On Chatter, we curate some of the most insightful comments from the earnings calls of Indian companies. However, a lot of context still gets left out. So we are experimenting with a new segment under Chatter called ‘Plotlines’.

Most financial analysis focuses on quarterly results and near-term guidance changes. Plotlines takes a different approach. We analyze executive commentary from earnings calls and investor presentations to identify long-term structural shifts that will shape industries over the coming years. Rather than chasing headline news, we look for strategic pivots, evolving competitive dynamics, and fundamental changes in how companies allocate capital.

Each week, we highlight the most significant "plotlines" from recent corporate communications—the unscripted moments and strategic insights that reveal where businesses are heading, not just where they've been. We focus on comments that signal permanent changes in market structure, technology adoption, or business models, and provide specific metrics to track whether these trends are materializing as expected.

What makes these shifts particularly significant is their permanence. These aren't tactical adjustments or pandemic hangovers. They represent irreversible changes in how value is created and captured. The companies recognizing these shifts first are positioning for sustained competitive advantages, while those clinging to legacy models face existential challenges.

This edition of Plotlines is covering 24 distinct plotlines across sectors like housing finance, construction vehicles, entertainment, meat/poultry, seafood, and life insurance

Since this is an experiment, we’d love your feedback. Tell us if there’s anything we missed—something we should add, change, or even remove completely. You can also let us know how you feel about the format, and whether it needs any adjustments.

Housing Finance Companies

HomeFirst: Co-lending becomes a second growth rail

The Signal: HomeFirst is institutionalizing co-lending (not a pilot), explicitly steering it toward ~10% of disbursements while keeping yields steady.

“Our disbursement on the co-lending increased by 87.5% y-o-y and 43.3% q-o-q to ₹78 crores for Q1, taking the co-lending book to ₹434 crores or 3.2% of the total AUM [Asset under management]. Co-lending will continue to be an important part of our strategy… We aim to take co-lending contribution to 10% of disbursements as we scale. With recent rate cuts and an improved long-term rating, we expect the cost of borrowing to improve in Q2… June and July marginal COB [Cost of Borrowing] is sub-8%.” — Nutan Gaba Patwari, CFO

Why It Matters:

Co-lending lets HomeFirst move up-ticket without compressing origination yields: partner balance sheets fund a slice of every loan while HomeFirst keeps the origination engine and customer relationship. With sub-8% marginal COB and AA rating momentum, the spread math works even as disbursement scale rises. This is a structural funding/product architecture choice, not quarterly noise.

Watch For:

Co-lending share of disbursements sustaining near/above 10%

AUM from co-lending > 5% with no NIM slippage

Average ticket size rises while yield holds ~13%+

Aavas: “Realization-based” disbursement recognition = governance moat

The Signal: Aavas has shifted to recognizing disbursements on cash realization (not on sanction), trading short-term optics for long-term fidelity.

“We have undertaken a historic step to move to a realization-based model for disbursement recognition. This strengthens governance, aligns revenue recognition with actual cash flows, and reduces volatility from sanction-to-disbursement timing.” — Sachinder Bhinder, MD & CEO

Why It Matters:

Affordable housing has intrinsic sanction→disbursement lags (title checks, stage payments). By reporting only realized cash, Aavas removes quarter-end bunching and “sanction gaming.” That tightens the link from origination to P&L and should lower earnings volatility. It’s a cultural tell: quality over pace.

Watch For:

Sanction→disbursement volatility compresses on the new base

The Street re-bases growth to ~18–20% with spreads intact

More granular disclosure on realization lags / milestones

Aptus Housing: A branch-light, app-heavy origination flywheel

The Signal: Digital referral + construction-ecosystem + social channels already drive ~21% of originations; management wants to “scale significantly.”

“About 21% of our Q1 FY26 business originated through our referral app, construction-ecosystem app and social media. Our mobile-first lead management platform… is streamlining ops, enhancing compliance and boosting collections productivity.” — P. Balaji, MD

Why It Matters:

In Tier-3/4 markets, owning a referral/app funnel cuts CAC, speeds TAT, and filters risk earlier than DSA-only models. With NIM ~13%+ and ROE ~20%, digitizing the top-of-funnel is the cleanest way to add velocity without opex bloat. This looks like a durable second pipe, not an experiment.

