Sometimes, a single slide can explain more than a long report. Points and Figures is our way of breaking down what India’s leading companies are telling their shareholders and analysts. We comb through the decks, pull out the charts and data points that actually matter, and highlight the signals behind the numbers—whether about growth plans, margins, new markets, or risks on the horizon.

This is an extension of The Chatter. While The Chatter focuses on management commentary and earnings call transcripts, Points and Figures dives into investor presentations—and soon, even annual reports—to decode what companies are showing, not just what they’re saying.

We go through every major investor presentation so you don’t have to—bringing you the sharpest takeaways that reveal not just what the company is saying, but what it really means for the business, its sector, and the broader economy.

In this edition, we have covered 17 companies across 7 industries

Financial Services

Billionbrains Garage Ventures Limited

CRISIL

Bajaj Housing Finance

Tata Capital

Engineering & Capital Goods

Websol Energy System

K2 Infragen

Emmvee Photovoltaic Power

KVS Castings

Shri Balaji Valve Co

Apollo Pipes

Solarworld Energy

Software Services

Trident Techlabs

Auto Ancillary

Auto Ancillary

Kinetic Engg

FMCG

TBI Corn

Media & Entertainment

Cash UR Drive Marketing

Logistics

Brace Port Logistics

Financial Services

Billionbrains Garage Ventures Limited (Groww) | Mid Cap | Financial Services

Groww, founded in 2017 in Bengaluru, is India’s leading digital investment platform offering stocks, mutual funds, ETFs, F&O, IPOs, and credit services. With a user-friendly app and strong technology, it enables millions to invest and build wealth easily.

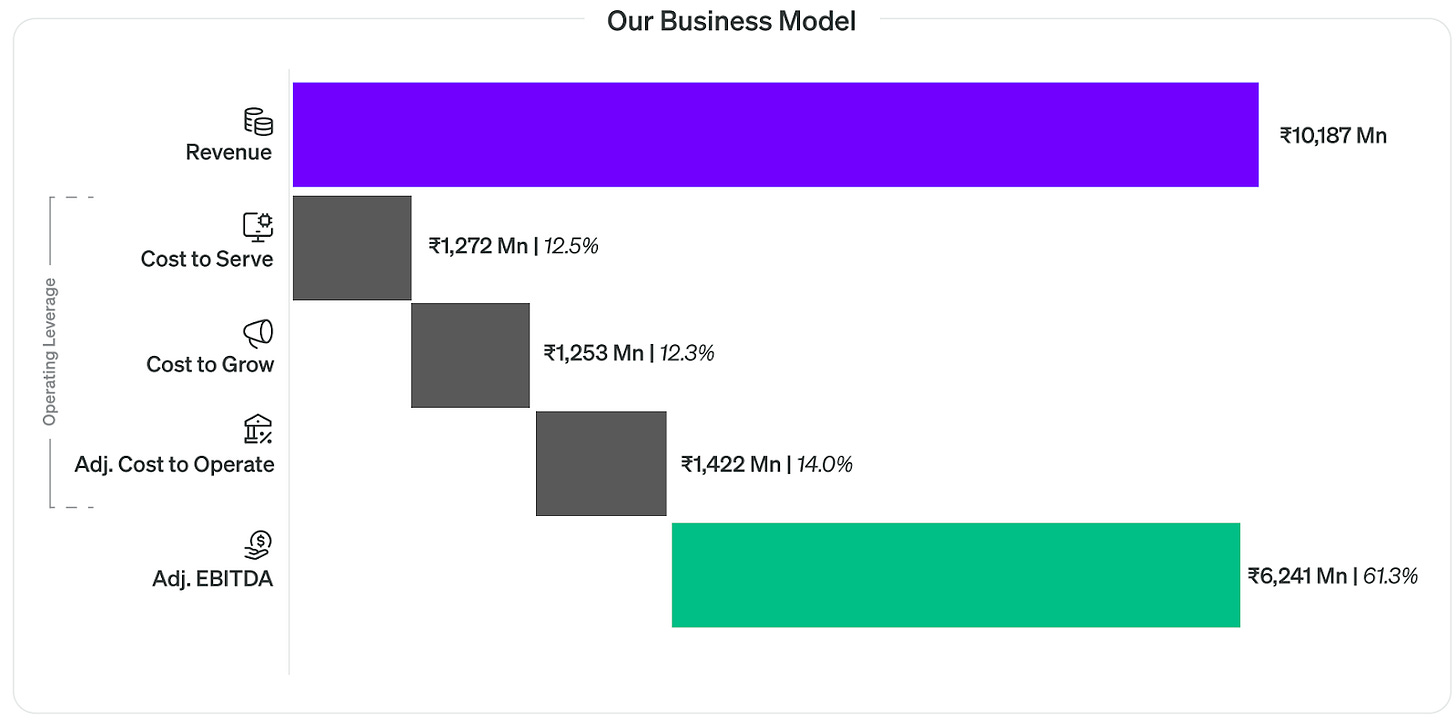

Groww’s business model shows just how much operating leverage the platform has built — after serving customers, acquiring new ones, and running the entire operation, over 60% of revenue still drops through to EBITDA. The cost structure is lean, scalable, and largely tech-driven.

Cost to Serve is what Groww spends to run its tech and process transactions, Cost to Grow is what it spends on marketing to acquire users, and Cost to Operate is what it takes to run the company day-to-day after excluding tech and marketing.

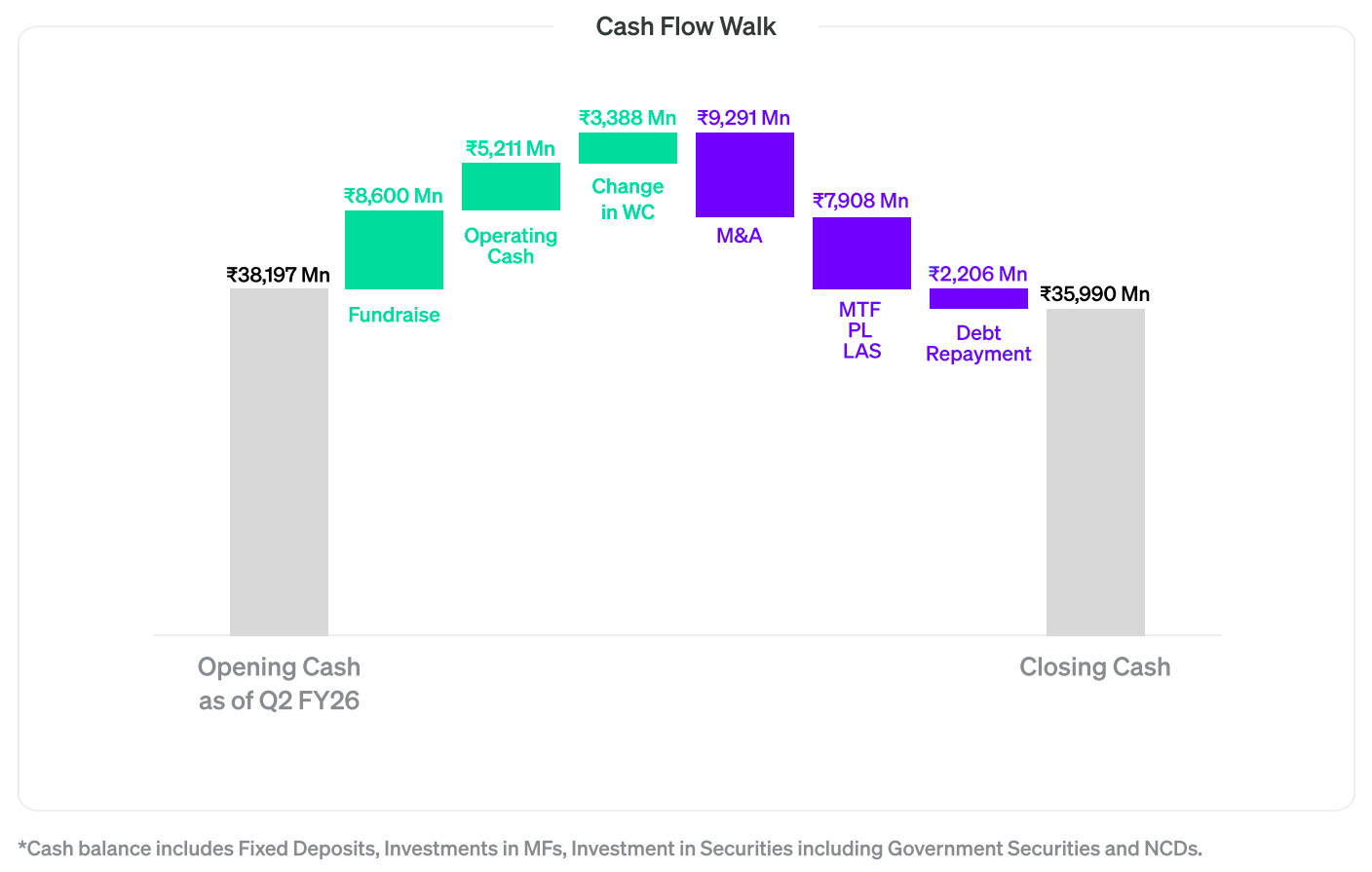

Groww’s cash walk shows a business still flush with liquidity — even after M&A spends, MTF/LAS funding, and debt repayment, the company ends the period with ₹36,000 crore in cash-like assets, thanks to strong operating cash flow and its recent fundraise.

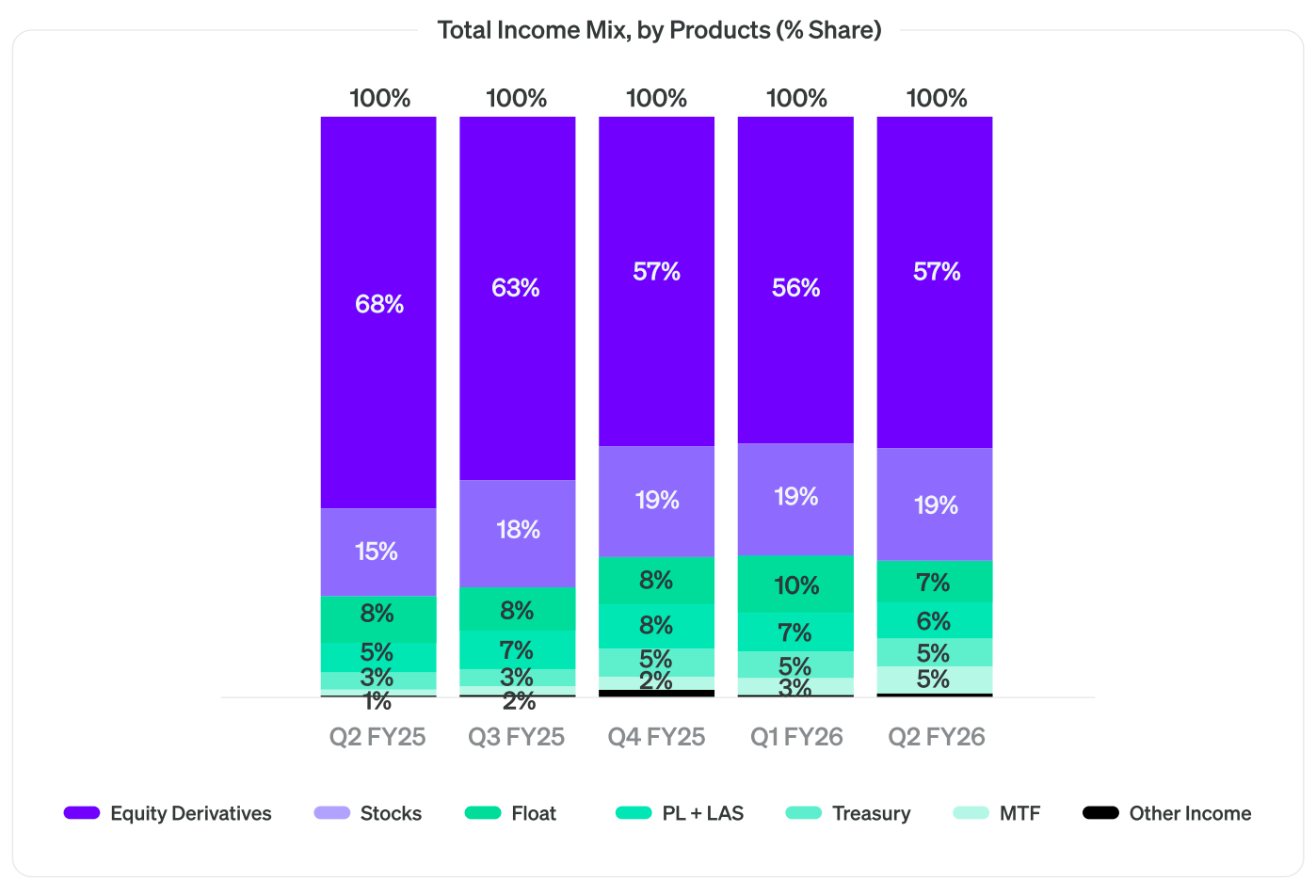

Groww’s revenue engine is still dominated by equity derivatives, which consistently make up more than half of total income — but the mix is slowly broadening as stocks, float income, and lending products (PL/LAS, MTF) contribute a growing share, reducing reliance on a single category.

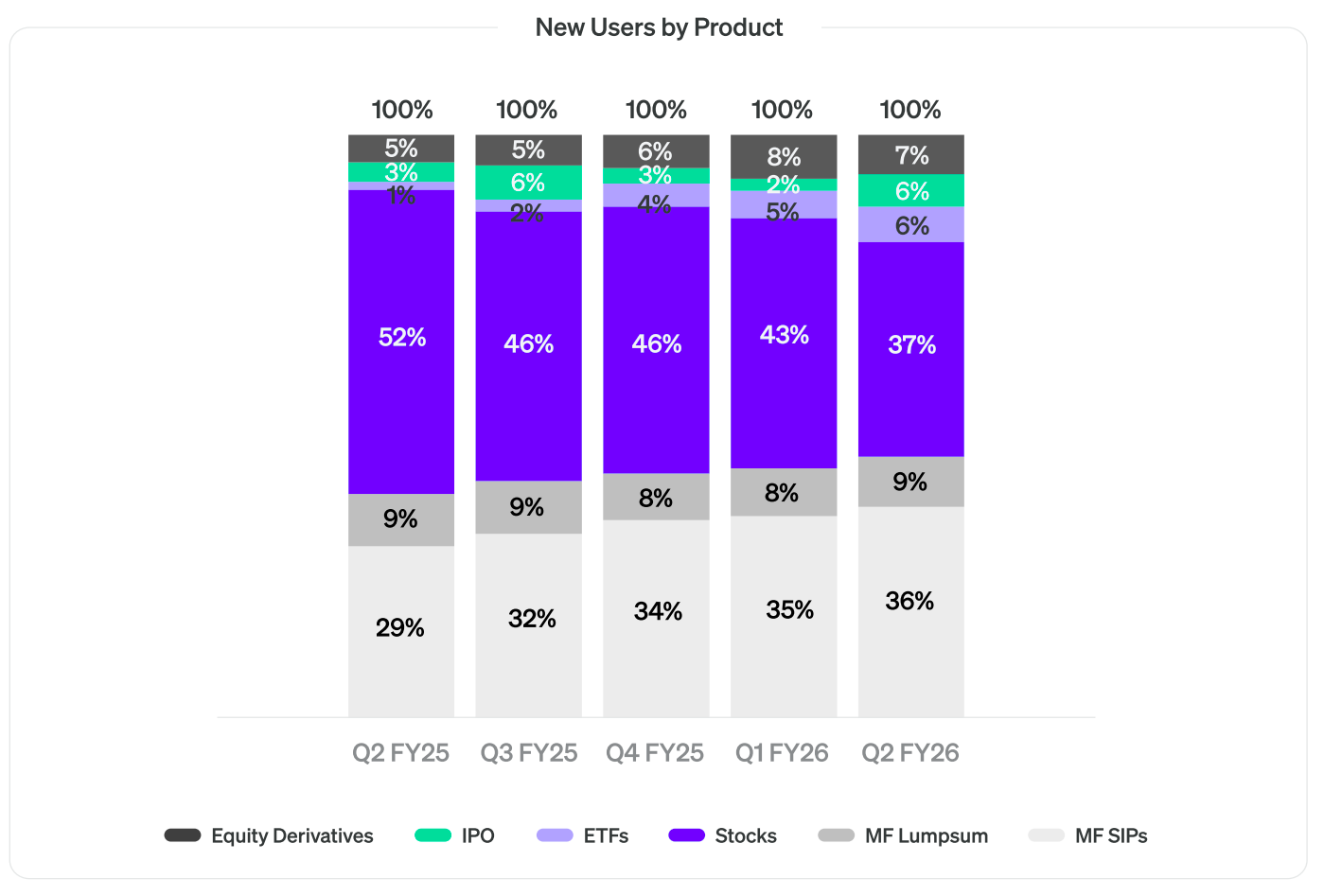

Groww’s user acquisition lately has been happening through MFs, compared to stocks earlier. This shows more and more new customers have lower monetization, since MF segment is free.

CRISIL | Small Cap | Financial Services

Crisil is a leading credit rating agency in India, offering bond ratings, bank loan ratings, SME ratings, and other grading services. It provides global business insights through collaborative research and analytical excellence, helping leaders and policymakers shape future strategies.

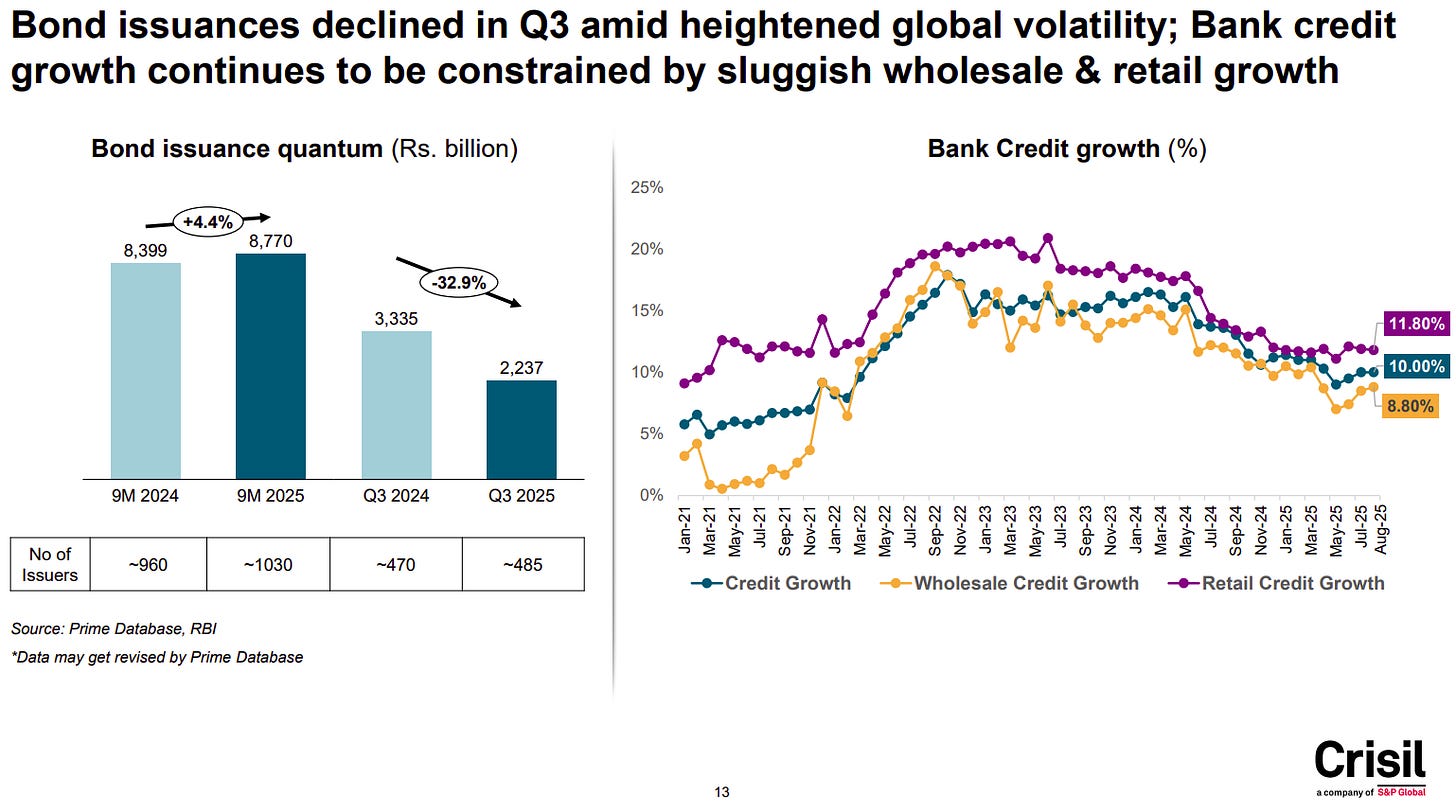

Bond issuance slowed sharply in Q3 — down 33% YoY — as global volatility kept issuers on the sidelines. At the same time, India’s bank credit growth has cooled across the board, with retail, wholesale, and overall credit slipping to 11.8%, 8.8%, and 10%, signalling broad-based softness in demand for borrowing.

