Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 14 companies across 9 industries

Energy

Tata Power

Engineering & Capital Goods

Siemens

Shri Balaji Valve Component

Jayant infratech

Fujiyama Power Systems

Swastika Castal

Telecom

Frog Innovations

Logistics

ABS Marine Services

Software Services

Coforge

Excelsoft Technologies

Packaging

Uflex

Chemicals

Sacheerome

Building Materials

Global Surfaces

Healthcare

BioconEnergy

Energy

Tata Power | Large Cap | Energy

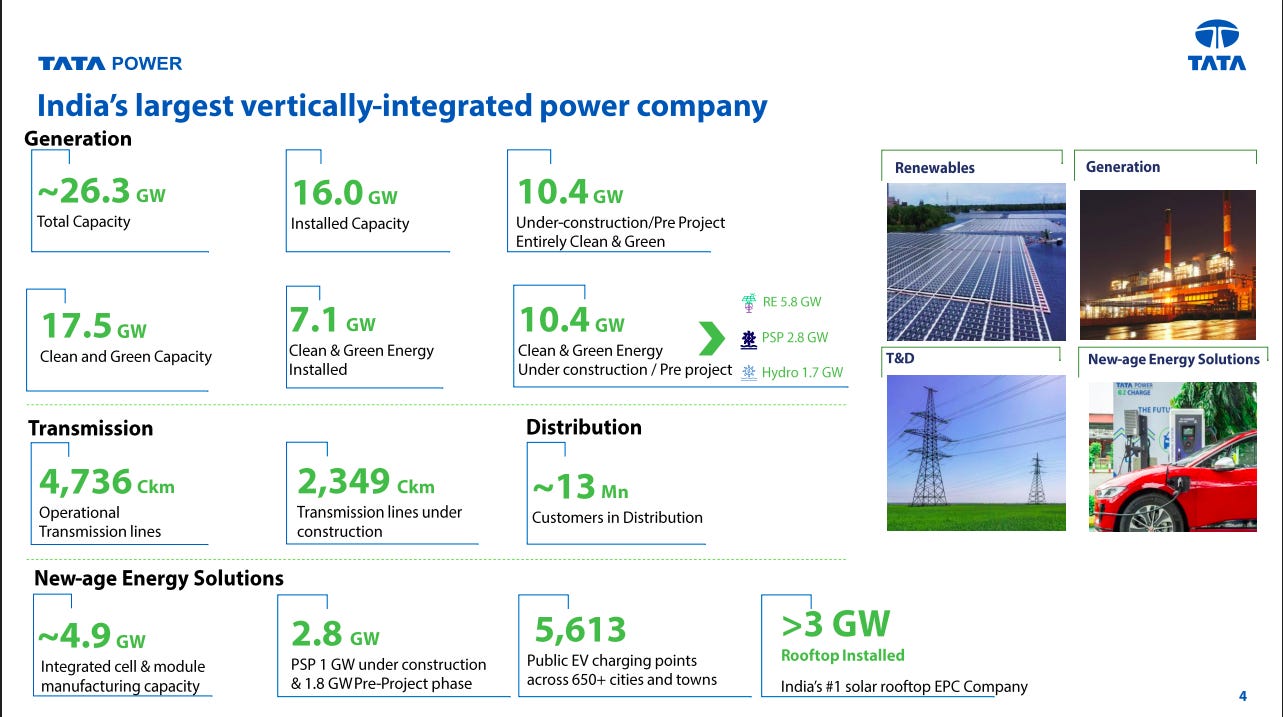

Tata Power Company is India’s largest vertically integrated power company, operating in renewable, thermal, and hydro energy generation, transmission, trading, distribution, and next-gen energy solutions. It focuses on expanding capacity, modernizing grids, and leading in rooftop solar, energy storage, and emerging technologies for a sustainable future.

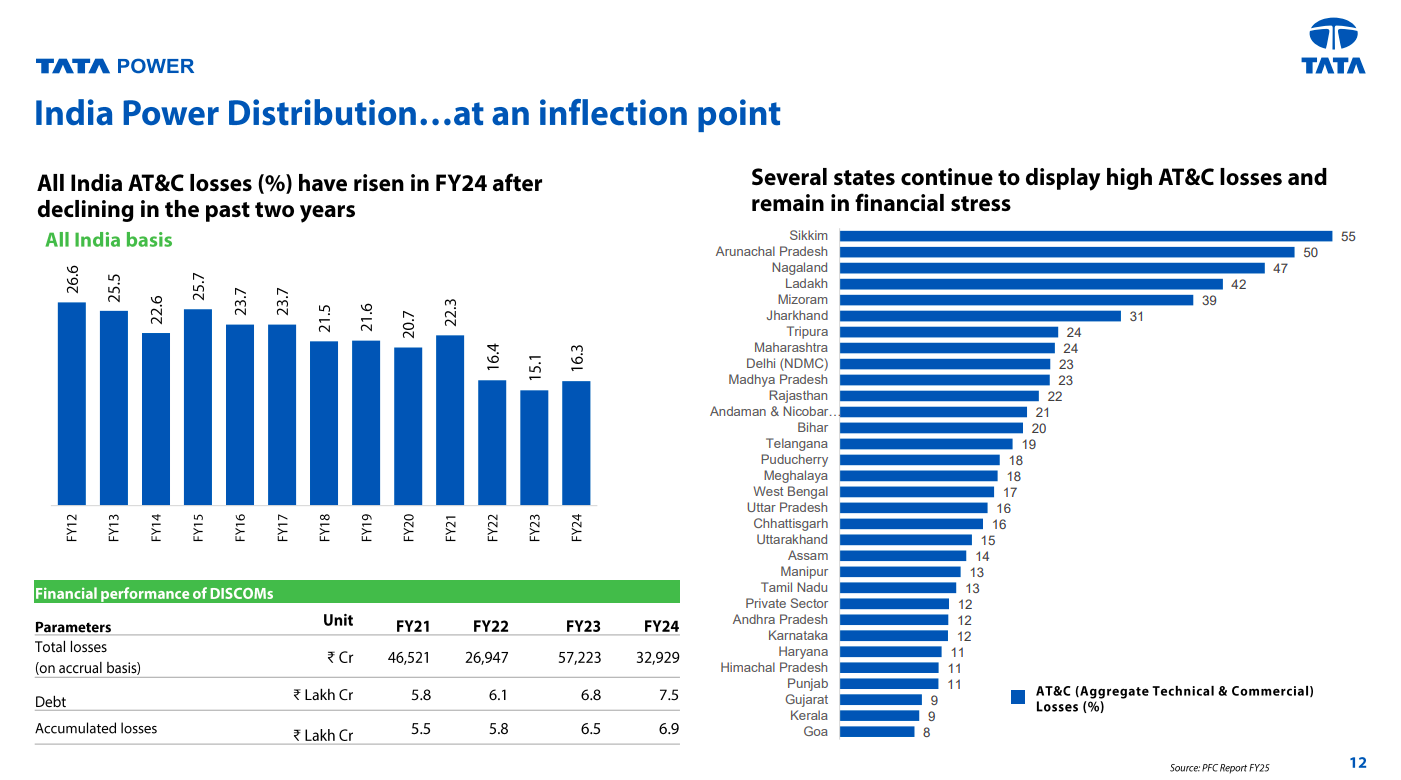

India’s power distribution sector is at an inflection point, with AT&C losses rising again in FY24 after two years of improvement. Several states continue to report very high losses, keeping DISCOM finances under strain despite recent reform efforts.

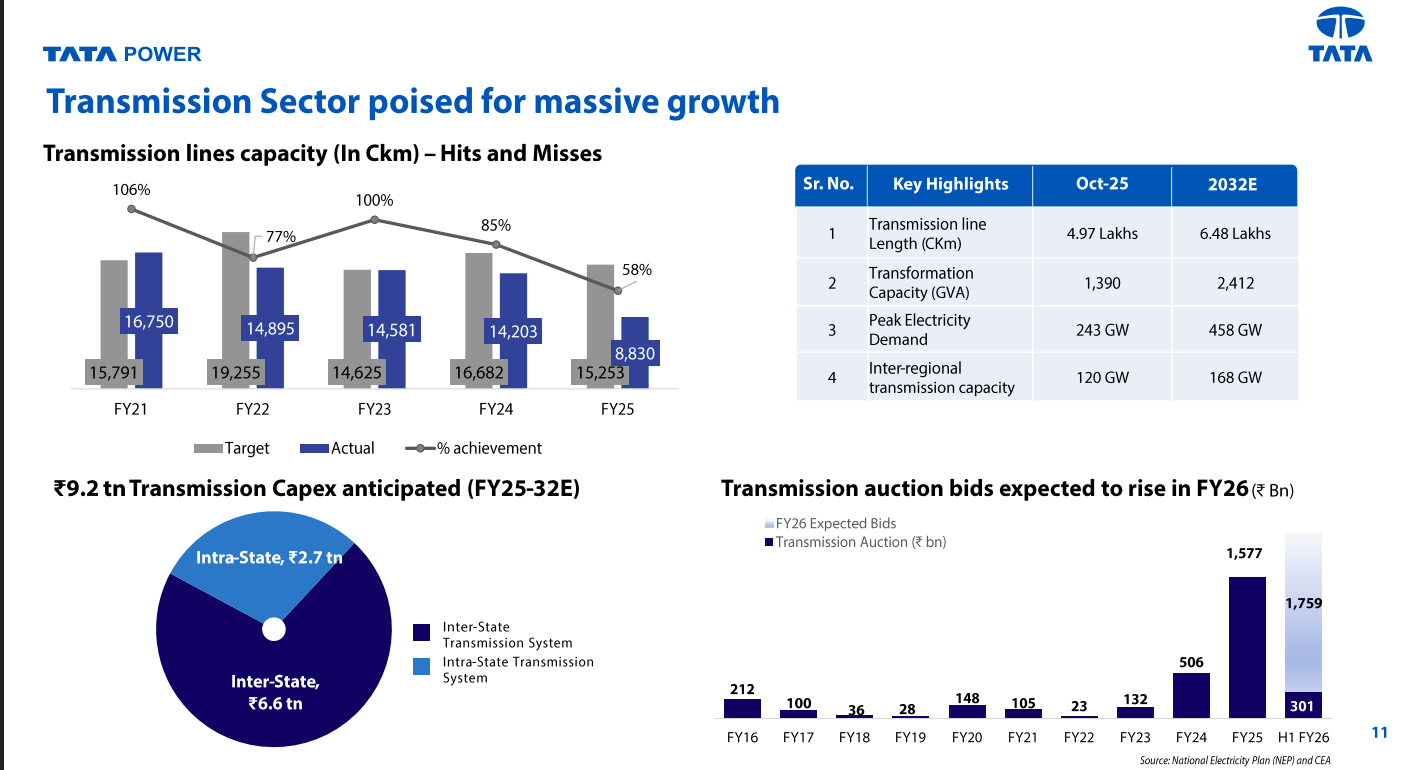

India’s transmission sector is set for strong multi-year growth, driven by rising power demand and renewable integration. Transmission capex of ~₹9.2 trillion is expected through FY32, with auction activity and network expansion accelerating meaningfully from FY26 onward.

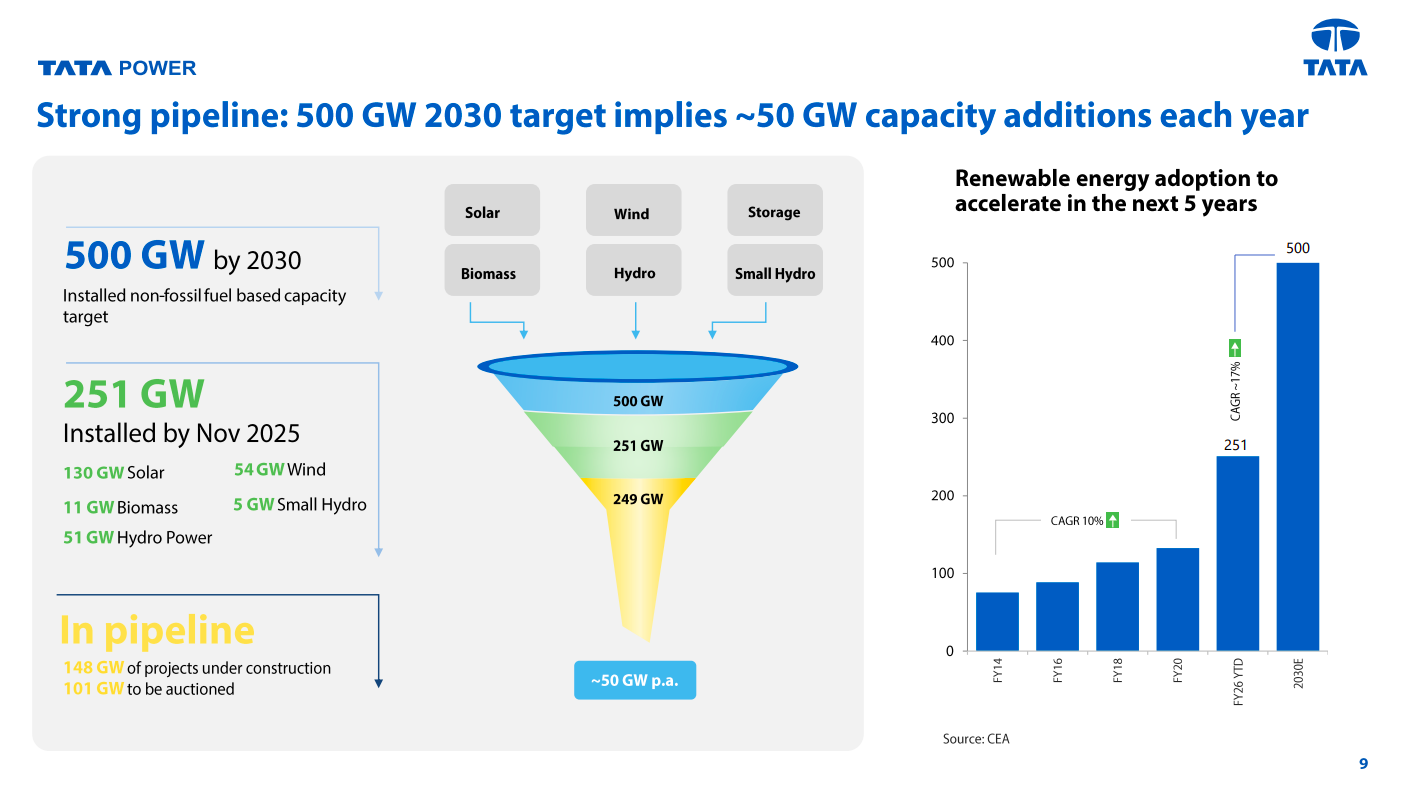

India’s 500 GW non-fossil capacity target by 2030 implies ~50 GW of annual additions, backed by a strong project pipeline. Renewable adoption is expected to accelerate sharply over the next five years, supported by solar, wind, hydro, and storage capacity build-out.

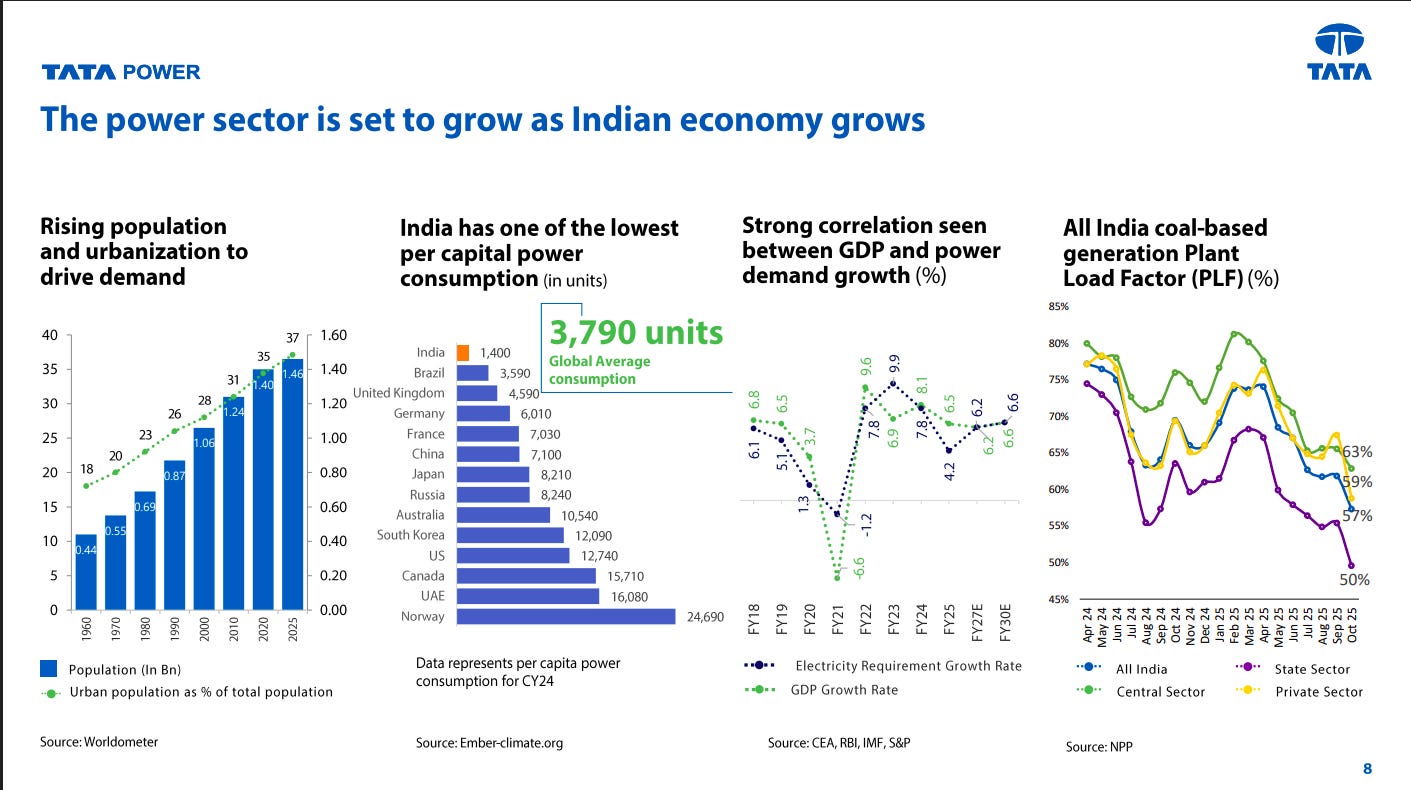

Power demand in India is structurally supported by population growth, urbanization, and low per-capita electricity consumption versus global averages. A strong correlation between GDP growth and electricity demand reinforces the long-term expansion outlook for the power sector.