Watch For:

Digital-led originations ≥25–30% through FY26

Opex/Assets trending ≤2.6–2.7% despite growth

Faster approval-to-disbursal TAT vs branch/DSA cohorts

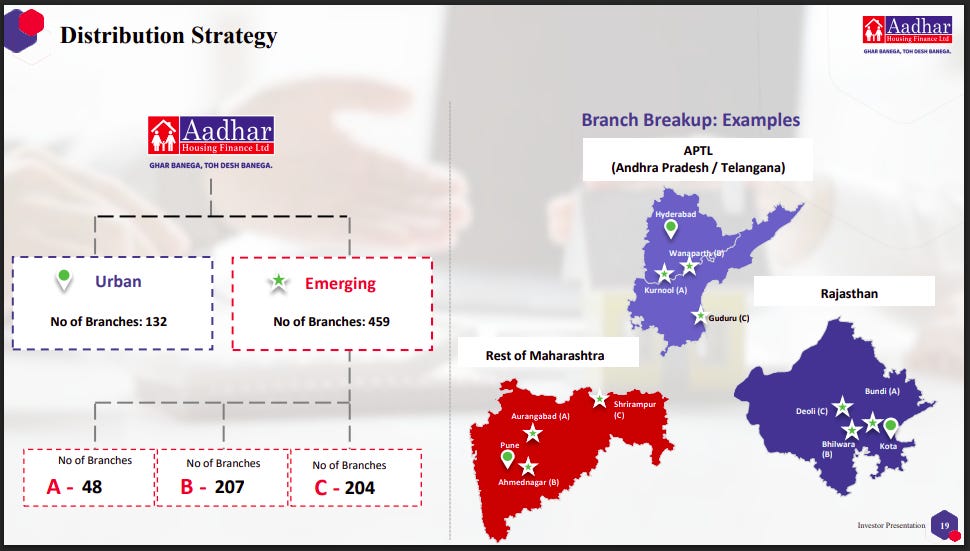

Aadhar Housing: “Urban vs Emerging” barbell + 75% floating on both sides

The Signal: Aadhar has formalized a two-speed GTM (Urban vs Emerging) and built a floating-on-both-sides balance sheet (~75% of assets and borrowings).

“Q1, the direct mix has jumped to 61%… Our ‘Urban and Emerging’ strategy is now live — ~130 branches in top-15 cities classified as Urban; the rest Emerging, with separate focus on ticket size, potential, yield and manpower.”

— Rishi Anand, MD & CEO

“About 75% of both our assets and borrowings are floating in nature… exit spread 5.8%.”

— Rajesh Viswanathan, CFO

Why It Matters:

Direct sourcing + geographic price/mix segmentation builds control over unit economics. Pair that with symmetrical floating-rate transmission and AA+ momentum, and Aadhar is positioned to keep spreads resilient while leaning into the rate-cut cycle to stoke demand.

Watch For:

Direct channel > 65%; Emerging outgrowing Urban with stable DPD

Spread stability (~5.7–5.9%) even as MCLR cuts transmit

Salaried mix inching up with no GNPA drift

Can Fin: Purity play — in-house origination, no co-lending, no construction finance

The Signal: Can Fin is saying no to co-lending and no to construction finance while scaling its own salesforce and contiguous branches.

“DSAs are only sales enablers; the core work will be done by our organization. We’re adding our own sales team… and plan 15 new branches in H1.”

— Suresh Iyer, MD & CEO

“We will not be doing co-lending with banks and we will not be doing construction finance.”

— Management

Why It Matters:

Owning the funnel tightens underwriting loops and keeps asset quality predictable; skipping co-lending/CF removes two common sources of complexity and tail risk. Short-term, growth might be slower; full-cycle, this is a clean, bank-like compounding posture.

Watch For:

In-house sourced disbursals rising as DSA share falls

15+ new branches with stable GNPA / ~15 bps credit cost

Zero exposure to co-lending/CF sustained

Construction Vehicles Companies

Ajax Engineering: Emission Transition Stress Test

The Signal: CEV-5 emission norms have raised costs and squeezed margins, but Ajax insists long-term demand remains intact.

"The shift from CEV-4 to CEV-5 emission standard effective 1st of July 2025 has had a notable impact… The transition to CEV-5 standards has led to an increase in the material cost, leading to an impact on the gross margin… Our pricing strategy will be very carefully calibrated after taking into account the market response and elasticity."