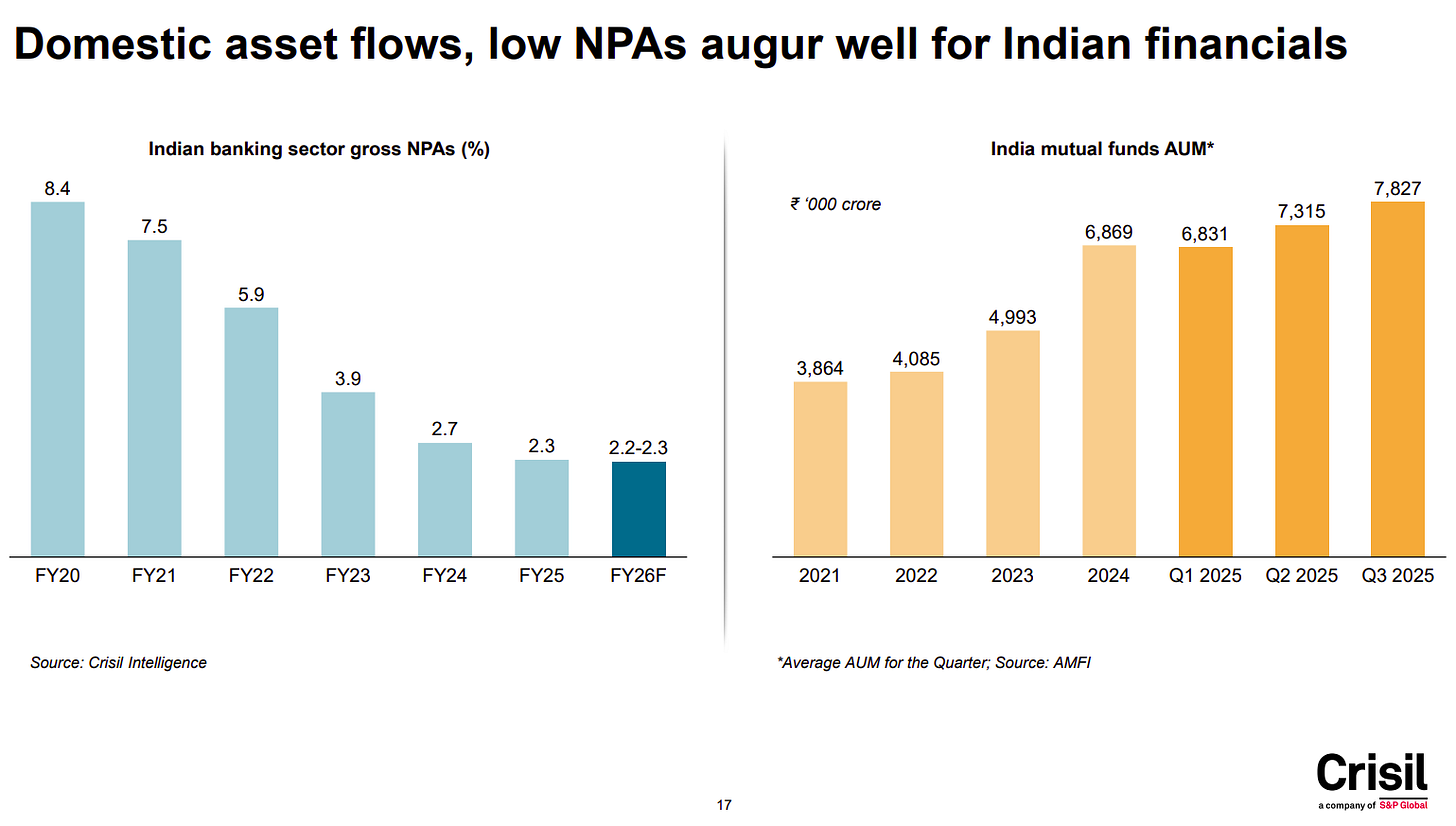

Indian financials are sitting on a sweet spot: bank NPAs have fallen from 8.4% to nearly 2% in six years, while domestic money is pouring into markets, with mutual fund AUM climbing to ₹7.8 lakh crore. Low credit stress + strong local flows = a supportive backdrop for the entire financial sector.

Bajaj Housing Finance | Mid Cap | Financial Services

Bajaj Housing Finance (BHFL) is a leading non-deposit-taking housing finance company (HFC) and a subsidiary of Bajaj Finance Ltd., offering various mortgage-related financial products like home loans, loans against property, lease rental discounting, and developer finance for individuals and corporates to buy, build, or renovate properties, focusing heavily on retail home loans.

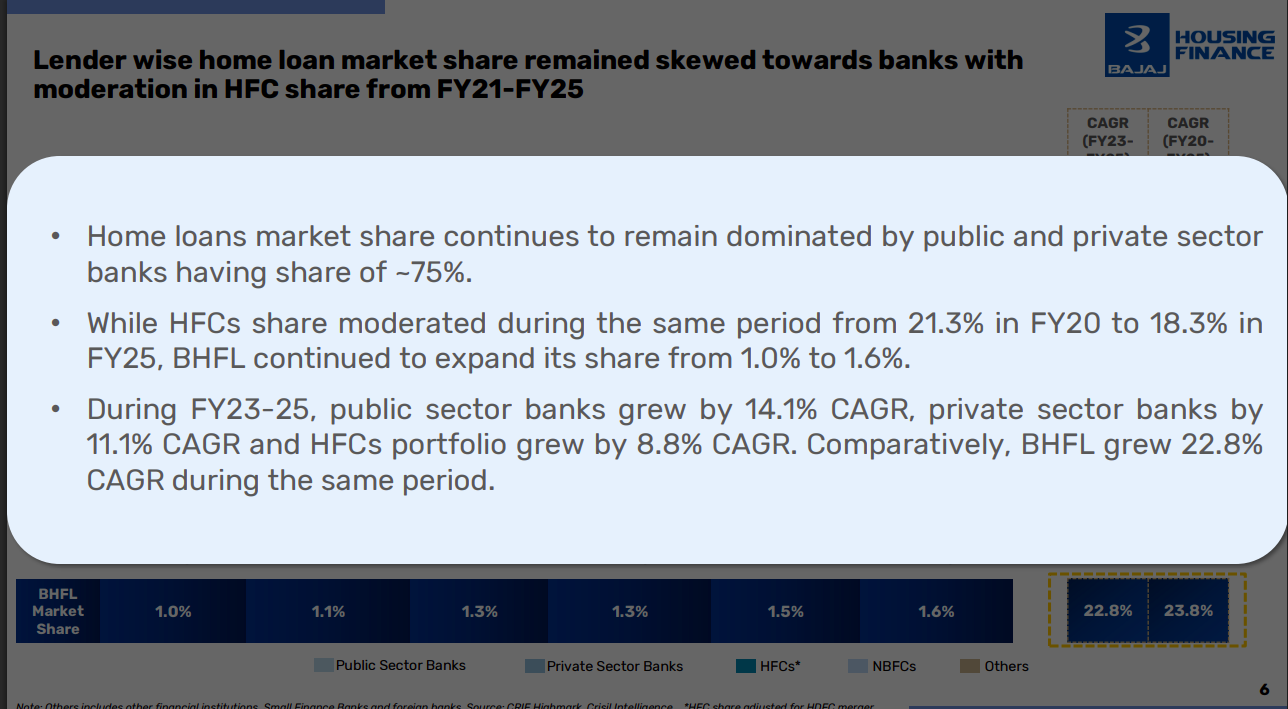

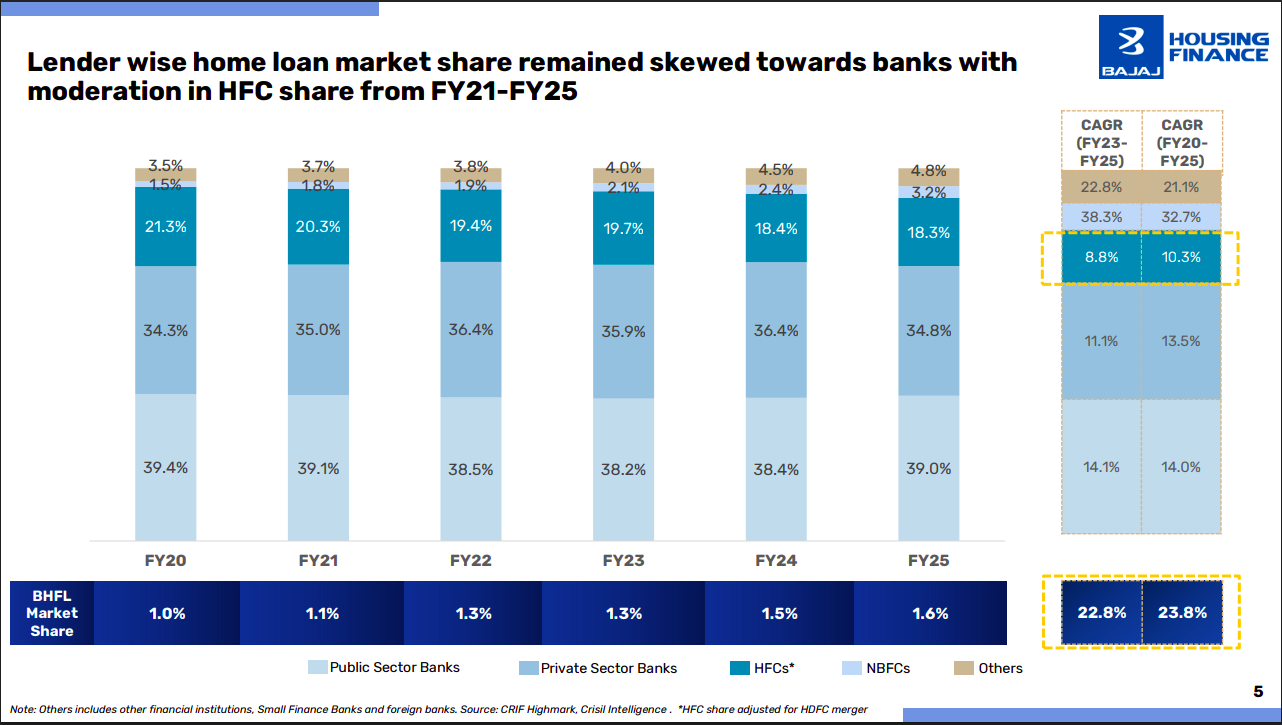

Home loan market share remains dominated by public and private sector banks at around 75%, while HFCs have seen a gradual moderation. Despite this shift, Bajaj Housing Finance has steadily expanded its share. During FY23–25, BHFL grew far faster than banks and HFCs, at a strong 22.8% CAGR.

From FY20 to FY25, the share of HFCs in home loans declined while banks gained share, but BHFL continued to grow within this changing mix. The chart highlights different lender segment shares over time and shows BHFL steadily rising to 1.6%.

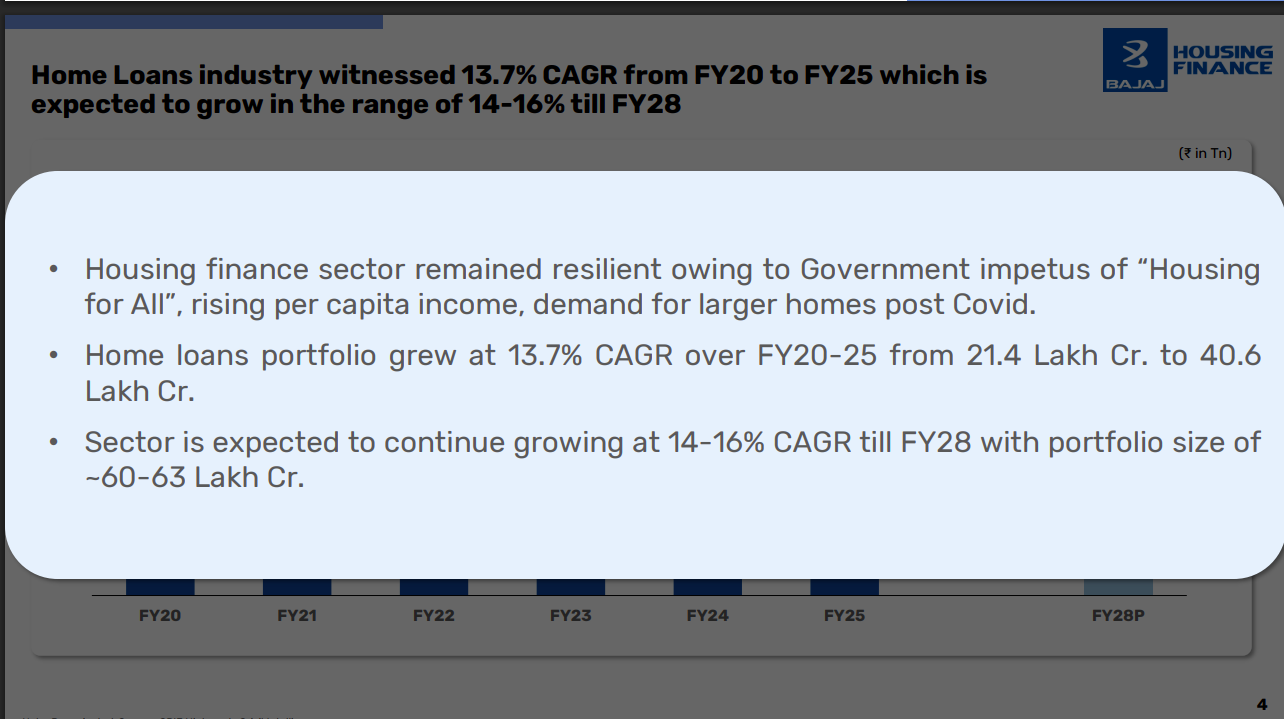

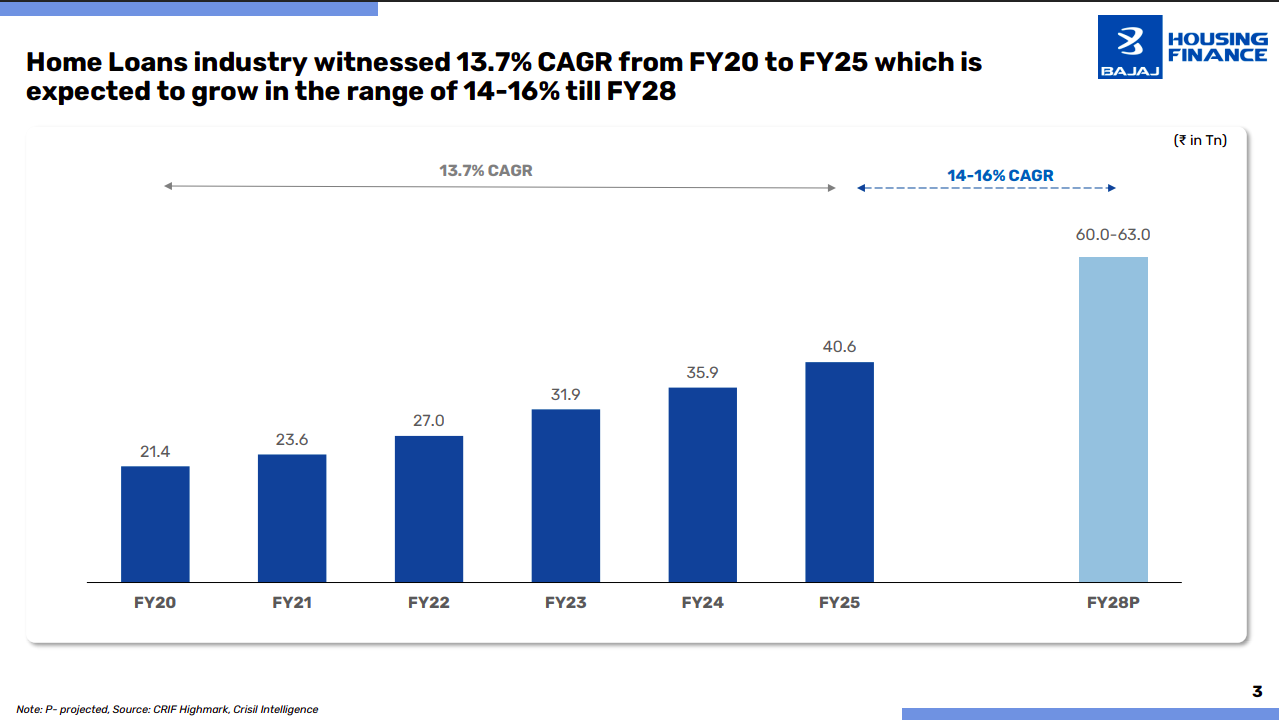

The broader housing finance sector grew steadily due to government focus on “Housing for All,” rising incomes, and demand for larger homes after Covid. Home loans grew at 13.7% CAGR over FY20–25. The industry is expected to sustain 14–16% CAGR till FY28.

The home loans market doubled from ₹21.4 lakh crore in FY20 to ₹40.6 lakh crore in FY25, reflecting a healthy 13.7% CAGR. Growth momentum is projected to continue, potentially reaching ₹60–63 lakh crore by FY28 at about 14–16% CAGR.

Tata Capital | Large Cap | Financial Services

Tata Capital Ltd, the flagship financial arm of the Tata Group, is a leading diversified NBFC. Its core business includes retail, SME, and corporate lending, along with wealth management, insurance distribution, and private equity services.