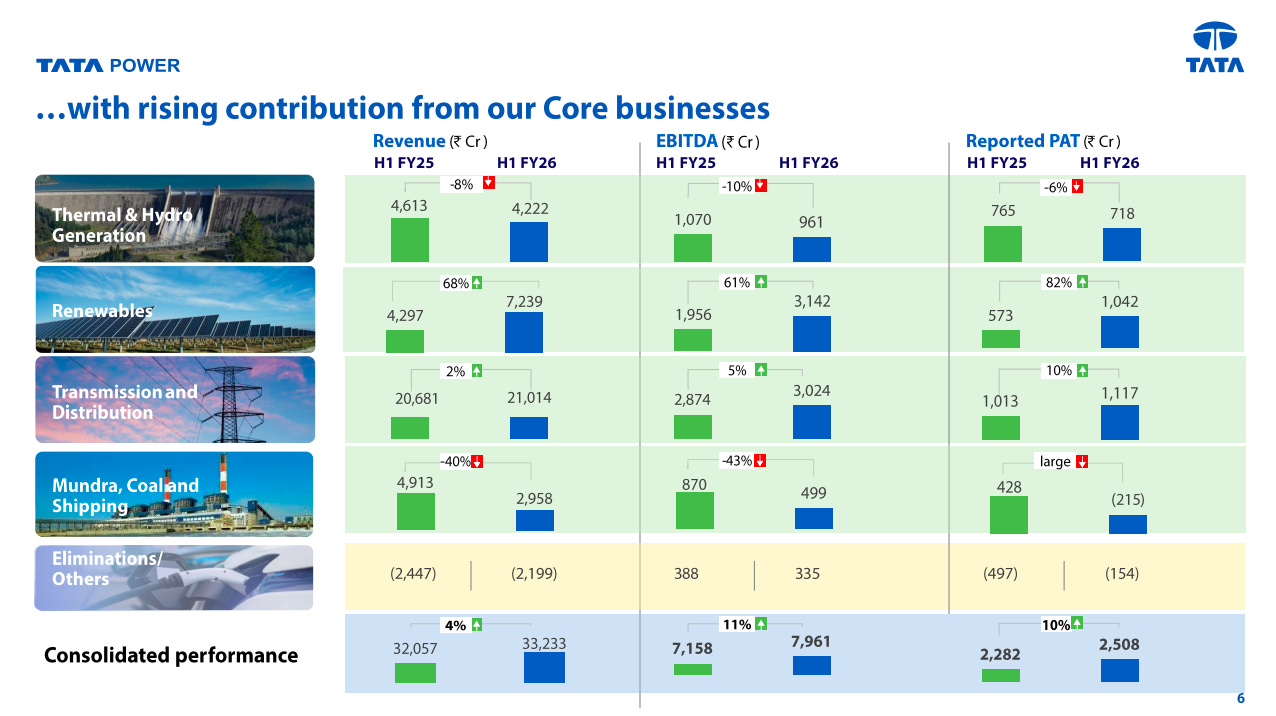

Tata Power’s core businesses are increasingly driving performance, with renewables and transmission delivering strong growth in revenue, EBITDA, and PAT. While thermal and coal-linked segments saw moderation, consolidated profitability continues to improve year-on-year.

Tata Power stands out as India’s largest vertically integrated power company, spanning generation, renewables, transmission, distribution, and new-age energy solutions. Its growing clean energy portfolio, EV charging network, and rooftop solar leadership position it well for the energy transition.

Engineering & Capital Goods

Siemens | Large Cap | Engineering & Capital Goods

Siemens is a global technology company specializing in industry, infrastructure, digital transformation, transportation, and electrical power generation. It aims to enhance efficiency, quality, flexibility, and speed through its diverse portfolio and market-oriented structure. With global technology leadership and local expertise, Siemens is well-positioned to support sustainable growth.

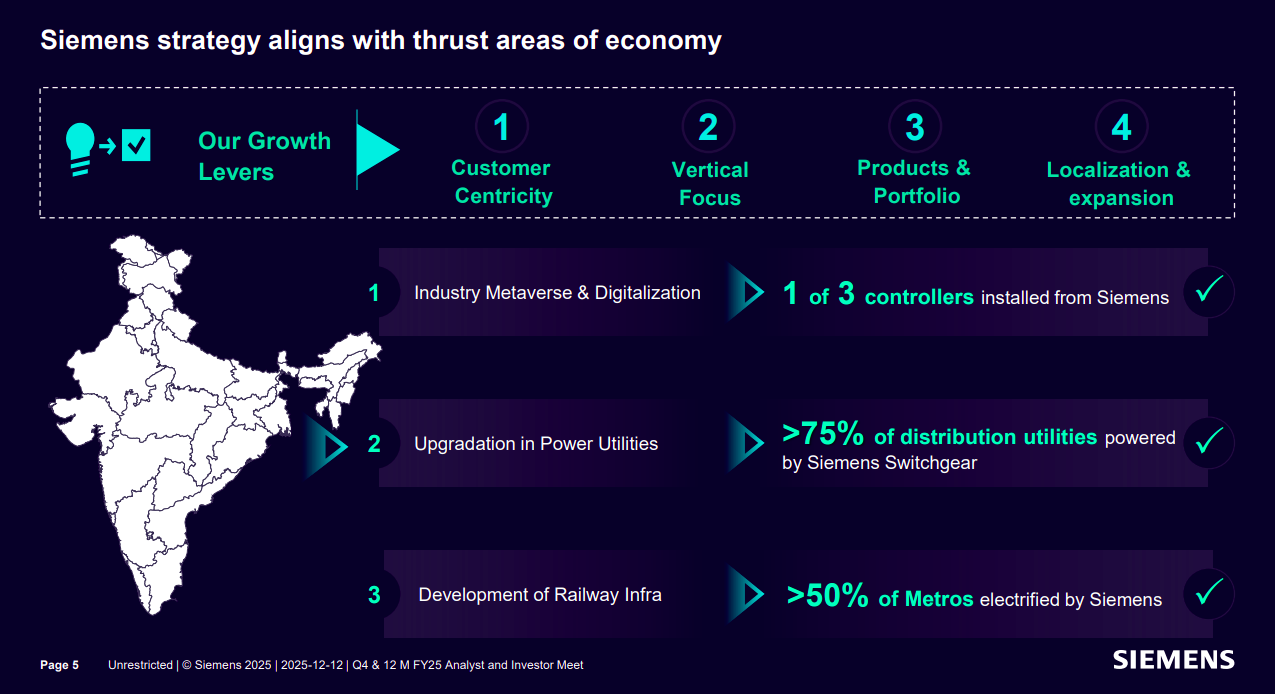

Siemens’ India strategy is anchored around four growth levers—customer centricity, vertical focus, portfolio strength, and localization—to align with key national priorities. The company has a dominant footprint across industry digitization, power utilities, and railways, with over 75% of distribution utilities and more than half of metro electrification powered by Siemens solutions.

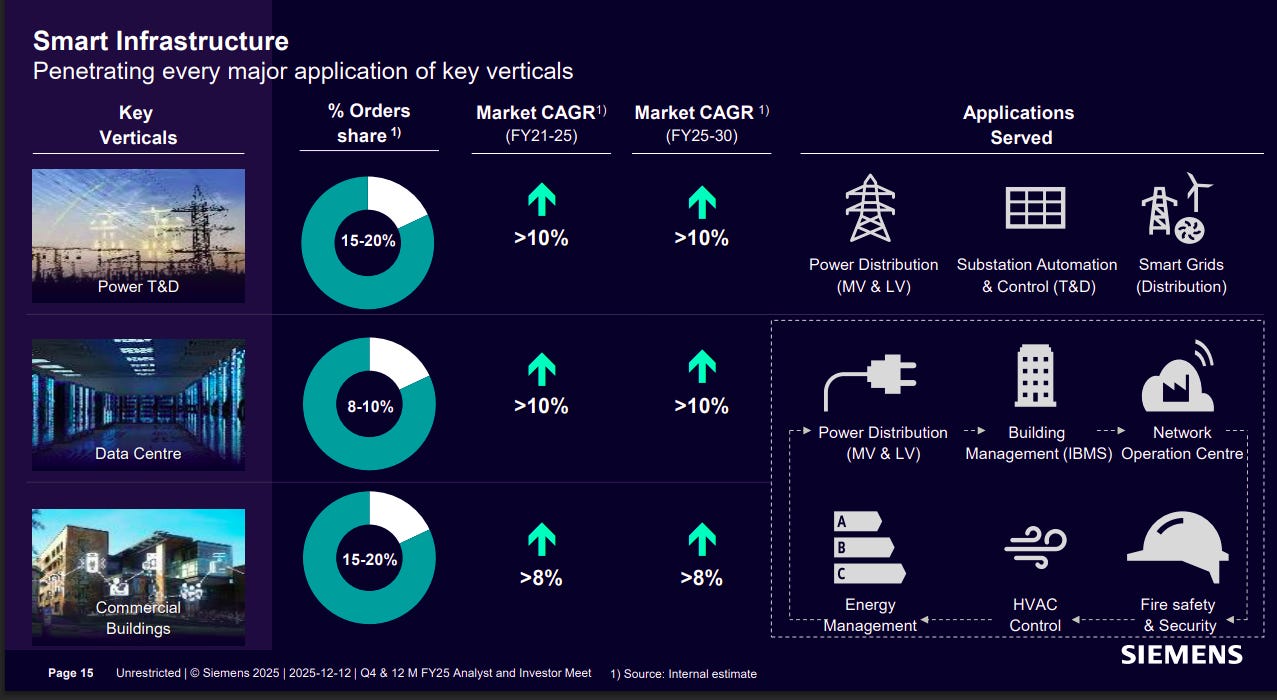

Siemens’ Smart Infrastructure business has deep penetration across power T&D, data centres, and commercial buildings, with order shares ranging from 8–20% and strong double-digit market growth visibility. Its integrated offerings span power distribution, substation automation, smart grids, building management, energy efficiency, and safety systems, positioning it well for sustained urban and infrastructure growth.

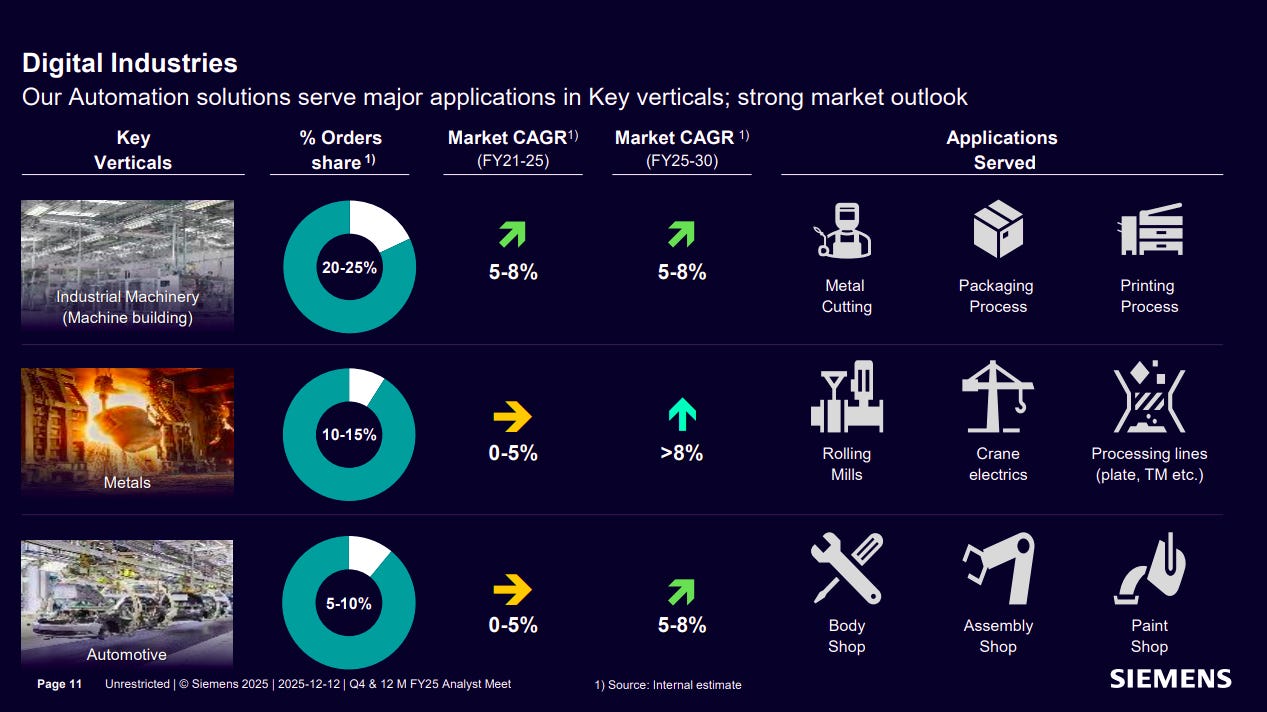

Siemens’ Digital Industries segment serves core manufacturing verticals such as industrial machinery, metals, and automotive, with order shares of 5–25% across segments. While near-term growth is moderate in some sectors, medium-term demand is supported by automation, electrification, and process optimization across cutting, packaging, rolling mills, and assembly lines.

Shri Balaji Valve Component | Nano Cap | Engineering & Capital Goods

Shri Balaji Valve Components Limited specializes in manufacturing ready-to-assemble valve components for various industries. They provide components for ball valves, butterfly valves, and forging products, customized to meet customer specifications across different sectors.

This slide highlights the company’s diversified end-market exposure across Oil & Gas, Petrochemicals, Power Generation, Food & Beverage, Defense, and Pharmaceuticals. It underscores a broad industrial footprint that reduces concentration risk while tapping into both cyclical and regulated sectors.

The focus is on next-generation growth areas such as smart valves integrated with IIoT, sustainability-driven efficiency solutions, and customized specialty valves. These trends reflect a shift toward digital monitoring, eco-friendly designs, and tailored products to meet complex, industry-specific requirements.

Jayant infratech | Nano Cap | Engineering & Capital Goods

Jayant Infratech Limited specializes in the design, supply, and commissioning of overhead equipment for railway electrification. They cater to key clients in the Indian Railways and public/private sectors, aiding in reducing dependency on fossil fuels and carbon footprint. Their services cover the entire process from concept to commissioning of railway infrastructure.

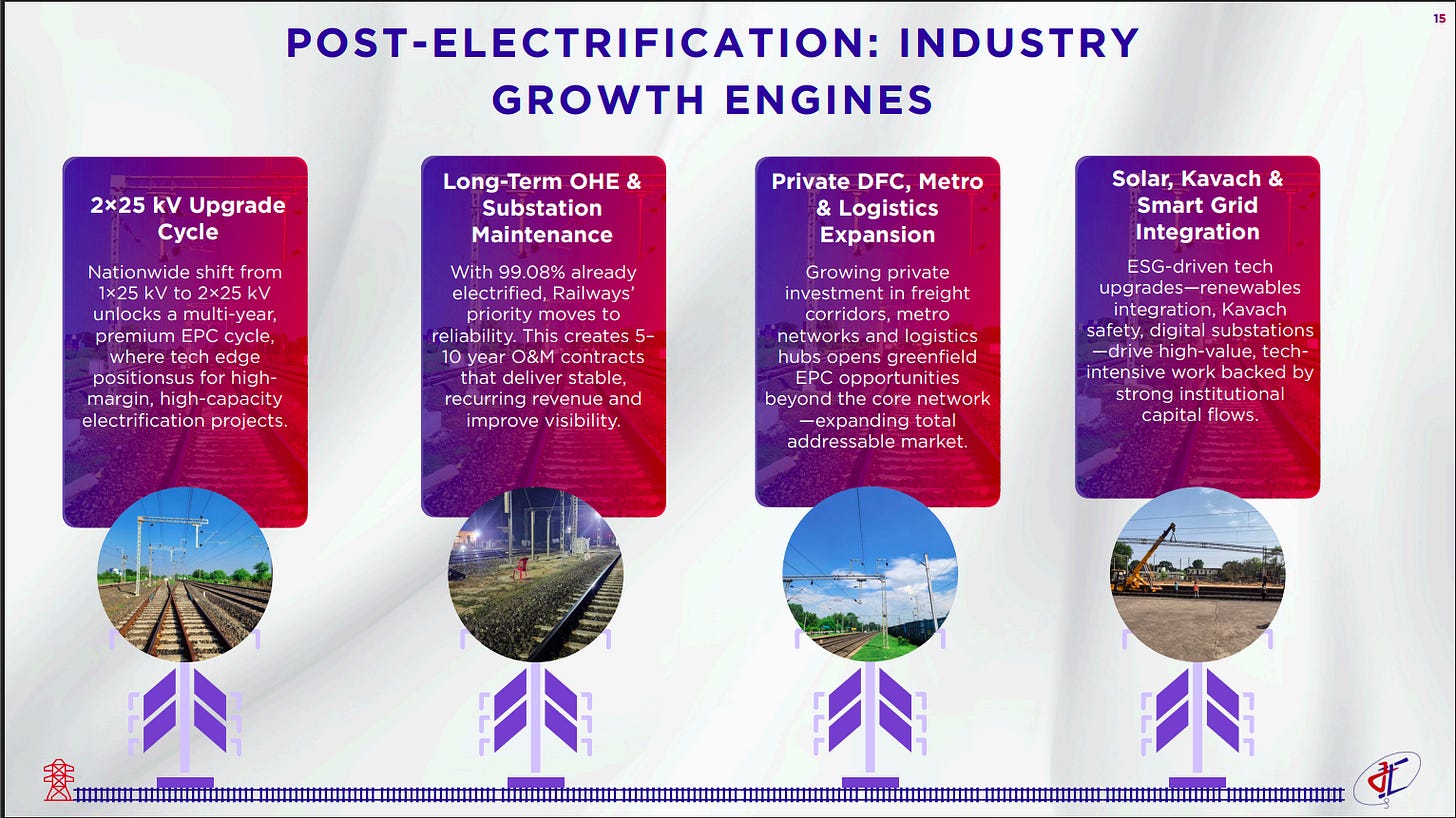

Post-electrification opens multiple long-duration growth levers for rail infrastructure, led by 2×25 kV upgrades, long-term OHE and substation maintenance, and expanding private DFC, metro, and logistics projects. Solar integration, Kavach safety systems, and smart grids further drive high-value, tech-intensive EPC opportunities with recurring revenue visibility.