— Shubhabrata Saha, MD

Why It Matters: India is forcing its construction equipment industry to meet global emission standards overnight. This raises costs by 400 bps, but Ajax’s disciplined response—holding pricing until the market digests the change—could help it preserve share. The long-term story is clear: mechanization in construction is non-negotiable. Emission shocks test financial resilience and execution discipline; Ajax’s ability to absorb near-term pain without discounting sets it apart.

Watch For:

Price hikes in CEV-5 machines by late Q2 FY26

Market share in self-loading concrete mixers reverting to historical 30%+

Action Construction Equipment (ACE): Defense & Export as Structural Growth Pillars

The Signal: ACE is embedding defense and exports as recurring 10–15% revenue contributors, moving beyond cyclical construction demand.

"Exports contributed close to around ₹27 crores… This year it appears it can easily go up to 6–7%. Coupled with defense, about 10% contribution can come from both of these put together… and like generally in the past our median term target was about 10%-15% from these two segments put together. So, hopefully we should be hitting a 10% mark this year."

— Sorab Agarwal, Executive Director

Why It Matters: ACE is signaling that construction demand alone cannot drive sustainable growth. By anchoring defense (multi-year orders with Ashok Leyland, Army, BRO) and exports (Europe dealer expansion, Bauma orders), ACE is building annuity-like revenue streams. If executed, this derisks the business from India’s monsoon and capex cycles while raising margins, since exports/defense carry better pricing.

Watch For:

Defense order execution exceeding ₹250 crores in FY26

Exports rising above 7% of revenue with EU dealer wins

TIL Limited: From Survival to Strategic Expansion

The Signal: Under Gainwell’s ownership, TIL has rebuilt management, secured capital, and is re-focusing on defense, exports, and IP-led crane categories.

"TIL is the only company in the country which has got an IP registered by Government of India for pick and carry crane… This product is going to be reintroduced in the country probably by the third quarter… Today’s Board has decided that TIL has decided to set up a separate SBU for defense, just to bring sharper focus on our defense business."

— Sunil Kumar Chaturvedi, CMD

Why It Matters: A company once written off is now using fresh capital and a clean slate to re-enter high-value niches—defense, IP-protected cranes, exports. By reintroducing proprietary products and leveraging synergies with Gainwell’s mining IP, TIL is positioning for 10x growth from a tiny base. The defense SBU move is especially telling: management sees structural opportunity in supplying custom cranes to Army/Navy/Air Force, not just commercial buyers.

Watch For:

Launch of IP-protected pick-and-carry cranes by Q3 FY26

Defense contributing 20%+ of order book within 2 years

BEML: From Platform Supplier to Systems Integrator

The Signal: BEML is pivoting from vehicle platforms to full defense/rail systems, while doubling down on “sustenance” (aftermarket spares & services) to reach 30% of revenues.

"One of the major shifts in our strategy is from high mobility vehicle platforms to the systems… We are executing mechanical minefield marking equipment as a complete system… Sustenance business contributed around 26% to the top line. This year, sustenance will again add… Ultimate aim is to see sustenance contributes more than 30% to the top line."

— Shantanu Roy, CMD

Why It Matters: BEML is explicitly breaking from its legacy as just a defense vehicle supplier. By moving into complete systems and embedding long-term maintenance contracts (15–35 years), it locks in recurring revenue. This is a structural margin shift: sustenance revenues are higher-margin, less cyclical, and defensible. Coupled with metro/rail expansion (Bangalore, MRVC, high-speed), BEML is evolving into India’s integrated rail-defense systems house.

Watch For:

Sustenance revenue share crossing 30% within 2–3 years

Metro/rail annual capacity expanding to 700–800 cars with new Bhopal facility

Entertainment

PVR INOX: From Asset-Heavy Exhibitor to Brand Platform

The Signal: PVR is pivoting from lease-driven expansion to asset-light FOCO and co-investment models, targeting hospitality-style economics where growth is decoupled from capital intensity.

"127 screens have already been signed under FOCO/asset-light… [This is] part of our strategy to sweat the brand now, the way it has been done in hospitality for a long time, but I think it's the first time a cinema company has basically gone on this path."