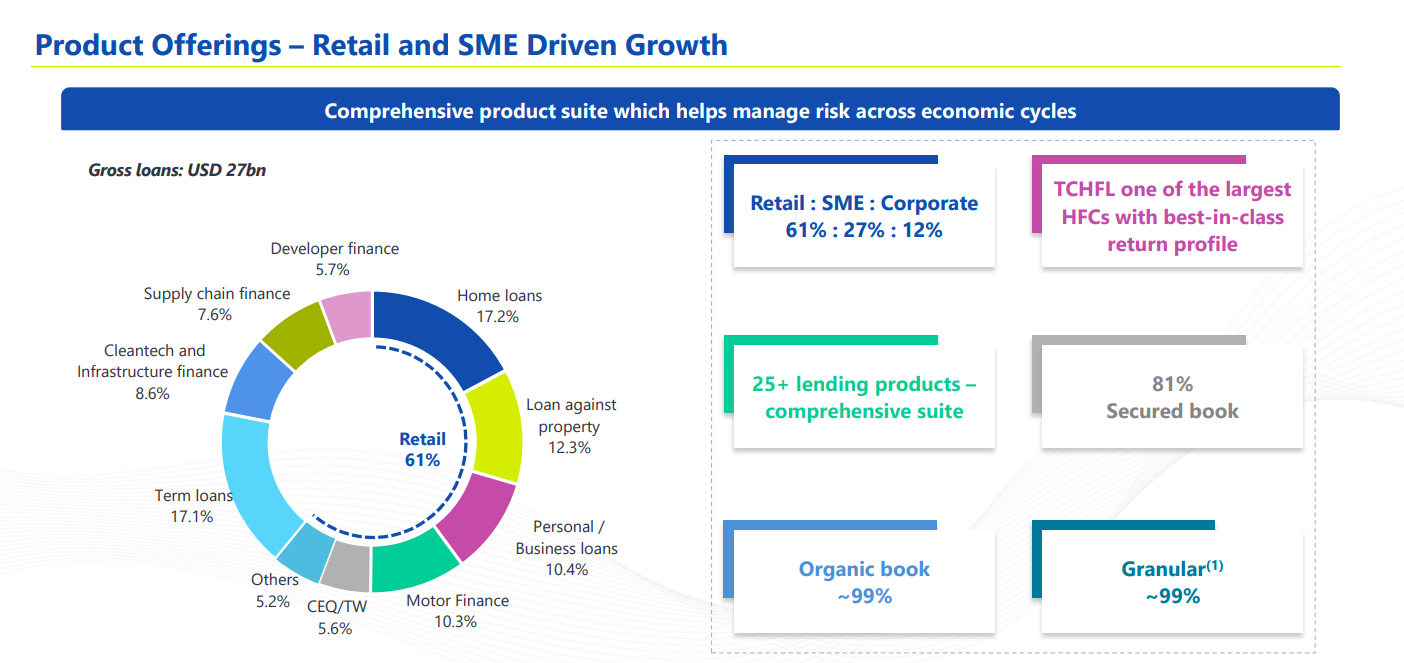

Tata Capital’s loan book is predominantly retail (61%), followed by SME and corporate, supported by 25+ lending products and a highly secured portfolio (~81%). The book remains largely organic and granular, helping the company manage risk across cycles and maintain a best-in-class HFC return profile.

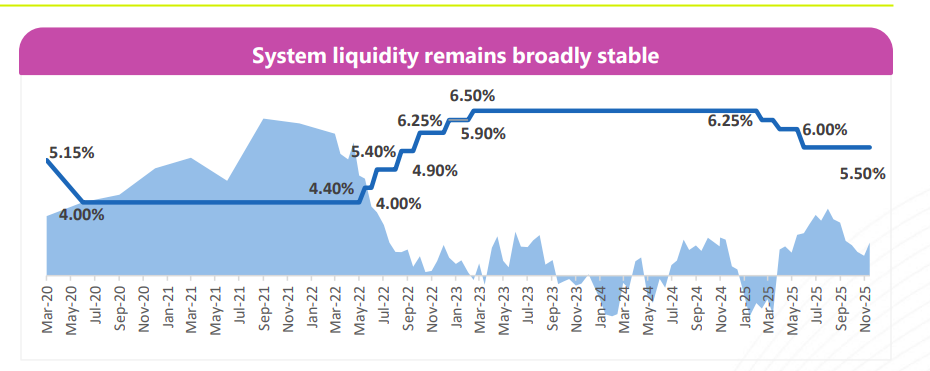

System liquidity has been broadly stable despite policy rate changes, with rates normalising after the pandemic-driven lows. Current levels indicate adequate liquidity conditions, supporting ongoing credit expansion without material stress.

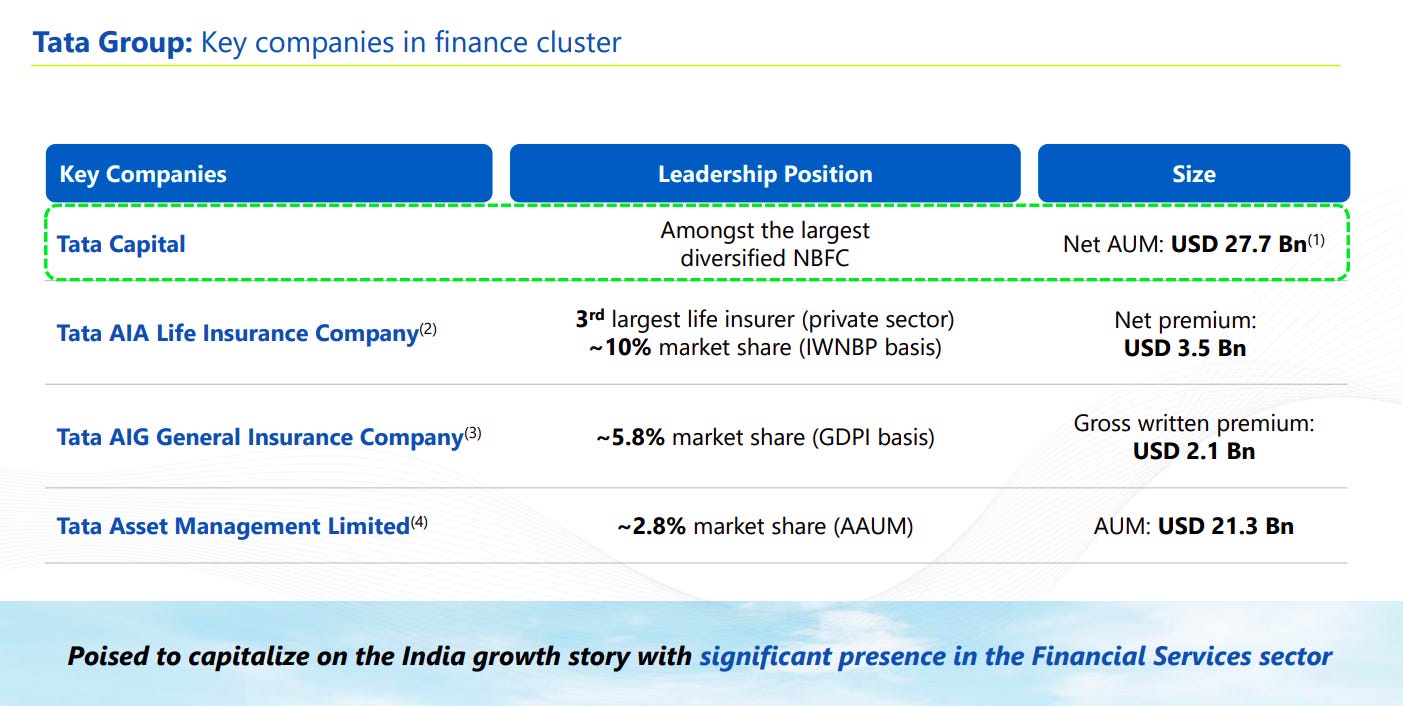

The Tata Group’s financial services cluster includes Tata Capital, Tata AIA, Tata AIG and Tata Asset Management, together spanning lending, insurance and asset management. This positions the group as a major diversified financial services ecosystem with strong market shares and sizeable premium/AUM bases.

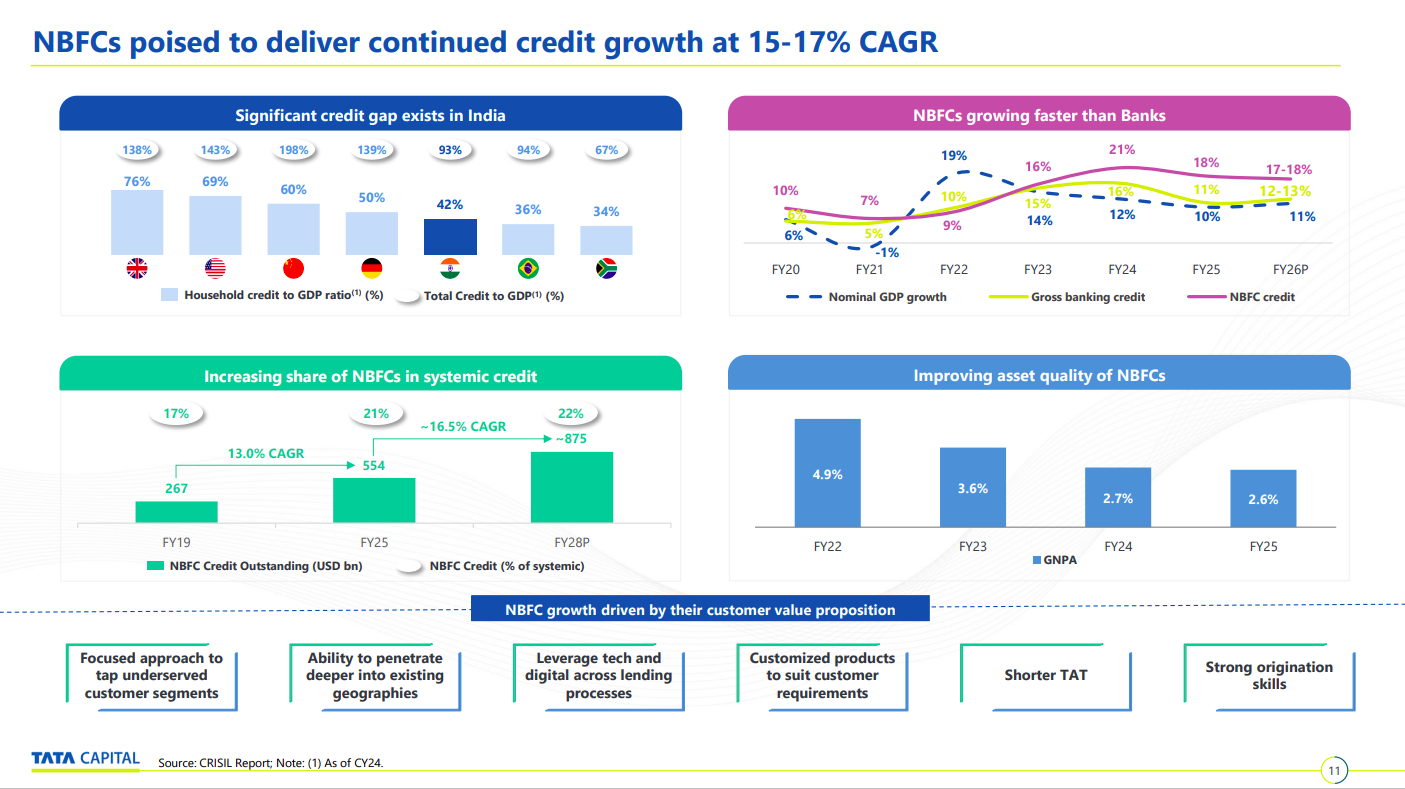

NBFCs are expected to deliver 15–17% credit growth supported by rising share in systemic credit, faster growth than banks, and improving asset quality. Strong demand, underserved segments, tech-led processes and product customization continue to drive long-term industry expansion.

Engineering & Capital Goods

Websol Energy System | Small Cap | Engineering & Capital Goods

Websol Energy System Limited, an Indian company established in 1990 and located at Falta SEZ, specializes in manufacturing photovoltaic crystalline solar cells and related modules. Their top-quality products cater to commercial and industrial setups in India and abroad.

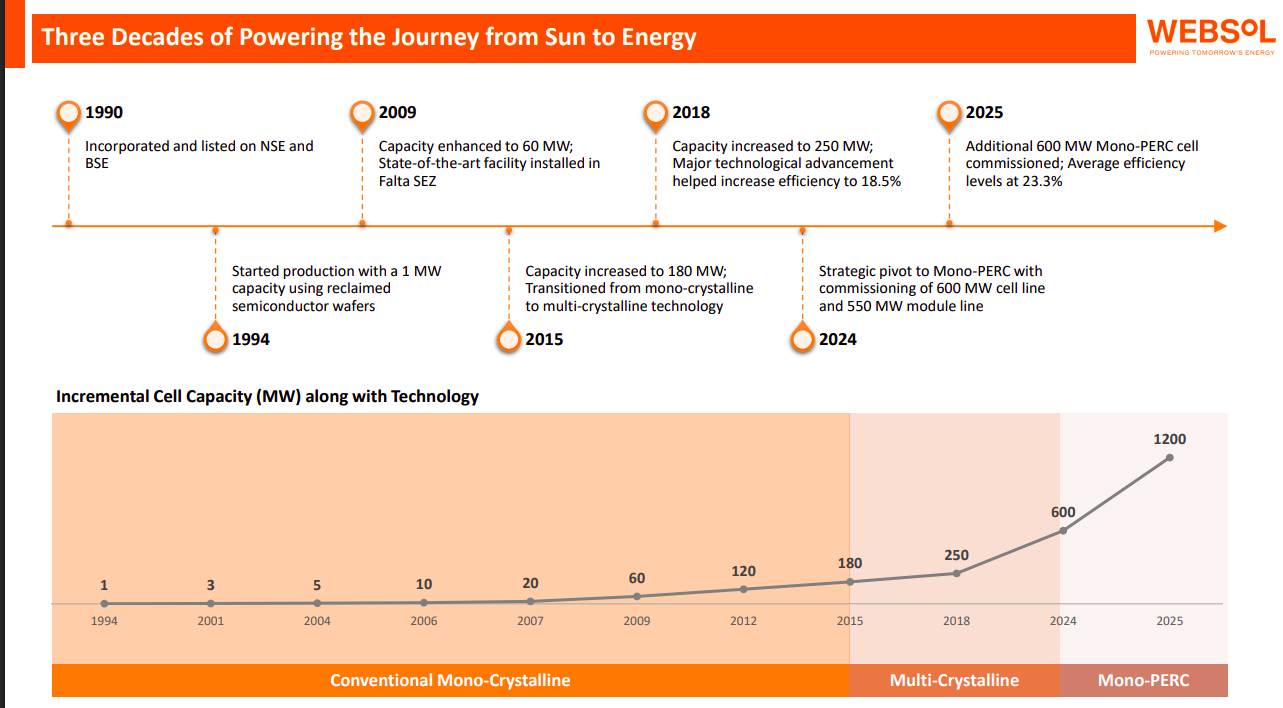

Websol has steadily expanded solar cell capacity over 30 years—from 1MW in 1994 to 1200MW projected by FY25—moving from mono-crystalline to multi-crystalline and now Mono-PERC. Major milestones include capacity upgrades in 2009, 2015, 2018 and a strategic pivot to advanced mono-PERC tech by FY24-25.

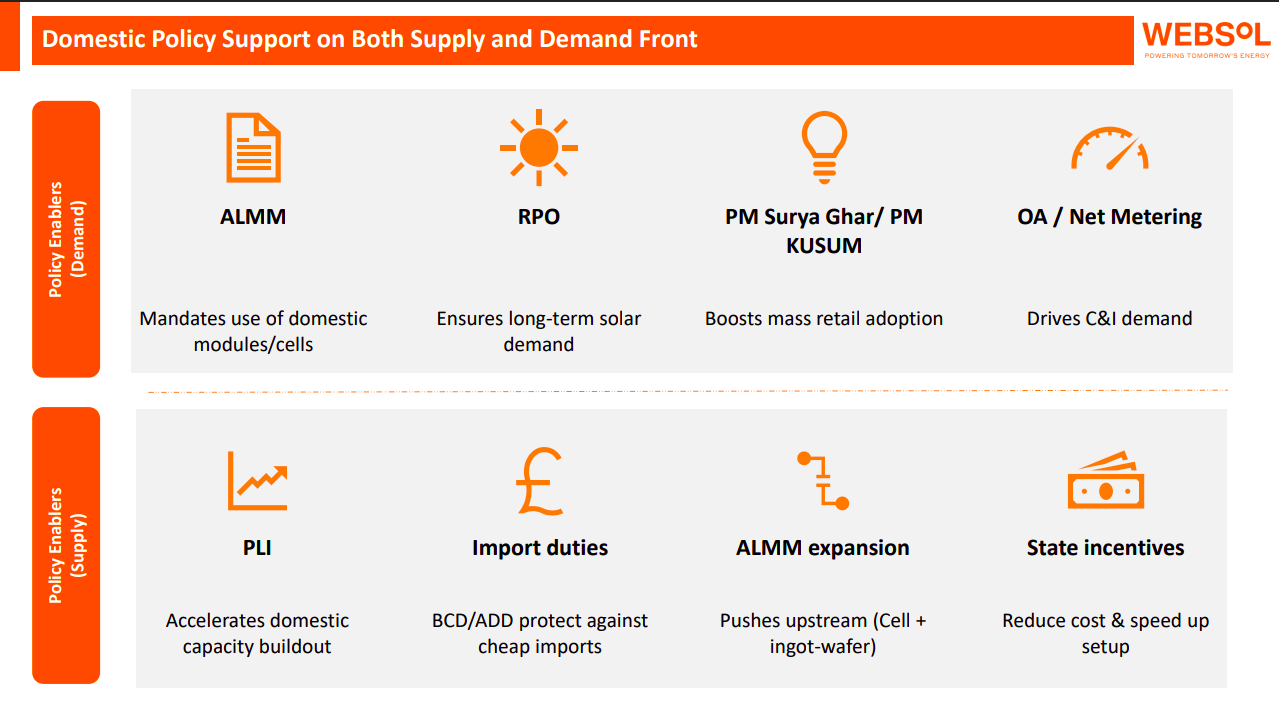

Government policies such as ALMM, RPO and Surya Ghar support long-term solar demand, while PLI, import duties, ALMM expansion and state incentives boost domestic manufacturing. Together, these measures strengthen both market demand and upstream manufacturing capability.

