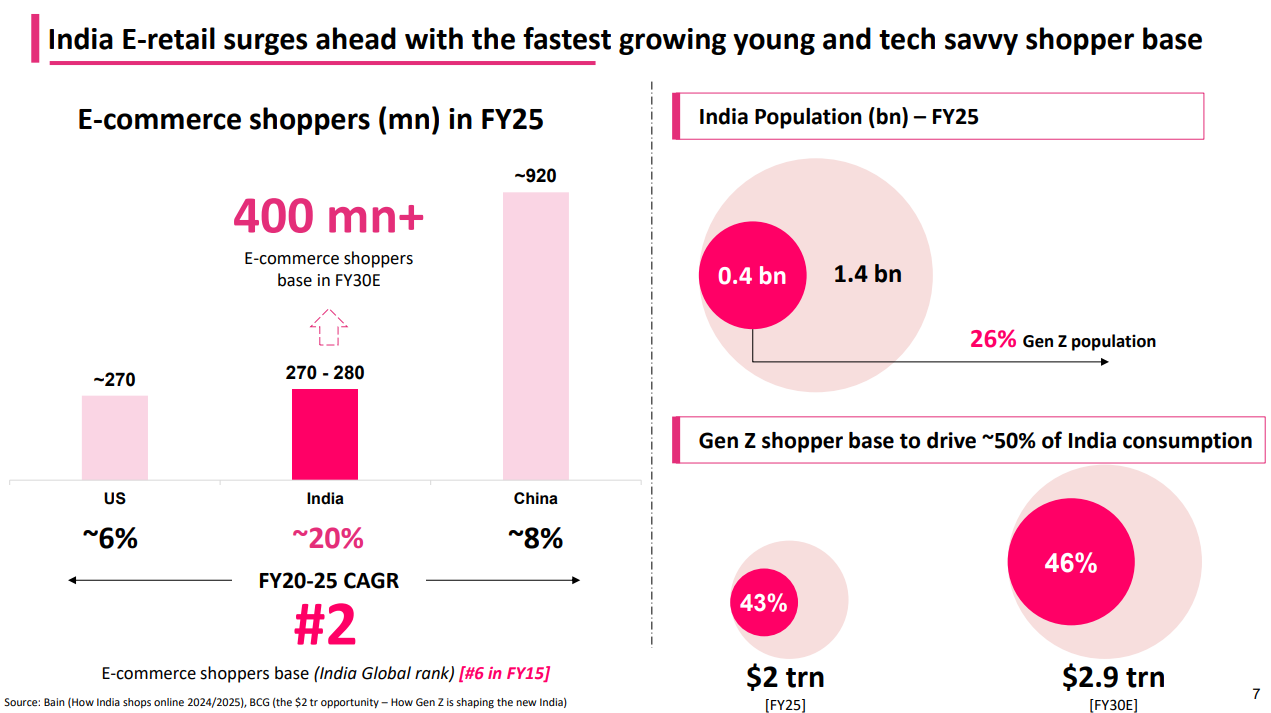

India has 270-280 million online shoppers today, expected to reach 400+ million by 2030 - growing at 20% annually, much faster than the US (6%) or China (8%). The key driver is India's young population: 26% are Gen Z, and this generation will account for nearly half of all consumer spending in India, growing from $2 trillion to $2.9 trillion by 2030.