— Ajay Bijli, MD

Why It Matters: This marks the biggest structural reset in India’s exhibition industry. By shifting to management-fee and shared-capex models, PVR can expand screens without expanding debt, boosting ROCE and reducing leverage. It also positions PVR as a brand platform rather than just a landlord of screens, creating optionality for global expansion and non-linear growth.

Watch For:

FOCO/asset-light share of new screen additions crossing 50%

Management fee income scaling beyond INR 50–100 cr annually

PVR INOX: Manufacturing Footfalls with Blockbuster Tuesday

The Signal: PVR has engineered a structural weekday demand lever through INR99 “Blockbuster Tuesday,” pulling in price-sensitive cohorts (students, housewives, seniors) and creating habit-based attendance.

"The idea was to get new customers on a specific day, and it's working brilliantly well. We don’t see the need for extending it beyond one specific day… This day has been marked out for people which are time-rich, cash-poor and still have the ability to walk into a PVR INOX cinema."

— Gautam Dutta, CEO – Revenue & Ops

Why It Matters: This is less a discounting tool and more a demand-generation strategy. By concentrating value on a single day, PVR avoids margin erosion while structurally expanding weekday audiences. If sticky, this program can smooth attendance volatility and create new revenue from previously underpenetrated demographics.

Watch For:

Weekday occupancies stabilizing >25%

Repeat-frequency data after 6 months of the program

PVR INOX: OTT Fatigue Brings Viewers Back to Cinemas

The Signal: Management sees a clear consumer swing away from streaming toward cinemas, citing “OTT fatigue,” demand for unadulterated experiences, and a shift from star power to storytelling.

"There is an OTT fatigue… Consumers are saying the best and the only way perhaps to enjoy an unadulterated movie experience is at the cinema… One big move is this whole shift from stars to stories."

— Gautam Dutta, CEO – Revenue & Ops

Why It Matters: This is a reversal of the pandemic-era narrative where OTT was seen as existential to theaters. If durable, it strengthens the economics of theatrical-first releases, stabilizes windows, and makes box office less dependent on mega-blockbusters. Pan-India storytelling further raises the baseline for distributed successes across languages.

Watch For:

Growth in films crossing INR100 cr per quarter

OTT platforms paying less for early-release rights

PVR INOX: Cinemas as Multipurpose Entertainment Hubs

The Signal: PVR aims to repurpose its theaters beyond movies—into live sports, concerts, conferences, and rereleases—turning cinemas into multi-entertainment infrastructure.

"Our long-term view is… [to] use our existing cinema infrastructure for multipurpose entertainment out of home, including movies, live events, IPL matches, comedy shows, conferences, rereleases."

— Gaurav Sharma, CFO

Why It Matters: This evolution smooths volatility and deepens monetization of fixed assets. By layering alternative content on top of film schedules, PVR can attract new cohorts, capture advertising opportunities, and build community stickiness. It’s a structural pivot from being a “cinema exhibitor” to an “experience orchestrator.”

Watch For:

Non-film revenues exceeding 10% of total

Regular partnerships for live sports/event screenings

Meat Products / Poultry Companies

HMA: From Regional Exporter to Global Meat Platform

The Signal: HMA has entered Cuba, marking the first-ever Indian meat export approval into Latin America, expanding beyond its historic strongholds in GCC, Southeast Asia, and Africa.

"This was the first initiative which was not happened before for the Indian product and we hope, slowly, we will build a good clientele from Latin America side also. This was the first step entering into the American continentals."

— Gulzeb Ahmed, CFO

Why It Matters: This isn’t just a new geography; it’s India’s entry into the Americas meat trade. Latin America is both competitor and customer—establishing a beachhead here could structurally diversify demand away from volatile Middle East/SE Asia markets and give HMA global positioning.

Watch For:

Further approvals in Brazil/Chile or other Latin markets

Americas share in exports crossing 5–10% within 3 years

Brand partnerships or local distribution tie-ups

Venky’s: From Poultry Supplier to Consumer Brand

The Signal: Venky’s is shifting from commodity poultry to branded processed food (ready-to-eat/cook), leaning on e-commerce and QSR channels, with 25–30% growth expected.

"Post-COVID, a lot of consumers are looking for the e-commerce chain… We concentrated our efforts for marketing our products through e-commerce… We expect the increase in our sales for this sector to more than 25% to 30% in next year… currently 10% of poultry revenue."