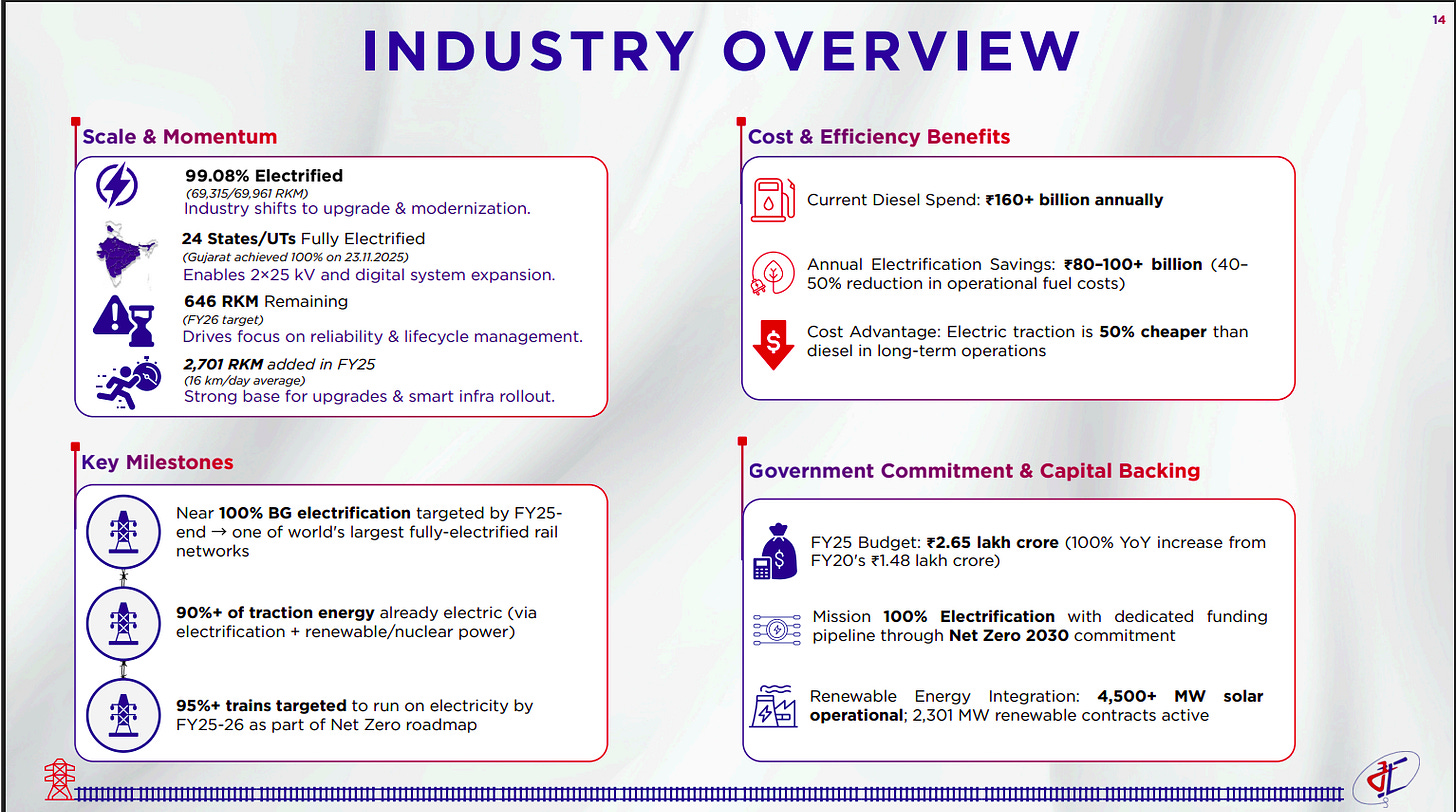

Indian Railways has reached ~99% electrification, creating a large upgrade and modernization opportunity focused on reliability, lifecycle management, and smart infrastructure rollout. Electrification delivers significant cost savings versus diesel, backed by strong government funding, Net Zero commitments, and growing renewable energy integration.

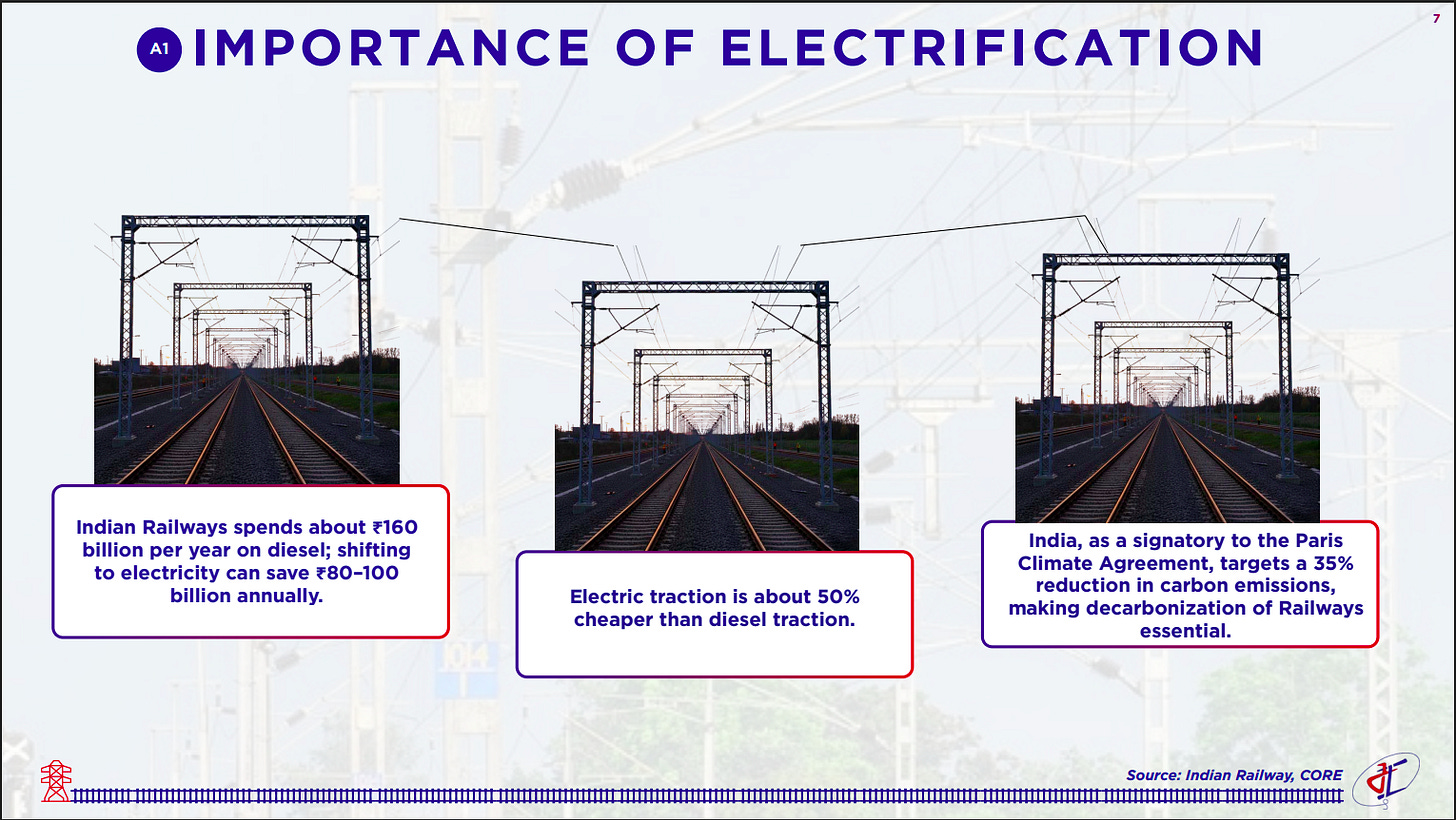

Electrification is a critical economic and environmental lever, with Indian Railways spending ~₹160 billion annually on diesel that can be reduced by ₹80–100 billion through electric traction. Electric traction is ~50% cheaper and supports India’s Paris Climate Agreement goals by accelerating decarbonization of rail transport.

The company serves a diversified set of infrastructure-heavy sectors including Indian Railways, metro and regional rail projects, power and steel plants, cement plants, mining and washeries, and ports and logistics hubs. These industries rely on rail electrification, traction systems, and OHE infrastructure for efficient bulk movement and connectivity.

Fujiyama Power Systems | Small Cap | Engineering & Capital Goods

Fujiyama Power Systems specializes in designing, supplying, and installing rooftop solar systems, offering solar panels, inverters, and batteries. The company focuses on innovation with patented rMPPT technology and provides a wide product portfolio under ‘UTL Solar’ and ‘Fujiyama Solar’ brands.

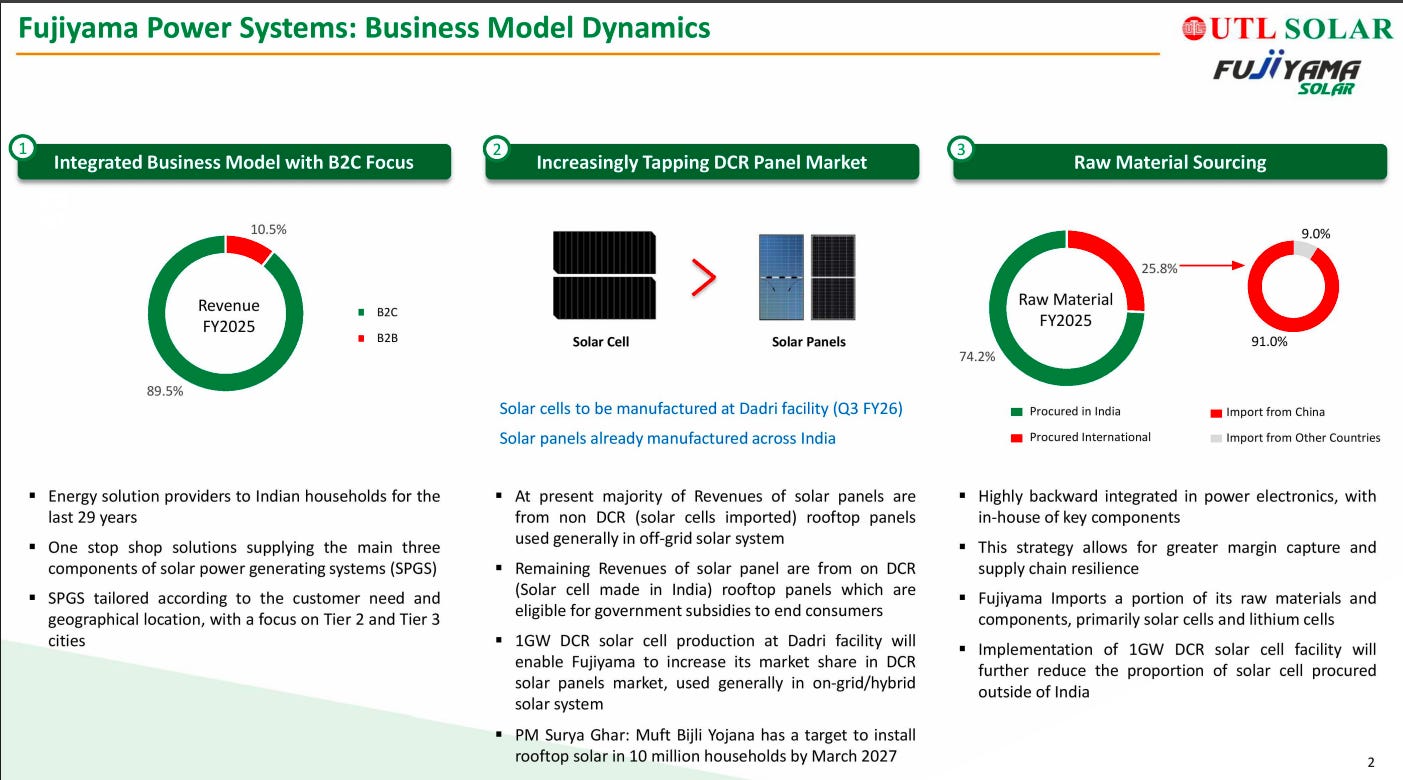

Fujiyama follows a highly integrated, B2C-focused solar business model with ~90% of FY25 revenues coming from retail consumers. The company is increasingly shifting toward DCR panels through in-house solar cell manufacturing, which should improve margins and reduce import dependence. Backward integration in power electronics strengthens supply-chain resilience and profitability.

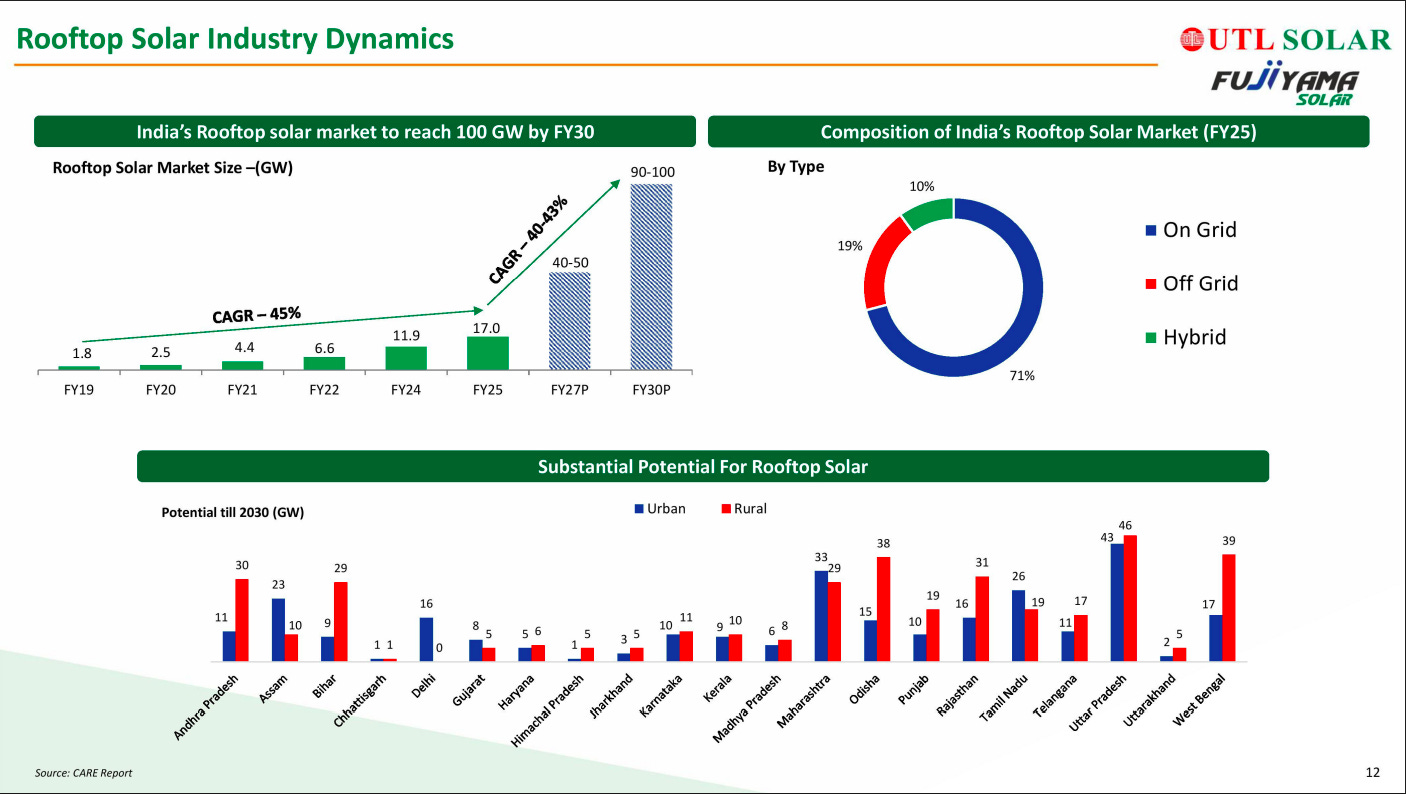

India’s rooftop solar market is on a steep growth trajectory, expected to scale from ~17 GW in FY25 to ~90–100 GW by FY30, implying ~40%+ CAGR. On-grid systems dominate with ~70% share, while hybrid and off-grid solutions cater to niche needs. Significant untapped potential exists across both urban and rural states, driven by policy support and falling costs.

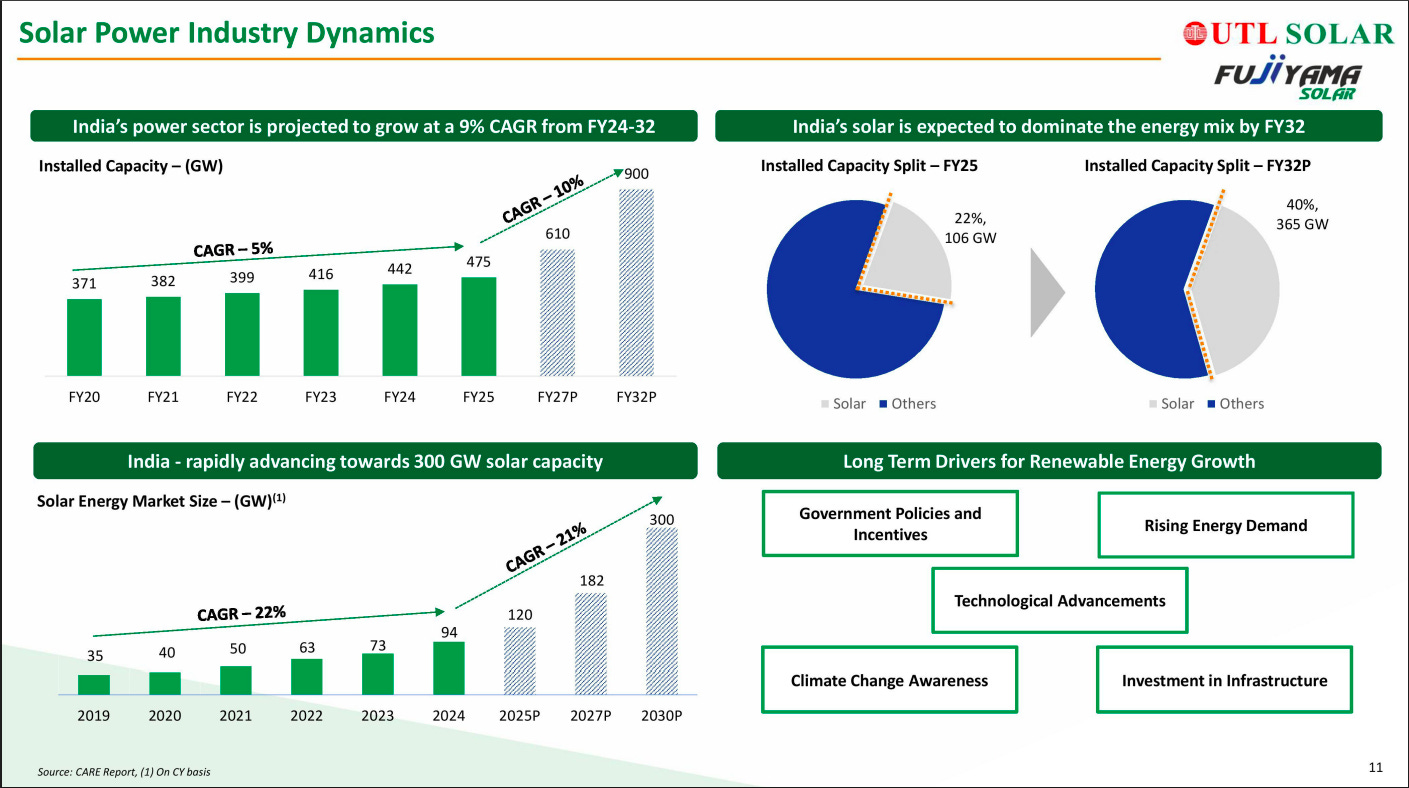

India’s overall power capacity is projected to grow at ~9–10% CAGR, with solar emerging as the dominant energy source by FY32. Solar capacity is expected to scale rapidly toward ~300 GW, driven by strong policy incentives, rising energy demand, and technology improvements. Long-term structural drivers like climate commitments and infrastructure investment underpin sustained renewable growth.