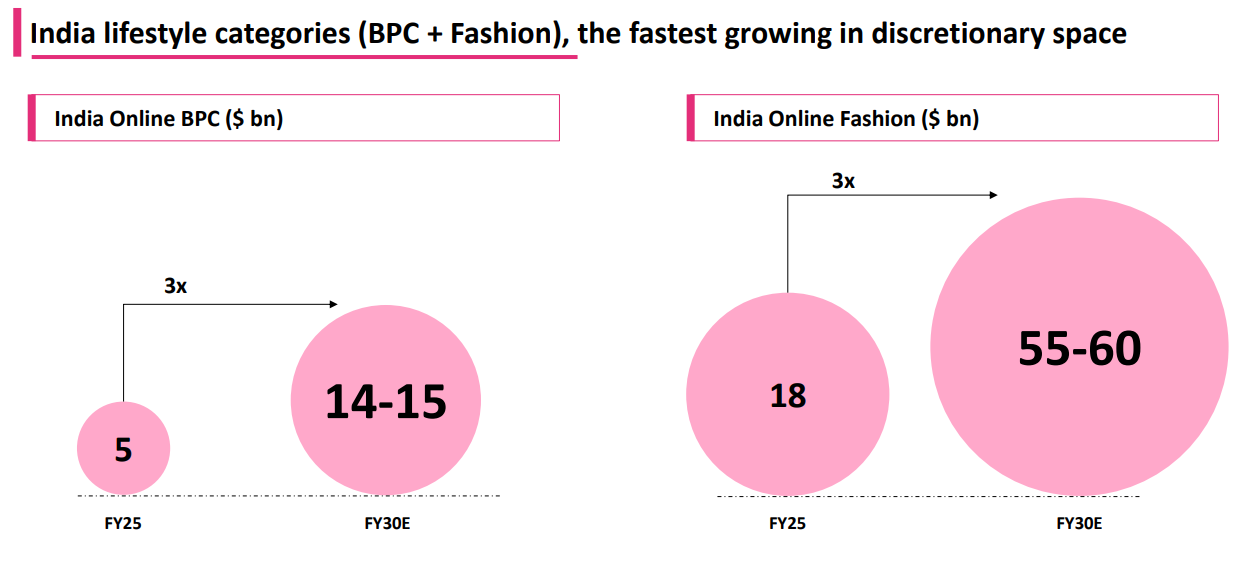

Online Beauty & Personal Care (BPC) is expected to triple from $5 billion to $14-15 billion by 2030, while online fashion will triple from $18 billion to $55-60 billion in the same period. These categories are growing much faster than other discretionary (non-essential) spending areas, making them attractive markets for companies like Nykaa to focus on.

Building Materials

Dalmia Bharat | Mid Cap | Building Materials

Dalmia Bharat is an Indian conglomerate focused on core manufacturing sectors, with cement, refractories, and sugar as its main businesses. The company is a major cement producer in India, a leader in slag cement, and has a growing presence in refractories globally and sugar production domestically.

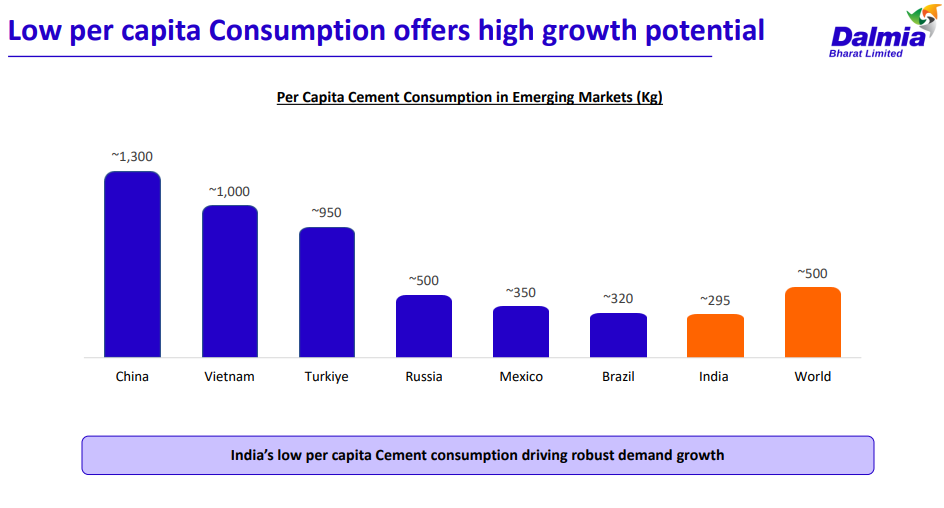

India uses far less cement per person than other major countries, but this gap points to big opportunities ahead. As the population grows, more houses are built, and investment pours into things like highways and railways, cement demand is expected to rise quickly, helping the country catch up with global averages. Right now, the bulk of new demand is coming from housing, infrastructure, and commercial projects, so as income and urbanization increase, India’s cement market has lots of room to expand and fuel the country’s growth.

Real Estate

Anant Raj | Small Cap | Real Estate

Anant Raj Limited, established in 1969, is a renowned infrastructure development enterprise in India. It specializes in constructing Special Economic Zones, IT Parks, residential apartments, service facilities, and recreational infrastructure.