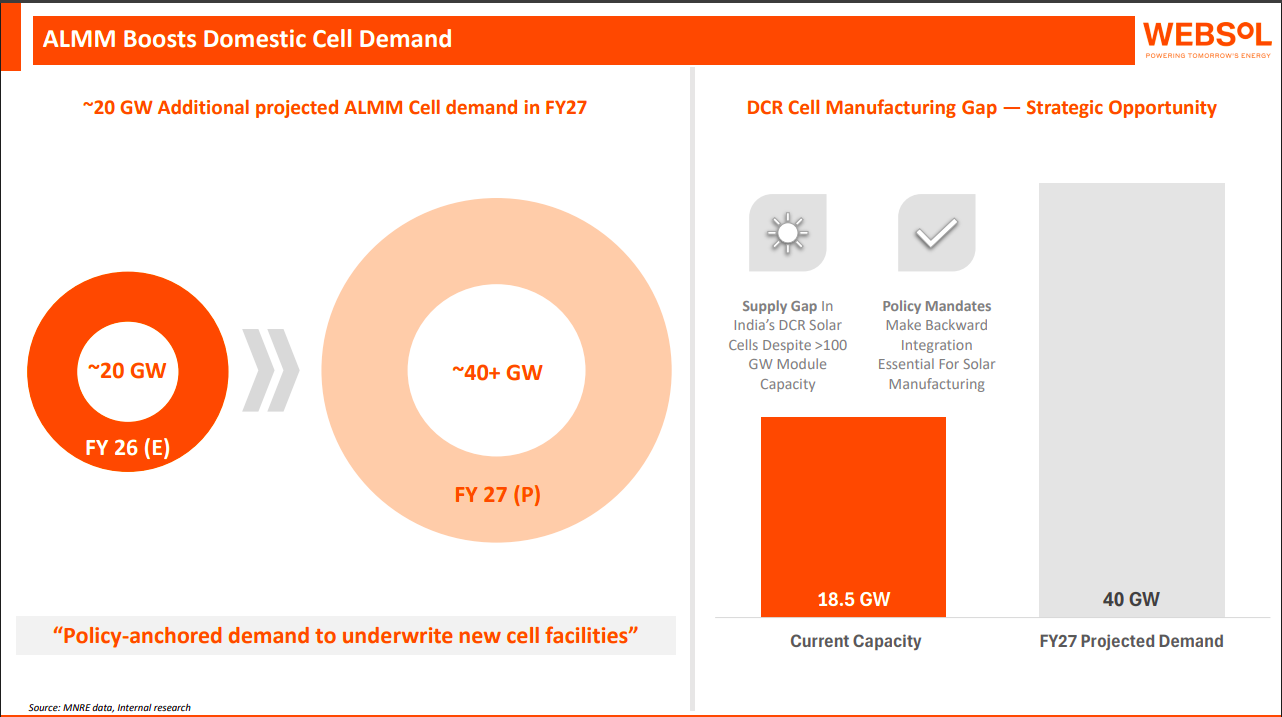

ALMM-driven demand is projected to push domestic solar cell requirements from ~20GW in FY26 to over 40GW by FY27, creating a major supply gap. With current capacity at just 18.5GW, this policy-anchored demand offers a strategic opportunity for large-scale new cell manufacturing in India.

K2 Infragen | Nano Cap | Engineering & Capital Goods

K2 Infragen, formerly known as K2 Powergen Private Limited, is an integrated engineering, procurement, and construction company focused on Power Engineering and Project Engineering. With experience in designing and constructing projects across multiple states in India, it offers services throughout the value chain, including design, procurement, construction supervision, subcontract management, and post-construction activities.

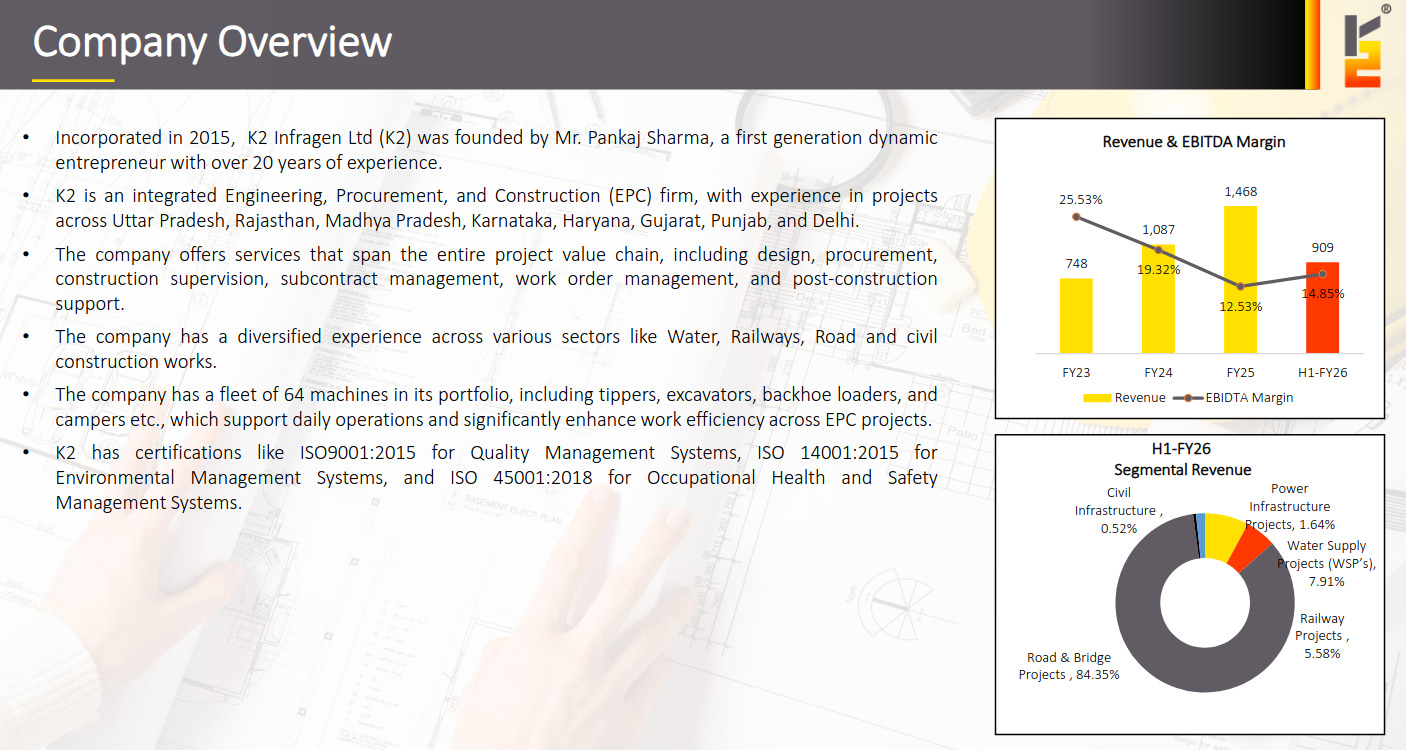

K2 Infracon is an EPC company founded in 2015 with diversified capabilities across water, railways, roads, and civil projects, backed by strong certifications and its own fleet. Revenue has grown steadily, though EBITDA margins have moderated in FY26. Most revenue currently comes from road and bridge projects.

K2 works with major national infrastructure players such as L&T, Tata Projects, Adani, ISGEC, and government bodies like PWD and Indian Railways. The client list highlights strong credibility across leading private developers and public-sector institutions.

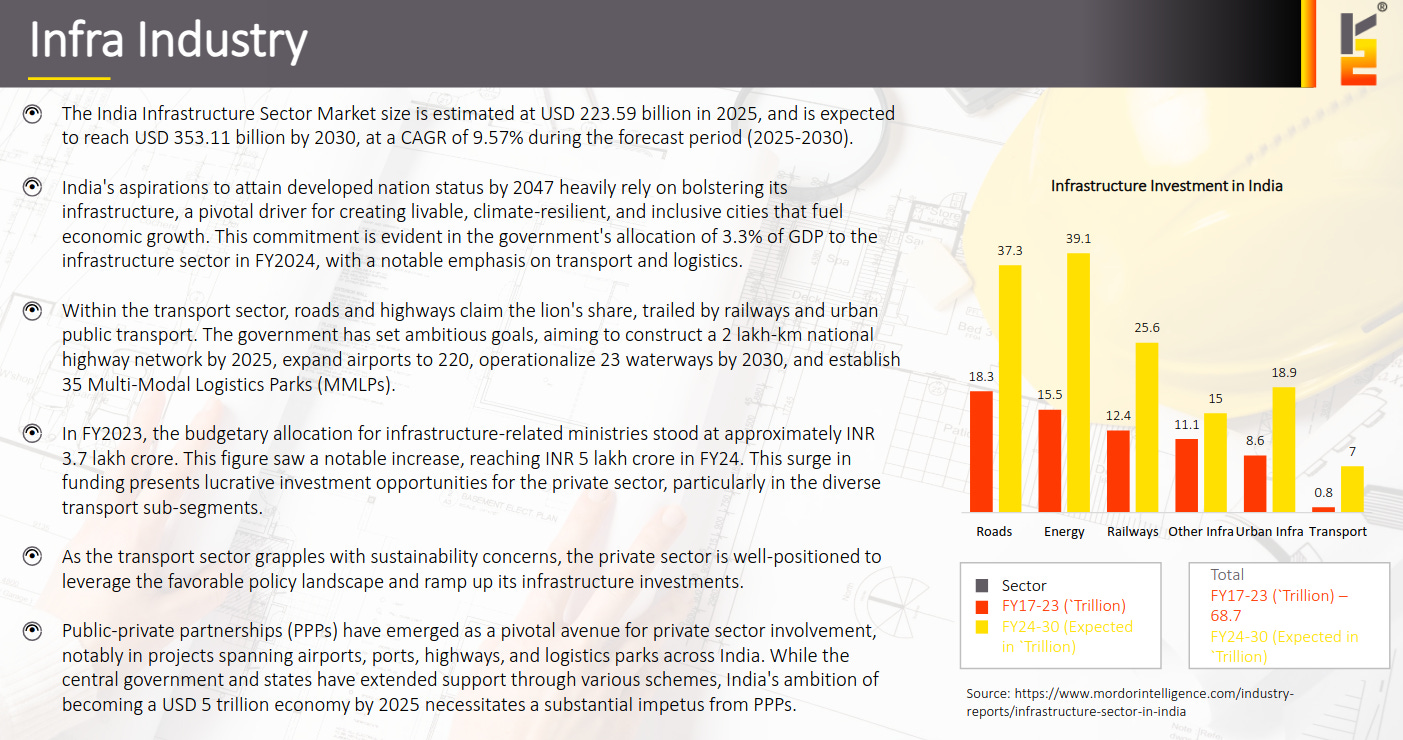

India’s infrastructure sector is expected to reach USD 353bn by 2030 driven by transport, logistics, and large public-spending programs. Roads dominate investment, followed by energy and rail, and government ambitions around multimodal hubs and PPP models are creating long-term opportunities.

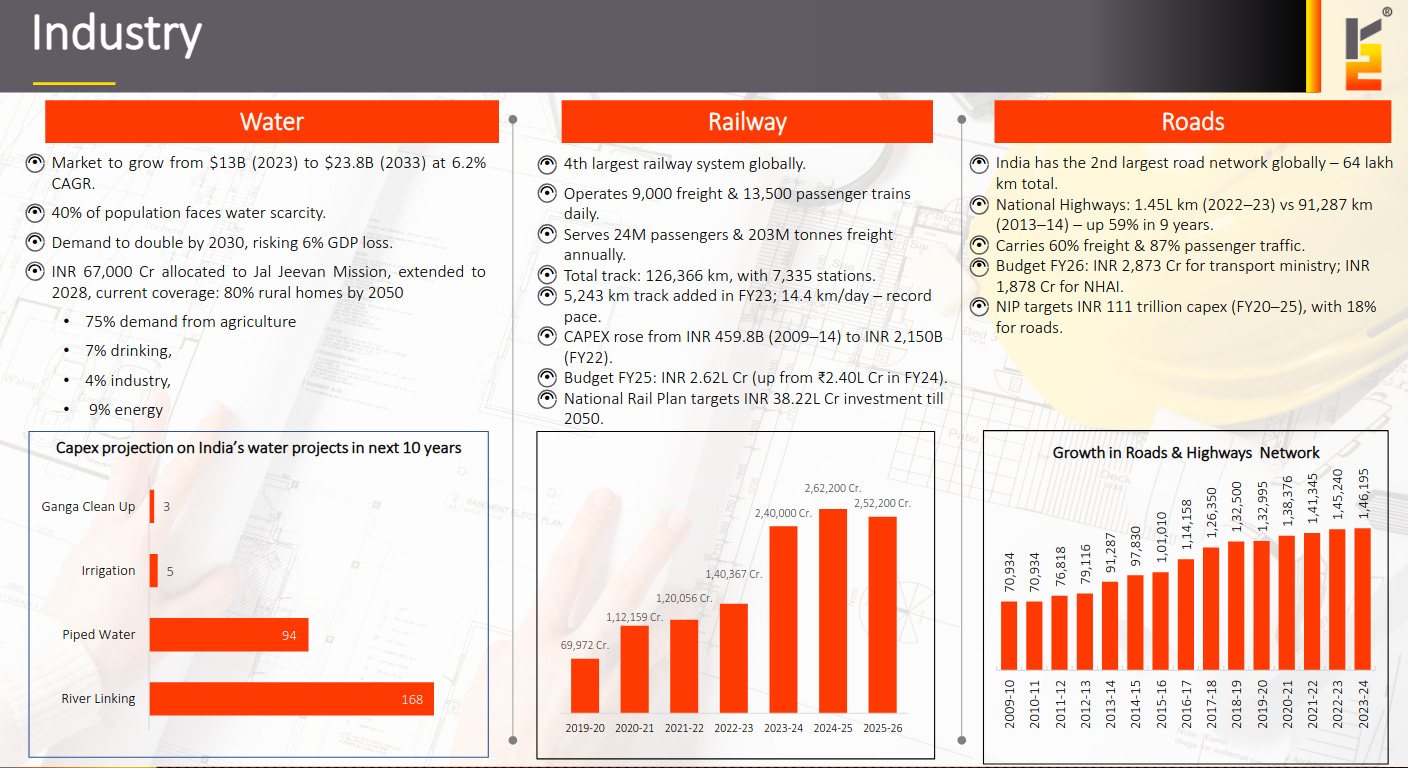

Water faces strong investment needs due to scarcity, while railways continue major capacity expansion and modernization. Roads remain India’s largest transport network with sustained budget allocations and national infrastructure targets fuelling construction opportunities.

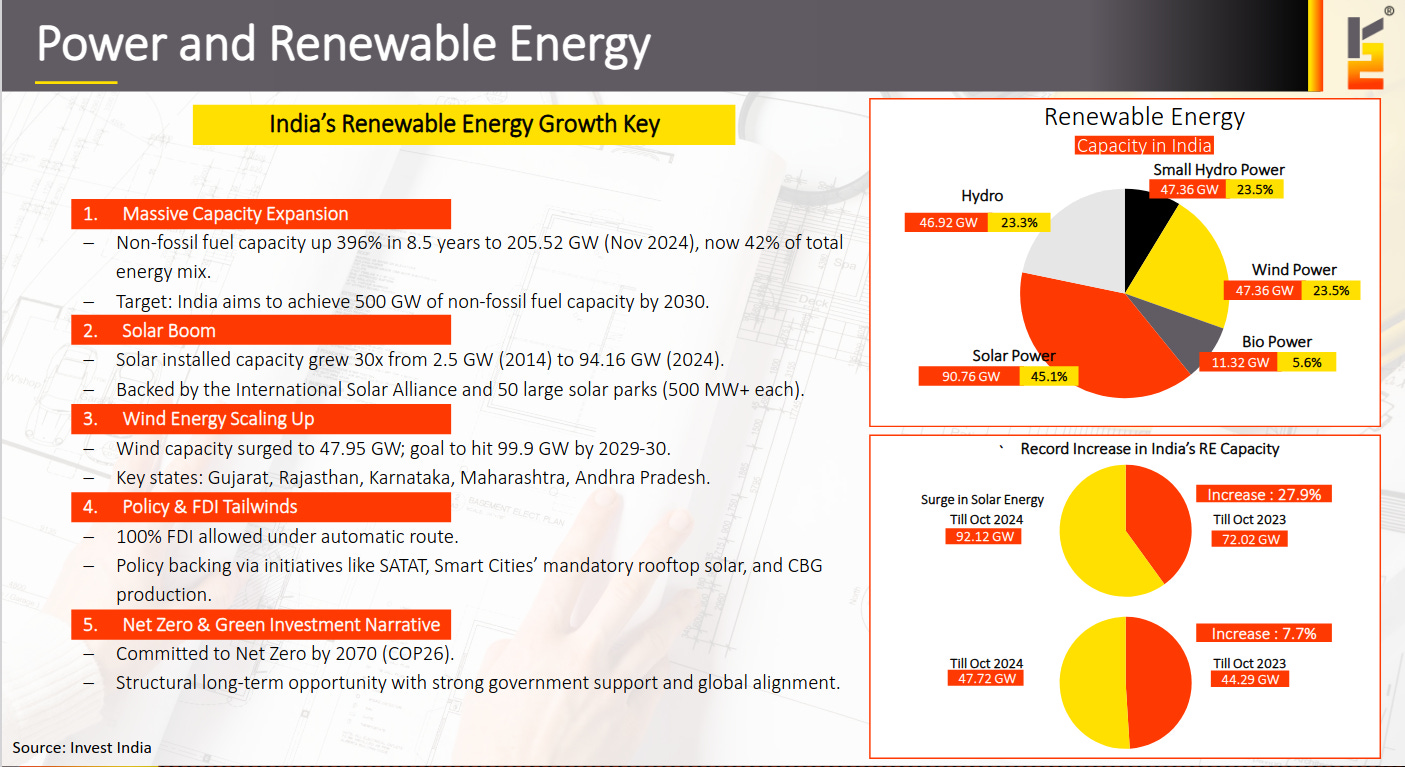

India’s renewable energy capacity has expanded rapidly led by solar and wind, with a strong government push toward 500GW of non-fossil capacity by 2030. Policies, FDI support, and net-zero goals are driving long-term structural growth in clean energy investments.

Emmvee Photovoltaic Power | Small Cap | Engineering & Capital Goods

Emmvee Photovoltaic Power Ltd, founded in 2007, is India’s second largest integrated solar PV module and cell maker with module and cell capacity. It produces TOPCon and Mono PERC modules, ALMM-listed, serving major IPPs and C&I clients.