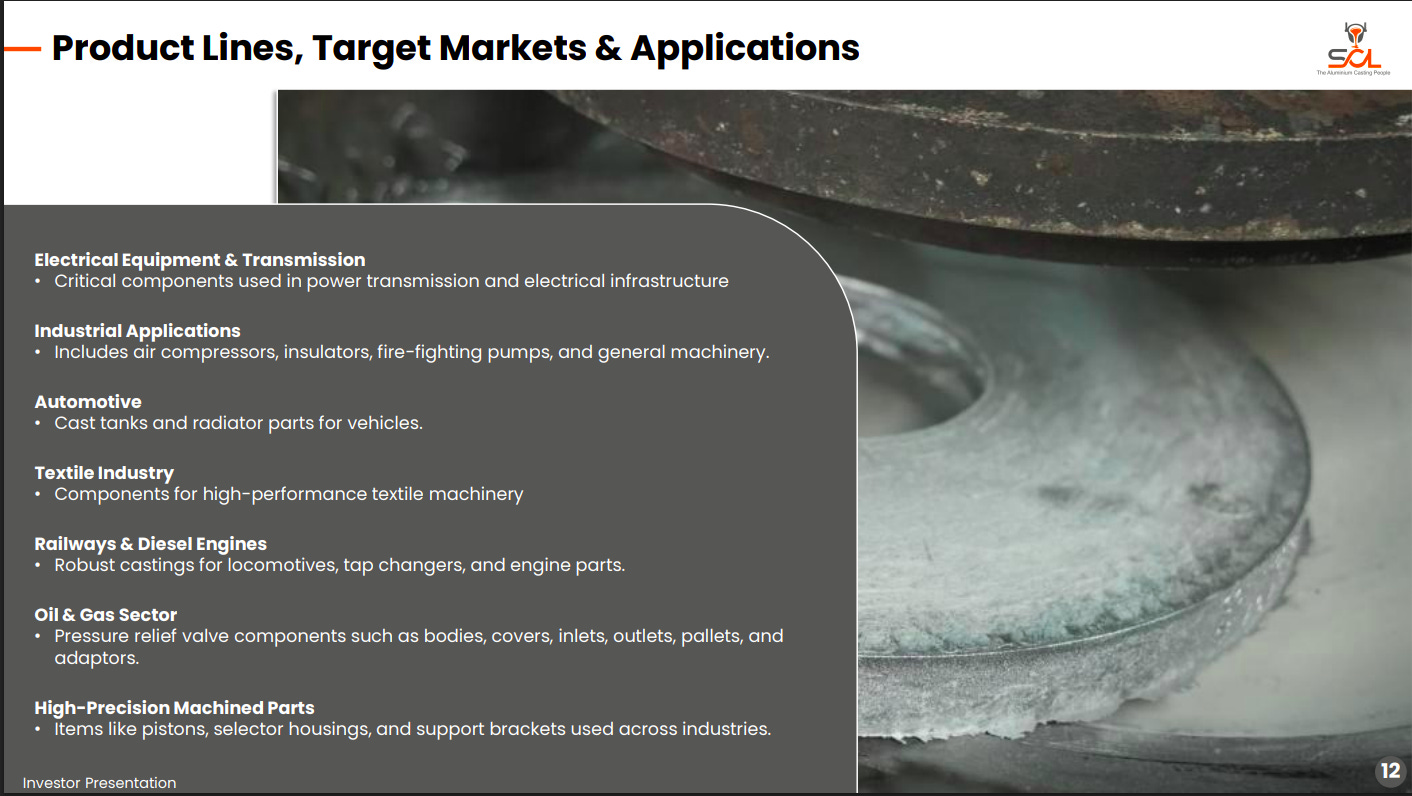

Swastika Castal | Nano Cap | Engineering & Capital Goods

Swastika Castal specializes in manufacturing aluminum casting products used in diverse industries such as automotive, power, and power transmission. Their products cater to a wide range of applications within these sectors.

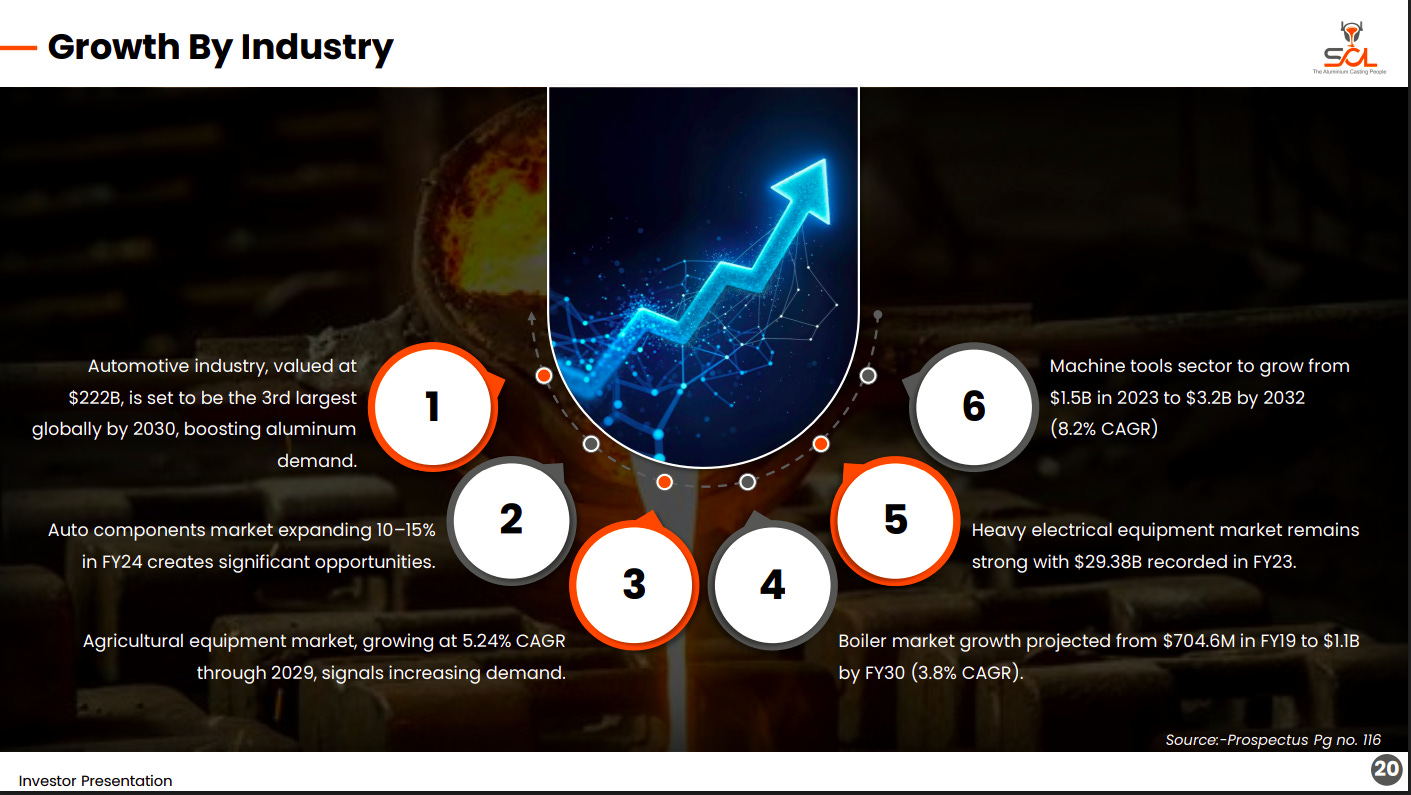

Multiple end-use industries are driving demand, led by automotive, which is set to become the world’s third-largest by 2030, significantly boosting aluminium consumption. Auto components, agriculture equipment, boilers, heavy electricals, and machine tools are all showing steady mid-to-high single-digit growth, creating diversified demand tailwinds.

India’s aluminium casting market is projected to grow from about USD 3.3 billion in 2020 to USD 6.1 billion by 2027, driven primarily by automotive die-casting. Stricter emission norms, lightweighting trends, and India’s cost-competitive manufacturing base are strengthening its position as a global production hub.

The global aluminium casting market stood at nearly USD 70 billion in 2024 and is expected to reach over USD 159 billion by 2034, sustaining ~8% CAGR. Growth is driven by EV adoption, renewable energy infrastructure, and increasing use of lightweight materials across automotive, aerospace, and industrial applications.

The company serves a strong, diversified customer base including global leaders such as Siemens, Toshiba, Hitachi, GE, ABB, and Continental Disc. Long-standing relationships with marquee OEMs reflect credibility, quality consistency, and deep integration into global supply chains.

The product portfolio spans electrical transmission, industrial machinery, automotive, textiles, railways, oil & gas, and high-precision machined components. This wide application coverage reduces dependence on any single sector while positioning the company to benefit from multiple industrial growth cycles.

Telecom

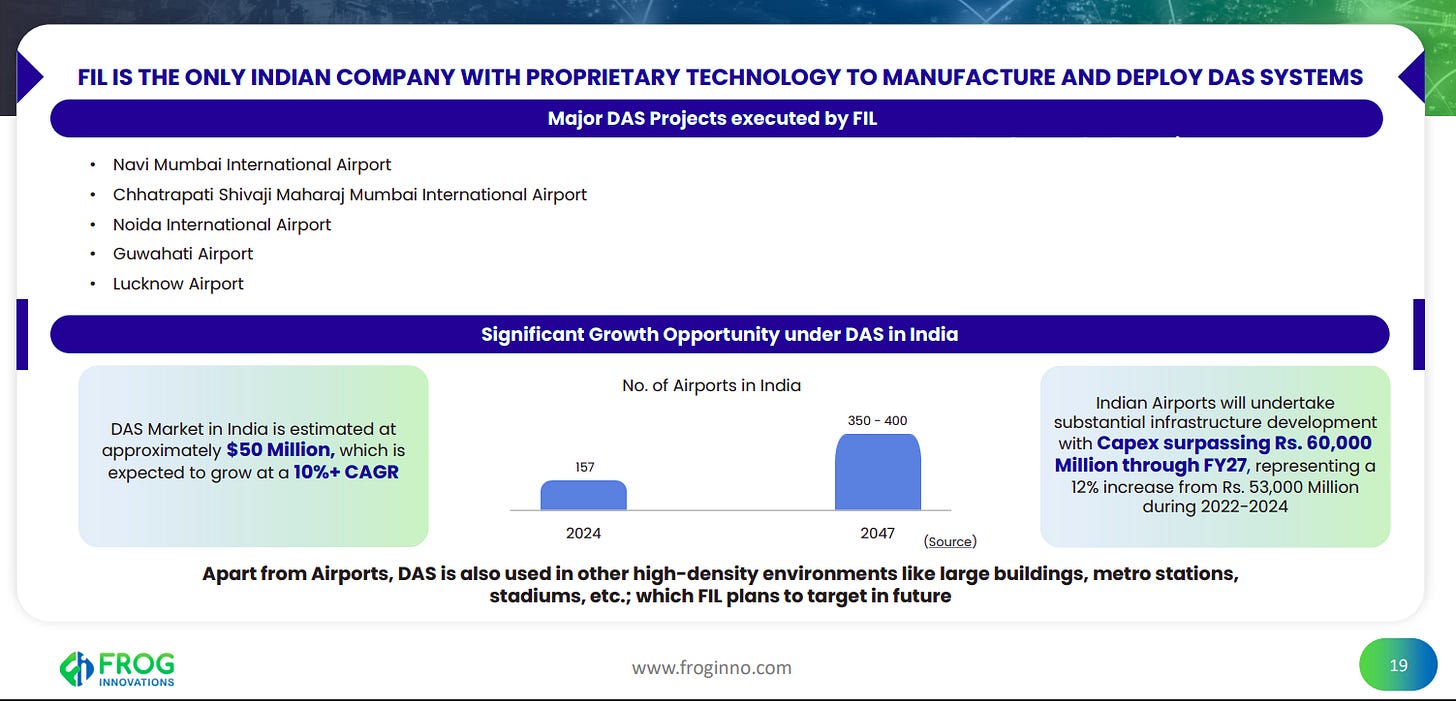

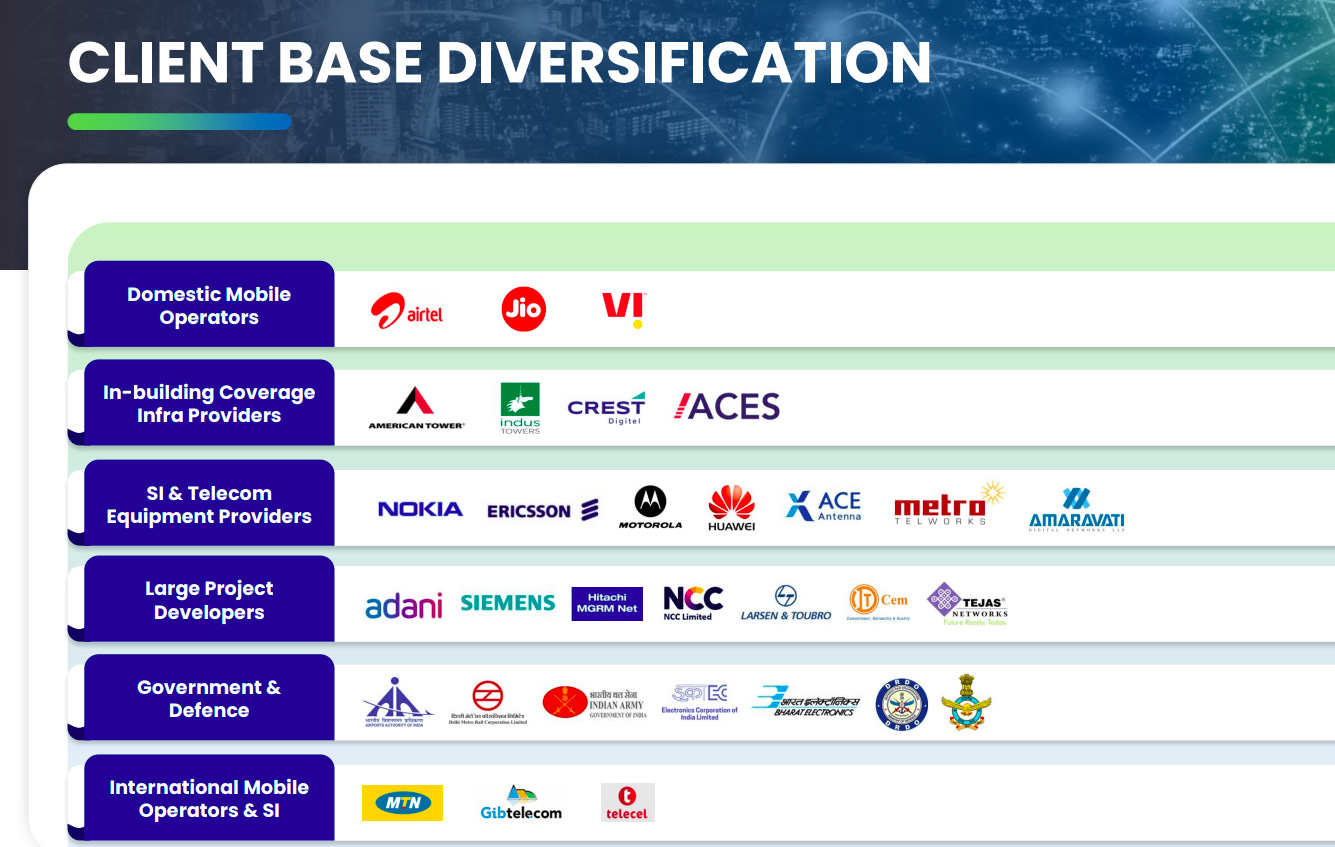

Frog Innovations | Nano Cap | Telecom

Frog Cellsat Limited is a telecom equipment manufacturer specializing in products for telecom towers. They produce a variety of RF repeaters, optical DAS systems, and provide services like in-building coverage planning. With ISO 9001:2015 certification, they offer price-competitive, field-proven, and reliable RF enhancement solutions. Their focus on innovative R&D ensures products that adhere to industry standards like ETSI and 3GPP.

FIL is the only Indian player with proprietary DAS technology, with marquee airport deployments already executed. With India’s DAS market at ~$50 million and growing at 10%+ CAGR, rising airport capex and expansion beyond airports into metros, stadiums, and large buildings create a strong growth runway.

FIL has a well-diversified customer base spanning domestic and international telecom operators, infrastructure providers, OEMs, large project developers, and government/defence agencies. This diversification reduces dependence on any single segment and strengthens revenue stability.

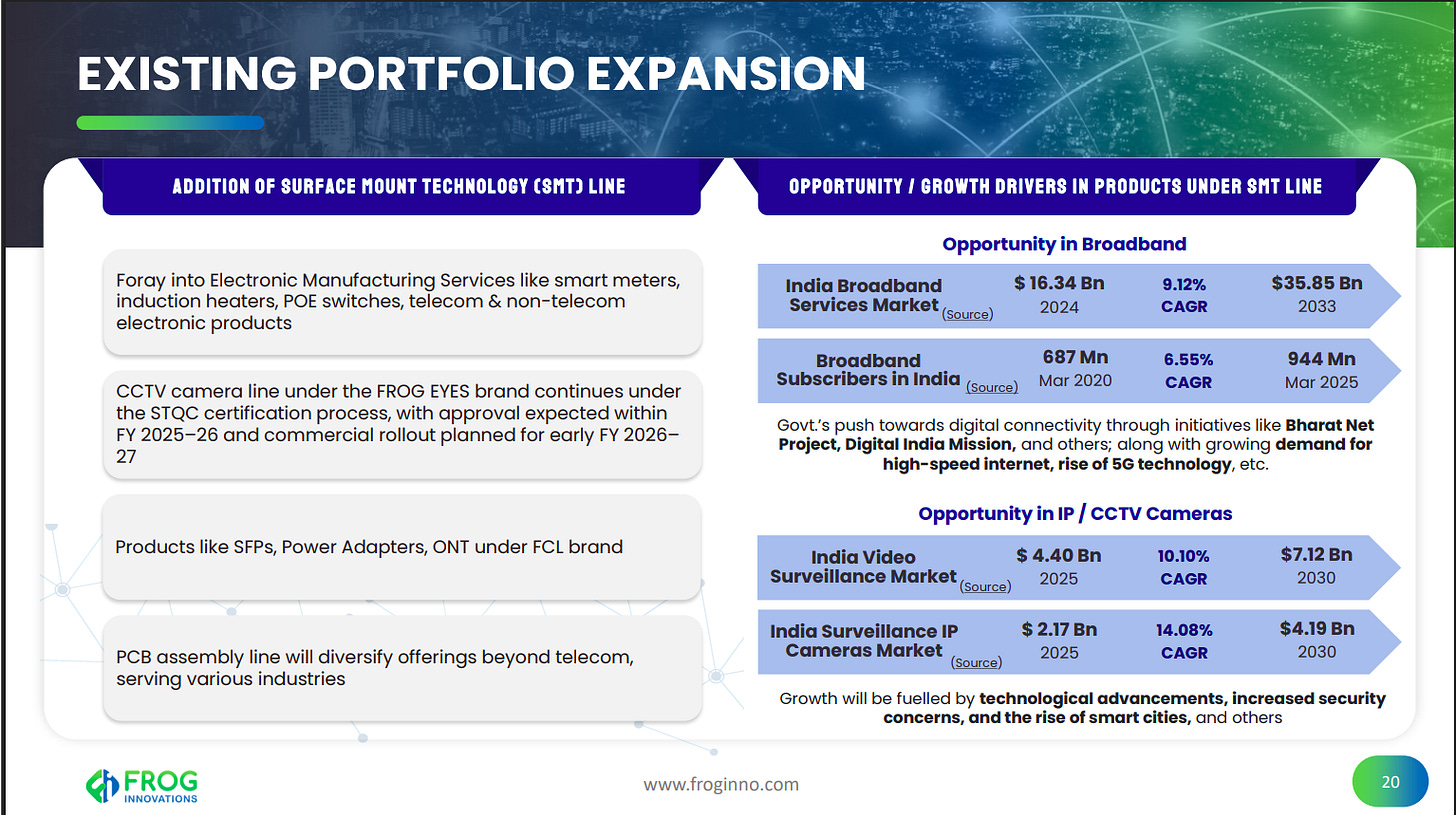

The addition of an SMT line enables FIL’s entry into electronic manufacturing services across telecom and non-telecom products, including CCTV, broadband equipment, and power adapters. Large, fast-growing markets in broadband and video surveillance provide clear monetization opportunities.