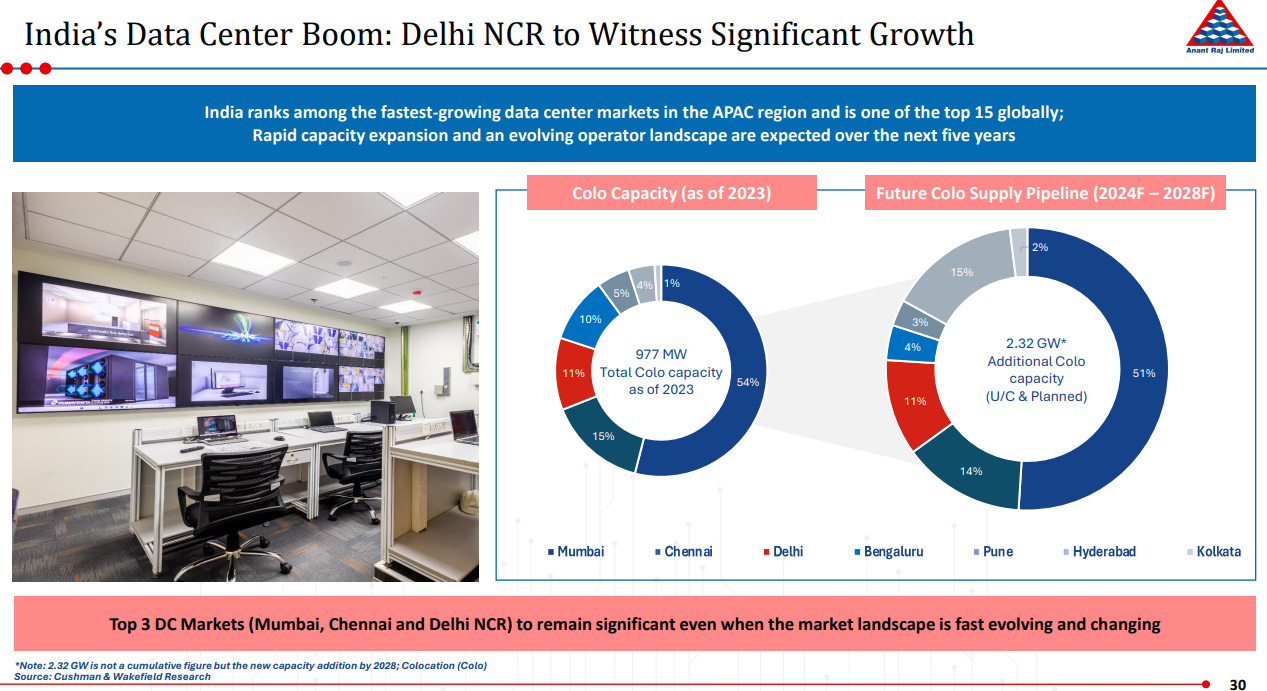

India’s data center market is expanding rapidly, with Delhi NCR set to become one of the country's main hubs for new capacity. The region will see significant growth in colocation facilities—large data centers that rent space and resources to multiple clients—adding to India’s reputation as a global leader in this field. Factors such as strong digital demand, more people using the internet and smartphones, and supportive government policies are fueling this surge, making Delhi NCR a hotspot for data center investments.

Anant Raj aims to increase its data centre capacity over the next several years, aiming for 307 megawatts by 2031. Expansion will take place at key locations including Manesar, Rai, and Panchkula, thanks to strong partnerships, certified facilities, and advanced design. The focus is on reliability, cost efficiency, and offering a full range of digital services—from basic data storage to cutting-edge cloud solutions—positioning the business to meet the growing needs of India’s digital economy.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

So, we're now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what's a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here's the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

We started a new experiment - Plotlines!

Plotlines is an extension of our Chatter newsletter. While most financial analysis focuses on quarterly results and near-term changes, Plotlines takes a different approach. We analyze executive commentary from earnings calls and investor presentations to identify long-term, structural shifts that will shape industries for years to come.

Instead of chasing headlines, we look for strategic pivots, evolving competitive dynamics, and fundamental changes in how companies allocate capital. Each week, we'll highlight the most significant "plotlines" from recent corporate communications, focusing on comments that signal permanent changes in market structure, technology adoption, or business models.

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.