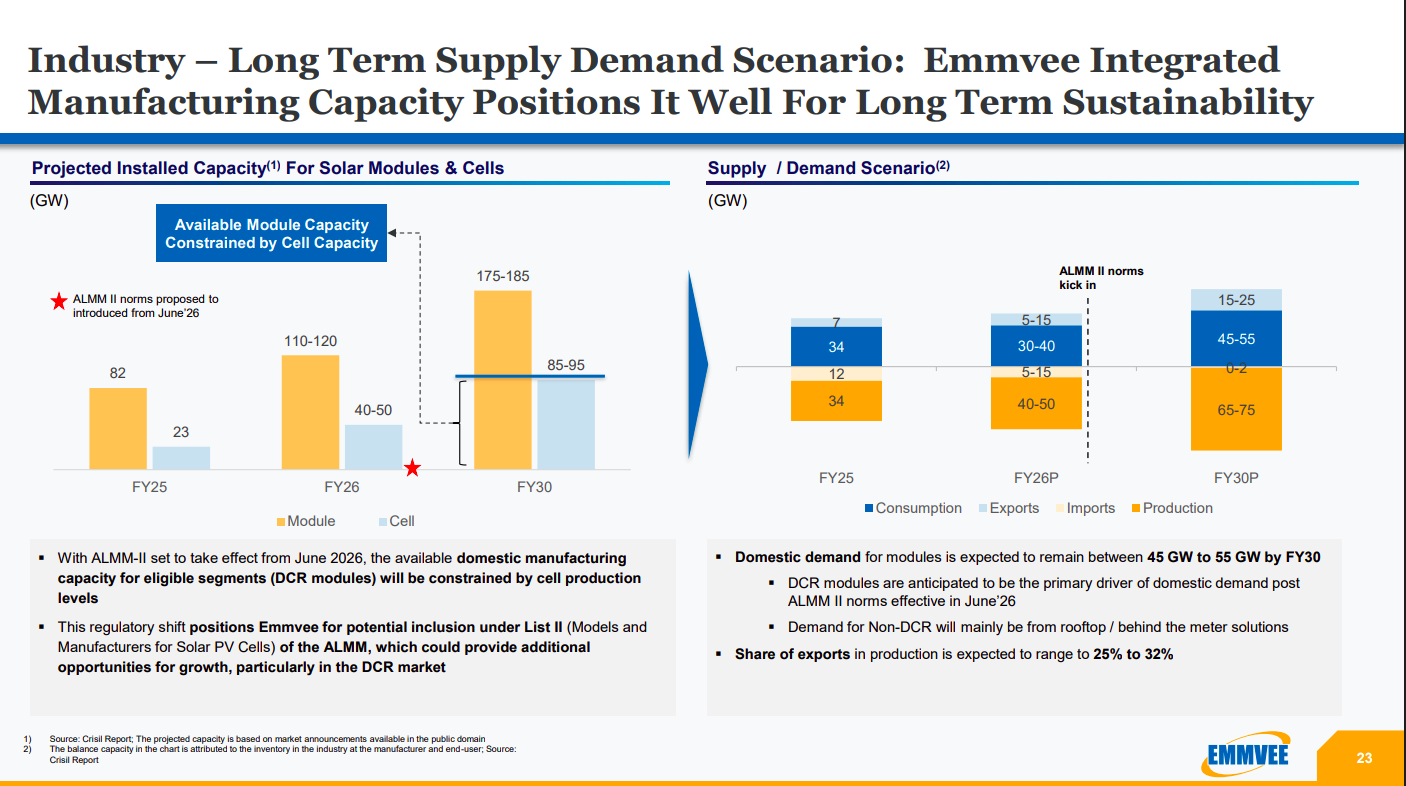

India’s solar manufacturing capacity is expected to rise sharply, but domestic module availability will be constrained by limited cell production, especially after ALMM-II norms from June 2026. Emmvee stands to gain from regulatory preference for DCR modules, with domestic demand expected at 45–55GW by FY30 and exports rising to 25–32%.

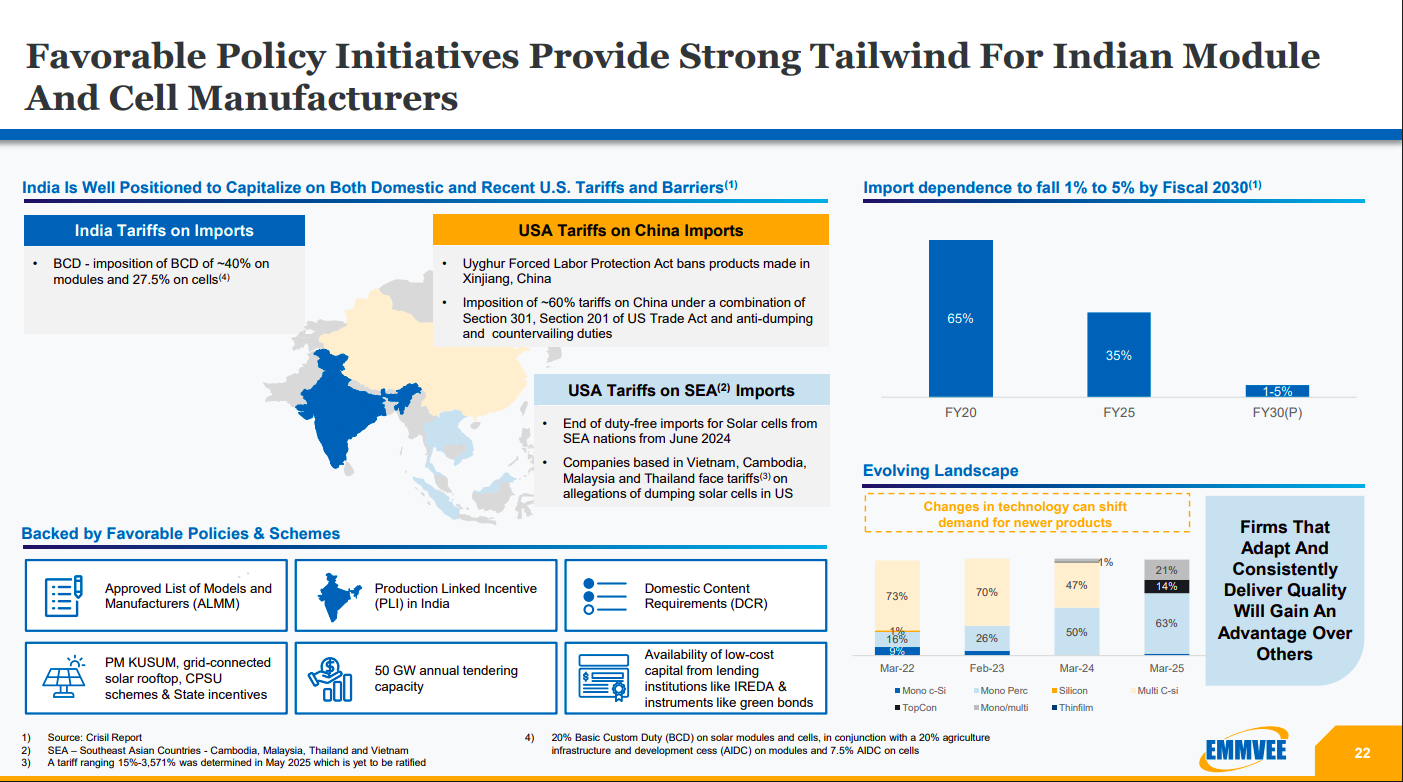

India benefits from strong policy tailwinds including high import tariffs, ALMM certification, PLI incentives, and domestic content rules, while US tariffs on China and SEA give India competitive advantage. Import dependence could fall to 1–5% by FY30, supporting domestic solar module and cell manufacturers.

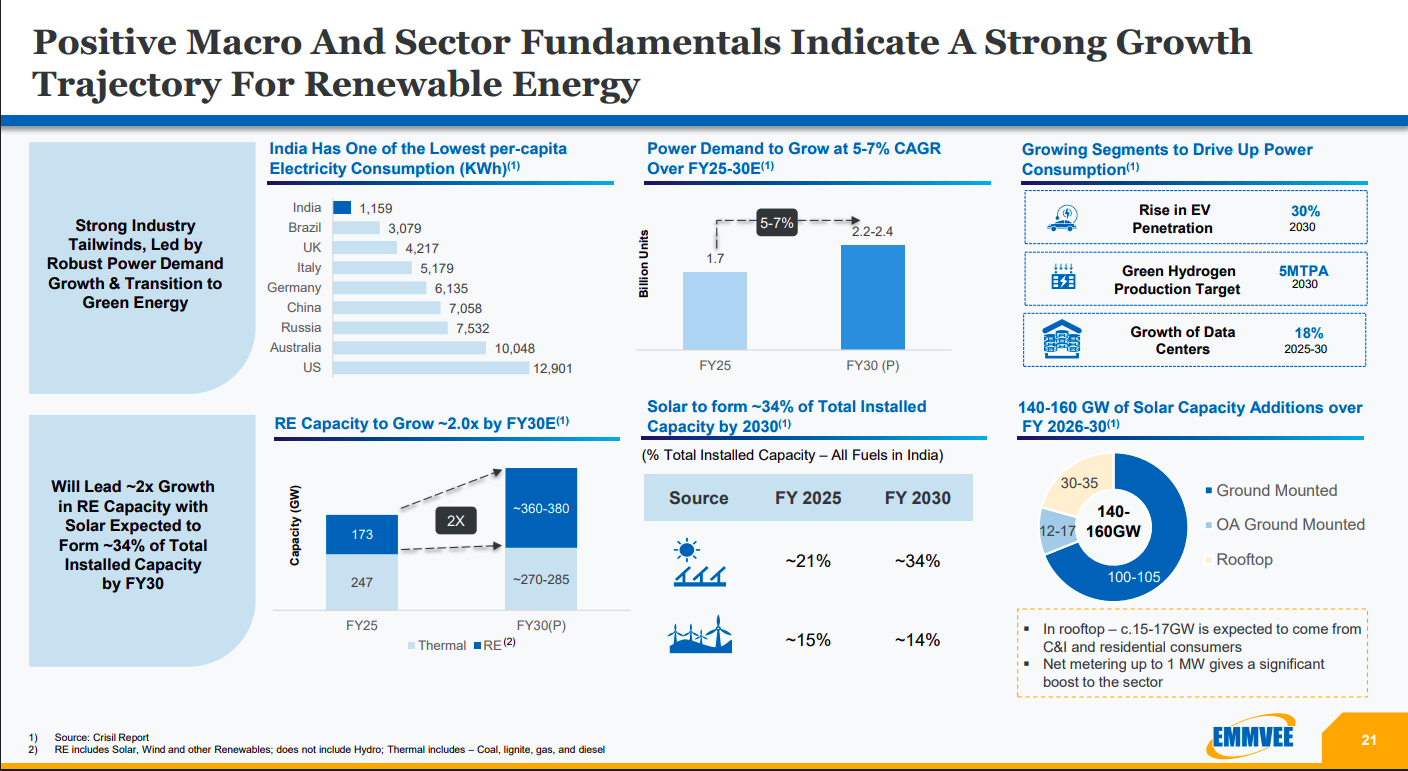

India’s transition to renewable energy is accelerating, with power demand expected to grow at 5–7% CAGR and solar forming around 34% of installed capacity by FY30. Growing segments like EVs, green hydrogen, and data centers will further boost demand, driving 140–160GW of solar additions between FY26–30.

KVS Castings | Nano Cap | Engineering & Capital Goods

KVS Castings manufactures a wide variety of castings, including cast iron, SG iron, alloy steel, and stainless steel components, primarily for the automobile, locomotive, and engineering sectors. The company emphasizes innovation and strict quality standards in its production processes.

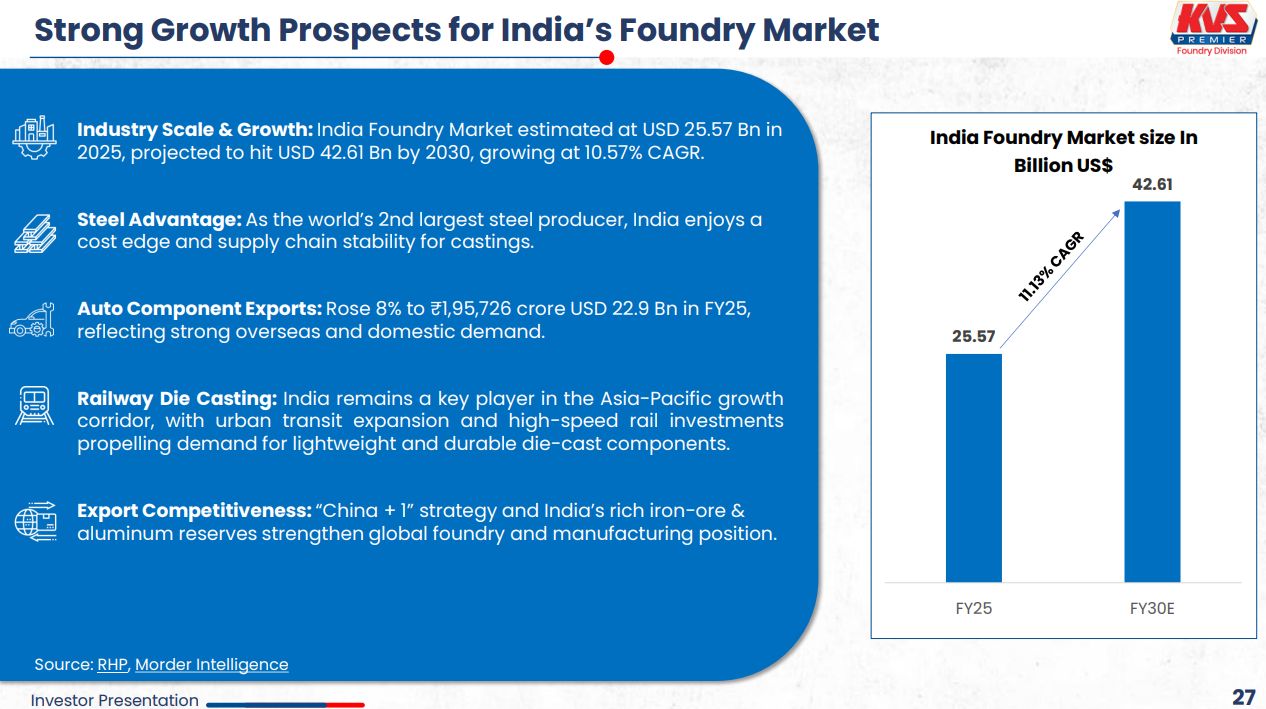

India’s foundry market is currently valued at USD 25.57 billion and is expected to grow to USD 42.61 billion by 2030 — that’s a 10.57% CAGR. The country has a natural advantage here: it’s the world’s second-largest steel producer, which means cheaper raw materials and a more stable supply chain for castings. Auto component exports are also climbing (up 8% to ₹1.96 lakh crore in FY25), and railway infrastructure investments are creating fresh demand for lightweight die-cast parts. Add to that the global “China + 1” shift, and India’s foundry sector is well-positioned to capture more export business.

Shri Balaji Valve Co | Nano Cap | Engineering & Capital Goods

Shri Balaji Valve Components Limited specializes in manufacturing ready-to-assemble valve components for various industries. They provide components for ball valves, butterfly valves, and forging products, customized to meet customer specifications across different sectors.

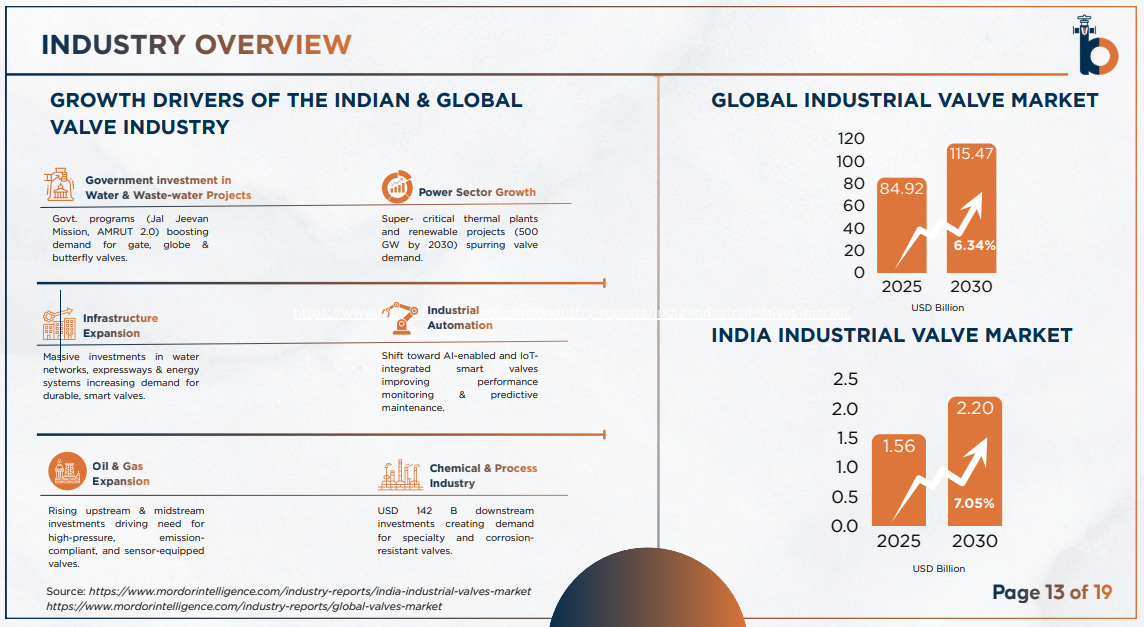

The global industrial valve market is expected to grow from $84.92 billion in 2025 to $115.47 billion by 2030, at a 6.34% CAGR. India’s valve market follows a similar trajectory — rising from $1.56 billion to $2.20 billion over the same period at 7.05% CAGR. Multiple sectors are driving this demand: government programs like Jal Jeevan Mission and AMRUT 2.0 are boosting water infrastructure needs, while power sector expansion (targeting 500 GW renewables by 2030) and oil & gas investments are pushing demand for specialized, high-pressure valves. The shift toward AI-enabled smart valves and $142 billion in downstream chemical investments add further tailwinds.

Apollo Pipes | Micro Cap | Engineering & Capital Goods

Apollo Pipes Limited, a key company of SUDESH GROUP, manufactures a wide range of PVC pipes for multiple sectors including Civil Infrastructure, Industrial, Agriculture, and Building & Construction. The company also offers solutions for the transportation of Oil and Gas through HDPE pipes and fittings, PLB Ducts, and PVC pipes. With a strong presence in Northern India, it operates plants in Dadri and Sikanderabad, Uttar Pradesh, featuring advanced infrastructure, testing equipment, and eco-friendly manufacturing processes.

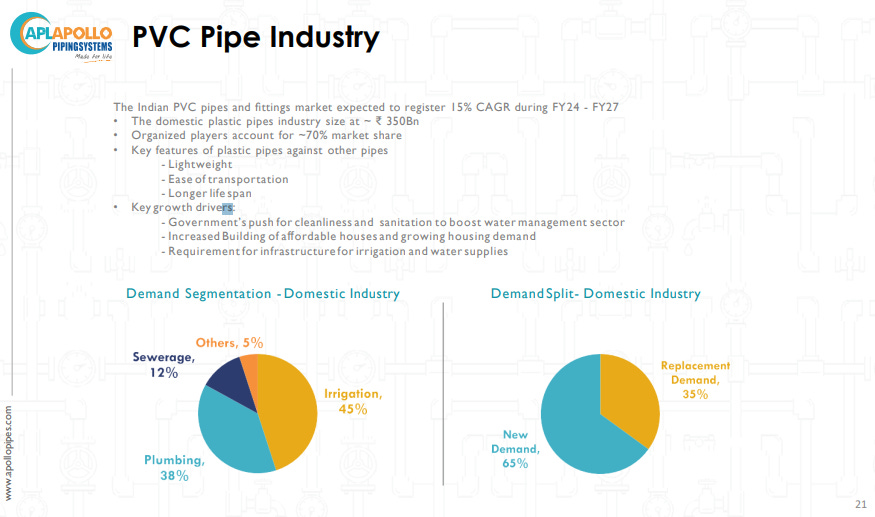

India’s PVC pipes and fittings market is expected to grow at 15% CAGR between FY24 and FY27, with the domestic plastic pipes industry currently sized at around ₹350 billion. Organized players hold about 70% market share, and plastic pipes are winning over alternatives due to their lightweight nature, easier transportation, and longer lifespan. Demand is split across irrigation (45%), plumbing (38%), and sewerage (12%), with 65% coming from new demand and 35% from replacements. Key growth drivers include the government’s sanitation push, rising affordable housing construction, and expanding irrigation infrastructure.

Solarworld Energy | Small Cap | Engineering & Capital Goods

Solarworld Energy Solutions specializes in solar power plant setup, engineering, procurement, and construction (EPC). The company, along with its subsidiaries, associates, and joint ventures, focuses on solar power projects, EPC services, solar accessories, and related construction activities.