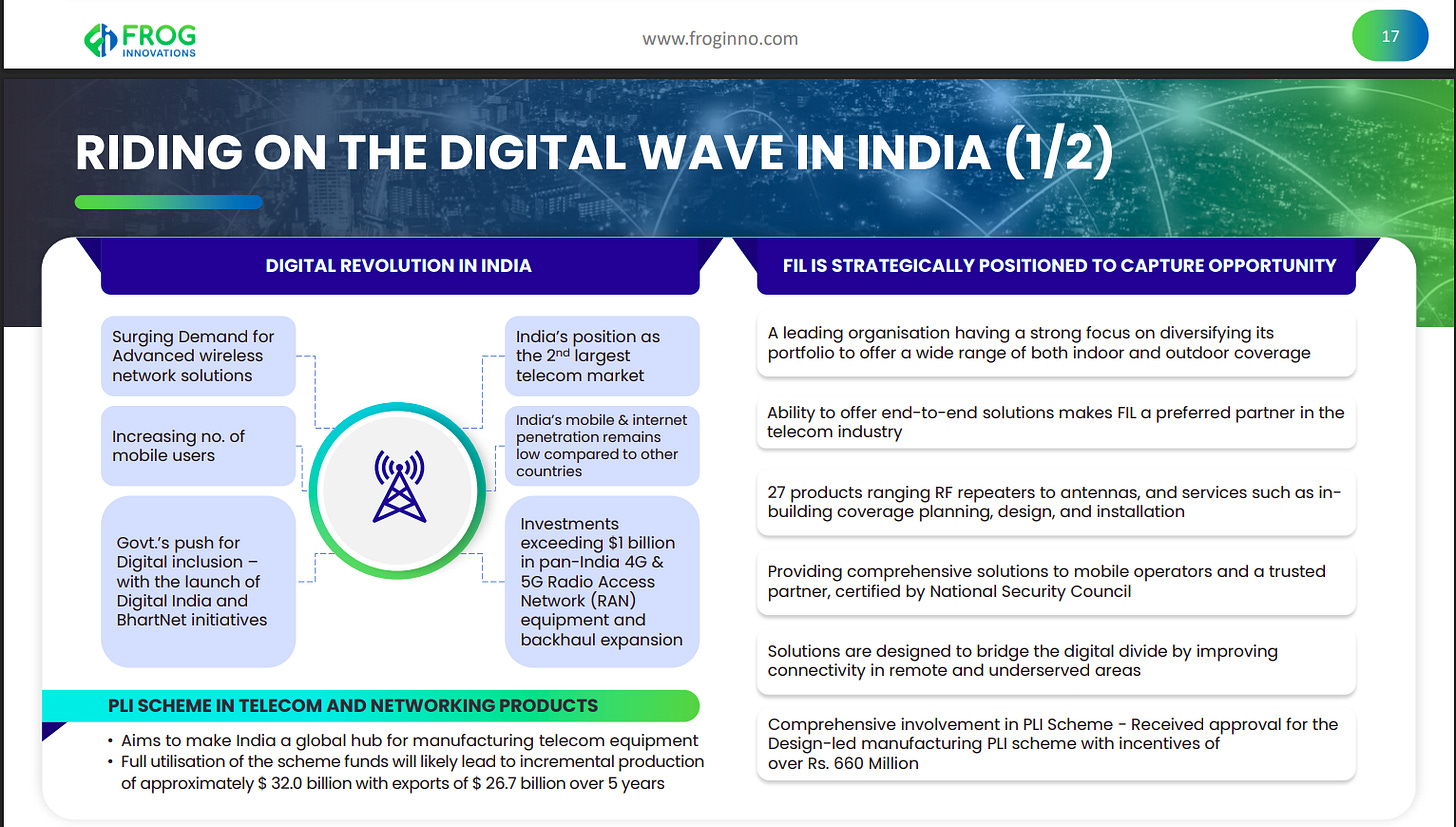

India’s rapid digital adoption, rising mobile penetration, and heavy investments in 4G/5G networks are driving demand for advanced wireless solutions. FIL is strategically positioned with end-to-end offerings, a wide product portfolio, and PLI support to capture this growth.

Logistics

ABS Marine Services | Micro Cap | Logistics

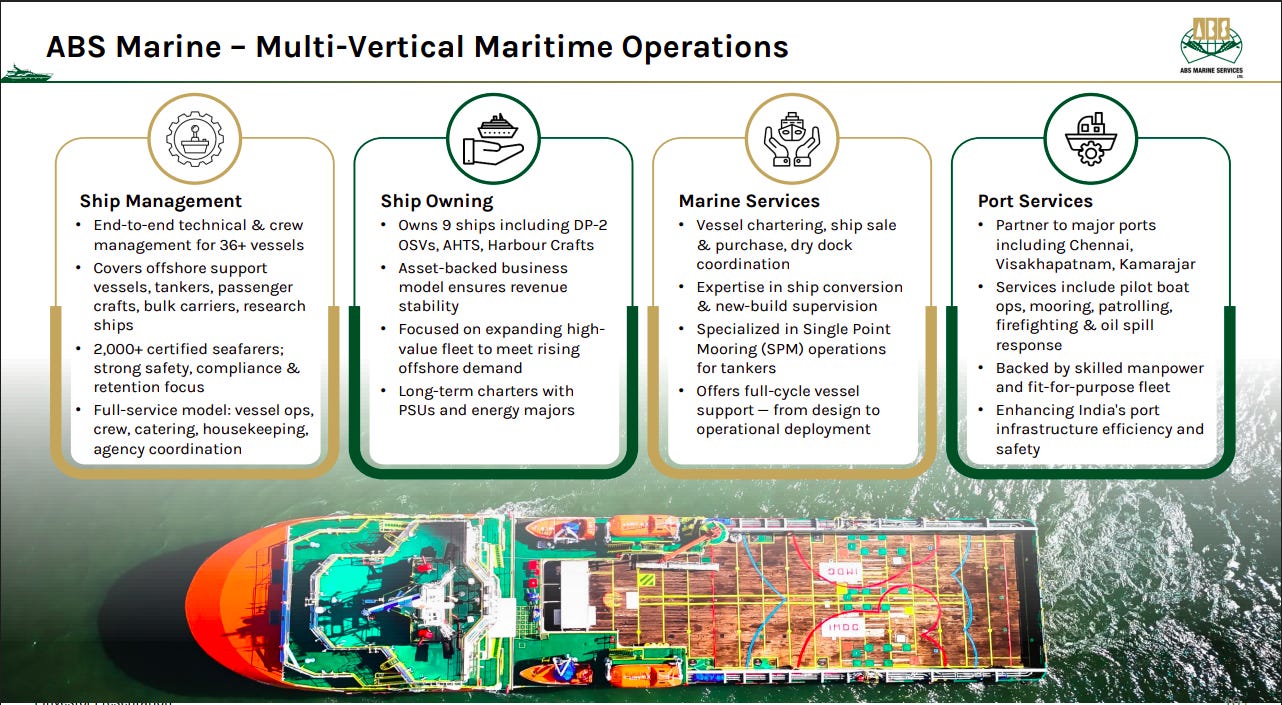

ABS Marine Services Limited, formerly known as ABS Marine Services Private Limited, has been operating since 1992. Over the years, the company has become a leading player in ship management, ship owning, marine services, and port services, demonstrating significant growth and expertise in the maritime industry.

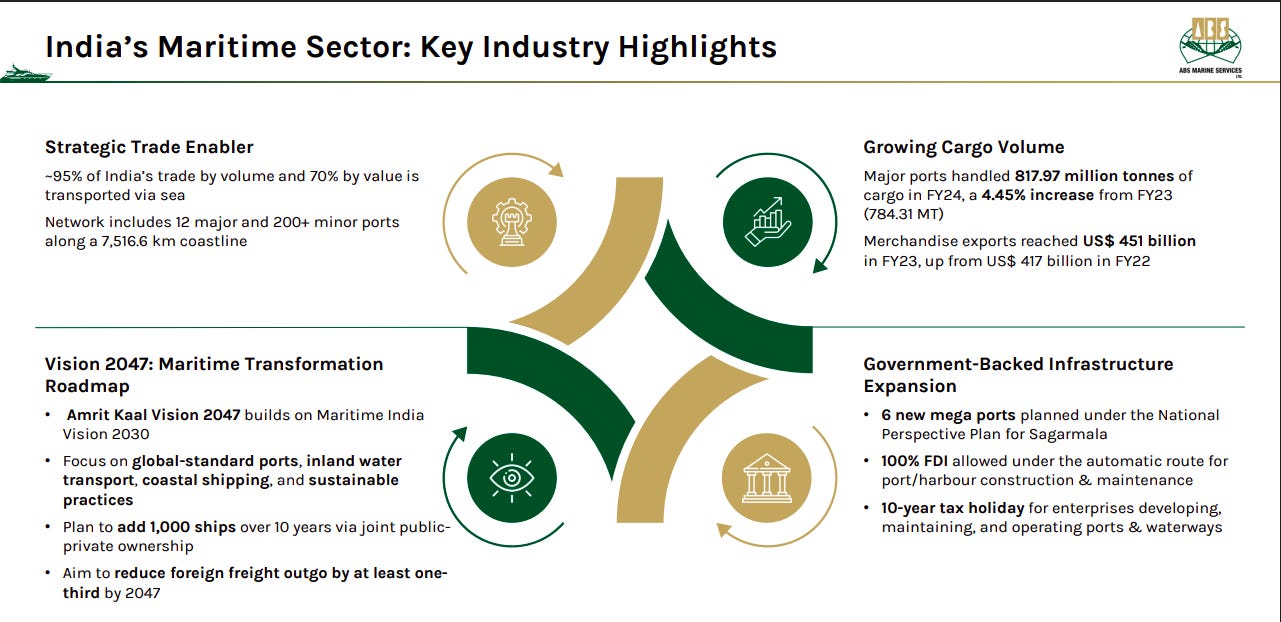

India’s maritime sector is a critical trade enabler, carrying ~95% of trade by volume, supported by a large port network and strong cargo growth. Vision 2047 and Sagarmala-driven investments, 100% FDI, and PPP-led port expansion position the sector for long-term transformation and reduced foreign freight dependence.

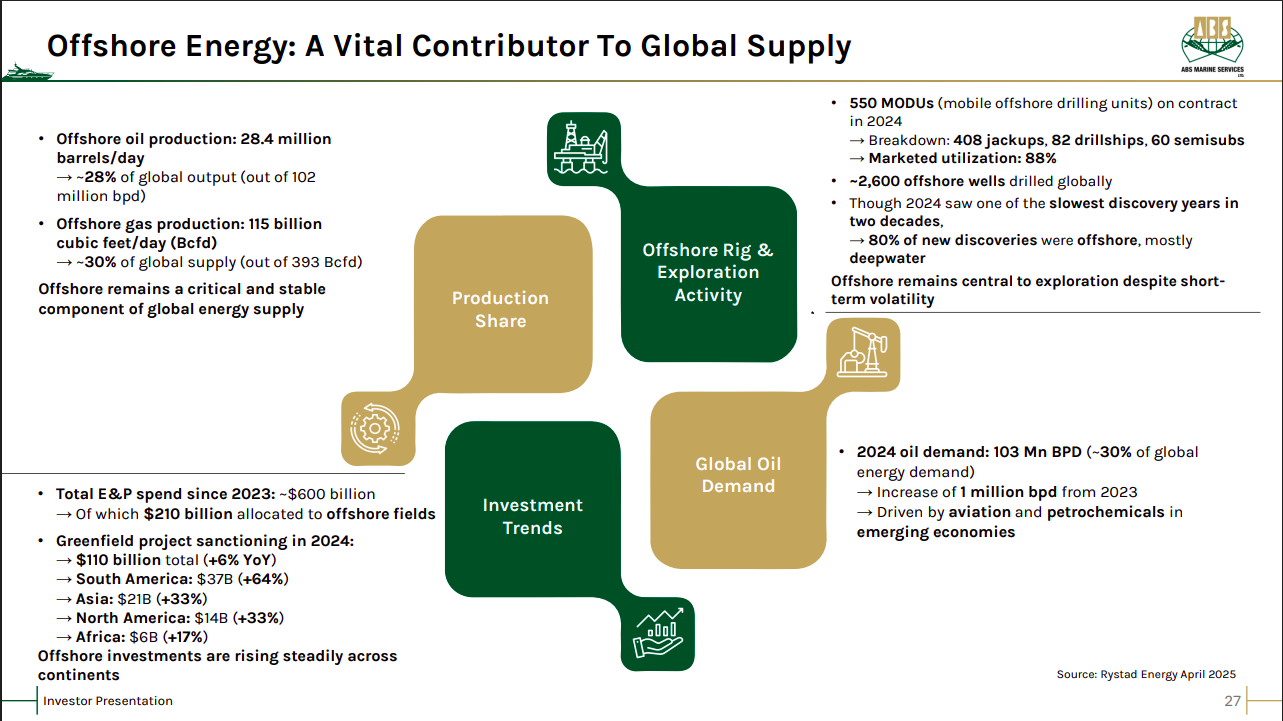

Offshore energy remains central to global oil and gas supply, contributing ~30% of global output, with utilization and investment levels staying resilient despite short-term volatility. Rising offshore E&P spending, deepwater discoveries, and steady global oil demand underpin sustained offshore activity.

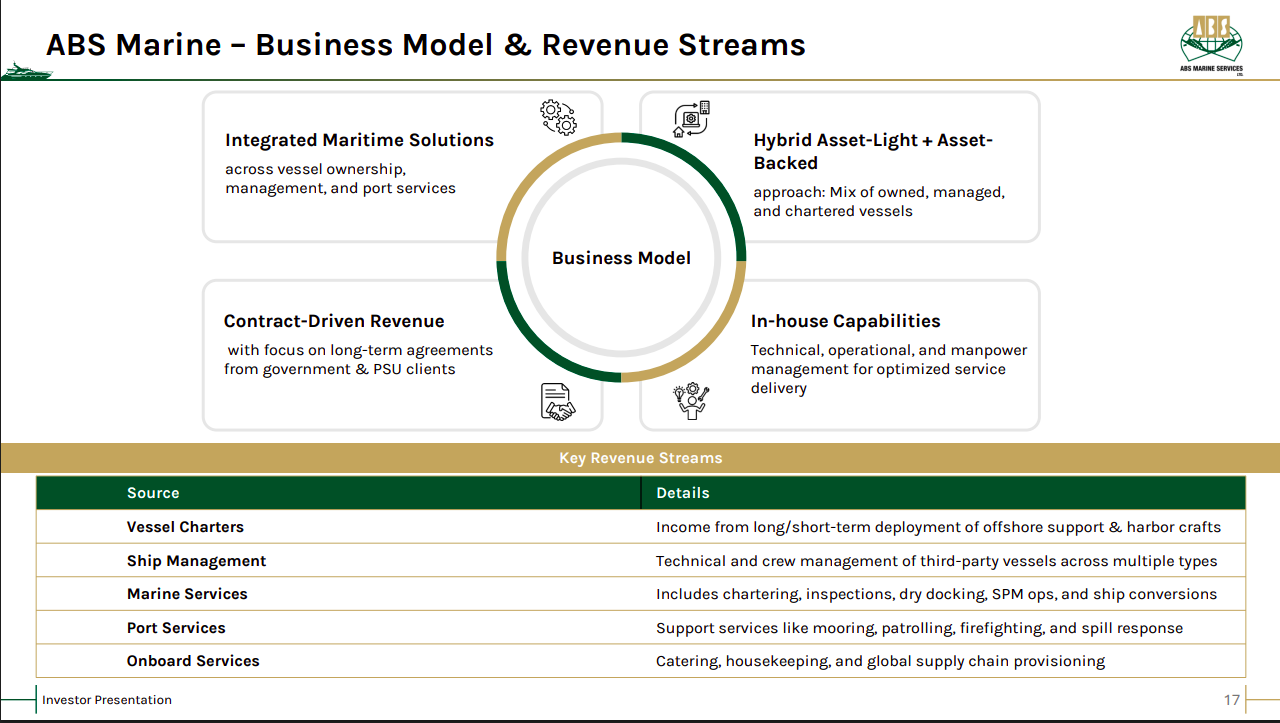

ABS Marine operates an integrated, contract-driven maritime model combining asset-light and asset-backed strategies across vessel ownership, management, and port services. Long-term PSU and government contracts, supported by strong in-house technical and operational capabilities, ensure revenue visibility and stability.

ABS Marine has diversified operations across ship management, ship owning, marine services, and port services, covering the full vessel lifecycle. Its asset-backed fleet, skilled manpower, and long-term charters with PSUs and energy majors create a resilient, scalable maritime platform.

Software Services

Coforge | Mid Cap | Software Services

Coforge provides IT/ITES solutions globally, specializing in Application Development & Maintenance, Managed Services, Cloud Computing, and Business Process Outsourcing. It serves sectors like Financial Services, Insurance, Travel, Transportation & Logistics, Manufacturing & Distribution, and Government, delivering tailored technology solutions to enhance business operations.

The global software testing market is expanding alongside rising software complexity, reaching ~$57 billion in 2025 and projected to grow sharply by 2032. The industry is shifting away from rate-and-capacity models toward AI-led, outcome-driven testing. Coforge positions itself with right-sized, differentiated testing assets and an AI-first approach as a competitive advantage.