— P.G. Pedgaonkar

Why It Matters: This pivot de-risks margins from maize/soya cycles and recasts Venky’s as a consumer food brand. Success would structurally reposition the company alongside FMCG peers rather than commodity producers.

Watch For:

Processed food share rising above 20% of poultry revenue

Tie-ups with leading e-commerce/QSR chains

Marketing/brand spends ramping up in disclosures

Venky’s: Building a Biotech Moat with SPF Eggs

The Signal: Venky’s is investing ₹70 crore in expanding Specific Pathogen Free (SPF) egg capacity, critical inputs for vaccine manufacturing, with exports already doubling.

"Export business has doubled from ₹7 crore last year to ₹20 crore. Expansion of ₹70 crore is underway… our product is mainly to be supplied to the vaccine manufacturer for human as well as the poultry."

— J.K. Handa, CFO

Why It Matters: This is Venky’s most strategic pivot—moving into pharma-grade biotech inputs with high entry barriers. If scaled, SPF eggs could transform Venky’s from cyclical poultry into a critical node in vaccine supply chains.

Watch For:

SPF exports crossing ₹50 crore+ in 3 years

Partnerships with vaccine majors like Serum/Bharat Biotech

Utilization of SPF facilities rising above 75%

Venky’s: Chasing Northern India’s Protein Boom

The Signal: Venky’s is rebalancing geographically, with 65–70% of poultry revenues now from Northern India, especially UP, Bihar, and Punjab.

"65% to 70% turnover comes from Northern India and balance 30% to 35% from Western India… UP is a consumption center, Haryana a production center. We are deliberately spreading across states to balance margins."

— J.K. Handa, CFO

Why It Matters: India’s protein consumption is shifting northward. By embedding early in UP/Bihar, Venky’s aligns with long-term demographic demand. This diversification reduces cyclicality tied to Maharashtra-centric production.

Watch For:

North India share of poultry revenues rising beyond 75%

New facilities in Bihar/UP

Stabilized realizations despite seasonal disruptions

Seafood Companies

Kings Infra: From Exporter to Fully Integrated Protein Company

The Signal: Kings Infra is moving beyond shrimp farming and exports to build India’s first fully integrated aquaculture-to-retail chain, spanning probiotics, farming, processing, and branded retail under Frigo and Bento.

“We will have a fully integrated chain of activities—the entire value chain from farm, probiotics, processing, to retail marketing and distribution… this will be one of the first fully integrated seafood companies in the country.”

— Shaji Baby John, CMD

Why It Matters: This is a structural shift from commodity export margins to branded food economics. By controlling the entire chain, Kings can deliver traceability and sustainability—features global buyers now demand—while capturing downstream retail margins that are higher and less volatile than exports. It positions Kings closer to global integrated protein players like CP Foods and Tyson, a first for Indian seafood.

Watch For:

Expansion of Frigo/Bento retail footprint beyond Kerala and Bengaluru

Retail margins sustaining above 20%

Probiotics and inputs adoption across leased farm network

Kings Infra: From Contract Farming to Lease Farming

The Signal: Kings Infra has abandoned contract farming, shifting to long-term lease farming to gain full control over ponds, enforce sustainability protocols, and secure supply chain traceability.

“Earlier, we wanted to scale by contract farming, but that model failed… [Now] we take farms on lease, put our own team, and give farmers fixed rent plus 2–5% of profits. This way, we have much better control and traceability.”

— Shaji Baby John, CMD

Why It Matters: Traceability and biosecurity are emerging as non-negotiables for export buyers. The lease model locks in control without heavy land CapEx, giving Kings an edge in certification-led exports. While more labor-intensive, it sets them apart from peers who remain dependent on farmer goodwill and spot markets.

Watch For:

Share of leased farms crossing 70% of total capacity

Certifications tied to leased-farm traceability

Crop cycles per pond increasing from 2.5 to 4–5 annually

Apex Frozen Foods: Hedging Away from U.S. Dependence

The Signal: Apex is structurally reducing reliance on the U.S., with non-U.S. revenue rising to 45% (from 30% two years ago), aided by long-awaited EU approval for its second facility.

“We have been strategically working to diversify… non-U.S. business now accounts for 45% of revenue, up from 30% in the same quarter two years ago. Our second facility has finally received EU listing approval.”