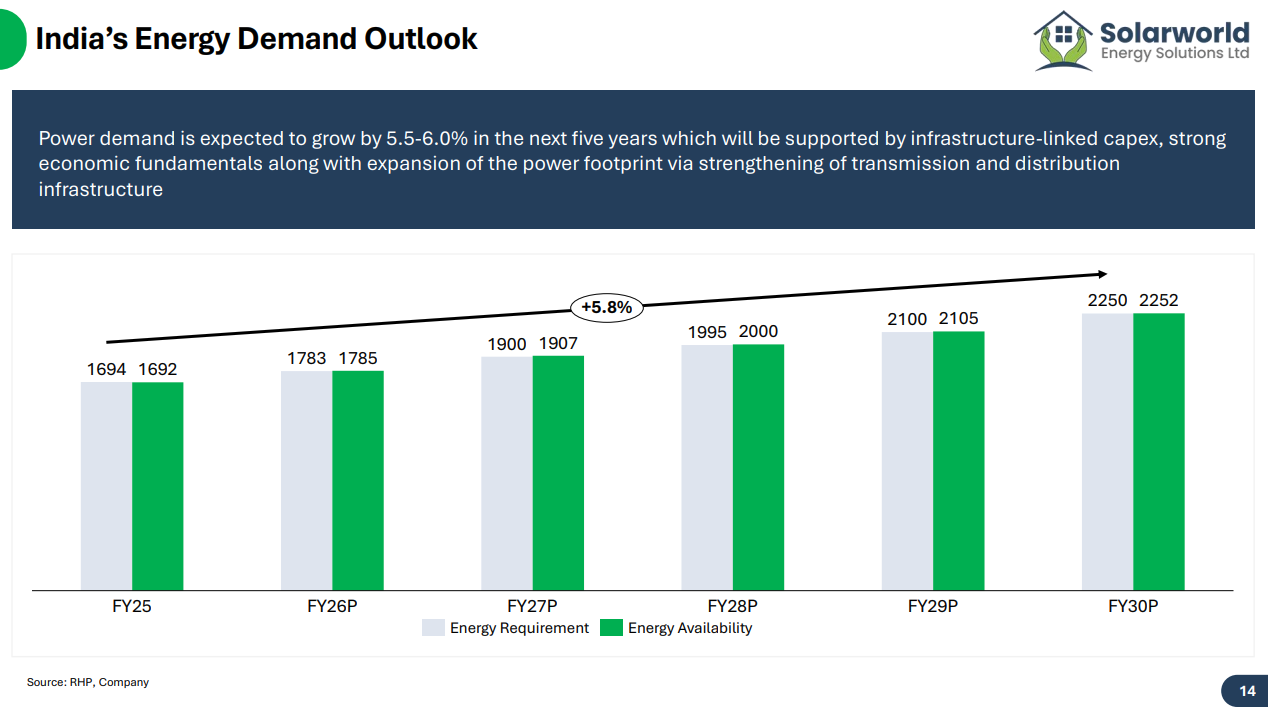

India’s power demand is projected to grow at 5.5–6.0% annually over the next five years, driven by infrastructure capex, strong economic fundamentals, and expansion of transmission and distribution networks. The chart shows energy requirement rising from 1,694 billion units in FY25 to 2,250 billion units by FY30. The good news: energy availability is expected to keep pace, moving from 1,692 billion units to 2,252 billion units over the same period. This tight balance between demand and supply underscores the need for continued capacity addition in the power sector.

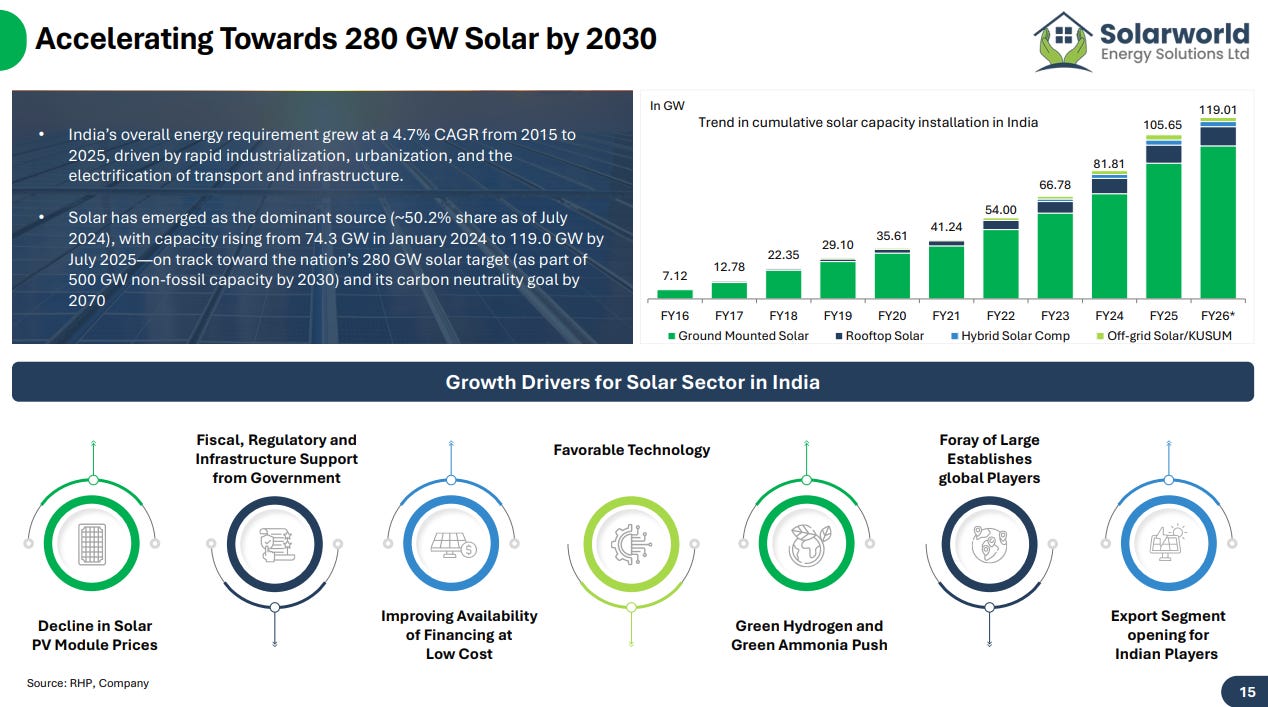

India’s solar capacity has grown rapidly — from just 7.12 GW in FY16 to 119 GW by FY26, making solar the dominant energy source with over 50% share as of July 2024. The country is on track to hit its 280 GW solar target by 2030, which is part of the broader 500 GW non-fossil fuel goal. This growth is being powered by multiple tailwinds: falling PV module prices, low-cost financing, government policy support, and the emerging green hydrogen push. Large global players entering the market and new export opportunities for Indian companies are adding further momentum to the sector.

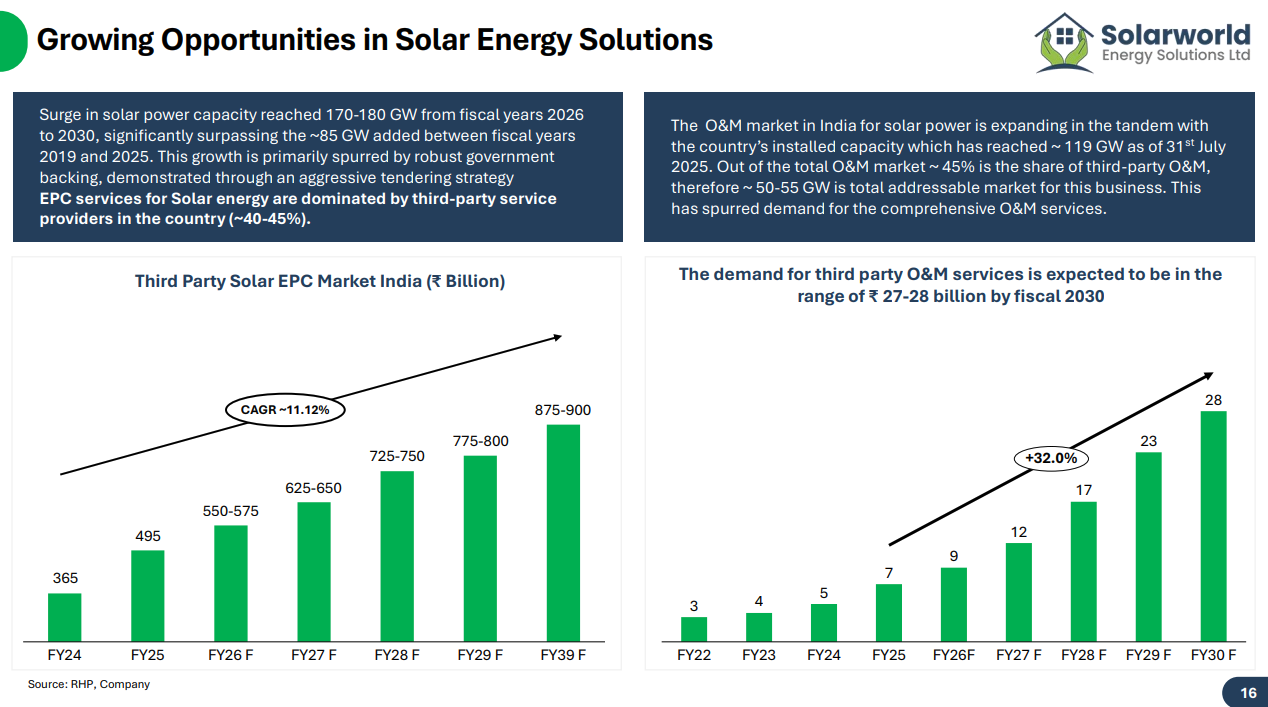

India is expected to add 170–180 GW of solar capacity between FY26 and FY30 — nearly double the ~85 GW added in the previous six years — driven by aggressive government tendering. Third-party EPC providers dominate this space with 40–45% market share, and the EPC market is projected to grow from ₹365 billion in FY24 to ₹875–900 billion by FY30 at ~11% CAGR. Alongside this, the O&M (operations and maintenance) market is expanding rapidly too — with installed capacity at 119 GW, the third-party O&M opportunity is expected to reach ₹27–28 billion by FY30, growing at 32% CAGR.

Software Services

Trident Techlabs | Micro Cap | Software Services

Trident Techlabs, founded in 2000, aimed to become a knowledge-based technology company in the engineering field. Initially offering pre-packaged software, the company understood the importance of adding value to its services for scaling up and entering new market segments.

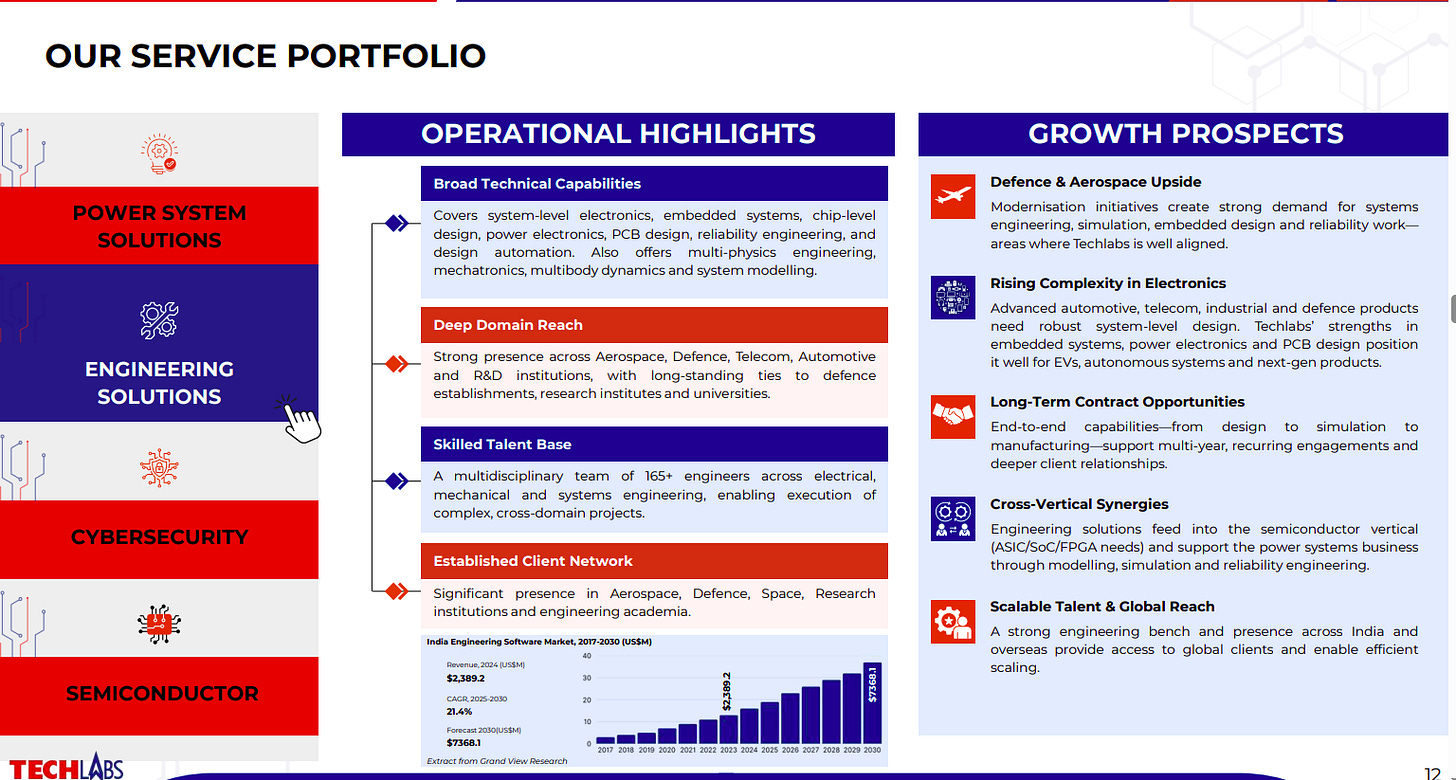

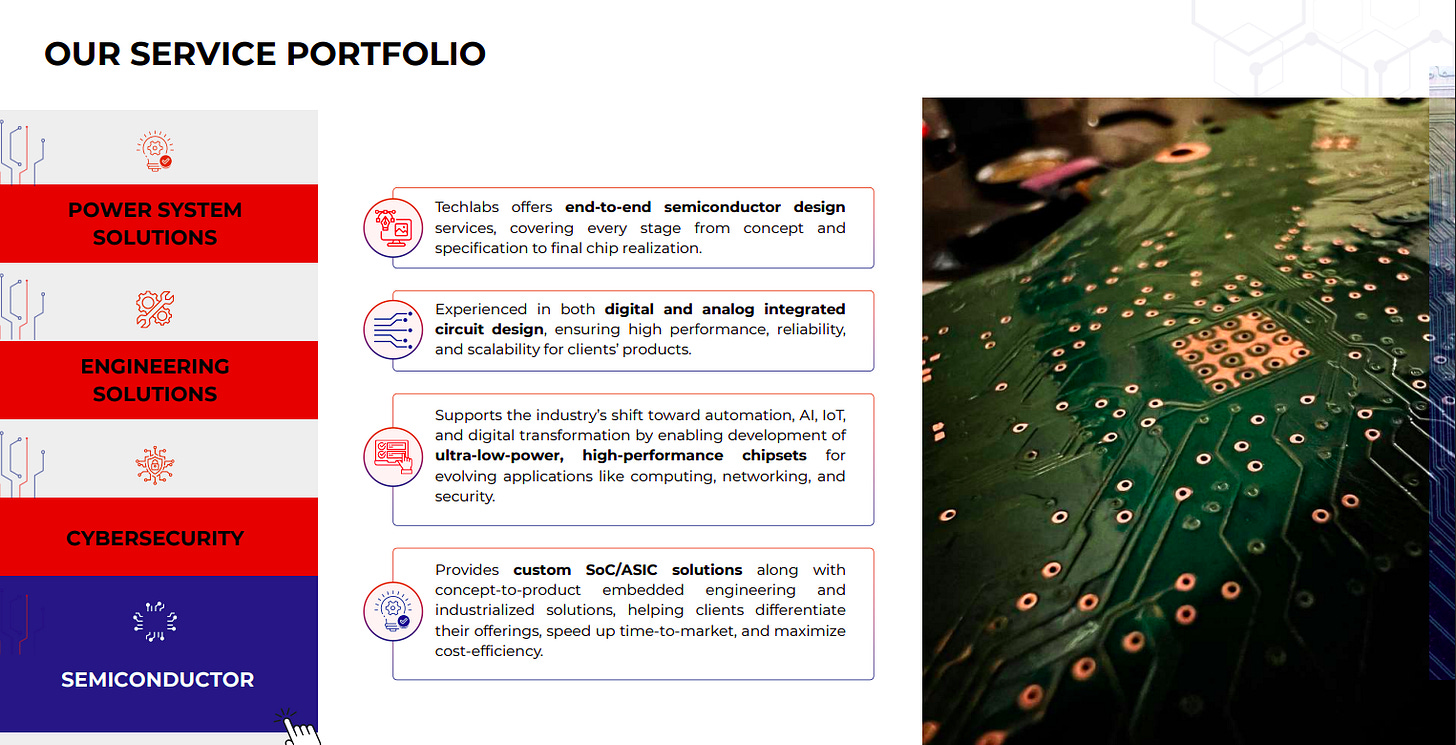

Techlabs highlights broad electronics and systems engineering capabilities, deep domain ties across aerospace, defence and telecom, and a skilled cross-disciplinary talent base. A strong client network enables complex project execution and positions the firm well for long-term defence and industrial opportunities.