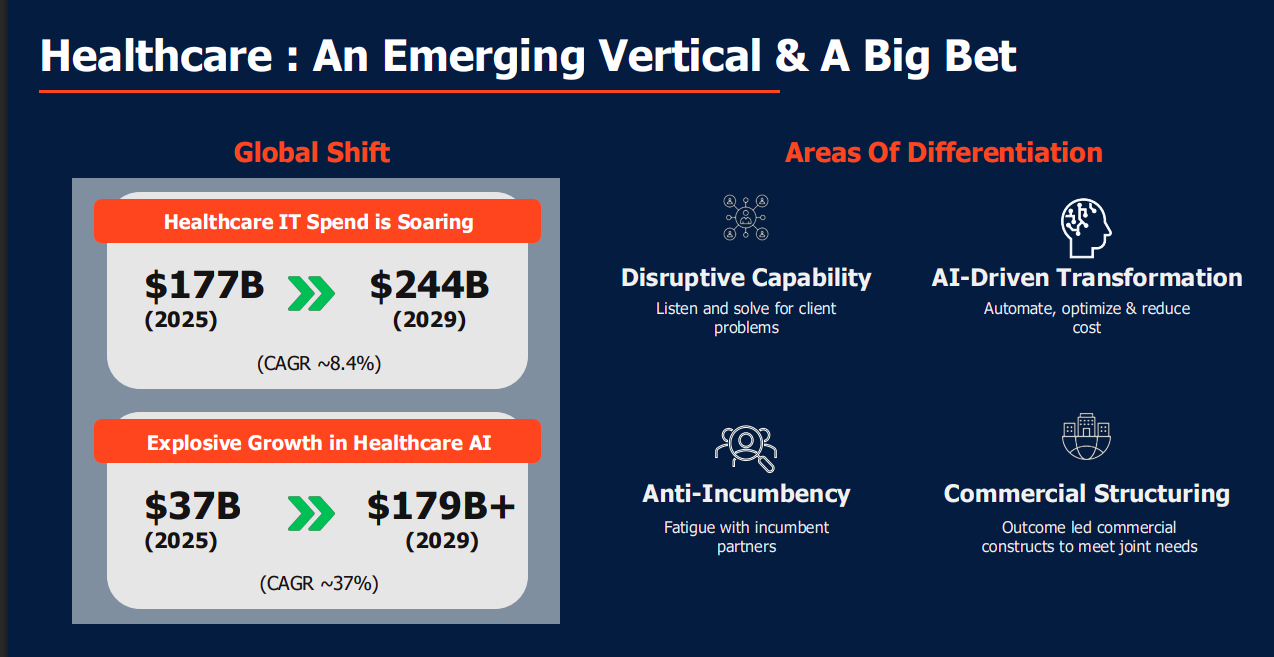

Healthcare is emerging as a major growth engine, with global healthcare IT spend rising from $177 billion in 2025 to $244 billion by 2029. Healthcare AI is growing even faster, scaling from $37 billion to over $179 billion in the same period. Coforge differentiates through AI-driven transformation, disruptive delivery models, and outcome-linked commercial structures.

Coforge operates at a ~$2 billion revenue run rate with ~35,000 employees across 25 countries and 33 delivery centers. The company serves 61 Forbes Global 1000 clients, enjoys ~95% repeat business, and maintains one of the lowest attrition rates in the industry at 11.4%. Valuations reflect strong growth expectations with elevated LTM and forward PEs.

Coforge has climbed rapidly from the 18th position in 2017 to become the 7th largest IT services company by 2025. This rise places it alongside established leaders like TCS, Infosys, and HCL Tech. The shift highlights sustained execution, scale expansion, and increasing relevance among mid-tier IT services firms.

Excelsoft Technologies | Micro Cap | Software Services

Excelsoft Technologies provides innovative technology-based solutions in education and e-learning, specializing in digital content and technology solutions. The Group excels in learning design and content development, delivering cost-effective, professionally developed solutions for diverse clients through a process-driven model.

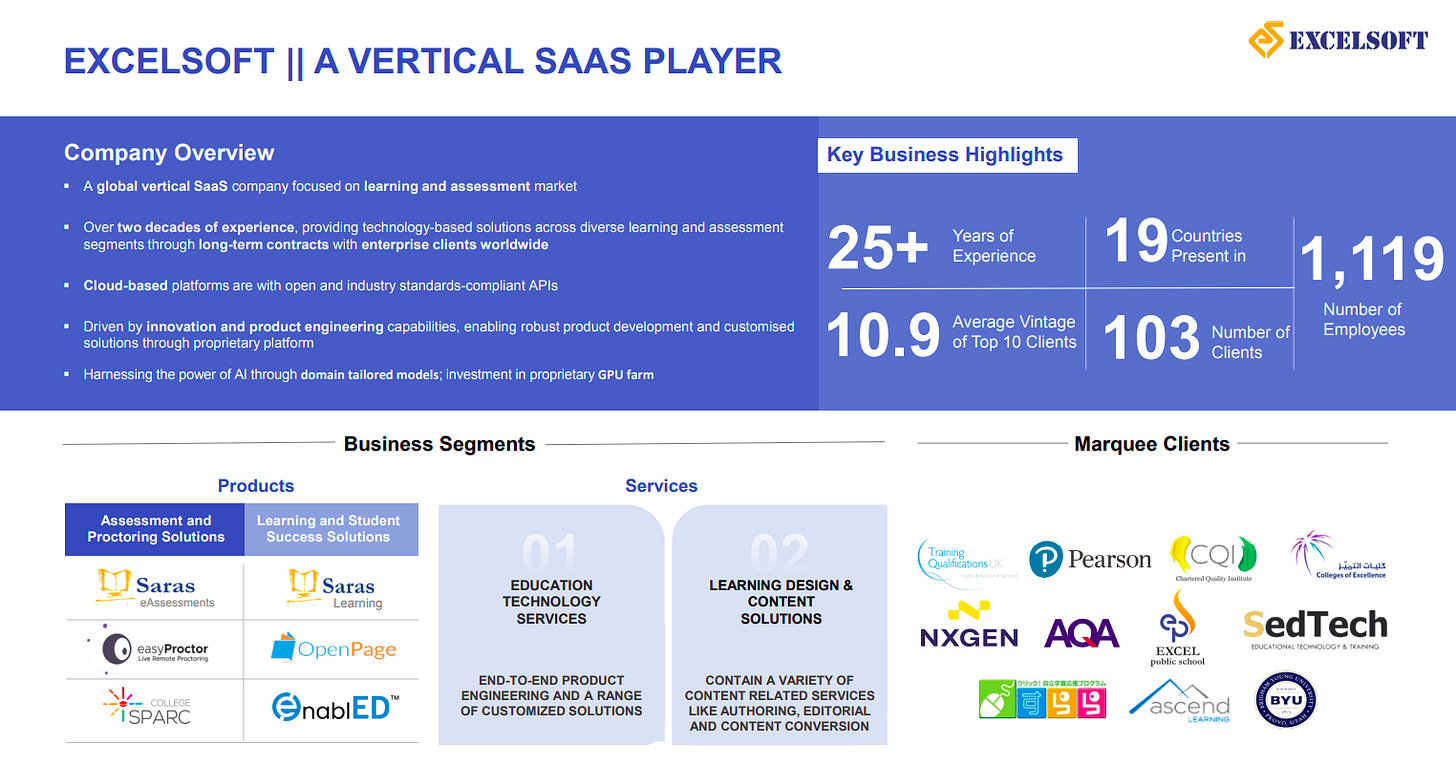

Excelsoft is a global vertical SaaS company focused on learning and assessment, with 25+ years of experience, presence in 19 countries, and 103 clients. It combines cloud-native platforms, AI-led innovation, and deep domain expertise to deliver scalable assessment, learning, and education technology solutions.

Excelsoft’s growth strategy centers on expanding revenues from existing and new customers, entering new geographies, and strengthening brand positioning. The company is also focused on AI-led product development, strategic acquisitions in EdTech, investments in modern technologies, and building strong global sales teams and people culture.

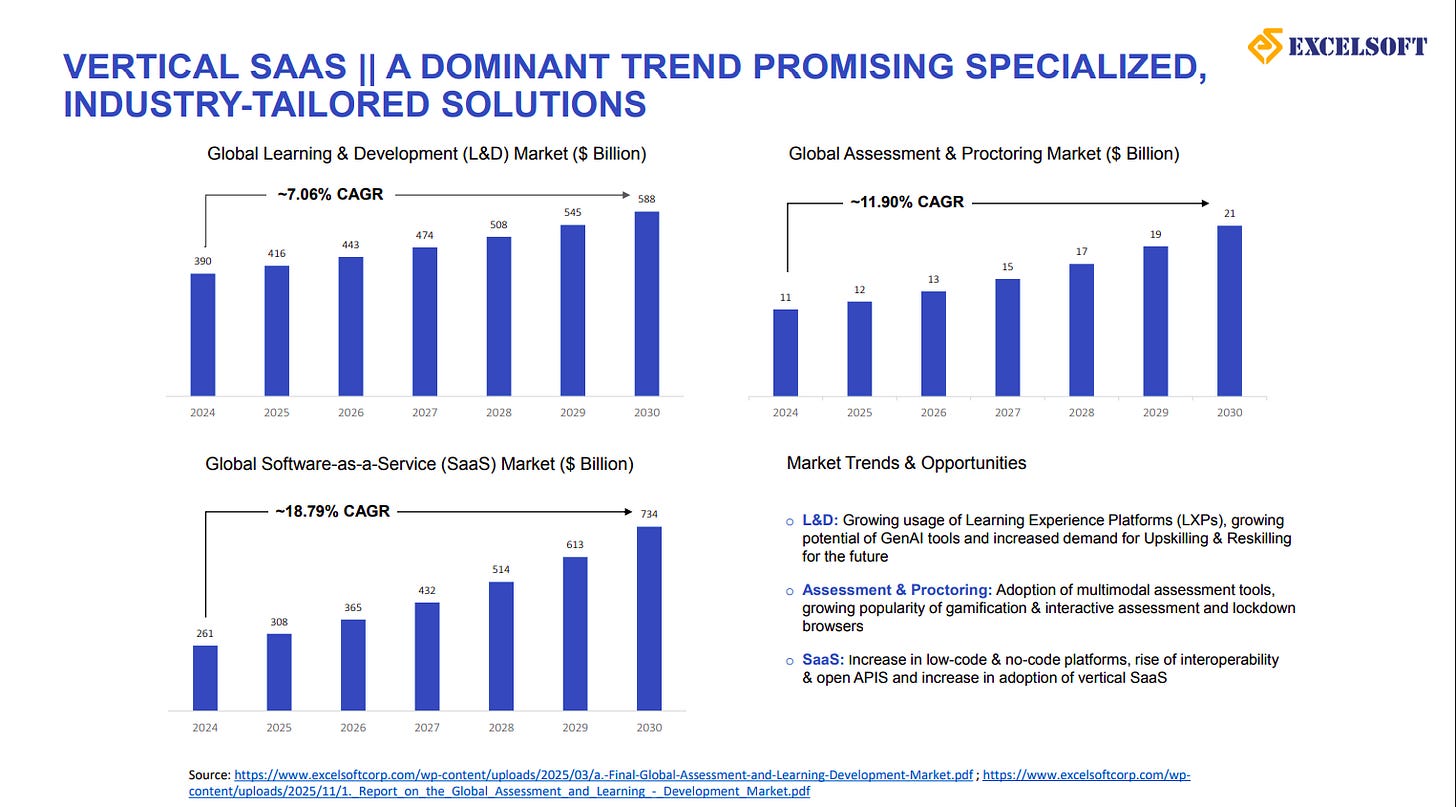

Vertical SaaS is emerging as a dominant trend, supported by steady growth in global L&D (~7% CAGR), assessment & proctoring (~12% CAGR), and SaaS (~19% CAGR) markets. Rising adoption of GenAI, multimodal assessments, low-code platforms, and industry-specific solutions creates a strong long-term opportunity for specialized SaaS players like Excelsoft.

Packaging

Uflex | Small Cap | Packaging

Uflex Limited is a leading Indian Multinational known for manufacturing and selling flexible packaging products globally. With a focus on quality innovation, it provides complete packaging solutions that help preserve freshness and extend shelf life of food products. Its reputation in the industry, both in India and overseas, positions it as a prominent name among printing and packaging companies.

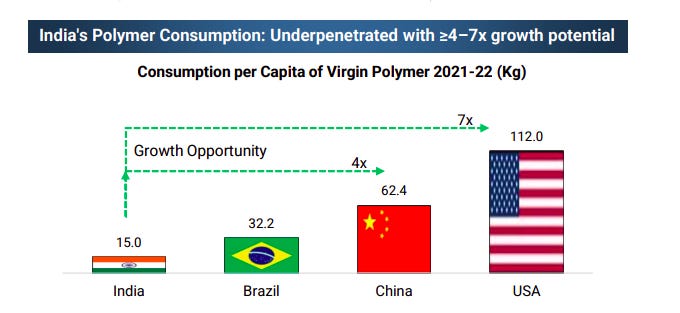

India’s per-capita polymer consumption remains significantly underpenetrated at ~15 kg versus China and the US, indicating a 4–7x long-term growth opportunity. Rising industrialization, packaging demand, and consumption-led growth position India for sustained polymer volume expansion.

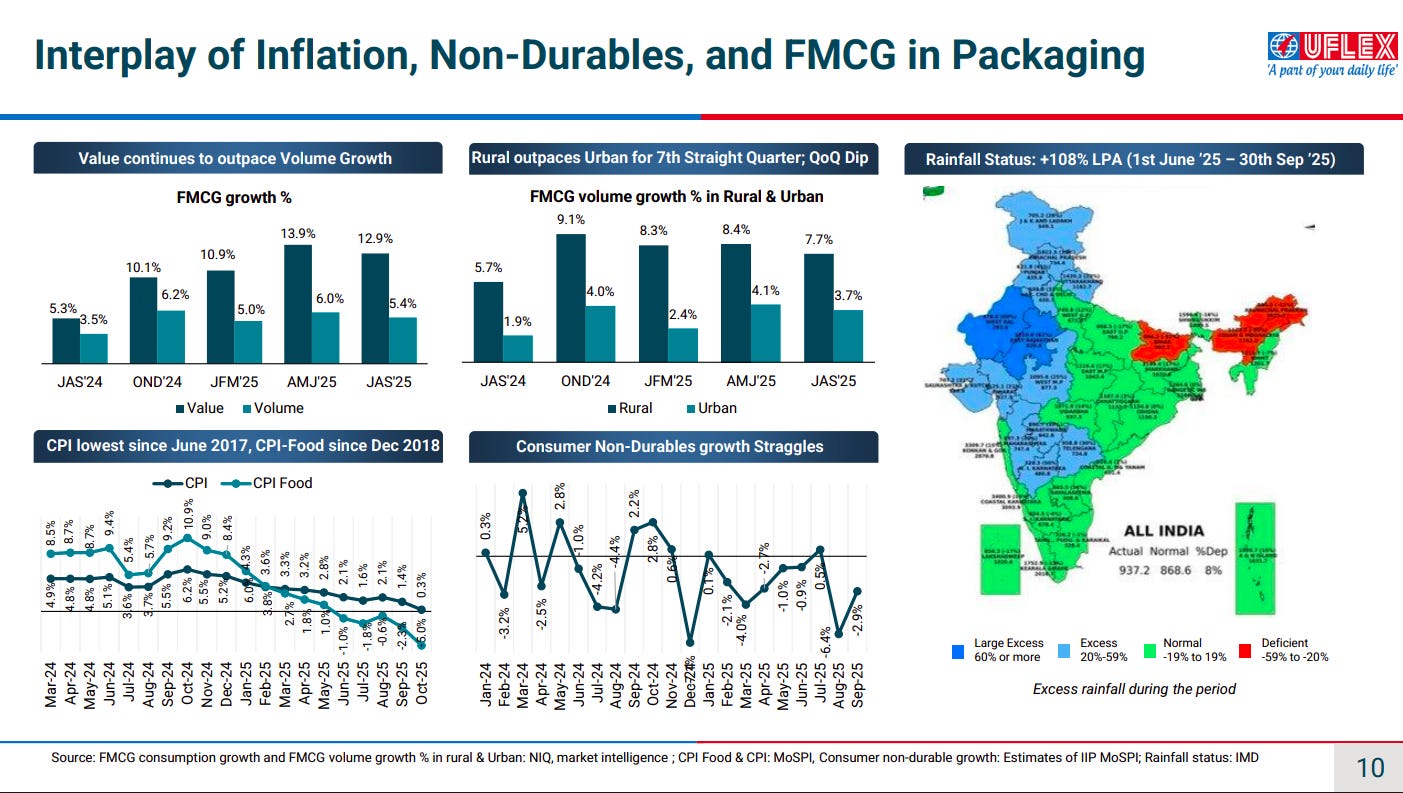

FMCG value growth continues to outpace volume growth, driven by pricing, while rural demand has consistently outperformed urban over the past several quarters. Moderating CPI, strong monsoons (+108% LPA), and gradual rural recovery provide a supportive backdrop for packaging demand.

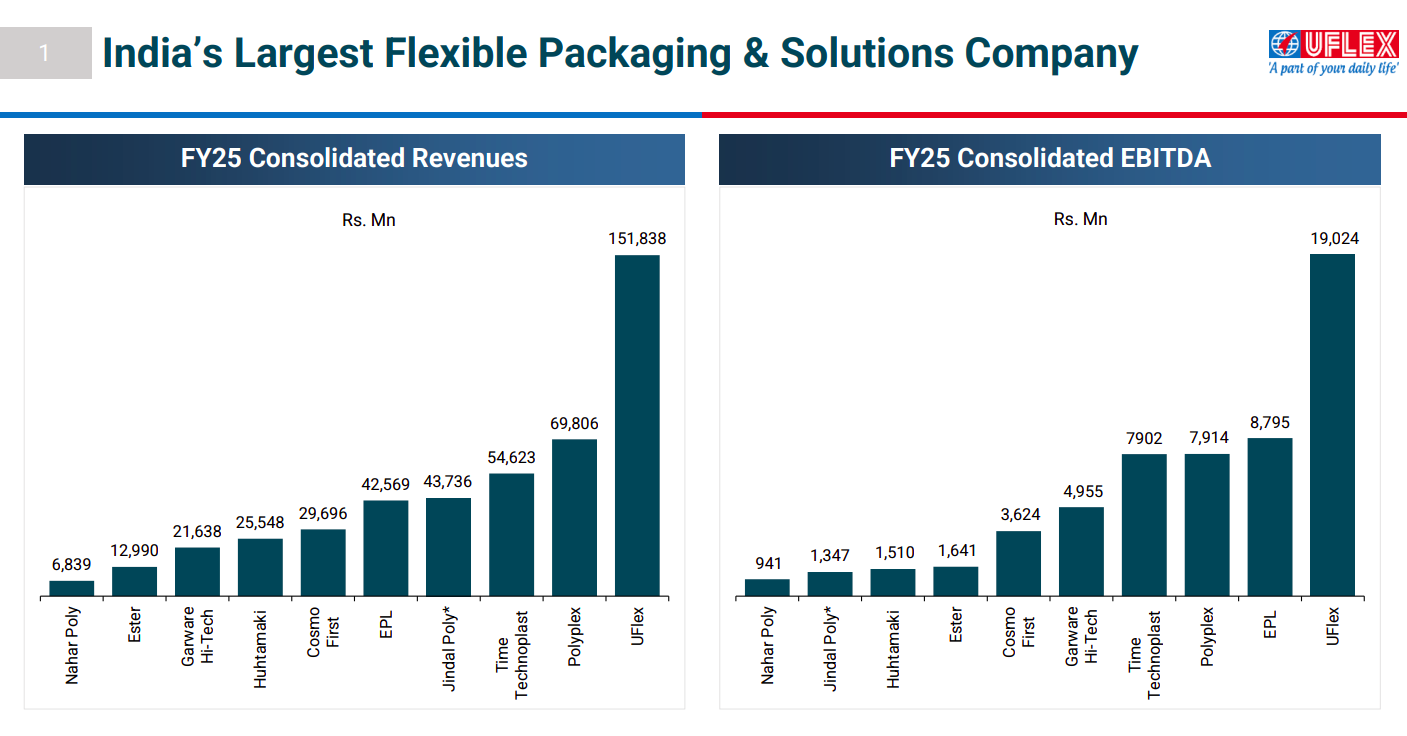

India’s flexible packaging market is consolidating, with scale players like UFlex leading on revenues and EBITDA in FY25. Strong integration, diversified end markets, and operating leverage position large players to benefit disproportionately from industry growth.