— Chowdary Karuturi, MD

Why It Matters: With U.S. tariffs destabilizing exports, Apex is repositioning itself as a diversified supplier, with Europe emerging as the growth anchor. The EU facility approval also opens the RTE category, further insulating Apex from U.S. policy swings. Over time, this shift could reset geographic risk for the company and re-rate its valuation multiple.

Watch For:

Non-U.S. sales crossing 50% of revenue mix

RTE contribution rising beyond 20%

AMR compliance readiness ahead of EU’s 2026 norms

Apex Frozen Foods: RTE Shrimp as the Growth Engine

The Signal: Apex is scaling its ready-to-eat (RTE) shrimp products, now 15% of revenue, leveraging EU approval to target high-margin demand pools.

“This approval paves the way for new opportunities… we can now sell our ready-to-eat products into the EU. RTE products stood at 15% of Q1 FY26 revenue.”

— Chowdary Karuturi, MD

Why It Matters: Shrimp as a commodity has volatile pricing, but RTE products align with global trends of convenience and premiumization. By scaling RTE, Apex can structurally expand margins and reposition itself from bulk processor to branded, value-added food supplier. This could be its moat against Ecuador and Indonesia, who dominate low-value segments.

Watch For:

RTE sales share rising above 20–25% of revenues

EU-specific contracts for RTE supply

Gross margins sustaining above 30%

Life Insurance Companies

LIC: From Agent Monopoly to Multi-Channel Insurer

The Signal: LIC’s bancassurance and alternate channels doubled YoY, now 7% of individual premiums vs. 3.7% last year.

“Bancassurance and alternate channels… account for nearly 7% of individual new business premium, up from 3.7% last year.”

— R. Doraiswamy, CEO

Why It Matters: LIC is slowly breaking its dependence on agents. Digital, banca, and web aggregators will bring stickier, urban customers, narrowing the efficiency gap with private peers.

Watch For: Banca/alternate share crossing 10% by FY27; expense ratio trending below 10%.

LIC: Women-Led Rural Distribution via Bima Sakhi

The Signal: LIC has mobilized nearly 2 lakh women as “Bima Sakhis,” embedding them across Gram Panchayats to sell insurance and expand rural penetration.

“As of June 30th, 2025, a total of 1.99 lakh women have been designated as Bima Sakhis, successfully selling 3.26 lakh policies and generating ₹429 crore of new business premium. Our objective is to appoint one Bima Sakhi in every Gram Panchayat.”

— Management

Why It Matters: This program transforms distribution by tapping women-led community networks, especially in rural India. It aligns with the national goal of “Insurance for All by 2047,” while also providing LIC a grassroots moat private players can’t easily replicate. Beyond sales, it strengthens financial literacy and trust at the village level — crucial for persistency.

Watch For: Coverage of 100% Gram Panchayats in major states; premium contribution from Bima Sakhis crossing 5% of LIC’s rural new business.

HDFC Life: Tier 2/3 Expansion as Core Growth Driver

The Signal: HDFC Life is aggressively expanding its physical presence in smaller towns, with 117 new branches opened in FY25 and Project Inspire aimed at deepening penetration beyond metros.

“We added 117 branches last year, largely in smaller towns, and Project Inspire is designed to build capabilities to serve Tier 2/3 markets.”

— Management

Why It Matters: This reflects a structural bet that India’s insurance penetration story will be driven by Bharat, not just metros. Tier 2/3 markets provide long runway for growth, higher ticket sizes as incomes rise, and less competition from digital-first players. By embedding early in these markets, HDFC Life is positioning itself to capture future middle-class savings and protection demand.

Watch For: Annual branch additions >100 in smaller towns; rising share of non-metro APE contribution; persistency rates improving in Tier 2/3 cohorts.

That’s it for now! Your feedback will really help shape how ‘Plotlines’ evolves. Drop it down in the comments below!

Disclaimer: We’ve used AI tools in filtering and cleaning up these quotes so there maybe some mistakes. Now, if you are thinking why we are using AI, please remember that we are just a small team of 5 people running everything you see on Zerodha Markets 😬 So, all the good stuff is human and mistakes are AI.

Really liked the format, espicially where all the peers in a sector are compared based on their startegies and clear 'what to look out for' section. Great work by the team.

Watch for section is a killer - very actionable!