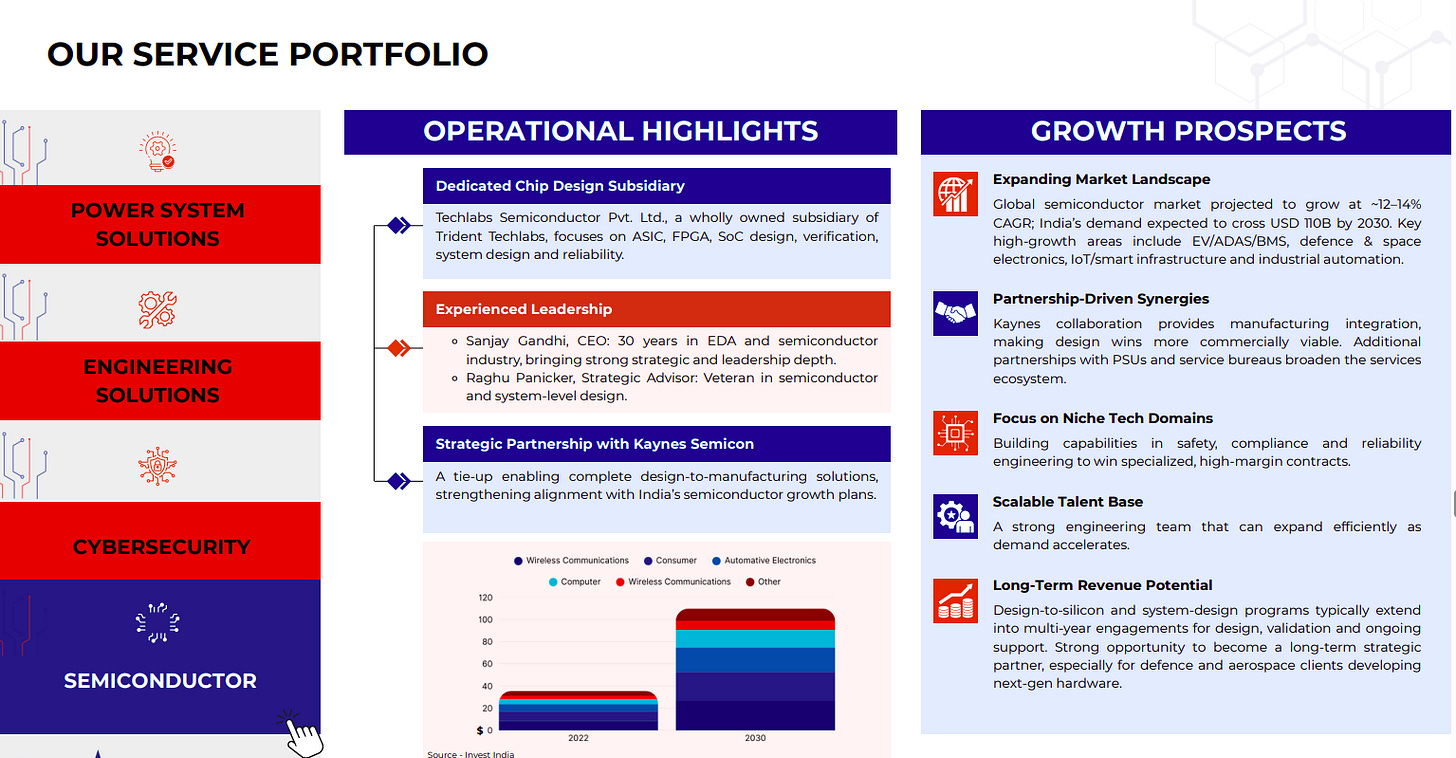

The semiconductor unit drives ASIC/FPGA/SoC design with experienced leadership and a strategic partnership with Kaynes that strengthens design-to-manufacturing capabilities. Expanding semiconductor demand and niche engineering strengths provide scalable growth and long-term revenue visibility.

Techlabs delivers advanced cybersecurity solutions through strong partnerships and intelligence capabilities, targeting government and enterprise sectors. With India’s cyber market growing at double-digit CAGR, the firm is positioned for sustained demand across critical infrastructure domains.

Techlabs offers end-to-end semiconductor design across digital and analog circuits, enabling ultra-low-power and high-performance chipsets for next-gen applications like AI and IoT. Custom SoC/ASIC solutions support faster time-to-market and differentiation for global clients.

The company serves major global and Indian names across power, engineering, semiconductor and defence segments, including ABB, Bosch, Tata, Qualcomm, Samsung and DRDO. This diversified roster reinforces credibility and deep industry relationships across high-value sectors.

Auto Ancillary

Tenneco Clean Air India | Small Cap | Auto Ancillary

Tenneco Clean Air India Ltd. (TCAIL), founded in 1979 and part of U.S.-based Tenneco Group, designs and manufactures clean air, powertrain, and suspension solutions for Indian and global OEMs. It leads in CT, OH, and PV segments and exports across major global markets.

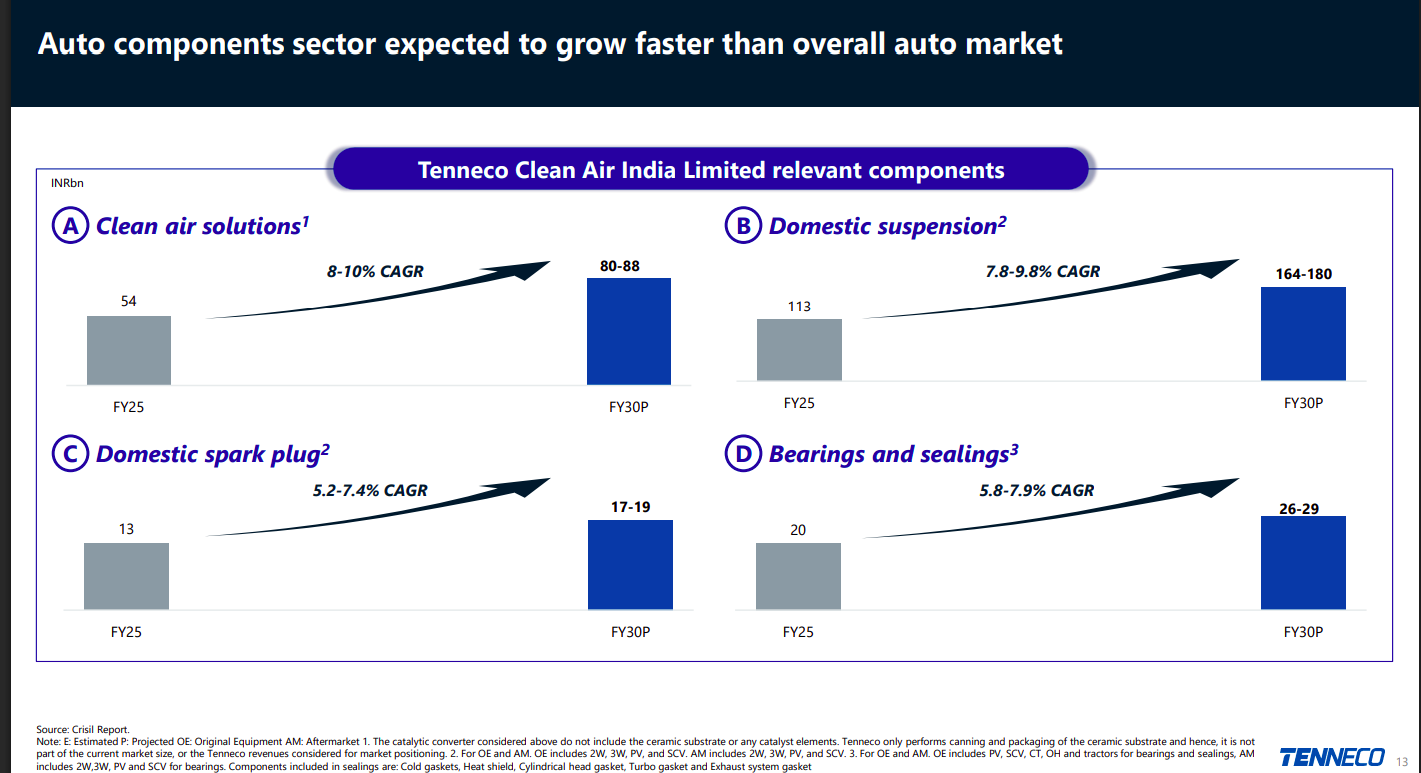

The slide shows strong projected growth across clean-air solutions, suspension, spark plugs, and bearings, each expected to grow between ~5% to 10% CAGR till FY30. Clean air and suspension are the biggest value pools, highlighting rising vehicle sophistication and regulatory needs in India.

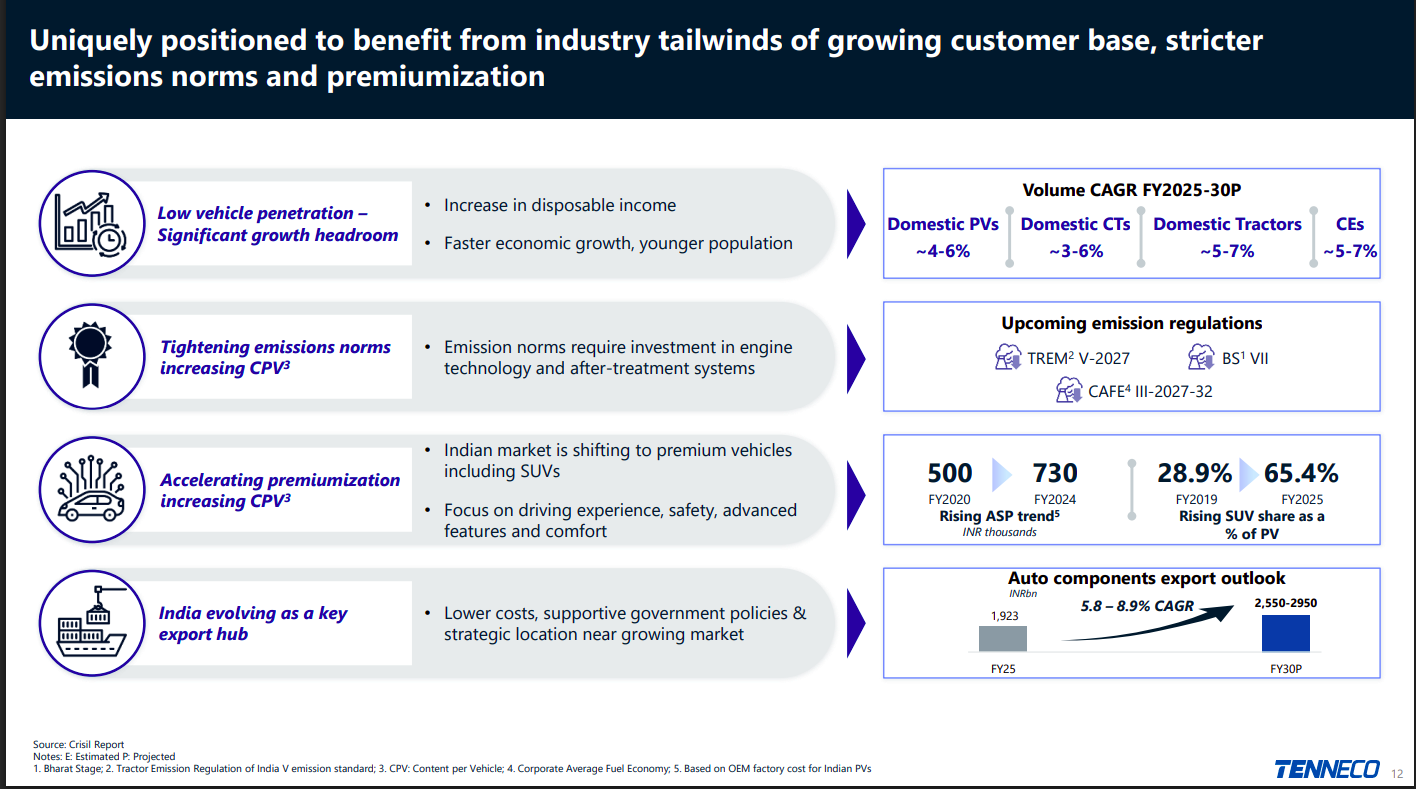

Tenneco stands to benefit from low vehicle penetration, stricter emission norms, and rising premiumization which increase components per vehicle (CPV). Export potential is also improving with India becoming a key manufacturing hub and auto components expected to grow at 5.8–8.9% CAGR.

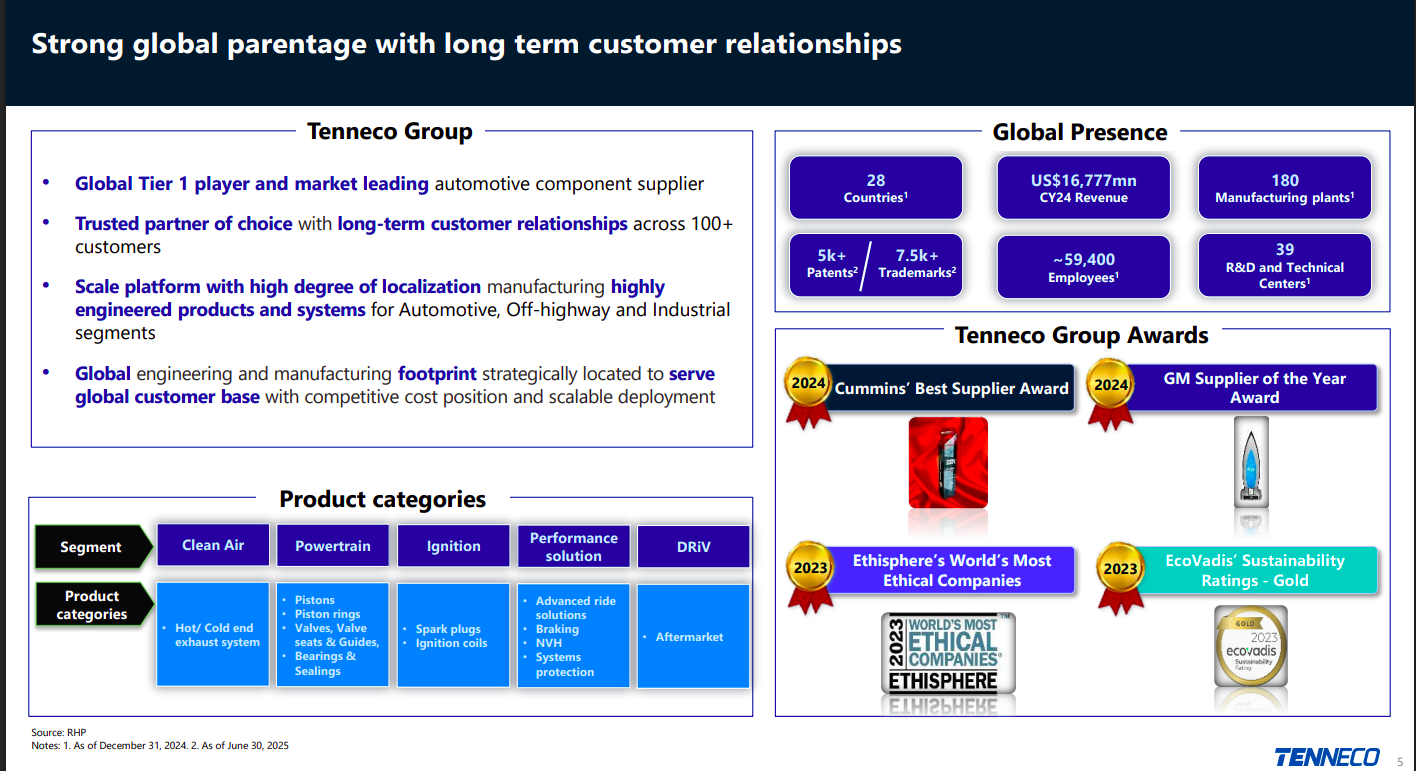

Tenneco is a global Tier-1 automotive supplier with large-scale manufacturing, strong customer relationships, and extensive engineering capability across 28 countries. Its diversified product categories and global awards reinforce credibility and support long-term growth in India.

Kinetic Engg | Micro Cap | Auto Ancillary

Kinetic Engineering Limited specializes in manufacturing high technology components and assemblies for various vehicles including passenger vehicles, commercial vehicles, tractors, two-three wheelers, and construction vehicles. They also cater to non-auto segments such as tractors, recreational products, and construction equipment.

Kinetic is making a comeback in the two-wheeler space — this time with an electric avatar of its iconic DX scooter. The new Kinetic DX and DX+ are being launched through its EV subsidiary, Kinetic Watts and Volts Ltd., with ₹72 crore already invested and another ₹177 crore planned to scale the platform. On the specs front, the scooter uses an LFP battery offering up to 116 km range, with 4x longer lifecycle than typical NMC batteries and better thermal stability for Indian summers. It charges to 50% in 2 hours and fully in 4 hours, with regenerative tech built in for efficiency.

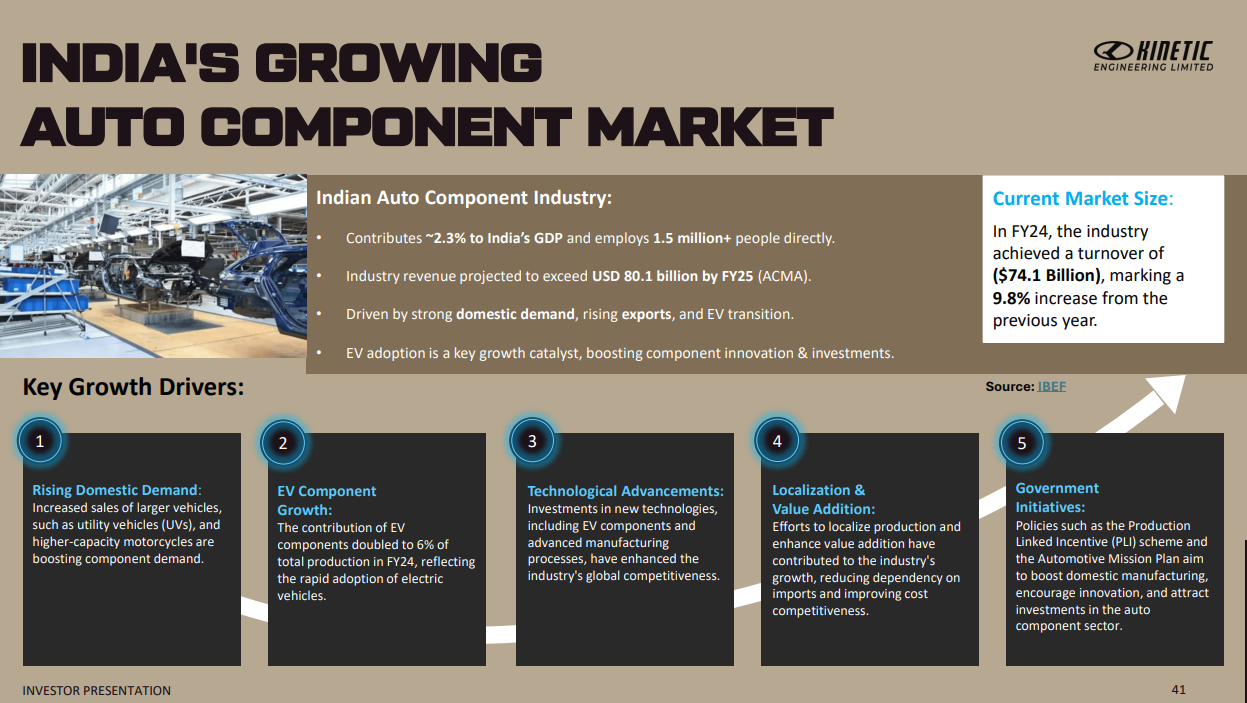

India’s auto component industry clocked a turnover of $74.1 billion in FY24 — up 9.8% from the previous year — and is expected to cross $80 billion by FY25. The sector contributes about 2.3% to India’s GDP and employs over 1.5 million people directly. Growth is being fueled by strong domestic demand (especially for UVs and higher-capacity motorcycles), rising exports, and the ongoing EV transition — EV components have already doubled to 6% of total production in FY24. Government support through schemes like PLI and the Automotive Mission Plan is also pushing localization and attracting fresh investments into the sector.

FMCG

TBI Corn | Nano Cap | FMCG

TBI Corn, an ISO certified company based in India, specializes in producing high-quality Corn / Maize Grits and related products. Established in 2000, it offers a range of products including Corn Flakes, Corn Flour, and Turmeric Finger, all manufactured without chemical additives or preservatives and GMO-free.

The slide highlights TBI Corn’s diverse customer base across leading Indian snack and food manufacturers like ITC, Prataap Snacks, Balaji Wafers and Vasaya, along with international players such as Oriental Brewery and Mudieb Haddad. It signals strong B2B relationships in both domestic and global food industries.