Both global and Indian BOPET/BOPP film markets are on a steady growth trajectory, driven by rising consumption, higher capacity utilization, and downstream FMCG demand. India is growing faster than global averages, supported by capacity additions and export competitiveness.

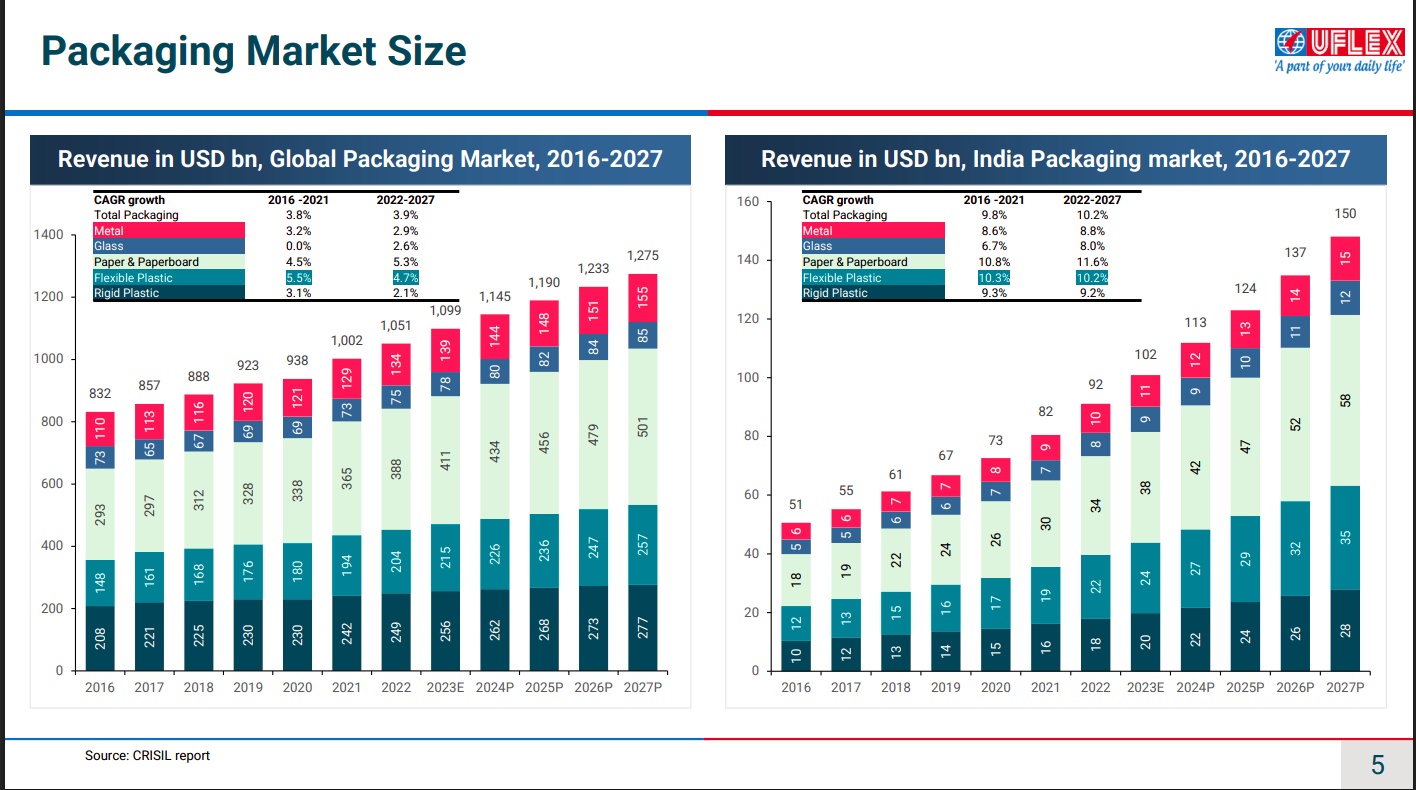

The global packaging market is growing steadily, while India’s packaging market is expanding at a materially higher CAGR, led by flexible plastics and paperboard. Structural drivers like urbanization, organized retail, and e-commerce continue to fuel long-term demand growth.

Chemicals

Sacheerome | Micro Cap | Chemicals

Sacheerome is a creative house specializing in designing and manufacturing fragrances and flavors. Their products meet global standards set by IFRA, EU, FSSAI, and FEMA, ensuring high quality and safety.

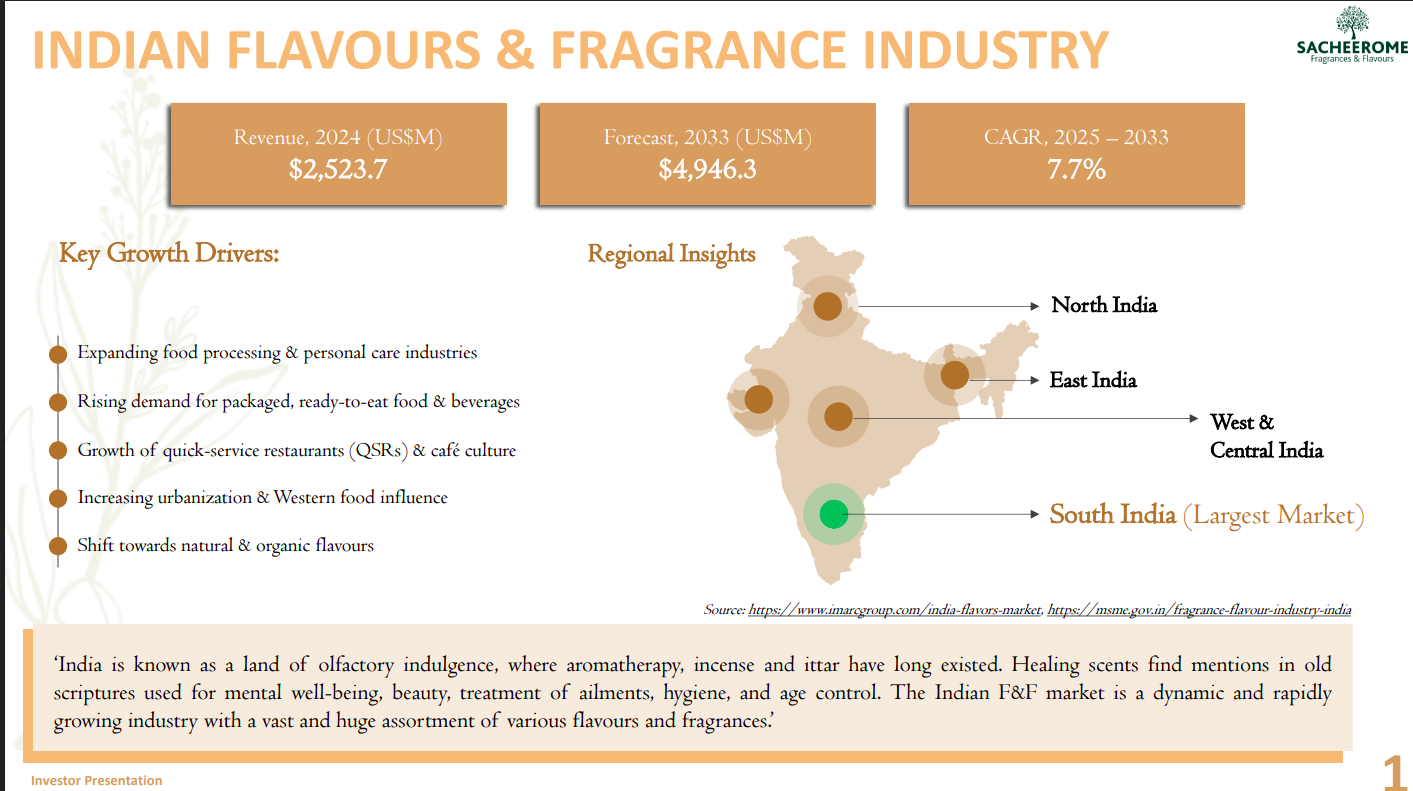

India’s flavours and fragrance market is a fast-growing domestic opportunity, with revenues of about US$2.5 bn in 2024 expected to nearly double to ~US$4.9 bn by 2033 at a ~7.7% CAGR. Growth is driven by food processing, packaged foods, QSR expansion, urbanization, and a shift toward natural and organic flavours, with South India emerging as the largest regional market.

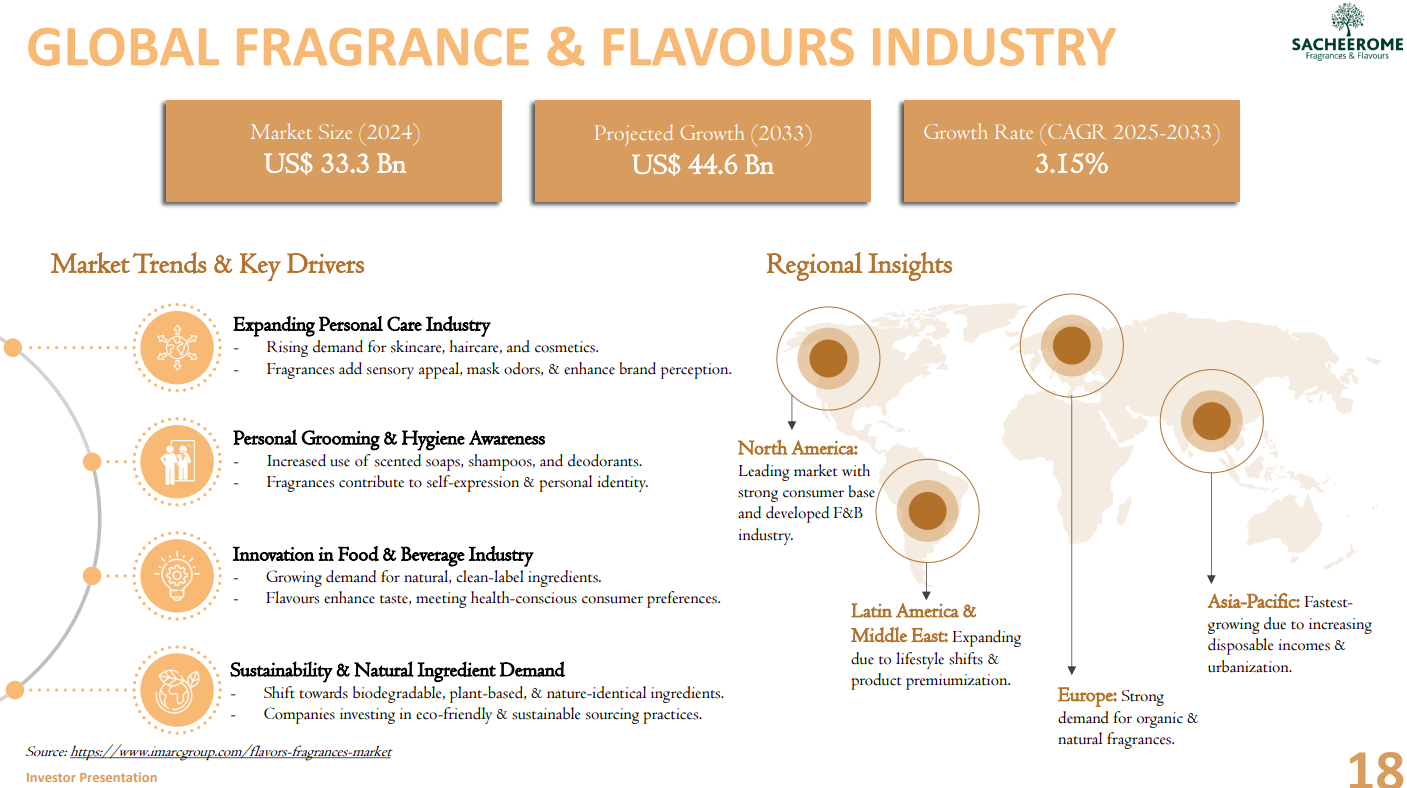

The global flavours and fragrances market stood at ~US$33.3 bn in 2024 and is projected to reach ~US$44.6 bn by 2033, growing at a steady ~3.15% CAGR. Demand is supported by personal care, grooming, and clean-label food trends, with North America leading consumption, Europe focused on natural fragrances, and Asia-Pacific the fastest-growing region due to rising incomes and urbanization.

Building Materials

Global Surfaces | Micro Cap | Building Materials

Global Surfaces Limited specializes in processing natural stones like granite, marble, and quartzite, which are known for their unique aesthetic appeal. They also manufacture engineered quartz countertops made of crushed stone bonded with resin. The company offers a range of products that cater to the construction and design industry.

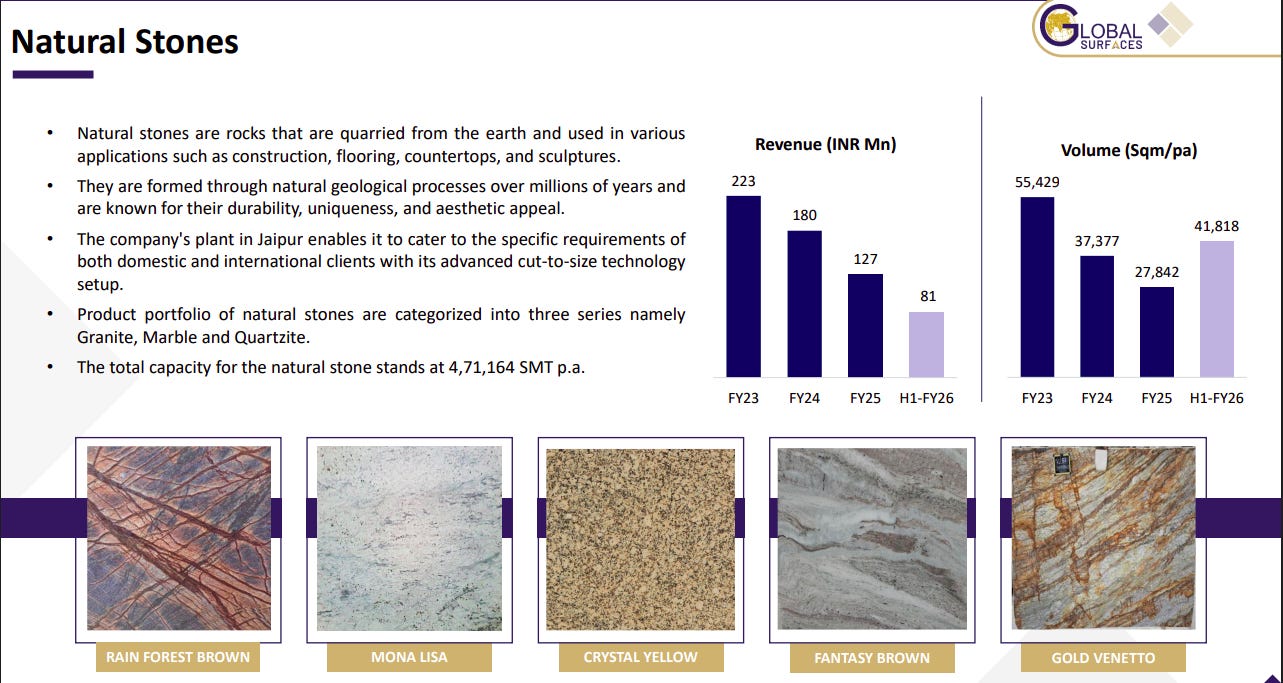

Natural stones are used across construction, flooring, countertops, and décor, valued for durability and aesthetics. The company offers granite, marble, and quartzite, supported by a Jaipur facility and strong cut-to-size capabilities. Revenue and volumes show moderation in FY25, with partial recovery in H1 FY26.

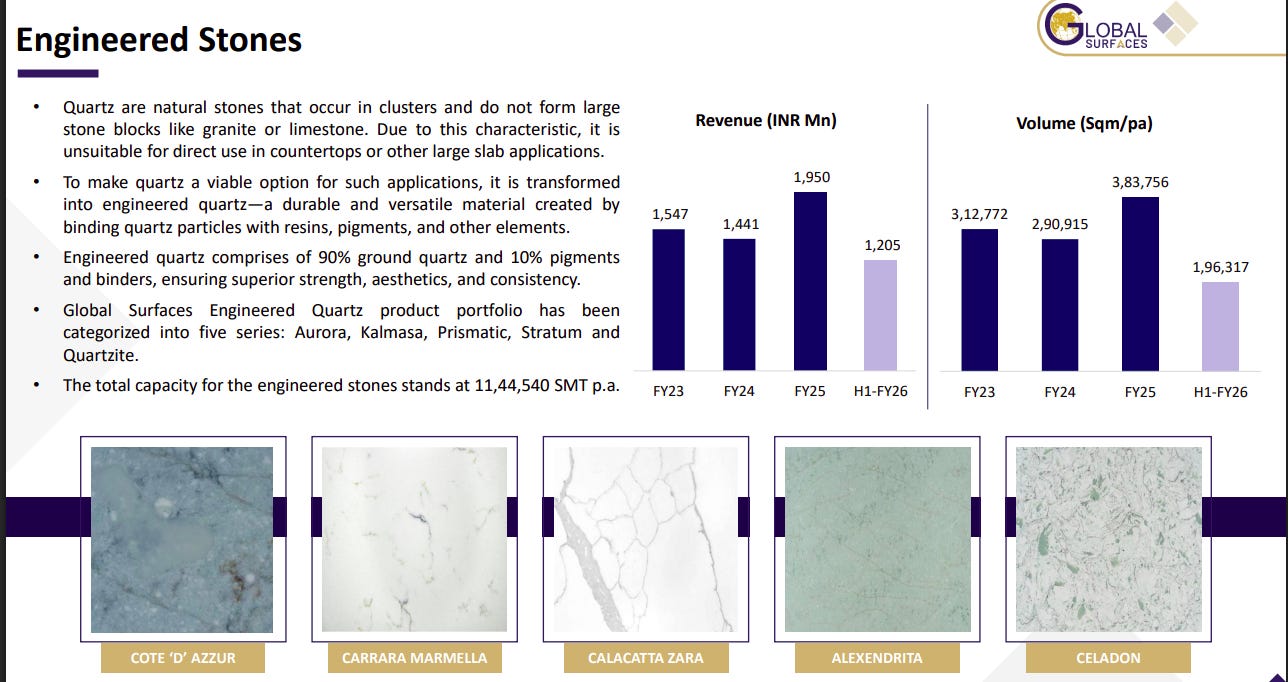

Engineered quartz is manufactured by binding quartz particles with resins, offering superior strength, consistency, and design flexibility. The portfolio spans five series and targets countertops and large slab applications. Despite strong FY25 revenue growth, H1 FY26 volumes softened, reflecting near-term demand normalization.