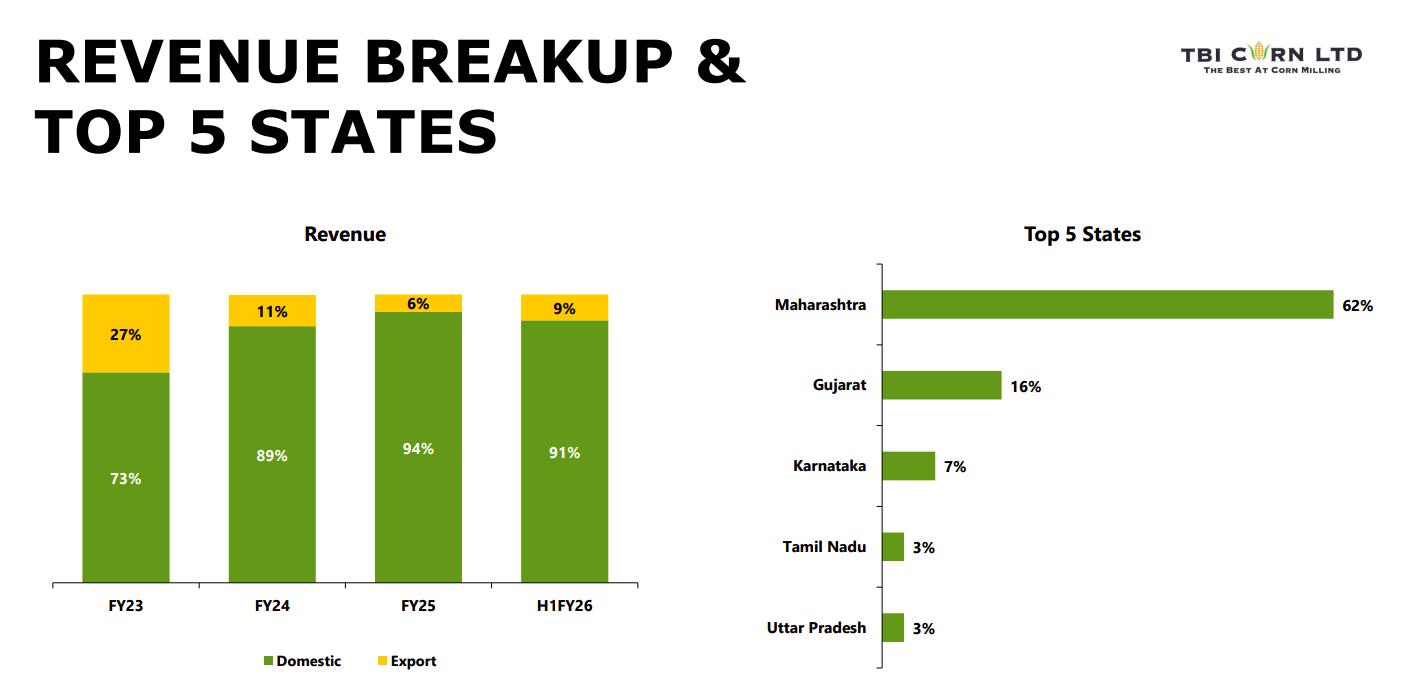

Domestic business contributes the majority of revenues (over 90% in FY25), while exports form a smaller share. Maharashtra alone accounts for 62% of sales, followed by Gujarat and Karnataka, showing strong regional concentration.

India’s snacks, hospitality, animal feed, corn oil, and breakfast food markets are growing strongly driven by urbanization, rising incomes, and changing dietary preferences. Significant growth is expected across these segments over the next decade, with increasing demand for processed and ready-to-eat products.

Media & Entertainment

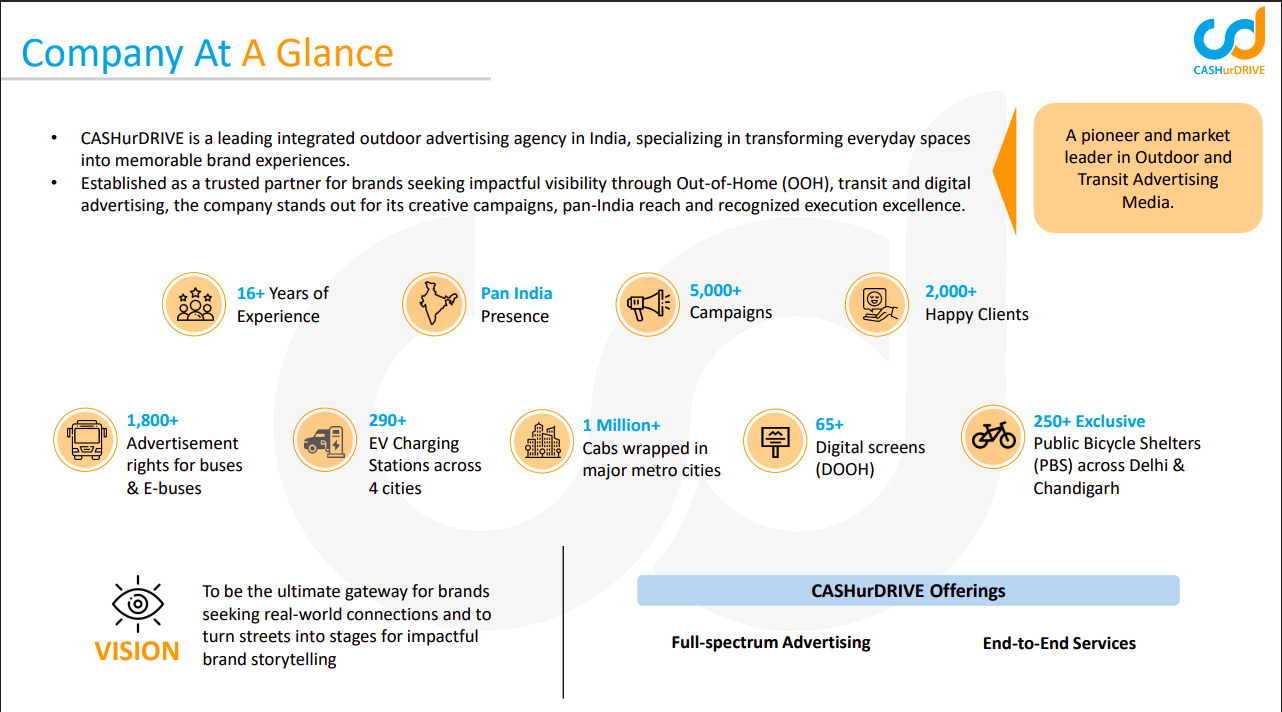

Cash UR Drive Marketing | Nano Cap | Media & Entertainment

Cash UR Drive Marketing is an Out of Home advertising company providing Transit, Outdoor, Print, and Digital Media Services to help clients reach their target audience. They have expanded into advertising on Electric Vehicles and charging stations to tap into the growing Electric Vehicle Industry.

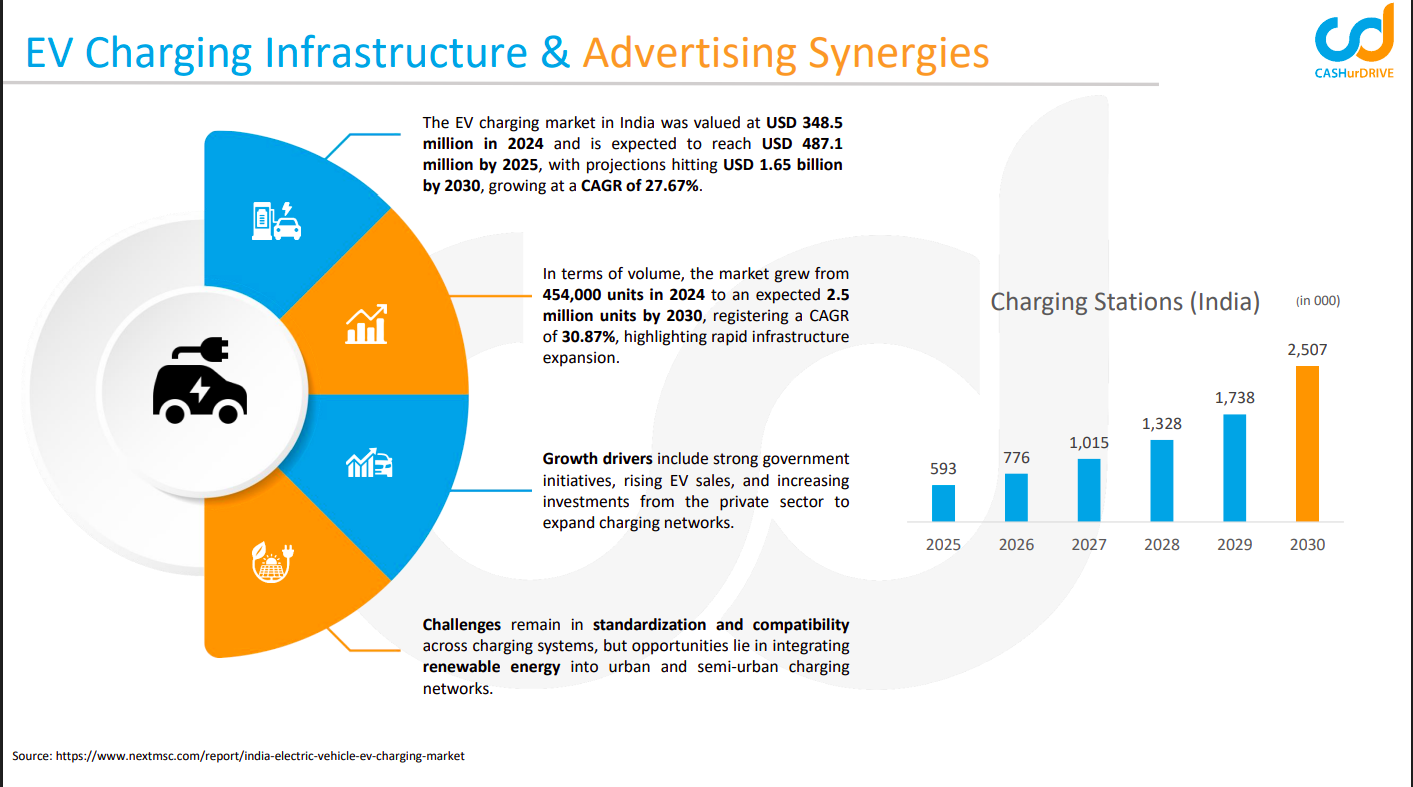

India’s EV charging market is projected to grow from USD 348.5M in 2024 to USD 1.65B by 2030, driven by strong EV adoption and government initiatives. Charging units are expected to rise from 454,000 to 2.5M by 2030, though standardization and compatibility remain challenges.

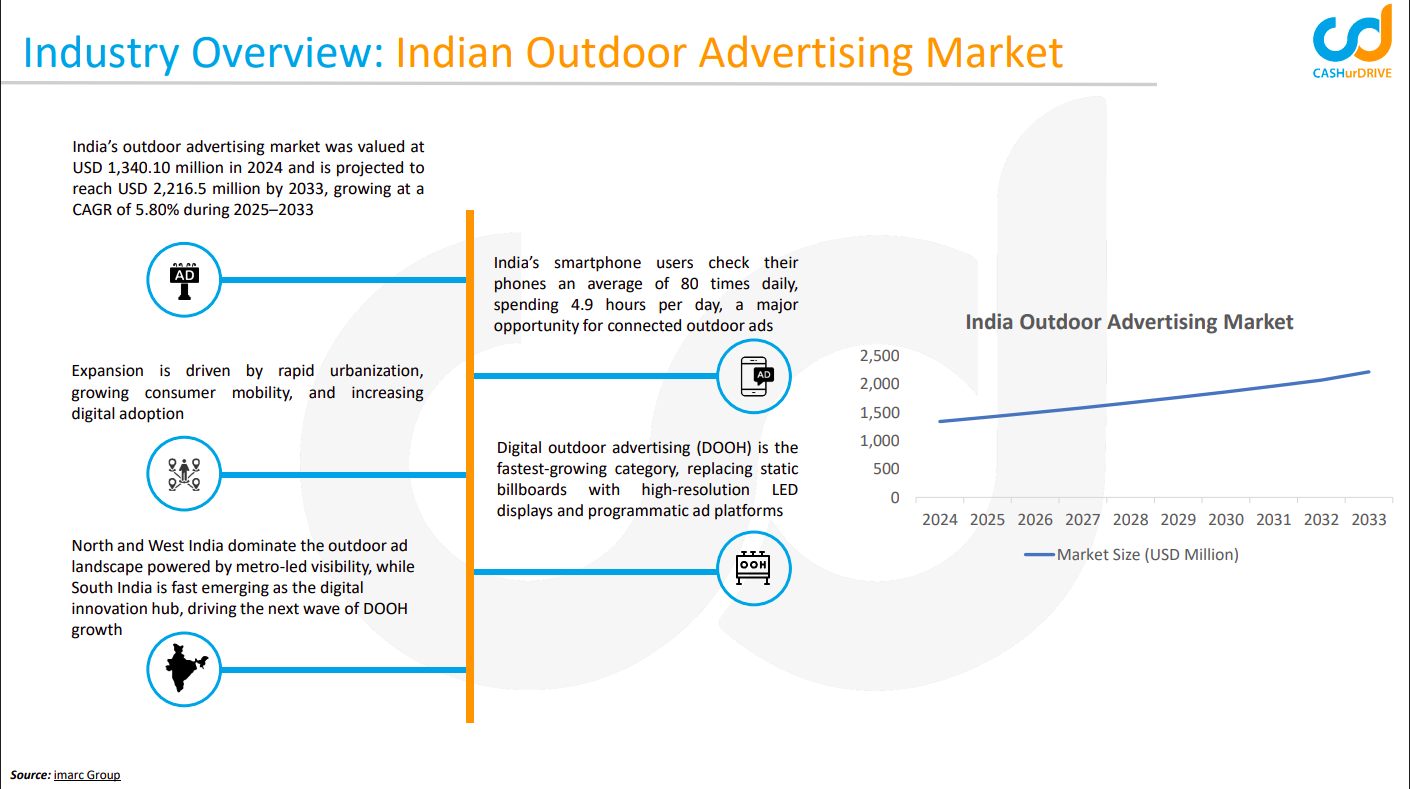

India’s outdoor advertising market is expected to grow from USD 1.34B in 2024 to USD 2.21B by 2033 as rapid urbanization, smartphone penetration, and digital adoption drive demand. DOOH is the fastest-growing category, led by high-resolution LED formats and programmatic platforms.

CASHurDRIVE is a leading outdoor and transit advertising agency with pan-India presence, over 5,000 campaigns, and 2,000+ clients. The company combines OOH, DOOH and EV charging locations, positioning itself as a creative, execution-focused partner for brands nationwide.

Logistics

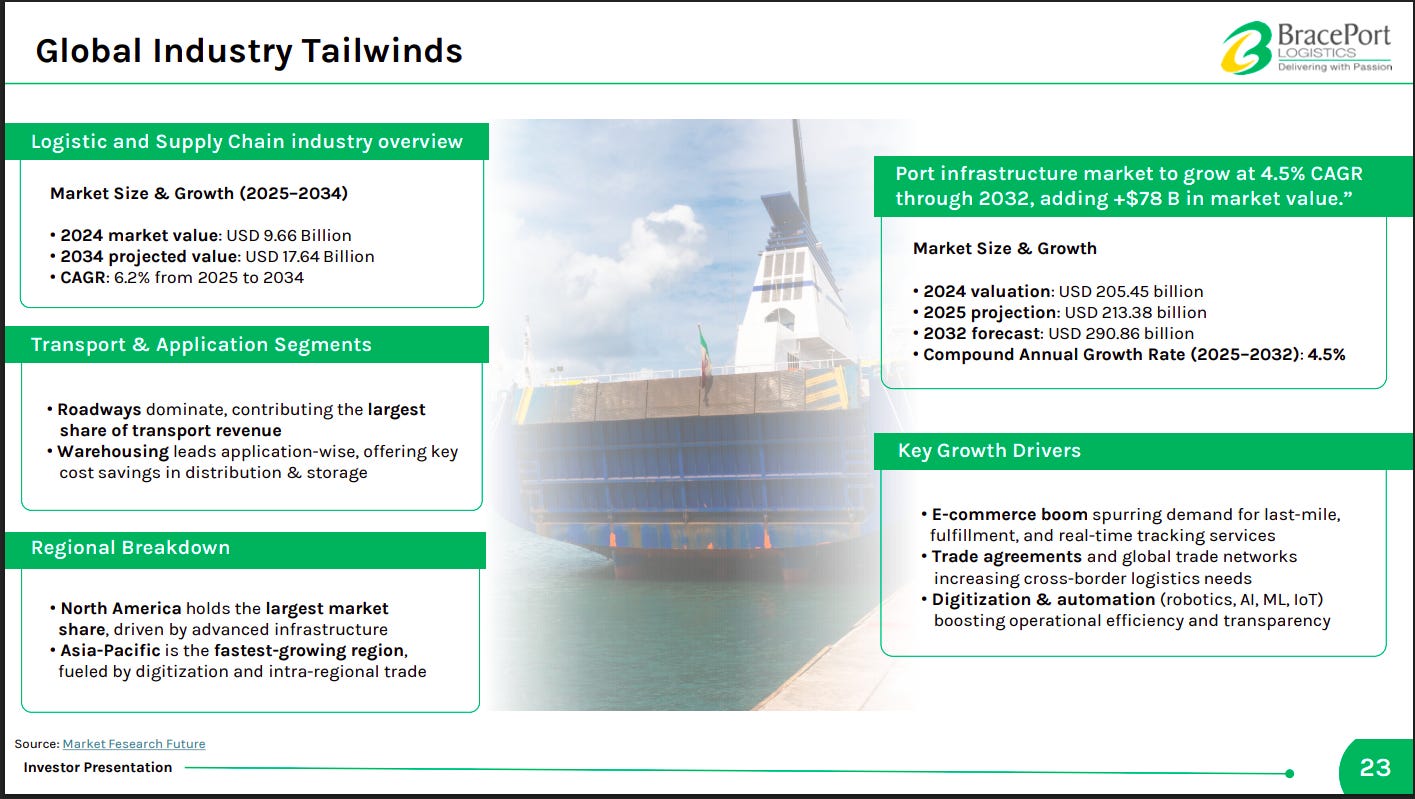

Brace Port Logistics | Nano Cap | Logistics

Brace Port Logistics is a service-based company specializing in Ocean cargo logistics services. They offer a range of services including Air Freight, Warehousing, special cargo handling, and custom clearance. With a focus on various sectors of the economy, they provide comprehensive logistics solutions to their clients.

BracePort highlights an asset-light, tech-first model with strong multimodal capabilities and Skyways backing, while also noting opportunities in healthcare, renewables, and global trade corridors. Weaknesses stem from exposure to global freight rates and FX variations, while geopolitical disruptions and regulatory shifts remain key threats.

The global logistics and supply-chain market is projected to grow steadily through 2034, driven by e-commerce, warehousing demand, and infrastructure expansion. North America leads in market size, Asia-Pacific grows fastest, and global port infrastructure investment is expected to rise with increasing cross-border and digital logistics needs.

That’s it for now! Your feedback will really help shape how Points and Figures evolves. Drop it down in the comments below!

Quotes in this newsletter were curated by Meher, Kashish & Vignesh.

Disclaimer: We’ve used AI tools in filtering and cleaning up the quotes from the images so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

We’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Points and Figures is run by the same team that creates The Daily Brief and Aftermarket Report.