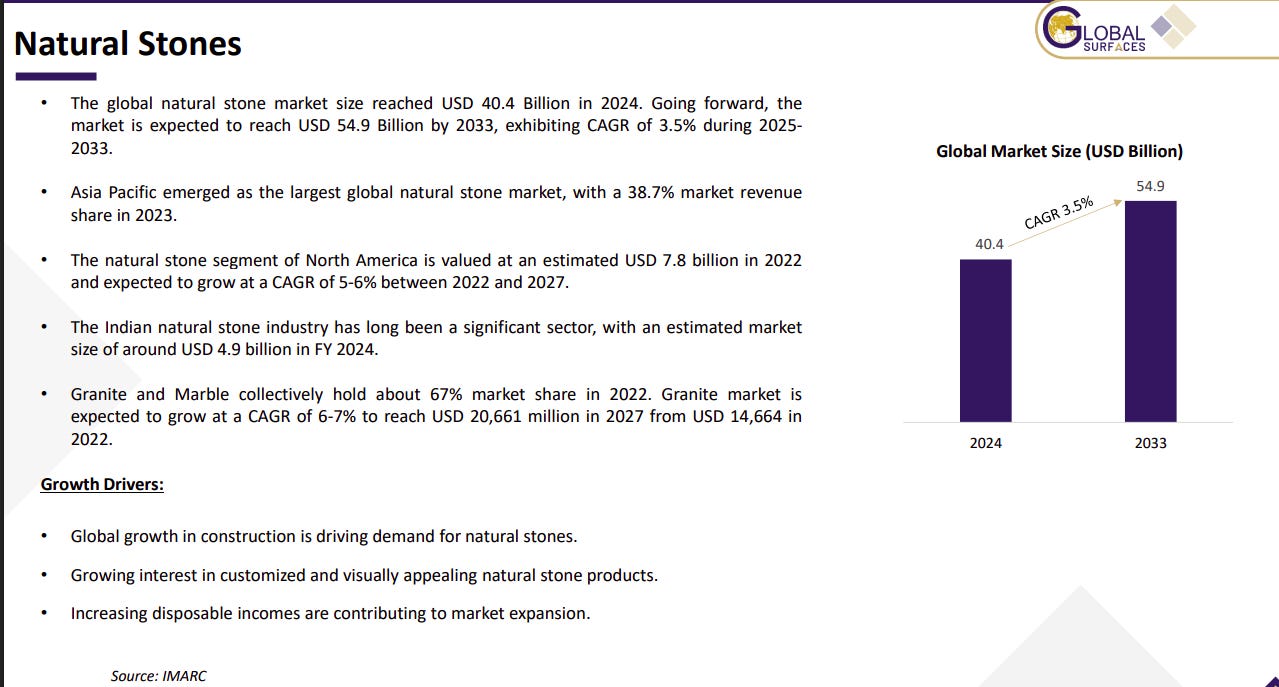

The global natural stone market stood at USD 40.4 billion in 2024 and is projected to reach USD 54.9 billion by 2033 at a ~3.5% CAGR. Asia-Pacific leads demand, while India remains a key producer with granite and marble accounting for the bulk of market share. Growth is driven by construction activity and rising preference for premium surfaces.

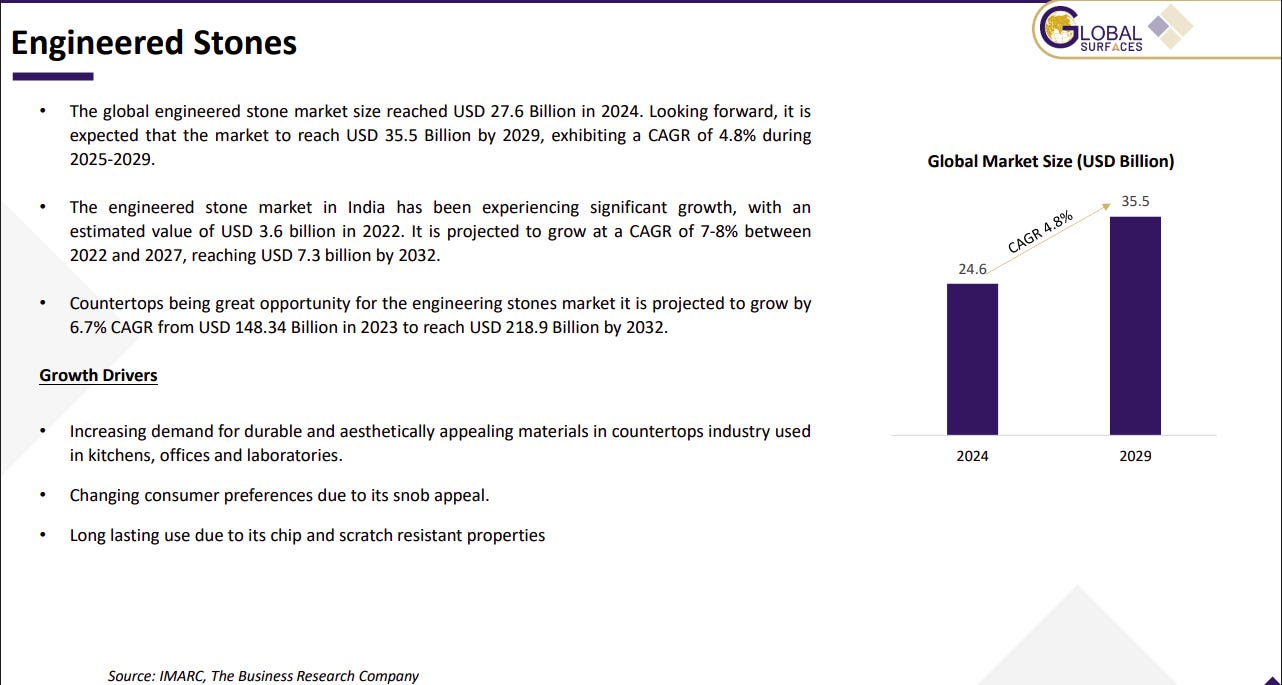

The global engineered stone market reached USD 27.6 billion in 2024 and is expected to grow to USD 35.5 billion by 2029 at a ~4.8% CAGR. India’s market is expanding faster, supported by countertop demand and premium interior applications. Durability, aesthetics, and scratch resistance are key adoption drivers.

Demand is being driven by urbanization, infrastructure expansion, and rising preference for durable, aesthetic surfaces in residential and commercial spaces. Export opportunities are improving, aided by tariffs on Chinese quartz. Technological advancements and AI-driven manufacturing are enhancing customization, quality, and efficiency.

Healthcare

Biocon | Mid Cap | Healthcare

Biocon is a global biopharmaceutical company focused on making complex therapies for chronic conditions like diabetes, cancer, and autoimmune diseases more affordable. It develops and commercializes biologics, biosimilars, and complex small molecule APIs in India and global markets, as well as generic formulations in the US and Europe.

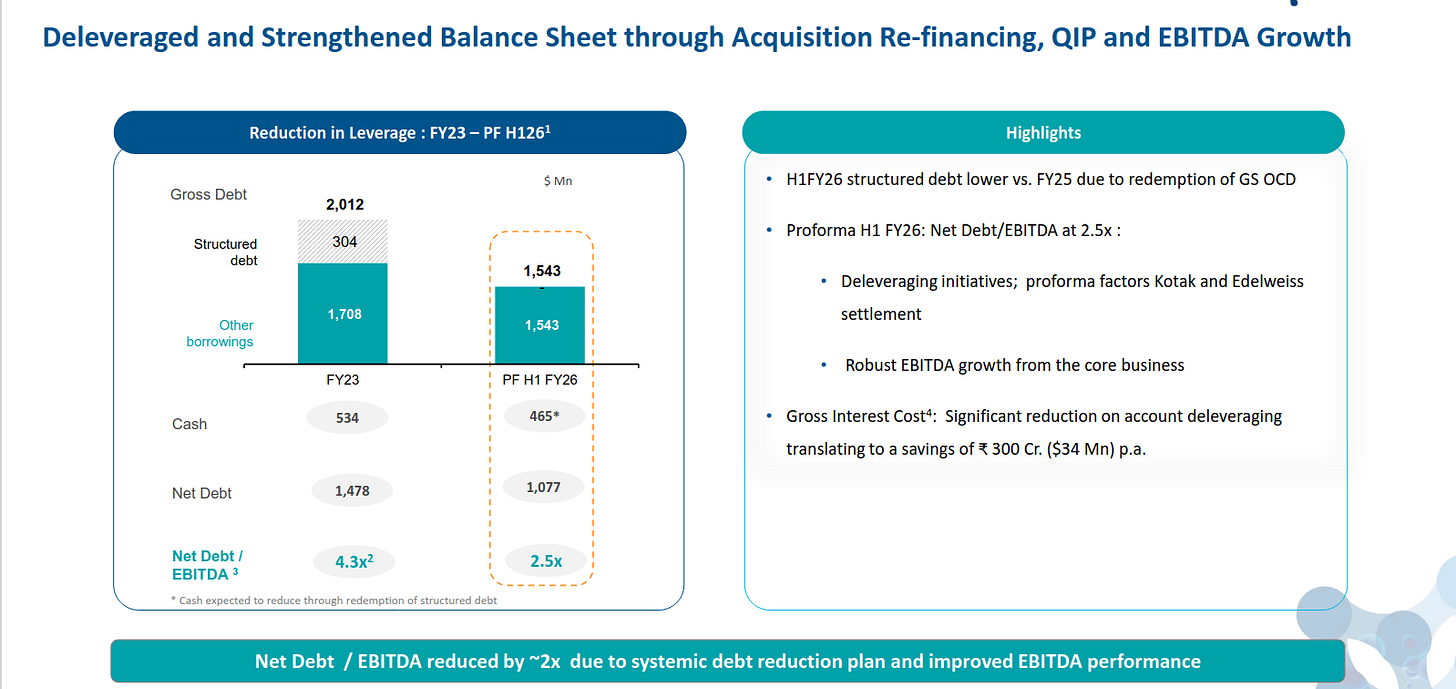

The company has significantly reduced leverage through refinancing, QIP, and strong EBITDA growth, bringing Net Debt/EBITDA down from 4.3x in FY23 to ~2.5x on a pro-forma H1 FY26 basis. Lower structured debt and interest costs are improving cash flows and balance-sheet resilience.

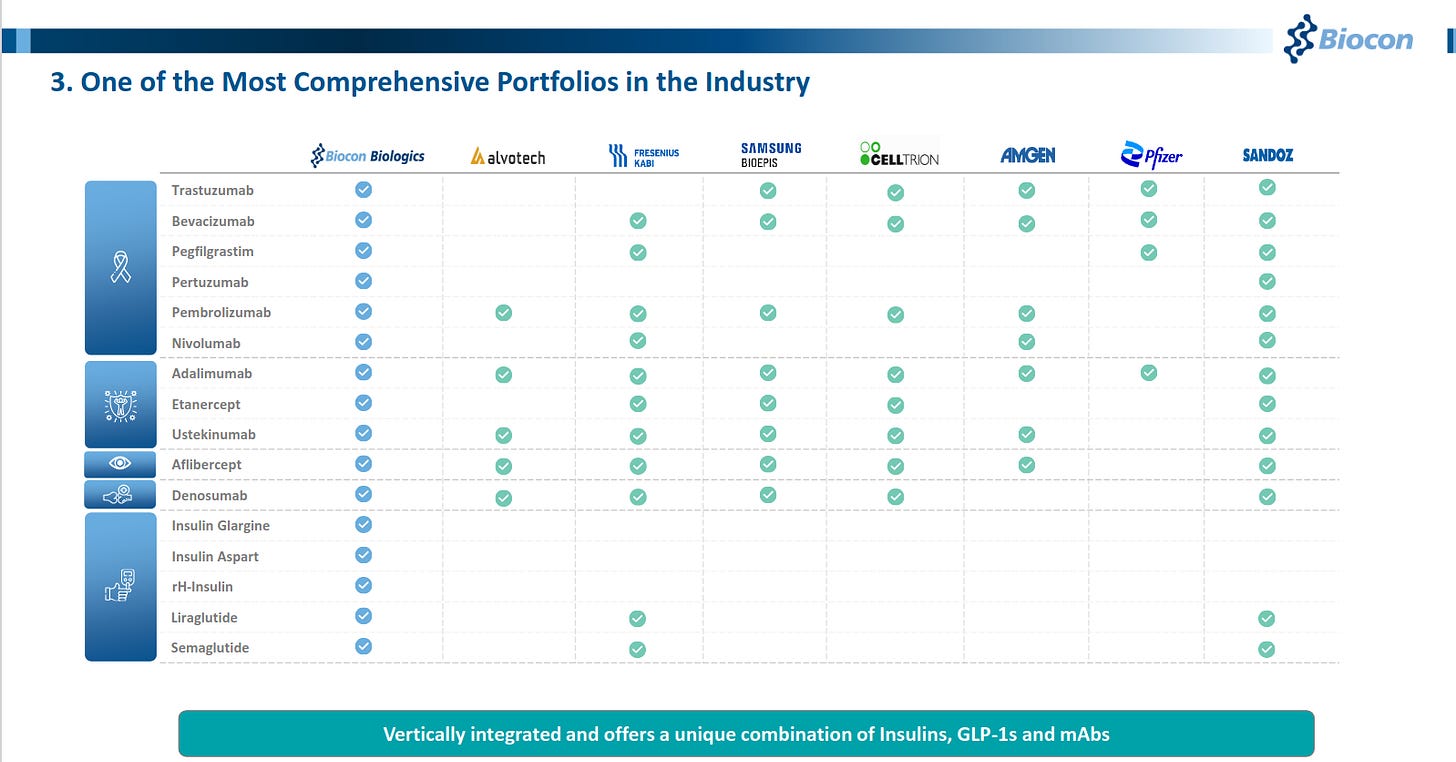

Biocon Biologics has one of the industry’s broadest biosimilar portfolios spanning insulins, GLP-1s, and monoclonal antibodies, comparable with global peers like Pfizer, Amgen, and Samsung Bioepis. Its vertically integrated model strengthens scale, cost efficiency, and long-term competitiveness across therapies.

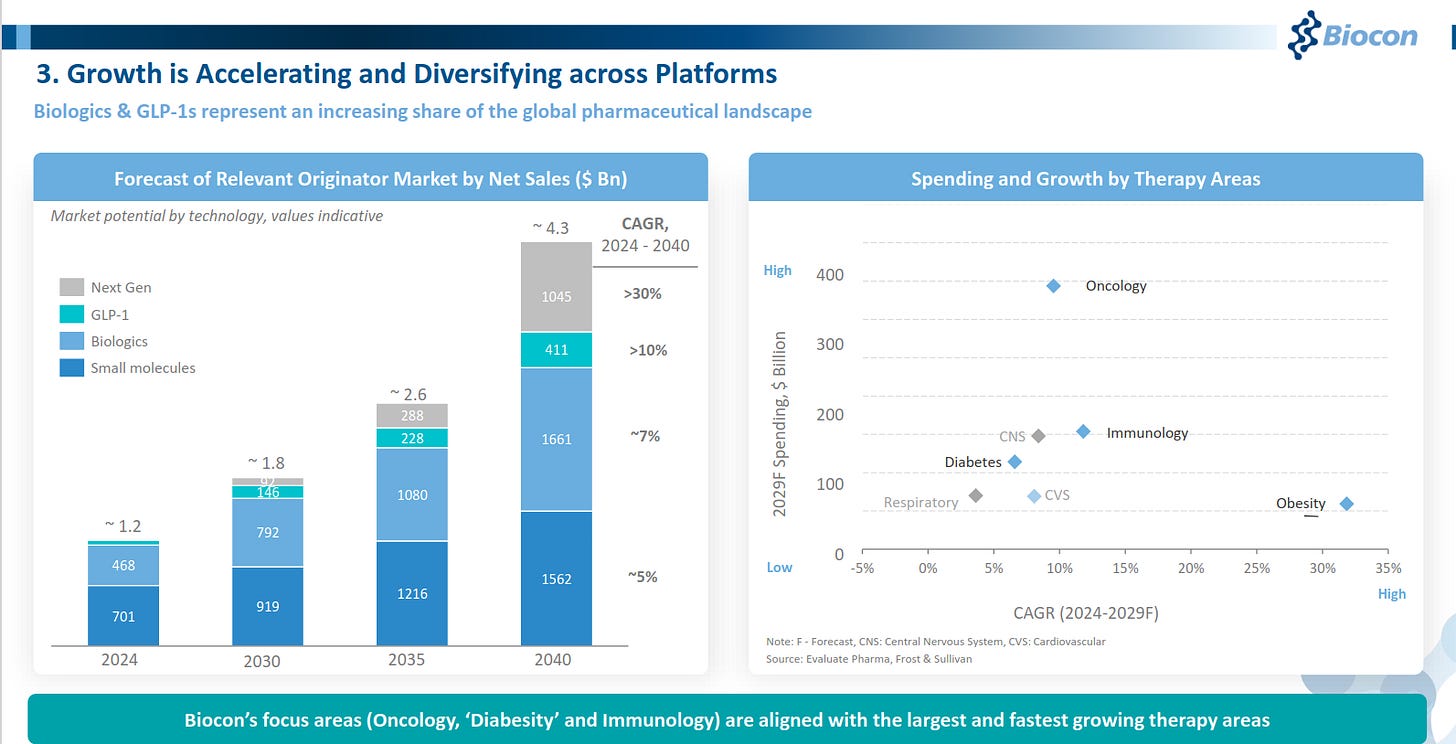

Growth is increasingly driven by biologics and GLP-1s, which are expanding faster than small molecules and gaining share in the global pharma market. Biocon’s focus on oncology, diabetes, and immunology aligns with the largest and fastest-growing therapy areas through 2040.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.

am